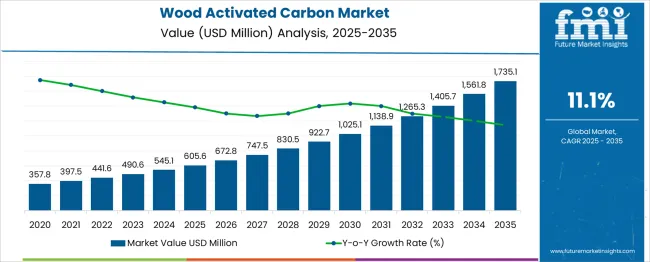

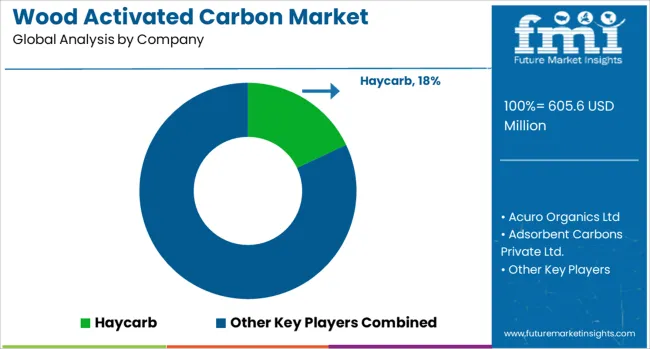

The Wood Activated Carbon Market is estimated to be valued at USD 605.6 million in 2025 and is projected to reach USD 1735.1 million by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period. This expansion reflects a growth multiplier of 2.86x, supported by a strong CAGR of 11.1%, driven by rising demand for water purification, air treatment, and pharmaceutical applications. In the first five-year phase (2025–2030), the market is expected to reach around USD 1,020 million, adding USD 414.4 million, which accounts for 36.7% of the total incremental growth, fueled by increasing investments in municipal water treatment and industrial effluent management. The second half (2030–2035) contributes USD 715.1 million, representing 63.3% of incremental growth, indicating accelerated adoption as stringent environmental regulations, food and beverage purification needs, and energy storage applications drive usage. Annual additions expand from USD 80 million in the early phase to nearly USD 150 million by the end of the forecast period, reflecting robust momentum. Companies focusing on sustainable raw material sourcing, advanced activation technologies, and expanded distribution networks will capture the largest share of this USD 1.13 billion opportunity, particularly in Asia-Pacific and North America where industrial growth and water safety requirements are highest.

| Metric | Value |

|---|---|

| Wood Activated Carbon Market Estimated Value in (2025 E) | USD 605.6 million |

| Wood Activated Carbon Market Forecast Value in (2035 F) | USD 1735.1 million |

| Forecast CAGR (2025 to 2035) | 11.1% |

The wood activated carbon market holds a distinct share across various purification and processing sectors. Within the overall Activated Carbon Market, it accounts for about 15%, as coal-based and coconut-shell variants dominate due to higher adsorption capacity and lower cost. In the Water and Wastewater Treatment Materials Market, its share is around 4%, given its role in removing organic contaminants and chlorine from potable water and industrial effluents. For the Air and Gas Purification Market, it represents approximately 6%, driven by applications in VOC control and odor removal. In the Food and Beverage Processing Materials Market, wood-based activated carbon contributes about 8%, particularly in sugar refining, beverage decolorization, and edible oil purification. Within the Pharmaceutical and Chemical Processing Market, its share is close to 5%, where it is used for purification and decolorization of intermediates. Growth is supported by demand for renewable and sustainable raw materials, regulatory compliance in water treatment, and rising usage in specialty applications. Its high porosity, superior color removal capabilities, and chemical compatibility make it a preferred choice for food-grade and pharmaceutical applications. Despite higher production costs compared to other sources, increasing adoption in premium sectors positions wood activated carbon as a vital material for high-quality purification processes.

The wood activated carbon market is gaining traction, driven by escalating environmental concerns, regulatory mandates on water and air purification, and growing demand across municipal and industrial sectors. Advancements in carbonization technologies and rising preference for bio-based filtration materials are encouraging adoption of wood-derived activated carbon.

Favorable characteristics such as high porosity, renewability, and low ash content have supported its integration in purification and remediation systems. Increasing investment in decentralized water treatment facilities and the tightening of effluent discharge standards across developed and emerging markets are reinforcing demand.

Moving forward, innovation in activation processes and scalability of raw material sourcing are expected to shape market competitiveness and product versatility.

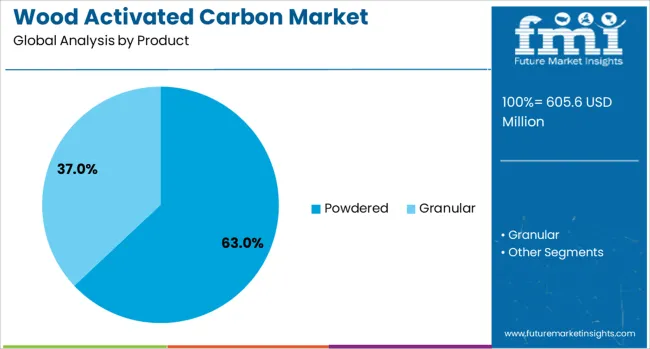

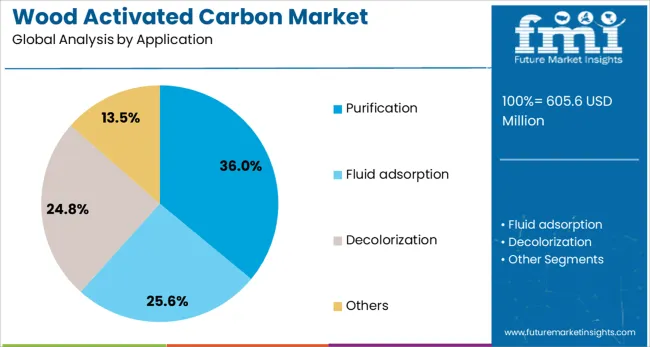

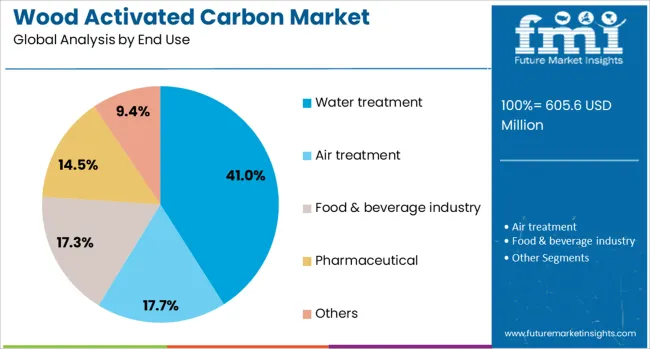

The wood activated carbon market is segmented by product, application, and end use and geographic regions. By product of the wood activated carbon market is divided into Powdered and Granular. In terms of application of the wood activated carbon market is classified into Purification, Fluid adsorption, Decolorization, and Others. Based on end use of the wood activated carbon market is segmented into Water treatment, Air treatment, Food & beverage industry, Pharmaceutical, and Others. Regionally, the wood activated carbon industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powdered form is projected to dominate the wood activated carbon market in 2025, contributing 63.0% of the overall revenue. This leadership has been driven by its superior adsorption capacity, ease of handling in liquid-phase applications, and compatibility with continuous dosing systems.

Its prevalent use in industrial processes and municipal water systems is attributed to faster kinetics and effective pollutant removal across varying pH levels.

The cost-efficiency of production and adaptability across purification and chemical processing industries have further reinforced its preference over other forms.

Purification is anticipated to lead with 36.0% share of the market by 2025. This segment’s growth is being shaped by rising demand for removal of contaminants, VOCs, and heavy metals from liquids and gases.

Industrial growth across chemical, pharmaceutical, and food sectors is accelerating demand for purification-grade activated carbon, especially where regulatory compliance and product purity are critical.

The ability to offer high throughput in filtration systems, coupled with its biodegradable sourcing, has positioned wood activated carbon as a preferred media in green purification technologies.

Water treatment applications are expected to hold 41.0% of the total market share in 2025, making it the leading end-use segment. This prominence is being supported by rising investment in municipal water infrastructure, increasing awareness of groundwater pollution, and stricter water quality standards globally.

Wood activated carbon is increasingly being utilized for its ability to remove chlorine, pesticides, organic compounds, and odor-causing agents efficiently.

Its use in point-of-use and large-scale filtration systems is being encouraged by its environmentally sustainable origin and effective lifecycle performance.

The wood activated carbon market is expanding due to increasing applications in water treatment, air purification, and food processing sectors. Growth in 2024 and 2025 was driven by rising demand for effective adsorption materials in industrial and municipal water systems. Opportunities are evident in pharmaceutical processing and energy storage applications where high-purity carbons are essential. Key trends include powdered carbon for liquid-phase treatment, advanced regeneration techniques, and integration in odor control systems. However, high production costs, raw material availability challenges, and performance variability under harsh conditions remain significant restraints affecting broader market adoption.

The primary growth driver is the growing reliance on activated carbon for efficient water purification. In 2024 and 2025, municipal water authorities and industrial plants increasingly adopted wood-based carbons for removing organic contaminants, chlorine by-products, and volatile compounds. Food and beverage industries used these materials to enhance product quality by eliminating color and taste impurities. Pharmaceutical filtration processes also incorporated wood carbons due to their superior porosity and surface area. These developments indicate that the necessity for clean water and high-quality processing solutions continues to propel the global demand for wood activated carbon.

Significant opportunities exist in pharmaceutical purification and energy storage systems. In 2025, demand surged for wood-based activated carbon in drug manufacturing for solvent recovery and impurity control, enhancing production efficiency. Emerging applications in supercapacitors and battery electrodes highlighted the role of high-surface-area carbons in advanced energy technologies. Manufacturers offering tailored solutions with precise pore structures gained traction in these specialized sectors. These factors suggest that companies focusing on research-driven formulations for high-performance segments will capture competitive advantages, particularly as functional material requirements expand across industrial and energy-related domains.

Emerging trends include increased adoption of IoT-enabled sensors and AI algorithms for real-time supply chain intelligence. In 2024, visibility platforms incorporated GPS tracking and RFID-based systems to monitor shipment conditions, reducing losses and delays. Predictive insights powered by machine learning optimized carrier selection and route planning, improving cost efficiency. Blockchain integration for secure and traceable data transactions also gained momentum. These developments indicate that future supply chain ecosystems will emphasize interconnected, data-driven solutions aimed at reducing inefficiencies, enhancing compliance, and delivering accurate, actionable insights across all operational stages.

Market restraints are shaped by elevated production costs and fluctuations in raw material supply. In 2024 and 2025, price volatility of hardwood feedstocks and rising energy costs during activation processes increased manufacturing expenses, limiting adoption in cost-sensitive regions. Performance limitations in aggressive chemical environments and difficulties in regenerating certain carbon grades added operational complexities. Limited supply chains in some emerging markets further restricted scalability. These constraints highlight the necessity for cost optimization, localized sourcing strategies, and material innovations to ensure long-term competitiveness of wood activated carbon in diverse applications.

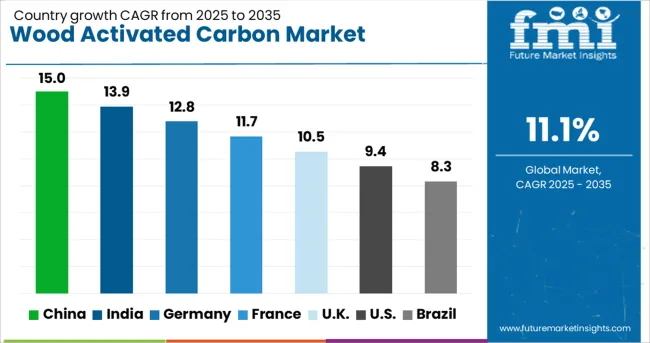

| Country | CAGR |

|---|---|

| China | 15.0% |

| India | 13.9% |

| Germany | 12.8% |

| France | 11.7% |

| UK | 10.5% |

| USA | 9.4% |

| Brazil | 8.3% |

The global wood activated carbon market is projected to grow at 11.1% CAGR from 2025 to 2035. China leads at 15.0% CAGR, driven by high demand in water treatment and industrial air purification. India follows at 13.9%, supported by growing adoption in food processing and pharmaceutical sectors. Germany posts 12.8% CAGR, emphasizing eco-compliant manufacturing for automotive and environmental applications. The United Kingdom grows at 10.5%, while the United States records 9.4%, reflecting steady adoption in mature markets focusing on renewable feedstock and high-performance filtration technologies. Asia-Pacific dominates growth due to large-scale production and urban infrastructure needs, while Europe and North America lead in sustainable and specialty-grade carbon innovations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wood activated carbon market in China is forecasted to grow at 15.0% CAGR, supported by increasing demand in water treatment plants and industrial emission control. Expanding urban infrastructure projects and stricter environmental regulations accelerate adoption of high-adsorption activated carbon for air and water purification. Manufacturers invest in steam activation and advanced carbonization technologies to improve pore structure and performance. Growing food and beverage sector also boosts demand for activated carbon in sugar refining and beverage purification applications.

The wood activated carbon market in India is projected to grow at 13.9% CAGR, driven by increasing use in wastewater treatment, pharmaceuticals, and packaged food industries. Demand for high-quality activated carbon rises due to strict regulatory norms for potable water and drug safety. Manufacturers emphasize cost-effective, eco-friendly production methods to cater to local requirements. Adoption in air purification systems for residential and industrial applications grows, supported by rising awareness of indoor air quality standards.

The wood activated carbon market in Germany is expected to grow at 12.8% CAGR, supported by EU sustainability directives and strong demand in automotive and chemical industries. Manufacturers focus on specialty-grade activated carbon for emission control in exhaust systems and volatile organic compound (VOC) reduction. Adoption in food and beverage processing, particularly in brewing and sugar refining, adds to demand. Producers invest in renewable feedstock-based production technologies, aligning with circular economy goals and green manufacturing practices.

The wood activated carbon market in the United Kingdom is forecasted to grow at 10.5% CAGR, driven by demand for sustainable filtration solutions across municipal water systems and indoor air quality products. Green building codes and strict emission reduction policies accelerate adoption in HVAC and industrial applications. Manufacturers develop high-performance carbon grades tailored for pharmaceutical purification and food safety. Expansion of e-commerce channels enhances availability of activated carbon for household air and water filters.

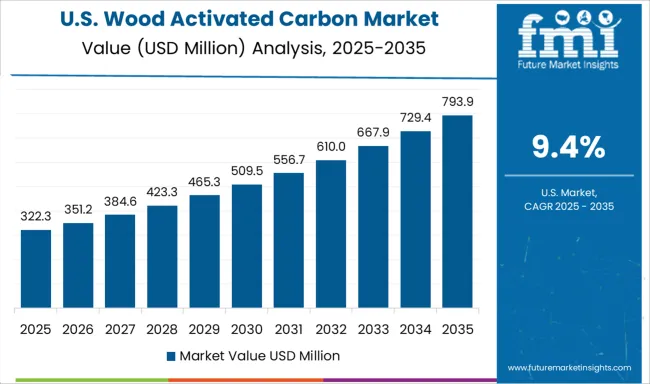

The wood activated carbon market in the United States is projected to grow at 9.4% CAGR, reflecting steady demand in water treatment, food, and environmental sectors. Rising investments in renewable energy projects drive adoption in gas purification systems. Producers prioritize high-porosity activated carbon for air quality control in industrial and residential environments. Regulatory requirements for mercury emission control in power plants further boost consumption. Product innovation focuses on activated carbon composites with enhanced adsorption capacity and recyclability.

The wood activated carbon market is dominated by Haycarb, which secures its leadership through a comprehensive range of high-quality activated carbon products used for water purification, air treatment, and industrial processing. Haycarb’s dominance is supported by vertically integrated operations, strong global distribution channels, and sustained investment in innovative activation technologies that deliver superior adsorption performance. Key players such as Jacobi Carbons, Kuraray, Ingevity, and Fujian Zhixing Activated Carbon maintain significant market shares by offering premium-grade wood-based activated carbons optimized for environmental, food, and pharmaceutical applications.

These companies focus on consistent quality, regulatory compliance, and capacity expansion to meet the growing demand for high-efficiency purification solutions. Emerging players including Acuro Organics Ltd, Adsorbent Carbons Private Ltd., Chemtex Speciality, D&R Corporation, and Induceramic are enhancing their presence by providing cost-effective products and targeting niche markets with customized specifications for specialty applications.

Market growth is being driven by increasing requirements for clean water and air, stringent environmental regulations, and the rising use of activated carbon in energy storage and chemical processing. Continuous advancements in activation techniques and the development of high-surface-area carbons are expected to shape future competitive strategies, ensuring strong opportunities for both established and emerging suppliers across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 605.6 Million |

| Product | Powdered and Granular |

| Application | Purification, Fluid adsorption, Decolorization, and Others |

| End Use | Water treatment, Air treatment, Food & beverage industry, Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Haycarb, Acuro Organics Ltd, Adsorbent Carbons Private Ltd., Chemtex Speciality, D&R Corporation, Fujian Zhixing Activated Carbon, Induceramic, Ingevity, Jacobi Carbons, and Kuraray |

| Additional Attributes | Dollar sales by activation method (physical vs chemical) and product form (pellets, powder, granules), segmented by industry (water purification, mining, food, pharma). Asia-Pacific leads demand, North America and Europe remain strong. Buyers prioritize low-carbon, certified solutions. Innovations include biochar-based activated carbon and low-temperature activation for reduced environmental impact. |

The global wood activated carbon market is estimated to be valued at USD 605.6 million in 2025.

The market size for the wood activated carbon market is projected to reach USD 1,735.1 million by 2035.

The wood activated carbon market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in wood activated carbon market are powdered and granular.

In terms of application, purification segment to command 36.0% share in the wood activated carbon market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast and Outlook 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA