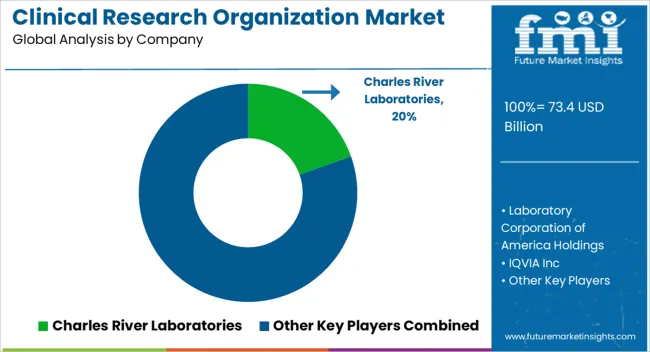

The Clinical Research Organization Market is estimated to be valued at USD 73.4 billion in 2025 and is projected to reach USD 164.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Clinical Research Organization Market Estimated Value in (2025 E) | USD 73.4 billion |

| Clinical Research Organization Market Forecast Value in (2035 F) | USD 164.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The clinical research organization market is expanding steadily due to the rising demand for outsourced research services, increasing complexity of drug development, and the growing pipeline of biologics and specialty medicines. Pharmaceutical and biotechnology companies are leveraging CRO partnerships to reduce costs, accelerate timelines, and gain access to specialized expertise.

Regulatory pressures and the high expense of in-house research infrastructure have further supported outsourcing trends. Advancements in clinical trial technologies including AI-driven patient recruitment, virtual trial platforms, and advanced data analytics are reshaping efficiency across the clinical development value chain.

Moreover, globalization of clinical trials and the need for diverse patient populations are encouraging companies to collaborate with CROs that have broad international reach. The outlook remains positive as CROs continue to evolve into strategic partners offering integrated, end-to-end solutions for discovery, development, and post-marketing studies.

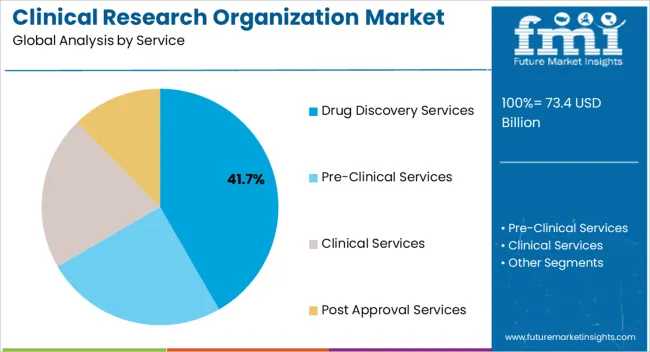

The drug discovery services segment is projected to account for 41.70% of total revenue by 2025 within the service category, making it the leading segment. This dominance is attributed to the increasing demand for novel therapeutic candidates, rapid advancements in biologics and biosimilars, and the rising costs associated with maintaining in-house discovery platforms.

CROs provide advanced screening technologies, bioinformatics expertise, and early-stage validation capabilities, enabling pharmaceutical firms to accelerate pipelines while controlling costs.

The availability of specialized infrastructure and domain expertise has reinforced the reliance on CROs for discovery activities, positioning this segment at the forefront of growth.

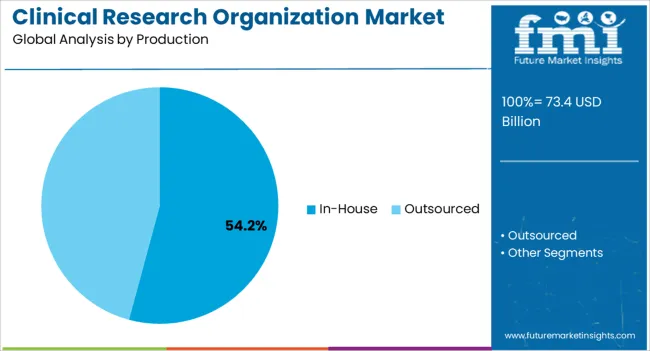

It is noted that the in-house production segment is expected to contribute 54.20% of total market revenue by 2025 under the production category. This leadership is being driven by large pharmaceutical and biotechnology firms maintaining control over critical production processes to safeguard intellectual property and ensure quality standards.

In-house operations allow for tighter oversight of manufacturing protocols, supply chain management, and regulatory compliance. Additionally, investment in advanced manufacturing technologies and flexible production systems has enabled efficient scaling of clinical trial materials.

As regulatory scrutiny on production processes intensifies, organizations are prioritizing in-house models to guarantee consistency and risk mitigation, thereby consolidating this segment’s dominance.

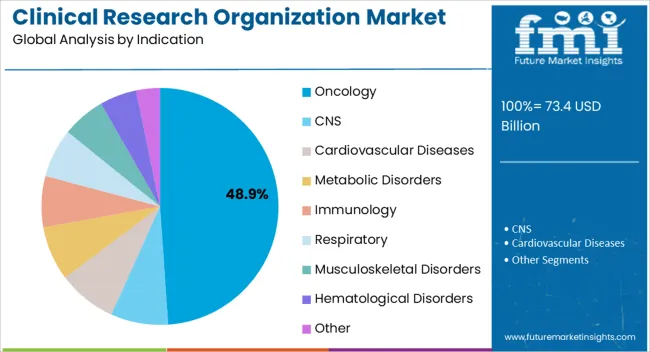

The oncology segment is projected to represent 48.90% of total revenue by 2025 within the indication category, establishing it as the leading application area. This growth is driven by the increasing global burden of cancer, rising investment in immuno-oncology and targeted therapies, and the expansion of personalized medicine approaches.

Oncology trials are complex, costly, and lengthy, making CRO partnerships essential for optimizing design, patient recruitment, and regulatory navigation. Advances in biomarkers and companion diagnostics have further intensified the need for specialized oncology expertise within CRO frameworks.

With oncology accounting for a substantial share of drug pipelines worldwide, this indication remains the dominant focus area in CRO service demand.

Sales of the market grew at a CAGR of 6.4% between 2020 to 2025.

With a historical forecast of stable growth, the clinical research organization (CRO) industry has seen significant growth in recent years. The rise in demand for outsourced clinical trials from pharmaceutical, biotechnology, and medical device businesses is what is causing this surge.

The clinical research organization (CRO) market is anticipated to maintain its growth trajectory in the upcoming years, according to the projection. The expansion of the CRO market is anticipated to be fueled by an increase in clinical trials, a rise in the need for personalized medication, and the prevalence of chronic diseases. Various clinical trial processes, including patient recruiting and retention, data analysis, and medication discovery, are using these technologies.

Considering this, FMI expects the global clinical research organization market to grow at a CAGR of 8.4% through the forecasted years.

CROs can provide specialized services for carrying out clinical studies in this field as personalized medicine and targeted medicines gain popularity. This covers the identification of biomarkers, patient screening, and customized trial planning. CROs now have more potential due to the use of real-world data and virtual trials.

Companies with expertise in these fields can provide pharma/biotech firms with specialized services and assistance for real-world research as well as for virtual studies, which can shorten the trial duration and expense. It can also include telemedicine and digital health technology in clinical trials to raise study compliance, increase patient participation, and offer ongoing monitoring. CROs can be assisted in adopting these technologies and incorporating them into clinical trial designs by businesses offering specialised services.

They are now also able to provide specialized services in data analytics and machine learning due to the increased availability of real-time data in clinical trials. To do this, one can employ predictive analytics to foresee dangers, spot trends, and improve study design, which thereby helps in the growth of the global market.

Ensuring compliance with regulatory regulations is one of the biggest issues for CRO businesses. Navigating through each nation's unique legislation can be time-consuming and expensive. To make sure that all applicable regulations are followed, CROs must have a strong regulatory staff.

Companies in the pharma and biotech industries are increasingly looking for CROs that can offer services at a low cost without sacrificing quality or timeliness. To remain competitive, CROs may need to modify their pricing strategies and business models in response to margin concerns.

Large-scale multicenter trials might be difficult to finance since there is sometimes a lack of funding for clinical trials. To maximize the cost-effectiveness of clinical studies, sponsors, researchers, and CROs must collaborate due to the high cost of drug development and growing cost constraints.

The capabilities of CROs may also be constrained by a lack of highly skilled workers, including researchers, data administrators, and statisticians. Lack of qualified personnel may cause inefficiencies, delays in hiring and retaining staff, and a general decline in the quality of project outputs.

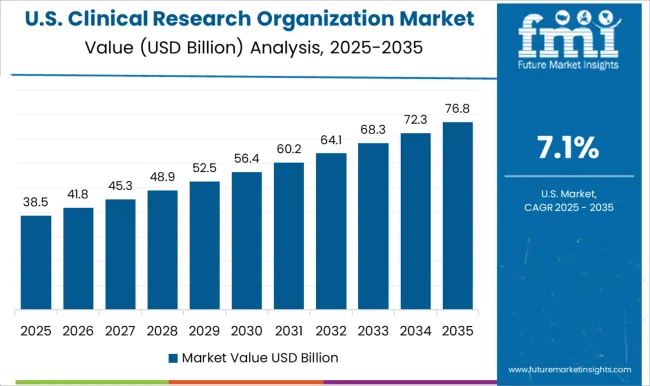

The USA clinical research organization market is expected to register 32.0% in the global market in 2025.

There are several life science businesses in the United States, and these businesses are embracing innovations in clinical research. CROs that offer these services are in demand as technological innovations like telemedicine and virtual trials are used more frequently. Drug development efforts by biotech and pharmaceutical firms are increasing in the USA These businesses are turning more and more to CROs for assistance, including access to facilities and programs for current patients, enrollment and recruiting information, personalized protocol design, higher trial completion rates, and lower costs.

China accounted for around 9.3% market share in 2025 globally.

The clinical research organization (CRO) market in China is expanding due to several factors. The rapidly ageing and expanding Chinese population is a significant contributing element, which has raised demand for cutting-edge medical cures and treatments. Furthermore, recent reforms and laws adopted by the Chinese government have made it simpler to conduct clinical trials and research there.

The government has put in place many steps to hasten the regulatory approval procedure for novel pharmaceuticals and therapies, luring multinational companies to locate their research and development operations in the nation. Additionally, the development of healthcare and rising income levels in China have raised the demand for advanced healthcare services, such as clinical research and triage.

India holds a 7.4% value share in the global market in 2025.

The clinical research organization (CRO) market is expanding in India for a variety of reasons. Large and diversified patient populations are a significant contributing element, which makes India a desirable location for carrying out clinical studies. Due to the country's accessible healthcare services and cheaper cost of living, clinical trials in India are also more economical than in many other nations.

The supportive regulatory environment created by the Indian government, which promotes clinical research activities by streamlining the approval procedure for clinical trials and cutting the time needed to secure regulatory approvals, is another important aspect. More foreign money has also been invested in India's clinical research sector as a result of the rise in medical tourism there.

The post-approval services segment held the major chunk of about 45.7% of the global market by the end of 2025.

A key factor in the expansion of the clinical research organization (CRO) market is post-approval services. Post-approval services are the actions taken after regulatory bodies or authorities have given their clearance for the use of a product or therapy. These services are essential for maintaining the product's safety and effectiveness as well as for carrying out additional studies that could increase the product or therapy's effectiveness.

In order to diversify their service portfolio and give their clients value-added services, several CROs offer post-approval services. Pharmacovigilance, medical monitoring, safety monitoring, data management, statistical analysis, quality assurance, and regulatory compliance are a few examples of the services that may be provided.

The In-house production segment contribute 58.3% share of the global market in 2025.

The term in-house describes a method of conducting all phases of clinical research within a single organization, often comprising study design, data management, monitoring, and statistical analysis. Clinical research organizations (CRO) market development is still mostly fueled by internal clinical research conducted by pharmaceutical and biotech corporations. The in-house methodology has several benefits, including more control over studies, quicker decision-making, and reduced reliance on outside suppliers.

A pharmaceutical or biotech company's ability to quickly and efficiently react to any noteworthy events or changes in the study protocol can be facilitated by in-house clinical research, which provides better control over study data and technological competence.

The oncology by indication segment accounted for a revenue share of 23.4% in the global market at the end of 2025.

One of the markets for clinical research organizations (CROs) that is expanding the quickest is oncology, which has had a big impact on the development of the sector. Cancer research is an appealing subject for CROs to concentrate their attention on because it is a complex and fast-developing field of medicine that calls for a high degree of knowledge and resources.

Many variables, such as the rising cancer burden globally, developments in molecular biology and genomics, and the creation of more advanced and novel immuno-oncology medicines, all contribute to the expansion of oncology research and the CRO business. The need for more advanced oncology therapies that can address patients' complicated requirements is growing as cancer rates are expected to keep rising.

The pharmaceutical and biotechnology companies hold a share of 45.6% of the global market in 2025.

The market for clinical research organizations (CROs) is expanding mostly due to the efforts of the pharmaceutical and biotechnology industries. These businesses invest a lot of money in the discovery of novel treatments and medications, and they frequently contract out some or all of the clinical research work to CROs to increase productivity and access to funding.

A great deal of financing for clinical research studies-particularly those involving new medicinal compounds-comes from pharmaceutical and biotech corporations. These businesses frequently look to collaborate with CROs who can offer specialized knowledge in research design, data administration, and general project management.

Pharmaceutical and biotech companies can shorten the time it takes to develop new drugs by outsourcing clinical trial efforts to CROs and concentrating internal resources on core research and development tasks.

The market's key vendors are concentrating on diversifying their product offerings to strengthen their market share in clinical research organizations and to broaden their presence in developing nations. Pricing strategies, market strategies, technology improvements, regulatory compliance, and acquisition and distribution agreements with other companies to extend their business are the main tactics used by manufacturers to acquire a competitive edge in the market.

For instance:

Similarly, recent developments have been tracked by the team at Future Market Insights related to companies in the clinical research organization market space, which are available in the full report

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East; and Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, UK, France, Italy, Spain, Russia, BENELUX, Nordics, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Philippines, Vietnam, Australia, New Zealand, Türkiye, South Africa, North Africa, and GCC Countries |

| Key Segments Covered | Service, Production, Indication, End User, and Region |

| Key Companies Profiled | Charles River Laboratories; Laboratory Corporation of America Holdings; IQVIA Inc; Parexel International Corporation; ICON plc.; Medpace, Syneos Health; CTI Clinical Trial and Consulting Services; Neuroservices Alliance; QPS Neuropharmacology; MD Biosciences; EphyX Neuroscience |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global clinical research organization market is estimated to be valued at USD 73.4 billion in 2025.

The market size for the clinical research organization market is projected to reach USD 164.3 billion by 2035.

The clinical research organization market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in clinical research organization market are drug discovery services, pre-clinical services, clinical services and post approval services.

In terms of production, in-house segment to command 54.2% share in the clinical research organization market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Research Publication Support Service Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Research And Development (R&D) Analytics Market Size and Share Forecast Outlook 2025 to 2035

Research Antibodies Market Size and Share Forecast Outlook 2025 to 2035

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Next-Generation Sequencing (NGS) Data Analysis Market Analysis by Solution and Services, Technology, End User, and Region through 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA