The pallet displays market is witnessing steady growth driven by the increasing demand for effective in-store product visibility and enhanced retail presentation strategies. The adoption of pallet displays is being fueled by the expansion of modern retail formats and the growing importance of point-of-purchase marketing. Manufacturers and retailers are increasingly investing in customizable and eco-friendly display solutions to improve brand appeal and optimize floor space utilization.

The market is also benefiting from the rise in consumer goods and packaged food sales, leading to higher demand for promotional and transport-efficient display systems. Additionally, advances in digital printing and sustainable materials have enhanced the design flexibility and cost-efficiency of pallet displays.

As global retail environments evolve, pallet displays are being integrated into omnichannel merchandising strategies, enabling improved consumer engagement and higher product turnover rates The future outlook remains positive as sustainability trends and visual merchandising innovations continue to reshape retail display strategies across both developed and emerging economies.

| Metric | Value |

|---|---|

| Pallet Displays Market Estimated Value in (2025 E) | USD 1.6 billion |

| Pallet Displays Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The market is segmented by Product, Material, and End use and region. By Product, the market is divided into Full pallet display, Half pallet display, and Quarter pallet display. In terms of Material, the market is classified into Paper and paperboard, Plastic, Glass, and Metal. Based on End use, the market is segmented into Food and beverages, Cosmetics and personal care, Pharmaceuticals, Electronics, Automotive, and Other industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The full pallet display segment is projected to hold 45.00% of the pallet displays market revenue share in 2025, making it the dominant product type. The growth of this segment is being influenced by its efficiency in accommodating large product volumes and reducing restocking efforts for retailers.

Full pallet displays have been widely adopted by large retail chains due to their convenience in logistics handling and direct placement on sales floors, minimizing labor costs and improving inventory management. Their ability to enhance brand visibility through larger graphic areas and improved structural stability has also contributed to their prominence.

Furthermore, the rising demand for bulk packaging and seasonal product promotions across supermarkets and hypermarkets is supporting this segment’s expansion The cost-effectiveness of using full pallet displays for high-traffic retail environments and their compatibility with automated handling systems are further strengthening their dominance in the global pallet display market.

The paper and paperboard material segment is estimated to account for 50.00% of the pallet displays market share in 2025, emerging as the leading material type. This growth is being driven by the increasing preference for sustainable and recyclable display materials in line with environmental regulations and corporate sustainability goals. Paper and paperboard materials offer excellent printability, allowing for high-quality graphics and branding, which are critical for consumer engagement at retail outlets.

The lightweight and cost-effective nature of these materials supports efficient transportation and easy assembly, making them suitable for short-term promotional use. Growing awareness among retailers and manufacturers regarding eco-friendly packaging solutions is further contributing to this segment’s leadership.

Additionally, continuous improvements in paperboard strength and coating technologies have enhanced durability and moisture resistance, making these materials suitable even for heavier product displays The segment’s growth is expected to remain strong as global retail sectors continue to transition toward sustainable display and packaging solutions.

The food and beverages segment is anticipated to capture 35.00% of the pallet displays market revenue share in 2025, positioning it as the leading end-use category. The segment’s dominance is attributed to the increasing utilization of pallet displays for promoting packaged foods, snacks, and beverages in retail environments. Rising consumption of convenience food products and frequent product launches have LED manufacturers to adopt pallet displays for effective point-of-sale marketing.

These displays enhance product visibility, encourage impulse purchases, and facilitate bulk promotions, which are key drivers in competitive retail spaces. Additionally, the growing penetration of supermarkets, hypermarkets, and warehouse clubs has amplified the demand for durable and visually appealing display systems tailored for food and beverage packaging.

The shift toward sustainable materials and customizable designs aligns with the marketing strategies of leading food and beverage brands, reinforcing this segment’s market leadership The continuous evolution of retail merchandising practices is expected to further strengthen the role of pallet displays in this industry.

The below table presents the expected CAGR for the global pallet displays market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 3.1% (2025 to 2035) |

| H2 | 3.5% (2025 to 2035) |

| H1 | 3.0% (2025 to 2035) |

| H2 | 3.6% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 3.1%, followed by a slightly higher growth rate of 3.5% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.0% in the first half and remain relatively moderate at 3.6% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Global E-commerce Spurs Pallet Displays Demand for Efficiency in Warehousing

With increasing consumer spending and preference for convenience in shopping, the e-commerce sector at the global level is experiencing an augmented response. E-commerce has enabled a diverse range of products by sitting in one place, instead of making efforts to visit the shops for buying purposes.

According to The International Trade Administration, USA Department of Commerce, business to commerce (B2C) e-commerce industry at the global level is estimated to reach USD 5.5 trillion at a rate of 14.4% by 2035. This growth translates to the demand for pallet displays for well-organized warehousing and logistics for enhancing order fulfilment efficiency.

Pallet displays allow for storage optimization by properly arranging and stocking products in the warehouse by labelling and grouping them accordingly, reducing the risks of shipping errors. They provide systematic tracking for inventory levels, which helps in maintaining adequate stock levels and fulfil customer orders promptly.

As these pallet displays streamline operations, reduce overall logistics costs and ensure quick access and retrieval of items from pallets, speeding up order processing time, they are facing burgeoning demand from the global e-commerce sector.

Eco-Friendly Paper Pallets Displays Surge amid Sustainability Trends

Due to rising worldwide sustainability concerns, stringent regulatory standards and transition among consumers for recyclable and biodegradable materials, the demand for paper and paperboard-based products in on the rise. Paper pallet displays are favored in regions like Europe where plastic has been banned.

Apart from its benefits to the environment, it also offers advantages such as being lightweight providing ease in handling and transport, and less expensive than other display materials like metal or heavy-duty plastic making it suitable for both small retailers needing simple, cost-effective displays.

This has enticed eco-conscious consumers for brands and their products highlighting their commitment to minimize the impact on the environment. As per the survey from Two Sides Global Network, 55% of consumers are choosing brands and retailers that have replaced plastic products with paper and paperboard products.

By using paper pallet displays, the manufacturers are focusing on reducing the dependency on finite resources and also reducing the amount of pollution created by traditional packaging materials. This in turn is assisting in curbing the carbon footprint across the globe.

Due to the escalating emphasis on sustainable practices in production, distribution and disposal and minimizing the use of material, the demand for eco-friendly products from consumers is driving the cement packaging market.

Fragility Challenges May Restrict Pallet Displays Market Growth

Although pallet displays have numerous benefits for many products, it poses significant challenges when used for fragile products. Pallet displays are general designed for high-volume, bulk display of products, which may not suit with the organized arrangement and spacing for fragile products like glassware, bottled goods, medical supplies, bulbs and many other products.

Standard pallet display don’t have the necessary support necessary to secure fragile items safely and making customized pallet displays with cushioning can lead to high investment costs. Inadequate support can lead to breakage and damage of fragile products during handling, transportation, and stocking due to collision with other products.

Such factors like improper safety or fragile and products and logistic challenges may cause hindrance for the pallet displays market.

The global pallet displays market recorded a CAGR of 2.4% during the historical period between 2020 and 2025. Market growth of pallet displays was positive as it reached a value of USD 1,463.9 million in 2025 from USD 1,332.4 million in 2020.

The pallet displays market is experiencing growth due to its increased usage in food and beverage, medical, cosmetics and personal care industries, electronics and automotive industries. Pallet displays are primarily used for improving product visibility for seeking the attention of customers in retail environments, leading to increased sales.

Pallet displays are available in different product types such as full pallet displays, half pallet displays and quarter pallet displays and multiple materials like paper, paperboard, glass, plastic and metal as per the promotional need, availability of space of the user and types of products to be displayed.

Apart from this, they are also used for amplifying logistic efficiency and cross-promotion by locating complementary products to encourage cross-selling and impulse purchases.

Full pallet displays are used more often because of their ability to increase product visibility to the maximum. Paper-made pallet displays are gaining popularity due to their recyclability and compliance with sustainability regulations and standards. Pallet displays possess flexibility for customizing as per the needs of different end-use industries depending on their product types.

The rise in demand for effective brand marketing methods from several end users for augmenting sales is expected to create opportunities for the market.

Tier 1 companies comprise market leaders with a market revenue of above USD 45 million capturing significant market share of 15% to 20% in global market. These market leaders are characterized by high production capacity for making products with multiple materials.

These market leaders are distinguished by their ability to design customized solutions, broad geographical reach, and strong customer base across the globe. Prominent companies within tier 1 include International Paper Company, DS Smith plc, Smurfit WestRock plc, Sonoco Products Company and Pratt Industries.

Tier 2 companies include mid-size players with revenue of USD 15 to USD 45 million having presence in specific regions and highly influencing the local market. These are characterized by their limited geographical footprint. These market players have good reputation in market but may not have availability of enough machinery and equipment to fulfill the fluctuating demands from several markets.

Prominent companies in tier 2 include siffron, Inc., Marketing Alliance Group, Felbro, Inc., Creative Displays Now, USA Display Group, Bennett, Abbott-Action Packaging, TPH Global Solutions and Berkley.

Tier 3 includes the majority of small-scale companies operating within target markets within their localities with revenue below USD 15 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of financial resources and research and development capacity for necessary technological advancement according to the changing demands from end users.

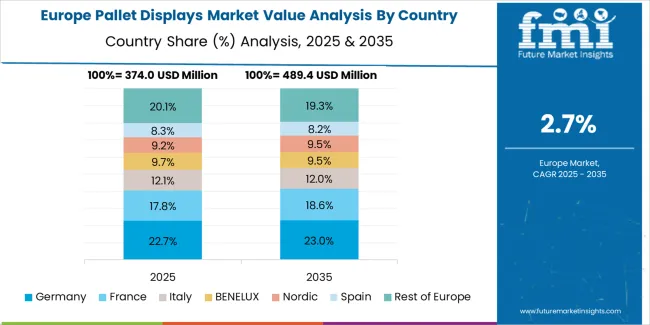

The section below covers the future forecast for the pallet displays market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 2.2% through 2035. In South Asia and Pacific, India is projected to witness a CAGR of 6.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.2% |

| Germany | 1.9% |

| China | 5.5% |

| UK | 2.4% |

| Spain | 3.2% |

| India | 6.1% |

| Canada | 2.0% |

The pallet displays industry in India is projected to grow at a CAGR of 6.1% compared to other countries in the South Asia and Pacific region by 2035.

Due to the rising population in India, the demand for various products across the rural and urban sectors has increased. Over the years, retail stores have been the most preferred distribution channel, especially in urban regions for shopping purposes.

As per the study of the Indian Brand Equity Foundation (IBEF), the retail industry in India is recognized as one of the past-faced industries, contributing 10% to the country’s economy and estimated for USD 2 trillion in value by 2035. Retail stores have availability of a variety of products pertaining to different industries, people usually choose these stores as they can get most of their products in one place.

Due to the diversity in products, pallet displays are being used on a large scale for effective visibility among other products, which helps customers to easily identify their products and drive their purchasing decisions. Due to its beneficial features which directly affect the sales growth of product, the plastic pallets are expected to experience surging demand in India.

The pallet displays industry in the USA offers a lot of opportunities amid sustainability initiatives such as using recycled paper over other materials. The country is anticipated to record a CAGR of 2.2% during the evaluation period.

Various organizations and government bodies have imposed stringent regulations over the use of non-recyclable materials like plastic. They are also promoting initiatives for the utilization of recycled paper as a primary material for products.

The American Forest and Paper Association (AF&PA) has aimed to increase the use of recycled paper for making new products to 50% by 2035 with the objective of curbing the use of traditional paper and related materials.

As pallet displays are made from paper, such initiatives are encouraging manufacturers to make innovative pallet displays made from paper and paperboard and also creating awareness among users towards choosing paper products over other products. These efforts taken by associations in the USA are expected to push the demand for pallet displays made from recycled paper in the upcoming years.

The section contains information about the leading segments in the industry. In terms of product, full pallet display is estimated to account for a share of 46.1% by 2035. By material, paper and paperboard is projected to dominate by holding a share of 64.1% by the end 2035.

| Product | Full Pallet Display |

|---|---|

| Value CAGR (2035) | 4.0% |

Out of the multiple product types, full pallet display is expected to lead the market during the forecast period. Full pallet display is anticipated to rise at a CAGR of 2.8%, and hold for 46.1% of the total market share till the end of 2035.

One of crucial reasons that impacts the sales of any product is the efficiency in seeking customer attention for the product. Full pallet displays are used for maximum visibility of the product for customers to attract their attention, leading to increased viewer-to-buyer ratio and ultimately boosting the sale of products.

Full pallet displays have the ability to accommodate large volume of products, making them ideal for high-volume sales environments and reducing the frequency of restocking.

These pallet displays are easier to handle for transportation and stocking of goods in retail stores or distribution centers using forklifts, leading to reduced operational downtime. Its versatility and flexibility allows for boarding variety or products and for making seasonal promotions or marketing campaigns in food and beverage, pharmaceutical, personal care and many other end use industries.

Due to the benefits of full pallet displays over other product types for maximizing the product exposure and sales growth, the pallet displays are expected to gain impetus demand in the assessment period.

| Material | Paper and Paperboard |

|---|---|

| Value CAGR (2035) | 3.2% |

Pallet displays made from paper and paperboard are estimated to lead the pallet displays market at a growth rate of 3.2% till 2035.

Various materials are used for making pallet displays including plastic, metal, glass, paper and paperboard as per the requirement of the end-use industries. Paper and paperboard pallet displays are favored over other materials due to their additional benefits.

Pallet displays made from paper are lightweight, offering ease in handling, and transport and reducing shipping costs. Additionally, these materials can be customized with cuts, folded, and molded into various shapes and sizes as per changing demands for creating eye-catching designs, printing slogans and branding on their displays.

These pallet displays are recyclable and biodegradable, aligning with increasing sustainability concerns and changing consumer preference for environment-friendly products.

Paperboard pallet displays are very easy to assemble in retail stores or grocery stores without the need for any tools or special equipment, saving time and labor costs during installation in retail environments. These comprehensive benefits make paper and paperboard pallet displays a preferred choice across various industries, propelling their demand over the forecast period.

Key players of pallet displays industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies for new product development.

Key Developments in Pallet Displays Market

The pallet displays market is segmented into multiple products which include full pallet displays, half pallet displays, and quarter pallet displays.

Pallet displays market is categorized in terms of materials into paper and paperboard, plastic, metal, and glass.

Major end user related to pallet displays market include food and beverage, cosmetics and personal care, pharmaceuticals, electronics, automotive, and other industrial.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

The global pallet displays market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the pallet displays market is projected to reach USD 2.2 billion by 2035.

The pallet displays market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in pallet displays market are full pallet display, half pallet display and quarter pallet display.

In terms of material, paper and paperboard segment to command 50.0% share in the pallet displays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizer Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pallet Jacks Market Size and Share Forecast Outlook 2025 to 2035

Pallet Drum Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Racking Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Palletizing Machines Market Growth & Demand 2025 to 2035

Pallet Corner Boards Market from 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA