The global protein A resins market is expected to grow from USD 713.31 million in 2024, to USD 738.85 million in 2025 and USD 1,022.26 million by 2035. The revenue during the forecast period is projected to grow with a CAGR of 3.3%.

Protein A resin is a major player in biotechnology, and it makes purification of monoclonal antibodies and immunoglobulins easier for scientists. Being over 15% in affinity, it does not make things complicated; one step is all it takes for researchers to get their target proteins. This is why it is the most convenient tool for many working with cell culture media in biopharmaceutical development. But that is not all. Scientists also use Protein A resin to understand how bacteria attach to the host surfaces; it will understand better the mechanisms of biofilm formation and infection.

Such a study, therefore is an antecedent to finding new treatments against bacterial infections. In the vast expanse of life sciences, Protein A resin unites the purification of antibodies and microbiology.It has become indispensable in the conduct of lab processes and improvements of research outcomes, leading to advancing drug development, vaccine research, and microbial studies in the world.

Global Protein A Resin Industry Assessment

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 738.85 million |

| Industry Value (2035F) | USD 1,022.26 million |

| CAGR (2025 to 2035) | 3.3% |

The Protein A resin market is expected to be quite optimistic over the next decade, with high acceptance by the research organizations. Key factors driving growth include an increasing demand for disposable packed columns, growing R&D expenditure, therapeutics development and drug discovery.

Several key drivers drive the growth in the Protein A resin market. First with the increase demand for disposable packed columns. This is because, in contrast to other matrices, the Proteins have a high binding selectivity for ligand attachment. The Protein A resins based on agarose exhibit enhanced mechanical strength, longevity, and a high capacity to include metal dopant absorption at an appropriate pH.

Protein A resin is a vital component in chromatography assays utilized during pharmaceutical development processes. Hence, growing the R&D expenditure. It is employed in the biopharmaceutical sector to produce GMP-compliant biologics that have been authorized for both clinical and commercial usage.

Government and several research institutes are now applying different strategies for promoting the use of Protein A resin by initiating programs like National Institutes of Health (NIH) in the United States and the Department of Biotechnology (DBT) in India that supports projects for improving resin stability, reuseability and capacity. Organisations like Bio-Process Systems Alliance(BPSA) have focused on improving scalabilityand sustainability of Protein A resin.

The compound annual growth rate of the global protein-a resins market for the first half of 2024 and 2025 is compared in the table below. This analysis provides critical insights in the performance of the industry by highlighting significant shifts and trends in revenue generation. The first half is the period from January to June.

The second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 3034 the business is forecasted to grow at a CAGR of 3.5% while it is likely to grow at slightly higher rates in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 3.5% |

| H2(2024 to 2034) | 3.9% |

| H1(2025 to 2035) | 3.3% |

| H2(2025 to 2035) | 4.0% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is likely to decline slightly in the first half to 3.3% but continues to be relatively higher in the second half at 4.0%. Industry shrinks by 20 BPS in the first half and grows by 13.4 BPS in the second half.

The market is segmented based on product, application, matrix, end user, and region. By product, the market is divided into natural protein A resin and recombinant protein A resin. In terms of application, it is segmented into immunoprecipitation and antibody purification. Based on matrix, the market is categorized into agarose-based matrix, glass or silica-based matrix, and organic polymer-based matrix.

By end user, the market is segmented into biopharmaceutical manufacturers, clinical research laboratories, and academic institutes. Regionally, the market is classified into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

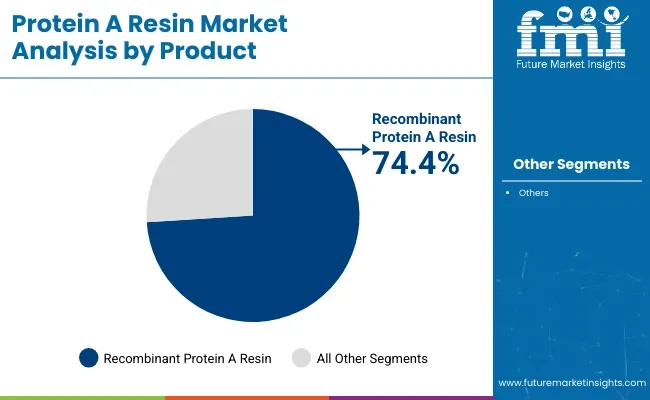

The recombinant protein A resin segment is projected to dominate the global protein A resins market, accounting for a substantial 74.4% market share in 2025. Recombinant protein A resins are genetically engineered to have high affinity for the Fc region of immunoglobulin G (IgG), enabling highly selective antibody capture.

Their superior stability, reproducibility, and tolerance to harsh purification conditions including high salt concentrations and denaturants make them ideal for both research and industrial-scale biopharmaceutical production.

Commercially, these resins are designed for long service life and consistent performance under rigorous operating environments. Their ability to support high binding capacities, maintain structural integrity, and minimize leakage or degradation positions them as a preferred choice for high-throughput purification.

Manufacturers such as Cytiva, Repligen, and Merck are investing in next-generation recombinant resins with even greater flow properties and compatibility with single-use systems. Due to their scalability and compatibility across a wide range of antibody subclasses and species, recombinant protein A resins are widely used in therapeutic antibody production and research applications.

As monoclonal antibody therapies continue to expand across oncology, autoimmune, and infectious disease segments, the demand for reliable and cost-effective purification media like recombinant protein A will remain strong.

| Product Segment | Market Share (2025) |

|---|---|

| Recombinant Protein A Resin | 74.4% |

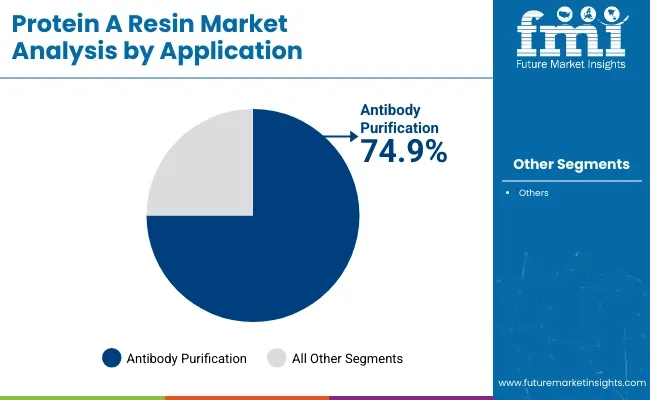

The antibody purification segment is expected to dominate the application landscape in the protein A resins market, capturing 74.9% of the global market share in 2025. Protein A resins play a crucial role in the selective purification of antibodies by binding specifically to the Fc region of IgG. This high-affinity interaction allows for efficient isolation of antibodies from complex biological mixtures, making it the gold standard for research, diagnostics, and therapeutic development.

The dominance of this segment is driven by the exponential rise in therapeutic monoclonal antibody (mAb) development, which requires large-scale and highly pure antibody production. Antibody purification using protein A chromatography is widely employed in biopharmaceutical manufacturing for both upstream and downstream processing. It ensures high product purity, yield, and batch-to-batch consistency critical parameters in regulatory compliance and patient safety.

Additionally, this technique supports key research applications such as immunoprecipitation, western blotting, ELISA, and cell-based assays. With increased demand for targeted therapies in oncology and immunology, the reliance on antibody purification workflows is rising. Leading market players continue to optimize resin chemistry to improve binding efficiency and reduce processing time. As biopharma pipelines expand globally, this segment will retain its leadership well into the forecast period.

| Application Segment | Market Share (2025) |

|---|---|

| Antibody Purification | 74.9% |

The agarose-based matrix segment is projected to grow at the fastest CAGR of 6.9% from 2025 to 2035 in the protein A resins market. Agarose is the most widely used matrix for affinity chromatography due to its high mechanical strength, biocompatibility, and low non-specific binding characteristics.

Its porous structure allows for high protein binding capacity, making it ideal for both analytical and preparative scale antibody purification. Agarose-based resins are especially favored in biopharmaceutical manufacturing for the purification of monoclonal antibodies, biosimilars, and recombinant proteins.

The matrix offers excellent flow properties and compatibility with a range of buffer systems, making it highly versatile for downstream processing. With regulatory demands for reproducibility and efficiency tightening, agarose-based matrices help ensure batch consistency and regulatory compliance.

Market leaders such as Cytiva (with its MabSelect line), Purolite, and Bio-Rad are continuously innovating agarose resins to improve capacity, stability, and elution performance. The increasing demand for single-use systems and continuous manufacturing is also pushing adoption of high-performance agarose resins with improved reusability.

As the biopharma industry expands into new antibody formats including bispecifics and antibody-drug conjugates agarose-based matrix resins will continue to serve as the backbone of scalable purification platforms.

| Matrix Segment | CAGR (2025 to 2035) |

|---|---|

| Agarose-Based Matrix | 6.9% |

The biopharmaceutical manufacturers segment is expected to grow at the fastest CAGR of 7.3% from 2025 to 2035, emerging as the most lucrative end-user category in the protein A resins market.

This growth is attributed to the surging demand for therapeutic monoclonal antibodies (mAbs), biosimilars, and advanced biologics targeting cancer, autoimmune diseases, and chronic infections. Biopharma companies require high-purity, scalable purification systems, and protein A resins remain the industry standard for initial capture in downstream processing.

With the global biologics pipeline expanding rapidly, especially in emerging markets, the demand for GMP-compliant, high-capacity, and cost-efficient purification media is accelerating. Additionally, the increasing adoption of continuous processing and modular production systems is further boosting resin consumption across manufacturing facilities.

Companies like Roche, Pfizer, Amgen, and new CDMOs are investing in advanced resin solutions that offer improved reusability, reduced ligand leaching, and superior throughput.

The segment also benefits from a surge in contract manufacturing demand, particularly for biosimilar production and pandemic-response therapeutics. As the biopharmaceutical landscape evolves with precision medicine and antibody engineering, protein A resins will remain indispensable to maintaining purification efficiency, regulatory compliance, and market scalability.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Biopharmaceutical Manufacturers | 7.3% |

Growing demand for Monoclonal antibodies (mAbs) is driving the Market Growth

An overwhelming boost for the usage of monoclonal antibodies drives this protein A resin market. For monoclonal antibodies, medical technology requirements have emerged by reason of rapid incidents of cases, from cancer up to autoimmune conditions, as well as chronic sickness. Monoclonal antibody purification relies very much on using Protein A Resin in treatments with the recent medicines found on earth, hence highly acclaimed.

It is in this context that the therapeutic monoclonal antibody industry continues to alter and new products emerge, making the importance of good and high-capacity Protein A Resin more and more apparent.

The gold standard in downstream processing for interacting preferably with immunoglobulin G is protein A resins while monoclonal antibodies require purification procedures that are highly effective. For example, according to reports by the industries, demand of Protein A resin is directly related with the growing market size of the world's monoclonal antibodies and growing at over 10% CAGR.

High Cost of Protein A Resins may Restrict Market Growth

Despite the growing growth and effective products in the market for Protein A resins, the high cost of these medium continues to be the major barrier towards their widespread use, especially in low- and middle-income countries. The manufacturing cost of Protein A resin medium is higher with limited number of reuse in some applications. Due to this reason, there is a major challenge in this market. Also, Protein A resins are highly specific and requires complex methods for its production that eventually makes it expensive.

As a reason, the Small-scale companies that has low budget can’t afford adopting these resins on a large scale. Additionally, disruptions in the supply chains during conditions like Covid-19 pandemic also contributed towards discontinued production, that eventually results in the rise of cost in Protein A resins market.

Expanding Market for Protein A Resins as Cancer Rates Rise

Use of monoclonal antibodies in cancer is rising since it offers targeted therapy that minimizes harm to the healthy cells. This growth is further supported with the rising cancer cases globally. These therapies are widely used across different types of cancer due to their precision and effectiveness.

The protein A resins market will continue to experience steady growth in the face of increasing demand for monoclonal antibody production. Advances in biopharmaceutical manufacturing and the development of new cancer treatments will drive this demand. While monoclonal antibodies will also be of even greater demands across the spectrum related to their consumption in treatment to cancer and oncology among cancer patients, producers of the said resin also obtain a bright light of potential massive demand.

As one example, there is a procedure called radio immunotherapy where the monoclonal antibody is bound to a minute radioactive particle which carries the treatment of radiation straight to cancerous cells but will reduce the radiation impact on other healthy cells. According to estimates by the WHO, 9.7 million people died due to cancer in 2022, while there were 20 million new cases diagnosed. An estimated 53.5 million individuals survived five years after the cancer diagnosis.

Government Initiatives and Funding Fueling Expansion in the Protein A Resin Market

Governments in many developing nations are actively supporting R&D for innovation in biopharmaceutical packaging industries, particularly in the field of monoclonal antibodies. Through Funding an favorable policies for the development of the monoclonal antibodies fields, indirectly support the growth of the protein A resin market. By attracting and supporting MNCs and start-up companies the government in Asia - Pacific region is focusing on developing new legislation (concerning patents or tax benefits) across the life sciences sector to encourage industrialization in developing countries.

It makes large market participants enhance their positions in the market through economies of scale. In May 2017 the Indian government sponsored a project led by the DBT to help develop a generic vaccine for the use in diagnostics and research.

Design support provided by the core themes of national initiatives such as 'Make in India' and 'Start-up India' in the hope to stimulate innovation, reduce dependence on imports and make products more affordable. Due to favorable policies and support from the government in the near future this market for protein A resin will be growing rapidly.

Tier 1 companies are the industry leaders with 44.2% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries. Tier 1 consists of companies having an excellent brand image along with good brands. Companies include, among others: Cytiva (Danaher), Purolite (Ecolab) and Merck KGaA.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 33.1% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Tosoh Bioscience, Kaneka Corporation, JSR Life Sciences, LLC, Repligen Corporation, and Avantor Inc.

Compared to Tiers 1 and 2, Tier 3 companies offer Protein A resin, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry. Tier 3 includes companies cumulatively hold around 22.7% share of the total market revenue. Thermo Fisher Scientific Inc., JNC CORPORATION, Bio Rad Laboratories, Abcam Limited, Suzhou Nanomicro Technology Co., Ltd., GenScript and Other are players which comprises tier III.

The market analysis for protein A resins is covered below in various countries and is grouped under the section following. As below have been mentioned important nations in North America Latin America Western Europe Eastern Europe East Asia, South Asia & Pacific and Middle East & Africa. By 2035 the United States will maintain its leading position in North America with a CAGR of 1.5%. By 2035 China market is predicted to experience a CAGR of 7.7% in the East Asia region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.5% |

| Germany | 1.0% |

| China | 5.2% |

| Japan | 1.2% |

| India | 6.8% |

| South Korea | 6.4% |

The global protein A resins market in Germany is expected to see a CAGR of 1.0% between 2025 and 535. Germany holds highest market share in European market. Advances in the demand for highly sophisticated chromatographic resins, especially Protein A resins, are on account of rapid biologic production, which comprises developing therapeutic antibodies that treat various autoimmune diseases and cancers.

Germany’s focus on biotechnology R&D is significant. Both the government and private players invests in innovation and technological advancements particularly in drug development. Germany is a major exporter of biopharmaceutical products. The growing demand of high quality product has a direct impact on Protein A resin market. Modifications in the chromatographic techniques are highly adopted by the german manufacturers that drives the market growth of Protein A resin.

Between 2025 and 1035 the United States market is projected to report a CAGR of 2.2%. The United States has the highest revenue share in the North America region.

The growing biosimilars, also known as biosimilars, play an important role in the market dynamics. These highly comparable and clinically equivalent products can be substituted with reference biologic drugs, contributing to their increased adoption in the market and its growth. The biosimilars which provide an increasingly affordable option for patients and their prescriber This recent rise in the production of biosimilars increases the requirement for protein A resin during preparation monoclonal antibodies.

The USA government is coupled with other helthcare providers encouraging their uptake, not to mention improvement of patient accessibility and a cost-cutting edge to drive further market expansion. This goes along with proper regulatory support measures in place.

Initiatives that would improve efficiency, like Biologics Price Competition and Innovation Act (BPCIA) to regulate biologic prices by competitions, provide some incentives toward production. In addition, the increasing incidence of chronic diseases such as cancer has increased the demand for biosimilars with monoclonal antibodies leading the treatment front. Consequently, the protein A market in United States is expected to grow.

The yearly growth for between 2025 and 3035 is likely to be seen at 6.8%. However, when the current year's forecast with this background revealed a slowdown at 13%. Research and Development in Biotechnology Involves investment in biotechnology.

Life science & Biotechnology is one of the biggest industries in India that is expanding fast. Both private and public sectors have been investing much in infrastructure and education in the last few years both as expected. The Government of India implements various programs and policies to advance innovation and industry growth to support the biotech sector.

The biotechnology companies are also investing tremendous amounts in research and development of monoclonal antibodies, making them more potent. Since these medicines are usually purified by Protein A resins, the continuous advancements in this area will have further demand for resins like Protein A resins. As a key component of the bioprocessing sector this will increase demand for these resins.

Monoclonal antibodies have been the mainstay of biopharmaceutical therapy in infectious, autoimmune, and cancerous diseases, especially for autoimmune reactions. India's mAb production has increased in light of the global demand for mAb and customized medications. Protein A resins are considered a must for monoclonal antibody purification, and demand for such resins rises with the increased production capacity by biotech companies in India. Biocon, Cipla, and Dr. Reddy's Laboratories have been investing more in biologics and biosimilar products thereby increasing sales of protein A resins.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Strategic partnerships and collaborations with research institutions and healthcare providers are being utilized to broaden their product portfolio. Geographical expansion into the emerging markets has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Protein A resins Industry Outlook

In terms of product, the industry is divided into Natural Protein A Resin and Recombinant Protein A Resin.

In terms of application, the industry is segregated into Immunoprecipitation and Antibody Purification.

In terms of matrix, the industry is divided into Agarose-based Matrix, Glass or Silica-based Matrix and Organic Polymer-based Matrix.

In terms of end user, the industry is divided into Biopharmaceutical Manufacturers, Clinical Research Laboratories and Academic Institutes.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global protein A resins market is expected to reach USD 1,022.26 million by 2035, growing from USD 738.85 million in 2025, at a CAGR of 3.3% during the forecast period.

The recombinant protein A resin segment is projected to hold the largest market share of 74.4% in 2025, supported by high binding capacity, durability, and wide applicability in therapeutic antibody production.

Antibody purification is expected to dominate the application segment with a market share of 74.9% in 2025, owing to its critical role in biopharmaceutical manufacturing and research workflows.

The agarose-based matrix segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2035, driven by its high biocompatibility, flow performance, and widespread use in monoclonal antibody purification.

Biopharmaceutical manufacturers are projected to register the fastest growth at a CAGR of 7.3% from 2025 to 2035, driven by rising biologics production and increased demand for high-efficiency purification platforms.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 4: Global Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 6: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 7: North America Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 8: North America Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 10: North America Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 11: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 12: Latin America Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 13: Latin America Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 14: Latin America Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 15: Latin America Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 16: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 17: Western Europe Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 18: Western Europe Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 19: Western Europe Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 20: Western Europe Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 21: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 22: Eastern Europe Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 23: Eastern Europe Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 24: Eastern Europe Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 25: Eastern Europe Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 29: South Asia and Pacific Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 30: South Asia and Pacific Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 31: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 32: East Asia Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 33: East Asia Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 34: East Asia Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 35: East Asia Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 36: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 37: Middle East and Africa Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 38: Middle East and Africa Market Value (USD Million) Forecast by Matrix, 2020 to 2035

Table 39: Middle East and Africa Market Value (USD Million) Forecast by Application , 2020 to 2035

Table 40: Middle East and Africa Market Value (USD Million) Forecast by End User, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Product, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Matrix, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Application , 2025 to 2035

Figure 4: Global Market Value (USD Million) by End User, 2025 to 2035

Figure 5: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 6: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 9: Global Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 12: Global Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 13: Global Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 14: Global Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 15: Global Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 16: Global Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 18: Global Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 21: Global Market Attractiveness by Product, 2025 to 2035

Figure 22: Global Market Attractiveness by Matrix, 2025 to 2035

Figure 23: Global Market Attractiveness by Application , 2025 to 2035

Figure 24: Global Market Attractiveness by End User, 2025 to 2035

Figure 25: Global Market Attractiveness by Region, 2025 to 2035

Figure 26: North America Market Value (USD Million) by Product, 2025 to 2035

Figure 27: North America Market Value (USD Million) by Matrix, 2025 to 2035

Figure 28: North America Market Value (USD Million) by Application , 2025 to 2035

Figure 29: North America Market Value (USD Million) by End User, 2025 to 2035

Figure 30: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 31: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 34: North America Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 38: North America Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 39: North America Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 40: North America Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 41: North America Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 43: North America Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 46: North America Market Attractiveness by Product, 2025 to 2035

Figure 47: North America Market Attractiveness by Matrix, 2025 to 2035

Figure 48: North America Market Attractiveness by Application , 2025 to 2035

Figure 49: North America Market Attractiveness by End User, 2025 to 2035

Figure 50: North America Market Attractiveness by Country, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) by Product, 2025 to 2035

Figure 52: Latin America Market Value (USD Million) by Matrix, 2025 to 2035

Figure 53: Latin America Market Value (USD Million) by Application , 2025 to 2035

Figure 54: Latin America Market Value (USD Million) by End User, 2025 to 2035

Figure 55: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 56: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 59: Latin America Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 62: Latin America Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 68: Latin America Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 71: Latin America Market Attractiveness by Product, 2025 to 2035

Figure 72: Latin America Market Attractiveness by Matrix, 2025 to 2035

Figure 73: Latin America Market Attractiveness by Application , 2025 to 2035

Figure 74: Latin America Market Attractiveness by End User, 2025 to 2035

Figure 75: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 76: Western Europe Market Value (USD Million) by Product, 2025 to 2035

Figure 77: Western Europe Market Value (USD Million) by Matrix, 2025 to 2035

Figure 78: Western Europe Market Value (USD Million) by Application , 2025 to 2035

Figure 79: Western Europe Market Value (USD Million) by End User, 2025 to 2035

Figure 80: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 81: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 84: Western Europe Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 87: Western Europe Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 90: Western Europe Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 93: Western Europe Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 96: Western Europe Market Attractiveness by Product, 2025 to 2035

Figure 97: Western Europe Market Attractiveness by Matrix, 2025 to 2035

Figure 98: Western Europe Market Attractiveness by Application , 2025 to 2035

Figure 99: Western Europe Market Attractiveness by End User, 2025 to 2035

Figure 100: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 101: Eastern Europe Market Value (USD Million) by Product, 2025 to 2035

Figure 102: Eastern Europe Market Value (USD Million) by Matrix, 2025 to 2035

Figure 103: Eastern Europe Market Value (USD Million) by Application , 2025 to 2035

Figure 104: Eastern Europe Market Value (USD Million) by End User, 2025 to 2035

Figure 105: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 106: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 109: Eastern Europe Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 112: Eastern Europe Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 115: Eastern Europe Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 118: Eastern Europe Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 121: Eastern Europe Market Attractiveness by Product, 2025 to 2035

Figure 122: Eastern Europe Market Attractiveness by Matrix, 2025 to 2035

Figure 123: Eastern Europe Market Attractiveness by Application , 2025 to 2035

Figure 124: Eastern Europe Market Attractiveness by End User, 2025 to 2035

Figure 125: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 126: South Asia and Pacific Market Value (USD Million) by Product, 2025 to 2035

Figure 127: South Asia and Pacific Market Value (USD Million) by Matrix, 2025 to 2035

Figure 128: South Asia and Pacific Market Value (USD Million) by Application , 2025 to 2035

Figure 129: South Asia and Pacific Market Value (USD Million) by End User, 2025 to 2035

Figure 130: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 131: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 134: South Asia and Pacific Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 137: South Asia and Pacific Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 140: South Asia and Pacific Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 143: South Asia and Pacific Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 146: South Asia and Pacific Market Attractiveness by Product, 2025 to 2035

Figure 147: South Asia and Pacific Market Attractiveness by Matrix, 2025 to 2035

Figure 148: South Asia and Pacific Market Attractiveness by Application , 2025 to 2035

Figure 149: South Asia and Pacific Market Attractiveness by End User, 2025 to 2035

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 151: East Asia Market Value (USD Million) by Product, 2025 to 2035

Figure 152: East Asia Market Value (USD Million) by Matrix, 2025 to 2035

Figure 153: East Asia Market Value (USD Million) by Application , 2025 to 2035

Figure 154: East Asia Market Value (USD Million) by End User, 2025 to 2035

Figure 155: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 156: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 159: East Asia Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 162: East Asia Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 165: East Asia Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 168: East Asia Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 171: East Asia Market Attractiveness by Product, 2025 to 2035

Figure 172: East Asia Market Attractiveness by Matrix, 2025 to 2035

Figure 173: East Asia Market Attractiveness by Application , 2025 to 2035

Figure 174: East Asia Market Attractiveness by End User, 2025 to 2035

Figure 175: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 176: Middle East and Africa Market Value (USD Million) by Product, 2025 to 2035

Figure 177: Middle East and Africa Market Value (USD Million) by Matrix, 2025 to 2035

Figure 178: Middle East and Africa Market Value (USD Million) by Application , 2025 to 2035

Figure 179: Middle East and Africa Market Value (USD Million) by End User, 2025 to 2035

Figure 180: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 181: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 184: Middle East and Africa Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 187: Middle East and Africa Market Value (USD Million) Analysis by Matrix, 2020 to 2035

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Matrix, 2025 to 2035

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Matrix, 2025 to 2035

Figure 190: Middle East and Africa Market Value (USD Million) Analysis by Application , 2020 to 2035

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Application , 2025 to 2035

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application , 2025 to 2035

Figure 193: Middle East and Africa Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 196: Middle East and Africa Market Attractiveness by Product, 2025 to 2035

Figure 197: Middle East and Africa Market Attractiveness by Matrix, 2025 to 2035

Figure 198: Middle East and Africa Market Attractiveness by Application , 2025 to 2035

Figure 199: Middle East and Africa Market Attractiveness by End User, 2025 to 2035

Figure 200: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Protein A Resins Market

Japan Protein A Resins Market Trends – Size, Share & Growth 2025-2035

India Protein A Resins Market Insights – Trends, Demand & Forecast 2025-2035

China Protein A Resins Market Report – Growth, Trends & Industry Outlook 2025-2035

Germany Protein A Resins Market Analysis – Demand, Innovations & Forecast 2025-2035

United States Protein A Resins Market Trends – Size, Share & Growth 2025-2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Protein Water Market Analysis by Product Type, Flavour, Packaging Type, Source and Distribution Channel Through 2035

Protein Labeling Market

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Protein Kinase B Inhibitors Market

Protein Crystallization and Crystallography Market Analysis - Growth & Forecast 2025 to 2035

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA