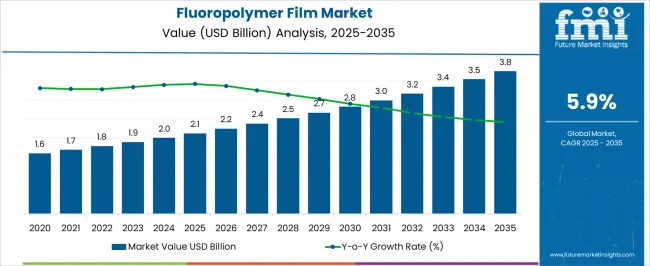

The Fluoropolymer Film Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The Fluoropolymer Film market is experiencing strong growth driven by the increasing demand for high-performance films in diverse industrial and commercial applications. The future outlook for this market is shaped by the superior chemical resistance, thermal stability, and electrical insulation properties offered by fluoropolymer films. Expanding applications in packaging, electrical insulation, and chemical processing industries are contributing to market growth.

The development of lightweight and durable films for flexible packaging, combined with growing consumer preference for sustainable and high-performance materials, further supports the market expansion. Additionally, rising investments in advanced manufacturing processes and innovations in film extrusion and coating techniques are enhancing the performance characteristics of fluoropolymer films, creating opportunities for market penetration in emerging regions.

As industries prioritize product longevity, operational efficiency, and regulatory compliance, fluoropolymer films are increasingly adopted across a range of end-use sectors The market is also benefiting from the trend toward miniaturization in electronics and growing demand for high-performance materials that can withstand extreme environmental conditions, ensuring continued growth potential globally.

| Metric | Value |

|---|---|

| Fluoropolymer Film Market Estimated Value in (2025 E) | USD 2.1 billion |

| Fluoropolymer Film Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

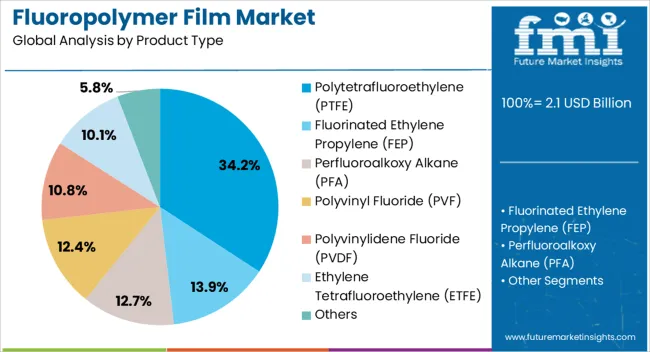

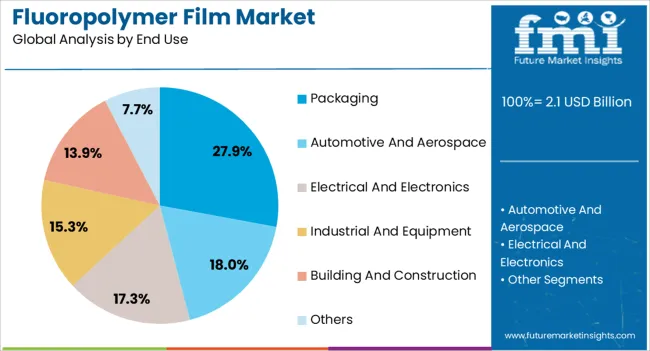

The market is segmented by Product Type and End Use and region. By Product Type, the market is divided into Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy Alkane (PFA), Polyvinyl Fluoride (PVF), Polyvinylidene Fluoride (PVDF), Ethylene Tetrafluoroethylene (ETFE), and Others. In terms of End Use, the market is classified into Packaging, Automotive And Aerospace, Electrical And Electronics, Industrial And Equipment, Building And Construction, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polytetrafluoroethylene (PTFE) segment is projected to hold 34.20% of the Fluoropolymer Film market revenue share in 2025, establishing it as the leading product type. This dominance is driven by PTFE’s exceptional chemical resistance, thermal stability, and low friction properties, which make it suitable for demanding industrial applications.

The segment’s growth is supported by the increasing use of PTFE films in electrical insulation, chemical processing, and protective coatings, where durability and performance are critical. Advancements in film processing technologies have further enhanced PTFE film properties, enabling thinner, more flexible, and highly reliable films.

The high demand for PTFE films in sectors requiring long-term stability and operational efficiency reinforces its leading position Additionally, PTFE films’ adaptability to customized applications and integration with other materials has contributed to sustained adoption, making the segment a primary contributor to the overall market growth.

The packaging end-use segment is expected to account for 27.90% of the Fluoropolymer Film market revenue share in 2025, positioning it as the leading application segment. This growth is driven by the increasing need for high-performance packaging solutions that offer chemical resistance, barrier protection, and thermal stability. Fluoropolymer films are particularly valued in food, pharmaceutical, and specialty packaging applications where product safety and longevity are paramount.

The segment has benefited from rising demand for lightweight, flexible, and durable films that improve storage efficiency and reduce material waste. Additionally, the shift towards sustainable and recyclable packaging materials has encouraged the adoption of advanced fluoropolymer films in packaging solutions.

The ability of these films to maintain product integrity under challenging conditions and support regulatory compliance has further reinforced their preference Increasing awareness of product safety, coupled with innovations in film manufacturing and coating technologies, continues to drive the adoption of fluoropolymer films in the packaging industry.

Budding Demand for Blister Packaging from the Pharmaceutical Industry

The pharmaceutical sector's improving need for blister packaging is anticipated to fuel the maturation of the industry. Blister packaging is used in a variety of medical and pharmaceutical applications, such as stoppers, fluid bags, liners for caps, and medical release liners.

Due to its superior chemical inertness, resilience to UV rays and weather, and less moisture absorption compared to traditional films like nylon, polypropylene, and polyethylene, FE films are in high demand. These properties make them sought-after for various applications.

The consumer base of fluoropolymer films is developing biocompatible due to their chemical inertness and ability to prevent adverse reactions. They are preferred in blister packaging and fluid bags for biological liquids due to their negligible moisture absorption and weather resistance. The demand for highly purified products in the medical and pharmaceutical industry is envisioned to helm the evolution of the industry.

Aggregate Demand from Automotive Industry Pushes Sales of Fluoropolymer Films

The escalating demand for fluoropolymer film in the automotive industry is pushing maturation owing to the ability to ensure the safety, performance, and efficiency of vehicles. Modern vehicles are equipped with complex wiring systems, advanced sensors, and electronic components.

These necessitate insulation materials capable of withstanding extreme conditions and maintaining consistent performance. These factors influence growth in the automobile manufacturing sector.

Sales of these films are on the rise as they serve as robust insulators for wire and cable applications. They effectively shield wires from external factors such as moisture, chemicals, and temperature fluctuations. This ensures the reliability and longevity of the vehicle's electrical systems. Such an element represents another key growth-inducing factor in the industry.

The automotive industry is increasingly embracing electric and hybrid vehicles. The significance of reliable insulation materials is essential to ensure safety and efficient power distribution. The trend of electronic vehicles is poised to create a positive industry outlook in the forthcoming decade.

Electronics Industry Ignites a Spark in the Demand for PFA Components

Due to exceptional chemical resistance and their high-temperature properties, fluoropolymers have become crucial in the semiconductor industry. This has enabled the manufacture of microchips and other electronic devices of higher purity. This, in turn, makes the semiconductor industry one of the earliest adopters of fluoropolymers.

Manufacturers are akin to perfluoroalkoxyalkane (PFA), a well-known fluoropolymer, because of its greater chemical resistance, improved functionality, dependability, and longevity. In addition, its melt-process ability allows for shaping and heating, enhancing its appeal in various applications.

Production of game consoles, mobile phones, and portable computers is propelling the electronics industry's rapid expansion. Future developments are predicted to propel fluoropolymers' growing significance due to the need for high-quality, high-performance electronic components.

The global demand for FE films has historically developed at a CAGR of 2.9%, obtaining a market valuation of USD 1.6 billion in 2020.

The need for fluoropolymers is predicted to increase globally. Manufacturers, primarily in North America and East Asia, are expected to benefit from increased consumption brought about by government efforts and industrial infrastructure.

Over time, it is anticipated that this dominance will persist. The expansion of the industry is foreseen to be propelled by investments made by provincial governments in industrial development.

The pandemic that occurred from 2024 to 2024 has significantly affected the demand. This has led to factory closures and concerns about a decline in output. The reduction in construction activity and the suspension of production activities are predicted to negatively affect industry expansion, causing lost revenues and damaged supply chains.

Sales, however, have started advancing at a far better pace, displaying a CAGR of 5.9% from 2025 to 2035. Leading manufacturers are developing their manufacturing capacity to meet end-user demand. They are also aggressively collaborating with industrial processing applications to ensure long-term supply.

The military sector is experiencing significant growth in demand for fluoropolymer films. This is due to their exceptional technical qualities like clarity, UV stability, moisture barrier, chemical inertness, and non-yellowing chemistry, which are visualized to continue in the future.

The fluoropolymer film market forecast includes key countries like North America, Asia Pacific, and Europe. The sectors in the United States and Canada are developing steadily, while European industries such as those in the United Kingdom and Germany are emerging slowly.

The demand for FE films in China and India has led to significant progress in the field. The fluoropolymer tape sector is expected to develop in these regions in the forthcoming decade.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.3% |

| Canada | 3.6% |

| Germany | 2.8% |

| United Kingdom | 2.3% |

| China | 6.6% |

| India | 8.8% |

The fluoropolymer film market in India is anticipated to develop with an 8.8% CAGR from 2025 to 2035. The rapid industrialization and growth in the manufacturing sector in India compel the need for cutting-edge fluoropolymer tapes.

Materials with superior thermal stability, chemical resistance, and durability are essential in various industries, like electronics, chemical processing, and the automotive sector in India. India's environmental regulations and growing emphasis on sustainability are forcing demand for fluoropolymers. These offer low ecological impact alternatives in industries such as wastewater treatment, construction, and packaging.

Germany holds a significant industry share in Europe's automotive sector, accounting for a quarter of the total volume and value. The fluoropolymer film market in Germany is projected to report a CAGR of 2.8% from 2025 to 2035.

The automotive segment, accounting for the notable revenue share of the German economy, is envisioned to experience faster growth compared to its counterparts.

German auto manufacturers are augmenting demand for fluoropolymer tapes for various applications. These applications include insulators, adhesives, photovoltaic cells, microphone membranes, surface coverings, airbags, and fuel hoses.

Canada presents a significant opportunity for the expansion of fluoropolymer applications in healthcare, with a foreseen CAGR of 3.6% during the forecast period. The growth in demand is predominantly attributed to the usefulness of medical fluoropolymers. These are used in the production of medical devices such as catheters, tubing, medication delivery devices, medical bags, and others.

The demand for fluoropolymer films in the Canadian medical sector is anticipated to rise in the coming years, particularly in the packaging of tablets and capsules. As a result, Canada's fluoropolymer film market is envisioned to inflate further, thus creating pristine avenues for growth and development in the region's healthcare industry.

The following section describes the top segments of the fluoropolymer film market. According to product analysis, Polytetrafluoroethylene (PTFE) is anticipated to hold a 34.2% revenue share in 2025. At the same time, for packaging applications, the industry share is 27.9%.

| Segment | Polytetrafluoroethylene (PTFE) (Product Type) |

|---|---|

| Value Share (2025) | 34.2% |

Polytetrafluoroethylene (PTFE) is widely used in various sectors due to its excellent electrical, thermal, and chemical properties. It is a popular choice for automotive, electronics, and chemical processing due to its exceptional chemical resistance and temperature stability.

Given its unique properties and capabilities, PTFE is a popular choice in various industries, including motor insulation and heat-resistant masks. The consumption of PTFE is anticipated to rise globally, with PTFE accounting for approximately 34.2% of the industry in 2025.

PTFE's non-stick characteristics, chemical resistance, optical transparency, and moisture resistance position it as a superior alternative to other resins. Its high strength, coupled with its exceptional thermal and electrical properties, enhances the comprehensive performance of products.

| Segment | Packaging (End Use) |

|---|---|

| Value Share (2025) | 27.9% |

The packaging industry is currently undergoing notable and dynamic changes as a direct consequence of the severe policies adopted by regional governments across the globe. This has resulted in significant growth in the demand for packaging materials, compelled by trends in eCommerce and home delivery systems.

Fluoropolymer films are employed more frequently in the manufacturing of packaging materials. This is due to their advantageous characteristics, which include surface protection, lightweight, and thermal management.

In 2025, it is estimated that the packaging industry accounts for approximately 27.9% of fluoropolymer film consumption. As the packaging industry continues to grow, it is anticipated to fuel the development of the fluoropolymer film market.

The future of the packaging industry looks promising, with manufacturers leveraging advanced packaging technologies and research to create efficient packing solutions.

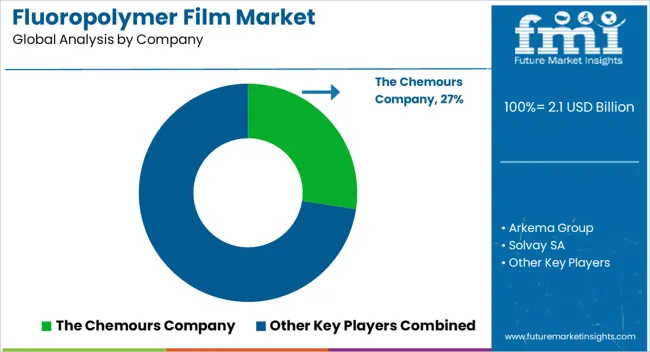

Key players in the global fluoropolymer film market are adopting strategic efforts, such as alliances, research and development, and industry expansion into growing regions, to bolster their positions.

There are few key vendors in the market, which makes it quite centralized. Manufacturers in the fiercely competitive fluoropolymer industry compete for industry share and use strategic activities such as mergers, acquisitions, collaborations, and product developments.

Businesses spend money on research and development to create cutting-edge fluoropolymer compositions and diversify their product lines. Distribution networks and global growth are also emphasized.

On the basis of quality, pricing, and customer service, the industry is quite competitive. As businesses work to provide sustainable fluoropolymer solutions, environmental laws and technological breakthroughs heighten competition.

Industry Updates

The industry is categorized into polytetrafluoroethylene (PTFE), fluorinated ethylene propylene (FEP), perfluoroalkoxy alkane (PFA), polyvinyl fluoride (PVF), polyvinylidene fluoride (PVDF), ethylene tetrafluoroethylene (ETFE), and others such as ECTFE, PCTFE, based on product type.

The demand for fluoropolymer films is entangled in automotive and aerospace, electrical and electronics, industrial and equipment, packaging, building and construction, and other end-use industries.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The global fluoropolymer film market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the fluoropolymer film market is projected to reach USD 3.8 billion by 2035.

The fluoropolymer film market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in fluoropolymer film market are polytetrafluoroethylene (ptfe), fluorinated ethylene propylene (fep), perfluoroalkoxy alkane (pfa), polyvinyl fluoride (pvf), polyvinylidene fluoride (pvdf), ethylene tetrafluoroethylene (etfe) and others.

In terms of end use, packaging segment to command 27.9% share in the fluoropolymer film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Additives Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Coating Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA