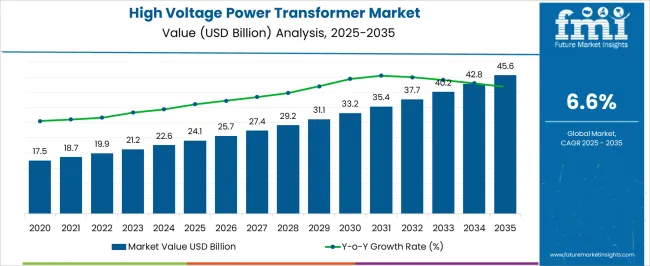

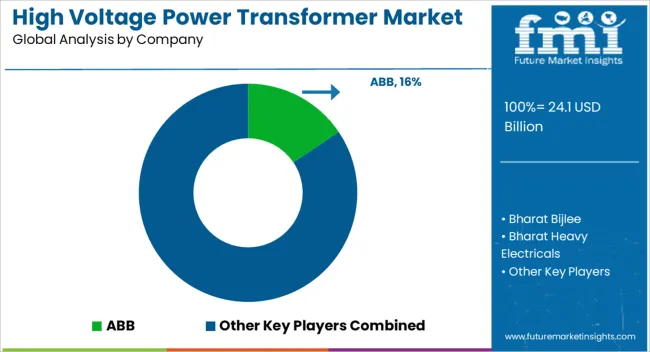

The high voltage power transformer market is estimated to be valued at USD 24.1 billion in 2025 and is projected to reach USD 45.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

The high voltage power transformer market is anticipated to expand from USD 24.1 billion in 2025 to USD 45.6 billion by 2035, registering a CAGR of 6.6%. Market growth is expected to be influenced by rising electricity demand, grid modernization efforts, and increasing investments in transmission and distribution infrastructure. The demand for reliable and efficient transformers is likely to be propelled by expanding power networks and replacement of aging assets in both developed and emerging economies. Pricing dynamics and raw material costs are projected to play a significant role in shaping the revenue potential across different regions.

During the 2025–2035 period, the high voltage power transformer market is expected to experience steady value accumulation driven by rising industrialization and electricity consumption patterns. Strategic initiatives, such as capacity expansions, mergers, and collaborations among key manufacturers, are anticipated to influence market shares and competitive positioning. Overall, the market is projected to witness consistent demand growth as utility operators, independent power producers, and industrial consumers increasingly prioritize performance, reliability, and long-term operational efficiency in transformer procurement and deployment decisions.

| Metric | Value |

|---|---|

| High Voltage Power Transformer Market Estimated Value in (2025 E) | USD 24.1 billion |

| High Voltage Power Transformer Market Forecast Value in (2035 F) | USD 45.6 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The high voltage power transformer market is estimated to hold a notable proportion within its parent markets, representing approximately 20-22% of the power transformers market, around 8-10% of the electrical equipment market, close to 12-14% of the transmission and distribution equipment market, about 15-17% of the substation equipment market, and roughly 5-6% of the industrial power infrastructure market. Collectively, the cumulative share across these parent segments is observed in the range of 60-69%, reflecting the strategic significance of high voltage power transformers in enabling efficient electricity transmission, ensuring grid stability, and supporting industrial and utility-scale power distribution.

The market has been driven by the increasing demand for reliable energy delivery, expansion of transmission networks, and the need to upgrade aging electrical infrastructure. Adoption is influenced by transformer capacity, voltage rating, efficiency, and integration with substation and grid systems. Market participants have focused on enhancing transformer performance, improving cooling and insulation systems, and optimizing design to minimize losses and extend operational lifespan. As a result, the high voltage power transformer market has captured a meaningful share within power transformers, substation equipment, and transmission infrastructure markets, underlining its importance in strengthening electrical networks, improving energy reliability, and supporting large-scale industrial and utility operations.

The high voltage power transformer market is expanding steadily, fueled by rising global energy demand, increased electrification, and significant upgrades to aging power infrastructure. With expanding grid networks and growing renewable energy integration, the need for reliable and efficient voltage regulation has become paramount.

Technological advancements in insulation, monitoring, and smart grid compatibility are transforming the operational performance of modern transformers, enhancing grid stability and reducing transmission losses. Regulatory support for energy efficiency and infrastructural investment in developing economies further propels the market forward.

In the coming years, growing urbanization, industrialization, and the push for sustainable energy transition are expected to accelerate transformer deployment across both transmission and distribution networks. The market outlook remains favorable as utilities and industries prioritize grid modernization, high-load handling, and long-term energy reliability

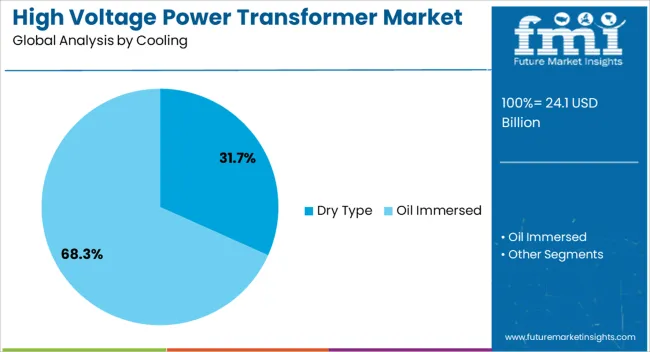

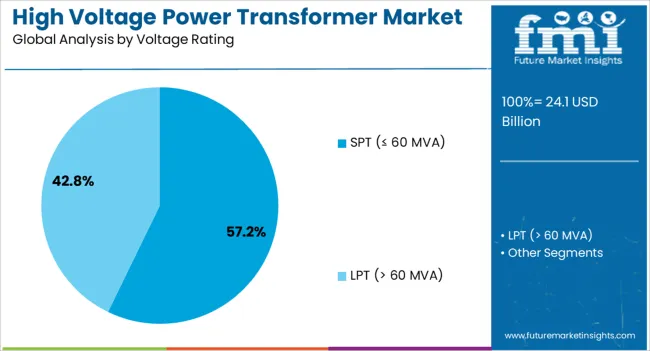

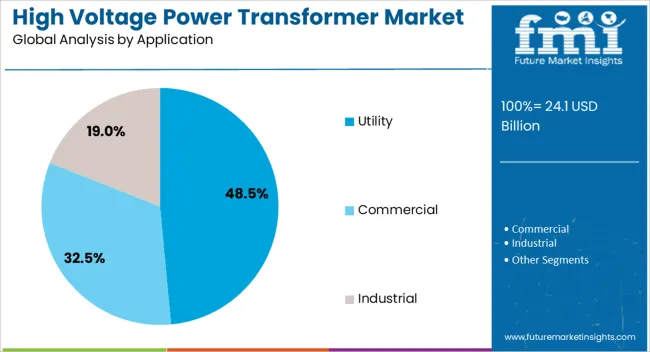

The high voltage power transformer market is segmented by cooling, voltage rating, application, and geographic regions. By cooling, high voltage power transformer market is divided into dry type and oil immersed. In terms of voltage rating, high voltage power transformer market is classified into SPT (≤ 60 MVA) and LPT (> 60 MVA). Based on application, high voltage power transformer market is segmented into utility, commercial, and industrial. Regionally, the high voltage power transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil immersed cooling segment accounts for 68.3% of the high voltage power transformer market, underscoring its position as the dominant and most widely adopted cooling technology. Leveraging oil as both an insulator and coolant, these transformers provide superior efficiency in heat dissipation and are preferred for high-capacity, outdoor, and long-duration grid applications.

Their application in utility substations, transmission corridors, and large-scale industrial facilities has been reinforced by their proven reliability, long service life, and ability to handle heavy electrical loads under demanding conditions. Continuous advancements in oil purification, monitoring systems, and fire-resistant insulating fluids have further strengthened their operational performance and safety profile.

As global electricity demand grows and large infrastructure projects expand, oil immersed transformers are expected to maintain their dominance due to their cost-effectiveness, durability, and compatibility with high-voltage and extra-high-voltage networks, ensuring continued leadership in the high voltage power transformer market.

The SPT (≤ 60 MVA) voltage rating segment dominates with a 57.2% share, indicating its wide-scale application across medium-load power transmission and distribution needs. This segment is critical for regional grids and industrial zones where moderate capacity and cost-efficiency are essential. Its growth is primarily supported by substation expansions, rural electrification initiatives, and the modernization of aging distribution infrastructure.

SPT transformers are also commonly deployed in renewable energy projects, particularly in solar and wind farms, where compact design and efficient power flow are prioritized. Standardization and modular design practices have made these units easier to transport, install, and commission.

The increasing demand for decentralized energy systems and microgrids further enhances the relevance of this segment. With continued infrastructure investment and rising electricity access in emerging regions, the SPT segment is expected to retain its market leadership

The utility segment leads with a 48.5% market share in the application category, reflecting the essential role of high voltage transformers in grid-scale transmission and distribution. Utilities rely on these systems to regulate voltage levels across expansive networks, ensuring efficiency and stability under fluctuating demand.

The rapid pace of electrification, growing population density, and shift toward renewable energy integration have elevated the demand for advanced transformer solutions in utility-grade installations. High voltage transformers used in utilities are increasingly embedded with smart features such as condition monitoring, fault diagnostics, and load optimization, enabling improved grid resilience and asset longevity.

Governments and grid operators are actively investing in transmission infrastructure upgrades and interconnection projects, especially in regions experiencing capacity bottlenecks. As utilities prioritize reliability, energy efficiency, and future-proofing of networks, this segment is projected to sustain its dominant position in the market

The high voltage power transformer market is being driven by expanding electrical networks, industrial growth, and grid modernization projects. Opportunities arise from renewable energy integration, smart grids, and aftermarket retrofits. Trends emphasize advanced insulation, modular designs, and digital monitoring. Challenges include raw material price volatility, regulatory compliance, and integration complexities. Overall, the market is positioned for steady growth as manufacturers balance efficiency, reliability, and regulatory adherence while addressing evolving electricity transmission requirements and global energy demands.

The high voltage power transformer market is witnessing significant demand as electricity grids across emerging and developed economies are being expanded and modernized. Growing industrialization, urban energy consumption, and government-driven initiatives to enhance grid reliability are driving the requirement for high-capacity transformers capable of handling increased load and voltage levels. Utilities are investing in robust transformers to reduce transmission losses, improve voltage regulation, and ensure uninterrupted power supply. Replacement and retrofitting of aging transformers in older grids are also fueling market expansion. Regional energy policies, large-scale power generation projects, and increasing adoption of renewable energy sources such as solar and wind are creating additional transformer deployment opportunities. The need for grid stability amid fluctuating energy inputs and the integration of smart monitoring systems are further emphasizing high-performance, durable transformer solutions. This rising electricity demand and grid expansion collectively reinforce market growth.

Opportunities in the high voltage power transformer market are being shaped by the increasing penetration of renewable energy sources and the shift toward smarter, automated grids. As solar, wind, and hydroelectric generation capacities increase, transformers are required to handle variable energy inputs efficiently while maintaining grid stability. Smart grid projects are promoting the integration of digital monitoring, predictive maintenance, and remote control capabilities in transformers, offering vendors chances to differentiate their products with advanced features. Growing investments in energy infrastructure in emerging markets are creating demand for customized, high-capacity transformers, while retrofitting aging grids in mature regions provides aftermarket opportunities. Furthermore, collaborations between utilities, engineering firms, and transformer manufacturers are enabling the development of solutions that improve operational efficiency and reduce downtime. The expansion of renewable energy portfolios, government incentives, and the emphasis on reliable transmission networks collectively position the market for sustained opportunity growth.

Market trends in high voltage power transformers indicate increasing adoption of advanced insulation systems, modular construction, and oil-immersed or dry-type configurations to enhance reliability and lifespan. Manufacturers are focusing on products that minimize energy losses, reduce maintenance requirements, and withstand thermal and mechanical stresses. Integration of online monitoring sensors and condition-based diagnostic systems is emerging as a trend to prevent unexpected failures and optimize performance. Additionally, compact and modular designs are gaining attention, enabling faster installation and easier integration into modern substations. Regional regulatory requirements, shifting energy generation profiles, and demand for high-efficiency transformers influence design choices. Collaboration between technology providers and transformer manufacturers is fostering trends toward higher capacity, lower-loss, and digitally connected solutions. These trends are redefining performance expectations and operational strategies, promoting smarter, safer, and more efficient power transmission.

Challenges in the high voltage power transformer market include volatility in raw material costs, stringent regulatory standards, and the technical complexity of designing high-capacity units. Copper and electrical steel prices fluctuate, directly impacting manufacturing costs and profitability. Compliance with regional standards for insulation, cooling, and environmental safety necessitates meticulous design, testing, and certification processes. Supply chain disruptions and geopolitical factors further complicate production and delivery schedules. Aging infrastructure in mature markets requires careful retrofitting without disrupting ongoing power supply, adding operational complexity. Moreover, the growing adoption of decentralized energy and intermittent renewable inputs poses engineering challenges to maintain transformer stability. Manufacturers must invest in quality control, strategic sourcing, and advanced engineering to overcome these barriers while meeting client expectations and operational demands.

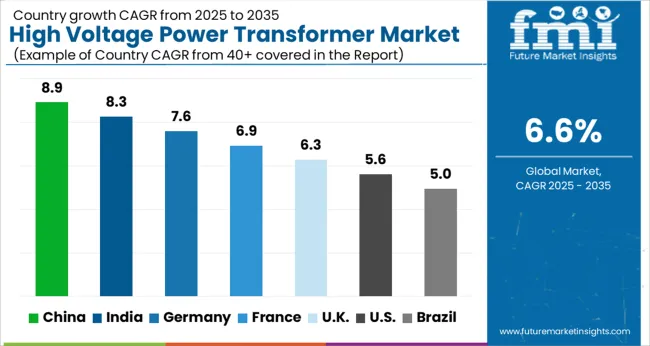

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global high voltage power transformer market is projected to grow at a CAGR of 6.6% from 2025 to 2035. China leads with a growth rate of 8.9%, followed by India at 8.3%, and France at 6.9%. The United Kingdom records a growth rate of 6.3%, while the United States shows the slowest growth at 5.6%. Market expansion is driven by increasing electricity demand, grid modernization, and investments in renewable energy infrastructure. Emerging economies such as China and India experience higher growth due to rapid industrialization, urban electrification, and expansion of power transmission networks, while developed markets like the USA, UK, and France focus on upgrading aging infrastructure and integrating smart grid technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The high voltage power transformer market in China is expanding at a CAGR of 8.9%, driven by rapid industrialization and increasing electricity demand. The Chinese government is heavily investing in grid modernization and expanding renewable energy infrastructure, which boosts transformer adoption. Domestic manufacturers are focusing on high-capacity and efficient transformers to meet growing energy requirements. Technological improvements in transformer design, coupled with government policies supporting energy efficiency and emission reduction, further strengthen the market. The market continues to benefit from urban electrification projects, renewable energy integration, and a growing industrial base, which collectively sustain strong demand for high voltage power transformers.

The high voltage power transformer market in India is growing at a CAGR of 8.3%, supported by rising electricity demand and government initiatives to modernize the national grid. Investment in renewable energy projects, particularly solar and wind, necessitates high-capacity transformer deployment. Indian manufacturers are focusing on producing energy-efficient and high-performance transformers to meet regulatory standards and growing industrial requirements. The market is further strengthened by government policies promoting rural electrification, smart grids, and grid stabilization projects. Increasing industrial activity, expanding urban areas, and efforts to reduce transmission losses are contributing to sustained market growth in India.

The high voltage power transformer market in France is growing at a CAGR of 6.9%, driven by the need to modernize aging power infrastructure and comply with European energy efficiency standards. Investments in renewable energy integration, such as offshore wind and solar farms, are increasing demand for high-capacity transformers. French manufacturers are emphasizing the development of transformers with enhanced reliability, efficiency, and reduced environmental impact. Additionally, government support for smart grid projects and grid stabilization programs is further boosting adoption. Overall, the market in France benefits from regulatory enforcement, renewable energy integration, and modernization of the national electricity transmission network.

The high voltage power transformer market in the United Kingdom is expanding at a CAGR of 6.3%, fueled by efforts to upgrade aging transmission networks and integrate renewable energy. UK utilities are investing in high-capacity and efficient transformers to improve grid stability and reduce energy losses. Market growth is further supported by government policies promoting decarbonization and enhanced grid resilience. The adoption of smart grid technologies, along with ongoing industrial and urban development, contributes to steady demand. Overall, regulatory compliance, renewable energy integration, and infrastructure modernization are key factors driving growth in the UK high voltage power transformer market.

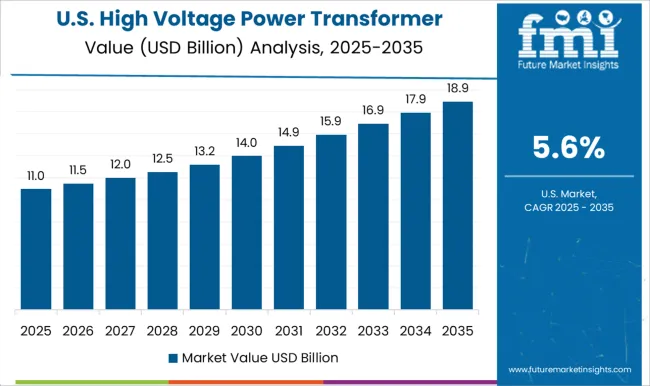

The high voltage power transformer market in the United States is growing at a CAGR of 5.6%, driven by the need to modernize aging transmission infrastructure and integrate renewable energy sources. US utilities are increasingly investing in efficient and reliable high voltage transformers to reduce energy losses and maintain grid stability. Federal and state regulations promoting clean energy and infrastructure upgrades further support market expansion. Market growth is also aided by increasing electricity demand from residential, commercial, and industrial sectors. Overall, the US market benefits from infrastructure modernization, smart grid adoption, and regulatory enforcement promoting energy efficiency and sustainable transmission solutions.

The high voltage power transformer market has experienced significant growth driven by the global demand for reliable and efficient electricity transmission across industrial, commercial, and utility sectors. Leading manufacturers such as ABB, Bharat Heavy Electricals, and CG Power and Industrial Solutions are developing transformers with enhanced thermal performance, reduced energy losses, and advanced insulation systems. Companies like General Electric, Hitachi Energy, and Siemens Energy focus on integrating smart monitoring solutions and digital diagnostics to improve operational efficiency and extend transformer life.

Regional players including Bharat Bijlee, Hyosung Heavy Industries, and Hyundai Electric are expanding production capacities and offering customized solutions to meet specific grid requirements in Asia-Pacific, Europe, and North America. Emphasis on eco-friendly insulating materials, reduced greenhouse gas emissions, and compliance with international standards such as IEC and IEEE is reshaping product development strategies. Manufacturers like Daihen, JSHP Transformer, Kirloskar Electric, LS Electric, Toshiba Energy Systems and Solutions, and WEG continue to invest in R&D to enhance core design, voltage regulation, and short-circuit performance, thereby maintaining a competitive edge in the global market.

The market growth is further propelled by the increasing adoption of renewable energy sources, expansion of smart grids, and modernization of aging infrastructure in developed and developing economies. Companies such as ABB and Siemens Energy are leveraging advanced materials and automated manufacturing technologies to improve transformer reliability, reduce downtime, and optimize lifecycle costs. Strategic collaborations with utilities and power generation companies enable seamless integration of high voltage transformers into large-scale transmission networks.

With rising investments in electricity infrastructure and government initiatives to improve energy efficiency, the demand for high voltage power transformers is projected to remain robust. Market leaders are also focusing on compact designs, modular configurations, and enhanced fault-tolerant systems to cater to urban transmission networks and industrial applications. As the industry evolves, players combining technological innovation, regulatory compliance, and regional expansion are expected to drive sustained growth and reinforce their leadership in the high voltage power transformer market globally.

| Items | Values |

|---|---|

| Quantitative Units | USD 24.1 billion |

| Cooling | Dry Type and Oil Immersed |

| Voltage Rating | SPT (≤ 60 MVA) and LPT (> 60 MVA) |

| Application | Utility, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Bijlee, Bharat Heavy Electricals, CG Power and Industrial Solutions, Daihen, General Electric, Hitachi Energy, Hyosung Heavy Industries, Hyundai Electric, JSHP Transformer, Kirloskar Electric, LS Electric, Siemens Energy, Toshiba Energy Systems and Solutions, and WEG |

| Additional Attributes | Dollar sales by transformer type (oil-immersed, dry-type) and rating (up to 200 kV, 201–500 kV, above 500 kV) are key metrics. Trends include rising demand for reliable power transmission, growth in renewable energy integration, and replacement of aging infrastructure. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global high voltage power transformer market is estimated to be valued at USD 24.1 billion in 2025.

The market size for the high voltage power transformer market is projected to reach USD 45.6 billion by 2035.

The high voltage power transformer market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in high voltage power transformer market are dry type and oil immersed.

In terms of voltage rating, spt (≤ 60 mva) segment to command 57.2% share in the high voltage power transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA