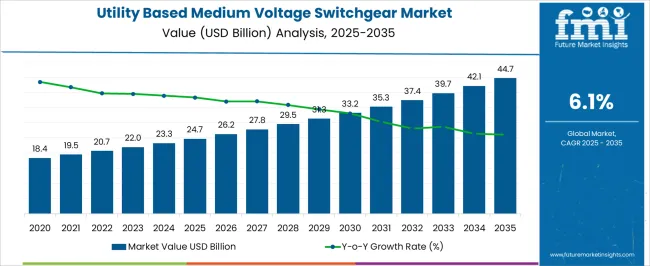

The utility-based medium voltage switchgear market is projected to grow from USD 24.7 billion in 2025 to USD 44.7 billion in 2035, reflecting a CAGR of 6.1%. This represents an absolute dollar opportunity of USD 20.0 billion over the decade. The market is expected to expand steadily, reaching USD 26.2 billion in 2026, USD 29.5 billion in 2029, USD 33.2 billion in 2031, and USD 42.1 billion in 2034.

The consistent growth highlights increasing demand for medium voltage switchgear in utility applications, providing manufacturers and investors with the opportunity to capture incremental revenue and strengthen their presence in a growing market. From an absolute dollar perspective, annual incremental growth ranges from USD 1.2 billion in the early years to over USD 2.6 billion in the later stages, culminating lucrative opportunity by 2035. This enables stakeholders to plan production, distribution, and market expansion efficiently. Capturing this opportunity allows businesses to leverage both steady annual growth and the cumulative USD 20.0 billion expansion in the utility-based medium voltage switchgear market over the decade.

| Metric | Value |

|---|---|

| Utility Based Medium Voltage Switchgear Market Estimated Value in (2025 E) | USD 24.7 billion |

| Utility Based Medium Voltage Switchgear Market Forecast Value in (2035 F) | USD 44.7 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

Continuing with the utility-based medium voltage switchgear market, a breakpoint analysis identifies periods of notable growth acceleration. Between 2025 and 2027, the market rises from USD 24.7 billion to USD 26.2 billion, representing the early adoption phase where initial deployments and utility investments set the foundation. Another key breakpoint occurs around 2029–2031, as the market grows from USD 29.5 billion to USD 33.2 billion, reflecting a phase of stronger expansion and increasing incremental revenue.

Recognizing these stages allows manufacturers and investors to optimize production capacity, align supply chains, and capture market share during critical periods of growth. The final major breakpoint is observed between 2033 and 2035, when the market surges from USD 42.1 billion to USD 44.7 billion, representing the largest absolute dollar growth within a two-year span. Intermediate years, such as 2030–2032, show steady growth from USD 31.3 billion to USD 39.7 billion, serving as bridging periods to sustain momentum.

Identifying these breakpoints enables stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential. Focusing on these stages ensures capturing both incremental and cumulative opportunities in the utility-based medium voltage switchgear market.

The utility based medium voltage switchgear market is expanding steadily, supported by growing investments in power distribution infrastructure and the modernization of electrical grids. Utility providers are increasingly adopting advanced switchgear solutions to enhance operational reliability, improve safety, and reduce downtime in power delivery systems. Regulatory mandates for energy efficiency and grid stability have accelerated the replacement of aging switchgear with modern, smart-enabled systems.

Technological advancements in monitoring, control, and automation have further improved switchgear performance, enabling utilities to manage loads more effectively and integrate renewable energy sources. Rising urbanization and industrialization in emerging markets are creating new demand for medium voltage switchgear to support expanding transmission and distribution networks.

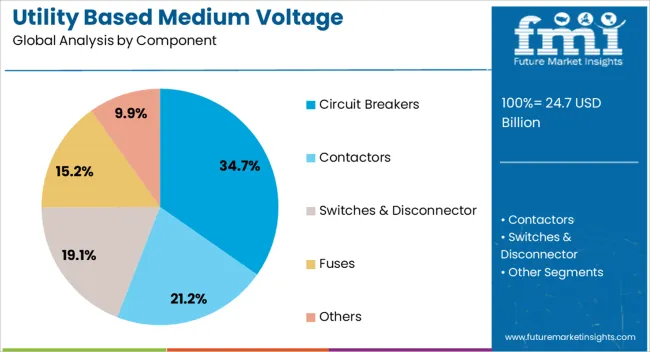

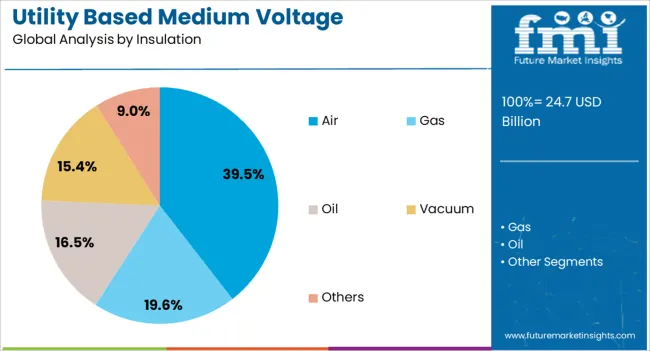

Additionally, emphasis on reducing maintenance costs and extending asset lifecycles is driving the adoption of designs with improved insulation materials and more efficient components. Segmental growth is expected to be led by circuit breakers, due to their role in grid protection, and by air insulation, owing to its cost-effectiveness and proven reliability in utility applications.

The utility based medium voltage switchgear market is segmented by component, insulation, and geographic regions. By component, utility based medium voltage switchgear market is divided into Circuit Breakers, Contactors, Switches & Disconnector, Fuses, and Others. In terms of insulation, utility based medium voltage switchgear market is classified into Air, Gas, Oil, Vacuum, and Others.

Regionally, the utility based medium voltage switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The circuit breakers segment is projected to account for 34.7% of the utility based medium voltage switchgear market revenue in 2025, maintaining its leading position among components. Growth in this segment has been driven by the critical role of circuit breakers in protecting distribution networks from faults, overloads, and short circuits.

Utility companies have increasingly favored modern circuit breaker designs that offer higher operational safety, reduced arc flash risks, and enhanced remote operation capabilities.

Additionally, advancements in vacuum and SF6-free breaker technologies have improved environmental compliance and reduced maintenance requirements. The growing adoption of automation and monitoring systems within substations has further elevated demand for circuit breakers that can be integrated into smart grid architectures. With the global push toward reliable, sustainable, and efficient power delivery, circuit breakers are expected to remain a central component in utility-based medium voltage switchgear configurations.

The air insulation segment is projected to contribute 39.5% of the utility based medium voltage switchgear market revenue in 2025, sustaining its leadership due to its cost-effectiveness and operational simplicity. Air-insulated switchgear (AIS) has been widely adopted in utilities for its proven reliability, ease of installation, and suitability for both indoor and outdoor applications.

Unlike gas-insulated alternatives, AIS systems have lower initial investment costs and simpler maintenance requirements, making them a preferred choice for projects with budget constraints or in regions with readily available installation space.

Utilities have also valued the adaptability of air insulation in varying climatic conditions, which supports long-term operational stability. The segment has further benefited from design improvements that enhance compactness and safety while reducing environmental impact by avoiding greenhouse gases. As grid expansion and refurbishment projects continue across developed and developing markets, the air insulation segment is expected to maintain its strong position, supported by its balance of performance, safety, and cost efficiency.

The utility based medium voltage switchgear market is expanding as power distribution networks require reliable, safe, and efficient equipment for industrial, commercial, and utility applications. These switchgear systems manage, isolate, and protect circuits operating between 1kV and 36kV, ensuring operational continuity and minimizing outages.

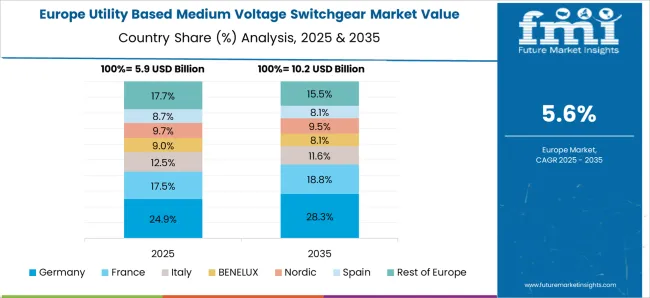

Europe and North America lead adoption due to advanced grid infrastructure and strict electrical standards, while Asia Pacific shows rapid growth driven by grid modernization, renewable integration, and expanding industrial demand. Manufacturers focus on compact design, modular construction, and advanced protection features, while installation costs, equipment reliability, and regulatory compliance influence adoption. Rising energy demand, increasing electricity consumption, and the need for safe distribution are driving utility investment in medium voltage switchgear solutions.

Ensuring operational reliability and protection is a critical factor for medium voltage switchgear. Variations in breaker mechanisms, insulation materials, and control units can compromise fault interruption, load handling, and system stability. Switchgear must withstand electrical surges, temperature fluctuations, and mechanical stress while maintaining consistent performance. Manufacturers provide standardized testing, certifications, and detailed operational guidelines to guarantee safety and reliability. Properly designed equipment minimizes outages, prevents damage to connected infrastructure, and ensures compliance with local and international standards. Suppliers delivering tested, high-performance switchgear gain preference from utility operators and industrial clients. Inconsistent performance or component failure can result in safety hazards, revenue loss, and reduced confidence in the network’s reliability.

Medium voltage switchgear is increasingly engineered for modularity, compact footprint, and ease of operation. Configurable layouts, accessible control panels, and integrated monitoring systems simplify installation, maintenance, and future expansion. Operational efficiency is enhanced through remote monitoring, automated fault detection, and minimal downtime during servicing. Suppliers offering adaptable designs for indoor and outdoor applications enable utilities to customize installations based on load requirements and site conditions. Reduced maintenance requirements, simplified retrofitting, and clear operational guidance improve adoption. Flexibility in design and operation allows utilities to efficiently manage complex distribution networks while minimizing labor costs and service interruptions, making switchgear suitable for both existing infrastructure upgrades and new installations.

Medium voltage switchgear is increasingly deployed across power generation plants, transmission networks, industrial facilities, commercial complexes, and renewable energy systems. Growing electricity demand, grid expansion, and integration of solar, wind, and hybrid energy sources drive adoption. Industrial clients require switchgear for reliable load management, process continuity, and safety in manufacturing operations. Modular and compact systems allow utilities to optimize space, accommodate future expansion, and integrate smart grid capabilities. Suppliers providing flexible configurations and reliable fault protection can serve multiple sectors efficiently. Expansion of urban infrastructure, renewable energy installations, and industrial electrification ensures sustained demand for medium voltage switchgear across utility and industrial applications worldwide.

Adoption is influenced by adherence to regional electrical standards, safety regulations, and certifications such as IEC, ANSI, and local guidelines. Compliance ensures operational safety, fault tolerance, and grid reliability. Supply chain factors, including availability of breakers, insulating materials, switchgear panels, and control systems, affect production timelines and project schedules.

Competition exists between established global manufacturers and regional suppliers offering cost-effective or specialized solutions. Companies that maintain regulatory compliance, ensure reliable component sourcing, and provide installation and technical support gain preference among utilities and industrial clients. Non-compliance, component shortages, or supply delays can impede projects, increase costs, and reduce confidence in equipment reliability.

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

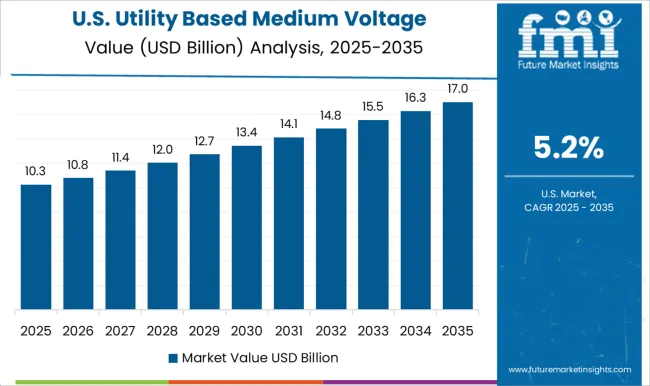

| USA | 5.2% |

| Brazil | 4.6% |

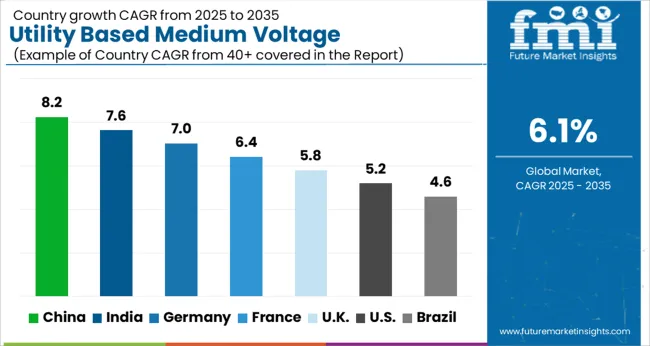

The global utility based medium voltage switchgear market was projected to grow at a 6.1% CAGR through 2035, driven by demand in power transmission, distribution networks, and industrial installations. Among BRICS nations, China recorded 8.2% growth as large-scale production facilities were commissioned and compliance with electrical safety standards was enforced, while India, at 7.6% growth, saw expansion of manufacturing units to support rising regional infrastructure projects.

In the OECD region, Germany, at 7.0% maintained substantial output under strict industrial and electrical regulations, while the United Kingdom, at 5.8% relied on moderate-scale operations for utilities and commercial installations. The USA, expanding at 5.2%, remained a mature market with steady demand across transmission, distribution, and industrial sectors, supported by adherence to federal and state-level electrical standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The utility based medium voltage switchgear market in China is growing at a CAGR of 8.2% due to increasing demand from power generation, transmission, and distribution sectors. Companies are investing in medium voltage switchgear to ensure a reliable electricity supply, improve operational efficiency, and maintain safety in industrial, commercial, and utility networks. Suppliers offer panels and systems with high load capacity, modular design, and compliance with national and international safety standards. Growth is supported by large scale infrastructure projects, expansion of power grids, and modernization of electrical distribution networks. Utilities are focusing on solutions that minimize downtime, enable easy maintenance, and provide monitoring capabilities. Manufacturers are offering switchgear suitable for outdoor and indoor applications, with flexibility for future expansion. Industrial plants, commercial complexes, and residential areas benefit from enhanced reliability and controlled power distribution, which encourages further adoption across sectors.

India is experiencing growth at a CAGR of 7.6% in the medium voltage switchgear market due to rising power generation capacity, infrastructure development, and industrial expansion. Utilities and industrial facilities are adopting switchgear to manage electrical loads efficiently, maintain safety, and ensure uninterrupted power distribution. Suppliers provide solutions that are modular, scalable, and compliant with electrical standards. Growth is further supported by modernization of power grids, urban and industrial expansion, and increased demand for energy management in factories and commercial buildings. Manufacturers focus on products that reduce downtime, allow easy maintenance, and integrate monitoring features for better operational control. Switchgear systems are used in power substations, manufacturing facilities, commercial buildings, and residential complexes to improve reliability and protect equipment. Adoption is driven by the need to ensure consistent electricity supply and meet regulatory safety requirements.

Germany is growing at a CAGR of 7.0% in the medium voltage switchgear market due to demand from utilities, industrial facilities, and commercial sectors. Companies are adopting switchgear to improve electrical safety, manage power distribution efficiently, and reduce operational risks. Industrial plants, power utilities, and commercial buildings are key users. Suppliers provide solutions with modular design, high load capacity, and advanced monitoring features.

Growth is supported by regulations that promote electrical safety, energy management, and reliability in distribution networks. Manufacturers focus on products that allow easy maintenance, minimize downtime, and enable system expansion. Utilities are adopting switchgear that can be integrated with smart grid systems and support digital monitoring. The increasing replacement of aging infrastructure and modernization of electrical networks continues to drive market growth in Germany, especially for outdoor and indoor switchgear applications in multiple industrial and utility sectors.

The United Kingdom market is growing at a CAGR of 5.8% due to rising demand from utilities, industrial facilities, and commercial sectors. Companies are investing in medium voltage switchgear to ensure reliable electricity supply, manage electrical loads, and maintain safety in power distribution networks. Suppliers provide modular, scalable, and high load capacity solutions that meet regulatory standards and allow easy maintenance. Growth is supported by modernization of aging infrastructure, expansion of industrial and commercial facilities, and increased demand for energy management. Utilities are adopting switchgear systems that reduce downtime, integrate monitoring features, and allow future expansion. Industrial plants, commercial buildings, and residential complexes are key end users. Adoption of medium voltage switchgear enhances operational efficiency, protects equipment, and ensures consistent power delivery across sectors. Manufacturers focus on solutions suitable for both indoor and outdoor applications to meet diverse operational requirements.

The United States market is expanding at a CAGR of 5.2% due to demand from utilities, industrial, and commercial sectors. Companies are adopting medium voltage switchgear to improve power distribution reliability, manage electrical loads, and maintain operational safety. Utilities and industrial facilities rely on panels with modular design, high load capacity, and monitoring features. Growth is supported by modernization of existing power grids, industrial expansion, and regulatory focus on electrical safety and reliability. Manufacturers provide solutions for indoor and outdoor applications that reduce downtime, simplify maintenance, and allow future system expansion. Switchgear is widely used in power substations, manufacturing plants, commercial buildings, and residential complexes to ensure continuous electricity supply. Adoption is further driven by increasing awareness of energy management, operational efficiency, and regulatory compliance. Businesses are prioritizing solutions that enhance safety, reliability, and efficiency in multiple sectors.

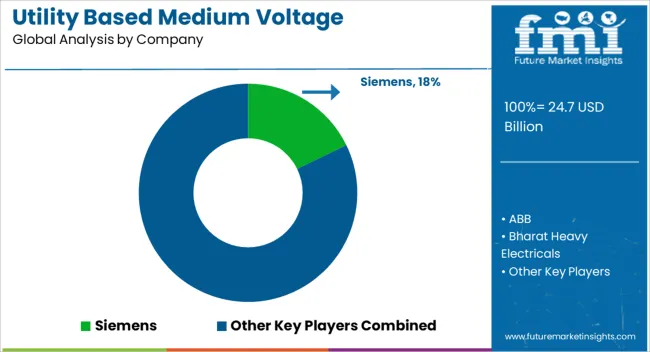

Siemens, ABB, and Bharat Heavy Electricals supply medium voltage switchgear for utilities, substations, and industrial distribution networks, with brochures highlighting rated voltage, short-circuit capacity, and panel modularity. CG Power and Industrial Solutions, E + I Engineering, and Eaton provide compact and gas-insulated designs, with datasheets detailing operational life, insulation type, and fault detection features. Fuji Electric, General Electric, and HD Hyundai Electric focus on smart switchgear solutions with integrated monitoring, with technical literature presenting protective relays, SCADA compatibility, and remote control functionality. Hitachi, Hyosung Heavy Industries, and Lucy Group offer customized configurations for utility-scale deployment, with brochures emphasizing thermal performance, arc flash resistance, and ease of maintenance. Mitsubishi Electric, Ormazabal, and Schneider Electric deliver IEC- and ANSI-compliant panels, with datasheets highlighting current transformer ratings, busbar design, and operational safety features. Skema, Toshiba, and other regional suppliers compete with cost-efficient or prefabricated units, with brochures emphasizing rapid installation, standardized modules, and compliance with regional electrical codes. Market strategies focus on reliability, operational efficiency, and intelligent monitoring.

Leading suppliers such as Siemens and ABB emphasize modular construction, predictive maintenance, and integration with grid management systems. Eaton and Fuji Electric differentiate through compact designs, low lifecycle costs, and enhanced fault protection. Observed industry patterns indicate adoption of digital monitoring, remote diagnostics, and environmentally friendly insulation media for gas-insulated switchgear. Product roadmaps frequently include smart metering integration, reduced footprint designs, and standardized modules for rapid deployment in new or upgraded substations. Differentiation is achieved through verified voltage and fault ratings, operational safety features, and detailed technical guidance provided in brochures. Brochures and datasheets are used to communicate rated voltage, short-circuit capacity, insulation type, operational life, protective features, modularity, arc flash resistance, and SCADA compatibility. Siemens, ABB, and BHEL literature emphasizes IEC/ANSI compliance, modular design, and remote monitoring. CG Power, E + I Engineering, and Eaton brochures highlight gas-insulated panels, fault detection, and maintenance accessibility. Hitachi, Hyosung, and Lucy Group datasheets provide thermal performance, current transformer specifications, and arc flash ratings. Mitsubishi, Ormazabal, and Schneider materials detail busbar design, protective relays, and environmental considerations.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.7 Billion |

| Component | Circuit Breakers, Contactors, Switches & Disconnector, Fuses, and Others |

| Insulation | Air, Gas, Oil, Vacuum, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Skema, and Toshiba |

| Additional Attributes | Dollar sales vary by switchgear type, including gas-insulated, air-insulated, and hybrid switchgear; by application, such as power transmission, distribution substations, and industrial utilities; by end-use industry, spanning utilities, infrastructure, and renewable energy projects; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising electricity demand, grid modernization, and renewable energy integration. |

The global utility based medium voltage switchgear market is estimated to be valued at USD 24.7 billion in 2025.

The market size for the utility based medium voltage switchgear market is projected to reach USD 44.7 billion by 2035.

The utility based medium voltage switchgear market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in utility based medium voltage switchgear market are circuit breakers, contactors, switches & disconnector, fuses and others.

In terms of insulation, air segment to command 39.5% share in the utility based medium voltage switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA