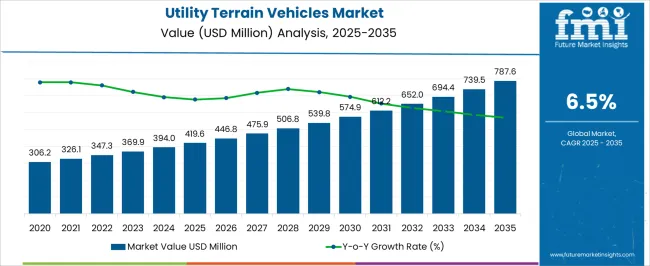

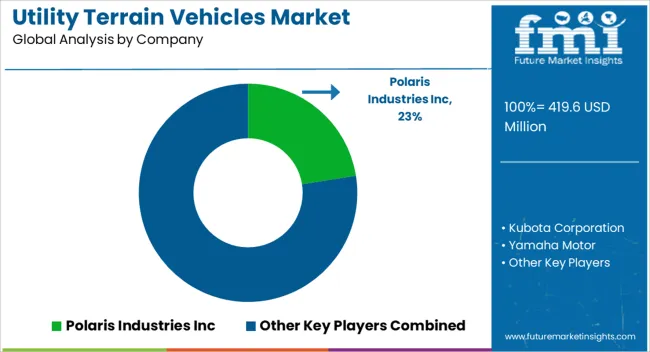

The utility terrain vehicles market is estimated to be valued at USD 419.6 million in 2025 and is projected to reach USD 787.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The absolute dollar opportunity in the utility terrain vehicles market is expected to experience notable growth, with market value projected to increase from USD 419.6 million in 2025 to USD 787.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%.

The market is anticipated to expand steadily as demand rises for versatile vehicles capable of performing in rugged and challenging terrains. These vehicles are increasingly being relied upon in industries such as agriculture, construction, mining, and outdoor recreation, where reliability, durability, and operational efficiency are critical for meeting performance expectations. By 2035, the market is expected to reach USD 787.6 million, highlighting the growing importance of utility terrain vehicles in both commercial and recreational applications.

The consistent growth indicates that manufacturers and suppliers who offer durable, high-performance vehicles are likely to capture a larger share of the market. With an emphasis on operational efficiency, load-handling capabilities, and all-terrain adaptability, utility terrain vehicles are anticipated to become an indispensable asset for operators in demanding environments.

| Metric | Value |

|---|---|

| Utility Terrain Vehicles Market Estimated Value in (2025 E) | USD 419.6 million |

| Utility Terrain Vehicles Market Forecast Value in (2035 F) | USD 787.6 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The utility terrain vehicles market is a specialized segment within the broader off-highway vehicles market, where it currently holds around 6-7% share, driven by its versatility in rough terrains and industrial applications. Within the automotive market, its share is smaller, approximately 2-3%, as UTs serve niche applications rather than mainstream transportation. In the agricultural machinery market, utility terrain vehicles represent roughly a 4-5% share, being widely used for farm operations, material handling, and field transportation due to their durability and off-road capability.

In the construction equipment market, UTs capture nearly 3-4% share, supporting on-site transportation, personnel movement, and equipment towing in rugged environments. Meanwhile, in the recreational vehicles market, their share is close to 5-6%, fueled by growing consumer demand for outdoor adventure, sports, and off-road recreational activities. Collectively, these parent markets demonstrate the dual nature of utility terrain vehicles as both industrial tools and recreational assets. The market benefits from advancements in engine efficiency, all-terrain capabilities, and regulatory compliance for emissions and safety.

As agriculture, construction, and recreational sectors expand globally, the utility terrain vehicles market is expected to grow steadily, increasing its penetration and share across these parent markets. Rising demand for versatile, reliable, and multi-purpose vehicles ensures sustained adoption and market expansion over the coming decade.

The utility terrain vehicles (UTVs) market is expanding rapidly due to rising demand across agriculture, sports, and defense sectors. Increasing versatility, robust suspension systems, and off-road capabilities are key factors propelling adoption.

Manufacturers are introducing advanced safety features, electric variants, and multi-purpose designs that cater to evolving consumer expectations. Additionally, the expansion of recreational parks and trail systems, especially in North America and Europe, is accelerating UTV usage in adventure and sport segments.

The market also benefits from improvements in driveline technology, payload capacity, and compliance with emissions standards, which are making UTVs more reliable and acceptable across both commercial and recreational applications.

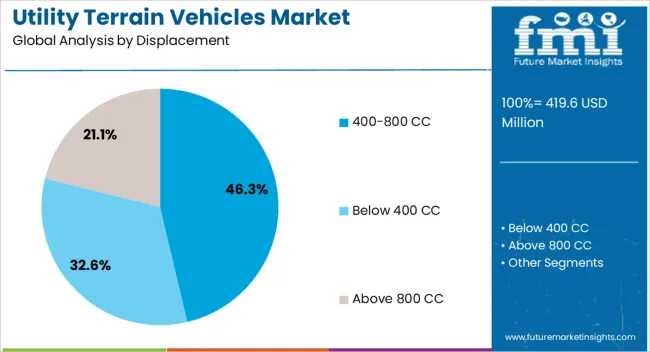

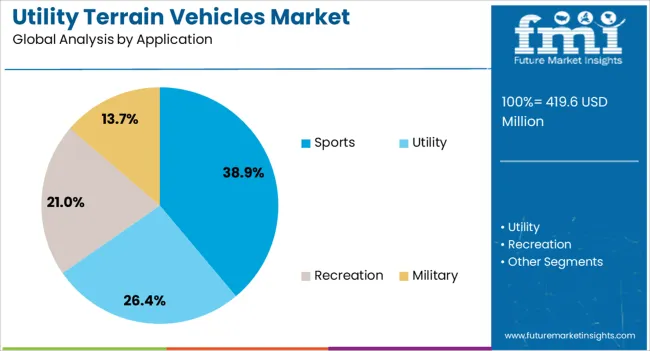

The utility terrain vehicles market is segmented by displacement, application, and geographic regions. By displacement, the utility terrain vehicles market is divided into 400-800 CC, Below 400 CC, and Above 800 CC. In terms of application, the utility terrain vehicles market is classified into Sports, Utility, Recreation, and Military. Regionally, the utility terrain vehicles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 400–800 CC displacement category dominates the market with a projected 46.30% share in 2025. This segment is favored due to its ideal balance of power, efficiency, and affordability, making it well-suited for both utility and recreational purposes.

Vehicles in this range offer superior maneuverability and fuel economy, which are essential for medium-duty off-road tasks and varied terrain conditions. Additionally, regulatory compliance and lower insurance premiums compared to higher-displacement models have broadened their appeal to first-time buyers and budget-conscious users.

OEMs are also focusing R&D on this range to integrate electric drivetrains and advanced suspension for broader consumer reach.

The sports segment is projected to lead the market with 38.90% share by 2025, driven by the popularity of adventure tourism, competitive racing, and off-road recreation events. Sports UTVs feature high ground clearance, enhanced torque delivery, and responsive steering capabilities that are critical for high-performance and endurance riding.

Increasing investments in trail infrastructure, especially in North America, along with growing UTV-centric events and clubs, are boosting the recreational use case. In addition, social media promotion and the aspirational appeal of rugged outdoor lifestyles are influencing consumer behavior in favor of sporty utility vehicles.

This trend is prompting manufacturers to launch customizable and limited-edition sports UTVs with advanced infotainment and safety features.

The utility terrain vehicles (UTVs) market is being driven by growing demand from agriculture, forestry, mining, and construction sectors. UTVs provide versatility, durability, and off-road capability, making them ideal for transporting equipment, personnel, and materials in challenging terrains. Farmers increasingly rely on UTVs for crop monitoring, livestock management, and hauling supplies, while industrial and mining operations use them for site inspections and utility tasks. Expanding commercial applications, combined with the recreational use segment, are collectively supporting steady market growth.

Significant opportunities exist in the recreational and specialized utility segments. Off-road enthusiasts and adventure tourism are contributing to rising sales of UTVs designed for leisure and sport purposes. Manufacturers are introducing customizable models, including electric UTVs, high-capacity cargo variants, and specialty vehicles for extreme terrains. Additionally, government and private initiatives for forestry management, wildfire control, and emergency response are opening avenues for purpose-built utility vehicles. Companies focusing on product differentiation and regional customization are well-positioned to capture these emerging opportunities.

A key trend in the UTV market is electrification, with battery-powered models gaining attention due to low emissions, quieter operation, and reduced maintenance. Integration of advanced safety features such as rollover protection systems, reinforced cabins, and driver-assist technologies is becoming standard in both recreational and utility-focused models. The adoption of telematics, GPS tracking, and smartphone connectivity is also enhancing vehicle monitoring and operational efficiency. These trends reflect the market’s shift toward sustainable, technologically enhanced, and user-friendly UTV solutions.

The UTV market faces challenges associated with high acquisition costs, especially for electric and specialized models. Price-sensitive buyers may prefer conventional ATVs or vehicles, limiting adoption in certain regions. Regulatory hurdles related to emissions, safety standards, and off-road vehicle restrictions vary across countries, complicating market expansion. Additionally, after-sales service and availability of spare parts can impact user experience and brand preference. Manufacturers must address these challenges by providing cost-effective options, compliance support, and strong service networks to ensure broader market penetration.

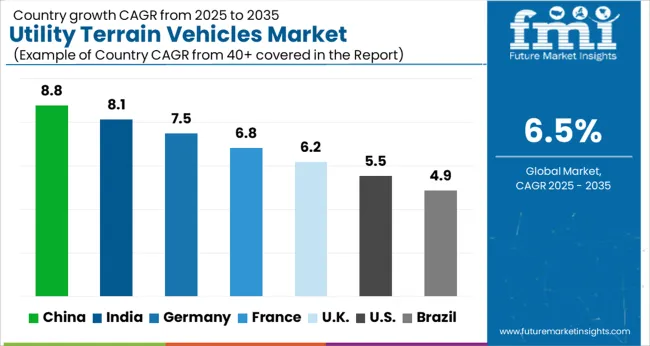

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

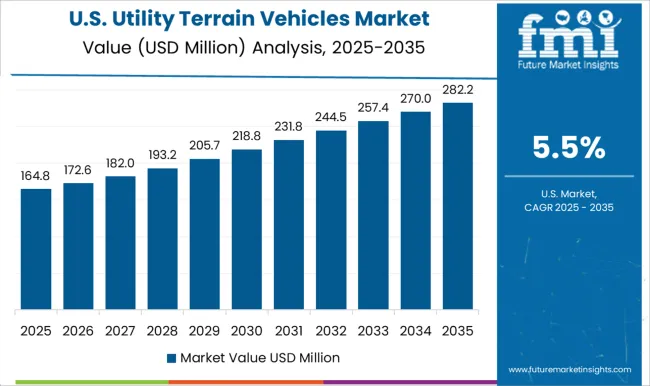

| USA | 5.5% |

| Brazil | 4.9% |

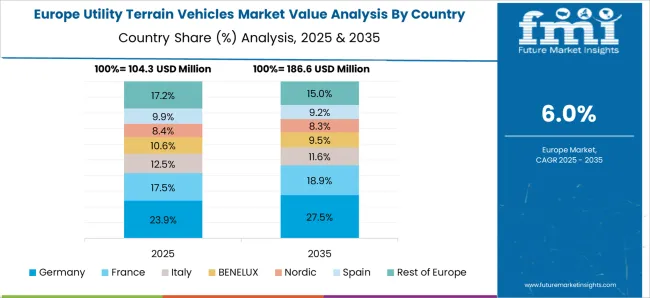

The global utility terrain vehicles market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads with a growth rate of 8.8%, followed by India at 8.1% and France at 6.8%. The United Kingdom records a growth rate of 6.2%, while the United States shows the slowest growth at 5.5%. Expansion is supported by rising demand in agriculture, construction, mining, and recreational activities. Emerging economies such as China and India are witnessing rapid adoption due to mechanization and infrastructure development, while developed countries like the USA, UK, and France are focusing on high-performance, utility-driven, and specialized vehicles. This report includes insights on 40+ countries; the top markets are shown here for reference.

The utility terrain vehicles market in China is growing at 8.8% CAGR, the highest among leading nations. Growth is driven by agricultural mechanization, infrastructure development, and rising demand in construction and mining operations. Chinese manufacturers are expanding production capacity and introducing multi-purpose and all-terrain models to meet diverse needs. Government incentives supporting rural development and mechanized farming further boost adoption. Recreational and commercial applications are also contributing to market expansion.

The utility terrain vehicles market in India is advancing at 8.1% CAGR, fueled by the growing agricultural and infrastructure sectors. The demand for high-performance vehicles in farms, construction sites, and industrial applications is increasing. Domestic manufacturers are introducing fuel-efficient and durable models tailored for rugged terrains. Government initiatives promoting mechanization and rural mobility enhance market expansion. Rising recreational usage and off-road sports participation also contribute to steady adoption.

The utility terrain vehicles market in France is growing at 6.8% CAGR, supported by agricultural, industrial, and recreational applications. Farmers are increasingly adopting UTVs for transportation, material handling, and field operations. Industrial sectors, including construction and mining, rely on UTVs for versatile and efficient on-site mobility. Recreational usage, such as off-road sports and leisure activities, is also fueling demand. Manufacturers are focusing on performance optimization, safety features, and compliance with European emission standards.

The utility terrain vehicles market in the United Kingdom is expanding at 6.2% CAGR, influenced by agricultural mechanization, recreational usage, and construction projects. UK farmers are adopting UTVs for efficient transportation and field work. Off-road sports and outdoor leisure activities further drive adoption. Construction and industrial sectors are investing in durable, high-performance vehicles for rugged terrains. Regulatory standards on emissions and safety features are shaping design and technology integration in UTVs.

The utility terrain vehicles market in the United States is growing at 5.5% CAGR, the slowest among leading nations but steady. Growth is supported by recreational off-road sports, agriculture, and construction activities. High-performance and specialized UTVs are adopted across farms, industrial sites, and recreational areas. Domestic manufacturers continue to focus on fuel efficiency, durability, and safety enhancements. Expansion in rural areas and commercial sectors reinforces demand for utility terrain vehicles.

Leading companies in the utility terrain vehicles market, such as Polaris Industries Inc., Kubota Corporation, and Yamaha Motor, are competing by offering vehicles that combine durability, off-road performance, and versatility for work and recreation. Polaris emphasizes multi-purpose UTVs with high payload capacity and advanced suspension systems, presenting brochures that highlight reliability in harsh environments. Kubota focuses on utility and agricultural applications, marketing vehicles engineered for heavy-duty tasks and fuel efficiency. Yamaha and Honda Motors highlight compact, agile designs suited for both recreational and commercial use, emphasizing ease of handling and low maintenance.

Other notable players, including John Deere, Kawasaki Motors, and Bombardier Recreational Products, differentiate themselves through specialized features such as enhanced towing capacity, all-weather performance, and customizable attachments. John Deere brochures stress integration with agricultural operations, while Kawasaki focuses on sport-utility hybrids. Bombardier markets high-performance vehicles designed for rugged terrains, promoting innovation in drivetrain and suspension technology. Strategies are framed around reliability, versatility, and user-focused design. Product brochures consistently highlight payload ratings, engine performance, and terrain adaptability, positioning these companies as key providers for industries and consumers seeking durable, efficient, and high-performing utility vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 419.6 Million |

| Displacement | 400-800 CC, Below 400 CC, and Above 800 CC |

| Application | Sports, Utility, Recreation, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Polaris Industries Inc, Kubota Corporation, Yamaha Motor, John Deere, Kawasaki Motors, Honda Motors, and Bombardier Recreational Products |

| Additional Attributes | Dollar sales by vehicle type (2-seater, 4-seater, side-by-side) and engine type (gasoline, electric, diesel) are key metrics. Trends include rising demand for recreational and utility applications, adoption in agriculture and construction, and growing interest in electric models. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global utility terrain vehicles market is estimated to be valued at USD 419.6 million in 2025.

The market size for the utility terrain vehicles market is projected to reach USD 787.6 million by 2035.

The utility terrain vehicles market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in utility terrain vehicles market are 400-800 cc, below 400 cc and above 800 cc.

In terms of application, sports segment to command 38.9% share in the utility terrain vehicles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA