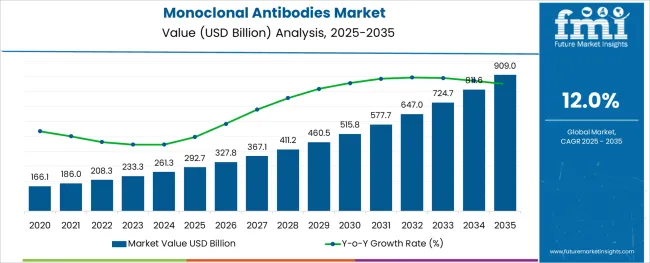

The Monoclonal Antibodies Market is estimated to be valued at USD 292.7 billion in 2025 and is projected to reach USD 909.0 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

The monoclonal antibodies market is experiencing robust growth driven by the rising prevalence of chronic diseases, increasing biologics approvals, and expanding oncology and autoimmune treatment pipelines. Advancements in recombinant DNA technology and antibody engineering have significantly improved production scalability and therapeutic specificity.

Moreover, pharmaceutical companies are actively expanding their monoclonal antibody portfolios to address unmet medical needs in cancer, infectious diseases, and inflammatory conditions. Regulatory agencies have accelerated approval pathways for monoclonal antibodies due to their targeted action and favorable clinical outcomes.

Ongoing investments in biomanufacturing infrastructure and strategic collaborations between biotech firms and research institutes are reinforcing market expansion. The future outlook remains positive as demand continues to rise for precision therapies that offer reduced side effects and higher efficacy across diverse therapeutic categories.

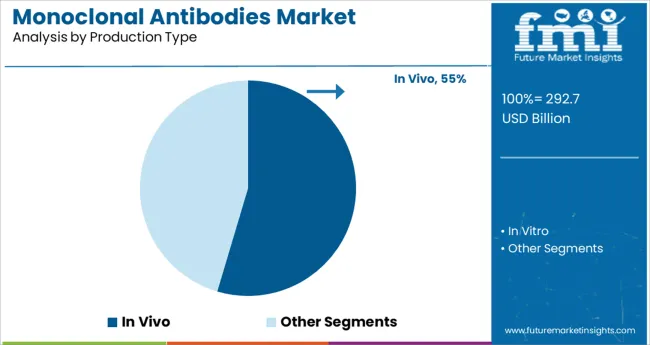

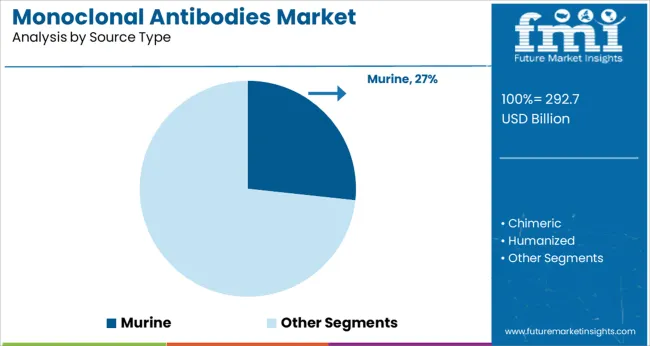

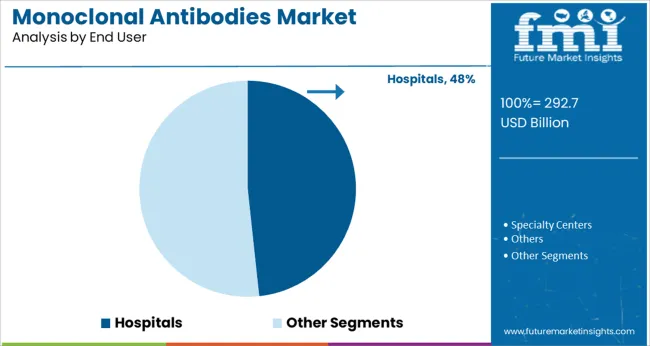

The market is segmented by Production Type, Source Type, End User, and Application and region. By Production Type, the market is divided into In Vivo and In Vitro. In terms of Source Type, the market is classified into Murine, Chimeric, Humanized, and Human. Based on End User, the market is segmented into Hospitals, Specialty Centers, and Others. By Application, the market is divided into Oncology, Autoimmune Diseases, Infectious Diseases, Neurological Diseases, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The in vivo segment is expected to account for 54.60% of total market revenue in 2025, making it the leading method under the production type category. This dominance is driven by its proven capability to produce high-yield, functional antibodies in a biologically active form.

The method remains preferred for commercial scale production due to its compatibility with hybridoma technology and cost effectiveness in traditional workflows. Despite emerging in vitro alternatives, in vivo methods continue to be adopted widely because of their established regulatory history, robust scalability, and reliable post-translational modification outcomes.

These attributes have reinforced its sustained use across therapeutic and diagnostic applications, ensuring its continued market leadership.

The murine segment is projected to hold 26.70% of overall revenue by 2025 under the source type category. This segment remains a key contributor due to its foundational role in monoclonal antibody development and accessibility for initial screening and discovery processes.

Murine antibodies have historically served as the starting point for chimeric and humanized antibody engineering. While fully human antibodies are gaining traction, murine derived products continue to offer research and cost advantages in preclinical applications.

Furthermore, their established use in diagnostics, particularly in immunoassays and imaging, has helped maintain their relevance. These consistent advantages have supported their position as a significant source in the monoclonal antibody landscape.

Hospitals are projected to contribute 48.30% of the market revenue by 2025 within the end user segment, solidifying their position as the primary channel for monoclonal antibody administration. This prominence is driven by the complexity of administration protocols, the need for infusion monitoring, and the high concentration of oncology and immunology treatments in clinical settings.

Hospitals offer the infrastructure required for managing biologic therapies, including cold chain logistics, patient observation, and emergency response capabilities. Additionally, most monoclonal antibody treatments are initiated under hospital supervision before transitioning to outpatient care or home infusion setups.

This has firmly positioned hospitals as the core point of delivery and care for monoclonal antibody-based therapies.

The global demand for Monoclonal Antibodies is projected to increase at a CAGR of 12% during the forecast period between 2025 and 2035, reaching a total of USD 909 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 6.1%.

Human mAbs offer efficient modulation in effector functions and are less immunogenic as compared to chimeric or humanized mAbs. Such antibodies can be produced through the use of phage display and hybridoma technologies in transgenic mice.

As a result, with recent technological progress in genetic engineering, the production of fully human mAbs is anticipated to gain traction in the near future.

Humanized mAbs are expected to reveal the fastest CAGR in the forecast period due to their widespread use against a broad range of target antigens such as cancer cells, immunosuppression, and immunomodulatory molecules.

Demand for such antibodies is also supported by their lower immunogenicity as compared to chimeric mAbs. However, these antibodies are more immunogenic as compared to human mAbs, which may restrict the market growth.

Extensive Uptake during the Pandemic Crisis for Developing Drugs provided a Major Boost in past years

In addition, the USA Department of Health and Human Services announced the distribution of at least 600,000 free bebtelovimab courses, along with an optional purchase of 500,000 additional doses in the future, thus creating new opportunities for growth of mAbs/Key advantages offered by mAb therapies over previous therapies in terms of specificity, effectiveness, and ease of delivery have led to numerous new product launches and approvals in this domain.

Over 100 mAb products have been approved by the US FDA and the scope of therapeutic mAb applications is expected to grow further due to the development of antibody fragments, antibody derivatives, and bispecific antibodies that offer advanced treatment options.

Increased Number of Strategic Initiatives Presenting Lucrative Opportunities for Monoclonal Antibodies

The market is also favored by the strategic initiatives undertaken by key players for the development and marketing of mAb products. For instance, in October 2024, T-Cure Bioscience, Inc. collaborated with Atlas Antibodies AB for the production and supply of CT83 mAbs.

Similarly, in January 2025, Ono Pharmaceutical Co., Ltd. and Neurimmune AG collaborated on the creation of mAb drugs against new therapeutic targets for neurodegenerative diseases. Such initiatives are expected to open new growth opportunities and positively affect market growth.

High Development Costs of Monoclonal Antibodies Hindering Growth

High costs associated with the development of mAbs and the resultant increase in prices for mAb therapeutics can impede market growth in the near future. For instance, COVID-19 treatment mAbs such as Regeneron’s REGEN-COV (casirivimab and imdevimab), and GlaxoSmithKline & Vir Biotechnology’s sotrovimab cost around USD 1,250 and USD 2,100 per infusion, respectively.

Such high drug prices can limit access to mAb therapies for large patient populations in developing countries and restrict mAbs adoption.

Expansion of the Healthcare Sector in the USA Will Drive the Adoption of Monoclonal Antibodies

North America recorded the largest market share of 46.2% in 2024 due to the presence of a highly developed healthcare infrastructure, high patient awareness, and growth in cancer research prospects, among other factors.

Moreover, increasing government expenditure for cancer research and the presence of key players such as Pfizer Inc., Amgen, Inc., and Merck & Co., among others, are expected to boost market growth.

Increasing Medical Tourism in Asia Pacific is Spurring Demand for Monoclonal Antibodies

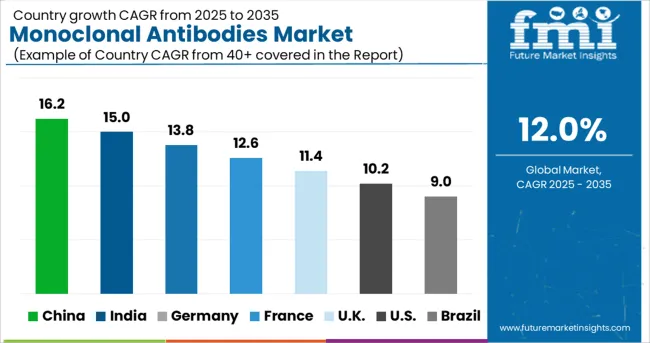

Asia Pacific region is projected to exhibit the fastest growth rate in the forecast period due to the increasing disposable income, availability of a large patient pool for mAb cancer therapeutics, and rising focus on healthcare.

Countries such as India and China offer attractive investment opportunities for clinical research and are anticipated to positively drive research and development prospects for mAbs.

In-vivo Production Type is expected to grow at a Significant Rate

In vivo production held the largest market share in 2024 due to its economic viability in long production runs and lower propensity for contamination with foreign antigens.

In addition, the availability of serum-free culture media and semi-permeable membrane-based systems has increased the feasibility of biomanufacturing operations and is likely to accelerate segment growth. However, the production type is limited by variations in hybridoma characteristics that can lead to the denaturation or inactivation of antibodies and restrict segment growth.

In vivo production type is expected to grow at a significant rate in the forecast period due to its highly cost-effective production as compared to in vitro techniques and its ability to produce a high concentration of mAbs.

These mAbs are used in the diagnostic industry, wherein cost considerations are of prime importance, and optimization of in vivo procedures can be done to increase the secretion of mAbs.

Demand for Monoclonal Antibodies in Hospitals to Gain Traction

The hospital end-use segment held the largest market share of 40.8% in 2024 due to the increasing adoption of mAbs for cancer treatment at hospitals.

Rising healthcare expenditure across the world, increasing patient awareness levels, and availability of advanced hospital infrastructure in developed countries are factors expected to result in the dominance of the segment during the forecast period.

Specialty centers accounted for a significant market share in 2024 due to the increasing government support in recent years. For instance, the National Cancer Institute’s Cancer Centers Program is establishing standards for transdisciplinary cancer centers focused on the prevention, diagnosis, and treatment of various types of cancers.

Such initiatives are expected to positively affect segment growth.

Oncology Segment to account for Dominant Application of Monoclonal Antibodies

The oncology segment dominated the applications market for mAbs and accounted for 50.1% of the market value in 2024. This can be attributed to the high number of regulatory approvals for mAbs aimed at cancer treatment.

The surge in the incidence of cancer is a key factor anticipated to drive the growth of mAbs therapeutics as these can have minimal adverse effects as compared to other drugs and chemotherapy interventions. Currently, available mAb therapeutics include those targeted against non-small cell lung, brain tumor, ovarian, breast, gastric, melanoma, colorectal, Hodgkin’s lymphoma, and others.

Applications of mAbs for the treatment of autoimmune diseases are projected to grow at a lucrative rate due to the increasing prevalence of autoimmune conditions such as rheumatoid arthritis.

Furthermore, with growth in the number of cytokine proteins identified in inflammatory pathways that can be targeted for disease mitigation, applications of mAbs in this domain are anticipated to witness growth.

Some of the start-ups in the monoclonal antibodies market include-

Key players in the Monoclonal Antibodies market are Novartis AG; Pfizer Inc; GlaxoSmithKline plc; Amgen Inc.; Merck & Co., Inc.; Daiichi Sankyo Company, Limited; Abbott Laboratories; AstraZeneca plc; Eli Lilly And Company; Johnson & Johnson Services, Inc. and many more.

| Report Attributes | Details |

|---|---|

| Market Value in 2025 | USD 292.7 billion |

| Market Value in 2035 | USD 909.0 billion |

| Growth Rate | CAGR of 12% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Production Type, Source Type, End-User, Application,Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa(MEA) |

| Key Countries Profiled | The US, Canada, Brazil, Argentina, Germany, The UK, France, Spain, Italy, Australia, New Zealand, China, Japan, South Korea, Singapore, Thailand, Indonesia, GCC, South Africa, Israel |

| Key Companies Profiled | Novartis AG; Pfizer Inc.; GlaxoSmithKline Plc.; Amgen Inc.; Merck & Co. Inc.; Daiichi Sankyo Company Limited; Abbott Laboratories; AstraZeneca Plc.; Eli Lilly & Company; Johnson & Johnson Services Inc.; Bayer AG; Bristol Myers Squibb; F. Hoffman-La Roche Ltd.; Viatris Inc.; Biogen Inc.; Thermo Fisher Scientific Inc.; Novo Nordisk A/S; Sanofi S.A. |

| Customization | Available Upon Request |

The global monoclonal antibodies market is estimated to be valued at USD 292.7 billion in 2025.

It is projected to reach USD 909.0 billion by 2035.

The market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types are in vivo and in vitro.

murine segment is expected to dominate with a 26.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Long-Acting Monoclonal Antibodies Market Insights – Trends & Forecast 2024-2034

Monoclonal Gammopathy of Undetermined Significance (MGUS) Management Market Size and Share Forecast Outlook 2025 to 2035

IVD Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Research Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Cardiolipin Antibodies Test Market

Phospho-specific Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA