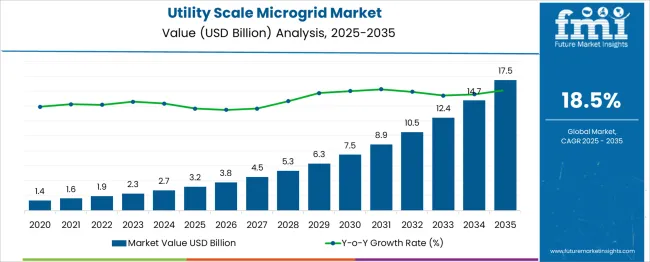

The Utility Scale Microgrid Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 17.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.5% over the forecast period. Between 2025 and 2030, the market is expected to surge from USD 3.2 billion to USD 7.5 billion, showcasing aggressive expansion. Year-on-year analysis indicates rapid acceleration, with growth from USD 3.2 billion in 2025 to USD 3.8 billion in 2026, and USD 4.5 billion in 2027, driven by higher investments in renewable energy integration and decentralized energy systems across utility grids.

By 2028, the market is forecasted to hit USD 5.3 billion, rising further to USD 6.3 billion in 2029 and USD 7.5 billion by 2030, reinforcing the momentum in distributed generation deployment. Advanced energy storage solutions, coupled with digital control systems and demand response capabilities, are expected to enhance operational efficiency, attracting large-scale utility adoption.

Declining battery costs and regulatory frameworks supporting grid resilience are projected to accelerate installations further. This trend underscores the strategic importance of utility-scale microgrids in addressing energy security, optimizing renewable penetration, and improving power quality across diverse geographies during the transition toward modernized energy infrastructure.

| Metric | Value |

|---|---|

| Utility Scale Microgrid Market Estimated Value in (2025 E) | USD 3.2 billion |

| Utility Scale Microgrid Market Forecast Value in (2035 F) | USD 17.5 billion |

| Forecast CAGR (2025 to 2035) | 18.5% |

The utility scale microgrid market forms a growing segment within the broader energy and power ecosystem. In the energy storage systems market, it represents about 10–12%, as large-scale microgrids rely on advanced storage solutions for stability and backup. Within the renewable energy integration market, its share is around 8–9%, since microgrids enable seamless utilization of solar, wind, and hybrid power sources.

In the distributed energy resources (DER) market, the contribution is higher at 15–18%, reflecting the core role microgrids play in decentralizing energy generation and ensuring grid resilience. The smart grid market sees a share of approximately 6–7%, given microgrids’ compatibility with digital grid infrastructure and advanced control systems. Within the power generation and distribution market, the share remains modest at 4–5%, as centralized systems still dominate.

The growing demand for energy security, grid independence, and decarbonization strategies is driving microgrid adoption in utilities. Enhanced by battery storage, advanced control software, and renewable integration, utility-scale microgrids are becoming key solutions for large campuses, remote communities, and industrial zones. Future growth will be reinforced by regulatory support, rising electricity demand, and investments in grid modernization, positioning this market as a cornerstone of next-generation energy infrastructure.

Increasing incidences of grid outages, rising renewable energy penetration, and supportive regulatory frameworks are fostering widespread adoption. The market is being shaped by growing investments in decarbonization initiatives, coupled with the need to integrate distributed energy resources seamlessly. Improved storage technologies and digital control systems are enhancing operational reliability while reducing costs, making microgrids more attractive for large-scale deployment.

Future growth is expected to be supported by technological advancements in storage, policy incentives for clean energy, and the escalating demand for grid stability in regions with aging infrastructure. Strategic collaborations between technology providers and utilities are paving the way for optimized, scalable solutions that align with sustainability and reliability goals.

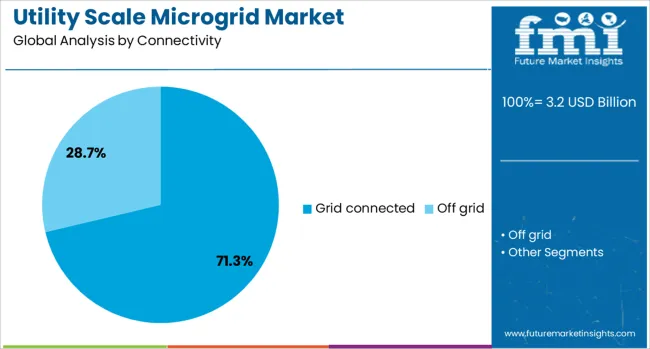

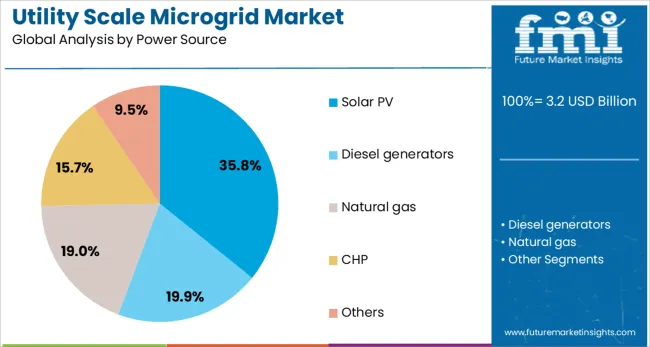

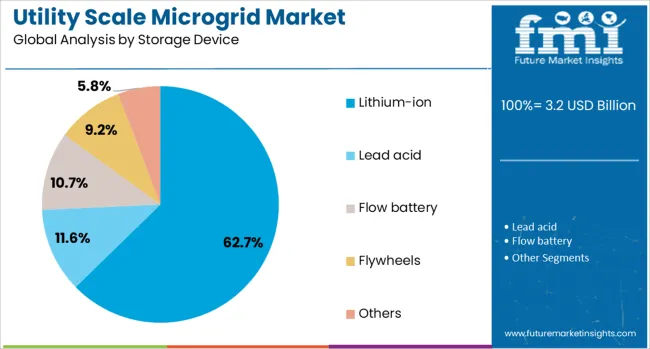

The utility-scale microgrid market is segmented by connectivity, power source, storage device, grid type, and geographic regions. By connectivity, the utility-scale microgrid market is divided into grid-connected and off-grid. In terms of power source, the utility-scale microgrid market is classified into Solar PV, Diesel generators, Natural gas, CHP, and Others. Based on storage devices, the utility-scale microgrid market is segmented into Lithium-ion, Lead acid, Flow battery, Flywheels, and Others.

By grid type, the utility-scale microgrid market is segmented into AC, DC, and Hybrid. Regionally, the utility scale microgrid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by connectivity, the grid-connected segment is expected to hold 71.30% of the total market revenue in 2025, establishing itself as the leading segment. This leadership has been enabled by its ability to ensure seamless integration with the main utility grid while providing flexibility to operate independently during disturbances.

Grid-connected configurations have been widely adopted as they allow surplus power to be exported and imported efficiently, optimizing asset utilization and ensuring economic viability. Utilities and developers have favored this model due to its compatibility with existing infrastructure and its ability to deliver stability to both the microgrid and the wider grid network.

Enhanced regulatory support for interconnection standards and improved digital control technologies have further reinforced the dominance of grid-connected systems in large-scale deployments.

Segmented by power source, the solar PV segment is projected to account for 35.80% of the market revenue in 2025, positioning it as the leading power source. This prominence has been supported by the declining cost of solar modules, widespread availability of solar resources, and policy-driven incentives for clean energy adoption.

The integration of solar PV into utility scale microgrids has been prioritized due to its ability to deliver predictable, low-cost electricity while contributing to emissions reduction targets. Advances in solar panel efficiency and the ease of scaling installations have enabled developers to design flexible, high-output systems that meet growing energy demands.

Additionally, the compatibility of solar PV with various storage solutions and its alignment with decarbonization objectives have strengthened its role as the preferred power source within this market.

When segmented by storage device, the lithium-ion segment is expected to command 62.70% of the market revenue in 2025, making it the dominant storage technology. This leadership has been driven by the superior energy density, fast response times, and declining costs of lithium-ion batteries compared to alternative storage solutions.

Utilities and developers have adopted lithium-ion extensively for its ability to stabilize power output from variable renewable sources, enhance grid reliability, and support peak shaving and load shifting. Improvements in battery management systems and advances in safety and cycle life have also reinforced confidence in large-scale deployments.

The scalability, compact footprint, and proven track record of lithium-ion storage have ensured its continued preference in utility-scale microgrids, securing its leading market share.

The utility scale microgrid market saw the total value reach approximately USD 2.7 billion in 2024, with projections indicating continued expansion through 2025 and beyond as utilities and large energy users seek enhanced grid resilience. Commercial and industrial microgrids that combine generation, storage, and automation are increasingly deployed to support uninterrupted power delivery and optimize operations across sectors.

Energy reliability challenges have prompted utilities and large consumers to adopt utility-scale microgrids. During 2024, industries such as manufacturing, data centers, and institutional campuses began investing in localized power islands capable of independent operation under outage conditions. In 2025, the trend accelerated as critical infrastructure stakeholders embraced private microgrids to avoid operational disruptions and revenue loss during grid failures. These installations reflect a shift in procurement priorities from cost-driven decisions toward resilience-driven energy planning.

The rise of utility-scale DC microgrid configurations is creating opportunities for more efficient direct-current energy distribution in grid-connected and off-grid contexts. Such deployments offer streamlined power pathways and lower conversion losses compared to traditional AC systems. In 2025, select utility and community-scale projects deployed hybrid AC/DC systems that integrate solar, storage, and generator segments to optimize energy flow across variable load profiles. Vendors able to offer hybrid-ready microgrid platforms with interoperability and scalable DC/AC switching capabilities are poised to capture growth in emerging use cases.

The substantial upfront investment needed for utility scale microgrids has emerged as a significant barrier for stakeholders. In 2024, large-scale installations faced delays due to financing challenges and extended return-on-investment periods, particularly in emerging markets. By 2025, even projects backed by strong grid operators experienced slow execution because of rising component costs and engineering complexities. These conditions indicate that financial viability, rather than technical readiness, is restricting wider adoption. Firms offering innovative financing models, modular deployments, and strategic partnerships are better positioned to overcome this hurdle and accelerate market penetration.

The shift toward intelligent control platforms within microgrid architecture is redefining operational priorities. In 2024, energy operators adopted systems enabling dynamic load balancing and real-time energy routing to optimize generation assets. By 2025, advanced software solutions offering predictive energy management and seamless integration with distributed generation gained prominence, improving efficiency and minimizing outages. This trend demonstrates that operational intelligence and automation, rather than hardware alone, are shaping procurement strategies. Providers offering microgrid control technologies with predictive capabilities, interoperability, and adaptive algorithms are expected to dominate future deployments across utility networks.

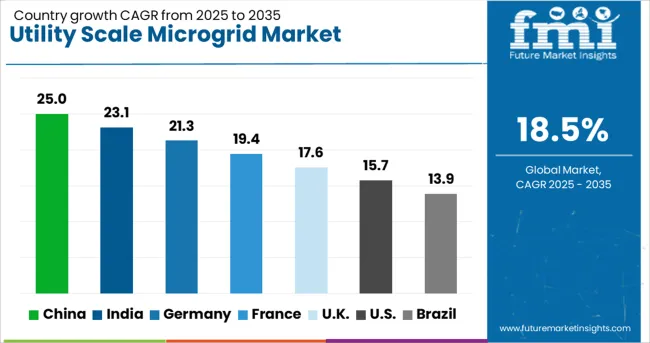

| Country | CAGR |

|---|---|

| China | 25.0% |

| India | 23.1% |

| Germany | 21.3% |

| France | 19.4% |

| UK | 17.6% |

| USA | 15.7% |

| Brazil | 13.9% |

Global space robotics market demand is projected to rise at a 5% value-based CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 5.8%, followed by India at 5.6%, and the United States at 5.3%, while Japan posts 4.9% and Germany records 4.7%. These rates translate to a growth premium of +16% for China, +12% for India, and +6% for the United States versus the baseline, while Germany shows slower growth. Divergence reflects local catalysts: increasing investments in space exploration and robotics in China and India, steady growth driven by ongoing space missions in the United States, and more moderate growth in Japan and Germany due to market maturity and competition from other space technologies.

China is forecast to grow at 25.0%, driven by strong investments in renewable energy projects and grid modernization. Utility-scale microgrids dominate adoption in solar and wind farms for energy balancing. AI-based control platforms ensure real-time optimization of distributed energy resources. Government subsidies and clean energy mandates accelerate large-scale deployments across industrial and commercial zones.

India is projected to grow at 23.1%, supported by rural electrification and growing demand for reliable power in industrial zones. Renewable-integrated microgrids dominate energy access programs, particularly in remote regions. Manufacturers prioritize modular microgrid systems for scalability and cost-effectiveness. Public-private partnerships enhance investment in energy storage-enabled solutions to ensure grid resilience.

France is forecast to grow at 19.4%, supported by clean energy transition programs and decentralized power generation strategies. Microgrids integrated with hydrogen storage dominate future-ready applications. Manufacturers invest in advanced energy management software for seamless renewable integration. Increased focus on microgrid resilience for critical infrastructure strengthens demand for intelligent energy solutions.

The UK is projected to grow at 17.6%, driven by distributed renewable projects and the need for grid decarbonization under Net Zero targets. Microgrids with advanced battery energy storage systems dominate in both urban and offshore projects. AI-driven optimization platforms enable real-time demand response and cost efficiency. Partnerships between energy companies and tech firms boost innovation in microgrid control systems.

Germany is expected to grow at 21.3%, driven by aggressive carbon reduction targets and renewable penetration in the national grid. Hybrid AC/DC microgrids dominate smart energy projects. Manufacturers develop advanced digital twin platforms for predictive load balancing and operational optimization. Compliance with EU grid standards encourages widespread microgrid integration in industrial clusters.

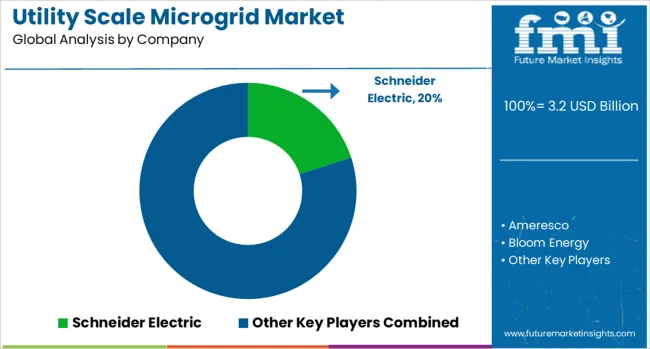

The utility scale microgrid market is moderately consolidated, with Schneider Electric recognized as a leading player for its advanced energy management systems, comprehensive microgrid solutions, and global deployment expertise. The company integrates hardware, software, and digital platforms to deliver resilient and efficient power infrastructure for utilities and large-scale facilities.

Key players include Ameresco, Bloom Energy, Caterpillar, Eaton, General Electric, PG&E, Piller Power Systems, S&C Electric Company, and Stellar Energy — each contributing through specialized offerings such as distributed energy resources (DER) integration, control systems, backup power solutions, and renewable generation support. These companies focus on delivering reliable microgrid architectures for critical infrastructure, grid stabilization, and renewable integration across diverse geographies.

The market is being driven by rising demand for energy resilience, increasing penetration of renewable energy sources, and the need for grid modernization to support electrification. Technological advancements in energy storage, advanced controllers, and real-time monitoring systems are further enhancing the efficiency and scalability of utility scale microgrids.

Strategic collaborations between utilities, technology providers, and government agencies are accelerating project deployments, particularly in regions with aging grid infrastructure and vulnerability to outages. Additionally, the emergence of hybrid microgrids combining solar, wind, and gas generation with storage is creating new opportunities for long-term sustainability and cost optimization.

The Calistoga Resiliency Center in California integrates green hydrogen and battery storage within a hybrid microgrid, delivering 8.5 MW of power and 293 MWh of capacity, ensuring up to 48 hours of backup energy for PG&E customers during outages.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Connectivity | Grid connected and Off grid |

| Power Source | Solar PV, Diesel generators, Natural gas, CHP, and Others |

| Storage Device | Lithium-ion, Lead acid, Flow battery, Flywheels, and Others |

| Grid Type | AC, DC, and Hybrid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Ameresco, Bloom Energy, Caterpillar, Eaton, General Electric, PG&E, Piller Power Systems, S&C Electric Company, and Stellar Energy |

| Additional Attributes | Dollar sales by generation/storage type, regional demand trends, competitive landscape, utility preferences for resilience-as-a-service, integration with renewables/grid balancing, innovations in AI-enabled control and hybrid systems. |

The global utility scale microgrid market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the utility scale microgrid market is projected to reach USD 17.5 billion by 2035.

The utility scale microgrid market is expected to grow at a 18.5% CAGR between 2025 and 2035.

The key product types in utility scale microgrid market are grid connected and off grid.

In terms of power source, solar pv segment to command 35.8% share in the utility scale microgrid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA