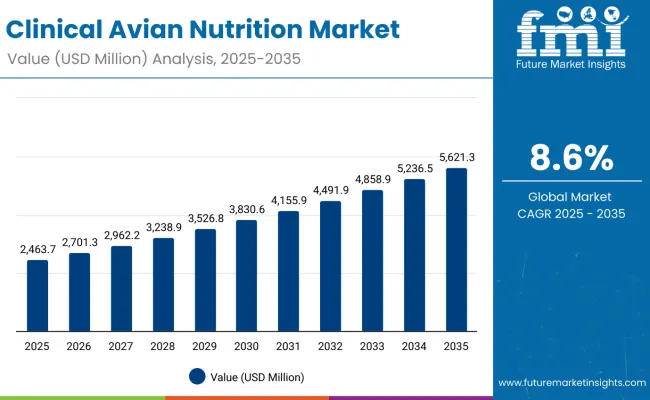

The clinical avian nutrition market is projected to grow from USD 2,463.7 million in 2025 to approximately USD 5,621.8 million by 2035, recording an absolute increase of USD 3,158.1 million over the forecast period. This translates into a total growth of 128.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.6% between 2025 and 2035.

The overall market size is expected to grow by nearly 2.3X during the same period, supported by increasing demand for specialized avian health solutions, growing prevalence of poultry diseases, and rising adoption of clinical nutrition products across the global poultry and veterinary care sectors.

Clinical Avian Nutrition Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,463.7 million |

| Forecast Value in (2035F) | USD 5,621.8 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

Between 2025 and 2030, the clinical avian nutrition market is projected to expand from USD 2,463.7 million to USD 3,721.6 million, resulting in a value increase of USD 1,257.9 million, which represents 39.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing poultry disease prevalence, rising demand for growth promotion solutions, and growing utilization in specialized veterinary nutrition applications. Feed manufacturers and veterinary specialists are expanding their clinical nutrition capabilities to address the growing preference for targeted therapeutic nutrition features in avian health systems.

From 2030 to 2035, the market is forecast to grow from USD 3,721.6 million to USD 5,621.8 million, adding another USD 1,900.2 million, which constitutes 60.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced veterinary nutrition technologies, the integration of precision nutrition systems for premium clinical avian products, and the development of enhanced disease-specific formulations for specialized applications. The growing emphasis on preventive avian healthcare and production optimization will drive demand for intelligent nutrition solutions with enhanced therapeutic effectiveness and improved bird health outcomes.

Between 2020 and 2024, the clinical avian nutrition market experienced strong growth from USD 1,695.6 million to USD 2,286.3 million at a 7.2% CAGR, driven by increasing poultry disease awareness and growing recognition of clinical nutrition systems' superior bird health capabilities across commercial and veterinary applications. The market developed as poultry farmers recognized the potential for clinical nutrition technology to enhance production outcomes while meeting modern agricultural requirements for disease prevention and performance optimization. Technological advancement in formulation design and therapeutic delivery systems began emphasizing the critical importance of maintaining bird health while extending production efficiency and improving feed conversion effectiveness.

The clinical avian nutrition market represents a rapidly expanding agricultural opportunity at the intersection of veterinary medicine, precision nutrition, and poultry production optimization, with the market projected to expand from USD 2,463.7 million in 2025 to USD 5,621.8 million by 2035 at a robust 8.6% CAGR-a 2.3X growth driven by increasing poultry disease prevalence, agricultural demand for superior bird health protection, and the integration of clinical nutrition technologies into commercial production systems.

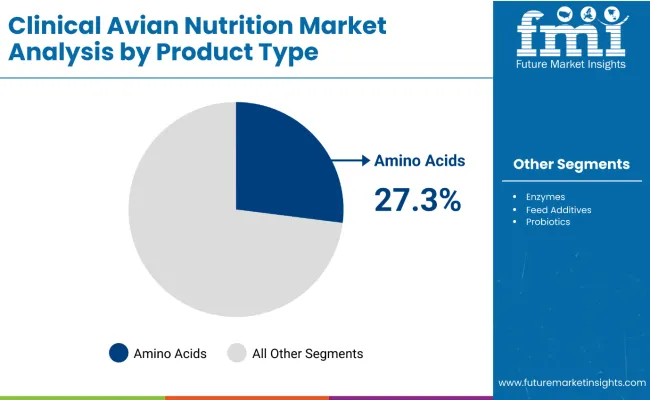

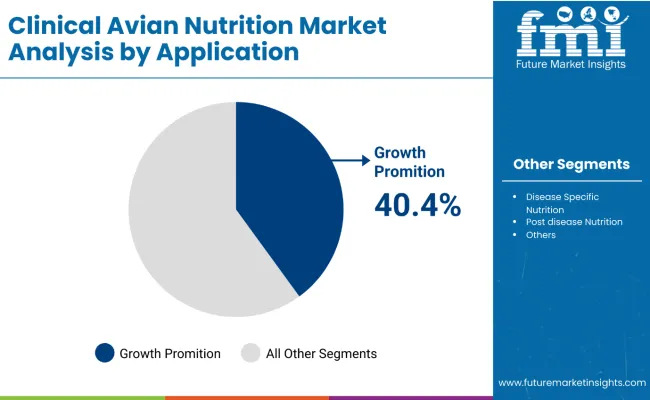

This convergence opportunity leverages the critical need for disease prevention in poultry production, the agricultural industry's shift toward antibiotic alternatives, and advances in nutritional science to create products that offer superior bird health management in commercial production applications. Amino acids lead with 27.3% market share due to their essential biological functions and growth optimization capabilities, while growth promotion applications dominate demand as commercial producers increasingly focus on production efficiency and performance optimization. Geographic growth is strongest in China (7.5% CAGR) and UK (7.0% CAGR), where poultry production expansion and agricultural modernization create ideal market conditions.

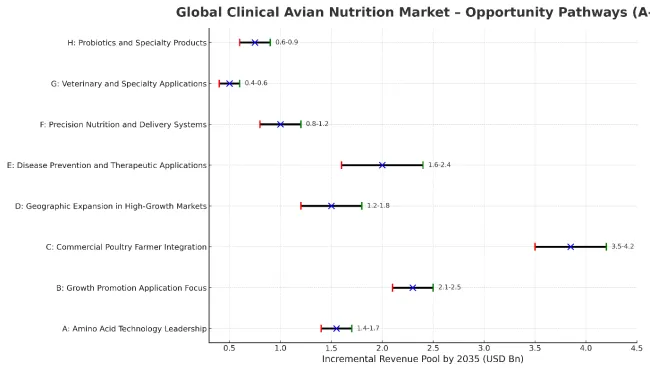

Pathway A - Amino Acid Technology Leadership

The dominant product category offers superior protein synthesis support, immune system enhancement, and metabolic optimization essential for clinical avian nutrition applications. Companies developing advanced amino acid formulations with enhanced bioavailability, improved stability, and optimized delivery systems will capture the leading technology segment. Expected revenue pool: USD 1,400-1,700 million.

Pathway B - Growth Promotion Application Focus

The largest application segment benefits from commercial poultry sector focus on production efficiency, feed conversion optimization, and performance enhancement. Providers developing comprehensive growth promotion solutions with integrated nutrition programs, performance monitoring, and economic optimization features will dominate this primary market. Opportunity: USD 2,100-2,500 million.

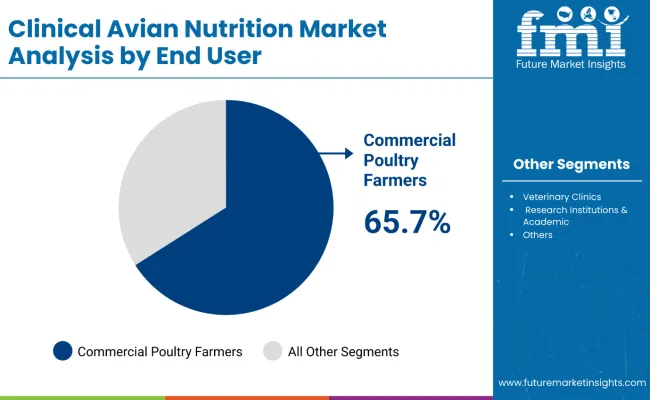

Pathway C - Commercial Poultry Farmer Integration

The dominant end-user segment with 65.7% market share requires comprehensive nutrition solutions for large-scale operations, cost optimization, and production consistency. Companies investing in commercial-scale nutrition systems, technical support programs, and integrated health management platforms will create competitive differentiation and market leadership. Revenue uplift: USD 3,500-4,200 million.

Pathway D - Geographic Expansion in High-Growth Markets

China and India's poultry production expansion and agricultural modernization create substantial opportunities. Local manufacturing partnerships, technical expertise, and cost-effective nutrition solutions enable market penetration in these high-growth regions. Pool: USD 1,200-1,800 million.

Pathway E - Disease Prevention and Therapeutic Applications

Modern poultry production increasingly prioritizes disease prevention, antibiotic alternatives, and targeted therapeutic interventions. Developing products with disease-specific formulations, preventive capabilities, and therapeutic effectiveness addresses growing health management demands while supporting regulatory compliance. Expected upside: USD 1,600-2,400 million.

Pathway F - Precision Nutrition and Delivery Systems

Advanced poultry operations require targeted nutrition delivery, bioavailability optimization, and performance tracking capabilities. Systems offering precision formulation technology, controlled-release mechanisms, and performance analytics create enhanced value propositions for commercial producers. USD 800-1,200 million.

Pathway G - Veterinary and Specialty Applications

Veterinary clinics and specialty poultry operations represent growing opportunities for therapeutic nutrition products, recovery protocols, and specialized health management solutions. Developing products specifically designed for veterinary applications with clinical validation and professional support expands beyond commercial production markets. Pool: USD 400-600 million.

Pathway H - Probiotics and Specialty Products

Comprehensive avian health requires specialized probiotics, enzymes, and functional additives for optimal gut health, immune function, and production performance. Companies developing integrated product portfolios with synergistic effects, quality assurance, and technical support will capture specialty nutrition opportunities. Expected revenue: USD 600-900 million.

Market expansion is being supported by the increasing global prevalence of poultry diseases and the corresponding shift toward clinical nutrition technologies that can provide superior bird health protection while meeting agricultural requirements for production efficiency and disease prevention capabilities. Modern poultry producers and veterinary specialists are increasingly focused on incorporating clinical nutrition products to enhance bird health outcomes while satisfying demands for advanced nutritional technologies and therapeutic feed solutions. Clinical avian nutrition products' proven ability to deliver superior disease resistance, growth optimization, and health maintenance capabilities makes them essential products for commercial poultry operations and veterinary treatment applications.

The growing emphasis on antibiotic reduction and sustainable production approaches is driving demand for high-quality clinical nutrition products that can support distinctive bird health experiences and comprehensive disease prevention across growth promotion, therapeutic treatment, and recovery support categories. Producer preference for nutrition systems that combine health enhancement excellence with production optimization capabilities is creating opportunities for innovative clinical implementations in both commercial production and veterinary care applications. The rising influence of precision nutrition and integrated health management ecosystems is also contributing to increased adoption of premium clinical avian nutrition products that can provide authentic agricultural integration characteristics.

The market is segmented by product and application. The demand for products is divided into vitamins & minerals, amino acids, enzymes, feed additives, probiotics, and others. Based on application, the market is categorized into growth promotion, disease specific nutrition, post disease nutrition, and others. By end user, the market includes commercial poultry farmers, veterinary clinics, research institutions & academic, and others.

The amino acids segment is projected to account for 27.3% of the clinical avian nutrition market in 2025, reaffirming its position as the leading product category. Feed manufacturers and veterinary specialists increasingly utilize amino acid technology for their superior protein synthesis support, immune system enhancement, and metabolic optimization in clinical avian nutrition applications across diverse poultry production settings. Amino acid technology's essential biological functions and proven performance directly address the nutritional requirements for optimal growth, disease resistance, and production efficiency in commercial poultry operations.

This product segment forms the foundation of modern clinical avian nutrition applications, as it represents the technology with the greatest biological importance and established compatibility across multiple poultry species and production systems. Manufacturer investments in amino acid optimization and delivery enhancement continue to strengthen adoption among feed producers. With poultry producers prioritizing bird health and production efficiency, amino acid systems align with both biological effectiveness objectives and economic performance requirements, making them the central component of comprehensive clinical nutrition strategies.

Growth promotion applications are projected to represent the largest share of clinical avian nutrition demand in 2025 at 40.4%, underscoring their critical role as the primary application for nutritional products in commercial poultry production and performance optimization protocols. Poultry producers and nutritionists prefer clinical nutrition systems for their exceptional growth enhancement capabilities, feed conversion efficiency features, and ability to maintain production performance while supporting bird health requirements during critical growth periods. Positioned as essential products for commercial poultry management, clinical nutrition products offer both production optimization and health maintenance advantages.

The segment is supported by continuous growth in commercial poultry production protocols and the growing availability of advanced nutritional technologies that enable enhanced production outcomes and efficiency improvement at the farm level. Additionally, agricultural systems are investing in performance optimization technologies to support production efficiency improvement and cost optimization. As poultry production continues to evolve and producers seek superior performance solutions, growth promotion applications will continue to dominate the application landscape while supporting technology advancement and production optimization strategies.

Commercial poultry farmers are projected to represent the largest share of clinical avian nutrition demand in 2025 at 65.7%, highlighting their position as the primary end users driving market growth through large-scale production operations and comprehensive nutrition program adoption. This dominant market position reflects the commercial poultry industry's substantial nutritional product consumption requirements and the critical role of clinical nutrition in maintaining bird health, optimizing production performance, and ensuring economic viability across broiler, layer, and turkey operations.

The segment benefits from continuous expansion in global poultry production, increasing adoption of intensive production systems, and growing focus on nutrition-based health management strategies that reduce reliance on therapeutic interventions. Commercial operations require consistent, high-volume nutrition solutions that can deliver measurable improvements in growth rates, feed conversion efficiency, mortality reduction, and overall flock performance while maintaining cost-effectiveness and regulatory compliance across diverse production environments.

The clinical avian nutrition market is advancing steadily due to increasing poultry disease prevalence and growing demand for therapeutic nutrition solutions that emphasize superior bird health protection across commercial production and veterinary treatment applications. However, the market faces challenges, including high product costs compared to conventional feed additives, technical complexity in formulation development, and competition from pharmaceutical alternatives. Innovation in delivery system enhancement and cost-effectiveness improvement continues to influence market development and expansion patterns.

Expansion of Disease Prevention Protocols

The growing adoption of clinical avian nutrition products in comprehensive disease prevention and health maintenance applications is enabling poultry producers to develop protocols that provide distinctive bird health capabilities while commanding premium positioning and enhanced production performance characteristics. Advanced prevention protocols provide superior disease resistance while allowing more sophisticated health management across various poultry categories and production segments. Agricultural systems are increasingly recognizing the competitive advantages of clinical nutrition positioning for comprehensive flock health development and poultry specialty market penetration.

Integration of Precision Nutrition and Targeted Delivery Systems

Modern clinical avian nutrition suppliers are incorporating advanced formulation technologies, targeted delivery systems, and precision nutrition approaches to enhance product efficacy, improve bird health outcomes, and meet producer demands for intelligent and effective nutritional solutions. These programs improve product performance while enabling new applications, including personalized nutrition and predictive health management systems. Advanced precision integration also allows suppliers to support premium market positioning and clinical excellence leadership beyond traditional feed additive products.

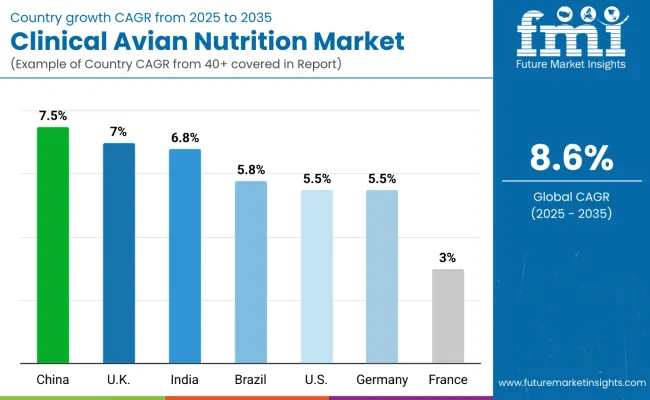

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

| UK | 7.0% |

| India | 6.8% |

| Brazil | 5.8% |

| USA | 5.5% |

| Germany | 5.5% |

| France | 3.0% |

The clinical avian nutrition market is experiencing robust growth globally, with China leading at a 7.5% CAGR through 2035, driven by expanding poultry production, rising protein consumption, and increasing adoption of advanced nutritional technologies. The UK follows at 7.0%, supported by growing agricultural investments, expanding commercial poultry operations, and rising focus on sustainable production practices. India shows growth at 6.8%, emphasizing agricultural modernization and expanding poultry industry capabilities.

Brazil demonstrates 5.8% growth, focusing on export-oriented poultry production and comprehensive nutrition optimization. The USA records 5.5%, prioritizing advanced nutritional innovation and production efficiency solutions. Germany exhibits 5.5% growth, supported by precision agriculture technologies and advanced nutritional product development. France shows 3.0% growth, focusing on premium poultry production and sustainable farming practices.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from clinical avian nutrition in China is projected to exhibit exceptional growth with a CAGR of 7.5% through 2035, driven by expanding poultry production capacity and rising protein consumption across major commercial and smallholder operations. The country's growing agricultural technology adoption and increasing focus on production efficiency are creating substantial demand for clinical nutrition solutions in both intensive and traditional poultry systems. Major feed manufacturers and agricultural companies are establishing comprehensive production and distribution capabilities to serve both domestic consumption needs and regional export markets.

Rising poultry production expansion and growing protein consumption are driving demand for clinical avian nutrition products across commercial producers, feed manufacturers, and agricultural cooperatives throughout major Chinese poultry regions. Strong government support for agricultural modernization and food security is supporting the rapid adoption of advanced nutrition solutions among producers seeking to meet evolving production standards and efficiency expectations.

Revenue from clinical avian nutrition in the UK is expanding at a CAGR of 7.0%, supported by growing agricultural investments, increasing focus on sustainable production practices, and expanding commercial poultry operations with advanced nutrition capabilities. The country's developing sustainable agriculture ecosystem and expanding precision farming sector are driving demand for sophisticated clinical nutrition products across both intensive poultry facilities and emerging free-range operations. International nutrition companies and domestic agricultural manufacturers are establishing comprehensive production and technical support capabilities to address growing market demand for advanced bird health solutions.

Rising agricultural investment and expanding sustainable production focus are creating opportunities for clinical avian nutrition adoption across farming systems, poultry producers, and feed suppliers in major British agricultural regions. Growing government emphasis on agricultural sustainability and animal welfare is driving the adoption of premium nutrition products among producers seeking to upgrade to advanced production technologies and environmental compliance standards.

Revenue from clinical avian nutrition in India is projected to grow at a CAGR of 6.8% through 2035, driven by agricultural modernization initiatives, expanding commercial poultry sector, and growing focus on protein security requiring advanced nutritional solutions. India's developing agricultural infrastructure and increasing emphasis on poultry production efficiency are creating substantial demand for both conventional and premium clinical nutrition varieties. Leading agricultural companies and nutrition specialists are establishing comprehensive production strategies to serve both Indian markets and growing regional agricultural demand.

Rising agricultural modernization and expanding poultry sector focus are driving demand for premium clinical avian nutrition products across farming systems, feed companies, and agricultural cooperatives seeking superior bird health capabilities. Strong agricultural development expertise and modernization initiatives are supporting the adoption of advanced nutrition technologies among producers prioritizing production excellence and efficiency improvement in commercial poultry applications.

Revenue from clinical avian nutrition in Brazil is projected to grow at a CAGR of 5.8% through 2035, supported by the country's export-oriented poultry production, agricultural innovation leadership capabilities, and established market for premium nutrition solutions. Brazilian poultry producers and feed manufacturers prioritize production efficiency, export quality standards, and technological advancement, making clinical avian nutrition essential products for both domestic consumption and international export protocols. The country's comprehensive agricultural ecosystem and production scale support continued market development.

Advanced export production capabilities and agricultural innovation leadership are driving demand for specialized clinical avian nutrition products across feed manufacturers, poultry integrators, and agricultural cooperatives serving domestic and international markets. Strong focus on production efficiency excellence and export quality standards is encouraging producers to adopt premium nutrition products that support competitive positioning and meet international quality standards for commercial poultry applications.

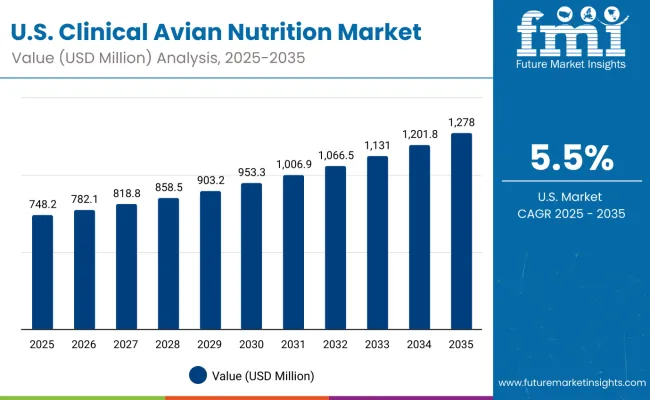

Revenue from clinical avian nutrition in the United States is projected to grow at a CAGR of 5.5% through 2035, supported by the country's agricultural innovation development sector, advanced research capabilities, and established expertise in premium nutrition applications. American poultry producers' focus on production efficiency, animal welfare, and technological innovation creates steady demand for intelligent nutrition products. The country's attention to agricultural advancement and production optimization drives consistent adoption across both conventional and organic poultry applications.

Agricultural innovation capabilities and advanced research development are driving steady demand for clinical avian nutrition products across feed companies, poultry producers, and agricultural technology specialists seeking superior nutrition capabilities and production efficiency enhancement. Strong innovation culture and research development focus are supporting the adoption of premium nutrition solutions among producers seeking to meet American quality expectations and production standards for advanced poultry operations.

Revenue from clinical avian nutrition in Germany is projected to grow at a CAGR of 5.5% through 2035, supported by the country's precision agriculture priorities, advanced agricultural development sector, and established focus on production efficiency and animal welfare innovation. German agricultural producers' emphasis on technological advancement, environmental compliance, and sustainable production creates steady demand for advanced nutrition products. The country's attention to agricultural quality and production precision drives consistent adoption across both conventional and organic production systems.

Precision agriculture priorities and advanced agricultural development are driving steady demand for clinical avian nutrition products across agricultural systems, feed companies, and poultry producers seeking superior nutrition capabilities and production efficiency enhancement. Strong technological advancement culture and agricultural development focus are supporting the adoption of validated nutrition solutions among producers seeking to meet German agricultural standards and sustainability expectations for advanced poultry production.

Revenue from clinical avian nutrition in France is projected to grow at a CAGR of 3.0% through 2035, supported by the country's premium poultry production sector, advanced agricultural capabilities, and established reputation for producing superior poultry products while working to enhance nutrition precision and develop high-quality farming technologies. France's agricultural industry continues to benefit from its reputation for quality excellence while focusing on sustainable innovation and production precision.

Premium production capabilities and advanced agricultural expertise are driving the development of high-quality clinical avian nutrition products that command premium prices in domestic and international markets while supporting technological advancement and quality excellence initiatives. Growing focus on agricultural innovation and sustainable production is supporting the adoption of advanced nutrition technologies among producers seeking to ensure production quality and maintain French reputation for agricultural excellence in poultry production applications.

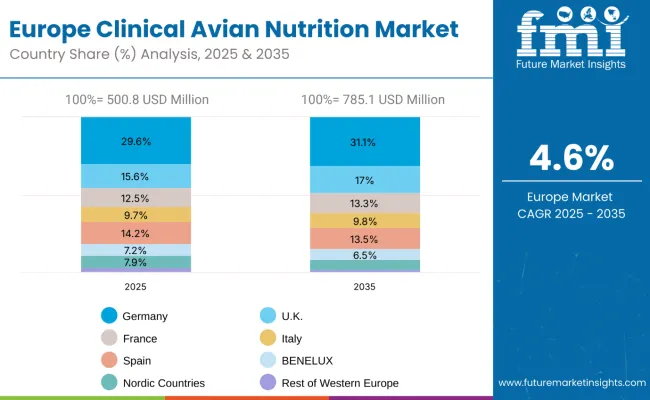

The clinical avian nutrition market in Europe is projected to grow at a CAGR of 4.6% from 2025 to 2035. Germany is expected to maintain its leadership position with a 29.6% market share in 2025, growing to 31.1% by 2035, supported by its precision agriculture sector, advanced agricultural infrastructure, and production capabilities serving regional and international markets.

The United Kingdom follows with a 15.6% share in 2025, projected to reach 17.0% by 2035, driven by priorities in sustainable agriculture, production innovation, and technology-based farming systems. France holds a 12.5% share in 2025, expected to maintain 13.3% by 2035, supported by premium poultry production and agricultural technology adoption, though facing challenges from competition and regulatory dynamics.

Spain accounts for 14.2% in 2025, projected to moderate to 13.5% by 2035, while Italy contributes 9.7% in 2025, remaining stable at 9.8% by 2035. The Nordic Countries represent 7.9% in 2025, declining to 6.9% in 2035, while BENELUX holds 7.2% in 2025, decreasing to 6.5% by 2035. The Rest of Western Europe region is expected to account for 3.4% in 2025, moderating to 1.8% by 2035, reflecting mixed growth dynamics across smaller and mature markets.

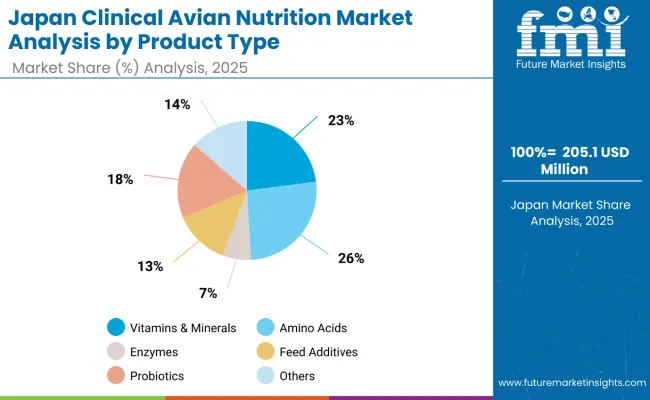

The clinical avian nutrition market in Japan is projected to grow from USD 205.1 million in 2025 to USD 334.1 million by 2035, supported by advanced agricultural technology, precision farming systems, and adoption of specialized nutrition solutions.

Vitamins & minerals are expected to maintain a 23.0% market share, reflecting ongoing demand for essential micronutrient supplementation. Amino acids lead with 26.1%, supported by focus on protein quality and growth optimization. Enzymes account for 6.6%, while feed additives represent 12.9% of the market. Probiotics hold 17.8%, driven by gut health emphasis, while others contribute 13.6%, including specialized and emerging nutrition categories.

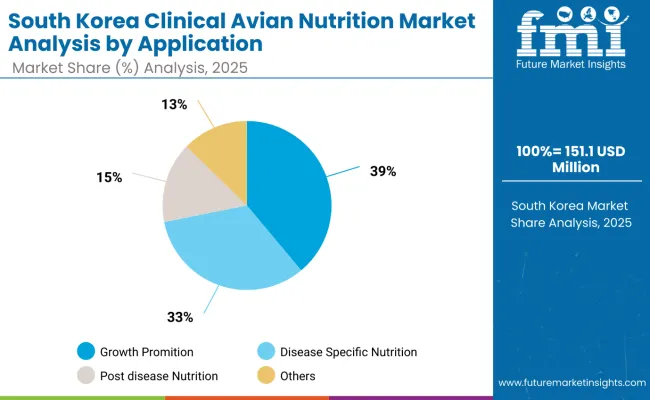

The clinical avian nutrition market in South Korea is projected to expand through 2035, driven by intensive poultry production, advanced agricultural technology adoption, and increasing focus on production efficiency optimization.

Growth promotion applications maintain leadership with a 38.9% market share, supported by commercial poultry sector focus on production efficiency and feed conversion optimization. Disease specific nutrition follows with 32.9%, reflecting increasing attention to health management and therapeutic nutrition applications in intensive production systems.

Post disease nutrition accounts for 15.4%, driven by recovery protocol requirements and veterinary nutrition support programs. Others represent 12.7%, including specialized applications and emerging therapeutic nutrition categories.

The clinical avian nutrition market is characterized by competition among established feed manufacturers, specialized nutrition companies, and integrated agricultural technology suppliers. Companies are investing in advanced formulation technologies, targeted delivery systems, application-specific product development, and comprehensive technical support capabilities to deliver consistent, high-performance, and effective clinical nutrition products. Innovation in bioavailability enhancement, stability improvement, and customized nutritional compatibility is central to strengthening market position and producer satisfaction.

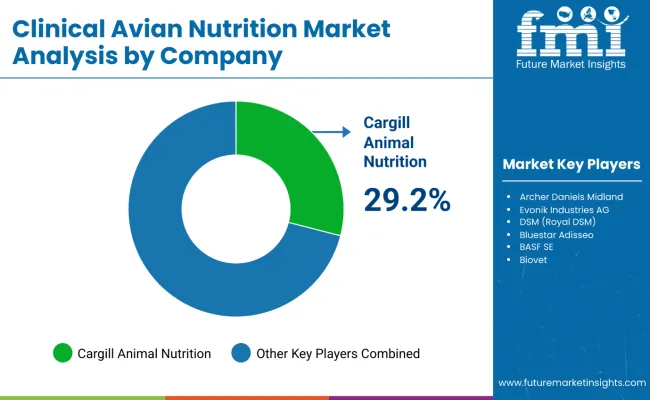

Cargill Animal Nutrition leads the market with a 29.2% share, focusing on comprehensive agricultural solutions and advanced nutrition technologies, offering premium clinical avian nutrition products with emphasis on production excellence and bird health optimization capabilities. Other key players provide specialized nutrition and feed additive capabilities with focus on innovation and technical support.

Archer Daniels Midland delivers integrated agricultural solutions with emphasis on production system integration and operational excellence. Evonik Industries AG specializes in amino acid technologies with focus on bioavailability and production efficiency. DSM (Royal DSM) focuses on vitamin and specialty nutrition with emphasis on advanced formulation technology and animal health optimization.

Clinical avian nutrition represents a rapidly expanding USD 2.5 billion market projected to reach USD 5.6 billion by 2035, driven by increasing poultry disease prevalence, antibiotic reduction mandates, and precision nutrition demands. With amino acids commanding 27.3% market share and growth promotion applications dominating at 40.4%, the sector requires coordinated stakeholder action across regulatory frameworks, technology development, supply chain optimization, and market access facilitation to capture the 8.6% CAGR growth opportunity.

Research & Development Incentives: Fund clinical trials on novel amino acid formulations, enzyme technologies, and probiotic strains specifically for poultry health applications. Establish dedicated research centers focusing on antibiotic alternatives and precision nutrition delivery systems for commercial poultry operations.

Regulatory Harmonization: Create streamlined approval pathways for clinical avian nutrition products across feed-grade and therapeutic applications, with clear guidelines on efficacy claims, safety thresholds, and cross-border recognition to facilitate the USD 3.2 billion market expansion.

Production Infrastructure Support: Offer tax incentives and concessional financing for establishing specialized manufacturing facilities for amino acids, probiotics, and enzyme production, particularly in high-growth regions like China (7.5% CAGR) and India (6.8% CAGR).

Antibiotic Reduction Programs: Implement phase-out schedules for growth-promoting antibiotics with corresponding subsidies for clinical nutrition alternatives, recognizing that 40.4% of market demand stems from growth promotion applications requiring performance maintenance.

Trade Facilitation: Establish mutual recognition agreements for clinical nutrition standards between major poultry-producing nations, addressing the global nature of supply chains serving the 65.7% commercial poultry farmer segment.

Efficacy Standardization: Develop unified protocols for measuring amino acid bioavailability, probiotic viability, and enzyme activity in poultry applications, enabling reliable product comparisons across the fragmented supplier landscape.

Application Guidelines: Create comprehensive formulation guides for integrating clinical nutrition products into growth promotion (40.4% market share), disease-specific nutrition (32.9%), and post-disease recovery protocols, addressing the technical complexity barrier.

Professional Certification: Establish certification programs for poultry nutritionists and feed formulators on clinical nutrition integration, supporting the commercial poultry farmer segment (65.7% market share) in optimizing product utilization.

Market Intelligence Platforms: Develop price discovery mechanisms and demand forecasting tools linking amino acid, enzyme, and probiotic suppliers with feed manufacturers and integrated poultry operations across key growth markets.

Sustainability Metrics: Define environmental impact assessments for clinical nutrition versus antibiotic-based growth promotion, supporting the shift toward sustainable poultry production practices.

Precision Delivery Systems: Develop targeted release technologies for amino acids and enzymes that optimize bioavailability while reducing product loss during feed processing and storage, addressing cost-effectiveness concerns.

Manufacturing Scale-Up: Provide modular fermentation and purification equipment for amino acid and probiotic production, enabling regional suppliers to serve local markets more cost-effectively than global players.

Quality Control Integration: Offer real-time monitoring systems for feed mills to verify amino acid content, enzyme activity, and probiotic viability throughout the production process, ensuring consistent product performance.

Digital Formulation Tools: Integrate clinical nutrition databases into feed formulation software, enabling precise cost-per-performance calculations for different amino acid profiles and application-specific requirements.

Cold Chain Solutions: Develop specialized storage and transport systems for temperature-sensitive probiotics and enzymes, maintaining product integrity from manufacturing to farm application.

How Suppliers and Manufacturers Could Navigate Market Dynamics

Product Portfolio Diversification: Develop tiered offerings spanning basic amino acid blends for price-sensitive markets, specialized enzyme combinations for premium applications, and targeted probiotic strains for specific disease challenges.

Regional Production Strategies: Establish manufacturing hubs in high-growth regions (China, India, Brazil) to capture local demand while reducing logistics costs and currency exposure across the global market.

Technical Service Excellence: Provide comprehensive on-farm support including performance trials, dosing optimization, and outcome monitoring to demonstrate value proposition and accelerate adoption among commercial producers.

Supply Chain Integration: Form strategic partnerships with feed manufacturers and poultry integrators to ensure consistent demand visibility and streamline product development for specific customer requirements.

Innovation Investment: Focus R&D spending on next-generation amino acid forms, multi-strain probiotic complexes, and enzyme stability improvements that command premium pricing in the competitive landscape.

Growth Capital Deployment: Target the USD 3.2 billion market expansion opportunity through investments in leading amino acid producers, probiotic specialists, and integrated nutrition companies positioned in high-growth geographies.

Technology Venture Funding: Support startups developing novel delivery mechanisms, fermentation technologies, and precision nutrition platforms that can capture market share from established players like Cargill (29.2% share) and ADM.

Market Consolidation Plays: Finance roll-up strategies among regional clinical nutrition suppliers to achieve scale advantages required to serve global poultry integrators and compete effectively against multinational corporations.

Infrastructure Development: Invest in specialized manufacturing facilities for amino acids and probiotics in emerging markets, particularly China and India, where local production can serve rapidly expanding domestic demand.

Impact Investment Opportunities: Deploy blended finance instruments linking returns to measurable outcomes in antibiotic reduction, production efficiency improvements, and sustainable poultry farming practices across developing markets.

Strategic Acquisition Support: Provide growth capital for established players to acquire complementary technologies, expand geographic reach, or integrate vertically into high-value application segments like disease-specific nutrition.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,463.7 million |

| Product | Vitamins & Minerals, Amino Acids, Enzymes, Feed Additives, Probiotics, Others |

| Application | Growth Promotion, Disease Specific Nutrition, Post Disease Nutrition, Others |

| End User | Commercial Poultry Farmers, Veterinary Clinics, Research Institutions & Academic, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Brazil, China, India, United Kingdom, Germany, France, Japan, South Korea and 40+ countries |

| Key Companies Profiled | Cargill Animal Nutrition, Archer Daniels Midland, Evonik Industries AG, DSM (Royal DSM), Bluestar Adisseo, BASF SE, Biovet, Nutricia (Danone) |

| Additional Attributes | Dollar sales by product and application, regional demand trends, competitive landscape, technological advancements in nutrition science, agricultural integration initiatives, production optimization programs, and clinical excellence enhancement strategies |

By North America

By Europe

By East Asia

By South Asia & Pacific

By Latin America

By Middle East & Africa

The global clinical avian nutrition market is valued at USD 2,463.7 million in 2025.

The size for the clinical avian nutrition market is projected to reach USD 5,621.8 million by 2035.

The clinical avian nutrition market is expected to grow at an 8.6% CAGR between 2025 and 2035.

The key product segments in the clinical avian nutrition market are vitamins & minerals, amino acids, enzymes, feed additives, probiotics, and others.

In terms of application, growth promotion segment is set to command 40.4% share in the clinical avian nutrition market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Next-Generation Sequencing (NGS) Data Analysis Market Analysis by Solution and Services, Technology, End User, and Region through 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Clinical Information System Market Analysis - Growth & Forecast 2024 to 2034

Clinical Chemistry Analyzers Market Trends – Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA