The clinical trial biorepository & archiving solution market is advancing steadily, propelled by the rising complexity of clinical trials, growing global regulatory requirements, and the increasing volume of biological samples generated from pharmaceutical and biotechnological research. Industry disclosures and annual reports have emphasized the critical need for secure, compliant, and long-term storage of biospecimens and trial documentation to support retrospective analysis and regulatory audits.

Biopharmaceutical sponsors and CROs have invested in purpose-built biorepository infrastructure featuring temperature-controlled environments and advanced tracking systems. Additionally, the global expansion of multi-site clinical trials has necessitated centralized archival solutions that ensure data integrity and traceability over extended periods.

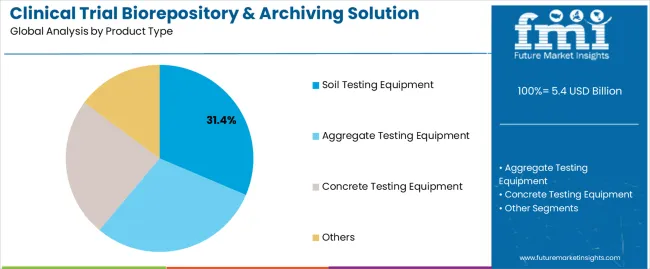

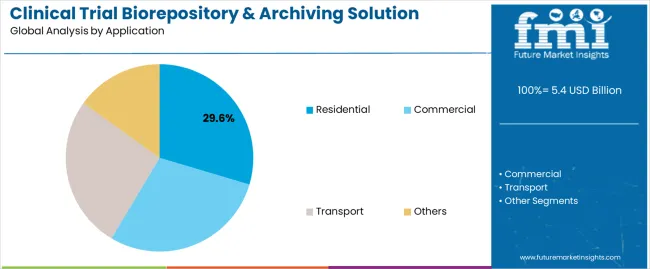

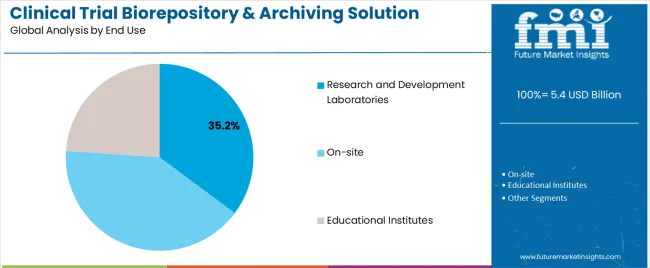

Market players are also developing digital archiving platforms integrated with AI-enabled data retrieval and compliance features. Looking forward, market growth is expected to be supported by increasing R&D activity in precision medicine, cell and gene therapies, and biologics. Segmental growth is forecast to be LED by Soil Testing Equipment as the key product category, Residential as the leading application area, and Research and Development Laboratories as the primary end-use environment.

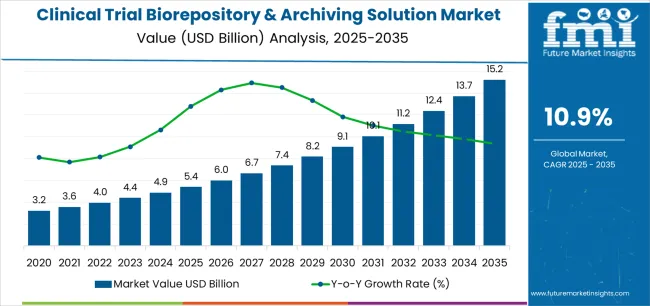

| Metric | Value |

|---|---|

| Clinical Trial Biorepository & Archiving Solution Market Estimated Value in (2025 E) | USD 5.4 billion |

| Clinical Trial Biorepository & Archiving Solution Market Forecast Value in (2035 F) | USD 15.2 billion |

| Forecast CAGR (2025 to 2035) | 10.9% |

The market is segmented by Product Type, Application, and End Use and region. By Product Type, the market is divided into Soil Testing Equipment, Aggregate Testing Equipment, Concrete Testing Equipment, and Others. In terms of Application, the market is classified into Residential, Commercial, Transport, and Others. Based on End Use, the market is segmented into Research and Development Laboratories, On-site, and Educational Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Soil Testing Equipment segment is projected to account for 31.4% of the clinical trial biorepository & archiving solution market revenue in 2025, holding the leading share within the product type category. Growth of this segment has been influenced by the adaptation of soil testing instruments for environmental monitoring and contamination control within clinical trial facilities.

These tools have been used to ensure site compliance with storage regulations by monitoring particulate matter, chemical residues, and microbial presence that could affect biospecimen integrity. Facility audits and risk mitigation strategies have encouraged investment in auxiliary testing equipment, including soil testing systems, for environmental qualification of storage and archiving sites.

Additionally, the broader adoption of sustainability standards and contamination-free research environments has underscored the role of soil testing equipment in ensuring biospecimen preservation under optimal conditions. This segment's presence reflects an evolving approach to holistic environmental management within biorepositories.

The Residential segment is expected to contribute 29.6% of the market revenue in 2025, emerging as the leading application segment within the biorepository and archiving solution space. Growth of this segment has been driven by the rise of decentralized clinical trials and at-home sample collection protocols, which have been increasingly adopted to improve trial accessibility and patient enrollment.

Biopharmaceutical companies and clinical research organizations have expanded home-based clinical trial frameworks, requiring secure and compliant sample storage and interim archiving solutions within residential settings. This trend has gained traction following global health disruptions, where remote data and sample collection became a necessary component of trial continuity.

Furthermore, technological advancements in portable storage units and cold-chain logistics have facilitated safe and monitored storage of clinical samples from patients’ homes. As digital health models and patient-centric trial designs become more prevalent, the Residential segment is anticipated to maintain a key role in the future clinical trial infrastructure.

The Research and Development Laboratories segment is forecasted to lead the market with 35.2% of revenue share in 2025, maintaining its position as the largest end-use category. This segment’s growth has been supported by the high volume of biospecimen generation, analytical documentation, and preclinical research data requiring long-term storage and regulated archiving.

R&D labs, particularly in pharmaceutical and biotechnology firms, have adopted biorepository solutions to streamline specimen tracking, ensure audit readiness, and facilitate data retrieval for late-phase analysis or drug repurposing efforts. Clinical trial protocols increasingly demand reproducibility and longitudinal studies, prompting laboratories to invest in compliant archiving systems that align with FDA and EMA storage mandates.

Additionally, research collaborations and multicenter studies have created a growing need for centralized digital archives that can be accessed remotely. With increasing investment in biologics and personalized medicine, Research and Development Laboratories are expected to remain the cornerstone of demand for integrated biorepository and archiving solutions.

Following is a table that illustrates the predicted CAGR for clinical trial biorepository and archiving solutions over several semi-annual periods from 2025 through 2035. In the first half of the decade (2025-2035), a CAGR of 12.5% is predicted, with a slightly lower growth rate of 12.1% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 12.5% (2025 to 2035) |

| H2 | 12.1% (2025 to 2035) |

| H1 | 11.5% (2025 to 2035) |

| H2 | 10.8% (2025 to 2035) |

The annual CAGR is predicted to reach 11.5% in the first half of 2025 and remain relatively low at 10.8% in H2 2035.

Research Activities and New Medications will Fuel the Growth of the Clinical Trial Biorepository & Archiving Solution Market

Green initiatives have been implemented by some stakeholders to reduce the environmental impact of biorepository operations in response to growing concerns regarding sustainability. Utilizing sustainable packaging materials, energy-efficient storage methods, and disposing of samples in a sustainable manner include recycling samples.

As players realize that patient engagement and informed consent are crucial to biobanking, they are adopting tactics to increase participatory knowledge and involvement. Patients and researchers may also communicate through the creation of patient centered permission forms, educational materials, and channels of communication.

To facilitate interoperability and data exchange between clinical trial networks and research institutions, players are aiming to set standards and simplify data formats.

The process involves using common data elements (CDEs) to describe clinical and biological data and compiling minimum information about biobanks in accordance with industry standards like the Minimum Information About a Biobank (MIABIS).

The discovery of new treatments and medications, particularly in infectious diseases, neurology, and oncology, has fueled the growth of biorepository services worldwide. Increasing genomic research interest and the need to store large amounts of genetic material has LED to the development of advanced biorepository systems for DNA, RNA, and other biomolecules.

Market Trends in Clinical Trial Archiving Solutions

The trend towards digitizing documents and developing automated tools to track and manage samples is a major trend. An automated system ensures better tracking and retrieval of samples, increases efficiency and reduces the chance of human error.

The threat of cyberattacks, particularly in the form of hacking, has made it increasingly important to improve data security procedures. Security and integrity of clinical trial data are ensured through the use of blockchain technology, sophisticated access controls, and advanced encryption.

In the wake of the COVID-19 pandemic, decentralized and remote clinical trials have become more prevalent. Biorepositories offer services that allow remote biological sample collection, protection, and transportation to be easier and more efficient.

Environmentally sustainable practices are becoming more prevalent in biorepository management, such as energy-efficient equipment, recycling of materials, and innovative storage solutions.

Biorepository solutions are becoming more integrated with bioinformatics capabilities. With this integration, researchers are able to analyze data more effectively, utilize samples more efficiently, and gain a deeper understanding of their findings.

Opportunity for Clinical Trial Biorepository & Archiving Solution

As preclinical products are increasingly needed, especially in personalized and genomic medicine, biorepositories and archiving systems are becoming more in demand.

The expansion of biochemical sample management and data preservation is driving this development. Integrating LIMS software to manage laboratory samples improves data management skills. With this integration, data collection and analysis will be more effective and precise, resulting in market growth.

Using modern technologies, such as neural networks, machine learning, and artificial intelligence, to enhance the ability of biorepositories to administer and analyze data is a significant step forward. Data collection and analysis will become more efficient and precise with this integration, resulting in a market boom.

Biorepositories and archives that comply with clinical trial data storage regulations are becoming increasingly important. Offering compliance services can add value by ensuring compliance with international regulations.

Regulatory Complexity and High Cost Regarding Clinical Trial Biorepository & Archiving Solution Could Limit Market Growth

Costs for clinical trial biorepository and archiving solutions include refrigeration services, tracking specimen temperatures, inventory management, and equipment management.

The lower cost of storage and cold-chain operations may pose a challenge for smaller pharmaceutical companies, so they may seek to outsource these functions in order to maximize their pharmaceutical research and development resources.

To maintain biological samples for an extended period, the clinical trials biorepository should have all the necessary facilities and expertise. This involves adhering to industry best practices in governance, workflow, and specimen handling. Multi-site initiatives can pose challenges in terms of coordinating and standardizing biorepository procedures.

For monitoring the location, use, and condition of samples, tracking them over time is crucial, however, these systems are often difficult to implement and expensive. Biomedical research has become increasingly complex as sports injuries and orthopedic disorders have become more common. Large numbers of samples pose challenges, especially in terms of storage and management.

The clinical trial biorepository & archiving solution industry experienced a CAGR of 12.1% during the historical period between 2020 and 2025. The value of the clinical trial biorepository & archiving solution industry increased from USD 2,307.9 billion in 2020 to USD 4,398.2 million in 2025.

Market penetration of digital archiving solutions in clinical trial management has become more prevalent in biorepositories, and security and privacy have improved. The deployment of robust cyber security measures and adherence to regulations such as HIPAA (Health Insurance Portability and Accountability Act) can help protect the privacy of patients as well as sensitive information that is processed by the organization.

Technological advancements have enabled the development of methods to store samples that maintain their integrity. Temperature regulation and light protection can be achieved using modern refrigeration and monitoring systems.

A variety of technologies, such as barcodes and RFID, have revolutionized the tracking of samples in biorepositories. The ability to track samples precisely and effectively with the help of these systems further reduces the possibility of errors and contributes to increased productivity.

Biorepositories are using database and informatics systems to manage data efficiently. The information related to biospecimens can be tracked, managed, and retrieved with the help of such systems, making it easy to access and organize.

As a result of the creation of digital inventory platforms, sample storage has become simpler and more efficient. Data on these platforms can be securely stored, documents can be easily edited, and monitoring can be integrated into the process, improving sample integrity, safety, efficacy, and security.

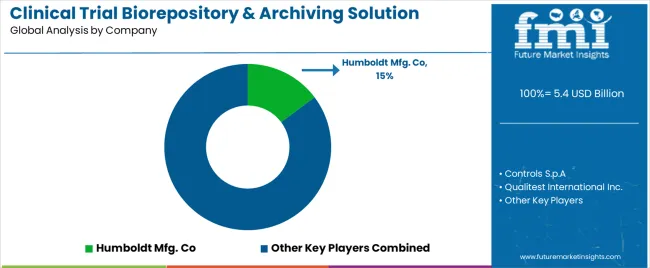

The top tier 1 companies hold a 45.7% share of the global market. Due to their global reach, extensive service offerings, and robust infrastructure, the tier 1 players dominate the market. Biorepositories and archiving solutions under their control set the industry standard for quality and innovation.

Players offer a wide range of services, from clinical trial management to biorepository solutions. They utilize an extensive global network and advanced technologies to offer innovative solutions to meet the needs of clients. Prominent companies in Tier 1 include LabCorp Drug Development and Charles River Laboratories.

In Tier 2, mid-sized players hold 29.7% of the market share and hold a strong influence in particular regions. Several Tier 2 players are expanding rapidly, gaining market share, and becoming more competitive. Although these companies usually offer high-quality services and have close client relationships, their global network may not be as extensive as that of Tier 1 players. Personalized medicine treatments are provided by the organization as part of its customized biorepository service. Tier 2 companies include Q2 Solutions, Medpace, and Precision for Medicine, Inc.

In Tier 3, the majority of companies are small businesses serving niche markets. Tier 3 companies typically supply Tier 2 companies with raw materials or basic components.

A Tier 3 player specializes in niche markets and caters to specialized needs. Although they may excel in certain fields, they are not able to influence the market as much as higher-tier firms. Players include Brooks Life Science, ATCC, Labconnect, Patheon, and Cell&Co BioServices.

Detailed market analyses of Clinical Trial Biorepository & Archiving Solution markets are provided for different countries. Global market demand is analyzed for a variety of regions, including North America, Asia Pacific, Europe, and others. Canada is expected to keep its place at the forefront in North America, exhibiting a CAGR of 5% from 2025 to 2035. In Asia Pacific, India is anticipated to experience a CAGR of 10.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Canada | 5% |

| United Kingdom | 3.3% |

| Germany | 2.9% |

| India | 10.5% |

| China | 9.2% |

| South Korea | 7.3% |

The United States industry predicted a 2.9% CAGR for the forecast period. With the advancement of drug development, personalized medicine, and the need for more data, the number of clinical trials conducted in the United States has risen. In the medical industry, technological advancements and advances are expected to drive demand for these solutions and services.

Increasing numbers of clinical trials, industry participation, and the introduction of medical trials are contributing to the research development in this country. A rising adoption of digital technologies and an increasing focus on preserving user data will increase demand in the market.

Cloud computing, blockchain, and artificial intelligence will become more popular in the medical field. It is expected that the demand for medical technologies will increase as telemedicine and telehealth become more prevalent.

Significant growth is expected in the United Kingdom market over the next few years. A CAGR of 3.3% is projected for the market over the forecast period. A number of organizations and service providers in the United Kingdom provide clinical trial archiving and biorepository services.

These suppliers manage, store, and track clinical study samples and documentation appropriately. In addition to following legal guidelines, they provide the infrastructure and resources needed to preserve samples for long periods of time.

Clinical research specimen integrity can be enhanced through the use of a central biorepository in multi-site clinical trials. By implementing standardized operational workflows and procedures, a central biorepository ensures a uniform approach to the processing, storage, and evaluation of biospecimens throughout the organization.

The Clinical Trials Regulations, in particular Regulation 31A of the Medicines for Human Use (Clinical Trials) Amendment Regulations 2006, define the archiving requirements for Clinical Trials of Investigational Medicinal Products (CTIMPs).

The clinical trial biorepository & archiving solution market in India is showing positive growth. The market in India is likely to expand at a CAGR of 10.5% from 2025 to 2035. A biorepository and archive solution is critical for managing and storing clinical samples and data efficiently. India has several organizations that provide services that meet international standards.

A significant improvement in life expectancy and a reduction in infant mortality has occurred in India in recent years. A combination of increasing government funding and a developing healthcare infrastructure is likely to create a market in the near future.

A total of 1,50,000 government-funded healthcare and wellness centers are being created by the Indian government in a bid to improve India's healthcare infrastructure. Growth in the healthcare market will be supported by rising investments in infrastructure improvement.

Information about the industry's leading segments is provided in this section. The clinical products segment contributed 85.4% of the value share in 2025. Based on the application, biorepository services held a market share of 73.6% in 2025.

| Type | Clinical Products |

|---|---|

| Value Share (2025) | 85.4% |

The clinical products segment held a market share of over 85.4% in 2025. An analysis kit is a pre-packaged set of materials that contain the necessary materials for collecting, storing, and analyzing biological samples.

These kits ensure standard and consistent sample collection across a wide range of studies and sites. Regulatory compliance tools like GCP, GLP, and 21 CFR Part 11 make sample storage and data management easier.

According to ClinicalTrials.gov, 386,583 studies had been registered in 219 countries by August 2025. According to the data, 362,524 tests were conducted in 2025, and 325,787 tests were conducted in 2020. Stimwave Technology is being advanced through the level-1 FREEDOM clinical research series, which includes randomized trials monitoring the responses of chronic pain patients over time to peripheral nerve stimulation (PNS).

In FREEDOM-1, the company is evaluating the Stimwave Freedom PNS device for the treatment of chronic knee pain in patients.

| Application | Biorepository Services |

|---|---|

| Value Share (2025) | 73.6% |

Revenue from biorepository services accounted for 73.6% of market share in 2025. In biorepository solutions, inventory management systems are key components for tracking and monitoring quantities, locations, and conditions of samples. It eliminates the potential for sample loss or misplacing and ensures that samples are recovered effectively.

A biorepository can offer sample distribution and analysis services, which may include aliquoting, centrifugation, and labeling of samples. The service of managing biorepository data is included in the range of services offered by the biorepository, which covers the clinical data, administration of sample metadata, and consent documents. Regulatory compliance, data integrity, and confidentiality can be assured by implementing secure data management solutions.

A biorepository solution involves retrieving and delivering samples to researchers or other laboratories for further examination. Sample tracking, packaging, and shipping are all necessary to maintain sample integrity during transportation.

Clinical study providers could offer customized biorepository services to meet the unique needs of each study. To accomplish this, data management systems, sample collection kits, and storage methods can be created.

Many companies are taking tactical measures to improve their services, including geographic expansion, business partnerships, mergers and acquisitions, and new business contracts.

Recent Industry Developments in Clinical Trial Biorepository & Archiving Solution Market

In terms of product type, the industry is classified into preclinical products and clinical products.

In terms of phase, the industry is segregated into phase I, phase II, phase III, and phase IV.

In terms of application, the market is segmented into biorepository services and archiving solution services.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, Middle East and Africa have been covered in the report.

The global clinical trial biorepository & archiving solution market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the clinical trial biorepository & archiving solution market is projected to reach USD 15.2 billion by 2035.

The clinical trial biorepository & archiving solution market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in clinical trial biorepository & archiving solution market are soil testing equipment, aggregate testing equipment, concrete testing equipment and others.

In terms of application, residential segment to command 29.6% share in the clinical trial biorepository & archiving solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

AI-based Clinical Trials Solution Provider Market Trends – Growth & Forecast 2024-2034

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Market Analysis - Size, Share, and Forecast 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Global Clinical Risk Grouping Solution Market Insights – Trends & Forecast 2024-2034

Neurology Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Global Pediatric Clinical Trial Market Analysis – Size, Share & Forecast 2024-2034

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wireless Broken Signal Solutions Market Growth – Trends & Forecast 2025 to 2035

Industrial Operational Intelligence Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cell and Gene Therapy Clinical Trial Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA