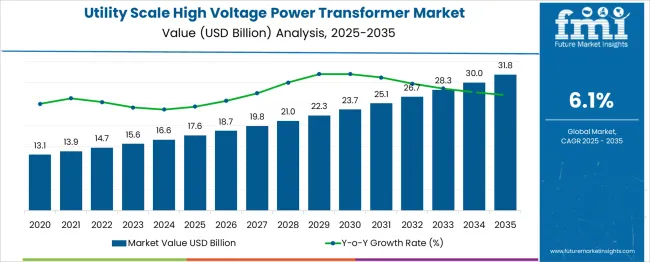

The Utility Scale High Voltage Power Transformer Market is estimated to be valued at USD 17.6 billion in 2025 and is projected to reach USD 31.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. A 5-year growth block analysis reveals steady yet accelerating expansion across the forecast horizon. From 2025 to 2030, the market advances from USD 17.6 billion to USD 23.7 billion, contributing approximately USD 6.1 billion or 43% of total growth, driven by grid modernization projects, renewable energy integration, and growing transmission capacity requirements across emerging economies. This phase is dominated by investments in ultra-high-voltage systems and smart monitoring capabilities to handle increasing power demand efficiently.

The second growth block, covering 2030 to 2035, adds USD 8.1 billion, taking the market to USD 31.8 billion, which accounts for nearly 57% of incremental growth, highlighting stronger momentum in the later phase as aging infrastructure replacement accelerates and energy transition policies spur large-scale electrification projects. Manufacturers focusing on digitally enabled transformers, advanced insulation materials, and modular designs will capture the largest share, while those integrating IoT-driven predictive maintenance features will gain a competitive edge in a market where operational reliability and grid resilience remain critical priorities.

| Metric | Value |

|---|---|

| Utility Scale High Voltage Power Transformer Market Estimated Value in (2025 E) | USD 17.6 billion |

| Utility Scale High Voltage Power Transformer Market Forecast Value in (2035 F) | USD 31.8 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

In the broader power transformer manufacturing market, utility‑scale high‑voltage transformers capture approximately 25–28%, as demand from utility-grade projects leads volume and revenue. Within the grid transmission and substation infrastructure market, they represent about 15–17%, reflecting their importance relative to other substation assets like breakers, relays, and conductors. In the asset modernization and low‑loss transformer technologies segment, high-voltage units account for 20–22%, supported by rising adoption of advanced cores and energy-saving transformers in retrofit programs. In the industrial and commercial utility distribution equipment market, they contribute 10–12%, since large-scale industrial users occasionally deploy high-voltage distribution transformers behind their substations. In the smart grid infrastructure and digital integration market, their share is 8–10%, as high-voltage transformers increasingly feature embedded sensors for thermal monitoring, load forecasting, and predictive maintenance. Key drivers include utilities upgrading aging infrastructure, regulatory mandates for efficiency, and integration of renewables that require robust, reliable transformer capacity. Advancements such as digital twin integration, automated tap changers, and bi-metallic/eco-core designs are reinforcing their role in future-ready grid systems worldwide.

National grid operators and utility companies are investing in advanced transmission and distribution systems that require reliable and high-capacity transformers. The shift toward decarbonized power generation and the integration of solar and wind energy into the grid have created a need for robust transformer systems capable of handling fluctuating loads and high voltages. Additionally, governments and energy regulators are mandating the adoption of efficient and resilient power infrastructure, further supporting demand.

Technological advancements in cooling systems, insulation materials, and transformer monitoring solutions have improved operational reliability and lifecycle performance. As developing countries scale their electrification efforts and developed nations replace aging infrastructure, utility-scale high voltage power transformers are expected to remain critical assets for grid stability, efficiency, and security, providing strong momentum for future market expansion..

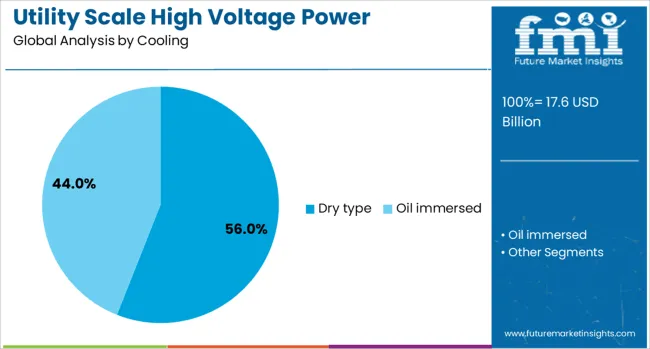

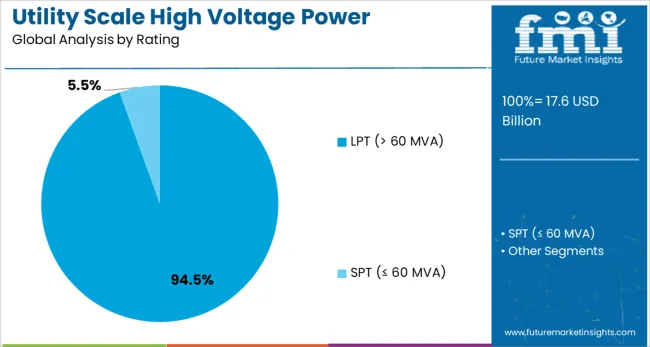

The utility scale high voltage power transformer market is segmented by cooling, rating, and geographic regions. By cooling, the utility-scale high-voltage power transformer market is divided into dry-type and oil-immersed. In terms of rating of the utility scale high voltage power transformer market, it is classified into LPT (> 60 MVA) and SPT (≤ 60 MVA). Regionally, the utility scale high voltage power transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dry type cooling segment is anticipated to account for 56% of the Utility Scale High Voltage Power Transformer market revenue share in 2025. Growth in this segment has been driven by the increasing preference for safer and environmentally friendly transformer cooling methods. Unlike oil-immersed transformers, dry type transformers eliminate the risk of fluid leaks and fires, making them suitable for installations in urban, industrial, and environmentally sensitive areas.

The adoption of dry type cooling has been influenced by its low maintenance requirements and operational safety, which aligns with stringent environmental and fire safety regulations. Advancements in air-forced and cast resin cooling techniques have enhanced heat dissipation efficiency, allowing dry type transformers to support heavy-duty performance in high-voltage utility applications.

Their compact design and adaptability to indoor installations have also contributed to greater deployment flexibility. As utilities prioritize safety, sustainability, and operational reliability, the dry type cooling segment has emerged as a preferred solution, enabling its continued dominance in the high-voltage transformer landscape..

The LPT greater than 60 MVA rating segment is expected to dominate the Utility Scale High Voltage Power Transformer market with a 94.50% revenue share in 2025. This leading position has been supported by the critical role that large power transformers play in bulk power transmission over long distances. As electricity demand surges and grids expand to accommodate remote renewable generation sources, the need for transformers with high power ratings has intensified.

Transformers in the LPT greater than 60 MVA category have been recognized for their ability to manage high voltage loads efficiently, ensuring grid stability and minimal transmission losses. The deployment of high-capacity substations and inter-regional transmission corridors has further driven demand for these transformers.

Additionally, large-scale industrial operations and infrastructure projects have contributed to this segment’s expansion by requiring continuous, high-volume power delivery. The robust performance, durability, and scalability of LPT units greater than 60 MVA have reinforced their dominance as essential components in utility-scale applications across global power networks..

Utility scale high voltage power transformers serve as critical components in transmission and distribution systems operating at voltages above 110 kV. These transformers support grid expansion, increased power demand, and infrastructure upgrades. Demand has been influenced by the need for reliable voltage regulation, high short‑circuit withstand capability, and long operational life. Suppliers offering units with advanced dielectric materials, thermal management systems, and robust insulation designs have gained preference. Products that enable seamless integration into transmission networks, support on‑site diagnostics, and minimize loss continue to guide procurement decisions by utilities and large infrastructure developers.

Adoption of utility-scale high voltage transformers has been driven by grid extension into remote and high‑growth areas and by power demand increases in industrial, urban, and inter-regional loads. Transformers that deliver reliable voltage control and withstand fault conditions are favored by transmission system planners. Operators have prioritized models that minimize failure risk under high short‑circuit stress and variable load cycles. Regulatory frameworks requiring enhanced reliability and asset availability have reinforced deployment. Network resilience initiatives and modernization efforts, including integration of renewable power sources, have contributed to heightened demand for high-performance transformer systems.

Large power transformer adoption has been constrained by high capital investment requirements and long delivery timelines due to custom engineering needs. Design and testing certification cycles for high voltage ratings and insulation systems are lengthy and resource-intensive. Integration with existing switchyard layouts and circuit protection schemes involves extensive planning. Specialized logistical support is required for transport, installation, and commissioning at high-voltage substations. Training personnel in maintenance and emergency protocols adds to operational overhead. Smaller utilities and emerging grids may find deployment cost-prohibitive. Lead times for factory acceptance testing and regulatory compliance further restrict rapid rollout of new transformer capacity.

Opportunities are emerging in partnerships with transit agencies to offer unified mobility passes combining shared rides and public transport access. Expansion into corporate mobility, tourist rental services, and peer-to-peer systems is increasing platform versatility. Real-time vehicle relocation and micro-hub installations support operational efficiency. Subscription models for frequent renters or students are generating recurring revenue streams. Incorporation of electric cargo bikes and accessible models broadens utility use cases. Data-driven fare discounts, loyalty programs, and dynamic pricing strategies are enabling service personalization. Strategic tie-ups with urban developers for mobility zones within smart districts are enhancing platform visibility and ridership adoption.

Trend setting developments include digital sensor integration for load tracking, oil analysis, and embedded temperature measurement supporting state‑of‑health dashboards. Advancements in solid insulation systems that mitigate gas sealing and aging limitations are gaining momentum. Research into alternative dielectric fluids and high-strength composite core materials is improving efficiency and reducing weight. Compact ultra-high‑voltage designs with lower footprint support transmission nodes in dense urban infrastructural spaces. Integration of open communication protocols across protective relays and control systems is enabling interoperability. Development of arc‑resistant tank structures and gas‑free insulation media allows better environmental compliance and installation flexibility.

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

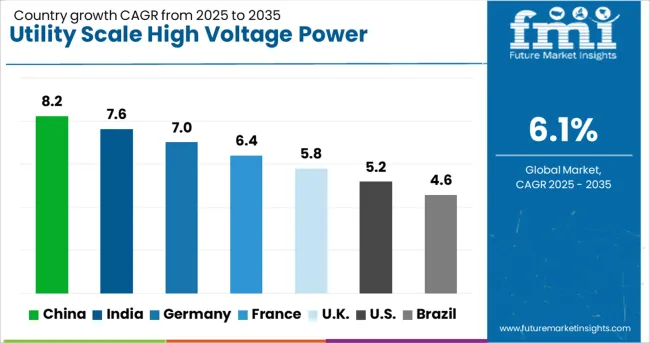

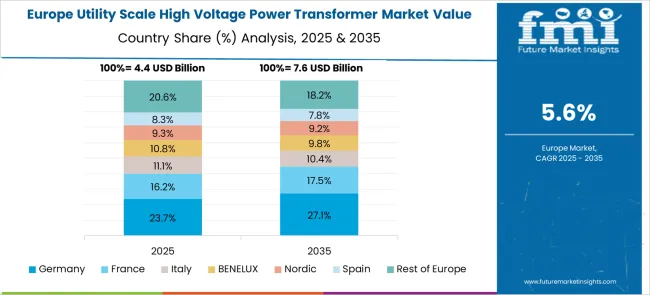

The utility scale high voltage power transformer market is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by grid reliability improvements, renewable energy integration, and cross-border transmission projects. BRICS nations lead growth, with China at 8.2% fueled by ultra-high voltage projects and offshore wind integration, and India at 7.6% supported by grid expansion and renewable capacity targets. Among OECD markets, France posts 6.4%, while the United Kingdom records 5.8% and the United States 5.2%, focusing on substation upgrades and digital-ready transformer adoption. The analysis includes over 40 countries, with the top five detailed below.

China is expected to achieve a CAGR of 8.2% through 2035, supported by ultra-high voltage (UHV) transmission projects and massive renewable energy integration. Demand is concentrated in high-capacity transformers required for large-scale solar and wind installations, particularly in western provinces. Domestic manufacturers dominate with advanced designs incorporating digital monitoring systems for real-time grid control. Offshore wind farm connections and cross-regional energy transmission further strengthen demand. With robust infrastructure investment and technological innovation, China remains the largest and fastest-growing market for utility scale high voltage power transformers worldwide.

India is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by rising power demand and the integration of renewable projects under its energy transition program. Large-scale transmission corridor development and new substation installations are primary demand drivers for high-voltage transformers. Manufacturers are introducing energy-efficient and low-loss designs to support national grid stability. Collaborations with global players are enhancing production capabilities, particularly in high-capacity and smart transformer segments. Growth is further supported by ongoing rural electrification projects and government-backed renewable power expansion programs.

France is forecasted to post a CAGR of 6.4% through 2035, with growth supported by modernization of aging grid infrastructure and the integration of offshore wind energy. Advanced transformer systems are in demand for substation upgrades, ensuring operational reliability and renewable integration. Manufacturers are adopting digital predictive monitoring solutions to enhance efficiency and reduce downtime in transmission systems. Cross-border interconnections under EU energy cooperation programs further strengthen transformer demand. These investments highlight France’s strategic role in Europe’s energy stability initiatives and grid optimization goals.

The United Kingdom is anticipated to grow at a CAGR of 5.8% through 2035, led by offshore wind expansion and smart grid upgrades. The deployment of high-voltage transformers is critical for efficient energy transfer from renewable generation sites to urban consumption centers. Manufacturers are emphasizing compact and energy-efficient transformer models for space-limited substations. Investments in cross-border energy trading infrastructure are creating additional opportunities. UK utilities are prioritizing predictive analytics and real-time performance monitoring to optimize operational efficiency in long-distance transmission networks.

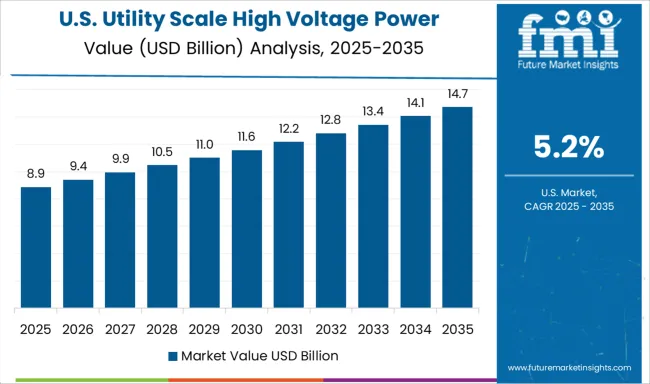

The United States is expected to grow at a CAGR of 5.2% through 2035, supported by large-scale replacement of aging transmission assets and renewable energy expansion. Demand is focused on high-voltage transformers featuring smart grid compatibility and eco-friendly insulation systems. Investments in inter-regional power corridors and modernized substations ensure grid reliability and capacity for renewable integration. Manufacturers are prioritizing automation and advanced monitoring technologies to improve transformer performance. Federal energy programs aimed at strengthening national transmission infrastructure continue to support steady growth across the US market.

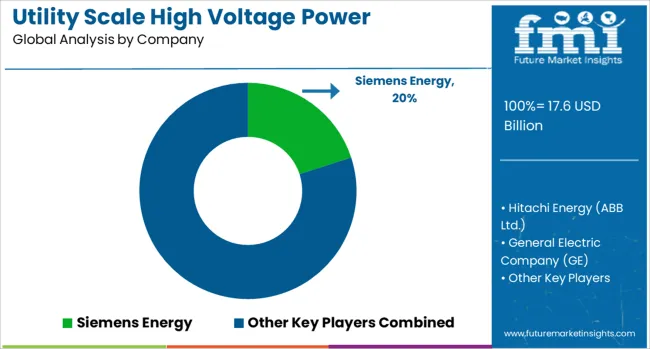

The utility scale high voltage power transformer market is dominated by global electrical infrastructure leaders such as Siemens Energy, Hitachi Energy (formerly ABB Ltd.), General Electric (GE), Schneider Electric SE, and Toshiba Energy Systems & Solutions. Siemens Energy leads with advanced high-voltage transformer solutions featuring enhanced efficiency, smart monitoring systems, and robust insulation technologies for grid stability. Hitachi Energy emphasizes digitalized transformer platforms integrated with predictive analytics and real-time condition monitoring to support utilities in modernizing power networks. General Electric focuses on supplying large-capacity transformers for transmission and renewable energy integration, leveraging decades of engineering expertise. Schneider Electric offers smart grid-compatible transformers with IoT-based performance management tools, while Toshiba delivers high-capacity units tailored for utility-scale power projects and interconnection of renewable energy sources. Competitive strategies include enhancing operational reliability through advanced insulation materials, introducing SF6-free technologies, and deploying digital twin solutions for predictive maintenance. Barriers to entry remain high due to capital-intensive manufacturing, strict global standards such as IEC and ANSI, and the need for long-term OEM partnerships with utilities. Key players are investing in localized production facilities to reduce lead times and in R&D to develop transformers that minimize energy losses under heavy load conditions. Future market growth will be driven by grid expansion projects, renewable energy integration, and replacement of aging infrastructure across developed markets. Companies focusing on eco-efficient technologies, modular transformer designs, and digital monitoring solutions will secure a competitive edge in meeting growing global electricity demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.6 Billion |

| Cooling | Dry type and Oil immersed |

| Rating | LPT (> 60 MVA) and SPT (≤ 60 MVA) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, Hitachi Energy (ABB Ltd.), General Electric Company (GE), Schneider Electric SE, Toshiba Energy Systems & Solutions, and Others |

| Additional Attributes | Dollar sales by transformer rating (above 100 MVA, 200 MVA, and extra-high capacity units) and application (utility transmission grids, renewable energy integration, and industrial power distribution), with demand driven by global electrification and grid modernization projects. Regional dynamics indicate Asia-Pacific as the largest growth market due to large-scale renewable projects and transmission upgrades, while North America and Europe prioritize grid reliability and energy-efficient transformer installations. Innovation trends include SF6-free insulation systems, digitalized transformers with IoT-based analytics, and adoption of advanced cooling techniques to enhance operational life and energy efficiency. |

The global utility scale high voltage power transformer market is estimated to be valued at USD 17.6 billion in 2025.

The market size for the utility scale high voltage power transformer market is projected to reach USD 31.8 billion by 2035.

The utility scale high voltage power transformer market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in utility scale high voltage power transformer market are dry type and oil immersed.

In terms of rating, lpt (> 60 mva) segment to command 94.5% share in the utility scale high voltage power transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA