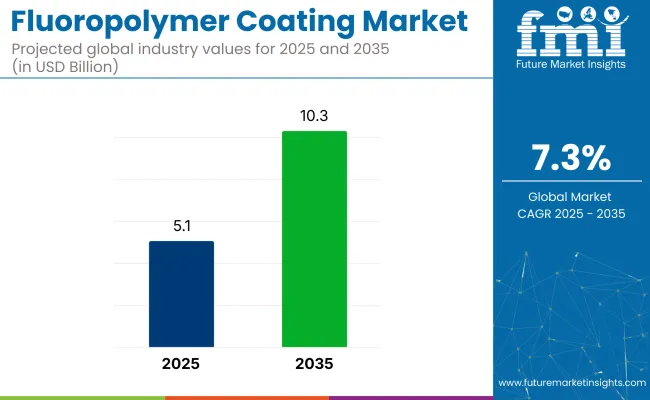

The fluoropolymer coating market is projected to grow from USD 5.1 billion in 2025 to USD 10.3 billion by 2035, growing at a CAGR of 7.3% from 2025 to 2035. This growth is driven by the increasing demand for corrosion-resistant and durable coatings.

| Metric | Values |

|---|---|

| Estimated Size (2025E) | USD 5.1 billion |

| Projected Value (2035F) | USD 10.3 billion |

| CAGR (2025 to 2035) | 7.3% |

The demand for fluoropolymer coatings is fueled by their superior properties, such as chemical resistance, low friction, and high-temperature stability. Applications in sectors like chemical processing and automotive are expected to dominate. The Asia-Pacific region, especially China and India, is expected to be a key growth driver.

In an interview, Mitsuhiro Suwabe, President of Tokyo Silicone Co., Ltd., emphasized the company’s diversified approach, stating, “We are not reliant on just one sector. That is our strength. However, as you pointed out, chemical materials must adhere to PFOA and PFOS regulations. We are a coating company, and we do business with manufacturers of those materials. They are developing materials that do not use those chemicals." This highlights efforts in safer coatings.

The industry holds a specialized share within its parent markets. Within the coatings market, it accounts for approximately 3-5%, as fluoropolymer coatings are a niche segment with specialized applications like corrosion resistance and non-stick properties. In the chemical market, its share is around 1-2%, as fluoropolymers are just one category within the broader chemicals used across industries.

Within the industrial equipment market, the share is about 4-6%, as coatings are essential for protecting equipment exposed to high temperatures and chemicals. In the construction and building materials market, it represents around 2-3%, used in materials requiring durable, long-lasting finishes. In the automotive and transportation market, the share is approximately 2-4%, applied in components for improved performance under extreme conditions.

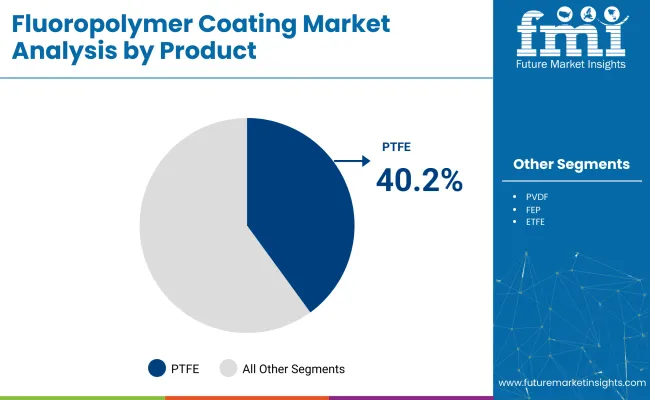

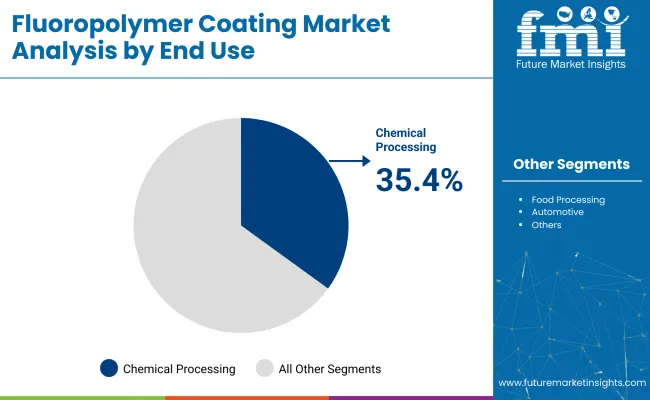

The industry is experiencing significant growth, driven by innovations and increasing industrialization. PTFE coatings are expected to capture 40.2% of the industry share in 2025, with the chemical processing sector leading the application segment with 35.4% share.

PTFE coatings are projected to dominate the industry, capturing 40.2% of the industry share in 2025. Known for their unmatched chemical resistance, high thermal stability, and non-stick properties, PTFE coatings are ideal for demanding applications in automotive, chemical processing, and electronics.

These coatings are valued for their durability and long-lasting performance, particularly in harsh environments. Leading companies like Akzo Nobel N.V. and PPG Industries are investing heavily in improving PTFE coatings’ efficiency and longevity. As industrialization continues to rise, particularly in emerging industries, PTFE coatings are expected to maintain their dominance in the industry.

The chemical processing sector is projected to hold 35.4% of the industry in 2025. The demand for coatings that can withstand aggressive chemicals, extreme temperatures, and harsh operational conditions is rising, especially in the chemical industry. As industrial chemical production continues to expand globally, the need for specialized coatings to prevent corrosion, improve safety, and extend equipment life is growing.

Companies such as The Sherwin-Williams Company and Axalta Coating Systems are focusing on developing high-performance coatings that meet the stringent demands of chemical processing environments. These innovations are expected to continue driving growth in this sector, particularly in industrializing regions.

The industry is growing due to increasing demand for corrosion-resistant and high-performance coatings. However, challenges such as high production costs and raw material price volatility, particularly in price-sensitive regions, limit industry expansion.

Rising Demand for Corrosion-Resistant and Durable Coatings Driving Market Growth

The industry is being significantly driven by the increasing demand for corrosion-resistant and durable coatings across various industries. These coatings are essential in protecting equipment, machinery, and infrastructure in industries such as automotive, aerospace, and chemical processing, where exposure to harsh environments and chemicals is common.

Fluoropolymer coatings offer superior resistance to heat, chemicals, and corrosion, making them ideal for applications that require long-term durability and performance. As industries continue to focus on equipment longevity and operational efficiency, the need for high-performance coatings like fluoropolymers is expected to drive continued market expansion.

High Production Costs and Raw Material Price Volatility

The industry faces challenges due to the high production cost of key raw materials, particularly PTFE. Price volatility, coupled with the complex and resource-intensive manufacturing process, constrains industry growth, especially in price-sensitive regions.

Fluctuations in raw material costs can drive up production expenses, affecting the overall pricing of coatings. To address this, companies are focusing on developing cost-effective alternatives, exploring new materials, and adopting innovative production methods to mitigate reliance on expensive raw materials.

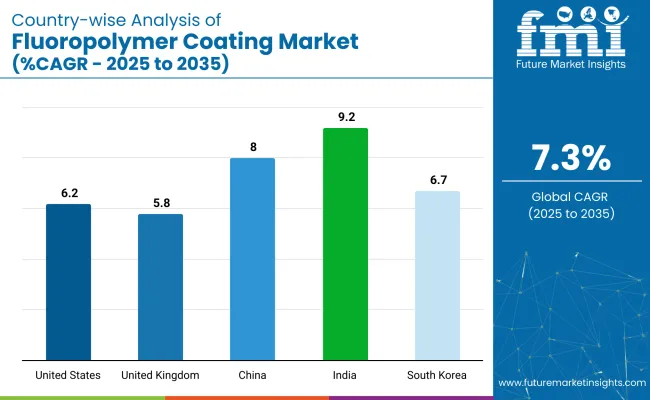

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

| United Kingdom | 5.8% |

| China | 8% |

| India | 9.2% |

| South Korea | 6.7% |

The global industry demand is projected to rise at a 7.3% CAGR from 2025 to 2035. Of the five profiled industries out of 40 covered, India leads at 9.2%, followed by China at 8% and South Korea at 6.7%, while the United States records 6.2% and the United Kingdom posts 5.8%.

These rates translate to a growth premium of +26% for India, +9% for China, and -15% for the United Kingdom versus the baseline, while the United States and South Korea show moderate growth. Divergence reflects local catalysts: increasing industrial applications and infrastructure developments in India, growing demand in construction and automotive sectors in China, a strong industrial base in South Korea, and steady demand from established sectors in the USA and UK.

The industry in the United States is set to record a CAGR of 6.2% through 2035. Demand has been anchored by stringent performance targets in automotive, chemical-processing, and electronics facilities, where extreme temperature and chemical resistance are required.

Continuous R&D funding is being channeled into next-generation PTFE, FEP, and PFA formulations, while pilot lines are being scaled by The Chemours Company and Axalta Coating Systems. Supply-chain depth, covering raw fluorocarbon feedstocks, dispersion plants, and contract coaters, has ensured reliable turnaround for OEM programs. Adoption of fluoropolymer powders in powder-coat booths is being encouraged to reduce volatile emissions and extend component life.

Sales of fluoropolymer coatings in the United Kingdom are projected to grow at a CAGR of 5.8% through 2035. Growth is being underpinned by tightened durability standards across automotive and offshore chemical installations. Akzo Nobel N.V. and PPG Industries are expanding local blending units to shorten lead times for bespoke formulations that withstand salt-spray and thermal-shock cycles.

Collaboration with university surface-science centers is being intensified to validate low-friction, low-surface-energy finishes for precision engineering firms. Adoption within battery-component lines is also being pursued, as lithium-ion manufacturers request non-reactive liners for slurry-mixing vessels.

The demand in China is estimated to grow at a CAGR of 8% through 2035. Large-scale industrialization has been coupled with mandates for higher product reliability, prompting rapid uptake of FEP and ETFE coatings in petrochemical reactors and electronics assembly lines.

Domestic formulators are partnering with multinationals to license high-purity resins, while provincial subsidies are being offered for capacity additions in fluorocarbon intermediates. Application robots equipped with infrared curing have been installed to raise throughput and cut energy consumption. Robust demand from EV battery plants and architectural-aluminum coaters is projected to keep utilization high.

Growing at a CAGR of 9.2%, India’s industry is rapidly expanding as industrial clusters embrace high-performance surface solutions. Increased capital expenditure in automotive, chemical-processing, and electronics corridors has driven interest in PTFE and FEP systems that tolerate aggressive chemistries and elevated temperatures.

Local toll-coaters are being equipped with electrostatic-spray booths, while global suppliers such as Akzo Nobel N.V. and PPG Industries are localizing resin compounding to meet tariff-barrier rules. Equipment durability targets set by EPC contractors have elevated fluoropolymer usage in pipework and reactor linings, especially within refinery expansions along the west coast.

The industry in South Korea is projected to grow at a CAGR of 6.7% through 2035. High-precision electronics and automotive exporters have demanded low-friction, non-stick finishes that survive thermal cycling and chemical etch environments.

Axalta Coating Systems and The Sherwin-Williams Company are expanding in-country R&D cells to customize fluoropolymer blends for OLED line hardware and turbocharger housings. Government tax credits tied to advanced-material localization are being utilized to construct additional dispersion-plant capacity. Stringent quality-control protocols within chaebol supply chains have ensured rapid validation of new grades.

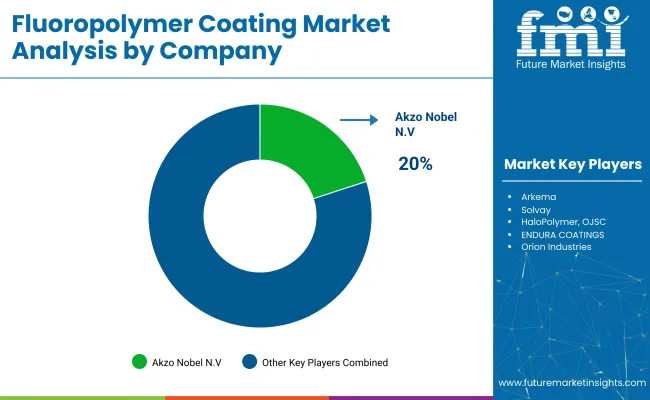

Leading Company - Akzo Nobel N.V. Industry Share 20%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Akzo Nobel N.V., PPG Industries, Inc., and The Sherwin-Williams Company lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across architectural, automotive, and industrial sectors.

Key players, including Axalta Coating Systems, LLC, The Chemours Company, and DAIKIN INDUSTRIES, Ltd., offer specialized coatings tailored to specific applications and regional industries. Emerging players, such as Arkema, Solvay, HaloPolymer, OJSC, Coating Systems, Inc. (Whitford Corporation), ENDURA COATINGS, and Orion Industries, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 5.1 billion |

| Projected Industry Size (2035) | USD 10.3 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square meters for volume |

| Product Segmentation | PTFE Coatings, PVDF Coatings, FEP Coatings, ETFE Coatings, Other Products |

| End-Use Segmentation | Food Processing, Automotive, Chemical Processing, Electrical & Electronics, Building & Construction, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Axalta Coating Systems, LLC, The Chemours Company, DAIKIN INDUSTRIES, Ltd., Arkema, Solvay, HaloPolymer, OJSC, Coating Systems, Inc. (Whitford Corporation), ENDURA COATINGS, Orion Industries |

| Additional Attributes | Dollar sales by product type, end-use, and region, increasing demand for corrosion-resistant coatings, rising applications in automotive, food processing, and electronics industries, regional growth in industrial applications and infrastructure projects. |

The industry is segmented into polytetrafluoroethylene (PTFE) coatings, PVDF coatings, FEP coatings, ETFE coatings, and other products.

The industry is segmented into food processing, automotive, chemical processing, electrical & electronics, building & construction, and others.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Middle East, and Africa.

The industry is projected to reach a size of USD 5.1 billion in 2025.

The industry is expected to grow to USD 10.3 billion by 2035.

The industry is expected to grow at a CAGR of 7.3% from 2025 to 2035.

PTFE Coatings lead demand in 2025 with an industry share of 40.2%.

India is the fastest-growing industry, with a CAGR of 9.2%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoropolymer Film Market Forecast and Outlook 2025 to 2035

Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Additives Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA