The global clinical oncology next-generation sequencing (NGS) market is poised for substantial growth, with its size estimated at USD 744.4 million in 2025 and projected to expand at a robust compound annual growth rate (CAGR) of 17.3% through 2034.

By the end of the forecast period, revenues are expected to surpass USD 3.13 billion, reflecting the increasing adoption of advanced genomic technologies in cancer diagnosis and treatment. The rising prevalence of cancer worldwide and the growing demand for precision medicine are significant drivers propelling market expansion.

Key applications of clinical oncology NGS include tumor profiling, liquid biopsy, companion diagnostics, and minimal residual disease monitoring. Tumor profiling remains the dominant application, as it supports the identification of actionable mutations and therapeutic targets across diverse cancer types.

Liquid biopsy, a minimally invasive technique, is gaining traction due to its potential for early cancer detection and real-time monitoring of treatment response. Companion diagnostics developed through NGS guide the selection of targeted therapies, aligning with the trend towards personalized oncology care.

In May 2025, Illumina Inc. expanded its clinical oncology portfolio to enhance precision cancer care. The company introduced the TruSight™ (TSO) Comprehensive test, the first FDA-approved distributable genomic profiling kit with pan-cancer companion diagnostic claims.

This test evaluates both DNA and RNA, enabling rapid tumor profiling and personalized therapy matching. Illumina's solutions, including TSO Comprehensive and Pillar oncoReveal CDx, are being adopted across community oncology practices, hospitals, and academic centers to improve patient outcomes.

The market growth is further supported by increasing investments from pharmaceutical and biotechnology companies in precision oncology research and the development of NGS-based assays. Collaborative efforts between diagnostic developers and healthcare providers are expanding the availability and adoption of NGS testing. Moreover, government initiatives aimed at enhancing cancer screening and precision medicine frameworks contribute to favorable market conditions.

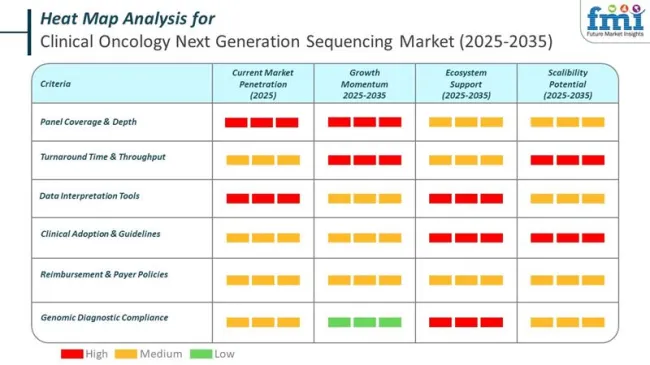

Despite the promising outlook, challenges such as regulatory complexities, data interpretation hurdles, and high costs associated with advanced sequencing technologies persist. However, ongoing technological innovations, standardization of testing protocols, and growing clinician awareness are expected to mitigate these barriers. Overall, the clinical oncology NGS market is set to experience dynamic growth driven by technological progress, expanding clinical applications, and the increasing emphasis on precision oncology.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 744.4 million |

| Industry Value (2035F) | USD 3.13 billion |

| CAGR (2025 to 2035) | 17.3% |

Illumina is investing heavily in intelligent NGS platforms to simplify oncology workflows and accelerate genomic insights. By embedding artificial intelligence and machine learning into its platforms, the company aims to reduce turnaround time while maintaining analytical accuracy. Its smart sequencing tools are designed to support real-time clinical decision-making and improve cancer patient outcomes.

Thermo Fisher Scientific integrates smart software, robotics, and predictive analytics into its NGS platforms tailored for oncology. Its solutions aim to minimize manual steps in cancer diagnostics and enhance detection of low-frequency variants. Through intelligent systems, Thermo Fisher supports both liquid biopsy and solid tumor profiling at scale.

F. Hoffmann-La Roche continues to build its smart oncology portfolio through the NAVIFY digital ecosystem. This platform combines sequencing data, electronic health records, and AI to create personalized insights for cancer treatment planning. The company emphasizes smart interpretation of NGS data for more effective therapy guidance.

Government regulations in the clinical oncology next-generation sequencing (NGS) market are becoming more stringent to ensure accuracy, patient safety, and data integrity. Regulatory authorities across major regions such as the US, EU, and Asia Pacific are introducing frameworks for diagnostic validity, software integration, and data interoperability in clinical sequencing platforms.

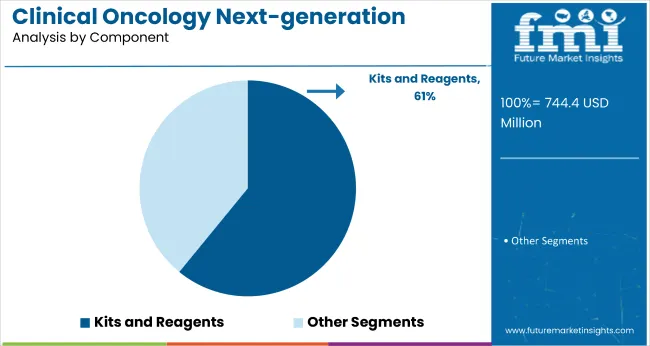

The kits and reagents segment is forecasted to hold around 60.9% market share in 2024, positioning it as the leading component in clinical oncology next-generation sequencing (NGS). The expanding use of NGS for tumor profiling, liquid biopsy, and companion diagnostics fuels demand for these consumables. Each application requires specialized kits and reagents designed to meet precise assay needs, making them critical to testing accuracy and reliability.

Technological progress and assay customization have led to advanced, high-performance consumables that enhance sensitivity and specificity. Automation and high-throughput solutions streamline laboratory workflows, increasing testing efficiency and throughput. Rising volumes of clinical research and diagnostic testing further escalate demand for these consumables.

As NGS integrates deeper into oncology diagnostics and personalized medicine, kits and reagents remain indispensable for achieving accurate, reproducible results. Their crucial role in clinical workflows ensures sustained market growth and continued innovation in product development throughout the forecast period.

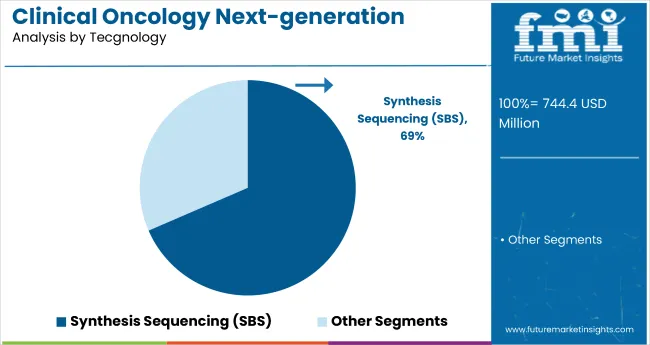

Synthesis sequencing technology is projected to dominate with an estimated 68.5% market share in 2024 within clinical oncology NGS. Its rapid analysis capabilities, cost-effectiveness, and scalability make it highly suitable for oncology diagnostics. The technology supports flexible workflows that accommodate diverse clinical sample types and volumes, requiring reduced sample inputs, which benefits clinical laboratories.

Recent advancements have improved sequencing accuracy and read lengths, expanding its clinical relevance in mutation detection and tumor profiling. These features streamline laboratory operations and reduce turnaround times, critical for timely diagnosis and treatment planning.

The technology’s adaptability allows deployment in both small research labs and large diagnostic centers, driving widespread adoption. As clinical demand for efficient and precise NGS testing grows, synthesis sequencing remains the preferred technology, expected to maintain dominance and propel innovation in oncology diagnostics over the forecast period.

Liquid Biopsy Technology Makes Advances in the Industry

One of the most revolutionary solutions in terms of cancer diagnostics and monitoring is liquid biopsies. Clinical oncology NGS technologies undoubtedly play a central role in liquid biopsies. They involve analyzing circulating tumor DNA or other biomarkers from blood or bodily fluids. It means that tumor dynamics and responses to treatment can be tracked in a minimally invasive manner.

As NGS technologies can detect genetic mutations in ctDNA with high sensitivity, they help better understand tumor heterogeneity and evolution on a regular basis. For this reason, the non-invasive nature of liquid biopsies opens uniquely new perspectives for cancer patient care. It can help detect tumor recurrence early and adjust treatment dynamically, which enhances patient outcomes significantly.

In February 2024, Twist Bioscience Corporation launched the cfDNA Library Preparation Kit to enable liquid biopsy research. It is designed to maximize the number of unique cfDNA molecules captured in library preparation.

Development of New Approaches Creates Opportunities in the Industry

The contributions to innovations in clinical oncology NGS by the investment in research and development have been steady and prolific. This has led to the introduction of new sequencing platforms that are considered revolutionary.

Advanced bioinformatics tools and non-traditional applications in the field of oncology continue to appear in the clinical oncology next-generation sequencing market. Key areas driving research include performance, throughput, and scalability, which has led to the clinical use of NGS technologies. Their utility is addressing challenges like data analysis plus interpretation.

Partnerships among academic institutions, industry partners, and government agencies have highly expedited efforts in NGS-based cancer research. In July 2023, a group of researchers from the Perelman School of Medicine at the University of Pennsylvania developed a new approach to mapping specific DNA marks known as 5-methylcytosine (5mC).

These marks play a regulatory role in gene expression and are pivotal in health and disease. This ground-breaking technique enables scientists to create a profile of DNA using minuscule samples that are virtually non-damageable. This new approach named Direct Methylation Sequencing (DM-Seq) has opened doors of opportunities of players.

Artificial Intelligence is Making Inroads in the Industry

Integration of artificial intelligence in NGS data analysis for cancer research continues to rise in the industry. Increasingly sophisticated artificial intelligence and machine learning algorithms allow geneticists to gain deeper insights into NGS data. They help improve the accuracy and precision of variant calling, annotation, and interpretation.

This allows the detection of medically relevant mutations and the prediction of therapeutic responses based on underlying molecular biology. They help in the identification of patient populations for tailored treatment selection/assignment.

The integration of these AI algorithms into NGS workflows can increase the level of clinical efficacy of NGS assays and empower precision oncology initiatives in general. These technologies are, therefore, witnessing more integration in the industry.

In September 2023, QIAGEN expanded its clinical decision support software to include AI-enhanced coverage of thousands of rare disease genes. Advancement of somatic NGS testing with QCI interpretation for oncology can lead to streamlined filtering of structural variants.

This section covers the future forecast of the clinical oncology next-generation sequencing industry in the top three countries. Information on regions like North America, Europe, Asia Pacific, and others is granulated, focusing on the top countries.

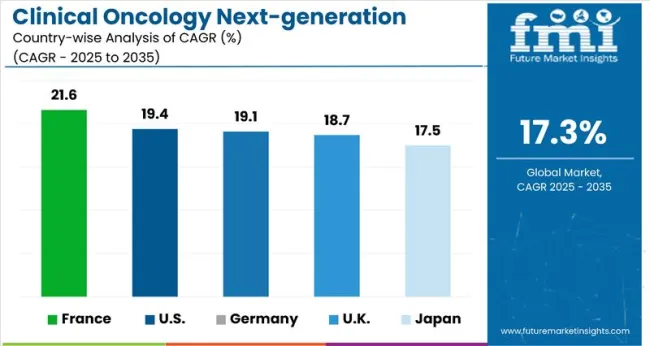

France is anticipated to be at the forefront with a 21.6% CAGR through 2035. The United States follows next at a 19.4% CAGR projected through 2035. Germany secures third place, expanding at a 19.2% CAGR through 2035. Analysis indicates that Europe is likely to be the most revenue generation region for the coming decade.

| Countries | CAGR 2025 to 2035 |

|---|---|

| France | 21.6% |

| United States | 19.4% |

| Germany | 19.1% |

The clinical oncology next-generation sequencing market expansion in France is anticipated at 21.6% through 2035. In France, a network of Next Generation Sequencing (NGS) interests is aligning to drive the technology forward in oncology research and clinical practice. This includes government initiatives and very generous funding programs, such as the National Cancer Institute and Investments for the Future.

There is a robust academic research infrastructure and premier research institutions for biomedical research. These include the Curie Institute and the Gustave Roussy Cancer Center, which are renowned for genomic and cancer biology innovation and excellence. Demand is growing for NGS-based genetic testing in rare and familial cancers, helping the industry thrive in France.

The clinical oncology next-generation sequencing market in the United States is anticipated to rise at a 19.4% CAGR through 2035. Initiatives such as ORIEN and NCI MATCH support genomic research studies and the recruitment of participants for trials.

Currently, genetic testing services offered directly to consumers are raising awareness among the public and creating a demand for NGS-based oncology testing.

FDA initiatives like the Breakthrough Devices Program speed up the introduction of assays into the industry. Also, linking with Electronic Health Records (EHRs) improves decision-making support and patient care. This diverse landscape establishes the United States as a runner in clinical oncology NGS. The country is promoting progress in precision medicine and research on genomic-driven oncology.

The clinical oncology next-generation sequencing market in Germany is expected to rise at a 19.1% CAGR through 2035. The robust healthcare system emphasizes diagnosing and treating diseases. This emphasis has led to an increase in the use of clinical oncology NGS technology in clinical genetics and cancer care.

Specialized centers and genetic testing programs provide NGS-based testing and counseling services, leading to a higher interest in precision medicine. Additionally, strict standardization and quality assurance measures ensure the precision and dependability of NGS results. This helps in building trust among healthcare professionals and patients. This holistic approach highlights Germany’s dedication to delivering top-notch healthcare services.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 744.4 million |

| Projected Market Size (2035) | USD 3.13 billion |

| CAGR (2025 to 2035) | 17.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Components Analyzed (Segment 1) | Sequencing Platforms, Sequencing Products, Kits and Reagents, Services |

| Technologies Covered (Segment 2) | Ion Semiconductor, Pyro-Sequencing, Synthesis Sequencing (SBS), Real-Time (SMRT), Ligation, Reversible Dye Termination, Nanopore Sequencing |

| Applications Covered (Segment 3) | Whole Tumor Genome Sequencing, Whole Tumor Exome Sequencing, Targeted Tumor Genome Profiling, Tumor Transcriptome Sequencing, Tumor-Normal Comparisons |

| End Users Covered (Segment 4) | Hospitals, Laboratories, Clinical Research Organizations, Diagnostic Laboratories |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, Germany, France, China, India, Japan |

| Key Players Influencing the Market | Illumina, Thermo Fisher Scientific, Qiagen, F. Hoffmann-La Roche, Pacific Biosciences, Oxford Nanopore, Agilent Technologies, BGI Group, PerkinElmer, Bio-Rad Laboratories |

| Additional Attributes | Dollar sales by component and technology, advances in liquid biopsy, AI integration, government funding impact, precision medicine trends |

| Customization and Pricing | Customization and Pricing Available on Request |

Based on component, the industry fragments into sequencing platforms, sequencing products, kits and reagents, and services.

Depending on technology, the sector is segmented into ion semiconductor sequencing, pyro-sequencing, synthesis sequencing (SBS), real time sequencing (SMRT), ligation sequencing, reversible dye termination sequencing, and Nano-pore sequencing.

Clinical oncology next-generation sequencing finds application in whole tumor genome sequencing, whole tumor exome sequencing, targeted tumor genome profiling, tumor transcriptome sequencing, tumor-normal comparisons, and others.

Top end user existing in this industry are hospitals, laboratories, clinical research organizations, diagnostic laboratories, and others.

Analysis of the market has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa (MEA).

Industry is set to reach USD 744.4 million in 2025.

The industry is expected to reach USD 3.13 billion by 2035.

Industry is set to report a CAGR of 17.3% from 2025 to 2035.

Kits and reagents lead the industry, with a share of 60.9% for 2025.

The market in France is expected to advance at a CAGR of 21.6% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Clinical Nutrition Market Insights – Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Clinical Information System Market Analysis - Growth & Forecast 2024 to 2034

Clinical Chemistry Analyzers Market Trends – Demand & Forecast 2024 to 2034

Clinical Communication & Collaboration Software Market Trends – Forecast through 2034

Clinical Decision Support App Market – AI-Powered Insights 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA