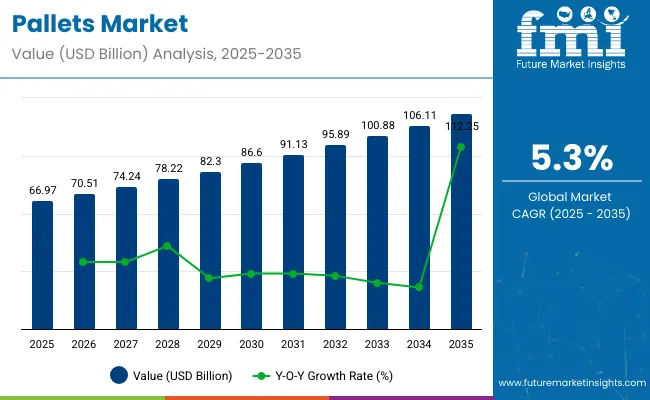

The global pallets market is estimated to generate USD 66.97 billion in 2025 and is projected to reach USD 112.25 billion by 2035, reflecting a CAGR of 5.3% over the forecast period. The revenue generated from pallets in 2024 was USD 63.60 billion. The food & beverage industry is the largest end-use sector, accounting for 38% of the market share, as pallets are extensively used for the handling, storage, and transportation of perishable products. To meet food safety standards, pallets with hygienic, pest-proof, and easy-to-clean features are increasingly required.

As global food trade and e-commerce continue to rise, manufacturers are investing in more effective pallet systems to improve supply chain efficiency and minimize product damage. In May 2024, DS Smith Plc invested €6 million to enhance its La Chevrolière packaging facility near Nantes, adding a new workshop for producing corrugated cardboard pallets. This move was aimed at meeting the growing regional demand for sustainable packaging solutions.

The pallet market is growing due to the increasing demands for efficient storage and transportation solutions in international trade, warehousing, and logistics. With the rise of e-commerce, seamless movement of goods is becoming crucial, prompting companies to prefer robust, reusable pallets that simplify shipping and storage.

The growing shift toward sustainability has led to increased demand for eco-friendly and recyclable pallets, particularly in materials such as wood, plastic, and metal. In December 2024, DS Smith partnered with Vilsund Blue, a Danish seafood producer, to replace plastic pallets with fiber-based corrugated alternatives, aimed at reducing CO₂ emissions and enhancing sustainability in seafood packaging. Smurfit Kappa Group also made strides in the industry with its merger with WestRock in July 2024, forming Smurfit WestRock, strengthening its global presence and capabilities in sustainable packaging solutions.

Technological advancements, including RFID-enabled intelligent pallets, are playing a key role in improving tracking, inventory management, and operational efficiency. The growing adoption of third-party logistics (3PL) and warehouse automation across industries is fueling further demand for advanced pallet systems. In November 2024, Smurfit WestRock introduced the EasySplit Bag-in-Box® design to help customers comply with upcoming packaging regulations, reinforcing the company’s commitment to sustainable packaging solutions. Despite challenges such as high initial investment costs and regulatory hurdles, the pallet market is set for continued expansion, with an incremental opportunity of USD 48.65 billion over the forecast period, expected to increase 1.8 times its current value by 2035.

| Metric | Value |

|---|---|

| Industry Size in 2025 | USD 66.97 billion |

| Industry Size in 2035 | USD 112.25 billion |

| CAGR (2025 to 2035) | 5.3% |

The global trade of pallets is influenced by their essential role in logistics, warehousing, and cross-border transportation. As supply chains grow more complex and globalized, the demand for durable and standardized pallets continues to rise in both developed and emerging markets. Trade activity reflects a balance between manufacturing hubs and high-demand import regions.

Pallets come in different materials such as wood, plastic, and metal, each regulated by specific standards to ensure safety, quality, and environmental compliance. Government regulations and certifications help maintain the integrity of pallets used in cross-border shipments, prevent pest contamination, and promote sustainable sourcing practices. These factors collectively shape the dynamics of the global pallets market.

The below table presents the expected CAGR for the global pallets market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 5.4% |

| H2(2024 to 2034) | 5.2% |

| H1(2025 to 2035) | 4.7% |

| H2(2025 to 2035) | 5.9% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.4%, followed by a slightly higher growth rate of 5.2% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.7% in the first half and remain relatively moderate at 5.9% in the second half. In the first half (H1) the market witnessed a decrease of 50 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

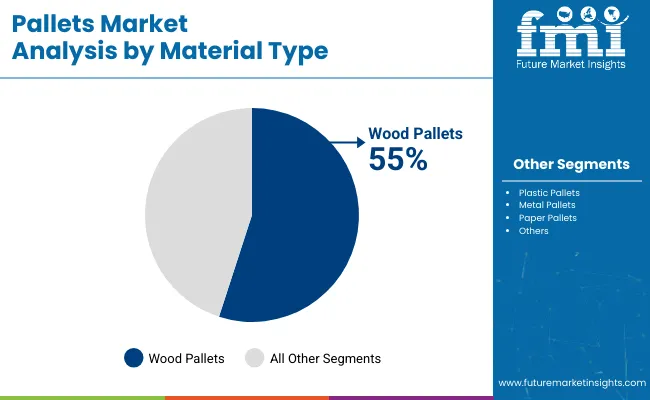

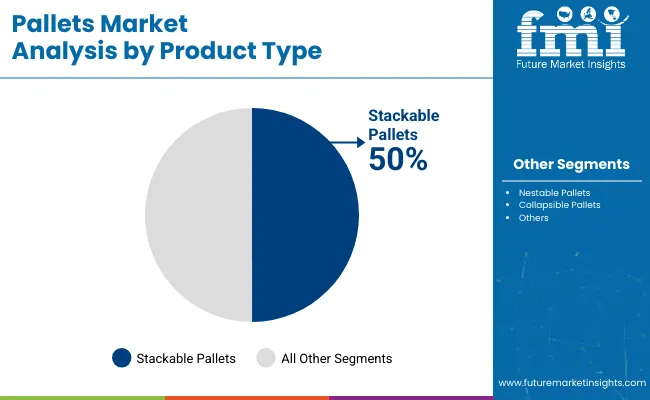

The pallets market is expected to experience steady growth, with key segments such as wood pallets and stackable pallets leading the market. Wood pallets are projected to dominate the material type segment, while stackable pallets will remain the leading product type, driven by their space-saving and efficient design in logistics and transportation.

Wood pallets are expected to capture 55% of the market share by 2025, remaining the dominant material type in the pallets market. Wood is the preferred material for pallets due to its durability, cost-effectiveness, and availability. Wood pallets are widely used across various industries, including food and beverage, automotive, pharmaceuticals, and manufacturing, due to their ability to withstand heavy loads and the ability to be easily repaired or recycled.

The widespread availability of wood and its environmental benefits in comparison to other materials like plastic or metal contribute to wood pallets continued dominance. Leading manufacturers such as CHEP, PalletOne, and Kuehne + Nagel offer wood pallets that cater to the growing demand for efficient and sustainable logistics solutions. Additionally, the rise in e-commerce and global trade is expected to fuel further demand for wood pallets, as they are a preferred choice for the storage and transportation of goods, reinforcing their position in the market.

Stackable pallets are projected to capture 50% of the market share by 2025, making them the dominant product type in the pallets market. Stackable pallets are favored for their space-efficient design, allowing them to be stacked on top of one another, maximizing storage and transportation capacity. This feature is particularly valuable in industries that require efficient use of space in warehouses, shipping containers, and trucks. Stackable pallets are commonly used in the food and beverage, retail, and logistics sectors due to their ability to improve supply chain efficiency and reduce storage costs.

Companies like ORBIS Corporation, Schoeller Allibert, and RPG Pallets manufacture stackable pallets, catering to the increasing demand for space-saving solutions in material handling. The growing focus on optimizing supply chain processes and reducing operational costs is expected to drive further demand for stackable pallets, ensuring their dominant position in the market. As industries continue to prioritize efficiency and sustainability, stackable pallets will remain a critical component in logistics and transportation.

With e-commerce and global trade expanding with the passage of time, there is a corresponding rise in demand for efficient material handling and transport applications. Again, since pallets are an integral part of warehousing, storage, and shipping, it is easy for a company to transport goods from one place to another, hence saving time and money in the process.

The pattern of third-party logistics providers, automated warehouses, and worldwide supply chains has urged a greater investment emphasis on reusable and durable pallet applications that have the ability to optimize operations. These also consist of automated material processing systems like robotic palletizers and conveyor systems that need standard pallets in order to work; therefore, this is an added driver for market growth.

A second reason for the demand is the growing adoption of just-in-time (JIT) inventory systems, as well as automation of warehouse functions, which require light, strong pallets that support rapid and efficient material handling.

Growing demand for biodegradable and recyclable pallets as a result of sustainability concerns and policy initiatives that promote widespread use of green packaging and logistics is driving growth in sustainable and recyclable pallet materials. Wooden pallets are manufactured without consideration to the environment and used for deforestation and wastage as well as manufacturing them. On the other hand, plastic pallets have issues related to the non-biodegradable factor.

So companies are directing efforts towards replacing with durable pallet material such as compressed wood, cardboard, bamboo, and recycled plastic, which are inexpensive carbon prints, durable, and highly recyclable. Governments around the globe enforce the strict packaging and waste management policies that compel companies to invest in reusable and recyclable pallet material. Besides, companies involved in ESG operations prefer eco-friendly pallet solutions that are a key growth driver for the market.

Wood, plastic, and metals make up the raw material market upon which the market for pallets constructs. Price volatilities of timber or price volatility of oil for plastics' production, or in metals can hugely affect production expenses of pallets. Intermitting interruption in the supply chain in periods of pandemics, geopolitics tensions, or trade regulations can also negatively hit raw material availability to make the production process expensive and delayed the delivery.

Inflation arising from rising transport and fuel prices also incurs expenses for pallet manufacturers, hence making it difficult to provide low-cost solutions. Every uncertainty in these poses a financial risk on their end for both consumers and manufacturers, particularly the ones relying heavily on bulk purchasing of pallets.

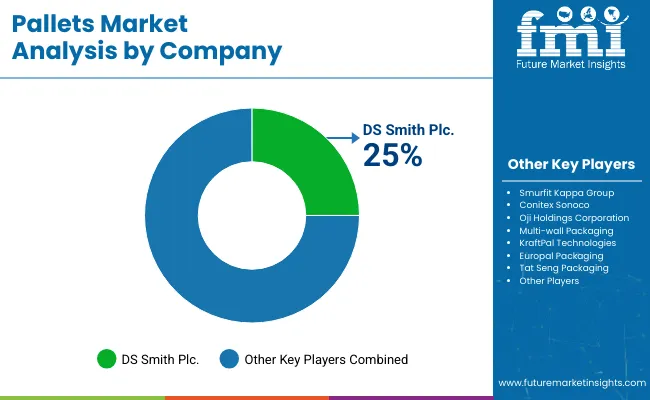

Tier 1 companies comprise market leaders capturing significant market share in pallets market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include DS Smith Plc., Smurfit Kappa Group, Conitex Sonoco, Oji Holdings Corporation.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Multi-wall Packaging, Kraft Pal Technologies Ltd., Europal Packaging, Tat Seng Packaging Group Ltd., Dopack, Interpal Industries Pte Ltd., Pheng Hoon Honeycomb Paper Products Pte. Ltd., Mabuchi Singapore Pte Ltd., The Alternative Pallet Company Ltd., Kimmo (Pty) Ltd., Tri-Wall Holdings Limited.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

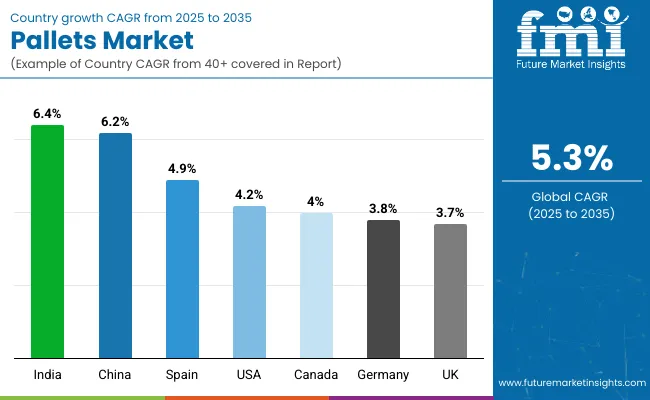

The section below covers the future forecast for the pallets market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 4.2% through 2035. In Europe, Spain is projected to witness a CAGR of 4.9% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Germany | 3.8% |

| China | 6.2% |

| UK | 3.7% |

| Spain | 4.9% |

| India | 6.4% |

| Canada | 4.0% |

The growth of Omni channel retail and e-commerce alongside warehouse automation in the United States has been high in terms of demand for pallets. Such completely met needs have their origins from some of the big retailers like Walmart, Amazon, and Target that operate thousands of fulfillment centers demanding millions of pallets to deal with take stock in an orderly manner out of these distribution centers.

Same-day services and online shopping have recently stolen the spotlight from most top companies, which have concentrated primarily on faster inventory movement and order fulfillment through the utilization of standardized pallets and then effective warehouse management. And most warehouse AS/RSs also need these pallets to be precision sized and durable for effective operation. Constant battery in terms of efficiency in time and cost leads to a strong demand for light, high-performance pallets in the USA market.

Germany has stringent packaging waste law that offers for environmentally friendly pallets. According to the Packaging Act, businesses are required to utilize packaging that is reusable or recyclable in an effort to reduce waste; thus German industries are moving towards recycled plastic pallets, compressed wood pallets, and biodegradable pallets. Quality pallets are thus required by the automotive, pharmaceutical, and machinery sectors, which must also be EU-compliant and safe.

Currently, the need for high-quality renewable products and good supply chain management has facilitated the implementation of sustainable and durable pallet solutions very easily among the German industries.

The pallets market is highly competitive, driven by increasing demand from logistics, manufacturing, and retail sectors. Key players compete by offering diverse pallet types including wood, plastic, and metal variants to meet specific industry needs.

Innovation in sustainable and reusable pallets is a major focus, as companies strive to reduce environmental impact and comply with regulations. Market leaders often leverage strong distribution networks and strategic partnerships to expand their global reach.

Price competitiveness, quality, and customization options are critical factors influencing buyer decisions. Smaller and regional manufacturers also play a significant role by catering to local demands with specialized solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 66.97 billion |

| Market Size in 2035 | USD 112.25 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed (Segment 1) | Wood, Plastic, Metal, Paper |

| Product Types Analyzed (Segment 2) | Stackable, Nestable, Collapsible |

| End-Use Industries Covered (Segment 3) | Food & Beverage, Pharmaceuticals, Cosmetics, Consumer Electronics, Engineering, Chemicals, Textiles, Agriculture, Construction, Automotive, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Germany, China, India, Japan, Brazil, United Kingdom, Australia |

| Key Players Influencing the Market | DS Smith Plc., Smurfit Kappa Group, Conitex Sonoco, Oji Holdings Corporation, Multi-wall Packaging, KraftPal Technologies, Europal Packaging, Tat Seng Packaging, Dopack, Interpal Industries, PhengHoon Honeycomb, Mabuchi Singapore, The Alternative Pallet Company, Kimmo (Pty) Ltd. |

| Additional Attributes | Dollar sales by material and product type, Regional demand by end-use industries, Sustainability impact of wood vs. plastic pallets, Logistics efficiency trends, Innovations in collapsible pallet designs |

The pallets market is categorized by material type, including plastic pallets, metal pallets, wood pallets, and paper pallets.

The market is segmented by product type into stackable pallets, nestable pallets, and collapsible pallets.

Pallets are used across various industries, including food & beverage, pharmaceuticals, cosmetics & personal care, consumer electronics, engineering products, chemicals, textile and handcraft, agriculture and allied industry, building & construction, automotive, and other end uses.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

The global pallets industry is projected to witness CAGR of 5.3% between 2025 and 2035.

The global pallets industry stood at 63,601.2 million in 2024.

Global pallets industry is anticipated to reach USD 112.25 billion by 2035 end.

East Asia is set to record a CAGR of 6.4% in assessment period.

The key players operating in the global pallets industry include DS Smith Plc., Smurfit Kappa Group, Conitex Sonoco, Oji Holdings Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material, 2023 to 2033

Figure 142: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Pallets Market Share Analysis – Trends, Demand & Forecast 2025–2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Wood Pallets Market Trends – Innovations & Growth 2025 to 2035

Block Pallets Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Block Pallets Industry

Wooden Pallets Market

Plastic Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Stringer Pallets Market Size and Share Forecast Outlook 2025 to 2035

Presswood Pallets Market Analysis – Trends & Growth 2025 to 2035

Crates And Pallets Packaging Market

Molded Wood Pallets Market Forecast and Outlook 2025 to 2035

Competitive Overview of Molded Wood Pallets Market Share

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA