The clinical hand hygiene products market is projected to witness significant growth from 2025 to 2035, driven by increasing awareness of infection prevention, stringent healthcare regulations, and rising hospital-acquired infection (HAI) rates.

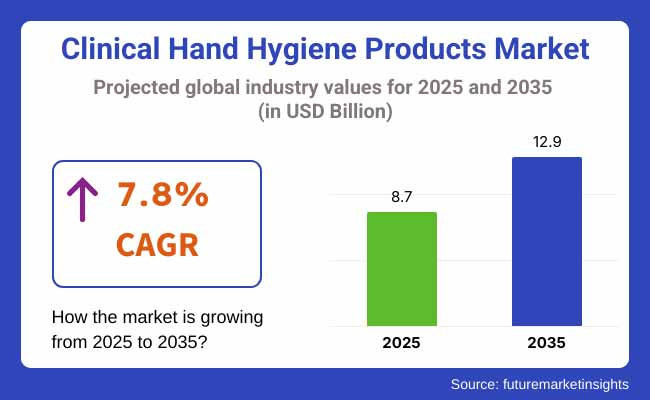

The market is expected to grow from USD 8.7 billion in 2025 to USD 12.9 billion by 2035, registering a CAGR of 7.8% over the forecast period.

Factors contributing to this expansion include the growing relinquishment of hand sanitizers, antimicrobial detergents, and detergent wipes in hospitals, conventions, and itinerant care centers. Also, the demand for skin-friendly and alcohol-free hand hygiene results is rising, as healthcare professionals seek effective yet non-irritating options for frequent use. The integration of smart hand hygiene monitoring systems and AI-driven compliance shadowing in medical installations will further drive market growth

North America will dominate the clinical hand hygiene products market due to strict infection control guidelines set by associations like the CDC and FDA. The USA healthcare sector is decreasingly investing in automated hand hygiene monitoring systems to ensure compliance in hospitals and long-term care installations.

The demand for alcohol- grounded hand sanitizers, froth detergents, and antiseptic wipes is rising, particularly in high-threat surroundings similar as ICUs and operating apartments. Also, growing consumer mindfulness about hygiene and the spread of contagious conditions will further support market growth.

Europe will see steady growth in the clinical hand hygiene products market, driven by the enforcement of strict hygiene protocols by the European Centre for Disease Prevention and Control (ECDC). Countries like Germany, the UK, and France are witnessing an increased relinquishment of sustainable and eco-friendly hygiene results.

The market will profit from the growing use of biodegradable hand wipes and factory-grounded hand sanitizers, aligning with Europe's commitment to reducing plastic waste and chemical-grounded products. Healthcare institutions are also enforcing digital tracking systems to cover hand hygiene compliance among medical staff.

Asia-Pacific is anticipated to witness the fastest growth, fuelled by the expansion of healthcare structure in China, India, Japan, and South Korea. Rising government enterprises to combat healthcare-associated infections (HAIs) and adding public mindfulness of hygiene norms post-pandemic are driving demand.

Numerous hospitals in the region are investing in touchless hand hygiene dispensers and AI- grounded compliance shadowing to ameliorate infection control. Also, manufacturers are developing affordable hand hygiene results acclimatized for high-population regions, further propelling market expansion.

Challenge

One of the biggest challenges in the clinical hand hygiene market is icing compliance among healthcare workers. Studies indicate that hand hygiene compliance rates in hospitals remain below 50, leading to an advanced threat of infections. While automated monitoring systems are being enforced, resistance to behavioral change and lack of proper training remain walls. Healthcare installations need to invest in ongoing education programs and real-time feedback systems to ameliorate compliance.

Opportunity

The integration of AI-driven hand hygiene monitoring systems presents a major occasion for market growth. Hospitals and healthcare institutions are decreasingly espousing detectors- grounded dispensers, RFID-tracking systems, and real-time compliance cautions to enhance hygiene practices. Companies investing in smart hand hygiene results that give data analytics and behavioral shadowing will gain a competitive advantage in the market. Also, the rising demand for antimicrobial and skin-friendly hand hygiene products opens new avenues for product invention.

| Country | United States |

|---|---|

| Population (Millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 32.50 |

| Country | China |

|---|---|

| Population (Millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 20.80 |

| Country | Germany |

|---|---|

| Population (Millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 25.40 |

| Country | United Kingdom |

|---|---|

| Population (Millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 23.90 |

| Country | Japan |

|---|---|

| Population (Millions) | 123.3 |

| Estimated Per Capita Spending (USD) | 22.10 |

The USA clinical hand hygiene products market is driven by strict healthcare regulations and high mindfulness of infection control. Hospitals, inpatient installations, and nursing homes considerably use alcohol- grounded hand sanitizers and antibacterial detergents. The demand for touch-free dispensers and moisturizing formulas has grown significantly.

China's market is expanding due to government healthcare reforms and increased hygiene mindfulness following the COVID- 19 epidemic. Hospitals, conventions, and food service diligence are crucial consumers. Alcohol-grounded sanitizers and antimicrobial wipes are in high demand, particularly in civic areas.

Germany's strict hygiene protocols in healthcare and food diligence support steady market growth. The demand for eco-friendly and scent-free hand hygiene results is rising, reflecting consumer preference for sustainable and skin-friendly phrasings. Hospitals and dental conventions lead in adoption.

In the UK, the National Health Service ( NHS) authorizations strict hand hygiene protocols, ensuring steady demand in hospitals, senior care homes, and primary healthcare installations. The hospitality and education sectors also contribute to market growth, favoring bulk packaging and refillable dispensers.

Japan’s market thrives on a strong culture of particular hygiene and infection forestalment. Hospitals, apothecaries, and retail stores stock a variety of hand hygiene products, including alcohol-free sanitizers suitable for sensitive skin. The growing population further drives demand in nursing care installations.

The market for clinical hand hygiene products is also rising with increased awareness of infection control, strict healthcare regulations, and growing application of hand hygiene practices in healthcare institutions. Consumer behaviour, marketplace patterns, and purchasing habits influencing the market are established through the survey of 300 respondents in North America, Europe, and Asia.

Effectiveness and compliance are the key considerations, with 80% of healthcare professionals choosing hand hygiene products based on antimicrobial effectiveness. 75% of North American purchasers favour alcoholic hand sanitizers with a minimum of 60% ethanol or isopropanol, while 70% of European purchasers have the highest priority for EN 1500 standard-compliant formulas.

Skin-friendliness and formulation preferences vary, with 65% of respondents preferring non-irritating, moisturizing hand sanitizers and soaps to prevent dryness from overuse. Foam-based and gel-based sanitizers are popular, with 58% of North American and 60% of European customers preferring fast-drying, residue-free products.

Geographic price responsiveness varies, with 72% of institutional purchasers opting for cost-cutting bulk purchasing for hospitals, clinics, and nursing homes. Yet, 45% of Asian respondents indicated a willingness to pay extra for fragrance-free and dermatologically tested products that reduce allergy risks.

Direct buying channels and the Internet lead in sales with 67% of healthcare purchasers reporting a preference for online channels and direct manufacturers for convenience reasons and for the range of products that are regulatory-approved. However, 48% of Asia and 50% of Europe respondents still rely on medical supply wholesalers and pharmacy distribution for on-hand availability.

Brand reputation and regulatory compliance play a role in purchasing decisions, with 65% of consumers wanting to purchase from reputable brands like Purell, Dettol, and 3M for established performance and adherence to international healthcare standards. Yet, 40% of price-sensitive consumers shop around hospital-branded or private labels.

As demand for effective, skin-compatible, and regulation-compliant clinical hand hygiene products continues to grow, brands that focus on antimicrobial effectiveness, skin protection, and eco-friendly packaging will continue to have a competitive advantage in this dynamic marketplace.

| Market Shift | 2020 to 2024 |

|---|---|

| Antimicrobial Innovation & Effectiveness | Surge in demand for alcohol-based hand sanitizers and antimicrobial soaps due to COVID-19. Growth in chlorhexidine, benzalkonium chloride, and povidone-iodine-based hand hygiene products. Introduction of long-lasting, residual-protection formulas to reduce frequent application. |

| Sustainability & Eco-Friendly Formulations | Shift toward biodegradable, non-toxic, and plant-based hand hygiene products. Brands introduced alcohol-free, water-based sanitizers to reduce skin irritation. Growth in refillable, plastic-free dispensers to minimize waste. |

| Smart Dispensing & Contactless Technology | Rise of touchless sanitizer dispensers in hospitals and clinics. Growth in foot-pedal, elbow-activated, and motion-sensing dispensers for improved hygiene. Expansion of automated hand hygiene monitoring systems in healthcare. |

| Customization & Skin Sensitivity Considerations | Brands introduced fragrance-free, hypoallergenic, and ph-balanced formulations for sensitive skin. Increased demand for moisturizing hand sanitizers with aloe vera, glycerin, and shea butter. Growth of dual-purpose sanitizers with skin-conditioning properties. |

| Regulatory & Compliance Standards | Stricter FDA, WHO, and CDC regulations on alcohol percentage and efficacy claims. Growth in demand for hospital-grade, EN1500-certified hand sanitizers. Increased emphasis on eco-certifications and allergen-free labeling. |

| Market Expansion & Consumer Adoption | Increased demand for clinical-grade hand hygiene products in hospitals, dental clinics, and nursing homes. Growth of portable, single-use hand hygiene wipes and sprays for healthcare workers. Expansion into elderly care, pediatrics, and immunocompromised patient hygiene solutions. |

| Influencer & Digital Marketing Strategies | Growth of medical influencers and hospital partnerships promoting clinical hand hygiene. Increased brand presence through tiktok, Instagram, and linkedin healthcare awareness campaigns. Rise of B2B e-commerce platforms offering bulk clinical hygiene products. |

| Consumer Trends & Behavior | Healthcare workers and consumers prioritized fast-drying, non-sticky, and non-irritating hand sanitizers. Increased demand for clinical-grade hand soaps with antibacterial protection. Growth in on-the-go hand hygiene solutions (mini bottles, wipes, pocket sprays). |

| Market Shift | 2025 to 2035 |

|---|---|

| Antimicrobial Innovation & Effectiveness | AI-optimized antimicrobial formulations balance efficacy with skin-friendliness. Nano-coating hand hygiene solutions provide extended antimicrobial protection. Self-activating, heat-responsive hand sanitizers deploy only when necessary to reduce overuse. |

| Sustainability & Eco-Friendly Formulations | Zero-waste, dissolvable hand sanitizing sheets replace traditional liquid formulas. AI-driven sustainable sourcing ensures ethical ingredient procurement. Enzyme-based hand cleansers provide deep cleaning without harming the skin microbiome. |

| Smart Dispensing & Contactless Technology | AI-powered smart dispensers track handwashing frequency and compliance in real time. Self-refilling, iot-connected dispensers optimize sanitizer levels automatically. UV-light hand sterilization stations provide chemical-free disinfection. |

| Customization & Skin Sensitivity Considerations | AI-personalized hand hygiene solutions recommend formulations based on skin type and occupation. Microbiome-friendly hand sanitizers preserve beneficial bacteria while eliminating harmful pathogens. Adaptive hydration-infused sanitizers adjust moisture levels based on environmental conditions. |

| Regulatory & Compliance Standards | Government-mandated tracking of hand hygiene compliance in clinical settings. AI-driven compliance verification systems ensure adherence to evolving hygiene standards. Blockchain-based ingredient tracking ensures transparency in formulation sourcing. |

| Market Expansion & Consumer Adoption | AI-powered hospital hygiene analytics track infection control patterns. Subscription-based hand hygiene delivery services ensure continuous supply for clinics and institutions. Metaverse-integrated training modules teach proper hand hygiene techniques with interactive simulations. |

| Influencer & Digital Marketing Strategies | AI-generated virtual health professionals educate users on proper hand hygiene. Augmented reality (AR)-based hygiene training for healthcare professionals. Live-streamed clinical hygiene Q&A sessions drive engagement and trust in brands. |

| Consumer Trends & Behavior | AI-powered hygiene habit tracking ensures individuals maintain proper handwashing practices. Consumers shift toward long-lasting, self-sterilizing hand hygiene solutions. Antiviral hand hygiene coatings become a mainstream protective measure. |

The USA clinical hand hygiene products market is witnessing strong growth, driven by adding healthcare regulations, rising mindfulness of infection control, and the growing demand for alcohol-grounded hand sanitizers and antimicrobial detergents. Major players include Purell, GOJO Diligence, and 3M.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.0% |

The UK clinical hand hygiene products market is expanding due to strict healthcare hygiene regulations, adding demand for hand sanitizing results in hospitals and conventions, and rising preference for eco-friendly and biodegradable phrasings. Leading brands include Dettol, Deb Group, and Sterillium.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.8% |

Germany’s clinical hand hygiene products market is growing, with healthcare institutions favouring high- quality, dermatologically tested, and sustainable hygiene results. Crucial players include Bode Chemie, Paul Hartmann AG, and Schülke & Mayr.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.9% |

India’s clinical hand hygiene products market is witnessing rapid-fire growth, fuelled by adding healthcare structure, rising mindfulness of infection control, and growing relinquishment of hand sanitizers and liquid hand wetlands. Major brands include Lifebuoy, Himalaya, and Savlon.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.3% |

China’s clinical hand hygiene products market is expanding significantly, driven by adding disposable inflows, growing sanitarium hygiene norms, and rising consumer preference for decoration antibacterial hand products. Crucial players include Blue Moon, Walch, and Dettol China.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.6% |

Hospitals, conventions, and nursing homes are prioritizing hand hygiene as a critical measure to help healthcare-associated infections ( HAIs). Strict regulations and guidelines from associations like the WHO and CDC are driving the demand for clinical hand hygiene products, including hand sanitizers, antimicrobial detergents, and detergent wipes.

Alcohol-grounded hand sanitizers are gaining wide acceptance in healthcare settings due to their effectiveness in killing origins and convenience of use. These products are preferred by medical professionals for quick disinfection between patient relations, reducing the spread of infections.

Frequent handwashing and sanitizer use can beget skin blankness and vexation, leading to increased demand for skin-friendly phrasings. Manufacturers are instituting moisturizing constituents similar to aloe vera, glycerin, and vitamin E to ensure effective hygiene without compromising skin health.

Hospitals and healthcare institutions are bulk-copping hand hygiene products through online channels and direct procurement contracts. E-commerce platforms also feed to individual medical professionals and conventions, offering a wide range of products, competitive pricing, and accessible delivery options.

The clinical hand hygiene products market is passing robust growth, driven by heightened mindfulness of infection control and strict healthcare regulations. Hospitals, conventions, and long- term care installations are prioritizing hand hygiene results to help healthcare-associated infections ( HAIs). The COVID-19 epidemic significantly accelerated demand, leading to nonstop inventions in alcohol-grounded sanitizers, antimicrobial detergents, and touchless dispensers.

Manufacturers are fastening on advanced phrasings with skin-friendly constituents to reduce vexation from frequent use. Sustainability is also gaining significance, with brands investing in biodegradable packaging and eco-friendly renewals. The expansion of e-commerce and direct sanitarium force channels has made clinical hand hygiene products more accessible worldwide.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| GOJO Industries (Purell) | 20-25% |

| Reckitt (Dettol) | 15-20% |

| Ecolab | 12-16% |

| 3M | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| GOJO Industries (Purell) | Market leader in alcohol-based hand sanitizers and foam soaps, focusing on hospital-grade formulations with skin-conditioning agents. |

| Reckitt (Dettol) | Offers antibacterial hand washes and sanitizers, leveraging strong brand recognition in infection prevention. |

| Ecolab | Specializes in clinical hand hygiene solutions integrated with hospital-wide sanitation programs, including antimicrobial formulations. |

| 3M | Produces high-performance hand hygiene products, including surgical scrubs and foam-based disinfectants for medical settings. |

Strategic Outlook of Key Companies

GOJO Industries (20-25%)

Continues to dominate the market with its flagship brand Purell, offering advanced, presto- drying hand sanitizers and detergents. The company is investing in biodegradable packaging and sanitarium-specific phrasings to maintain leadership in infection control.

Reckitt (15-20%)

Expanding its Dettol clinical hand hygiene range by fastening on antibacterial hand wetlands and dermatologically tested sanitizers. The company is targeting healthcare professionals and consumers likewise with multipurpose hygiene results.

Ecolab (12-16%)

Strengthening its presence in hospital infection control by integrating hand hygiene products with broader sanitation and hygiene protocols. The brand is investing in research to develop long-lasting antimicrobial formulas for frequent-use environments.

3M (8-12%)

Enhancing its medical- grade hand hygiene portfolio with alcohol- grounded surgical hand aggravations and innovative dispensers. The company is fastening on ergonomic, easy- to- use results for healthcare professionals to reduce impurity pitfalls.

Other Key Players (30-40% Combined)

Several other companies contribute to market growth by offering specialized clinical hand hygiene products tailored to hospitals, clinics, and medical institutions. Notable names include:

Hand Sanitizers, Hand Wash & Soaps, Hand Wipes, Hand Disinfectants, and Others.

Gel, Liquid, Foam, Spray, and Wipes.

Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Specialty Stores, and Others.

Hospitals & Clinics, Ambulatory Surgical Centers, Laboratories, and Long-Term Care Facilities.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Clinical Hand Hygiene Products Market is projected to witness a CAGR of 7.8% between 2025 and 2035.

The Clinical Hand Hygiene Products Market stood at USD 6.3 billion in 2024.

The Clinical Hand Hygiene Products Market is anticipated to reach USD 12.9 billion by 2035 end.

Alcohol-based hand sanitizers are set to record the highest CAGR of 7.8%, driven by increasing infection prevention protocols in healthcare settings.

The key players operating in the Clinical Hand Hygiene Products Market include GOJO Industries, Reckitt Benckiser, 3M, Ecolab, Kimberly-Clark, and B. Braun Melsungen AG.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Industrial and Institutional Hand Hygiene Chemicals Market - Trends & Forecast 2025 to 2035

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA