The high voltage equipment market is expanding steadily due to rising global energy consumption, grid modernization initiatives, and the growing integration of renewable power sources. Increased investment in transmission and distribution networks has driven demand for reliable high-voltage components capable of ensuring grid stability and operational safety.

The market is influenced by stringent regulatory frameworks promoting efficiency and sustainability in power infrastructure. Emerging economies are prioritizing electrification projects, which are further stimulating demand for high-capacity transmission equipment.

Technological innovations such as smart monitoring systems, compact switchgear, and gas-insulated designs are enhancing system reliability and reducing maintenance costs. With utilities focusing on upgrading aging grid assets, the market outlook remains favorable for continued growth.

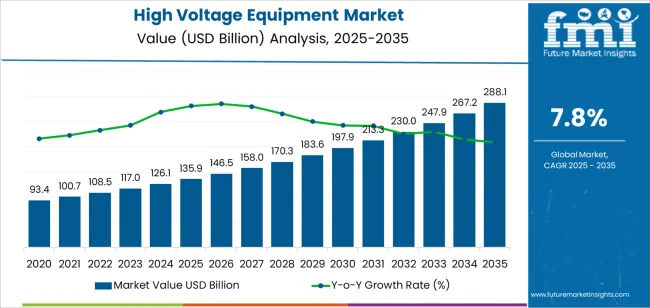

| Metric | Value |

|---|---|

| High Voltage Equipment Market Estimated Value in (2025 E) | USD 135.9 billion |

| High Voltage Equipment Market Forecast Value in (2035 F) | USD 288.1 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

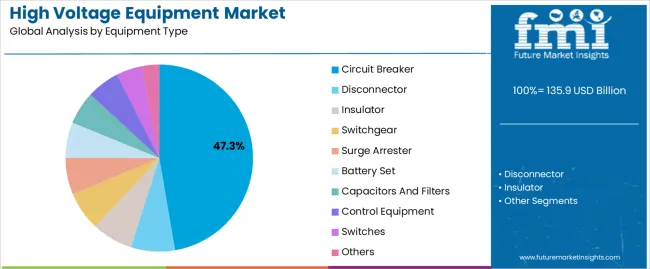

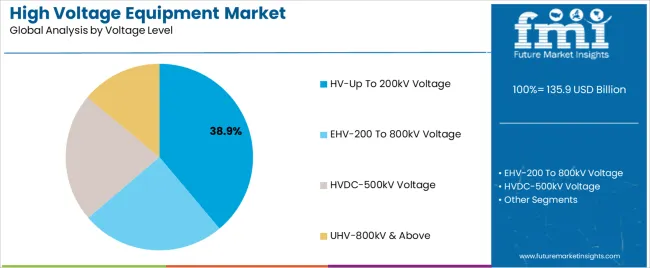

The market is segmented by Equipment Type and Voltage Level and region. By Equipment Type, the market is divided into Circuit Breaker, Disconnector, Insulator, Switchgear, Surge Arrester, Battery Set, Capacitors And Filters, Control Equipment, Switches, and Others. In terms of Voltage Level, the market is classified into HV-Up To 200kV Voltage, EHV-200 To 800kV Voltage, HVDC-500kV Voltage, and UHV-800kV & Above. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The circuit breaker segment holds approximately 47.3% share of the equipment type category, reflecting its critical role in protecting power systems from overloads and short circuits. Circuit breakers ensure operational safety and prevent costly damage to grid infrastructure by interrupting fault currents efficiently.

The segment’s dominance is supported by increasing substation installations and demand for smart breakers with remote monitoring and automated control features. Continuous innovation in vacuum and SF₆-free technologies is enhancing environmental compliance and performance.

The transition toward renewable integration and distributed energy systems has further boosted the need for adaptive and high-speed switching solutions. With grid expansion and modernization efforts intensifying worldwide, circuit breakers are expected to remain a cornerstone component in high voltage applications.

The HV-up to 200kV voltage segment accounts for approximately 38.9% share, supported by its extensive application in regional transmission and distribution networks. This voltage range balances cost efficiency with performance, making it suitable for medium to long-distance power transmission projects.

Urbanization, industrial expansion, and rural electrification programs have significantly increased demand in this category. Equipment within this range offers operational reliability and flexibility across substation and grid reinforcement projects.

Ongoing replacement of outdated infrastructure and integration of renewable power sources have also reinforced growth. With utilities emphasizing system efficiency and safety, the HV-up to 200kV segment is projected to sustain its strong market position over the forecast period.

The circuit breaker is the equipment most commonly used when it comes to high voltage applications. A voltage level of up to 200kV is sufficient for most equipment.

| Attributes | Details |

|---|---|

| Top Equipment Type | Circuit Breakers |

| Forecasted CAGR (2025 to 2035) | 7.5% |

Circuit breakers are expected to advance at a CAGR of 7.5% over the forecast period. Some of the factors influencing the progress of circuit breakers are:

| Attributes | Details |

|---|---|

| Top Voltage Level | HV-Up to 200kV Voltage |

| Forecasted CAGR (2025 to 2035) | 7.3% |

HV equipment with voltage levels up to 200kV is expected to progress at a CAGR of 7.3% through the forecast period. Some of the reasons for the progress of HV equipment up to 200kV are:

Efforts in the Asia Pacific to supply electricity to remote areas have paid off with the help of high voltage equipment. The need for high voltage equipment is also felt in the diverse industrial landscape of the region.

With trends towards reduced usage of oil, Europe is a lucrative region for the market. With increased investment in renewable energy, the market has bright prospects in the region.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.6% |

| United Kingdom | 6.4% |

| China | 9.7% |

| Japan | 9.0% |

| South Korea | 5.3% |

The CAGR of the market for the forecast period in South Korea is anticipated to be 5.3%. Some of the factors influencing solid growth are:

The high voltage equipment market is expected to register a CAGR of 9.0% in Japan over the forecast period. Some of the factors leading to the growth of the market in Japan are:

The market is expected to showcase a CAGR of 9.7% in China. Some of the factors responsible for the growth of the market are:

The high voltage equipment market is expected to progress at a CAGR of 6.4% in the United Kingdom. Some factors influencing the progress are:

The market is expected to register a CAGR of 7.6% in the United States. Some factors influencing the growth of the market in the country are:

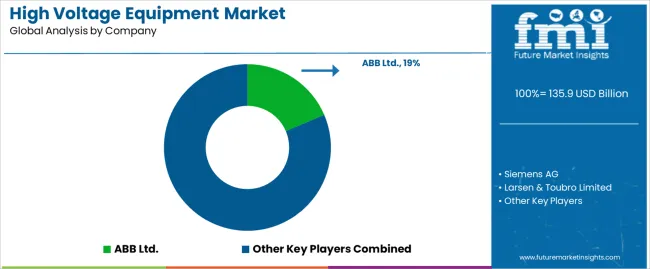

The market is highly fragmented. The diverse nature of high voltage equipment means small-scale market players can concentrate on their own niche and develop demand.

Market players are also demonstrating collaborative strategies, whether with other equipment manufacturers or with companies in the power sector. Partnerships are helping stagnant market players receive a jolt of inspiration in developing demand.

Recent Developments in the High Voltage Equipment Market

The global high voltage equipment market is estimated to be valued at USD 135.9 billion in 2025.

The market size for the high voltage equipment market is projected to reach USD 288.1 billion by 2035.

The high voltage equipment market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in high voltage equipment market are circuit breaker, disconnector, insulator, switchgear, surge arrester, battery set, capacitors and filters, control equipment, switches and others.

In terms of voltage level, hv-up to 200kv voltage segment to command 38.9% share in the high voltage equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Capacitors Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Oil Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Insulators Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current Power Supply Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA