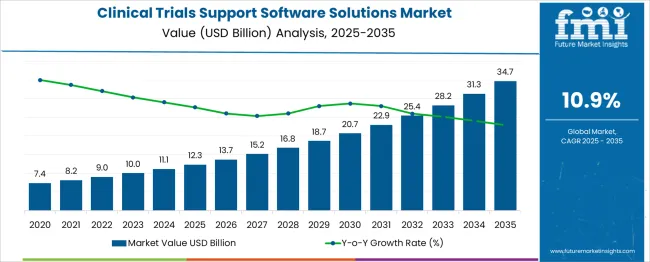

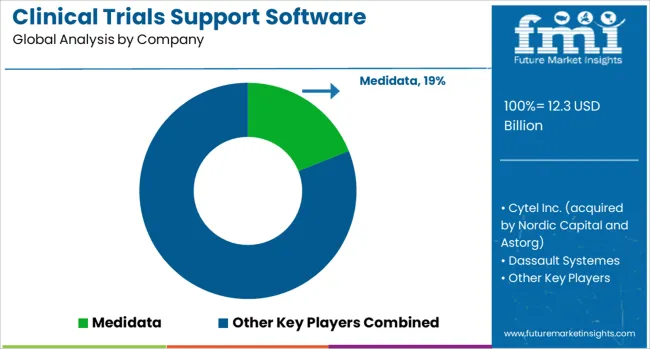

The global clinical trials support software solutions market is projected to grow from USD 12.3 billion in 2025 to approximately USD 34.7 billion by 2035, recording an absolute increase of USD 22.4 billion over the forecast period. This translates into a total growth of 182.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.9% between 2025 and 2035. The overall market size is expected to grow by nearly 2.8X during the same period, supported by increasing digitalization of clinical trials, rising demand for data-driven drug development, and growing focus on patient-centric trial designs and regulatory compliance automation.

Between 2025 and 2030, the clinical trials support software solutions market is projected to expand from USD 12.3 billion to USD 21.8 billion, resulting in a value increase of USD 9.5 billion, which represents 42.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of cloud-based platforms, increasing demand for integrated clinical data management systems, and growing penetration of artificial intelligence and machine learning technologies in clinical trial processes. Pharmaceutical and biotechnology companies are expanding their digital transformation initiatives to address the growing need for efficient trial management and regulatory compliance solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 12.3 billion |

| Forecast Value in (2035F) | USD 34.7 billion |

| Forecast CAGR (2025 to 2035) | 10.9% |

From 2030 to 2035, the market is forecast to grow from USD 21.8 billion to USD 34.7 billion, adding another USD 12.9 billion, which constitutes 57.6% of the overall ten-year expansion. This period is expected to be characterized by expansion of remote and decentralized clinical trial capabilities, integration of advanced analytics and real-world evidence platforms, and development of personalized medicine and precision trial solutions. The growing adoption of patient-centric trial designs and regulatory technology solutions will drive demand for comprehensive clinical trials support software with enhanced interoperability and data security features.

Between 2020 and 2025, the clinical trials support software solutions market experienced robust expansion, driven by increasing digitalization of clinical research processes and growing emphasis on data integrity and regulatory compliance. The market developed as pharmaceutical companies recognized the need for integrated software platforms to streamline trial operations, reduce costs, and accelerate drug development timelines. COVID-19 pandemic accelerated adoption of remote monitoring capabilities and virtual trial technologies, fundamentally transforming clinical trial methodologies.

Market expansion is being supported by the increasing complexity of clinical trials and the corresponding demand for sophisticated software solutions that can manage multi-site, multi-regional studies efficiently. Modern pharmaceutical companies are increasingly focused on reducing drug development timelines and costs while maintaining regulatory compliance and data quality standards. Advanced clinical trials support software provides essential capabilities for protocol management, patient recruitment, data collection, and regulatory reporting across diverse therapeutic areas.

The growing emphasis on patient-centric trial designs and real-world evidence generation is driving demand for flexible, scalable software platforms that can support hybrid and decentralized trial models. Regulatory agencies' increasing focus on data integrity, audit trails, and electronic submissions is creating opportunities for comprehensive compliance management solutions. The rising influence of artificial intelligence, machine learning, and predictive analytics is also contributing to enhanced trial optimization and risk management capabilities across different phases of clinical development.

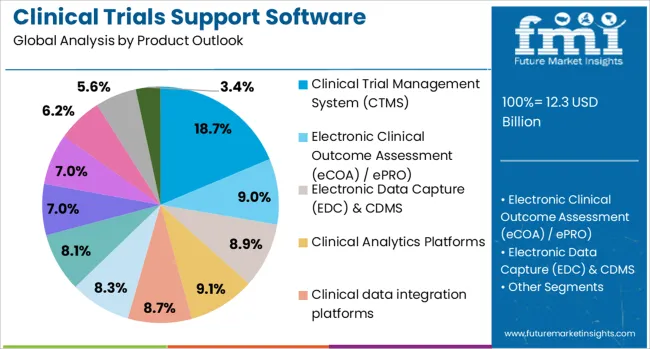

The market is segmented by product outlook, delivery mode outlook, phase outlook, and end use outlook. By product outlook, the market is divided into clinical trial management system (CTMS), electronic clinical outcome assessment (eCOA) / ePRO, electronic data capture (EDC) & CDMS, clinical analytics platforms, clinical data integration platforms, safety solutions, randomization and trial supply management (rtsm), electronic trial master file (eTMF), eConsent, payments / investigator payments solutions, electronic investigator site file (eISF), and patient matching / feasibility solutions. Based on delivery mode, the market is categorized into cloud and web based and on-premise solutions. In terms of phase outlook, the market is segmented into Phase III, Phase II, Phase I, and Phase IV (Post-marketing). By end use outlook, the market is classified into contract research organizations (CROs), academic & research institutions, pharmaceutical companies, biopharmaceutical companies, medical device companies, and hospitals/healthcare providers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Clinical Trial Management System (CTMS) segment is projected to account for 18.7% of the clinical trials support software solutions market in 2025, reaffirming its position as the foundational technology platform for clinical trial operations. CTMS solutions provide comprehensive project management capabilities, enabling sponsors and CROs to plan, track, and manage all aspects of clinical trials from protocol development through study completion. These systems offer centralized visibility into trial timelines, milestones, budgets, and regulatory requirements.

The segment's dominance is driven by the increasing complexity of multi-site, multi-regional clinical trials that require sophisticated coordination and oversight capabilities. CTMS platforms integrate with other clinical technology solutions to provide seamless data flow and operational efficiency. As regulatory requirements become more stringent and trial designs more complex, CTMS solutions serve as the central nervous system for clinical operations, ensuring compliance, quality, and timely study completion.

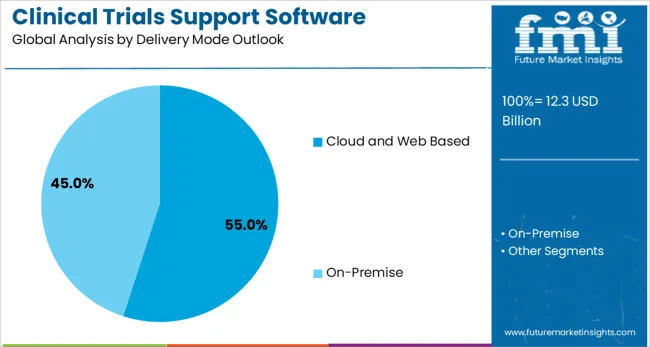

Cloud and Web Based solutions are projected to represent 55.0% of clinical trials support software solutions demand in 2025, underscoring their role as the preferred deployment model for modern clinical research organizations. Cloud-based platforms offer superior scalability, accessibility, and cost-effectiveness compared to traditional on-premise solutions. These platforms enable real-time collaboration among global research teams, facilitate remote monitoring capabilities, and provide automatic software updates and security patches.

The segment is supported by the growing adoption of remote and hybrid trial models that require flexible, accessible technology platforms. Cloud solutions offer enhanced data security, disaster recovery capabilities, and compliance with international data protection regulations. Additionally, cloud platforms enable rapid deployment of new studies, seamless integration with third-party systems, and advanced analytics capabilities that support data-driven decision making throughout the clinical development process.

The Phase III segment is forecasted to contribute 53.4% of the clinical trials support software solutions market in 2025, reflecting the significant complexity and resource requirements of late-stage clinical trials. Phase III studies typically involve large patient populations across multiple geographic regions, requiring sophisticated software platforms for patient management, data collection, and regulatory compliance. These trials generate substantial amounts of clinical data that must be managed, analyzed, and reported according to stringent regulatory standards.

Phase III trials represent the most expensive and time-sensitive component of clinical development, driving demand for comprehensive software solutions that can optimize operational efficiency and reduce study timelines. The segment benefits from increasing regulatory scrutiny and the need for robust data integrity systems. Advanced analytics capabilities, real-time monitoring tools, and automated compliance reporting are essential features that support successful Phase III trial execution and regulatory approval processes.

.webp)

The Contract Research Organizations (CROs) segment is projected to represent 37.2% of clinical trials support software solutions demand in 2025, highlighting their central role in the global clinical research ecosystem. CROs manage clinical trials on behalf of pharmaceutical and biotechnology companies, requiring comprehensive software platforms that can support multiple sponsors, therapeutic areas, and regulatory jurisdictions simultaneously. These organizations demand scalable, flexible solutions that can accommodate diverse client requirements and study protocols.

CROs are driving innovation in clinical trials support software through their focus on operational efficiency, cost reduction, and quality improvement. They require platforms that can integrate with client systems, provide transparent reporting capabilities, and ensure compliance with international regulatory standards. The segment's growth is supported by the increasing outsourcing of clinical research activities and the need for specialized expertise in complex therapeutic areas and emerging trial methodologies.

The clinical trials support software solutions market is advancing rapidly due to increasing digitalization of clinical research processes and growing demand for integrated trial management platforms. However, the market faces challenges including data security concerns, integration complexity issues, and regulatory compliance variations across different jurisdictions. Innovation in artificial intelligence, real-world evidence integration, and patient-centric technologies continue to influence product development and market expansion patterns.

The growing adoption of decentralized clinical trials (DCTs) and hybrid trial models is enabling sponsors to reduce patient burden, increase enrollment rates, and improve trial efficiency. These approaches leverage remote monitoring technologies, telemedicine platforms, and mobile health applications to conduct trials outside traditional clinical sites. Software platforms that support virtual visits, remote data collection, and digital patient engagement are becoming essential components of modern clinical research infrastructure.

Modern clinical trials support software manufacturers are incorporating artificial intelligence and machine learning capabilities to enhance trial design, patient recruitment, and data analysis processes. These technologies improve predictive modeling for patient enrollment, enable real-time safety monitoring, and provide advanced analytics for clinical decision making. AI-driven solutions also facilitate automated protocol deviations detection, risk-based monitoring, and regulatory submission preparation, significantly improving trial efficiency and quality.

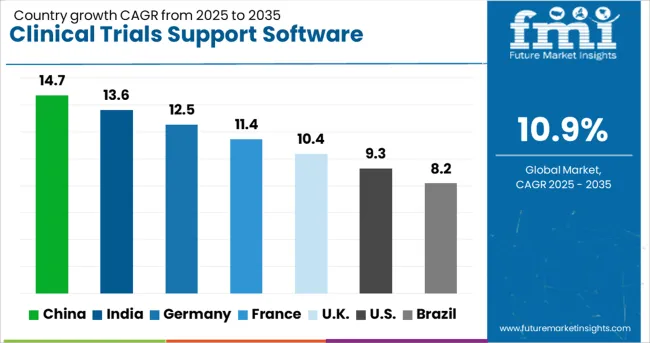

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| France | 11.4% |

| UK | 10.4% |

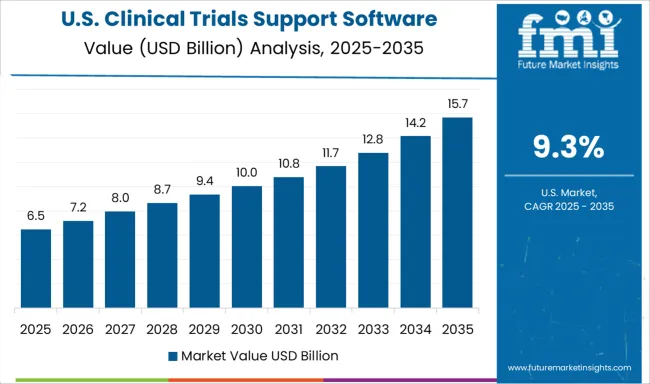

| USA | 9.3% |

| Brazil | 8.2% |

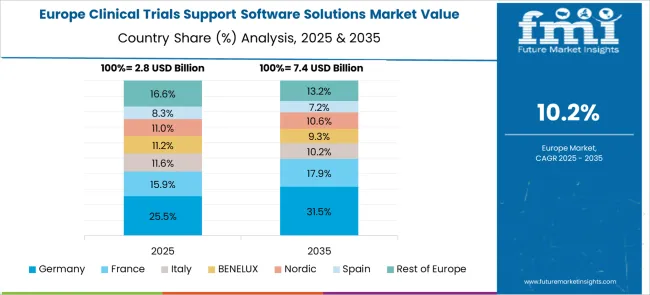

The clinical trials support software solutions market is experiencing robust growth globally, with China leading at a 14.7% CAGR through 2035, driven by rapidly expanding pharmaceutical industry, increasing clinical research investments, and growing adoption of digital health technologies. India follows closely at 13.6%, supported by cost-effective clinical research infrastructure, large patient populations, and increasing participation in global clinical trials. Germany shows strong growth at 12.5%, emphasizing regulatory compliance and advanced trial management systems. France records 11.4%, focusing on biotechnology innovation and integrated clinical research platforms. The UK shows 10.4% growth, prioritizing regulatory excellence and digital transformation initiatives. The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from clinical trials support software solutions in China is projected to exhibit strong growth with a CAGR of 14.7% through 2035, driven by rapid expansion of domestic pharmaceutical companies and increasing participation in global clinical development programs. The country's growing investment in biotechnology research and development is creating significant demand for sophisticated trial management platforms. Major international and domestic software providers are establishing comprehensive service networks to serve the expanding clinical research community across major metropolitan areas and emerging research hubs.

Revenue from clinical trials support software solutions in India is expanding at a CAGR of 13.6%, supported by cost-effective clinical research infrastructure, large patient populations, and increasing participation in international clinical development programs. The country's established CRO industry and growing pharmaceutical sector are driving demand for comprehensive trial management platforms. International software vendors and domestic technology companies are establishing partnerships to serve the growing demand for clinical research automation and data management solutions.

Demand for clinical trials support software solutions in the USA is projected to grow at a CAGR of 9.3%, supported by sophisticated pharmaceutical industry infrastructure and stringent regulatory requirements. American organizations are increasingly focused on operational efficiency, data integrity, and accelerated drug development timelines. The market is characterized by strong demand for advanced analytics platforms that combine trial management capabilities with artificial intelligence and real-world evidence integration for enhanced clinical decision making.

Revenue from clinical trials support software solutions in Germany is projected to grow at a CAGR of 12.5% through 2035, driven by the country's strong pharmaceutical industry presence and emphasis on regulatory compliance excellence. German organizations consistently demand high-quality, validated software platforms that deliver operational efficiency while maintaining strict data privacy and security standards according to EU regulations.

Revenue from clinical trials support software solutions in the UK is projected to grow at a CAGR of 10.4% through 2035, supported by strong clinical research heritage and regulatory leadership following Brexit transition. British organizations value operational excellence, data transparency, and innovative trial methodologies, positioning comprehensive clinical trials support software as essential infrastructure for competitive clinical development programs.

Revenue from clinical trials support software solutions in France is projected to grow at a CAGR of 11.4% through 2035, supported by the country's strong biotechnology sector and government initiatives promoting clinical research excellence. French organizations prioritize innovative trial designs, patient-centric approaches, and advanced data analytics capabilities, making comprehensive clinical trials support software essential for maintaining competitive advantage in global pharmaceutical development.

The clinical trials support software solutions market is characterized by competition among established healthcare technology companies, specialized clinical research software providers, and emerging digital health innovators. Companies are investing in artificial intelligence capabilities, cloud platform development, regulatory compliance automation, and user experience optimization to deliver comprehensive, scalable, and user-friendly clinical trials support solutions. Platform integration, data security, and regulatory compliance are central to strengthening product portfolios and market presence.

Medidata, USA-based, leads the market with significant global presence, offering comprehensive clinical trials support platforms with focus on data management, analytics, and regulatory compliance. Cytel Inc., acquired by Nordic Capital and Astorg, provides specialized statistical software and clinical trial optimization solutions with emphasis on adaptive trial designs and biostatistics. Dassault Systemes delivers integrated clinical research platforms that combine trial management with advanced simulation and modeling capabilities. Veeva Systems focuses on cloud-based clinical applications designed specifically for life sciences companies.

IQVIA, operating globally, provides comprehensive clinical research services and technology platforms across multiple therapeutic areas and development phases. Castor offers modern, user-friendly clinical data management solutions with emphasis on electronic data capture and clinical trial management. Oracle delivers enterprise-grade clinical research platforms with robust data management and regulatory compliance capabilities. Parexel International Corporation provides integrated clinical research services supported by proprietary technology platforms. Clario specializes in clinical endpoint and cardiac safety solutions, while RealTime Software Solutions focuses on clinical trial management and data collection platforms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 12.3 billion |

| Product Outlook | Clinical Trial Management System (CTMS), Electronic Clinical Outcome Assessment (eCOA) / ePRO, Electronic Data Capture (EDC) & CDMS, Clinical Analytics Platforms, Clinical data integration platforms, Safety solutions, Randomization and Trial Supply Management (RTSM), Electronic Trial Master File (eTMF), eConsent, Payments / Investigator Payments Solutions, Electronic Investigator Site File (eISF), Patient Matching / Feasibility Solutions |

| Delivery Mode Outlook | Cloud and Web Based, On-Premise |

| Phase Outlook | Phase III, Phase II, Phase I, Phase IV (Post-marketing) |

| End Use Outlook | Contract Research Organizations (CROs), Academic & Research Institutions, Pharmaceutical Companies, Biopharmaceutical Companies, Medical Device Companies, Hospitals/Healthcare Providers |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Medidata, Cytel Inc., Dassault Systemes, Veeva Systems, IQVIA, Castor, Oracle, Parexel International Corporation, Clario, and RealTime Software Solutions |

| Additional Attributes | Dollar sales by software module and integration level, regional adoption trends, competitive landscape, buyer preferences for cloud versus on-premise deployment, integration with artificial intelligence and machine learning capabilities, innovations in patient engagement technologies, regulatory compliance automation, and decentralized trial support functionalities |

The global clinical trials support software solutions market is estimated to be valued at USD 12.3 billion in 2025.

The market size for the clinical trials support software solutions market is projected to reach USD 34.7 billion by 2035.

The clinical trials support software solutions market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in clinical trials support software solutions market are clinical trial management system (CTMS), electronic clinical outcome assessment (ECOA) / EPRO), electronic data capture (EDC) & CDMS, clinical analytics platforms, clinical data integration platforms, and others.

In terms of delivery mode outlook, cloud and web based segment to command 55.0% share in the clinical trials support software solutions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Next-Generation Sequencing (NGS) Data Analysis Market Analysis by Solution and Services, Technology, End User, and Region through 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Clinical Nutrition Market Insights – Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Clinical Information System Market Analysis - Growth & Forecast 2024 to 2034

Clinical Chemistry Analyzers Market Trends – Demand & Forecast 2024 to 2034

Global Clinical Documentation Improvement Market Insights – Trends & Forecast 2024-2034

Global Clinical Risk Grouping Solution Market Insights – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA