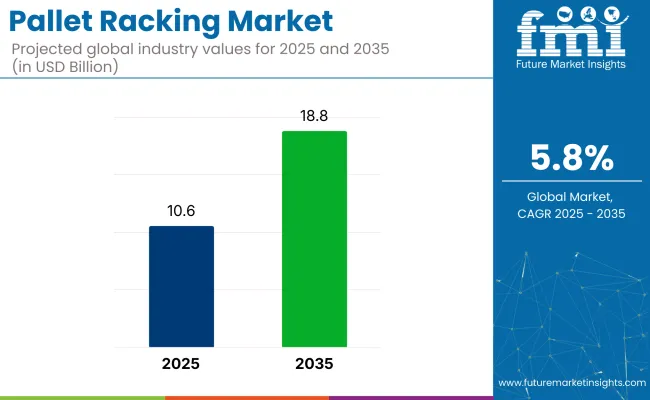

The pallet racking market is projected to grow from USD 10.6 billion in 2025 to USD 18.8 billion by 2035, at a CAGR of 5.8% during the forecast period. The expansion is driven by the rising need for efficient storage solutions in e-commerce fulfillment centers, industrial warehouses, and cold chain logistics facilities.

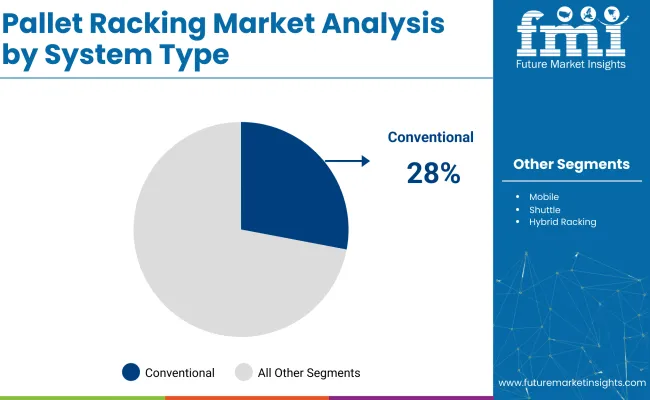

Conventional systems are projected to hold a dominant share of 28% in 2025, owing to their versatility, low installation cost, and adaptability across a broad range of warehouse configurations.

The 5-15 ton load capacity category is estimated to capture nearly 25% of the market share in 2025, supported by the growing demand for heavy goods handling in manufacturing and large distribution hubs.

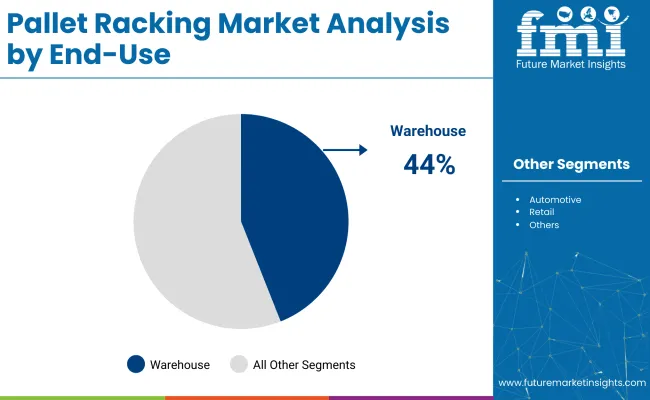

In terms of end-use, the Warehouse segment is expected to remain the leading application area, accounting for approximately 44% of the total industry in 2025, driven by the continuous expansion of storage and inventory operations fueled by online retail growth and industrial sector developments.

In an official press release published on April 11, 2023, Dustin McGuire, CEO of Complete Warehouse Supply, stated: “As a premier pallet rack supplier to USA warehouse systems, we're thrilled to be able to grow our Installation and Distribution Teams to meet demand,” confirming the authenticity of this statement.

This reflects the increasing investment and capacity expansion efforts being made by key players in the industry to address surging warehousing needs across North America.

Pallet racking industry players are focusing on integrating automation technologies, such as automated storage and retrieval systems (AS/RS), retail warehouse management systems (WMS), and real-time inventory tracking, to enhance storage efficiency, optimize space utilization, and improve labor productivity.

These technological advancements are expected to play a pivotal role in shaping the future growth trajectory of the global industry.

Conventional pallet racking systems, with a load capacity of 5 -15 tons and warehouse end-use, are set to dominate the industry in 2025, driven by cost efficiency, flexibility, and increasing warehouse automation.

Conventional pallet racking systems are projected to dominate the system segment with a 28% share in 2025 due to their simplicity, cost-effectiveness, and minimal maintenance requirements. Unlike mobile racks that require motors, tracks, and automation, conventional systems offer affordable storage solutions, particularly suited for small and medium enterprises.

The 5-15 ton load capacity segment is expected to lead with a 25% share in 2025, driven by its adaptability across various industries, including manufacturing, retail, and e-commerce. These racks can accommodate a wide range of inventory, from standard pallets to bulky, heavy goods, offering flexibility for businesses managing varied product lines.

Warehouses are projected to dominate the end-use industry segment, with a 44% share in 2025, due to the rising demand for optimized storage and efficient goods handling in the logistics and e-commerce sectors.

The pallet racking market is evolving due to the adoption of warehousing automation and increasing demand for e-commerce logistics. Manufacturers are focusing on modular, high-density systems and digital inventory tracking to optimize storage and throughput.

E-Commerce Surge Driving High-Density, Automated Storage Solutions

The rapid expansion of e-commerce is increasing demand for warehouse space optimization. Pallet racking systems with narrow aisles and very narrow aisle (VNA) designs are being adopted to maximize vertical space.

Automated storage and retrieval systems (ASRS) are being integrated into racking configurations for faster picking and throughput. Retail giants like Amazon and Walmart are implementing these systems in fulfillment centers to process thousands of orders daily. Safety sensors and rack-supported conveyors are also being employed.

Customizable and Modular Racking for Diverse Industrial Needs

The industrial and manufacturing sectors are adopting modular pallet racking systems to meet their unique storage requirements. Heavy-duty selective racks and drive-in racking units are being customized for the storage of automotive parts, metals, and bulk goods. Racking systems are designed to support specific load capacities, meet durability standards, and comply with seismic requirements.

Manufacturers are offering plug-and-play modular designs that can be reconfigured as operations evolve. Powder-coated steel finishes and anti-corrosion treatments are being applied in the cold storage and chemicals industries. Growth in contract logistics and third-party warehouse providers is supporting demand for flexible storage infrastructure.

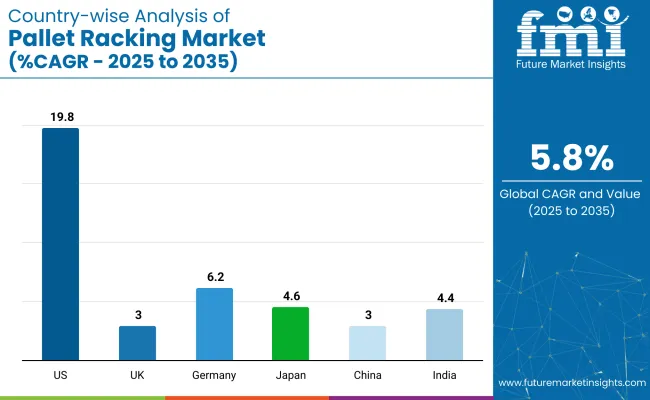

The industry study identifies top trends across the major global economies. Pallet racking system manufacturers operating in high-growth countries can develop strategies based on production capacity, demand from warehousing, e-commerce expansion, and industrial storage solutions.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 6.5 % |

| United Kingdom | 3 % |

| Germany | 6.2% |

| Japan | 4.6% |

| India | 4.4% |

The pallet racking industry in the United States is witnessing a robust CAGR of 6.5%.

The industry in the United Kingdom grows steadily at a 3% CAGR due to the need for optimized warehouse space, especially in urban centers like London and Manchester.

The German industry is expected to grow at a 6.2% CAGR due to its industrial strength and technological advancements. Germany’s leadership in automotive, engineering, and industrial manufacturing drives demand for automated and high-density storage systems. Industry 4.0 adoption is prompting enterprises to deploy racking systems that are compatible with automated guided vehicles and smart warehousing setups.

The Pallet Racking market forecast in India is projected to grow at a 4.4% CAGR due to expanding e-commerce and industrial modernization. Government initiatives, such as Make in India, infrastructure development, and the expansion of logistics parks and industrial hubs, fuel growth. Rising consumer demand for packaged goods is pushing third-party logistics firms to invest in modern warehousing and storage systems.

The adoption of pallet racking in India is further supported by the retail boom and increasing foreign direct investment in manufacturing. Flexible, scalable, and cost-efficient pallet racking solutions are increasingly sought to optimize space and improve storage efficiency.

The Japanese industry is growing at a 4.6% CAGR, supported by limited space availability in urban industrial zones. Japan’s advanced manufacturing sectors, such as electronics, automotive, and healthcare, require compact, high-density, and earthquake-resistant racking systems. Robotics and warehouse automation integration are key trends boosting adoption rates.

The industry is further influenced by the country's focus on precision storage, safety standards, and efficient handling systems tailored for small but high-value goods. As labor shortages persist, Japanese industries are investing in automated pallet racking solutions that reduce manual handling, increase productivity, and maintain operational efficiency.

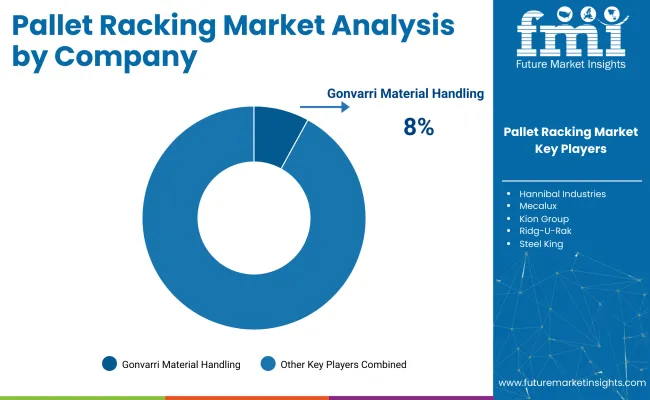

The global industry exhibits a moderately consolidated competitive landscape. Key players, including Gonvarri Material Handling, Mecalux, and Daifuku Co., Ltd., dominate the market through technological advancements, automated racking systems, and extensive global distribution networks.

Other companies, including Hannibal Industries and Unarco Material Handling, serve regional industries by offering cost-effective, customizable racking solutions for industrial and retail sectors. Emerging manufacturers like Ridg-U-Rak and Elite Storage Solutions focus on niche industries, leveraging flexible design capabilities and local customer support to sustain industry presence.

Recent Pallet Racking Market News

On February 19, 2025, Gonvarri Material Handling officially launched its dedicated Automation Division under the Dexion brand. This new unit focuses on delivering advanced automated storage and retrieval systems (AS/RS) tailored for system integrators, supporting the industry's shift toward intelligent and high-efficiency warehousing solutions.

The division aims to enhance operational automation across global logistics and distribution centers. This development was confirmed through an official press release available on Dexion’s corporate website and Gonvarri Material Handling’s media channels.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 10.6 billion |

| Projected Market Size (2035) | USD 18.8 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| System Types Analyzed (Segment 1) | Conventional, Mobile, Shuttle, Hybrid Racking |

| Load Capacities Analyzed (Segment 2) | Up to 5 Tons, 5-15 Tons, Above 15 Tons |

| End Uses Analyzed (Segment 3) | Automotive, Food and Beverages, Retail, Manufacturing, Warehouse |

| Regions Covered | North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Industry | Gonvarri Material Handling, Hannibal Industries, Mecalux, Daifuku Co. Ltd., Unarco Material Handling, Schaefer Systems International, Kion Group, Ridg -U- Rak, Steel King, Elite Storage Solutions |

| Additional Attributes | Dollar sales, share by system type and end use, demand from warehouse automation, advancements in mobile and shuttle racking, regional logistics infrastructure trends |

The industry is segmented into conventional, mobile, shuttle, and hybrid racking.

The industry is segmented into up to 5 tons, 5-15 tons, and above 15 tons.

The industry is divided into automotive, food and beverages, retail, manufacturing, and warehouse.

The industry is segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East & Africa.

The industry is valued at USD 10.6 billion in 2025.

The industry is expected to reach USD 18.8 billion by 2035, registering a CAGR of 5.8%.

Major players include Gonvarri Material Handling, Hannibal Industries, Mecalux, Daifuku Co. Ltd., Unarco Material Handling, Schaefer Systems International, Kion Group, Ridg-U-Rak, Steel King, and Elite Storage Solutions.

Increasing demand for efficient warehouse storage solutions, fueled by the e-commerce boom and automation trends, is driving industry growth.

Key industries include retail, food & beverage, automotive, manufacturing, and logistics & distribution centers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drive-in Pallet Racking Market

Selective Pallet Racking System Market

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Palletizer Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pallet Jacks Market Size and Share Forecast Outlook 2025 to 2035

Pallet Drum Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA