The global wooden pallet rental service market is positioned for robust expansion over the next decade, driven by increasing emphasis on supply chain sustainability, growing adoption of circular economy principles in logistics operations, and rising demand for cost-effective asset management solutions across manufacturing and distribution sectors. The wooden pallet rental service market is projected to grow from USD 377.8 billion in 2025 to approximately USD 609.6 billion by 2035, representing an absolute increase of USD 231.8 billion over the forecast period. Demand translates into a total growth of 61.4%, with the wooden pallet rental service market expanding at a compound annual growth rate (CAGR) of 4.9% between 2025 and 2035.

The substantial growth trajectory reflects accelerating recognition of rental models' operational advantages, including reduced capital expenditure requirements, elimination of asset disposal complexity, and access to professionally maintained pallet pools that ensure consistent quality and regulatory compliance. The overall market size is expected to grow by approximately 1.6X during the forecast period, supported by expanding e-commerce fulfillment operations requiring flexible logistics infrastructure, manufacturing sector growth in emerging markets creating sustained pallet demand, and increasing corporate sustainability commitments driving the transition from ownership to rental models that optimize asset utilization and reduce environmental impact.

Industry dynamics are characterized by ongoing consolidation among major rental providers seeking scale advantages, technological innovation in pallet tracking and asset management systems, and development of hybrid service models combining rental flexibility with value-added logistics support. The transition from traditional pallet ownership to professionally managed rental pools creates substantial opportunities for established providers with comprehensive depot networks, reverse logistics capabilities, and quality assurance systems that ensure pallet availability and condition standards across diverse geographic markets and industry applications.

The competitive landscape features global rental providers with extensive pooling operations, regional specialists focusing on specific industry verticals or geographic markets, and emerging platforms leveraging digital technologies to optimize asset deployment and customer connectivity. Market concentration in developed economies contrasts with fragmented structures in emerging markets, where traditional ownership models remain prevalent but gradually transition toward rental adoption as logistics infrastructure matures and sustainability priorities gain prominence. The interplay between service quality requirements, pricing pressures, and operational efficiency considerations shapes procurement strategies across diverse end-use industries, from cost-sensitive commodity distribution to quality-critical pharmaceutical and food operations.

Market participants are increasingly investing in technology initiatives focused on improving asset visibility through RFID and IoT integration, optimizing depot networks and reverse logistics operations to reduce transportation costs, and developing sustainability reporting capabilities that support customer ESG objectives. These strategic advances, combined with favorable regulatory environments promoting reusable packaging systems and declining total cost of ownership compared to single-use alternatives, position the wooden pallet rental service market for sustained growth throughout the forecast period despite cyclical economic fluctuations affecting manufacturing and distribution activities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 377.8 billion |

| Market Forecast Value (2035) | USD 609.6 billion |

| Forecast CAGR (2025-2035) | 4.9% |

| SUSTAINABILITY & CIRCULAR ECONOMY | OPERATIONAL EFFICIENCY DEMANDS | LOGISTICS TRANSFORMATION |

|---|---|---|

| Corporate ESG Commitments Increasing corporate sustainability goals driving transition from pallet ownership to rental models that optimize asset utilization, reduce waste generation, and support circular economy principles across supply chains. |

Capital Expenditure Optimization Manufacturing and distribution operations seeking to minimize upfront capital investments and convert fixed asset costs to variable operational expenses through flexible rental arrangements. |

E-commerce Fulfillment Expansion Rapid growth of online retail and fulfillment operations creating sustained demand for scalable pallet solutions supporting dynamic inventory requirements and distribution complexity. |

| Waste Reduction Initiatives Growing emphasis on eliminating single-use packaging and minimizing disposal requirements driving adoption of reusable pallet pooling systems with professional maintenance and quality assurance. |

Quality Consistency Requirements Manufacturers and distributors requiring consistent pallet quality, dimensional accuracy, and condition standards that professional rental providers ensure through systematic inspection and maintenance programs. |

Supply Chain Complexity Expanding global supply chains and multi-tier distribution networks requiring flexible pallet deployment and retrieval capabilities that rental providers deliver through comprehensive depot networks. |

| Regulatory Compliance Support Increasing food safety, pharmaceutical handling, and export compliance requirements favoring professionally managed pallet pools with comprehensive quality documentation and traceability capabilities. |

Reverse Logistics Elimination Companies seeking to eliminate internal pallet management burden, including storage, repair, and disposition activities, through outsourcing to specialized rental providers with dedicated reverse logistics infrastructure. |

Technology Integration Development of advanced tracking systems, IoT-enabled asset monitoring, and digital platform connectivity enabling optimized pallet deployment and real-time visibility across distribution networks. |

| Category | Segments Covered |

|---|---|

| By Rental Duration | Long-term Rental, Short-term Rental |

| By Application | Food and Beverage Industry, Machinery and Metal Industry, Automotive Industry, Construction Industry, Other |

| By Region | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Long-term Rental | Dominates market in 2025 with 64.3% share, driven by manufacturing operations, established distribution centers, and retailers requiring predictable pallet availability with consistent pricing structures. Long-term contracts spanning 12+ months provide operational stability, preferential pricing, and dedicated pallet pool allocation supporting high-volume operations with consistent throughput. Momentum: steady growth through 2035 as manufacturers optimize working capital and eliminate pallet ownership complexity through multi-year service agreements. Watchouts: pricing pressure from competitive bidding, customer consolidation reducing contract values, technology requirements increasing service delivery costs. |

| Short-term Rental | Commands 35.7% market share in 2025, benefiting from seasonal operations, project-based logistics requirements, and companies testing rental models before long-term commitment. Flexible contracts supporting peak season demand, temporary distribution operations, and promotional activities create sustained short-term rental demand. Momentum: moderate growth driven by e-commerce fulfillment volatility, seasonal agricultural shipments, and construction project variability requiring flexible pallet access without long-term obligations. Watchouts: higher per-unit pricing limiting adoption for cost-sensitive operations, asset availability constraints during peak periods, complexity of managing variable customer base. |

| Segment | 2025 to 2035 Outlook |

|---|---|

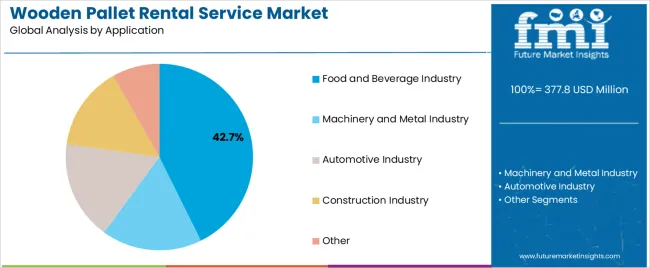

| Food and Beverage Industry | Largest application segment with 42.7% market share in 2025, driven by stringent hygiene requirements, high pallet turnover rates, and preference for professionally maintained pooling systems ensuring food safety compliance. Grocery distribution, beverage manufacturing, and food processing operations require consistent pallet quality and comprehensive cleaning protocols. Momentum: strong steady growth through 2035 supported by food safety regulations, cold chain expansion, and organized retail growth in emerging markets. Watchouts: quality specification complexity, cleaning and sanitation cost pressures, customer consolidation among major retailers affecting pricing power. |

| Machinery and Metal Industry | Holds 23.8% share in 2025, benefiting from heavy-duty pallet requirements, long-distance shipping operations, and preference for rental models eliminating pallet return logistics from distant manufacturing locations. Industrial equipment, metal fabrication, and machinery distribution require robust pallet specifications and flexible deployment. Momentum: moderate growth tied to industrial production cycles, infrastructure investment, and manufacturing sector expansion in emerging markets. Watchouts: cyclical demand volatility, extended rental periods reducing asset turnover, damage rates from heavy loads increasing maintenance costs. |

| Automotive Industry | Commands 16.4% market share, driven by just-in-time manufacturing requirements, established pallet pooling relationships, and preference for standardized pallet specifications supporting global supply chain integration. Parts distribution, assembly operations, and automotive logistics require precise pallet specifications and reliable availability. Momentum: steady growth through 2030 as automotive manufacturing expands in Asia and electric vehicle production scales, moderating thereafter as market matures. Watchouts: automotive industry cyclicality, OEM pricing pressures, transition to alternative packaging systems for certain components. |

| Construction Industry | Represents 10.6% share, characterized by project-based demand, variable pallet requirements, and preference for flexible rental arrangements supporting temporary site operations. Building materials distribution, concrete products, and construction equipment require short-term pallet access and flexible contract terms. Momentum: moderate growth driven by infrastructure investment programs and commercial construction activity, with regional variation based on development cycles. Watchouts: project completion timing variability, high damage rates from construction site conditions, seasonal demand fluctuations in temperate climates. |

| Other | Accounts for 6.5% share encompassing pharmaceutical distribution, chemical handling, paper products, and diverse manufacturing applications. Varying quality requirements, specialized handling needs, and diverse operational patterns create fragmented demand across multiple vertical markets. Momentum: selective growth in pharmaceutical and chemical segments driven by compliance requirements, offset by mature demand in traditional manufacturing applications. Watchouts: specialized specification requirements increasing service complexity, limited scale in niche segments, customer price sensitivity in commodity applications. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Sustainability Imperatives Corporate environmental commitments and regulatory frameworks promoting reusable packaging systems driving adoption of professionally managed pallet pooling services. Working Capital Optimization Manufacturers and distributors seeking to reduce capital tied up in pallet ownership and convert fixed costs to variable operational expenses. Quality Assurance Requirements Growing emphasis on consistent pallet condition, dimensional accuracy, and food safety compliance favoring professionally maintained rental pools over self-managed ownership. |

Pallet Loss and Damage Asset attrition through loss, theft, and irreparable damage creating ongoing replacement costs and reducing effective asset utilization for rental providers. Transportation Cost Pressure Reverse logistics expenses for pallet collection and redistribution representing significant operational costs affecting service pricing and profitability. Customer Switching Hesitation Established pallet ownership models and internal logistics processes creating organizational inertia and resistance to transitioning to rental service relationships. |

Digital Platform Integration Development of IoT-enabled tracking systems, mobile applications, and digital ordering platforms enabling real-time asset visibility and automated inventory management. Hybrid Service Models Evolution of integrated offerings combining pallet rental with value-added services including quality inspection, cleaning protocols, and supply chain analytics. Network Optimization Strategic depot expansion and consolidation initiatives reducing transportation distances and improving service responsiveness while controlling reverse logistics costs. Sustainability Reporting Enhanced environmental impact documentation and carbon footprint calculation capabilities supporting customer ESG reporting requirements and sustainability communications. |

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| United States | 4.7% |

Revenue from Wooden Pallet Rental Services in China is projected to expand significantly by 2035, driven by the country's extensive manufacturing base, growing e-commerce logistics infrastructure, and increasing adoption of modern supply chain practices among domestic companies. China's position as global manufacturing hub creates substantial pallet rental demand across diverse industries including automotive, machinery, consumer goods, and food processing operations requiring flexible logistics infrastructure.

Major rental providers including JPR and international operators are establishing comprehensive depot networks across primary manufacturing regions and logistics hubs to support growing customer requirements. The country's Belt and Road Initiative and expanding export operations create sustained demand for standardized pallet pooling systems supporting international shipping requirements.

Revenue from Wooden Pallet Rental Services in India is expanding rapidly by 2035, supported by comprehensive logistics infrastructure development, organized retail growth, and increasing adoption of modern supply chain practices replacing traditional loose cargo handling methods. India's manufacturing sector expansion and FDI growth in warehousing operations are creating sustained demand for standardized pallet systems.

International rental providers and domestic specialists are investing in depot networks and pallet inventory to support customer transition from ownership to rental models. Government initiatives promoting organized warehousing and food processing infrastructure development create favorable conditions for pallet rental adoption.

Demand for Wooden Pallet Rental Services in Germany is projected to grow steadily by 2035, supported by the country's mature pallet pooling market, sophisticated logistics infrastructure, and stringent quality standards requiring professionally maintained rental systems. German manufacturers and retailers maintain long-established relationships with major rental providers including CHEP and LPR.

The country's emphasis on sustainability, circular economy principles, and supply chain efficiency drives continued preference for rental models over pallet ownership. Comprehensive depot networks, reverse logistics capabilities, and quality assurance systems support reliable service delivery across diverse industry applications.

Revenue from Wooden Pallet Rental Services in Brazil is growing substantially by 2035, driven by agricultural export operations, domestic manufacturing growth, and increasing adoption of modern logistics practices in organized retail and food processing sectors. The country's position as major agricultural exporter creates sustained pallet demand for cargo handling and international shipping operations.

Major rental providers including CHEP are expanding depot networks and service capabilities to support growing customer requirements. Infrastructure investments in warehousing and distribution facilities create opportunities for pallet rental adoption replacing traditional handling methods.

Demand for Wooden Pallet Rental Services in United States is projected to grow moderately by 2035, reflecting market maturity but sustained by e-commerce fulfillment expansion, food safety emphasis, and ongoing service innovation enhancing value delivery. The established pallet pooling market features comprehensive depot networks, sophisticated tracking systems, and diverse service offerings.

Major providers including CHEP, PECO Pallet, and iGPS Logistics maintain competitive positions through service quality, technology integration, and customer relationships. Market dynamics emphasize operational efficiency, sustainability performance, and value-added service capabilities differentiating providers beyond basic pallet rental functionality.

The wooden pallet rental service market in Europe is projected to grow from USD 98.4 billion in 2025 to USD 156.7 billion by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 32.6% market share in 2025, declining slightly to 31.8% by 2035, supported by its extensive manufacturing base, sophisticated logistics infrastructure, and mature pallet pooling adoption across automotive, food and beverage, and industrial sectors.

France follows with a 21.4% share in 2025, projected to reach 22.1% by 2035, driven by organized retail growth, food processing industry requirements, and comprehensive logistics modernization programs. The United Kingdom holds a 18.7% share in 2025, expected to stabilize at 18.3% by 2035 despite market maturity and post-Brexit logistics adjustments. Spain commands a 13.9% share, benefiting from agricultural export operations and manufacturing sector expansion, while Italy accounts for 9.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.2% to 5.4% by 2035, attributed to logistics infrastructure development in Poland, Czech Republic, and other Eastern European countries implementing modern warehousing operations and transitioning from traditional pallet ownership to professional rental services.

Japanese Wooden Pallet Rental Service operations reflect the country's exacting quality standards, sophisticated logistics infrastructure, and preference for long-term supplier relationships ensuring consistent service delivery. Major rental providers including Sanko, Nissei Co., and specialized regional operators maintain rigorous quality control processes, comprehensive maintenance programs, and customer-specific specifications supporting diverse industry requirements from automotive manufacturing to food distribution.

The Japanese market demonstrates unique operational characteristics, with significant emphasis on pallet cleanliness, dimensional precision, and condition standards exceeding typical international specifications. Companies require detailed quality documentation, batch traceability, and comprehensive inspection protocols that support food safety compliance, pharmaceutical handling requirements, and automotive just-in-time delivery systems.

Regulatory oversight through the Ministry of Agriculture, Forestry and Fisheries establishes phytosanitary standards for wooden pallets, while food safety regulations require comprehensive hygiene protocols for pallets used in grocery distribution and food processing applications. These stringent requirements create barriers for international providers but ensure quality levels supporting Japan's premium manufacturing and distribution operations.

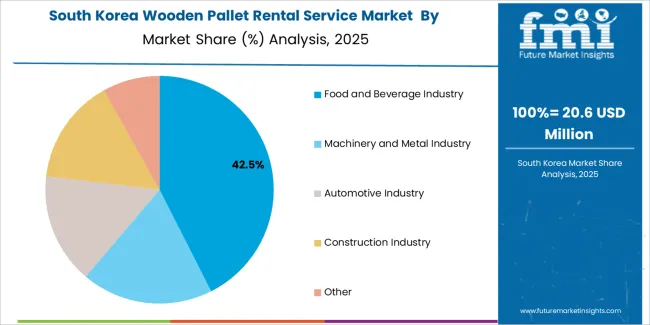

South Korean Wooden Pallet Rental Service operations reflect the country's technologically advanced logistics sector, export-oriented manufacturing economy, and emphasis on supply chain efficiency optimization. Major conglomerates including Samsung, LG, and Hyundai maintain sophisticated pallet management requirements supporting just-in-time manufacturing, export shipping operations, and comprehensive quality assurance systems.

The Korean market demonstrates particular strength in integrating pallet rental services with comprehensive logistics solutions, with providers offering value-added services including warehouse management support, inventory optimization, and supply chain analytics alongside basic rental functionality. This integrated approach creates competitive differentiation and supports long-term customer relationships.

Regulatory frameworks emphasize environmental sustainability and resource efficiency, with government initiatives promoting circular economy principles and reusable packaging systems. The Ministry of Environment supports pallet pooling adoption through favorable regulations and sustainability incentive programs that encourage transition from single-use packaging to professionally managed rental systems.

The competitive landscape in the wooden pallet rental service market reflects pronounced consolidation around global scale providers, comprehensive depot network coverage, and operational excellence in reverse logistics management. Profit pools concentrate among established rental providers commanding market leadership through extensive asset bases, strategic depot locations, and long-term customer relationships built over decades of consistent service delivery. Value migration accelerates toward providers demonstrating superior asset utilization, technology-enabled tracking and visibility, and comprehensive sustainability documentation supporting customer ESG objectives.

CHEP maintains global market leadership through its blue pallet pooling platform, comprehensive international depot network spanning 60+ countries, and established relationships with major retailers, manufacturers, and logistics providers across diverse industries. The company's scale advantages enable competitive pricing while maintaining quality standards, supported by sophisticated asset tracking systems and optimized reverse logistics operations. PECO Pallet commands significant North American market share through red pallet pool recognition, established grocery distribution relationships, and quality consistency supporting food safety requirements.

Regional and national providers including JPR in Asia, Loscam in Asia Pacific, and LPR in Europe maintain competitive positions through geographic focus, industry specialization, and customer service responsiveness that larger global platforms may struggle to match in specific markets. These specialists leverage local market knowledge, flexible service offerings, and established customer relationships to defend market share despite scale disadvantages relative to global providers.

Switching costs remain substantial due to operational integration complexity, established logistics workflows, and quality specification requirements that create barriers to provider transition. Companies maintain multi-year contracts providing pricing stability and asset availability assurance, while providers face significant capital requirements for depot infrastructure, pallet inventory investment, and reverse logistics capabilities that limit new market entry.

Digital transformation initiatives accelerate as providers implement RFID tracking, IoT-enabled asset monitoring, and customer portal technologies enabling real-time visibility, automated ordering, and comprehensive reporting capabilities. These technology investments support operational efficiency while enhancing customer value delivery through improved asset deployment optimization and supply chain integration. Sustainability documentation capabilities become increasingly important as customers require carbon footprint calculation, circular economy metrics, and environmental impact reporting supporting corporate ESG commitments.

Consolidation continues through acquisition activity as larger providers expand geographic coverage and customer base while achieving operational synergies through depot network optimization and shared service platforms. Strategic priorities include depot network expansion in high-growth emerging markets, technology platform enhancement supporting customer connectivity and operational efficiency, and development of hybrid service models integrating pallet rental with value-added logistics capabilities that increase customer switching costs and support pricing premiums beyond commodity rental functionality.

| Items | Values |

|---|---|

| Quantitative Units | USD 377.8 billion |

| Rental Duration | Long-term Rental, Short-term Rental |

| Application | Food and Beverage Industry, Machinery and Metal Industry, Automotive Industry, Construction Industry, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, and other 40+ countries |

| Key Companies Profiled | CHEP, JPR, Kamps Pallets, Sanko, PPS, LPR, Mah Sing Plastics, Nissei Co., Ltd., iGPS Logistics, LLC, Ozkor, Loscam, PECO Pallet, LHT Holdings, Demes Logistics GmbH & Co. KG, Pallet Renew |

| Additional Attributes | Dollar sales by rental duration/application, regional demand (Asia Pacific, Europe, North America), competitive landscape, digital platform integration, sustainability documentation capabilities, and reverse logistics optimization driving operational efficiency, environmental performance, and circular economy implementation |

By Rental Duration

The global wooden pallet rental service market is estimated to be valued at USD 377.8 million in 2025.

The market size for the wooden pallet rental service market is projected to reach USD 609.6 million by 2035.

The wooden pallet rental service market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in wooden pallet rental service market are long-term rental and short-term rental.

In terms of application, food and beverage industry segment to command 42.7% share in the wooden pallet rental service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Wooden Decking Market Size, Growth, and Forecast 2025 to 2035

Wooden Barrels Market Growth - Demand & Forecast 2025 to 2035

Market Share Insights of Wooden Crate Providers

Wooden Box Market Demand & Premium Packaging Trends 2024-2034

Wooden Pallets Market

Wooden Pallet Collars Market

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Palletizer Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA