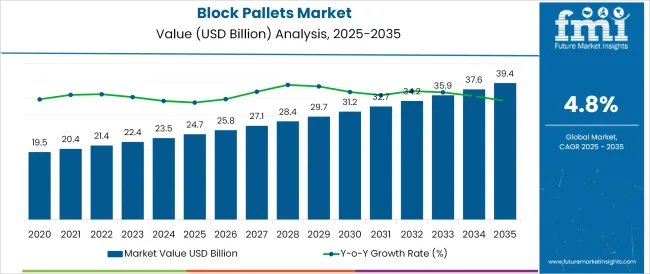

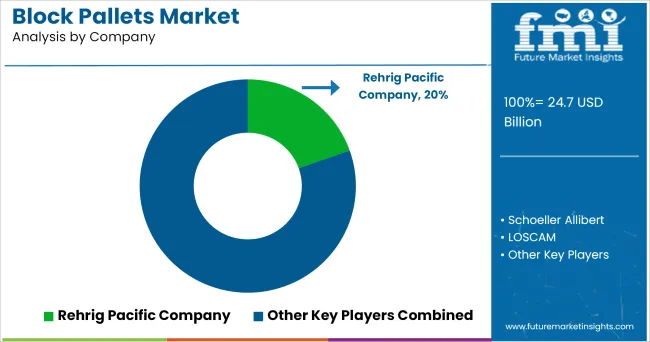

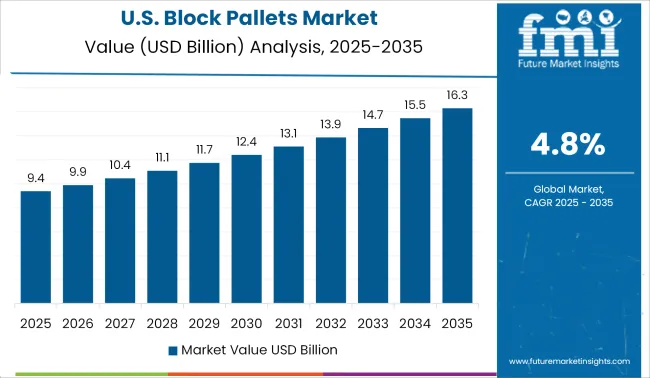

The Block Pallets Market is estimated to be valued at USD 24.7 billion in 2025 and is projected to reach USD 39.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The block pallets market is witnessing steady growth, driven by increasing global trade volumes, enhanced supply chain efficiency requirements, and sustainability concerns influencing material choices. Industry reports and corporate announcements have highlighted a shift toward standardized pallet sizes and durable materials to meet the needs of automated warehousing and logistics systems.

Growth in cross border e commerce and large scale distribution networks has further propelled demand for block pallets capable of supporting heavy loads and high frequency reuse. Additionally, sustainability initiatives within key industries have encouraged the adoption of recyclable and renewable materials. Ongoing investments in pallet pooling systems and returnable transit packaging solutions are further driving adoption.

The market outlook remains favorable as industries prioritize cost efficient durable, and sustainable material handling solutions. Segmental leadership is expected to be driven by Wood as the dominant material, the 48 inches X 40 inches pallet size due to its compatibility with global transport standards, and the Food & Beverages industry, reflecting the sector's high volume logistics and hygiene compliance needs.

The market is segmented by Material, Pallet Size, and End-User Industry and region. By Material, the market is divided into Wood, Plastic, and Metal. In terms of Pallet Size, the market is classified into 48 inches X 40 inches, 42 inches X 42 inches, and 48 inches X 48 inches.

Based on End-User Industry, the market is segmented into Food & Beverages, Automotive, Chemicals, Construction, Shipping & logistics, Pharmaceutical, Electronics & Electricals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

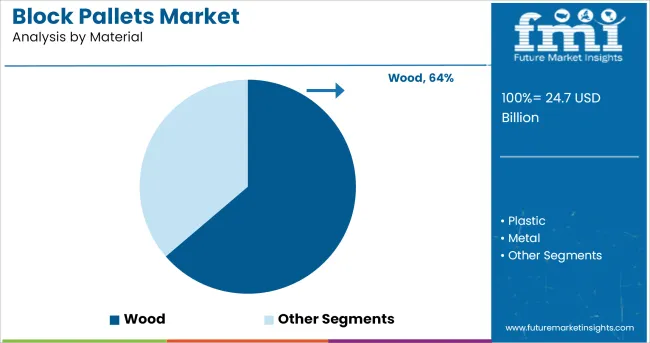

The Wood segment is projected to contribute 63.7% of the block pallets market revenue in 2025, retaining its status as the leading material type. Growth in this segment has been fueled by wood’s widespread availability, cost effectiveness, and structural strength, which make it ideal for manufacturing durable pallets. Supply chain managers have favored wooden block pallets for their adaptability across industries and their ability to support heavy and varied loads in both storage and transportation settings.

Furthermore, wood has remained a preferred choice due to its recyclability and ease of repair, aligning with circular economy practices adopted by logistics companies. The simplicity of manufacturing processes and the ability to source wood locally have contributed to its sustained dominance.

Additionally, regulatory standards and hygiene protocols in key industries have supported the use of heat treated wooden pallets for international shipments. As demand for sustainable packaging solutions grows, the Wood segment is expected to maintain its leadership in the block pallets market.

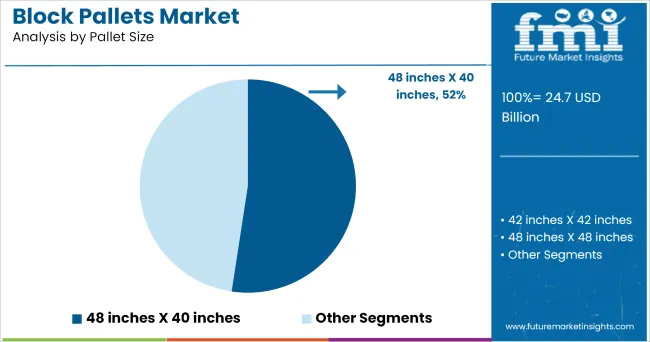

The 48 inches X 40 inches pallet size segment is projected to account for 52.4% of the block pallets market revenue in 2025, securing its place as the leading pallet size. This segment’s growth has been driven by its global recognition as the industry standard, particularly in North America, for optimizing warehouse storage, transport efficiency, and compatibility with automated material handling systems.

Manufacturers and retailers have standardized operations around this pallet size to streamline cross industry logistics, reduce handling costs, and minimize product damage during transit. Supply chain operations have increasingly relied on this pallet size for its ability to maximize container utilization and facilitate easy stacking in racking systems.

Furthermore, pallet pooling companies have favored this standardized size to simplify inventory management and rental operations. As globalization and automation continue to reshape logistics networks, the 48 inches X 40 inches segment is expected to remain the dominant choice for manufacturers, retailers, and logistics providers.

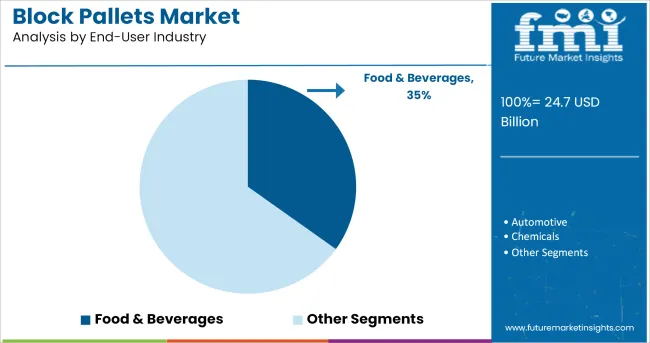

The Food & Beverages segment is projected to hold 34.9% of the block pallets market revenue in 2025, establishing itself as the largest end user industry. Growth in this segment has been driven by the high volume movement of packaged goods requiring reliable, hygienic, and structurally sound pallets for distribution.

Food processors, beverage manufacturers, and grocery retailers have prioritized block pallets for their strength, ease of handling by forklifts from all four sides, and compliance with safety standards governing food contact surfaces. Additionally, the perishability of many food products has necessitated robust supply chain processes where block pallets play a critical role in maintaining product integrity during transit.

The segment has also benefited from the expansion of global food trade and cold chain logistics, where standardized pallets are essential for streamlined warehouse operations. As consumer demand for packaged food and beverages continues to grow worldwide, the Food & Beverages segment is expected to sustain its leadership in the block pallets market.

Block pallets are essential storage and transportation solutions for local as well as international transportation of any manufacturing or shipping company. The pallets made up of wood, plastic or plywood, also known as ‘’four-way’’ pallets are made up of 12 cylindrical blocks to support the top deck board are known as block pallets globally.

The block pallets allows forklifts and other pallet jacks to access the pallet from all four sides, though block pallets are more stronger than other types of pallets such as stringer pallets. Block pallets are gaining worldwide popularity due to safety it provides to the bulk loaded on it while transit.

In modern day supply chain pallets are regarded as essential elements, as foundation of unit loads for shrink wrapping, simply storing them or either manufacturer or shipper is strapping or shipping their bulk sized loads.

Most unique feature of block pallets is they can be easily customized as per the requirement of the load to be stored on it, for carrying food & beverages, for carrying automotive equipment, varied uses of block pallets across all industries has positive impact on its demand across continents.

Manufacturers producing wooden block pallets are making wooden pallets matching the international safety and quality standards making them suitable for carrying loads to the farthest markets.

The wooden block pallets do not require any chemical coating and resistant to harsh environmental changes during the transit of loads, along with designs which are lighter than other load carrying counterparts indicates towards expansion of global block pallet market due to rise in demand registered in all parts of the world.

The cost of block pallets is higher than the other load handling pallets, manufacturers and operational facilities operators are preferring over other alternative pallets available in the market in lesser price. Thus, high cost incurred for procurement of block pallets has a negative impact on demand for block pallets globally.

Blocks places inside the block pallets to support the unit load placed on it are not repairable, instead of repairs those blocks needs to be replaced in shorter time periods, thus it incurs a high cost of maintenance for the end user industries using block pallets. Moreover, it impacts the overall growth potential of the global block pallets market over the forecasted period.

Key global industry players are switching to sustainable practices and marketing themselves as sustainable practitioners, the wooden block pallets can allow them to meet their sustainability goals as wooden block pallets are made up of wood and does not have any negative impact on the environment. Eventually provides a lucrative growth opportunity for the block pallet manufacturers in all parts of world.

The manufacturers of block pallets can differentiate themselves from each other by marketing their pallets as 100% recyclable features of wooden block pallets. Large scale industries and shipping companies adapting block pallets over other types of pallets, indicates towards expansion of global block pallets market.

Currently the block pallets are most preferred pallet type in Europe only, due to increase in market popularity and variety of safety features offered to bulk loads by block pallets, the key global market players of block pallets can target larger untapped markets witnessing fast paced development in manufacturing and logistics sector to expand their market bases by catering developing markets.

Stringent pallets were most used pallet type in the USA market, but due to more international trade organizations and key manufacturers adapting block pallets for enhanced safety and convenience for storage & movement of bulk loads, recent decade has witnessed a sharp rise in demand for block pallets in the USA

Manufacturers of pallets are using sustainable raw materials such as wood and metals to produce block pallets to serve the increasing demand from ever-growing food & beverages industry and thriving chemical production industries in the country. In addition to all this the rise in demand for block pallets in USA market indicates towards expansion of global block pallets market in whole North American region over the forecasted period.

Exponential growth witnessed by shipping & logistics industry in India, along with increasing warehousing and storage facilities due to favourable government policies and easy finance schemes throughout the country has resulted in sharp rise in demand for safe unit material handling solutions such as block pallets across the country.

Being a global manufacturing hub for almost all the industries including automobiles, electronics and chemicals, presence of large scale operational facilities in the country, makes China a fast growing market for block pallets. Due to significant rise in exports driving demand for bulk material handling and storage solutions such as block pallets made of different materials, resulting in growing sales of block pallets in China.

The global block pallets market is estimated to be valued at USD 24.7 billion in 2025.

The market size for the block pallets market is projected to reach USD 39.4 billion by 2035.

The block pallets market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in block pallets market are wood, plastic and metal.

In terms of pallet size, 48 inches x 40 inches segment to command 52.4% share in the block pallets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Block Pallets Industry

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Block Sack Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Global Pallets Market Share Analysis – Trends, Demand & Forecast 2025–2035

Blockchain in Banking Market

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Block Margarine Market

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Antiblock Additive Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA