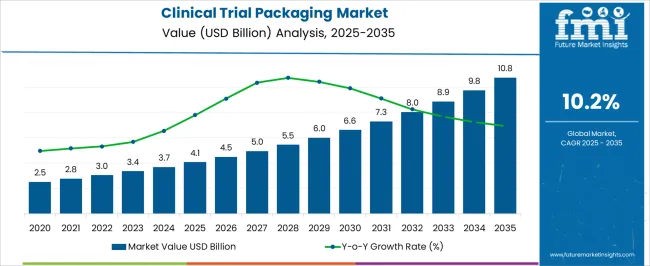

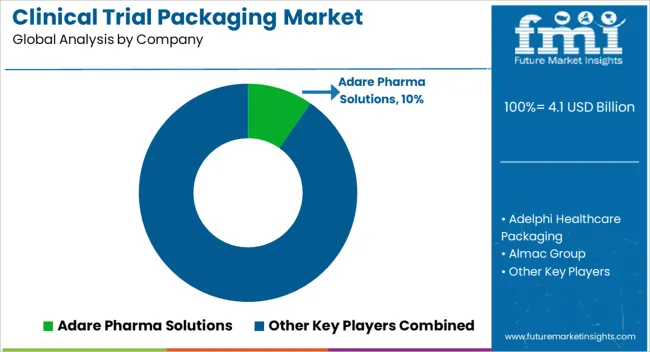

The clinical trial packaging market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 10.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period.

the clinical trial packaging market is projected at USD 4.1 billion in 2025 and is expected to reach USD 10.8 billion by 2035, reflecting a CAGR of 10.2%. this trajectory creates an absolute dollar opportunity of USD 6.7 billion over the forecast period. between 2025 and 2030, the market is forecast to rise from USD 4.1 billion to USD 6.0 billion, adding USD 1.9 billion in just five years. this period captures nearly 30% of the total incremental growth, driven by the scaling of trial activities and increasing complexity in packaging solutions required to support diversified therapeutic pipelines worldwide.

from 2030 to 2035, the market expands further from USD 6.0 billion to USD 10.8 billion, generating an additional USD 4.8 billion in opportunity. this stage alone accounts for over 70% of the absolute dollar growth, highlighting the acceleration of value creation in the latter half of the decade. the total opportunity of USD 6.7 billion between 2025 and 2035 positions this market as a strong revenue channel for packaging manufacturers, contract research organizations, and supply chain providers. with a compound annual growth rate of 10.2%, consistent double-digit expansion ensures a favorable environment for long-term strategic investments.

| Metric | Value |

|---|---|

| Clinical Trial Packaging Market Estimated Value in (2025 E) | USD 4.1 billion |

| Clinical Trial Packaging Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The clinical trial packaging market, valued at USD 4.1 billion in 2025 and projected to reach USD 10.8 billion by 2035 at a CAGR of 10.2%, shows critical breakpoints where growth accelerates. The first breakpoint occurs between 2027 and 2029, when the market moves from USD 5.0 billion in 2027 to USD 6.0 billion in 2029, adding USD 1.0 billion in just two years. This rapid upswing reflects heightened clinical trial activity and the increasing regulatory requirements that drive demand for advanced packaging formats. Crossing the USD 6.0 billion threshold in 2029 signals a strong shift into large-scale adoption.

A second major breakpoint is observed between 2031 and 2033, when revenues rise sharply from USD 7.3 billion in 2031 to USD 8.9 billion in 2033, an addition of USD 1.6 billion in just two years. This period represents a tipping point where the market achieves maturity through higher trial volumes, complex study designs, and broader geographic participation. By 2035, at USD 10.8 billion, the market completes a significant transformation, consolidating nearly USD 6.7 billion in absolute dollar opportunity since 2025. These breakpoints highlight phases of accelerated adoption where investment timing becomes critical for market players.

The clinical trial packaging market is experiencing steady growth, fueled by the rising number of clinical studies, stringent regulatory requirements, and increasing complexity of trial protocols. Industry publications and pharmaceutical supply chain reports have emphasized the growing need for packaging solutions that ensure product integrity, patient safety, and compliance with international standards.

Advances in packaging technologies, such as tamper-evident seals, temperature-controlled systems, and smart labeling, have enhanced traceability and reduced risks of contamination or dosing errors. The globalization of clinical trials has expanded demand for packaging that meets varied regional regulations while facilitating efficient logistics and distribution across multiple trial sites.

Additionally, the rise in biologics and personalized medicine has driven the need for specialized packaging formats capable of handling temperature-sensitive and small-batch products. With research laboratories, contract research organizations, and pharmaceutical companies investing in advanced packaging capabilities, the market is set to expand further, supported by innovation in materials, product design, and supply chain integration.

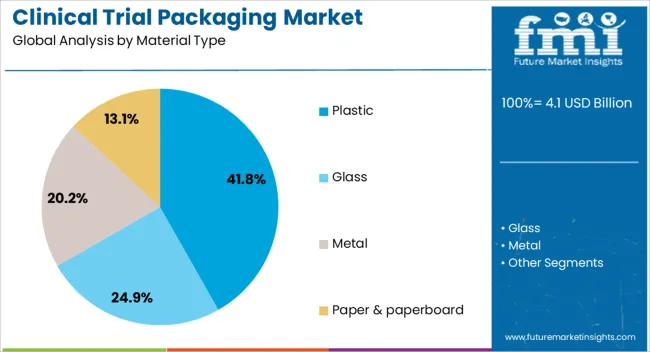

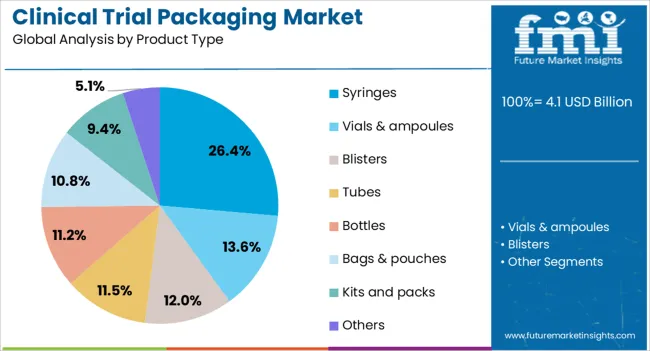

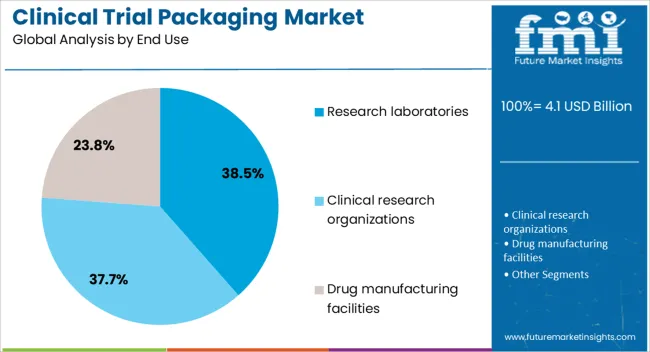

The clinical trial packaging market is segmented by material type, product type, end use, and geographic regions. By material type, clinical trial packaging market is divided into plastic, glass, metal, and paper & paperboard. In terms of product type, clinical trial packaging market is classified into syringes, vials & ampoules, blisters, tubes, bottles, bags & pouches, kits and packs, and others. Based on end use, clinical trial packaging market is segmented into research laboratories, clinical research organizations, and drug manufacturing facilities. Regionally, the clinical trial packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is projected to account for 41.8% of the clinical trial packaging market revenue in 2025, retaining its leadership in material usage. This dominance is supported by plastic’s versatility, cost-effectiveness, and adaptability to various packaging formats used in clinical studies.

Pharmaceutical packaging teams have favored plastics for their lightweight properties, durability, and compatibility with sterile manufacturing environments. Additionally, plastic materials such as polypropylene and polyethylene have demonstrated strong barrier protection against moisture and contaminants, safeguarding product stability during transport and storage.

The scalability of plastic manufacturing, coupled with the ability to produce customized shapes and closures, has further reinforced its widespread adoption. Regulatory acceptance of medical-grade plastics for primary and secondary packaging has also contributed to sustained demand. As innovations in biodegradable and recyclable plastics advance, the segment is expected to maintain its leading role while aligning with sustainability objectives in clinical trial supply chains.

The syringes segment is projected to hold 26.4% of the clinical trial packaging market revenue in 2025, making it the leading product type. Growth in this segment is driven by the increasing prevalence of parenteral drug administration in clinical trials, particularly for biologics, vaccines, and injectable therapies.

Syringes provide precise dosing, sterility, and patient compliance advantages, which are critical in maintaining trial accuracy and safety. Industry reports have noted a shift towards prefilled and safety-engineered syringes to reduce preparation time and minimize the risk of needlestick injuries.

Additionally, syringes are often paired with advanced labeling and serialization technologies, ensuring accurate patient identification and regulatory compliance. The demand for syringes in trial packaging has also been supported by the growing number of self-administration studies, where user-friendly designs and clear dosing indicators are prioritized. With injectable formulations gaining prominence in drug development pipelines, the syringes segment is expected to remain a key driver of market growth.

The research laboratories segment is projected to contribute 38.5% of the clinical trial packaging market revenue in 2025, sustaining its role as the primary end-use category. This dominance stems from the central role laboratories play in drug development, preclinical studies, and early-phase clinical research.

Research laboratories require packaging solutions that ensure accurate sample handling, storage stability, and adherence to trial protocols. Their demand for high-quality packaging has been reinforced by increasing trial complexity, where precise tracking, labeling, and environmental control are essential.

Laboratories often handle diverse product types, from solid dosage forms to temperature-sensitive biologics, requiring flexible packaging solutions that meet varied storage and transport needs. Investment in laboratory infrastructure, particularly in emerging markets, has expanded the scope for packaging suppliers targeting this segment. As trial designs evolve to include adaptive and decentralized models, research laboratories will continue to rely on advanced packaging systems to maintain data integrity and ensure patient safety.

The clinical trial packaging market is expanding as pharmaceutical, biotechnology, and research organizations require specialized solutions for drug testing, storage, and distribution. Clinical trial packaging ensures accurate dosage delivery, patient compliance, and regulatory adherence throughout study phases. Increasing clinical research activity, driven by new drug discoveries, biologics, and personalized medicine, supports demand. Packaging providers offering innovative formats such as blister packs, vials, pouches, and bottles with features like tamper evidence, temperature control, and smart labeling gain a competitive advantage. The rise of decentralized and virtual clinical trials also creates a need for patient-friendly, secure, and trackable packaging solutions. With growing emphasis on sustainability and supply chain visibility, the market continues to benefit from technological advances in serialization, digital monitoring, and eco-friendly materials.

The clinical trial packaging market faces challenges due to complex regulatory requirements across regions. Pharmaceutical packaging must comply with strict guidelines on labeling, traceability, sterility, and patient safety, which vary among agencies such as the FDA, EMA, and other national authorities. Manufacturers must invest in quality systems, validation procedures, and good manufacturing practice (GMP) certifications to meet compliance. Any deviations or non-conformities can delay trials and increase costs. Global clinical trials add further complexity by requiring multilingual labels, region-specific packaging standards, and harmonization across multiple jurisdictions. This regulatory landscape creates significant operational challenges for packaging providers, especially smaller players with limited resources. Until harmonized standards or streamlined processes become more widespread, compliance-related complexities will remain a critical barrier in the clinical trial packaging market.

Technological innovation and the growing emphasis on patient-centricity are influencing trends in the clinical trial packaging market. Smart packaging with features like QR codes, RFID tags, and digital sensors allows real-time monitoring of drug adherence, storage conditions, and supply chain tracking. Patient-friendly designs, including easy-to-open packs, unit-dose packaging, and digital reminders, enhance compliance and support decentralized clinical trials. Automation and digital printing technologies improve flexibility in producing smaller, customized batches for different trial phases. Sustainability is also shaping packaging innovation, with increasing use of recyclable and eco-friendly materials. Together, these trends highlight a shift toward packaging that integrates functionality, compliance, sustainability, and digital connectivity, enabling pharmaceutical companies to improve patient engagement and operational efficiency.

The clinical trial packaging market is benefiting from rising investments in clinical research, personalized medicine, and biologics. As pharmaceutical companies and research institutions accelerate drug development pipelines, the demand for specialized packaging that ensures stability, accuracy, and traceability is rising. Personalized medicine, with its focus on tailored therapies, requires flexible, small-batch packaging solutions that can accommodate patient-specific formulations. Growth in biologics and biosimilars also creates opportunities for temperature-controlled and sterile packaging. Emerging markets, especially in Asia-Pacific and Latin America, are seeing rapid growth in clinical trial activity, creating new opportunities for global packaging providers. Companies offering scalable, customizable, and compliant packaging solutions stand to capture significant market share as clinical trials expand worldwide.

The clinical trial packaging market faces restraints from supply chain challenges and cost pressures. Clinical packaging requires specialized materials, temperature-controlled logistics, and precise labeling, which increase operational costs. Shortages in raw materials, such as high-grade plastics, glass vials, or specialty films, can delay production and trial timelines. Global supply chain disruptions, including transportation delays and limited availability of cold chain infrastructure, further exacerbate the issue. Pharmaceutical sponsors also face mounting pressure to reduce clinical trial costs, putting downward pricing pressure on packaging providers. Until supply chain resilience improves and cost-effective packaging technologies become more widely available, these constraints will remain significant barriers to large-scale adoption, especially in cost-sensitive markets.

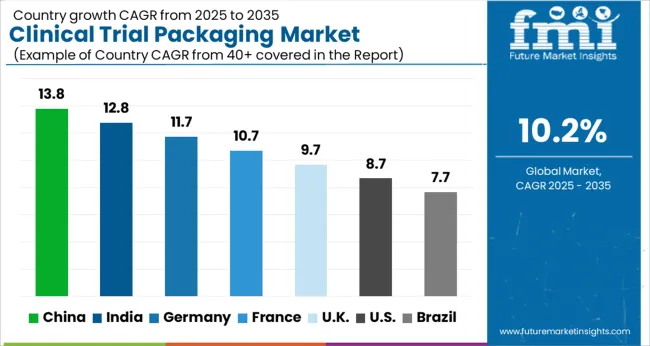

| Country | CAGR |

|---|---|

| China | 13.8% |

| India | 12.8% |

| Germany | 11.7% |

| France | 10.7% |

| UK | 9.7% |

| USA | 8.7% |

| Brazil | 7.7% |

The global clinical trial packaging market was projected to grow at a 10.2% CAGR through 2035, driven by demand in pharmaceuticals, biotechnology, and contract research activities. Among BRICS nations, China recorded 13.8% growth as specialized packaging facilities were commissioned and compliance with pharmaceutical safety standards was enforced, while India at 12.8% growth saw expansion of operations to support rising clinical research and drug development projects. In the OECD region, Germany at 11.7% maintained substantial output under strict healthcare and regulatory frameworks, while the United Kingdom at 9.7% relied on moderate-scale facilities serving both domestic and international trials. The USA, expanding at 8.7%, remained a mature market with steady demand across pharmaceutical and biotech trials, supported by adherence to federal and state-level regulatory requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Clinical trial packaging market in China is expanding at a strong CAGR of 13.8%, supported by rapid pharmaceutical innovation and government backed research programs. Rising participation of Chinese organizations in international clinical trials has created consistent demand for compliant and patient friendly packaging solutions. Multinational pharmaceutical companies are investing in local facilities that follow global Good Manufacturing Practice standards. Packaging providers are focusing on temperature controlled logistics, tamper evident seals, and multi language labeling to support cross border studies. Growth of digital healthcare platforms is driving interest in packaging formats that improve patient adherence and tracking. Local manufacturers are adopting smart labeling and track and trace systems, aligning with international compliance requirements. Regulatory support, combined with investment inflows and advanced technologies, is positioning China as a leading hub in the Asia Pacific clinical trial packaging industry.

Clinical trial packaging market in India is expanding at a CAGR of 12.8%, supported by cost effective research services and an expanding base of clinical studies. The country benefits from a large patient pool and growing pharmaceutical manufacturing capacity, making it an attractive destination for trial sponsors. Packaging providers are focusing on child resistant containers, tamper proof seals, and unit dose packaging to meet international safety standards. Rising number of biologics and vaccine trials is driving demand for temperature sensitive packaging. Contract research organizations are offering integrated packaging and logistics services, enabling streamlined trial operations. Regulatory authorities are strengthening quality standards to ensure global compatibility. Sustainability is becoming a priority, with manufacturers introducing recyclable and eco friendly materials that maintain product integrity. These combined factors are reinforcing India as a cost competitive yet quality focused leader in the global clinical trial packaging landscape.

Clinical trial packaging market in Germany is growing at a CAGR of 11.7%, driven by a strong pharmaceutical base and rigorous regulatory standards. Germany hosts numerous research projects in therapeutic areas such as oncology, immunology, and rare diseases. Packaging companies are investing in automation and serialization to align with European Union requirements. Demand is strong for blister packs, smart labels, and vials that improve patient adherence and monitoring. Biologics in clinical pipelines are increasing the need for cold chain packaging solutions. Germany is also advancing digital health integration, leading to adoption of electronic monitoring systems for clinical supplies. Collaboration between packaging firms and contract research organizations is creating efficiency in trial logistics. The market combines innovation, compliance, and patient centered packaging, strengthening Germany role as a leading European center for clinical trial packaging development.

Clinical trial packaging market in the United Kingdom is expanding at a CAGR of 9.7%, supported by strong research institutions and continuous life science investments. London and Cambridge are leading centers for advanced studies, which require specialized packaging solutions. The regulatory environment emphasizes patient safety and supply chain transparency, leading to wider use of serialization systems and tamper proof designs. Adaptive trial models are creating demand for flexible packaging that supports smaller and variable batch sizes. Cold chain packaging is increasingly important as biologics dominate clinical pipelines. Sustainability initiatives are encouraging manufacturers to introduce recyclable and eco friendly solutions. Collaboration among pharmaceutical companies, logistics providers, and packaging firms ensures efficient execution of international trials. With its balanced focus on compliance, flexibility, and innovation, the United Kingdom maintains a competitive role in the European clinical trial packaging industry.

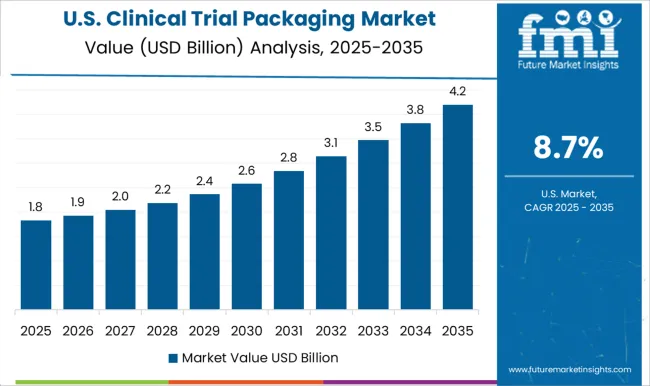

Clinical trial packaging market in the United States is advancing at a CAGR of 8.7%, supported by the largest global pharmaceutical research ecosystem. Continuous investments in biotechnology and drug development are driving high demand for specialized packaging. Strict regulations by the Food and Drug Administration ensure safety, quality, and reliability of packaging solutions. Providers are adopting blister packs, prefilled syringes, and smart packaging with digital monitoring features. Rising adoption of cell and gene therapies is boosting demand for cold chain packaging. Track and trace technologies are widely integrated to ensure compliance and improve patient adherence. Contract packaging organizations deliver customized solutions for sponsors of different sizes, providing scalability and efficiency. While sustainability is gradually emerging, regulatory compliance and operational excellence remain top priorities. The United States continues to play a central role in shaping global clinical trial packaging practices.

The clinical trial packaging market is driven by key suppliers including Adare Pharma Solutions, Adelphi Healthcare Packaging, Almac Group, Amcor plc, AptarGroup, Inc., Berry Global Inc., Brentwood Industries, Inc., Caprihans India Limited, CCL Industries Inc., DWK Life Sciences, Gerresheimer AG, Korber AG, Parexel International (MA) Corporation, SCHOTT AG, SGD Pharma, Sharp Services, LLC, TA Instruments, WestRock Company, and Yourway.

Competition is structured around innovation in patient-centric packaging, compliance with regulatory frameworks, and adaptability for small-batch and multi-country trials. Technical brochures from suppliers such as Amcor and Aptar highlight barrier properties, controlled moisture transmission rates, and stability data. Pharmaceutical contract packagers like Almac and Sharp Services focus on serialization, tamper evidence, and global distribution requirements, while Gerresheimer and SCHOTT emphasize primary container integrity for biologics and injectables.

Market strategies concentrate on differentiation through scalability, flexibility, and regulatory expertise. Companies such as Almac Group and Parexel International integrate packaging with clinical trial supply chain management, ensuring traceability and temperature control across global networks. WestRock and Berry Global deliver sustainable secondary packaging solutions with recyclable and lightweight materials, often highlighting compliance with FDA, EMA, and ICH guidelines in technical documents.

CCL Industries and Korber invest in smart-labeling and automation for clinical trial kits, with datasheets detailing serialization capability, label adhesion testing, and data integration features. Observed trends suggest increasing demand for adaptive packaging technologies, digital compliance tools, and eco-friendly materials aligned with global sustainability goals. Datasheets and brochures typically emphasize parameters such as container closure integrity, chemical compatibility, storage temperature tolerance, child-resistance, and tamper-proof features.

Suppliers like DWK Life Sciences and SGD Pharma specify material characteristics of glass and polymer systems, sterilization methods, and mechanical durability. Adare Pharma Solutions and Adelphi Healthcare Packaging highlight patient adherence packaging, with details on unit-dose blister packs, calendar formats, and usability testing. Sharp Services and Yourway emphasize their ability to deliver clinical trial packaging under GMP conditions, providing technical documentation on process validation, batch traceability, and cold-chain stability. Across the sector, detailed technical communication enables pharmaceutical sponsors, CROs, and regulators to evaluate suitability, safety, and compliance for investigational product delivery.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Material Type | Plastic, Glass, Metal, and Paper & paperboard |

| Product Type | Syringes, Vials & ampoules, Blisters, Tubes, Bottles, Bags & pouches, Kits and packs, and Others |

| End Use | Research laboratories, Clinical research organizations, and Drug manufacturing facilities |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adare Pharma Solutions, Adelphi Healthcare Packaging, Almac Group, Amcor plc, AptarGroup, Inc., Berry Global Inc., Brentwood Industries, Inc., Caprihans India Limited, CCL Industries Inc., DWK Life Sciences, Gerresheimer AG, Korber AG, Parexel International (MA) Corporation, SCHOTT AG, SGD Pharma, Sharp Services, LLC, TA Instruments, WestRock Company, and Yourway |

| Additional Attributes | Dollar sales vary by packaging type, including blisters, bottles, vials, syringes, and pouches; by material, spanning plastics, glass, and metals; by application, such as solid dosage, liquid dosage, and injectable drugs; by end-use, covering pharmaceuticals, biotechnology, and research organizations; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising clinical trial activities, personalized medicine, and demand for secure, compliant packaging. |

The global clinical trial packaging market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the clinical trial packaging market is projected to reach USD 10.8 billion by 2035.

The clinical trial packaging market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in clinical trial packaging market are plastic, glass, metal and paper & paperboard.

In terms of product type, syringes segment to command 26.4% share in the clinical trial packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Next-Generation Sequencing (NGS) Data Analysis Market Analysis by Solution and Services, Technology, End User, and Region through 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Clinical Nutrition Market Insights – Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Clinical Information System Market Analysis - Growth & Forecast 2024 to 2034

Clinical Chemistry Analyzers Market Trends – Demand & Forecast 2024 to 2034

Clinical Communication & Collaboration Software Market Trends – Forecast through 2034

Clinical Decision Support App Market – AI-Powered Insights 2034

Global Clinical Documentation Improvement Market Insights – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA