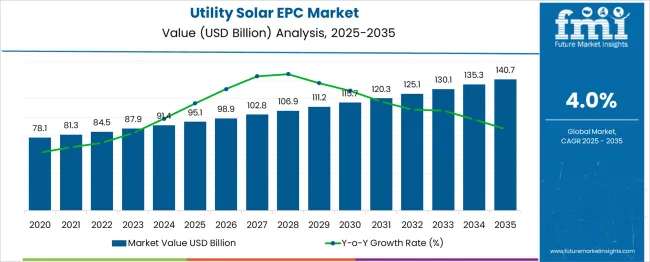

The utility solar EPC market is estimated to be valued at USD 95.1 billion in 2025 and is projected to reach USD 140.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. Between 2025 and 2030, the market is expected to expand from USD 95.1 billion to USD 115.7 billion, showing steady growth supported by large-scale solar deployment initiatives and government-driven renewable energy targets. Year-on-year analysis reveals incremental gains, reaching USD 98.9 billion in 2026 and USD 102.8 billion in 2027, fueled by ongoing solar farm installations and grid integration projects worldwide.

By 2028, the market is projected to reach USD 106.9 billion, advancing to USD 111.2 billion in 2029 and USD 115.7 billion by 2030. Technological enhancements in PV modules, cost reductions in solar equipment, and greater availability of financing models for utility-scale solar projects will reinforce demand. Increased emphasis on energy transition strategies and decarbonization goals by major economies will further influence growth. These factors position utility solar EPC services as a critical component in scaling renewable power generation, ensuring reliable execution of large solar projects, and supporting global clean energy commitments over the next decade.

| Metric | Value |

|---|---|

| Utility Solar EPC Market Estimated Value in (2025 E) | USD 95.1 billion |

| Utility Solar EPC Market Forecast Value in (2035 F) | USD 140.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The utility solar EPC market holds a dominant position within several renewable energy and infrastructure sectors. In the solar energy market, its share is approximately 28–30%, as EPC services form a critical part of utility-scale project execution. Within the renewable energy EPC market, the contribution is higher at 35–38%, reflecting the rapid growth of large-scale solar projects compared to wind and hydro segments.

For the power generation EPC market, its share stands at 10–12%, given the presence of conventional thermal, hydro, and nuclear power projects. In the utility-scale renewable energy market, the share is substantial at 40–45%, as solar dominates new capacity additions globally. The energy infrastructure and grid integration market sees a smaller share of 4–5%, since this includes broader transmission, distribution, and grid modernization efforts.

Market expansion is fueled by declining solar module costs, favorable government policies, and rising investments in large-scale solar farms to meet renewable energy targets. EPC providers play a crucial role in managing complex project timelines, sourcing high-efficiency modules, and ensuring grid compliance. With the increasing push toward decarbonization and energy security, the utility solar EPC segment is expected to capture a greater share in these parent markets, positioning itself as a backbone for global renewable energy deployment.

The utility solar EPC market is demonstrating strong momentum, driven by the global transition toward renewable energy, favorable policy frameworks, and declining costs of photovoltaic technology. Large-scale solar installations are being prioritized to meet national and corporate decarbonization targets while ensuring grid stability and energy security.

Competitive bidding mechanisms and power purchase agreements are enabling cost-efficient deployment at utility scale, attracting investments from established energy players and financial institutions. Future growth is expected to be underpinned by advancements in storage integration, improvements in construction methodologies, and expansion into emerging markets seeking to diversify their energy mix.

The increasing availability of land, maturing supply chains, and innovations in panel efficiency are paving the way for accelerated adoption and sustained market expansion.

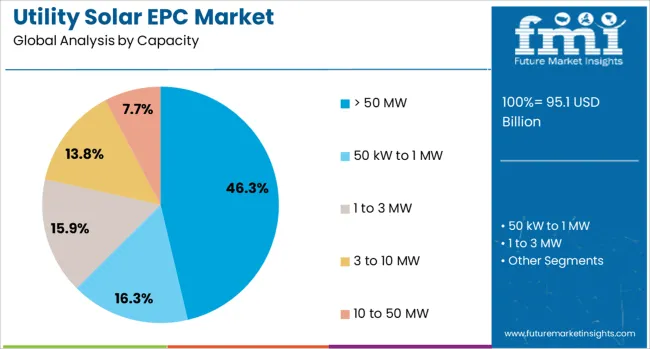

The utility solar epc market is segmented by capacity and geographic regions. By capacity of the utility solar epc market is divided into > 50 MW, 50 kW to 1 MW, 1 to 3 MW, 3 to 10 MW, and 10 to 50 MW. Regionally, the utility solar epc industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by capacity, the > 50 MW segment is projected to account for 46.30% of the total market revenue in 2025, establishing itself as the leading capacity segment. This dominance is attributed to economies of scale achieved through larger project footprints, which allow developers to optimize material procurement, labor deployment, and engineering resources.

Utility-scale buyers have been favoring projects exceeding 50 MW to maximize land utilization and meet long-term energy procurement goals more efficiently. This segment’s growth has also been reinforced by its ability to deliver a lower levelized cost of energy compared to smaller installations, making it more competitive in auctions and tenders.

Availability of financing for large, bankable projects and the preference of institutional investors for sizable, stable assets have further solidified the position of the > 50 MW capacity segment as the primary driver of revenue in the utility solar EPC market.

The utility solar EPC market is driven by accelerating utility-scale solar project development, policy-driven renewable targets, and declining photovoltaic installation costs. Opportunities exist in hybrid solar-plus-storage projects and modular EPC solutions tailored for emerging regions. Growing adoption of digital platforms for remote asset management and real-time performance monitoring is becoming a dominant trend. However, challenges such as volatile raw material pricing, skilled labor shortages, and land acquisition hurdles continue to restrict large-scale deployments. Recent government-backed initiatives and private sector investments are reshaping the competitive landscape, creating avenues for EPC providers to scale globally through strategic alliances and integrated service offerings.

Growth in the utility solar EPC market is being driven by the rise of large-scale solar power projects supported by national energy transition targets and attractive tariff-based tenders. In 2024, India awarded multiple EPC contracts for projects above 500 MW, while the US saw significant utility procurement commitments from states targeting grid decarbonization. EPC players are benefiting from economies of scale as module prices soften and financing structures improve for renewable projects. It is strongly believed that partnerships between EPC providers and IPPs are accelerating contract awards, allowing projects to achieve faster commissioning and improved project bankability globally.

Opportunities in the market are expected to increase with the integration of battery energy storage systems (BESS) into EPC offerings. In 2025, leading EPC firms in North America and Asia-Pacific introduced hybrid project designs combining solar PV and large-scale storage to ensure grid reliability and peak load balancing. This integration is opening new revenue streams for EPC providers as developers and utilities prefer single-contract solutions. Growth opportunities are also being observed in emerging markets where distributed energy procurement policies and auction mechanisms favor hybrid project deployment, creating a competitive edge for EPC companies delivering integrated solar and storage solutions.

An emerging trend in the utility solar EPC market is the adoption of digital platforms for project lifecycle management, enabling remote performance monitoring and predictive analytics. In 2024, several EPC providers launched AI-powered platforms to optimize asset utilization and maintenance scheduling across multiple sites. Digitalization is helping reduce operational downtime while improving energy yield projections for investors. Predictive maintenance and remote troubleshooting have become differentiators for EPC firms offering full-service solutions. This trend is considered essential for improving profitability in an increasingly competitive market, as real-time analytics allow EPC providers to deliver data-driven decision-making and operational excellence.

One of the significant restraints for the utility solar EPC market is the volatility in raw material prices and persistent supply chain challenges. In 2024, polysilicon price fluctuations and module shipment delays from Asia caused execution bottlenecks for several projects in Europe and the US. These cost variations directly impact EPC margins and force frequent renegotiation of contracts with developers. Additionally, shortages of skilled labor for complex solar-plus-storage projects are adding to operational delays. It is considered a limiting factor that small and mid-scale EPC firms struggle to mitigate without strategic procurement partnerships or localized sourcing strategies.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

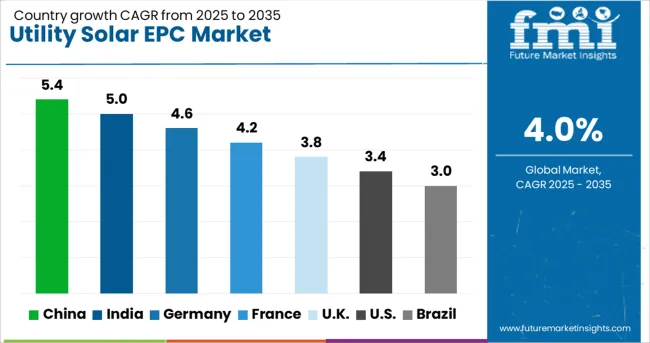

The global utility solar EPC market is projected to grow at a CAGR of 4% from 2025 to 2035. China leads with 5.4%, followed by India at 5.0% and Germany at 4.6%. France records 4.2%, while the United Kingdom posts 3.8%. Growth is supported by increased renewable energy targets, falling solar module costs, and investments in large-scale solar farms. China and India dominate adoption due to government-backed energy transition initiatives, while Germany focuses on hybrid grid-integrated solar projects. France and the UK prioritize EPC solutions that align with stringent carbon-reduction commitments and energy security goals.

The utility solar EPC market in China is forecast to grow at 5.4%, driven by aggressive solar capacity additions under national renewable energy policies. Ground-mounted solar farms dominate EPC project portfolios. EPC firms integrate AI-based monitoring for performance optimization and predictive maintenance. Strategic government incentives further strengthen investment in high-capacity solar developments.

The utility solar EPC market in India is expected to grow at 5.0%, supported by ambitious solar energy targets under the National Solar Mission. Fixed-tilt and single-axis tracker systems dominate deployments in large-scale projects. EPC contractors adopt modular designs to speed up installations. Increased financing support from green energy funds strengthens project execution timelines.

The utility solar EPC market in Germany is projected to grow at 4.6%, driven by expansion of hybrid solar-plus-storage projects. Floating solar installations dominate recent EPC innovations to optimize land use. EPC providers integrate digital twin technology for advanced performance simulations. Strong regulatory frameworks favor decentralized solar energy generation across commercial zones.

The utility solar EPC market in France is forecast to grow at 4.2%, supported by solar energy investments under the Multiannual Energy Program. Dual-use solar farms dominate EPC planning in agricultural zones. EPC contractors introduce smart grid integration for optimized load management. Government subsidies for clean energy projects reinforce large-scale EPC implementation.

The utility solar EPC market in the UK is expected to grow at 3.8%, driven by increasing renewable portfolio obligations and the need for low-carbon energy solutions. Utility-scale solar farms dominate EPC deployments in rural and coastal areas. EPC companies leverage advanced automation for faster construction timelines. Strong demand for hybrid solar-plus-storage systems further boosts project viability.

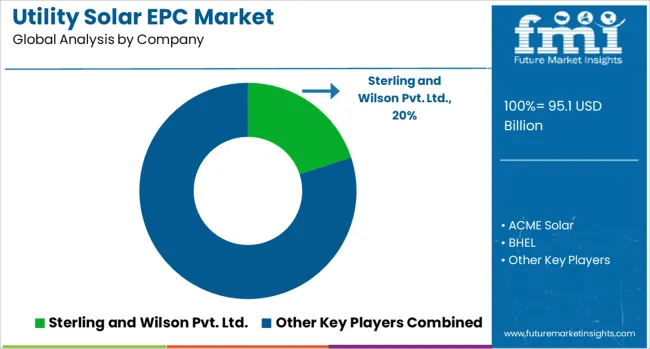

The utility solar EPC (Engineering, Procurement, and Construction) market is moderately consolidated, with Sterling and Wilson Pvt. Ltd. recognized as a leading player due to its strong global project execution capabilities, large-scale utility solar installations, and integrated services across design, procurement, and commissioning. The company’s extensive experience in delivering high-capacity solar plants has positioned it as a trusted EPC partner for utility developers worldwide.

Key players include ACME Solar, BHEL, Hild Energy Pvt. Ltd., KEC International Ltd., Prozeal Green Energy, RISEN ENERGY Co., Ltd., Swinerton Incorporated, SUNGROW, Tata Power Solar, VIKRAM SOLAR LTD., and Waaree Energies Ltd. These companies focus on delivering turnkey EPC solutions encompassing solar module supply, balance-of-system integration, grid connectivity, and performance monitoring for large-scale solar projects.

Market growth is being driven by increasing investments in renewable energy infrastructure, declining solar module costs, and supportive government policies promoting utility-scale solar development. Leading EPC providers are investing in advanced tracking systems, energy storage integration, and digital project management tools to enhance plant efficiency and reduce levelized cost of energy (LCOE). Asia-Pacific, led by India and China, remains the fastest-growing region, while North America and the Middle East are emerging as key markets driven by large utility solar tenders and private sector participation.

| Item | Value |

|---|---|

| Quantitative Units | USD 95.1 Billion |

| Capacity | > 50 MW, 50 kW to 1 MW, 1 to 3 MW, 3 to 10 MW, and 10 to 50 MW |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sterling and Wilson Pvt. Ltd., ACME Solar, BHEL, Hild Energy Pvt. Ltd., KEC International Ltd., Prozeal Green Energy, RISEN ENERGY Co., LTD., Swinerton Incorporated, SUNGROW, Tata Power Solar, VIKRAM SOLAR LTD., and Waaree Energies Ltd. |

| Additional Attributes | Dollar sales by service type (engineering, procurement, construction), dollar sales by project capacity (small-scale solar farms vs utility-scale solar parks), regional demand trends (Asia-Pacific dominant, North America and Europe expanding), competitive landscape, buyer preferences for turnkey EPC versus EPC-plus-operations models, integration with energy storage systems and advanced grid-balancing services, innovations in hybrid PV-wind installations, AI-driven site selection, predictive performance analytics, digital twin-based construction planning, and modular EPC workflows to reduce project timelines and optimize cost structures. |

The global utility solar epc market is estimated to be valued at USD 95.1 billion in 2025.

The market size for the utility solar epc market is projected to reach USD 140.7 billion by 2035.

The utility solar epc market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in utility solar epc market are > 50 mw, 50 kw to 1 mw, 1 to 3 mw, 3 to 10 mw and 10 to 50 mw.

In terms of , segment to command 0.0% share in the utility solar epc market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA