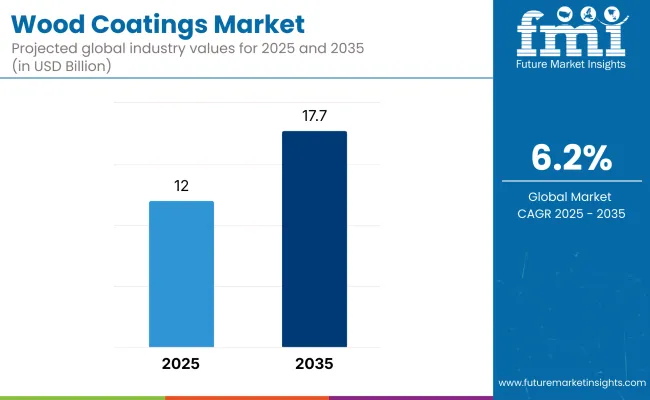

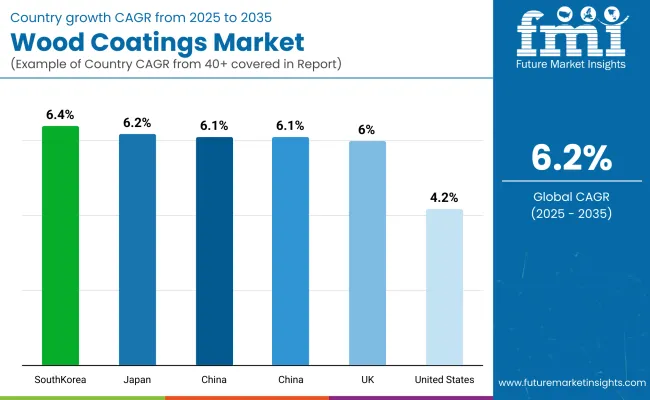

The wood coatings market is poised to expand from USD 12.0 billion in 2025 to USD 17.7 billion by 2035, registering a robust CAGR of 6.2%. Among regional markets, China remains the most lucrative, supported by large-scale urbanization and infrastructure investments, while South Korea is set to grow the fastest with a projected CAGR of 6.4% over the forecast period.

The market is experiencing strong tailwinds from the booming furniture and construction sectors, especially in emerging economies. As urban populations grow and housing demands rise, the need for high-performance wood coatings in interiors and exteriors becomes more pronounced. Demand is further reinforced by increasing awareness of aesthetic wood finishes, durability, and wood protection. Regulatory bodies across North America and Europe are pushing for eco-friendly formulations, shifting manufacturers toward low-VOC, water-based, and UV-curable systems.

However, the market is not without challenges-volatile raw material prices and complex environmental regulations continue to impact production costs and compliance strategies. Key trends include the emergence of antimicrobial coatings, self-healing surfaces, and multi-functional polyurethane blends. Manufacturers are increasingly focused on UV protection, rapid curing, and high abrasion resistance across application sectors.

Looking ahead, the industry will undergo a transformative shift toward sustainable, smart coatings. Technologies offering UV resistance, moisture shielding, and microbial defense will gain traction, particularly in applications like sports flooring, hospital interiors, and industrial surfaces. Government-backed green building initiatives and rising adoption of eco-friendly home décor will drive product innovation and broader market reach. The integration of AI and nanotechnology in coating formulations is expected to enhance performance and customization.

Digital tools for precise application and real-time monitoring of coating conditions will also streamline operations and reduce waste. Between 2025 and 2035, the wood coatings industry is expected to play a vital role in redefining aesthetic standards and environmental stewardship in both residential and commercial construction landscapes.

The table below presents the annual growth rates of the global wood coatings market from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 6.2% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.0% (2024 to 2034) |

| H2 2024 | 6.2% (2024 to 2034) |

| H1 2025 | 6.1% (2025 to 2035) |

| H2 2025 | 6.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 6.1% in the first half and relatively increase to 6.3% in the second half. In the first half (H1), the sector saw an increase of 10 BPS, while in the second half (H2), there was a slight increase of 10 BPS.

The wood coatings market is broadly segmented across multiple categories to reflect diverse applications and formulation needs. By resin type, the market includes polyurethane, acrylics, melamine formaldehyde, nitrocellulose, and others, which typically comprise epoxy resins, alkyds, and hybrid resins used in specialized or performance-intensive applications. By product type, it is classified into stains & varnishes, shellac coatings, wood preservatives, water repellents, and others, which may include sealants, wax-based coatings, and multi-functional topcoats designed for niche decorative or protective finishes.

By technology type, the segmentation includes oil-based, water-based, solvent-based, and others, where the latter refers to emerging technologies like UV-cured coatings, powder coatings, and bio-based or nanotech-enhanced solutions. By application, the market is divided into furniture, cabinets, sides & decks, and others, with others encompassing wooden toys, wall panels, moldings, wooden sports courts, and interior trims. Finally, by region, the market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

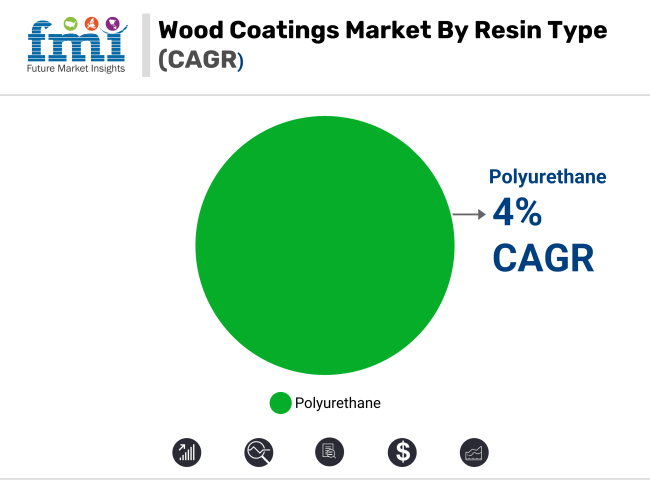

The global wood coatings market is led by the polyurethane resin segment, which is projected to maintain dominance from 2025 to 2035, registering a CAGR of 4.0%. However, the segment’s position as the most lucrative resin category is driven by scale, repeat consumption, and widespread application in high-wear environments like flooring and cabinetry. Its dual compatibility with both water- and oil-based formulations enables greater versatility across diverse climatic zones and user preferences.

Furthermore, polyurethane’s superior resistance to scratches, chemicals, and moisture makes it a preferred choice for both residential and commercial end-use sectors, reinforcing its long-term market leadership. The acrylics segment follows closely in adoption due to its environmental appeal and ease of formulation but often lacks the superior abrasion resistance of polyurethane. Melamine formaldehyde is mainly used in pre-catalyzed formulations for budget-sensitive applications, but volume remains constrained by low recoatability.

Nitrocellulose coatings maintain relevance in quick-dry use cases but are declining due to VOC concerns. The others segment includes hybrid blends such as epoxy-acrylate systems and newer bio-based or alkyd formulations-emerging but yet to reach critical mass.

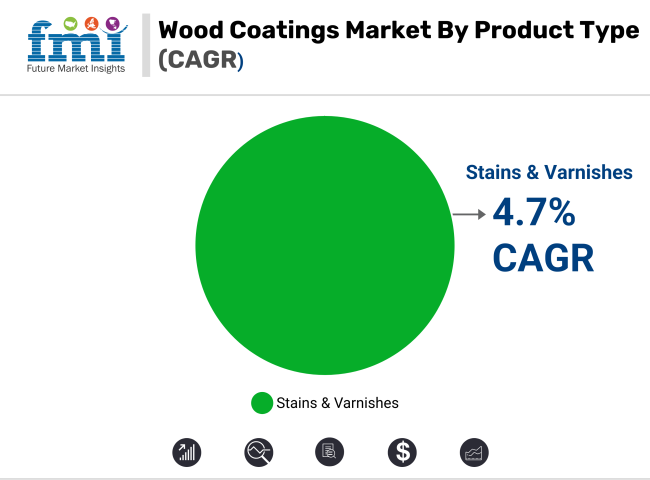

Among product types in the global wood coatings market, stains & varnishes are expected to remain the most lucrative segment between 2025 and 2035, reflecting a steady CAGR of 4.7%. The segment's strong performance is underpinned by its extensive usage across furniture, paneling, and decorative interior wood products. Additionally, the dual role of enhancing aesthetic appeal and providing protective coverage enables higher frequency of re-application and cross-segment demand spanning both residential and commercial sectors.

The shellac coating segment continues to serve niche restoration and artisanal wood applications, but its scalability is limited by lower industrial demand. Wood preservatives are seeing demand in decking and exterior structural wood, yet growth is offset by periodic regulatory reevaluations. Water repellents are widely used in outdoor settings but are often bundled with other treatment systems, limiting standalone volume capture. The others category, encompassing hybrid sealers and specialty topcoats, remains fragmented and technically differentiated but lacks uniform market penetration.

In the technology type category, water-based coatings are set to drive the largest absolute value growth in the global wood coatings market from 2025 to 2035, posting a solid CAGR of 5.2%. This growth is attributed to increasing regulatory pressure for VOC reduction, rising demand for safer indoor air quality, and advancements in formulation performance. Water-based coatings are now capable of delivering comparable durability, drying time, and finish clarity to their oil- and solvent-based counterparts, making them the default choice for furniture, cabinetry, flooring, and even sporting surfaces.

Oil-based coatings, while appreciated for deep finish and heritage appeal, continue to lose share due to environmental compliance constraints. Solvent-based technologies retain niche applications in industrial settings where rapid curing and chemical resistance are critical, but their standalone growth potential is limited under tightening global emissions regulations. The others segment including UV-cured, powder-based, and hybrid technologies are fast-evolving but still largely confined to high-end or experimental applications lacking mass adoption.

| Technology Type Segment | CAGR (2025 to 2035) |

|---|---|

| Water-Based | 5.2% |

Across application segments in the wood coatings market, furniture stands out as the most lucrative segment in terms of absolute value growth, recording a steady CAGR of 5.1%. Furniture continues to account for the largest consumption of wood coatings due to its extensive use across residential, hospitality, and commercial real estate. The segment benefits from repeat demand driven by lifestyle upgrades, interior renovation cycles (typically every 7-10 years), and shifting aesthetic preferences.

In emerging economies, rising disposable incomes and urban migration are further accelerating furniture purchases, especially in modular and custom-built formats. Cabinets are a strong secondary application, especially in kitchens and storage spaces, but volume is more replacement-driven and less exposed to rapid design trends. Sides & decks demand weather-resistant, high-durability coatings but have limited penetration beyond developed markets.

The others segment includes applications such as wooden toys, interior trims, sport court flooring, railings, panels, and wooden sculptures niche but growing due to innovation in design and materials. However, none match the consistent, globalized scale of furniture applications. Thus, furniture coatings dominate both in value share and future scalability within the application segment landscape.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Furniture | 5.1% |

Stringent environmental regulations are limiting VOC emissions, favouring waterborne and UV coatings

Stringent environmental regulations are compelling the wood coatings industry to reduce volatile organic compound (VOC) emissions, leading to a significant shift from solvent-based to waterborne and UV-cured coatings. These regulations, aimed at minimizing air pollution and health risks, have prompted manufacturers to innovate and adopt eco-friendly alternatives.

For instance, BASF has been at the forefront of developing waterborne UV coatings, which combine the advantages of both technologies to meet regulatory standards and market demands.

The higher quality interior wood coatings can last between 7 to 10 years on well-used surfaces, with some lasting up to 15-20 years, thereby prolonging the wood's lifespan by protecting it from wear and environmental factors. The durability of coatings on exterior wood varies widely.

For instance, paints can last from a few months to over 20 years, depending on product quality, application methods, and environmental conditions. High-quality paints and stains generally offer longer protection, especially in locations shielded from direct sunlight and moisture.

Surge in construction activities fueling the growth of wood coating

Rapid urbanization, rise in government spending on infrastructure, and growth in population are factors leading to an increase in construction projects around the world. Developing countries such as India, South Africa, and China spend significantly on building activities to generate employment, build critical assets, and cater to evolving needs of rural and urban population.

Construction of residential spaces in form of apartments, bungalows, farmhouse and commercial facilities such as hotels, airports, and resorts necessitates the need for esthetic furniture and interior designs, thereby creating lucrative wood coatings opportunities.

According to Japan Property Central, the construction of more than 780 new high rises accommodating nearly 109, 908 individual apartments in 2021. As per the data publically available by the European Commission, the construction sector contributes about 9.0% to the GDP of the European Union, employing an estimated 18 million people.

Technological advancements in coating formulation is driving the demand for wood coatings

A significant technological advancement in wood coatings is the development of waterborne polyurethane formulations, which offer exceptional durability, scratch resistance, and smoothness. These coatings are particularly ideal for interior wood applications.

AkzoNobel, introduced its innovative Interpon WoodCoat range. This new line utilizes UV-curing technology and advanced waterborne resins, delivering superior protection against fading, wear, and moisture, while providing a smooth and glossy finish.

These coatings not only enhance the aesthetic appeal of wood but also align with sustainability goals by reducing the use of solvents and minimizing environmental impact. AkzoNobel’s commitment to developing high-performance, eco-friendly coatings is driving advancements in the wood coatings industry and setting new standards for quality and sustainability.

With the increasing demand for hygiene and cleanliness, especially in high-traffic areas, antimicrobial wood coatings have become a key development. These coatings incorporate antimicrobial agents that inhibit the growth of bacteria, mold, and mildew, making them ideal for use in healthcare facilities, kitchens, and other environments where hygiene is a top priority.

Rising awareness for wood protection and maintenance solution fuels the need for wood coatings

The products like stains & varnishes, shellac coatings, wood preservatives, and water repellents, is helping in protection of wood and helping in increasing their life. As wood continues to be a main product in both residential and commercial spaces, there is the need to preserve its appearance and extend its lifespan.

Stains and varnishes not only enhance the natural beauty of wood but also provide essential protection against wear, weathering, and environmental damage. Wood preservatives and water repellents guard against moisture, mold, and decay, further prolonging the life of wooden products.

With growing awareness about the importance of maintaining wood surfaces and the increasing popularity of sustainable, eco-friendly home décor, consumers are increasingly seeking high-performance coatings. This shift is driving a greater demand for specialized coatings that improve the durability, appearance, and longevity of wood.

Tier-1 companies account for around 50-55% of the overall market with a product revenue from the wood coatings market of more than USD 100 million. PPG Industries, The Sherwin-Williams Company, AkzoNobel, and other players.

Tier-2 and other companies such as Kansai Paint, Masco Corporation, RPM International and other players are projected to account for 45-50% of the overall market with the estimated revenue under the range of USD 100 million through the sales of wood coatings.

The section below covers the industry analysis for wood coatings in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

| South Korea | 6.4% |

| Japan | 6.2% |

| United States | 4.2% |

| UK | 6.0% |

China's rapid urbanization and infrastructure development have significantly contributed to the growing demand for wood coatings. With urbanization progressing at a remarkable pace, China is expected to continue building new cities, residential areas, and commercial structures.

According to the World Bank, China’s urban population is projected to reach 70% by 2030, up from around 60% in 2019. This surge in urban construction has led to an increased need for high-quality materials, including wood products, in both residential and commercial spaces.

Wood coatings are essential for protecting wooden surfaces like flooring, furniture, and cabinetry, enhancing their durability, aesthetics, and longevity. As the construction industry in China continues to expand - accounting for over 40% of the country’s GDP - there is a growing demand for wood coatings to maintain the quality of wood materials used in buildings.

The increasing focus on both interior and exterior finishes in new developments further fuels the demand for specialized, eco-friendly wood coatings.

The growing popularity of premium hardwood flooring in industrial settings is boosting the demand for wood coatings in the USA Known for its durability, strength, and aesthetic appeal, hardwood is becoming the preferred option for high-performance flooring in challenging environments.

Industrial spaces such as warehouses, factories, and manufacturing plants demand flooring that can withstand heavy machinery, foot traffic, and exposure to oils, chemicals, and other harsh conditions. Premium hardwood provides a superior option compared to alternative materials due to its long-lasting performance.

Wood coatings are essential in protecting these hardwood floors from environmental factors such as oil spills, chemicals, and moisture. Coatings help prevent surface reactions, stains, and damage, ensuring the floor’s longevity and functionality in demanding industrial settings.

As industrial flooring in the USA is projected to grow, demand for advanced wood coatings is expected to rise in tandem. Companies like Sherwin-Williams have responded by developing high-performance coatings that offer enhanced protection against harsh conditions.

Their “ProIndustrial” coatings line specifically targets industrial environments, offering solutions for hardwood floors that need to withstand chemical exposure, abrasion, and heavy-duty use. This trend reflects the need for coatings that not only preserve the beauty of wood but also provide crucial protection against wear and environmental factors.

Japan's aging population is a significant factor driving the demand for home renovations and, consequently, wood coatings. As of 2023, nearly 30% of Japan’s population is over 65 years old, making it one of the most elderly populations in the world.

This demographic trend has led many elderly individuals to renovate their homes for improved accessibility, comfort, and aesthetics. Refurbishments often involve updating furniture, flooring, and cabinetry, which require high-quality wood coatings to enhance durability and maintain the natural appearance of wood.

The Japanese government has also supported home renovations through initiatives like the "Renovation Support Program," which encourages seniors to upgrade their homes for safer, more functional living spaces. This increased focus on home renovations has significantly boosted the demand for wood coatings in Japan.

These coatings not only protect the wood but also ensure that it remains visually appealing and functional, addressing both the practical and aesthetic needs of Japan’s aging population.

Technological advancements in the wood coating industry are enhancing durability, finish quality, and environmental performance. The shift toward water-based coatings is gaining traction due to their low VOC emissions, faster drying times, and compliance with stringent environmental regulations in regions like North America and Europe.

Manufacturers are increasingly focusing on developing high-performance coatings that offer improved scratch resistance, UV protection, and anti-microbial properties to meet the growing demand for long-lasting, low-maintenance finishes. Innovations in resin technologies, such as polyurethane and acrylic-based formulations, are driving improvements in coating longevity and application versatility.

The growing emphasis on sustainability has led to the development of eco-friendly coatings that are non-toxic, biodegradable, and free from harmful chemicals. These advancements are fuelling the demand for wood coatings across residential, commercial, and industrial sectors, making them an essential solution for wood protection and aesthetics in modern architecture and furniture.

Recent Industry Developments

The resin type segment is further categorized into Polyurethane, Acrylics, Melamine Formaldehyde, Nitrocellulose and Others.

The product type is classified into Stains & varnishes, Shellac coating, Wood preservatives, Water repellents and others.

The technology type is further segmented into Oil-based, Water-based, Solvent-based and others.

The application segment is classified into Furniture, Cabinets, Sides & Decks and Others.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The wood coatings was valued at USD 11,400 million in 2024.

The demand for Wood Coatings is set to reach USD 12.0 billion in 2025.

The global wood coating market is driven by urbanization, infrastructural development and renovation of buildings.

The wood coating demand is projected to reach USD 17.7 billion by 2035.

Polyurethane are expected to lead during the forecasted period due to its exceptional durability, abrasion resistance, and versatility, offering superior protection against moisture, UV damage, and wear & tear, making it ideal for both indoor and outdoor wood applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wood Preservative Coatings Market 2017-2027

Wooden Crate Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Wood Pallets Market Trends – Innovations & Growth 2025 to 2035

Wood Based Panel Market Size and Share Forecast Outlook 2025 to 2035

Wood Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Wooden Decking Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA