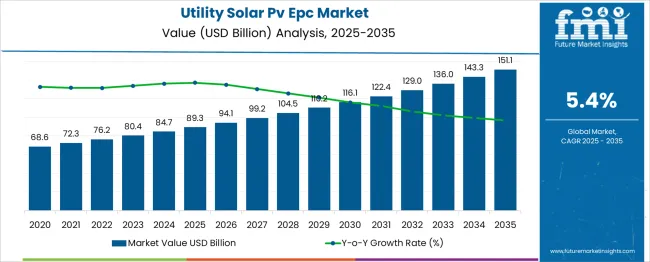

The Utility Solar PV EPC Market is estimated to be valued at USD 89.3 billion in 2025 and is projected to reach USD 151.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 89.3 billion to USD 116.1 billion, driven by expanding investments in large-scale solar power projects and global renewable energy targets. Year-on-year analysis shows consistent growth, with values reaching USD 94.1 billion in 2026 and USD 99.2 billion in 2027, supported by the ongoing transition toward clean energy solutions. By 2028, the market is projected to hit USD 104.5 billion, advancing to USD 110.2 billion in 2029 and USD 116.1 billion by 2030. Growth is expected to be fueled by technological advancements in photovoltaic panel efficiency, declining installation costs, and the increasing integration of solar PV with energy storage systems. This trajectory positions the utility solar PV EPC market as a critical driver of sustainable power generation, offering significant opportunities for companies involved in solar project development, installation, and infrastructure services.

| Metric | Value |

|---|---|

| Utility Solar PV EPC Market Estimated Value in (2025 E) | USD 89.3 billion |

| Utility Solar PV EPC Market Forecast Value in (2035 F) | USD 151.1 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The utility solar PV EPC market is witnessing steady expansion, supported by a global push toward decarbonization, declining module costs, and favorable policy frameworks across emerging and developed economies. Large-scale capacity additions by independent power producers (IPPs) and government-backed tenders are strengthening demand for experienced EPC players capable of managing end-to-end execution in challenging terrains and climates.

Technological advancements in bifacial modules, digitalized construction planning, and AI-based performance optimization tools are enhancing the operational efficiency of EPC services. Increasing investor appetite for renewable infrastructure, paired with transmission integration initiatives and regulatory mandates, is laying a strong foundation for long-term growth.

Additionally, EPC players with robust financial structuring capabilities, international project credentials, and supply chain resilience are well positioned to capture the accelerating shift toward clean utility-scale energy solutions.

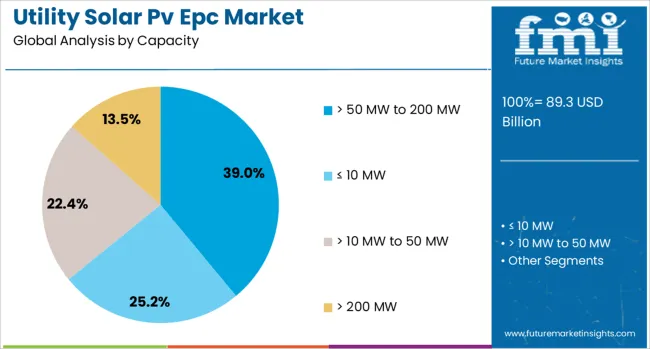

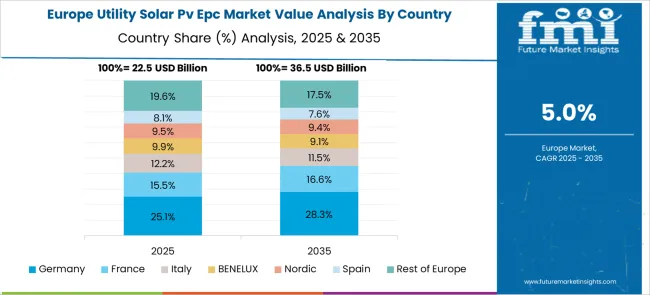

The utility solar PV EPC market is segmented by capacity and geographic regions. By capacity of the utility solar PV EPC market is divided into > 50 MW to 200 MW, ≤ 10 MW, > 10 MW to 50 MW> 200 MW. Regionally, the utility solar PV EPC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Projects in the >50 MW to 200 MW capacity range are expected to account for 39.00% of the market share in 2025, establishing this as the dominant segment in utility solar PV EPC deployments. This capacity range has been preferred due to its optimal balance between cost efficiencies and grid integration feasibility.

Such projects allow developers to secure economies of scale in procurement, labor, and land use, without encountering the logistical complexity of mega-scale solar parks. EPC contractors benefit from quicker execution timelines, streamlined permitting, and reduced capital risk compared to larger installations.

Governments and private investors alike are favoring this segment for its scalability and faster return on investment, particularly in regions with evolving infrastructure and moderate grid capacity. As transmission corridors expand and distributed utility projects gain traction, the 50–200 MW range is expected to remain the strategic sweet spot for both developers and EPC firms.

The utility solar PV EPC market is expanding due to the growing demand for renewable energy and government-backed clean energy initiatives. In 2024 and 2025, increased investments in large-scale solar power projects and the rising focus on reducing electricity costs contributed to market growth. Opportunities lie in the integration of energy storage systems with solar PV and emerging markets with growing energy needs. Key trends include modular solar installations and the adoption of bifacial solar panels. However, high project costs, land acquisition issues, and regulatory barriers remain major market constraints.

The primary growth driver is the increasing demand for renewable energy solutions and the need for cost-effective electricity. In 2024 and 2025, the demand for solar power projects in commercial and industrial sectors rose due to falling costs of solar equipment and operational efficiency. Additionally, government incentives and policies encouraging clean energy adoption propelled utility-scale solar PV installations. These factors highlight how the quest for sustainable, affordable power solutions continues to drive market growth in the utility solar PV EPC sector.

Significant opportunities exist in integrating energy storage systems with utility-scale solar PV projects. In 2025, the integration of batteries with solar PV systems became increasingly popular for grid stability and energy management. Additionally, emerging markets in Asia-Pacific and Africa, with growing energy consumption, presented new growth prospects. As energy infrastructure expands in these regions, solar PV solutions supported by EPC providers are poised to meet both commercial and residential energy needs. These factors suggest that markets with evolving energy systems will see significant adoption of solar PV.

Emerging trends include the adoption of modular solar installations and bifacial panels for enhanced energy production. In 2024, EPC providers introduced modular systems that allow for quick scaling of solar projects and cost-effective installation. Bifacial panels, capable of capturing sunlight from both sides, gained traction for their improved energy yield. These trends reflect a shift towards more flexible, efficient, and scalable solar power solutions, aligning with the increasing demand for high-performance, cost-effective energy systems in the utility sector.

The major market restraints include high initial project costs and complex regulatory hurdles. In 2024 and 2025, while solar PV projects offered long-term cost savings, high upfront capital expenditure remained a barrier for many utilities. Additionally, regulatory challenges such as land acquisition, permitting delays, and interconnection approvals in certain regions slowed project deployment. These constraints emphasize the need for more streamlined regulatory processes and cost reduction strategies to ensure the wider adoption of utility-scale solar PV solutions in diverse markets.

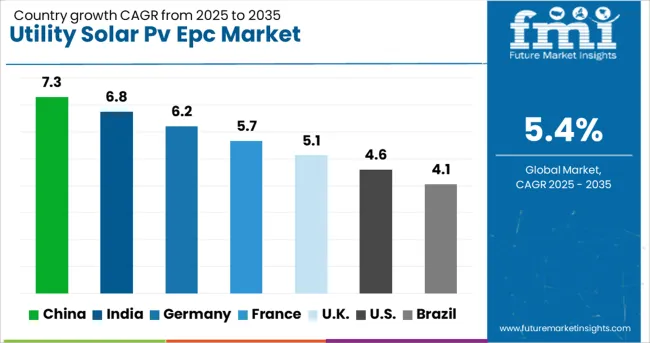

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

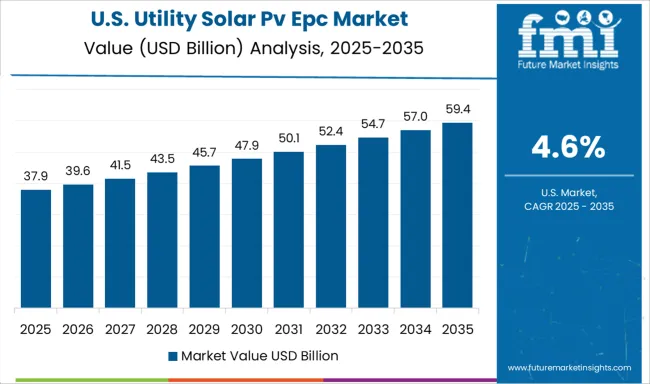

| USA | 4.6% |

| Brazil | 4.1% |

The global utility solar PV EPC (Engineering, Procurement, and Construction) market is projected to grow at 5.4% CAGR from 2025 to 2035. China leads with 7.3% CAGR, driven by strong government incentives and massive investments in renewable energy infrastructure. India follows at 6.8%, fueled by increasing demand for clean energy solutions and ambitious solar power targets. Germany records 6.2% CAGR, supported by EU green energy policies and a strong focus on large-scale solar projects. The United Kingdom grows at 5.1%, while the United States posts 4.6%, reflecting steady growth in mature markets with an increasing focus on solar energy as a clean and sustainable alternative. Asia-Pacific is leading growth, while Europe and North America focus on scaling up solar capacity and integrating innovative technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The utility solar PV EPC market in China is forecasted to grow at 7.3% CAGR, driven by the country’s aggressive push toward solar energy development and the government’s green energy policies. With one of the largest solar installations in the world, China continues to expand its solar capacity, focusing on large-scale utility solar projects. The country’s focus on reducing its carbon footprint and reliance on fossil fuels accelerates the adoption of EPC solutions, while significant investments in solar infrastructure create opportunities for major EPC players.

The utility solar PV EPC market in India is projected to grow at 6.8% CAGR, supported by the country’s renewable energy targets and expanding solar power capacity. India’s government plans to meet ambitious solar power generation goals, fueling demand for EPC services in both utility-scale and rooftop solar projects. The country’s focus on energy access in rural areas and improving grid infrastructure further increases the need for utility-scale solar installations. Additionally, state-led initiatives and private sector investments in solar projects will drive future demand.

The utility solar PV EPC market in Germany is expected to grow at 6.2% CAGR, driven by the country’s commitment to the EU’s Green Deal and the shift toward sustainable energy solutions. Germany’s focus on transitioning away from coal and other fossil fuels supports the adoption of solar energy in utility-scale projects. Demand for EPC services in large solar parks is growing as the country’s energy grid moves toward renewables, and high-tech solar installations become more widespread.

The utility solar PV EPC market in the United Kingdom is projected to grow at 5.1% CAGR, driven by the country’s commitment to achieving net-zero carbon emissions. The UK government’s investment in renewable energy and solar infrastructure increases the demand for utility-scale solar power projects. With a growing focus on grid modernization and solar energy integration, the demand for EPC services continues to rise, especially in solar power plants and commercial installations.

The utility solar PV EPC market in the United States is projected to grow at 4.6% CAGR, reflecting steady demand for solar power solutions in the utility sector. Federal and state-level incentives to promote renewable energy, coupled with growing interest in solar power as a clean energy source, provide significant opportunities for EPC providers. The increasing need for renewable energy sources in the face of climate change drives demand for utility-scale solar PV installations, and innovations in solar storage technologies boost the need for integrated EPC solutions.

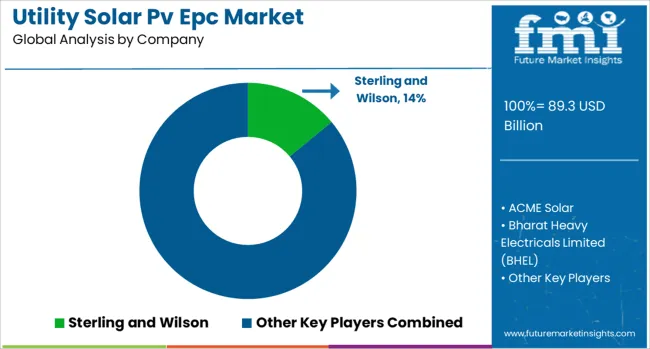

The utility solar PV EPC market is dominated by Sterling and Wilson, which secures its leadership through extensive experience in large-scale solar project engineering, procurement, and construction (EPC) services across multiple geographies. Sterling and Wilson’s dominance is supported by its strong global presence, operational expertise, and a broad portfolio of utility-scale solar projects. Key players such as ACME Solar, BELECTRIC, First Solar, and Tata Power Solar Systems Ltd. maintain significant market shares by offering reliable solar power solutions, including design, installation, and integration services tailored for power plants and industrial clients. These companies focus on delivering cost-effective, high-performance solar projects that comply with regulatory standards and offer optimal long-term energy savings.

Emerging players like Bharat Heavy Electricals Limited (BHEL), COBRA Group, Canadian Solar, JUWI AG, and Power Construction Corporation of China, Ltd. are expanding their market footprint by providing specialized services for energy storage integration, power plant maintenance, and innovative grid solutions. Their strategies involve enhancing solar efficiency, reducing project timelines, and offering tailored solutions for large-scale solar energy systems. Market growth is driven by rising investments in renewable energy, government incentives for solar power adoption, and the increasing demand for sustainable and cost-effective energy generation. Advancements in solar technology, storage integration, and energy management systems are expected to further shape competitive dynamics in the global utility solar PV EPC market.

| Item | Value |

|---|---|

| Quantitative Units | USD 89.3 Billion |

| Capacity | > 50 MW to 200 MW, ≤ 10 MW, > 10 MW to 50 MW, and > 200 MW |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sterling and Wilson, ACME Solar, Bharat Heavy Electricals Limited (BHEL), BELECTRIC, COBRA Group, Canadian Solar, First Solar, JUWI AG, KEC International Limited, Larsen & Toubro Limited, Power Construction Corporation of China, Ltd., Risen Energy Co. Ltd., Ritis Meera Infra Energy LLP, STEAG GmbH, Swinerton Renewable Energy, SunPower Corporation, SUNGROW, TBEA Co., Ltd., Tata Power Solar Systems Ltd., Topsun Energy Limited, and Trina Solar |

| Additional Attributes | Dollar sales by project size (≤10 MW, 10–50 MW, 50–200 MW, >200 MW), installation type (ground-mounted, rooftop, floating), and end-use sector (residential, commercial, industrial, utility); regional market share (Asia-Pacific leading with 25.0 USD billion in 2023, followed by North America at 15.0 USD billion); innovation in bifacial modules, smart inverters, and hybrid solar-storage systems; impact of policy incentives like the Inflation Reduction Act and feed-in tariffs; and emerging trends in floating solar and agrivoltaics. |

The global utility solar PV EPC market is estimated to be valued at USD 89.3 billion in 2025.

The market size for the utility solar PV EPC market is projected to reach USD 151.1 billion by 2035.

The utility solar PV EPC market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in utility solar PV EPC market are > 50 mw to 200 mw, ≤ 10 mw, > 10 mw to 50 mw and > 200 mw.

In terms of , segment to command 0.0% share in the utility solar PV EPC market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA