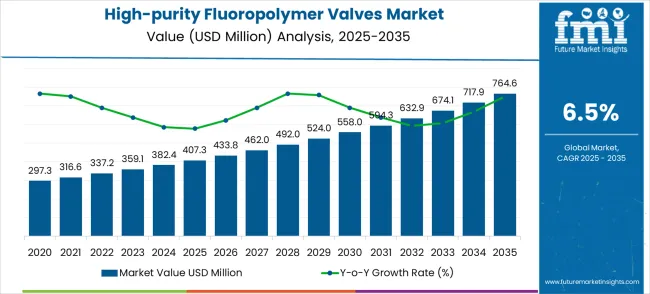

The high-purity fluoropolymer valves market is valued at USD 407.3 million in 2025 and is expected to reach USD 764.6 million by 2035, with a CAGR of 6.5%. From 2021 to 2025, the market is expected to grow from USD 297.3 million to USD 407.3 million, passing through intermediate values of USD 316.6 million, USD 337.2 million, USD 359.1 million, and USD 382.4 million. During this phase, the growth is driven primarily by volume expansion, as industries such as semiconductor manufacturing, chemical processing, and pharmaceuticals continue to require high-purity valves for critical applications. The demand for these valves is increasing as businesses focus on maintaining high-quality standards and improving production efficiencies.

Between 2026 and 2030, the market is expected to continue growing from USD 407.3 million to USD 558.0 million, with intermediate values of USD 433.8 million, USD 462.0 million, and USD 492.0 million. During this period, both volume and price growth contribute more equally. The adoption of high-purity fluoropolymer valves in industries like biotechnology and food processing is increasing, driving volume growth. However, the increase in the price of these valves, driven by advancements in material technology, higher performance standards, and stricter regulatory requirements, also plays a significant role. By 2030, the market will reach USD 594.3 million. From 2031 to 2035, the market achieves continued growth to USD 764.6 million, with price growth increasingly contributing to the expansion as the market matures.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 407.3 million |

| Forecast Value in (2035F) | USD 765 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The chemical processing market contributes about 35-40%, driven by the increasing use of high-purity valves in applications requiring resistance to aggressive chemicals and high temperatures. These valves are crucial in handling corrosive and reactive chemicals in industries like pharmaceuticals, petrochemicals, and biotechnology. The semiconductor manufacturing market adds roughly 25-30%, as high-purity fluoropolymer valves are essential for controlling ultra-pure gases and liquids in semiconductor fabrication processes, where contamination control is critical.

The pharmaceutical market contributes around 15-18%, with the growing need for hygienic and contamination-free valve systems in drug manufacturing and production processes, especially for high-quality biopharmaceuticals. The food and beverage industry accounts for approximately 10-12%, driven by the demand for high-purity valves in food processing and packaging applications, where strict hygiene and purity standards must be maintained. The water treatment market contributes about 8-10%, with high-purity fluoropolymer valves being used in advanced filtration and water purification systems, ensuring contamination-free flow in critical water treatment processes.

Market expansion is being supported by the rapid growth of semiconductor manufacturing worldwide and the corresponding need for chemically inert fluid handling systems that can maintain contamination-free conditions throughout complex production processes involving aggressive chemicals and ultrapure media. Modern semiconductor fabrication requires precise control of process chemicals, etching gases, and cleaning solvents with contamination levels measured in parts per billion while withstanding highly corrosive operating conditions. High-purity fluoropolymer valves provide the necessary chemical resistance, material purity, and operational reliability to ensure optimal manufacturing yields and product quality in these demanding applications.

The growing complexity of pharmaceutical and chemical processing operations is driving demand for fluoropolymer valve solutions that can maintain sterile conditions while providing precise flow control for corrosive and reactive chemical applications. Advanced chemical manufacturing requires contamination-free handling of aggressive chemicals, specialty solvents, and reactive intermediates that demand the highest levels of chemical compatibility and material purity. Regulatory requirements and industry standards are establishing stringent contamination control and safety protocols that require specialized valve technologies with validated chemical resistance and comprehensive performance documentation.

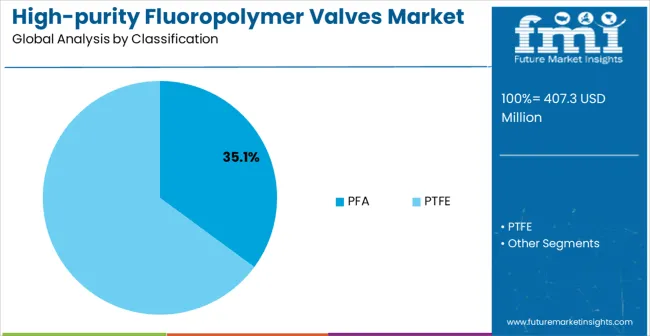

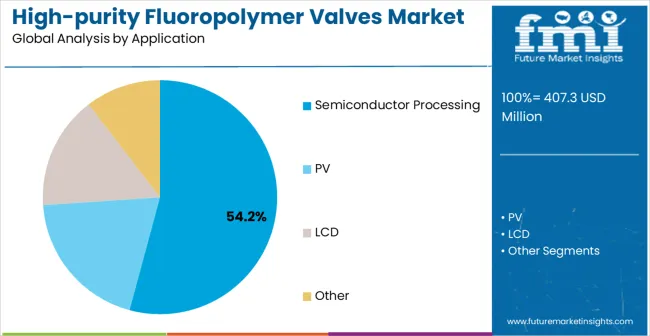

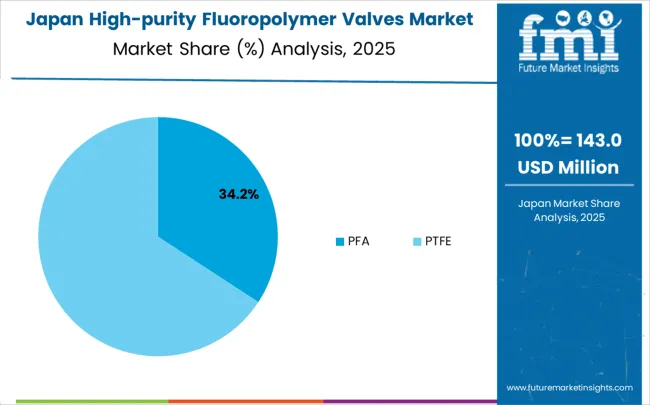

The market is segmented by material type, end-use industry, and region. By material type, the market is divided into PFA and PTFE. By end-use industry, the market is categorized into semiconductor processing, photovoltaic (PV), LCD manufacturing, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

PFA (Perfluoroalkoxy) valves are projected to account for 35.1% of the high-purity fluoropolymer valves market in 2025. This leading share is supported by the superior chemical resistance and processing characteristics of PFA materials in demanding high-purity applications. PFA valves provide excellent corrosion resistance against virtually all chemicals, superior thermal stability, and exceptional purity levels that meet stringent semiconductor and pharmaceutical manufacturing requirements. The segment benefits from established manufacturing processes, comprehensive material specifications, and extensive validation databases that facilitate adoption across diverse critical applications. Advanced PFA formulations and specialized processing techniques enable superior surface finish quality and enhanced contamination control performance while maintaining excellent mechanical properties.

PFA valve technology continues advancing through development of specialized grades with enhanced purity levels, improved mechanical strength, and optimized processing characteristics that meet evolving application requirements. The segment growth reflects increasing adoption of PFA solutions in expanding semiconductor fabrication facilities and growing pharmaceutical manufacturing operations that demand superior chemical compatibility. Manufacturers are developing next-generation PFA valve designs with integrated monitoring capabilities, enhanced sealing systems, and comprehensive traceability features that support advanced process control and quality assurance requirements.

Semiconductor processing applications are expected to represent 54.2% of high-purity fluoropolymer valve demand in 2025. This dominant share reflects the semiconductor industry's extensive use of aggressive chemicals and ultrapure media that require specialized fluoropolymer valve solutions throughout fabrication facilities. Modern semiconductor manufacturing involves hundreds of different process chemicals including hydrofluoric acid, strong bases, and organic solvents that can damage conventional valve materials while requiring contamination levels below detectable limits. The segment benefits from ongoing capacity expansion in semiconductor manufacturing and increasing complexity of advanced node technologies that require more sophisticated chemical handling systems with superior contamination control.

Semiconductor industry transformation toward smaller geometries and advanced packaging technologies is driving significant fluoropolymer valve demand as manufacturers implement more stringent contamination control requirements and complex chemical process sequences. The segment expansion reflects increasing emphasis on process yield optimization, operational reliability, and manufacturing efficiency that depend on superior valve performance and chemical compatibility characteristics. Advanced semiconductor applications are incorporating real-time monitoring systems, predictive maintenance capabilities, and comprehensive process analytics that require sophisticated valve technologies with enhanced connectivity and diagnostic features.

The high-purity fluoropolymer valves market is advancing steadily due to increasing semiconductor manufacturing complexity and growing emphasis on chemical compatibility in critical applications. The market faces challenges including high material costs, complex manufacturing requirements, and stringent qualification protocols. Technological advancement efforts and industry standardization programs continue to influence product development and market expansion patterns.

The growing implementation of specialized surface treatment and finishing technologies in fluoropolymer valve manufacturing is enabling enhanced contamination control performance, improved chemical resistance, and superior surface quality that meet evolving application requirements. Advanced surface finishing techniques provide reduced particle generation, enhanced chemical inertness, and improved cleanability that support stringent purity requirements. These technological advances enable manufacturers to achieve higher levels of process reliability and product quality while reducing contamination risks and maintenance requirements.

Valve manufacturers are developing advanced fluoropolymer materials and specialized formulations that provide enhanced performance characteristics including improved mechanical strength, superior chemical resistance, and optimized processing properties. Next-generation fluoropolymer compounds enable enhanced temperature capability, improved stress crack resistance, and specialized electrical properties that address specific application challenges. These material innovations support broader market adoption by providing enhanced performance characteristics that meet demanding application requirements while maintaining the inherent advantages of fluoropolymer materials.

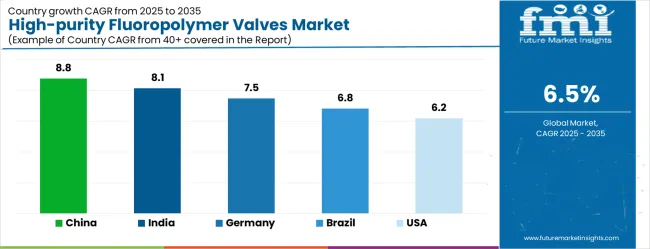

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| United States | 6.2% |

| United Kingdom | 5.5% |

| Japan | 4.9% |

The high-purity fluoropolymer valves market demonstrates varied growth patterns across key countries, with China leading at an 8.8% CAGR through 2035, driven by massive semiconductor manufacturing expansion, government technology initiatives, and growing chemical processing capabilities. India follows at 8.1%, supported by increasing electronics manufacturing, expanding pharmaceutical sector, and growing foreign investment in high-technology industries. Germany records 7.5% growth, emphasizing advanced manufacturing technologies, precision engineering excellence, and comprehensive quality management systems. Brazil shows steady growth at 6.8%, developing chemical processing capabilities and expanding pharmaceutical manufacturing infrastructure. The United States maintains 6.2% growth, focusing on semiconductor technology leadership and pharmaceutical innovation. The United Kingdom demonstrates 5.5% expansion, supported by biotechnology sector development and specialty manufacturing capabilities. Japan records 4.9% growth, leveraging technological leadership and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

The high-purity fluoropolymer valves market in China is expanding at the highest growth rate with a CAGR of 8.8% through 2035, driven by unprecedented semiconductor manufacturing capacity expansion, government support for domestic technology development, and growing chemical processing requirements across diverse industrial sectors. The country's comprehensive semiconductor industry development strategy includes massive investments in fabrication facilities, advanced packaging operations, and supporting infrastructure that require sophisticated fluoropolymer valve solutions for aggressive chemical handling applications. Major technology companies and manufacturing conglomerates are establishing comprehensive supply chains that support domestic fluoropolymer valve production and technology development capabilities. Government initiatives promoting technological self-reliance are driving demand for indigenous fluoropolymer valve capabilities across semiconductor, pharmaceutical, and chemical processing sectors.

Revenue from high-purity fluoropolymer valves in India is growing at a CAGR of 8.1%, supported by rapid electronics manufacturing development, increasing pharmaceutical production capabilities, and growing foreign direct investment in high-technology industries. The country's emphasis on becoming a global manufacturing hub is driving demand for fluoropolymer valve solutions that support semiconductor assembly, pharmaceutical production, and specialty chemical manufacturing operations requiring superior chemical resistance. Government programs promoting electronics manufacturing are creating favorable conditions for fluoropolymer valve adoption across diverse industrial applications. Major international companies are establishing manufacturing facilities that require comprehensive fluoropolymer valve systems and technical support services.

Demand for high-purity fluoropolymer valves in Germany is projected to expand at a CAGR of 7.5%, supported by the country's leadership in advanced manufacturing technologies, comprehensive quality management systems, and emphasis on precision engineering excellence. German manufacturers are implementing sophisticated fluoropolymer valve solutions that meet stringent performance standards while supporting complex manufacturing processes across semiconductor, pharmaceutical, and specialty chemical industries. The country's extensive research and development capabilities are driving innovation in fluoropolymer valve technology and application development. Chemical industry transformation toward specialty products is creating new demand for fluoropolymer valve applications in advanced materials processing and high-purity chemical manufacturing.

The high-purity fluoropolymer valves market in Brazil is anticipated to grow at a CAGR of 6.8%, driven by expanding pharmaceutical manufacturing capabilities, growing chemical processing sector development, and increasing emphasis on industrial modernization initiatives. Brazilian manufacturers are investing in fluoropolymer valve solutions to enhance production capabilities and meet international quality standards while supporting domestic market requirements and export opportunities. Government programs supporting industrial development are facilitating access to advanced manufacturing technologies and technical expertise. Regional manufacturing centers are developing specialized capabilities that support diverse fluoropolymer valve applications across pharmaceutical, chemical processing, and electronics industries.

Demand for high-purity fluoropolymer valves in the United States is expected to expand at a CAGR of 6.2%, driven by semiconductor industry leadership, pharmaceutical innovation capabilities, and ongoing technology advancement initiatives across high-technology manufacturing sectors. American manufacturers are implementing advanced fluoropolymer valve solutions to maintain global competitiveness while supporting cutting-edge research and development programs. The biotechnology sector is driving significant fluoropolymer valve demand for specialized applications including cell therapy production, biopharmaceutical manufacturing, and advanced drug development processes requiring superior chemical compatibility. Government initiatives supporting domestic semiconductor manufacturing are creating substantial demand for fluoropolymer valve systems and technical support services.

The high-purity fluoropolymer valves market in the United Kingdom is projected to expand at a CAGR of 5.5%, supported by expanding biotechnology sector capabilities, pharmaceutical manufacturing development, and increasing emphasis on specialty chemical production requiring superior chemical resistance characteristics. British manufacturers are investing in fluoropolymer valve solutions to support advanced pharmaceutical development, biotechnology research, and specialty manufacturing operations. The country's strong academic research base is facilitating technology development and application innovation across diverse fluoropolymer valve applications. Government initiatives supporting life sciences sector development are creating favorable conditions for fluoropolymer valve adoption and technology advancement.

Revenue from high-purity fluoropolymer valves in Japan is projected to grow at a CAGR of 4.9%, supported by advanced semiconductor technology development, comprehensive manufacturing expertise, and emphasis on precision engineering principles across high-technology applications. Japanese manufacturers are implementing sophisticated fluoropolymer valve solutions that demonstrate superior performance characteristics while supporting diverse high-technology applications requiring chemical resistance and contamination control. The country's electronics and semiconductor sectors are driving demand for advanced fluoropolymer valve technologies that support precision manufacturing processes and stringent contamination control requirements. Collaborative research programs between industry and academic institutions are developing innovative fluoropolymer valve technologies.

The high-purity fluoropolymer valves market is characterized by competition among specialized valve manufacturers, fluoropolymer technology providers, and precision engineering companies. Companies are investing in advanced materials technology, specialized manufacturing capabilities, comprehensive testing facilities, and technical support services to deliver chemically resistant, contamination-free, and high-performance valve solutions. Strategic partnerships, technological innovation, and application expertise development are central to strengthening product portfolios and market presence.

Parker Hannifin, USA-based, offers comprehensive high-purity fluoropolymer valve solutions with focus on semiconductor applications, advanced materials technology, and precision manufacturing capabilities. Swagelok, USA, provides specialized fluoropolymer valve systems emphasizing reliability, comprehensive support services, and application expertise across diverse industries requiring chemical resistance. CKD Corporation, Japan, delivers advanced valve technologies with focus on precision control, contamination prevention, and comprehensive system integration capabilities.

SMC Corporation, Japan, emphasizes pneumatic and fluid control solutions with specialized fluoropolymer valve offerings for semiconductor and pharmaceutical applications requiring chemical compatibility. Entegris, USA, focuses on contamination control technologies and specialized valve solutions for critical applications involving aggressive chemicals. TK-Fujikin, Japan, provides precision valve technologies with emphasis on ultra-clean applications and advanced chemical processing requirements. Saint-Gobain Performance Plastics offers specialized fluoropolymer materials and valve components that support demanding high-purity applications across diverse industrial sectors requiring superior chemical resistance.

High-purity fluoropolymer valves represent the pinnacle of chemical resistance and contamination control in critical fluid handling applications. With the market growing from $407.3M to $764.6M at 6.5% CAGR, driven by advanced semiconductor manufacturing demands, aggressive process chemistries, and zero-defect production requirements, this specialized segment requires coordinated stakeholder action to address fluoropolymer supply chain vulnerabilities, advanced manufacturing challenges, and evolving purity specifications.

How Governments Could Secure Critical Fluoropolymer Manufacturing?

Strategic Material Security: Recognize fluoropolymer manufacturing as critical infrastructure and provide incentives for domestic production capabilities, reducing dependence on limited global suppliers for materials essential to semiconductor and advanced manufacturing competitiveness.

Environmental Regulation Balance: Develop nuanced PFAS regulations that distinguish between essential industrial fluoropolymers and consumer-facing applications, ensuring continued availability of high-performance materials while addressing legitimate environmental concerns.

Advanced Chemistry Research: Fund fundamental research into next-generation fluoropolymer chemistries that maintain exceptional chemical resistance and purity while addressing concerns and reducing manufacturing complexity.

Export Control Framework: Implement strategic controls on high-purity fluoropolymer valve exports to maintain technological advantages while ensuring domestic industries have priority access during supply constraints.

Manufacturing Infrastructure: Support development of specialized fluoropolymer processing facilities including clean rooms, precision molding equipment, and ultra-pure testing capabilities that enable domestic valve production.

How Chemical Industry Associations Could Strengthen Material Foundations?

Purity Specification Harmonization: Establish unified standards for fluoropolymer purity grades (trace metals, extractables, particle levels) across semiconductor, pharmaceutical, and specialty chemical applications to enable economies of scale in production.

Supply Chain Resilience Mapping: Create shared intelligence on fluoropolymer raw material sources, manufacturing capacity constraints, and alternative supply pathways to mitigate disruptions in this concentrated supply base.

Eco-Conscious Roadmap Development: Spearhead industry initiatives for fluoropolymer recycling, life cycle assessment, and the development of next-generation chemistries that preserve performance while addressing environmental lifecycle challenges.

Technical Knowledge Sharing: Facilitate exchange of processing expertise, contamination control techniques, and quality assurance methods among fluoropolymer processors and valve manufacturers.

Regulatory Advocacy Coordination: Represent industry interests in developing science-based regulations that protect essential industrial uses while addressing environmental concerns through appropriate risk assessment frameworks.

How Fluoropolymer Valve Manufacturers Could Maximize Market Position?

Advanced Processing Innovation: Develop proprietary molding and machining techniques that minimize contamination introduction during manufacturing while enabling complex geometries required for high-performance valve designs.

Material Differentiation Strategy: Create specialized fluoropolymer formulations optimized for specific applications (plasma resistance for semiconductor, biocompatibility for pharma, chemical compatibility for specialty chemicals) rather than generic solutions.

Integrated Design Capabilities: Combine fluoropolymer expertise with valve engineering to create optimized solutions where material properties and mechanical design are co-developed for maximum performance.

Quality System Excellence: Implement advanced statistical process control, contamination monitoring, and traceability systems that demonstrate consistent production of ultra-high purity components to demanding customers.

Technical Service Differentiation: Provide specialized application engineering, contamination troubleshooting, and process optimization services that create customer dependency beyond simple product supply.

How End-User Process Industries Could Optimize Fluoropolymer Valve Performance?

Process-Specific Specification: Work closely with suppliers to develop application-optimized purity and performance specifications rather than applying generic requirements that may over-specify or miss critical parameters.

Lifecycle Cost Optimization: Implement total cost of ownership analysis that considers valve longevity, contamination prevention, and process uptime rather than focusing solely on initial purchase price.

Predictive Replacement Programs: Develop models for predicting fluoropolymer valve degradation based on process chemistry exposure, temperature cycling, and mechanical stress to optimize replacement timing.

Cross-Industry Learning: Participate in industry forums sharing fluoropolymer valve performance data across semiconductor, pharmaceutical, and chemical processing applications to accelerate best practice adoption.

Supplier Development Partnership: Engage in joint development programs with valve manufacturers to address specific process challenges and develop next-generation solutions for evolving manufacturing requirements.

How Financial Stakeholders Could Enable Technology Advancement?

Fluoropolymer Manufacturing Investment: Finance specialized production capabilities including ultra-clean polymerization facilities, precision forming equipment, and advanced purification systems required for high-purity fluoropolymer production.

Technology Innovation Funding: Support R&D investments in breakthrough fluoropolymer chemistries, processing technologies, and quality control methods that can significantly improve performance or reduce environmental impact.

Supply Chain Diversification Capital: Back initiatives to develop alternative fluoropolymer suppliers and processing locations, reducing market concentration risks and improving supply security for critical applications.

Eco-Transition Investment: Fund the development of recycling technologies, alternative chemical research, and process improvements that tackle environmental challenges while ensuring performance standards are upheld.

Market Consolidation Opportunities: Support strategic combinations that create integrated fluoropolymer-to-valve suppliers with sufficient scale to invest in next-generation technologies while serving global high-tech manufacturing markets.

How Equipment Integrators Could Enhance System Performance?

Holistic System Design: Integrate fluoropolymer valve specifications into overall fluid handling system design, optimizing performance across interconnected components rather than treating valves as isolated components.

Contamination Control Integration: Develop system-level approaches to contamination prevention that consider valve placement, purging protocols, and maintenance procedures in overall system design.

Performance Monitoring Integration: Incorporate valve condition monitoring into broader equipment health management systems, enabling predictive maintenance and process optimization.

Installation & Service Excellence: Develop specialized installation and maintenance procedures for fluoropolymer valves that preserve material integrity and prevent contamination introduction during service.

Application Knowledge Transfer: Train field service teams on fluoropolymer valve characteristics, proper handling techniques, and troubleshooting methods to ensure optimal performance throughout equipment lifecycle.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 407.3 million |

| Material Type | PFA and PTFE |

| End-Use Industry | Semiconductor Processing, Photovoltaic (PV), LCD Manufacturing, and Other Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Parker, Swagelok, CKD Corporation, SMC Corporation, Entegris, TK-Fujikin, Saint-Gobain Performance Plastics |

| Additional Attributes | Dollar sales by material type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established valve manufacturers and specialized fluoropolymer technology providers, buyer preferences for PFA versus PTFE valve solutions, integration with advanced semiconductor manufacturing processes and pharmaceutical production systems, innovations in surface treatment technologies and advanced material formulations, and adoption of next-generation fluoropolymer compounds and specialized manufacturing techniques for enhanced chemical resistance and contamination control performance. |

The global high-purity fluoropolymer valves market is estimated to be valued at USD 407.3 million in 2025.

The market size for the high-purity fluoropolymer valves market is projected to reach USD 764.6 million by 2035.

The high-purity fluoropolymer valves market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in high-purity fluoropolymer valves market are pfa and ptfe.

In terms of application, semiconductor processing segment to command 54.2% share in the high-purity fluoropolymer valves market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoropolymer Film Market Forecast and Outlook 2025 to 2035

Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Additives Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Coating Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Slurry Valves Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Breakdown of Aerosol Valves Industry

Aerosol Valves Market Growth and Trends 2025 to 2035

Pigging Valves Market

Blow-Off Valves Market Growth – Trends & Forecast 2025 to 2035

Isolator Valves Market

Degassing Valves Market Size and Share Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Assessing Degassing Valves Market Share & Industry Trends

Slide Gate Valves Market Size and Share Forecast Outlook 2025 to 2035

Automotive Valves Market Size and Share Forecast Outlook 2025 to 2035

Anti Siphon Valves Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA