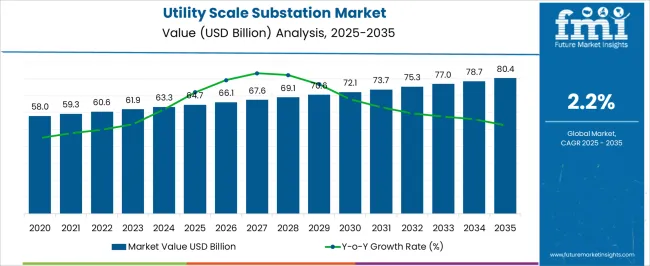

The Utility Scale Substation Market is estimated to be valued at USD 64.7 billion in 2025 and is projected to reach USD 80.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.2% over the forecast period. The utility scale substation market is projected to generate an absolute gain of USD 15.7 billion and a growth multiplier of 1.24x over the decade. Supported by a steady CAGR of 2.2%, this growth is driven by increasing investments in grid infrastructure and the growing need for reliable energy distribution.

During the first five years (2025–2030), the market will rise from USD 64.7 billion to USD 72.1 billion, adding USD 7.4 billion, which accounts for 47.1% of the total incremental growth, with a 5-year multiplier of 1.11x. The second phase (2030–2035) contributes USD 8.3 billion, representing 52.9% of incremental growth, reflecting stronger momentum driven by the expansion of smart grid technologies, renewable energy integration, and infrastructure modernization. Annual increments rise from USD 0.5 billion in early years to USD 1 billion by 2035, signaling stronger growth driven by automation and advanced energy systems. Manufacturers focusing on high-efficiency, flexible substations and sustainable energy solutions will capture the largest share of this USD 15.7 billion opportunity.

| Metric | Value |

|---|---|

| Utility Scale Substation Market Estimated Value in (2025 E) | USD 64.7 billion |

| Utility Scale Substation Market Forecast Value in (2035 F) | USD 80.4 billion |

| Forecast CAGR (2025 to 2035) | 2.2% |

The utility scale substation market is witnessing steady growth, driven by the modernization of power transmission networks and increasing electricity demand worldwide. Growing investments in grid infrastructure and the integration of renewable energy sources have prompted upgrades to existing substations and the construction of new facilities.

Industry trends show a continued reliance on conventional technology due to its proven reliability and widespread deployment. However, advancements in automation and digital control systems are shaping the future of substation operations, enhancing efficiency and reducing downtime.

Regulatory emphasis on grid stability and reliability has further accelerated market growth. As the demand for electricity transmission intensifies with expanding urban and industrial developments, the market outlook remains positive. Segmental growth is expected to be driven by the dominance of conventional technology, the growing adoption of substation automation systems as key components, and transmission as the primary application.

The utility scale substation market is segmented by technology, component, application, voltage level, category, and geographic regions. By technology, the utility scale substation market is divided into Conventional and Digital. In terms of components, the utility scale substation market is classified into Substation automation system, Utility scale substation automation system, Communication network, Electrical system, Monitoring & control system, and Others. Based on application, the utility scale substation market is segmented into Transmission and Distribution.

By voltage level, the utility-scale substation market is segmented into High and Medium. By category of the utility scale substation market is segmented into New and Refurbished. Regionally, the utility scale substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

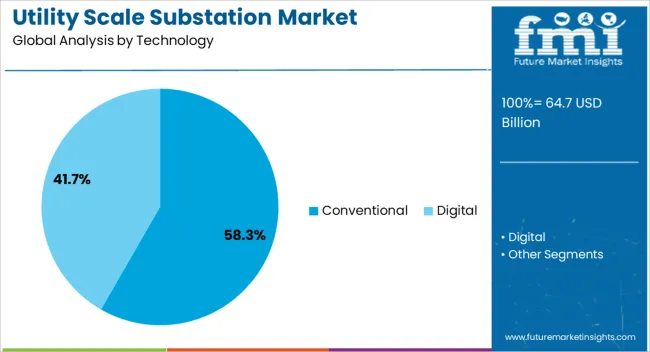

The Conventional technology segment is projected to hold 58.3% of the utility scale substation market revenue in 2025, maintaining its leadership position. This segment’s strength lies in its established infrastructure and familiarity among utility operators.

Conventional substations are valued for their robustness and reliability in handling high voltage and large power flows. Despite increasing interest in digital solutions, many utilities continue to depend on conventional technology due to its proven performance and ease of maintenance.

Additionally, the long lifecycle and high capital investment in conventional substations create a preference for upgrading existing equipment rather than complete replacement. As utilities balance modernization with operational continuity, the conventional segment is expected to remain dominant in the near term.

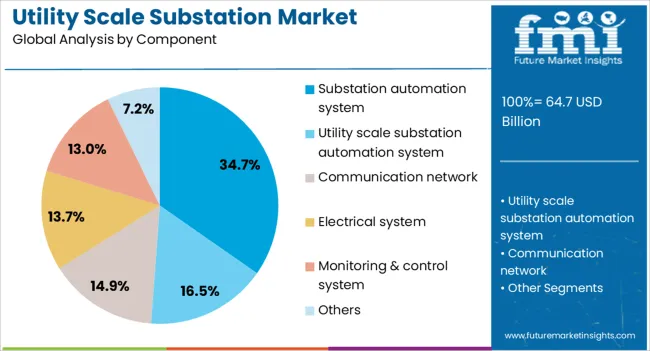

The substation automation system segment is expected to contribute 34.7% of the market revenue in 2025, reflecting growing adoption of digital control and monitoring technologies. Automation systems enhance grid reliability by providing real-time data, remote operation capabilities, and faster fault detection.

Utilities have increasingly integrated automation to improve efficiency, reduce operational costs, and support smart grid initiatives. The segment benefits from advancements in communication protocols and cybersecurity, making automation more accessible and secure.

As grid complexity rises with distributed generation and renewable integration, the demand for automated substation components is expected to accelerate. The substation automation system segment is positioned as a key growth driver within the utility scale substation market.

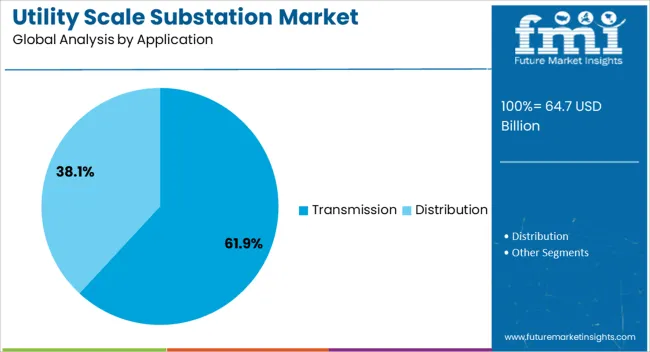

The Transmission application segment is projected to account for 61.9% of the utility scale substation market revenue in 2025, reflecting its critical role in power delivery. Transmission substations facilitate the transfer of high voltage electricity from generation plants to distribution networks and industrial users.

The segment benefits from infrastructure upgrades aimed at reducing transmission losses and improving grid stability. Investments in expanding transmission capacity to support growing electricity demand and integration of renewables have driven market expansion.

Transmission substations require reliable equipment capable of handling fluctuating loads and environmental challenges. As energy systems evolve to meet sustainability goals, the Transmission segment is expected to sustain its market leadership due to its foundational role in the power grid.

The utility-scale substation market is driven by the growing demand for reliable power distribution and grid expansion, especially with renewable energy integration. Opportunities in expanding smart grids and automation are reshaping the market, while challenges such as high costs and regulatory constraints may limit growth. By 2025, overcoming these barriers through efficient project planning and regulatory support will be key to sustaining market growth and improving power distribution systems globally.

The utility-scale substation market is growing due to the increasing demand for reliable power distribution and the expansion of electrical grids. As the need for more efficient power transmission systems rises, utility-scale substations become essential in transforming high-voltage electricity to lower voltage levels for widespread distribution. By 2025, this demand will continue to increase, particularly with the expansion of renewable energy projects and the growing need for modernizing power infrastructure in emerging economies.

Opportunities in the utility-scale substation market are growing with the increasing adoption of renewable energy sources and the expansion of smart grid projects. Substations play a crucial role in connecting renewable energy generation systems, like solar and wind, to the grid. Additionally, the rise in smart grid infrastructure allows for improved management of energy distribution, leading to more efficient power systems. By 2025, these developments are expected to create significant opportunities in the market, driving demand for advanced substation solutions.

Emerging trends in the utility-scale substation market include the increasing automation and digitalization of substations. Advanced monitoring systems and automation technologies allow for real-time data analysis, improving operational efficiency and reducing downtime. These systems also enhance predictive maintenance, ensuring reliability and reducing costs. By 2025, the market is expected to see significant growth in digitalized substations, as utilities seek to optimize performance and increase the resilience of power distribution networks.

Despite market growth, challenges related to high initial investment and regulatory constraints persist in the utility-scale substation market. The cost of building and upgrading substations, including land acquisition and compliance with local regulations, can be significant, especially in developing regions. Additionally, regulatory approvals for infrastructure projects may cause delays and increase project timelines. By 2025, addressing these financial and regulatory barriers through more efficient planning and policy collaboration will be crucial for market expansion.

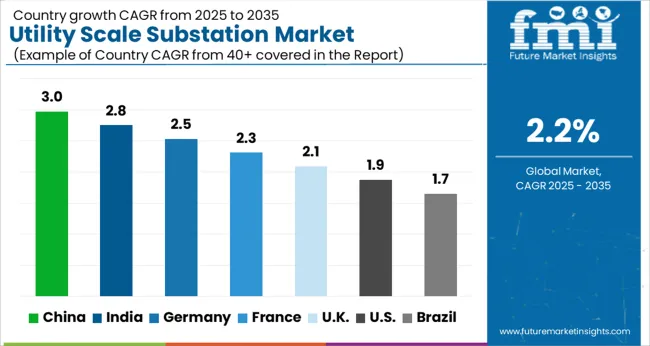

The global utility scale substation market is projected to grow at a 2.2% CAGR from 2025 to 2035. China leads with a growth rate of 3.0%, followed by India at 2.8%, and France at 2.3%. The United Kingdom records a growth rate of 2.1%, while the United States shows the slowest growth at 1.9%. These varying growth rates are driven by factors such as increasing investments in electricity distribution infrastructure, the growing adoption of renewable energy, and the need for modernized grid systems. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, infrastructure expansion, and the transition to smart grids, while more mature markets like the USA and the UK see slower growth due to established infrastructure and the ongoing transition toward renewable energy sources. This report includes insights on 40+ countries; the top markets are shown here for reference.

The utility scale substation market in China is growing at a strong pace, with a projected CAGR of 3.0%. China’s ongoing investments in energy infrastructure, particularly in power distribution networks, are driving demand for utility scale substations. The country’s rapid urbanization, along with its growing commitment to renewable energy, including wind and solar power, is fueling the need for efficient grid systems and substations. Additionally, China’s focus on modernizing its electrical grid with smart grid technologies and improving energy security is further accelerating the adoption of utility scale substations.

The utility scale substation market in India is projected to grow at a CAGR of 2.8%. India’s expanding power generation capacity, coupled with the need to improve power distribution infrastructure, is significantly contributing to the market’s growth. The increasing demand for electricity due to urbanization, industrialization, and rising population is driving the need for modern substations. Additionally, India’s focus on integrating renewable energy into the grid and improving power distribution in rural areas is fueling the demand for utility scale substations to enhance grid stability and reliability.

The utility scale substation market in France is projected to grow at a CAGR of 2.3%. France’s ongoing efforts to modernize its electrical grid, particularly in light of increasing renewable energy integration, are driving demand for utility scale substations. The country’s focus on improving grid reliability, energy efficiency, and reducing carbon emissions through smart grid technologies and energy storage systems further accelerates market growth. Additionally, France’s commitment to energy security and sustainable infrastructure development contributes to the growing need for utility scale substations to support its clean energy transition.

The utility scale substation market in the United Kingdom is projected to grow at a CAGR of 2.1%. The UK is increasingly focusing on modernizing its grid infrastructure and integrating renewable energy sources into the national grid. The government’s commitment to decarbonizing the energy sector and improving energy efficiency is contributing to steady demand for utility scale substations. Additionally, the adoption of smart grid technologies and energy storage solutions in the UK is further accelerating the need for advanced substations that can ensure reliable and efficient power distribution.

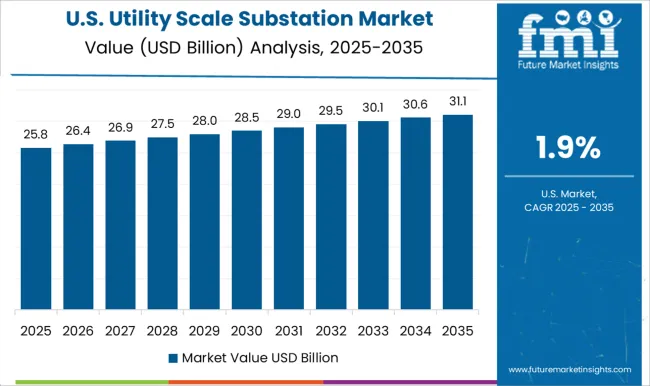

The utility scale substation market in the United States is expected to grow at a CAGR of 1.9%. The USA market remains steady, driven by the ongoing need to modernize aging electrical grid infrastructure, particularly with the increasing integration of renewable energy sources like wind and solar. The focus on grid resilience and energy security, along with government investments in upgrading power distribution systems, continues to support the demand for utility scale substations. Despite slower growth compared to emerging markets, the USA remains a key player in the market due to technological advancements in smart grids and energy storage systems.

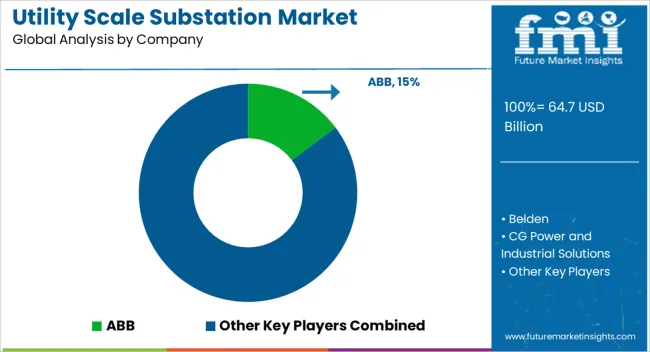

ABB’s dominance is supported by its extensive product portfolio, innovative technologies, and strong global presence in both developed and emerging markets. Key players such as Eaton, General Electric, and Siemens maintain significant market shares by providing robust, scalable, and energy-efficient substation equipment that supports modern power grid management, renewable energy integration, and grid stability. These companies focus on improving substation automation, optimizing energy efficiency, and integrating advanced digital technologies to meet the evolving demands of the energy sector.

Emerging players like Belden, Cisco Systems, and Hitachi Energy are expanding their market presence by offering specialized substation solutions designed for niche applications such as smart grid integration, real-time monitoring, and advanced protective relaying. Their strategies include enhancing communication infrastructure, improving automation, and integrating AI-driven systems for enhanced predictive maintenance. Market growth is driven by increasing global demand for electricity, the need for modernized power grids, and rising investments in renewable energy projects. Innovations in digital substations, grid automation, and energy storage integration are expected to continue shaping competitive dynamics and fuel further growth in the global utility-scale substation market.

| Item | Value |

|---|---|

| Quantitative Units | USD 64.7 Billion |

| Technology | Conventional and Digital |

| Component | Substation automation system, Utility scale substation automation system, Communication network, Electrical system, Monitoring & control system, and Others |

| Application | Transmission and Distribution |

| Voltage Level | High and Medium |

| Category | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Belden, CG Power and Industrial Solutions, Cisco Systems, Eaton, Efacec, General Electric, Hitachi Energy, L&T Electrical and Automation, Locamation, Netcontrol Group, NR Electric, Open System International, Rockwell Automation, Schneider Electric, Siemens, Sifang, Tesco Automation, and Texas Instruments |

| Additional Attributes | Dollar sales by substation type and application, demand dynamics across power transmission, renewable energy, and industrial sectors, regional trends in utility-scale substation adoption, innovation in smart grid integration and energy storage, impact of regulatory standards on safety and emissions, and emerging use cases in renewable energy integration and grid modernization. |

The global utility scale substation market is estimated to be valued at USD 64.7 billion in 2025.

The market size for the utility scale substation market is projected to reach USD 80.4 billion by 2035.

The utility scale substation market is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in utility scale substation market are conventional and digital.

In terms of component, substation automation system segment to command 34.7% share in the utility scale substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA