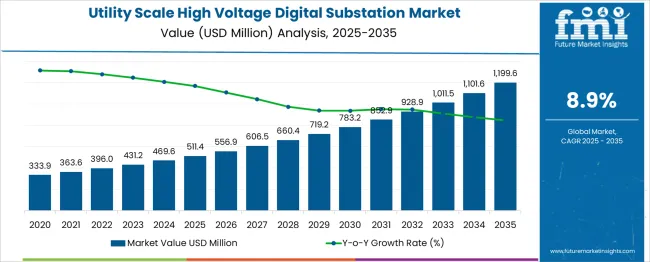

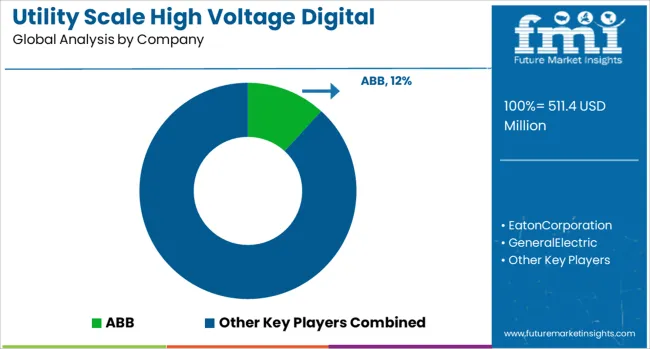

The Utility-Scale High Voltage Digital Substation Market is estimated to be valued at USD 511.4 million in 2025 and is projected to reach USD 1199.6 million by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period. A market growth curve shape analysis reveals steady, gradual growth, with a notable acceleration in the middle of the forecast period. Between 2025 and 2030, the market grows from USD 511.4 million to USD 783.2 million, contributing USD 271.8 million in growth, with a CAGR of 9.3%.

Rising investments in renewable energy integration, grid modernization, and the increasing need for efficient power distribution systems drive this early phase acceleration. Digital substations are gaining popularity due to their ability to improve grid reliability and reduce operational costs, prompting widespread adoption. From 2030 to 2035, the market continues to expand from USD 783.2 million to USD 1,199.6 million, adding USD 416.4 million in growth, with a slightly lower CAGR of 8.2%. This deceleration reflects the market maturing as the technology becomes more widely deployed, but continued demand for more advanced grid infrastructure, especially in emerging markets, ensures steady growth. The overall growth curve shows an early-stage surge followed by continued, more stable expansion, with the market set to benefit from ongoing technological advancements in digital substation solutions.

| Metric | Value |

|---|---|

| Utility-Scale High Voltage Digital Substation Market Estimated Value in (2025 E) | USD 511.4 million |

| Utility-Scale High Voltage Digital Substation Market Forecast Value in (2035 F) | USD 1199.6 million |

| Forecast CAGR (2025 to 2035) | 8.9% |

The utility scale high voltage digital substation market is gaining strong momentum due to the rising need for grid stability, higher energy efficiency, and improved asset management across high-voltage transmission networks. The shift from conventional substations to digital configurations is being supported by advancements in IEC 61850 communication protocols, digital sensors, and process bus architecture that enable real-time control, monitoring, and automation.

Utilities are actively adopting digital substations to minimize maintenance costs, reduce operational risks, and manage the growing complexity of renewable energy integration into the grid. Increased investment in T&D infrastructure, especially in developing economies and interconnection projects, is accelerating the deployment of utility-scale high voltage digital substations.

Furthermore, heightened regulatory emphasis on decarbonization, resilience, and cybersecurity is pushing utilities to modernize legacy infrastructure. The future outlook remains robust, with collaborative innovation between OEMs, utility companies, and technology vendors expected to unlock new value streams through software-defined functionalities and predictive maintenance.

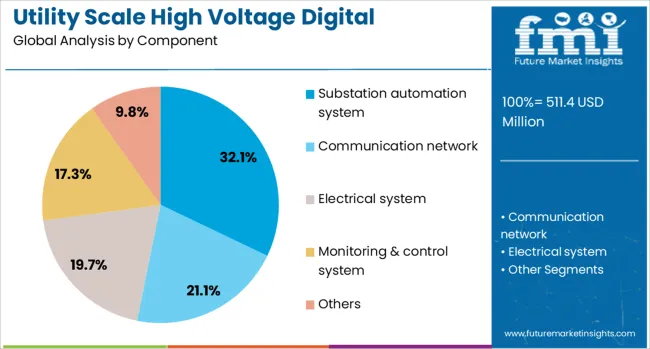

The utility-scale high voltage digital substation market is segmented by component, architecture, installation, and geographic regions. By component, the utility-scale high voltage digital substation market is divided into Substation automation system, Communication network, Electrical system, Monitoring & control system, and others.

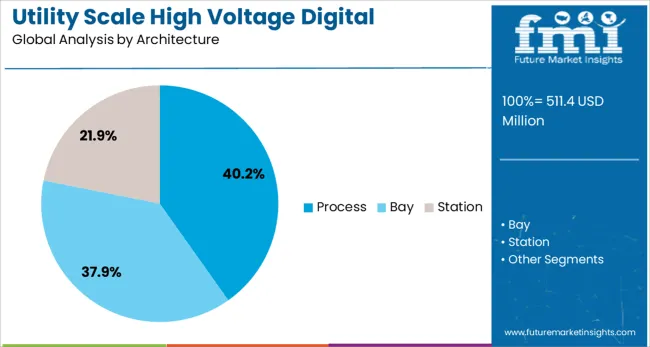

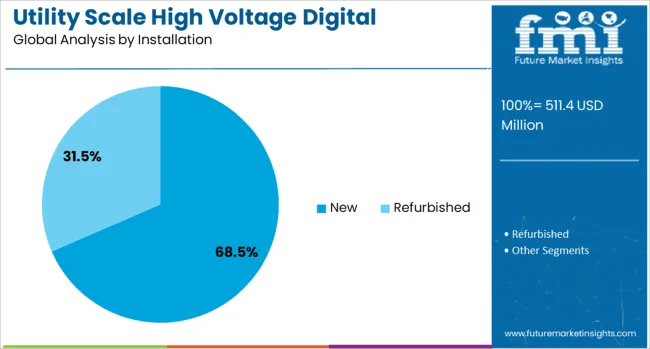

In terms of architecture, the utility-scale high voltage digital substation market is classified into Process and BayStation. Based on installation, the utility-scale high voltage digital substation market is segmented into New and Refurbished. Regionally, the utility-scale high voltage digital substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The substation automation system segment is expected to hold 32.1% of the total revenue share in the utility scale high voltage digital substation market in 2025, driven by its central role in enabling intelligent control and real-time data visibility. The growth of this segment is being fueled by increasing emphasis on operational reliability, fault diagnosis, and automation of protection and control functions within high-voltage substations.

Substation automation systems have allowed utilities to remotely monitor equipment health, reduce manual intervention, and ensure faster fault response, which has significantly improved system availability. Enhanced communication frameworks, interoperability standards, and cybersecurity protocols have strengthened the deployment of automation systems as digital backbones of substations.

Their ability to interface with SCADA, IEDs, and asset management tools has supported predictive maintenance and system-wide optimization. As utilities face pressure to increase grid efficiency while managing aging infrastructure, substation automation systems are playing a critical role in enabling safe, secure, and scalable operations.

The process architecture segment is anticipated to account for 40.2% of the overall revenue share in the utility-scale high-voltage digital substation market in 2025. The segment’s dominance is being shaped by the migration toward process bus implementations, which eliminate traditional copper wiring through digitized communication between bay and process levels.

This architectural shift has enabled real-time signal processing, enhanced fault isolation, and faster control loop execution. Adoption of process architecture is also being influenced by the growing deployment of non-conventional instrument transformers, merging units, and digital sensors that facilitate seamless data acquisition and reduced wiring complexity.

Process architecture supports higher levels of modularity and simplifies maintenance operations, which is crucial for large-scale substations managing high fault currents and complex protection schemes. As digital substations evolve to handle dynamic grid conditions, the process architecture is emerging as a foundational layer to support adaptive control, grid reliability, and system security.

The new installation segment is projected to hold 68.5% of the total revenue share in the utility-scale high-voltage digital substation market in 2025, driven by global investments in greenfield transmission infrastructure and smart grid deployment. This segment’s growth is being primarily fueled by large-scale electrification programs, renewable energy expansion, and cross-border interconnection projects that require modern, efficient, and scalable substation designs.

New installations allow for end-to-end digital integration from the outset, facilitating optimal layout, reduced footprint, and lifecycle cost savings. The demand for new digital substations is particularly strong in regions with aging infrastructure or where electricity access is being expanded, allowing utilities to bypass legacy constraints and directly adopt next-generation systems.

The integration of real-time control, AI-based monitoring, and cybersecurity from day one enhances grid readiness and future-proofs infrastructure investments. As utilities accelerate decarbonization and digital transformation, new installations are being prioritized to support high-capacity, high-voltage energy flow with enhanced operational intelligence.

Utility scale high voltage digital substations are crucial in modernizing power distribution systems. These systems integrate advanced digital technologies to improve grid monitoring, control, and protection, ensuring greater efficiency and reliability. The increasing integration of renewable energy and the growing demand for smart grids are major drivers of the market. Despite challenges like high initial costs and integration complexities, technological innovations in automation and digital control are propelling market expansion. The need for optimized power distribution and improved grid stability continues to support the growth of digital substations in the energy sector.

The growing need for smart grids and efficient power distribution is driving the demand for high voltage digital substations. These substations incorporate real-time monitoring, automation, and advanced control systems to enhance power grid performance. As renewable energy sources like wind and solar power become more integrated into the grid, the ability to manage variable energy inputs is becoming essential. Digital substations provide a solution by ensuring grid stability while optimizing energy flows. The rising adoption of smart grid technologies in both developed and emerging markets is further fueling the market for high voltage digital substations.

A major challenge in the high voltage digital substation market is the high upfront cost for purchasing and installing digital substations. These systems often involve significant capital investment in advanced technologies, which may limit adoption, especially in price-sensitive regions. The integration of digital solutions with legacy power systems also poses a challenge, as it can involve compatibility issues and the need for specialized equipment. The complexity of installation and the requirement for skilled professionals to operate and maintain these systems can lead to delays and increased operational costs, slowing the pace of widespread adoption.

The market for high voltage digital substations is expanding due to technological advancements that improve the efficiency, cost-effectiveness, and performance of these systems. Innovations in digital control systems, data analytics, and automation are making digital substations more accessible and affordable. The integration of renewable energy sources into the power grid also presents significant growth opportunities, as digital substations help manage the fluctuations in energy supply from renewable sources like solar and wind. As industries continue to invest in modernizing grid infrastructure, especially in emerging markets, the demand for digital substations is set to rise significantly.

A key trend in the high voltage digital substation market is the increasing integration of automation and data-driven solutions. The use of IoT-enabled sensors, AI, and machine learning for predictive maintenance, real-time diagnostics, and fault detection is transforming substation operations. These technologies improve system efficiency, reduce downtime, and enhance grid reliability. The rise in remote monitoring capabilities enables utilities to manage substations without needing on-site personnel, further improving operational efficiency. As smart grid technology becomes more prevalent and the need for better grid management increases, the role of automated and data-driven solutions in digital substations continues to grow.

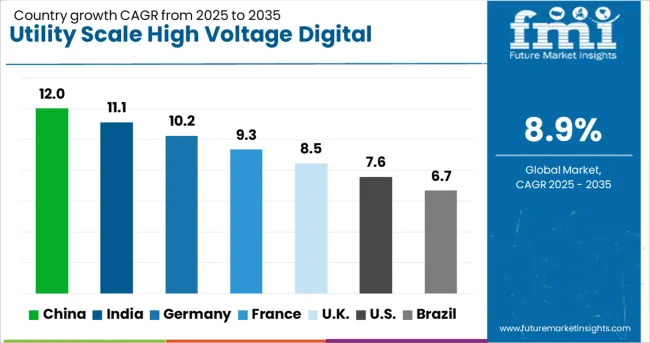

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The utility scale high voltage digital substation market is witnessing significant growth globally, with a global CAGR of 8.9%. China leads the market with a growth rate of 12.0%, followed by India at 11.1%. France records a growth rate of 9.3%, while the UK and USA show growth rates of 8.5% and 7.6%, respectively. The increasing demand for efficient energy distribution systems and the modernization of electrical grids across various regions are key drivers of this growth. The demand for digital substations is further supported by the need to improve grid stability, reduce transmission losses, and integrate renewable energy sources into existing power grids. The analysis includes over 40+ countries, with the leading markets detailed below.

China leads the utility scale high voltage digital substation market, with a growth rate of 12.0%. The country's rapid industrial development, particularly in the energy sector, has accelerated the need for modernized substations capable of managing the growing energy demands. As China continues its transition to a more intelligent and flexible energy grid, the demand for digital substations is rising. Investment in cutting-edge technologies to optimize power distribution networks and reduce transmission losses. Government-driven projects to integrate smart grid solutions and enhance energy efficiency in both urban and rural regions further contribute to market growth.

Sales of high voltage digital substations in India is projected to grow at a rate of 11.1%. With increasing energy consumption, particularly in urban areas, India’s electrical grid is facing significant challenges. The country is undergoing large-scale infrastructure projects aimed at modernizing its grid and improving transmission efficiency. The growing integration of renewable energy sources, such as solar and wind, into the grid requires advanced substations to manage intermittent supply and demand fluctuations. Government initiatives like the Smart Grid Mission and efforts to improve grid stability have increased the adoption of digital substations.

Demand forutility scale high voltage digital substations in France is growing at a rate of 9.3%. As part of its commitment to improving grid resilience and integrating renewable energy, France is focusing on upgrading its electricity infrastructure. The transition towards more distributed power generation, especially from renewable sources, has led to an increased demand for digital substations that can handle complex energy flows and enhance grid stability. Regulations favor the use of digital substations to ensure that energy distribution is more efficient, secure, and adaptable to future energy needs.

The UK utility scale high voltage digital substation market is projected to grow at a rate of 8.5%. The UK is focused on upgrading its aging grid infrastructure to accommodate increasing electricity demand, particularly due to the rising use of electric vehicles and renewable energy sources. The adoption of smart grid technologies, designed to improve grid monitoring, performance, and energy distribution, is driving the demand for digital substations. The push to enhance power reliability and manage decentralized energy generation effectively is also fostering market expansion.

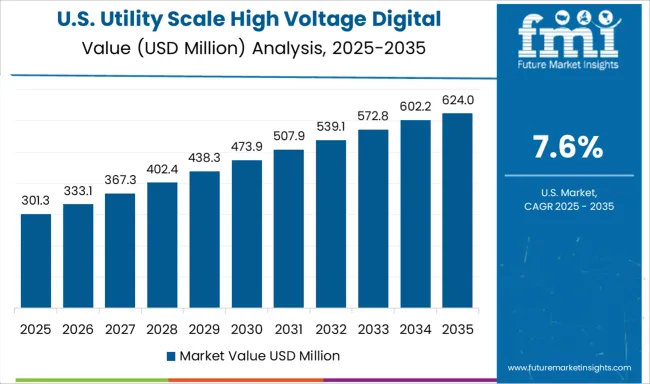

The USA utility scale high voltage digital substation market is expected to grow at a rate of 7.6%. The electrical grid is undergoing a significant transformation, driven by the need for greater reliability, efficiency, and the ability to integrate more renewable energy. The adoption of digital substations in the USA is being propelled by advancements in automation, real-time monitoring, and grid management capabilities. Government incentives for the integration of clean energy sources and grid modernization efforts are driving the demand for advanced substations to support the USA energy transition.

The utility-scale high voltage digital substation market is driven by major players specializing in advanced digital solutions for power transmission, ensuring efficient, reliable, and automated control systems for electricity distribution. ABB is a market leader, providing high-performance digital substations with a focus on automation, grid management, and efficiency optimization, utilizing advanced technologies such as digital relays, communication systems, and smart monitoring solutions. Eaton Corporation offers a wide range of high-voltage digital substation solutions, focusing on improving grid stability, reducing transmission losses, and enhancing system control.

General Electric and Hitachi Energy provide integrated digital substation technologies that enable utilities to monitor, control, and automate power distribution processes in real time, improving system reliability and operational efficiency. Hubbell offers advanced digital substation solutions designed to enhance power grid management and optimize energy usage in utility-scale applications. Larson & Toubro Limited and NR Electric Co. Ltd. focus on providing smart grid solutions and automation systems for high voltage substations, offering cost-effective solutions that improve system performance and reduce operational costs. Netcontrol Group and Powell Industries provide digital substation solutions that focus on improving reliability, safety, and operational efficiency, with systems tailored to utility-scale applications. Siemens, Schneider Electric, and Toshiba Energy Systems & Solutions Corporation offer advanced digital substations designed for seamless integration with existing grid infrastructure, enhancing overall control, monitoring, and protection. WAGO and WEG focus on providing digital control and protection solutions, with an emphasis on improving system flexibility and performance in utility-scale substations.

| Item | Value |

|---|---|

| Quantitative Units | USD 511.4 Million |

| Component | Substation automation system, Communication network, Electrical system, Monitoring & control system, and Others |

| Architecture | Process, Bay, and Station |

| Installation | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, EatonCorporation, GeneralElectric, HitachiEnergy, Hubbell, Larson&ToubroLimited, NRElectricCo.Ltd., NetcontrolGroup, PowellIndustries, Siemens, SchneiderElectric, ToshibaEnergySystems&SolutionsCorporation, WAGO, and WEG |

| Additional Attributes | Dollar sales by product type (digital protection systems, automation solutions, control systems, monitoring solutions) and end-use segments (power generation, transmission, distribution, utilities). Demand dynamics are driven by the increasing adoption of smart grid technologies, the need for improved energy efficiency, and growing regulatory pressure for reliable and automated power distribution. Regional trends indicate strong growth in North America and Europe due to grid modernization and increasing investments in renewable energy integration, while Asia-Pacific is expanding rapidly due to growing industrialization and urbanization. |

The global utility-scale high voltage digital substation market is estimated to be valued at USD 511.4 million in 2025.

The market size for the utility-scale high voltage digital substation market is projected to reach USD 1,199.6 million by 2035.

The utility-scale high voltage digital substation market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in utility-scale high voltage digital substation market are substation automation system, communication network, electrical system, monitoring & control system and others.

In terms of architecture, process segment to command 40.2% share in the utility-scale high voltage digital substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA