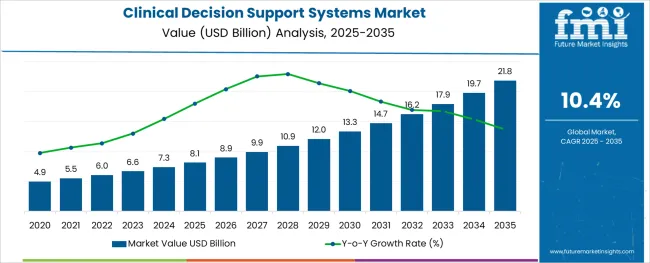

The Clinical Decision Support Systems Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 21.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

The Clinical Decision Support Systems market is being driven by increasing commitments across healthcare organizations toward enhancing patient safety efficiency and compliance. Heightened emphasis on reducing medication errors and adverse drug events has led to widespread adoption of decision support tools.

Integration with electronic health records and computerized physician order entry systems has been prioritized to streamline clinician workflows and reinforce best practice alerts. Additionally regulatory encouragement for evidence based care and quality reporting has emphasized the value of real time clinical guidance.

Investment in AI powered analytics and interoperability improvements is expected to further support market expansion. As healthcare providers pursue both cost containment and improved outcomes this market is projected to continue gaining traction with scalable technology solutions aligned with care quality objectives.

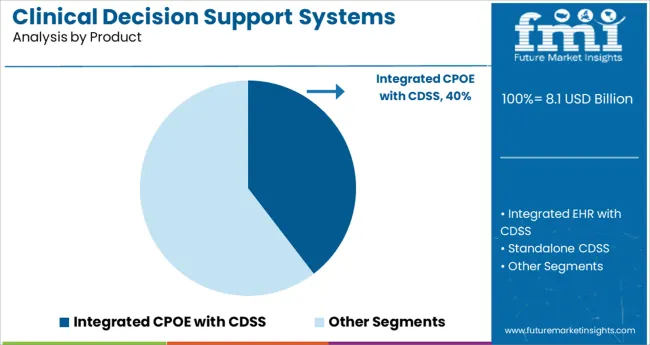

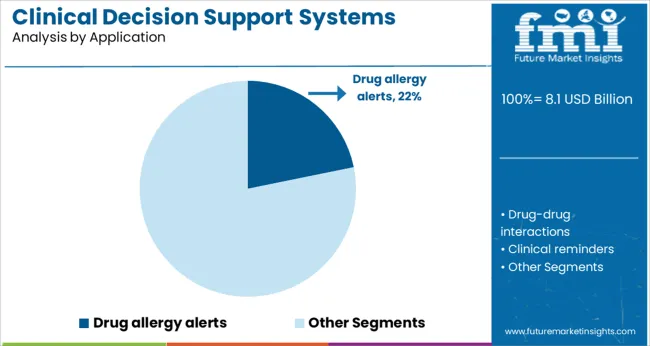

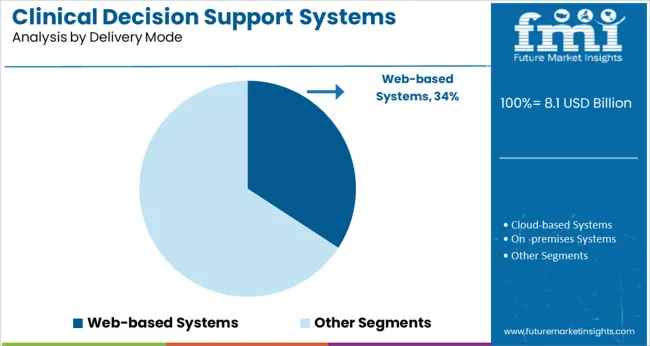

The market is segmented by Product, Application, Delivery Mode, and Component and region. By Product, the market is divided into Integrated CPOE with CDSS, Integrated EHR with CDSS, Standalone CDSS, and Integrated CDSS with CPOE & EHR. In terms of Application, the market is classified into Drug allergy alerts, Drug-drug interactions, Clinical reminders, Clinical guidelines, Drug dosing support, and Others. Based on Delivery Mode, the market is segmented into Web-based Systems, Cloud-based Systems, and On -premises Systems. By Component, the market is divided into Hardware, Software, and Services. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that the integrated CPOE with CDSS product segment holds 39.60% share of the market reflecting its leadership position. This is driven by its ability to automate order entry reduce prescribing errors and ensure adherence to clinical guidelines at the point of care.

Adoption has been fueled by operational efficiencies realized through reduced duplication of tests and streamlined provider workflows. Financial incentives for electronic health record meaningful use have further fueled deployment of integrated solutions.

The combination of enhanced patient safety and verified clinician support has cemented its dominance within the product category.

It is noted that the drug allergy alerts application segment accounts for 21.80% share of the market positioning it as the top application area. This prominence is grounded in the mandate to prevent adverse drug reactions and ensure patient safety.

Healthcare organizations have been prioritizing these alerts to minimize liability risks and enhance clinical oversight. The availability of robust patient allergy information within interoperable records has reinforced reliance on this application.

The measurable impact on reducing adverse events and promoting safer prescribing practices has underpinned growth in this subsegment.

It is observed that the web‑based systems delivery mode segment commands 34.20% share of the market making it the leading delivery format. This growth can be attributed to its ease of deployment across multiple care settings without significant on premise infrastructure costs.

It enables remote access real time updates and centralized management which aligns well with healthcare mobility trends. Updates to clinical content and system maintenance have been simplified under this model resulting in reduced IT overhead.

The adaptability and scalability of web based platforms have reinforced their appeal among providers pursuing rapid implementation and secure care collaboration.

The growth of the cloud-based sector of the market is being fuelled primarily by rising healthcare costs and the widespread use of cloud computing. Governments across Europe are taking steps to encourage the expansion of healthcare IT. For instance, in February 2024, nearly two million National Health Services (NHS) mail mailboxes were migrated to Exchange Online, which is a part of Microsoft's Azure Cloud, as part of the UK government's aim to embrace a fully linked cloud-driven health service. Staff across NHS organizations and departments is expected to be able to communicate with one another more effectively and have easier access to relevant data as a result of this. Because of this, the need for HCIT Change Management services in the United Kingdom is likely to rise, driving the industry forward.

Additionally, clinical decision support solutions that rely on local knowledge management may incur substantial running expenses due to the large amounts of processing power and storage space that may be required. Unlike locally hosted apps, cloud-based ones are hosted on remote servers and don't necessitate a lot of processing power or storage space on the user's end.

By design, cloud-based apps are more secure than their web-based counterparts since they don't rely on browsers. The processing nodes of cloud-based clinical decision support solutions reside on distant servers, which may be in several different data centres across the world. Over the forecast period, cloud-based CDSS adoption is likely to rise in tandem with the proliferation of cloud technologies due to their many advantages.

Increasing technological sophistication and the growing influence of social media.

Another developing pattern in CDSS products is providing access to many media outlets. For instance, social media data acquired for patients with chronic diseases have been included in the cloud-based Smart Clinical Decision Support System (Smart CDSS) established by independent researchers. This information is combined with clinical observations from actual patient experiences. Patient health, mood, and hobbies are tracked through their social media activity by the system. It gathers patient-specific information from Twitter, e-mail analysis, and other social media platforms by mining for keywords, concepts, and feelings. As a result, doctors are better able to make treatment decisions based on the individual patient's behaviour and way of life. The data is then used by the Smart CDSS to make personalised suggestions for each individual patient.

Problems with cloud based CDSS data security

Data hosted by the vendor is not as secure as on-premises data, which is a big problem with cloud-based CDSS. The confidentiality of patient records is of the utmost importance to ensure that data is only accessed by those who have a legitimate need to know. Data privacy regulations regulated under HIPAA, for example, are constantly under review by legal frameworks (Health Insurance Portability and Accountability Act). The EU Data Protection Regulation also has ramifications for the security of personal health information in the European Union. The healthcare business is uncertain about the efficacy of private clouds, despite their offering of additional access methods and health information technology systems.

A severe lack of competent information technology specialists is plaguing the healthcare sector.

Strong IT infrastructure and support, both inside the company and from the solution vendor, are required for the effective use of healthcare IT solutions. It is essential for a healthcare business to have reliable technical assistance in order to keep its server and network running smoothly, which is essential for clinical workflows and healthcare IT system interface performance. Poor server or network maintenance can cause screen loads, which in turn can impede down clinical workflow. Adoption and deployment of health information technology systems, whether cloud-based or installed on-premises, are hampered by a lack of educated and qualified labor in key markets.

In 2024, standalone CDSS had more than 31.0% of the market because of its widespread adoption, low cost, and ease of use. As a result of its superior usability in healthcare facilities, it has taken the lead in most of these applications. Throughout the anticipated time frame, the solo subsegment is expected to maintain its dominant position. CDSS solutions can function alone or can be integrated with an electronic health record system or computerized provider order entry system.

By 2035, the market for integrated EHR and CDSS is expected to have grown substantially. The percentage of CDSS that is integrated with EHR is likely to change as more and more multi-specialty healthcare units become familiar with and use EHR. These health information technology systems collect patient data and send it to a clinical decision support system (CDSS), which then automates the clinical workflow by providing the doctor with clinical solutions and prescription recommendations. Integration between CDSS and EHRs is commonplace to facilitate the utilization of existing data sets and improve efficiency. The increasing integration of CDSS features into EHR systems is a factor that bodes well for the development of this market.

In 2024, drug allergy alerts had more than 26.0% share of the market. Since many people have life-threatening reactions to even the smallest amounts of some medications, it's crucial to have early warning systems in place. Allergies, especially those to medication, are becoming more of a problem. Accidental pharmaceutical administration to a patient with a known allergy, for example, is an example of a medicine error that can have serious consequences at any stage of the drug's life cycle.

During the foreseeable future, the market for clinical guidelines should expand at a profitable rate. The CDS provides recommendations for both diagnosis and treatment. It accesses information stored in a database and applies it to patient care, giving the doctor or nurse specific instructions to follow when they provide treatment.

| Market Value (2025) | USD 8.1 billion |

|---|---|

| Market Value (2035) | USD 21.8 Billion |

| CAGR | 10.4% |

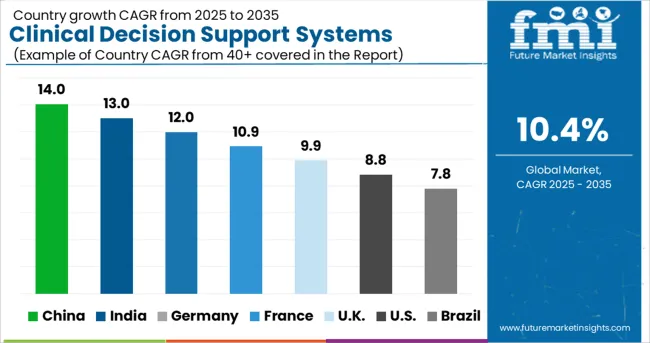

USA market is expected to reach a valuation of USD 21.8 Billion by 2035 from USD 8.1 Billion in 2025. The growth rate is likely to be 9.3%.

One of the key factors in the region's rising market revenue is the development of information technology in the medical sector. The use of electronic health record (EHR)-equipped clinical decision support system platforms is expected to rise in the United States throughout the healthcare industry in the next years, as reported by the Office of the National Coordinator for Health Information Technology (ONC). A rise in adoption can be seen in areas such as pediatric healthcare (68%) and specialty industries (43%). The increasing need for CDSS that integrates with electronic health records is driving the market expansion in this area. This region's governments are likewise making investments in an automated healthcare environment powered by AI.

Furthermore, governments are implementing programmes to raise awareness among hospitals of the uses and benefits of CDSS, as well as the wide range of innovative CDSS technologies currently available. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) announced on November 18, 2024, that it would offer incentives to doctors who use certain clinical decision-support devices when making a diagnosis. Incentives for the use of Viz.ai's ContaCT and Digital Diagnostics' IDX-DR have been announced by CMS. There has been a rise in market revenue in this area thanks to these strategic activities.

In 2024, Europe remained a reliable source of revenue. The clinical decision support system market is growing as a result of rising investments in the digitalization and automation of healthcare services. UK-based NHS provider Global Digital Exemplar reports that the government of the United Kingdom invested GBP 395 million to facilitate greater integration of clinical decision support solutions across the healthcare sector. Clinical decision systems in healthcare that are integrated with artificial intelligence have been established with funding from the governments of France (EUR 500 million) and Germany (EUR 3.4 billion). It is anticipated that these funds would be used to enhance Europe's clinical decision support system platform's information technology infrastructure and related services.

Demand for clinical decision support system hardware is growing in this area for several reasons, including the region's growing elderly population. European Union (EU) estimates suggest that by 2024, one in five Europeans is expected to be 65 or older. The percentage of the EU's population that is 80 or older is projected to rise from 6% in 2024 to 14.6% in 2100. Moreover, an aging population means an increase in patient load, which should boost demand for clinical decision support systems in the future.

High rates of medication errors, the rising popularity of big data and mobile health applications, the rising adoption of cloud computing in healthcare, rising returns on investment for CDSS solutions, and collaborations between clinical decision support businesses and medical research organisations are the primary factors propelling the CDSS market. However, the industry could be hampered by skepticism about mobile CDSS, worries about cloud-based CDSS's security, the need for costly IT infrastructure, and a lack of interoperability. Increases in healthcare IT solution innovation and the emergence of new healthcare IT markets present promising prospects.

Significant clinical decision support systems market revenue growth in this region is being driven by an increase in the number of patients and an increase in the need for AI-enabled automated equipment. There has been a recent uptick in the number of healthcare and IT company mergers, which bodes well for the market's future revenue growth. Elsevier and Gramin Health Care launched their artificial intelligence (AI)-powered platform ClinicalPath Primary Care India in the fall of 2024. A clinical decision support tool, it automates clinical guidelines for antenatal care, allowing for more individualized care for mothers experiencing complications during pregnancy. Additionally, it gives first responders in the field of mother and infant health access to automated medical prescriptions and counseling.

New Entrants to Foster Innovation in the Global Market

The startups in the clinical decision support systems market are adding a new edge to the properties of excavators by curating innovations beyond the imagination. They are continually upgrading the Clinical Decision Support Systems with advanced technology, and manufacturers and sellers are continuously attempting to reduce costs for greater accessibility to the market share. Startup firms are triggering the expansion of the clinical decision support systems market with their unique attempts.

Top startups operating in the market are:

| Name | Description |

|---|---|

| DXS International | As a clinical decision support provider, DXS International has been serving the primary care and retail pharmacy industries. A Clinical Decision Support System, DXS Point-of-Care (DXS PoC) (CDSS). Best Triage is a triage management solution that helps prioritise patients for medical treatment based on the severity of the condition or injury and acts as a referral peer review platform; Best Script is a medicine database; and Best Pathways is a care protocol that includes NHS Best Evidence guidance for each stage of the management of a patient with a specific condition. DXS Directory-of-Services (DoS) is an up-to-date resource for primary care physicians and nurses looking for referral information. |

| Agathos | Clinicians' decision-making software. The company's web interface and analytics platform compile a wide range of clinical, claims, and economic data; define objectives by blending external standards with administrator and physician incentives; deliver timely, relevant, and actionable insights to physicians; and modify content to maximise user engagement and the attainment of objectives. Most of the the company's income comes from monthly subscription fees charged to doctors by system administrators for using the software as a service. |

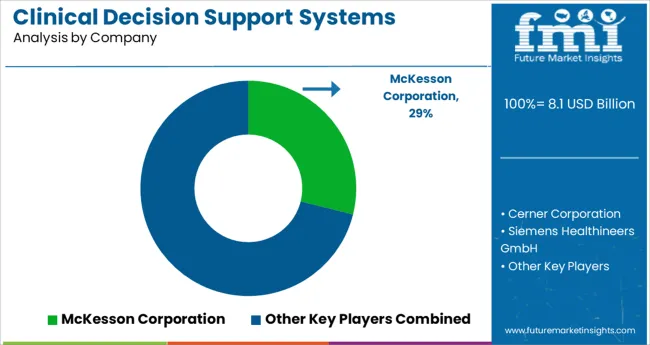

As with many industries, competition in the global demand for clinical decision support systems is fierce. Market leaders include companies like McKesson, Philips, Wolters Kluwer, Cerner, Siemens, and Wolters Kluwer NU. To differentiate themselves from the competition, these companies create new products, develop improved versions of existing ones, merge with others, and form strategic alliances.

Market leaders in clinical decision support systems worldwide include:

The global clinical decision support systems market is estimated to be valued at USD 8.1 billion in 2025.

It is projected to reach USD 21.8 billion by 2035.

The market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types are integrated cpoe with cdss, integrated ehr with cdss, standalone cdss and integrated cdss with cpoe & ehr.

drug allergy alerts segment is expected to dominate with a 21.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Trials Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Next-Generation Sequencing (NGS) Data Analysis Market Analysis by Solution and Services, Technology, End User, and Region through 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Clinical Nutrition Market Insights – Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Clinical Information System Market Analysis - Growth & Forecast 2024 to 2034

Clinical Chemistry Analyzers Market Trends – Demand & Forecast 2024 to 2034

Clinical Communication & Collaboration Software Market Trends – Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA