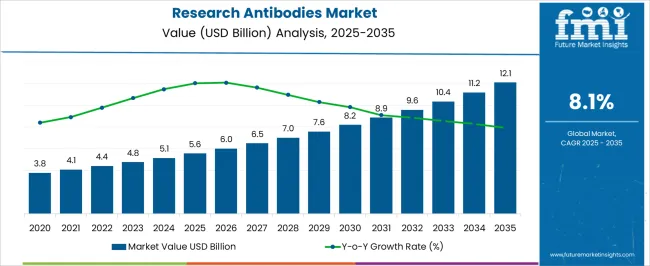

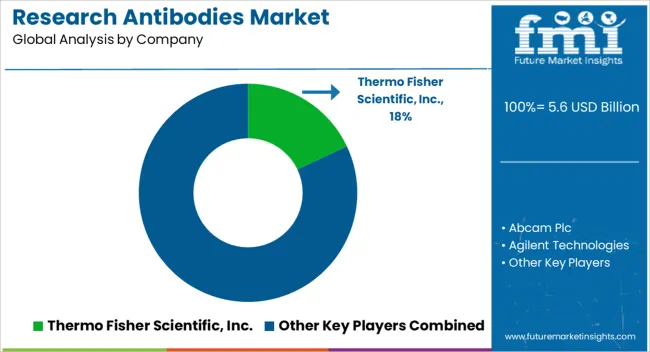

The Research Antibodies Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 12.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Research Antibodies Market Estimated Value in (2025 E) | USD 5.6 billion |

| Research Antibodies Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The research antibodies market is experiencing consistent expansion, supported by the increasing volume of proteomics and genomics research, rising demand for targeted therapeutics, and growing investment in academic and biopharmaceutical R&D activities. The surge in biomarker discovery, drug development pipelines, and high-throughput screening platforms has intensified the need for reliable, high-affinity antibodies.

Regulatory shifts favoring reproducibility in scientific research have led to greater scrutiny over antibody validation and specificity. As a result, the market has moved toward the adoption of well-characterized, high-performance antibodies developed through standardized manufacturing processes.

Technological advancements in hybridoma and recombinant platforms, alongside automation in antibody screening and labeling, have improved efficiency, reproducibility, and customization. Looking ahead, growth is expected to be driven by expansion in precision medicine, oncology research, and neurological disorder investigations that depend on antibody-based detection and quantification systems.

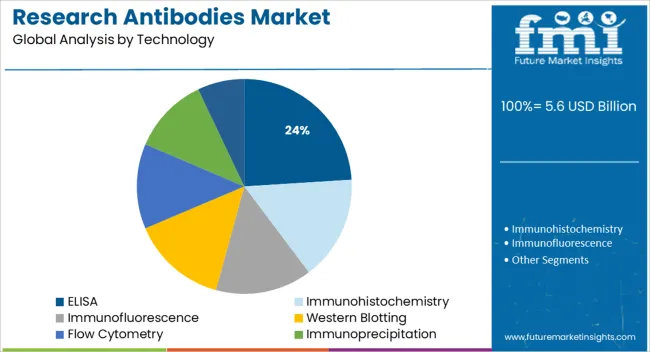

The market is segmented by Product Type, Type, Technology, and Source and region. By Product Type, the market is divided into Primary and Secondary. In terms of Type, the market is classified into Monoclonal Antibodies and Polyclonal Antibodies. Based on Technology, the market is segmented into ELISA, Immunohistochemistry, Immunofluorescence, Western Blotting, Flow Cytometry, Immunoprecipitation, and Other Technologies. By Source, the market is divided into Mouse, Rabbit, Goat, and Other Sources. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

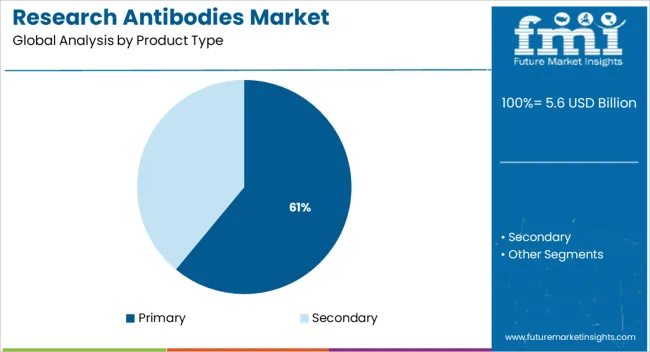

Primary antibodies are projected to hold 61.0% of the total market revenue in 2025, establishing them as the leading product type. This dominance is attributed to their direct interaction with target antigens, enabling greater specificity in protein detection and localization across diverse assay formats.

Their wide applicability in Western blotting, immunohistochemistry, flow cytometry, and ELISA has solidified their foundational role in both academic and commercial laboratories. Increased adoption of pathway-specific and disease-specific primary antibodies is being driven by the need for reliable molecular diagnostics and translational research outcomes.

Additionally, continued development of recombinant primary antibodies with enhanced affinity and batch-to-batch consistency is contributing to their sustained demand in regulated research environments.

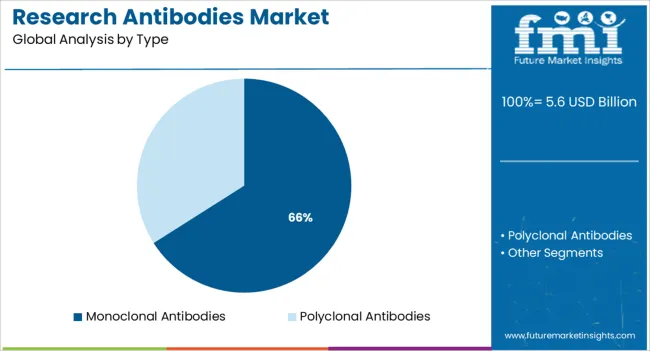

Monoclonal antibodies are expected to account for 66.0% of the total revenue share by 2025, making them the leading antibody type in the research segment. Their high specificity and affinity toward single epitopes have enabled improved reproducibility and minimal cross-reactivity, especially in clinical and pharmaceutical research settings.

The scalability of monoclonal antibody production through hybridoma and recombinant DNA technology has ensured consistent quality and reduced variability in experiments. Increasing preference for monoclonal formats in diagnostic development, therapeutic screening, and biomarker validation is being reinforced by their ability to bind with high precision to known targets.

The expansion of monoclonal libraries and engineered variants such as bispecific antibodies is further strengthening this segment’s role in next-generation research applications.

ELISA-based applications are projected to hold 24.0% of the total research antibodies market share in 2025, positioning this technology as the most widely adopted for quantitative detection. The dominance of ELISA stems from its cost-effectiveness, sensitivity, and compatibility with both monoclonal and polyclonal antibodies.

It has become a standard tool for cytokine measurement, antibody titration, and antigen quantification across drug discovery, infectious disease research, and vaccine development. Automation and multiplexing capabilities have enhanced ELISA throughput, reducing assay time and increasing reliability.

Additionally, ease of data interpretation and protocol standardization have made ELISA highly favored in academic institutions and CROs alike. As demand rises for high-throughput immunoassays that provide accurate, reproducible results, ELISA is expected to remain integral to core research workflows.

The market in the United States is expected to expand at an 8.3% CAGR between 2025 and 2035. This developmental rate is significantly higher than the historical rate of 6.5% from 2020 to 2024. In the next ten years, the USA market is anticipated to support the largest absolute dollar opportunity of USD 1.5 Billion.

The growing emphasis on biomedical, stem cell, and cancer research has been a major factor contributing to the substantial market in the United States. The increased incidence of cardiovascular and blood diseases is likely to contribute to its growth.

The growing acceptance and utilization of Research Antibodies have generated a competitive environment among industry stakeholders.

Furthermore, the fundamental approaches of huge companies such as mergers, partnerships, and acquisitions are expected to increase sales volume and intensify competition. To uphold their dominant position, the industry leaders are working to develop cost-effective antibodies by investing heavily in R&D.

Abcam Plc, Agilent Technologies, Bio-rad Laboratories, Becton Dickinson & Company, Cell Signalling Technology, Inc., F. Hoffmann La Roche Ltd., Lonza Group, Merck Millipore, Perkinelmer Inc., and Thermo Fisher Scientific, Inc. are the key players in the market in the Research Antibodies Market.

With the aging populace added to the increasing prevalence of neurodegenerative diseases, the limited success of preventative treatments, the attractiveness of advancing healthcare services, and greater funding for genomic research, the demand for biographical antibodies has seen a tremendous upsurge recently.

As per the Research Antibodies Market report published by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market of Research Antibodies grew at a CAGR of 6.6% while the projected growth stands at a CAGR of 8.1% during the period between 2025 and 2035.

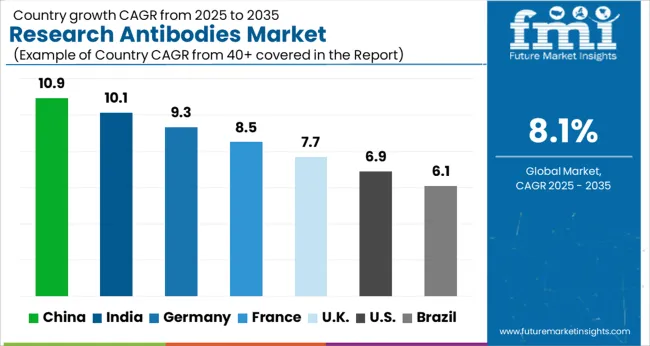

The global market is valued at USD 5.6 Billion in 2025 and is expected to reach the valuation of USD 12.1 Billion by the end of 2035. USA is likely to dominate the market for Research Antibodies with nearly 29% stake in the global market rising at a CAGR of 8.3% during the period between 2025 and 2035. The market in Japan and China is expected to grow at the highest CAGR of 10.8% and 10.6% respectively during 2025 to 2035.

Western Blotting segment leads the global market for Regenerative Antibodies by growing at a CAGR of 7.6% during 2025 to 2035.

The rising prevalence of neurodegenerative illnesses, the ageing population, the lack of viable treatments, and increased funding for genomics research have all contributed to a significant increase in demand for research antibodies.

The rising prevalence of neurodegenerative disorders like Huntington's disease, Multiple Sclerosis, and Parkinson's disease is spurring neurobiology research market.

Due to a dearth of alternative therapy choices, research antibodies are in high demand to create personalised medicines, improved therapies, and effective treatments. With the onset of pandemic, the global pharmaceutical giants got an option to invest heavily in R&D to produce novel vaccines, treatment techniques, and diagnostic kits.

Another factor expected to enhance market expansion is increased funding supplied by government entities and private companies for proteomics and genomics research. With the help of genomic technologies, the scientists were able to identify the root causes of death.

Emerging markets are projected to provide new growth prospects for large research antibody makers. Growth in the biopharmaceutical industry, as well as rising R&D spending in emerging regions, could lead to new opportunities in the research antibody market.

Rising cases of cancer have significantly pushed the demand for research antibodies. As a result of increased investment in stem cells related research activities, the market for Research Antibodies surged.

The USA dominates the global market for Research Antibodies with a significant market share of around 29% in 2035.

This market is expected to increase at a projected CAGR of 8.3% during the period between 2025 and 2035. This growth is significantly higher than the historical growth of just 6.5% during 2020-2024. The USA market is expected to offer the largest absolute dollar opportunity of USD 5.6 Billion in the next 10 years.

A growing emphasis on biomedical, stem cell and cancer research is a key contributor to the large market in USA Its growth is likely to be fuelled by the increased prevalence of cardiovascular and blood diseases. As per the American Cancer Society Report, in the United States, approximately 1.8 Million new cancer cases were diagnosed and 606,520 new deaths were reported. These stats amplify the need for cancer and stem cell research which leads to an increased adoption rate of modern research antibodies products.

The USA is the largest contributor in the global Research Antibodies market with an absolute dollar opportunity of USD 5.6 Billion in the upcoming 10 years. Furthermore, Japan and China are leading the market in terms of high CAGR of 10.8% and 10.6% respectively for the period between 2025 and 2035.

Western Blotting segment leads the global market share with the majority stake growing at a CAGR of 8.8% during the forecast period. This segment is expected to grow significantly as compared to its historic CAGR of just 6.5%. This technology is widely used due to the rising prevalence of disorders with limited treatment alternatives.

Due to the increased precision afforded by the western blotting technique, it is increasingly being favoured over all the other technologies for diagnosing HIV antibodies including ELISA testing and flow cytometry.

The Primary product segment is the largest contributor to the global Research Antibodies Market with an expected CAGR of 8.4% during the period between 2025 and 2035. This growth has been significantly higher than the historical growth of 7.1%.

The increasing acceptance and implementation of Research Antibodies has created a competitive environment among industry players. Furthermore, the large corporations' fundamental strategies of mergers, partnerships, and acquisitions are expected to expand market share and intensify competition. In order to maintain their dominant position, the leading firms are working on building cost-effective antibodies by investing highly in R&D domain.

The key competitors in Research Antibodies Market are Abcam Plc, Agilent Technologies, Bio-rad Laboratories, Becton Dickinson & Company, Cell Signalling Technology, Inc., F. Hoffmann La Roche Ltd., Lonza Group, Merck Millipore, Perkinelmer Inc., and Thermo Fisher Scientific, Inc.

Some of the key developments in the Global research Antibodies Market being channelized by market players are as follows:

Similarly, recent developments related to companies offering Research Antibodies have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Quantitative Units | In USD Billion |

| Key Regions Covered | North America; Latin America; Europe; APAC and MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Russia, China, Japan, India, South Korea, Australia, South Africa, Saudi Arabia, UAE, Israel |

| Key Market Segments Covered | Product Type and Region |

| Key Companies Profiled | Abcam Plc; Agilent Technologies; Bio-rad Laboratories; Becton Dickinson & Company; Cell Signalling Technology, Inc.; F. Hoffmann La Roche Ltd.; Lonza Group; Merck Millipore; Perkinelmer Inc.; Thermo Fisher Scientific, Inc. |

| Pricing | Available upon Request |

The global research antibodies market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the research antibodies market is projected to reach USD 12.1 billion by 2035.

The research antibodies market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in research antibodies market are primary and secondary.

In terms of type, monoclonal antibodies segment to command 66.0% share in the research antibodies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Research And Development (R&D) Analytics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

IVD Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Monoclonal Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Cardiolipin Antibodies Test Market

Phospho-specific Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Long-Acting Monoclonal Antibodies Market Insights – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA