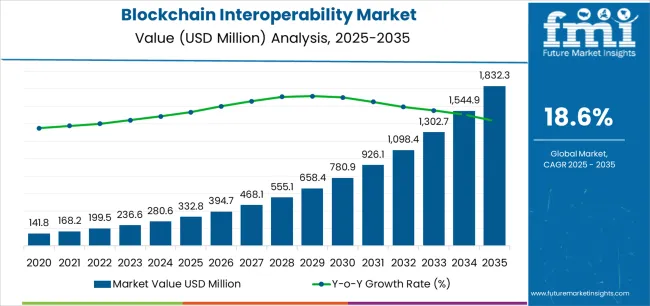

The Blockchain Interoperability Market is estimated to be valued at USD 332.8 million in 2025 and is projected to reach USD 1832.3 million by 2035, registering a compound annual growth rate (CAGR) of 18.6% over the forecast period.

The blockchain interoperability market is witnessing significant expansion, driven by the growing demand for cross-network communication and asset transfer capabilities across decentralized ecosystems. Increasing adoption of multiple blockchain platforms in finance, supply chain, and digital identity management has emphasized the need for seamless interoperability.

The market is benefiting from the proliferation of decentralized applications (dApps) and smart contract-based ecosystems, where interoperability solutions enhance efficiency, reduce latency, and mitigate data silos. Technological advancements in protocol design and the emergence of multi-chain frameworks have further strengthened integration potential.

Regulatory developments encouraging transparency and cross-border digital asset transactions are also contributing to market maturity. Looking ahead, rising institutional adoption of blockchain infrastructure and the growing complexity of multi-chain networks are expected to sustain growth, positioning interoperability as a foundational enabler for the next phase of blockchain scalability and collaboration..

| Metric | Value |

|---|---|

| Blockchain Interoperability Market Estimated Value in (2025 E) | USD 332.8 million |

| Blockchain Interoperability Market Forecast Value in (2035 F) | USD 1832.3 million |

| Forecast CAGR (2025 to 2035) | 18.6% |

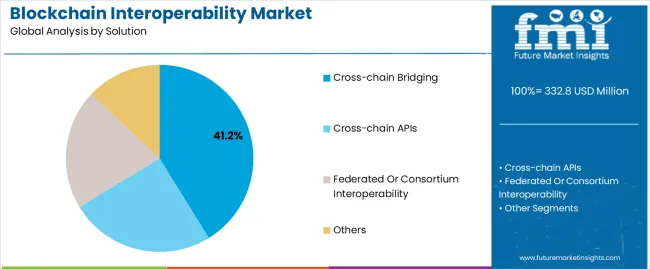

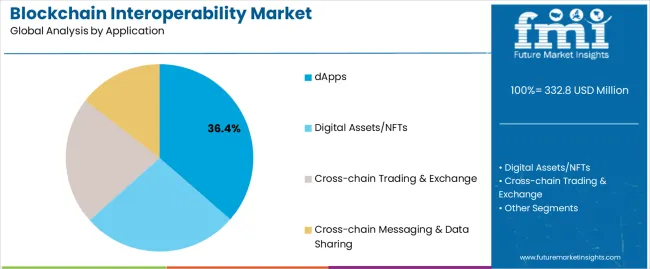

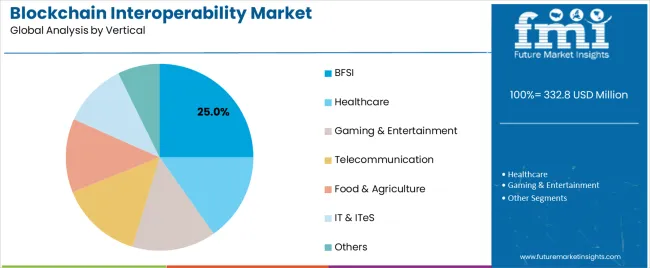

The market is segmented by Solution, Application, and Vertical and region. By Solution, the market is divided into Cross-chain Bridging, Cross-chain APIs, Federated Or Consortium Interoperability, and Others. In terms of Application, the market is classified into dApps, Digital Assets/NFTs, Cross-chain Trading & Exchange, and Cross-chain Messaging & Data Sharing. Based on Vertical, the market is segmented into BFSI, Healthcare, Gaming & Entertainment, Telecommunication, Food & Agriculture, IT & ITeS, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cross-chain bridging segment dominates the solution category with approximately 41.20% share, reflecting its essential role in facilitating asset transfers and data exchange between distinct blockchain networks. This solution allows decentralized ecosystems to operate cohesively, improving liquidity flow and enabling multi-platform interoperability.

Its adoption has been accelerated by the expansion of decentralized finance (DeFi) applications, where users demand cross-network access without intermediaries. The segment’s growth is reinforced by ongoing innovations in bridge security and efficiency, addressing vulnerabilities associated with early-generation protocols.

Institutional blockchain projects are increasingly integrating bridging solutions to streamline asset management across public and private chains. With interoperability becoming central to blockchain scalability, the cross-chain bridging segment is expected to maintain its dominance through continued technical refinement and integration into multi-chain infrastructures..

The dApps segment leads the application category with approximately 36.40% share, driven by the growing need for seamless connectivity across decentralized platforms. Blockchain interoperability enhances the operational capabilities of dApps by enabling them to access data and resources from multiple chains simultaneously.

This functionality expands use cases in gaming, decentralized exchanges, and digital identity, creating richer and more efficient ecosystems. The segment benefits from developer initiatives to design interoperable frameworks that improve scalability and transaction speed.

Increased venture capital investment in cross-chain development projects has also supported adoption. As multi-chain dApp ecosystems mature and demand for fluid data exchange intensifies, the dApps segment is expected to continue leading the application landscape in blockchain interoperability..

The BFSI segment holds approximately 25.00% share within the vertical category, underscoring its pivotal role in early adoption of interoperability solutions. Financial institutions are leveraging cross-chain frameworks to improve settlement efficiency, reduce transaction costs, and facilitate digital asset interoperability across networks.

The segment benefits from regulatory support for secure digital ledger integration and the growing adoption of tokenized assets in cross-border payments. Interoperability enhances transparency, enabling real-time reconciliation across diverse financial systems.

Strategic collaborations between blockchain firms and traditional banks have further accelerated deployment. With the sector’s focus on secure and efficient digital transaction infrastructure, the BFSI segment is expected to remain a key driver of blockchain interoperability adoption..

The global demand for the blockchain interoperability market was estimated to reach a valuation of USD 141.8 million in 2020, according to a report from Future Market Insights. From 2020 to 2025, sales witnessed significant growth in the blockchain interoperability market, registering a stellar CAGR of 31%.

| Historical CAGR from 2020 to 2025 | 31% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 27.5% |

The market for blockchain interoperability is driven by the growing need for decentralized exchanges (DEXs) and cross-chain asset swaps. Consumers who manage digital assets across many blockchain networks look for autonomy and liquidity. The creation of interoperability solutions, which enable smooth asset movement and exchange between various platforms, is fueled by this need.

Some important factors that will boost the market growth through 2035 are:

Rising Popularity of DeFi Apps to boost Demand

The market for blockchain interoperability is being driven in part by the growing popularity of decentralized financial (DeFi) applications. Interoperability solutions are becoming more and more necessary as DeFi gains popularity in order to facilitate asset transfers and smooth communication between various blockchain networks.

DeFi protocols require interoperability in order to access a wider variety of assets and liquidity pools. This promotes the growth of the blockchain interoperability market and allows for the development of novel financial services.

Growth of Blockchain Alliances and Consortiums to bolster demand Globally

The growth of blockchain alliances and consortiums is a major factor propelling the market for blockchain interoperability. To create interoperability standards, protocols, and solutions, these cooperative projects bring together industry players, including businesses, startups, and technology suppliers.

Blockchain consortiums promote the adoption of interoperable solutions and drive market growth by promoting collaboration and shared innovation. They also promote best practices and information sharing, which advances the creation and application of blockchain interoperability technology.

Regulatory Uncertainties and Scalability Issues to Impede the Market Growth

Interoperability attempts may be hampered by adoption difficulties brought forth by conflicting standards and unclear regulations. Technical difficulties including security flaws and scalability problems might impede the creation and application of interoperable solutions.

Cooperation across diverse blockchain networks and stakeholders is necessary for interoperability, which may provide governance and coordination issues. Effectively overcoming these challenges is essential to guaranteeing the market for blockchain interoperability continues to expand.

This section focuses on providing detailed analysis of two particular market segments for blockchain interoperability, the dominant solution type and the significant application type. The two main segments discussed below are cross-chain bridging and dApps.

| Solution | Cross-chain Bridging |

|---|---|

| CAGR from 2025 to 2035 | 27.3% |

During the forecast period, the cross-chain bridging segment is likely to garner a 27.3% CAGR. Since cross-chain bridging may resolve interoperability issues across different blockchain networks, it is the best option available globally.

Through the smooth movement of assets and communication across chains, cross-chain bridging improves the functionality, accessibility, and liquidity of the blockchain ecosystem.

By encouraging cooperation and integration amongst many platforms, this approach opens up new possibilities for supply chain management, decentralized finance, and other applications. Cross-chain bridging is becoming an increasingly important means of enabling blockchain interoperability as the need for cross-chain functionality increases.

| Application | dApps |

|---|---|

| Market Share in 2025 | 50.9% |

In 2025, the dApps segment is likely to acquire a 52.3% global market share. The inherent benefits of decentralized apps (dApps) will likely cause them to dominate the market. They support the principles of blockchain technology by providing transparency, immutability, and resistance to censorship. Decentralized applications (dApps) remove middlemen, saving money and improving productivity.

dApps make it possible for transactions to be automated and trustless with programmable smart contracts. dApps are becoming the go-to option for a wide range of applications, from supply chain management to finance, as the need for decentralized solutions increases. This is propelling dApps' dominance in the market by application type.

The markets for blockchain interoperability in a few significant countries, including the United States, the United Kingdom, China, Japan, and South Korea, will be covered in detail in this section. This section will concentrate on the major variables that are increasing the demand in these nations for blockchain interoperability.

| Countries | Forecast CAGR from 2025 to 2035 |

|---|---|

| The United States | 27.7% |

| The United Kingdom | 29% |

| China | 28% |

| Japan | 28.2% |

| South Korea | 29.2% |

The United States blockchain interoperability landscape is anticipated to gain a CAGR of 27.7% through 2035. The United States has a diversified blockchain atmosphere, with tech-heavy areas like Austin, New York City, as well as San Francisco serving as innovation hotspots.

This dynamic ecosystem encourages investment, cooperation, and entrepreneurship, which propels the creation of revolutionary blockchain solutions across a range of sectors.

Numerous regulatory agencies oversee the complicated regulatory environment in the United States around cryptocurrencies and blockchain technology. While this complexity presents issues, it also provides opportunity for regulatory clarity and innovation as authorities strive to find a balance between promoting innovation and safeguarding consumers.

The market in the United Kingdom is expected to expand with a 29% CAGR through 2035. The United Kingdom is positioning itself as a centre of regulatory innovation for companies involved in blockchain and cryptocurrencies.

The United Kingdom offers a favorable regulatory framework for blockchain enterprises to flourish and evolve, including programs like the Financial Conduct Authority's (FCA) regulatory sandbox, which enables entrepreneurs to test novel products in a supervised setting.

The country has a long history of being a leader in blockchain and distributed ledger technology (DLT) academia. Prominent academic institutions like Imperial College London and the University of Cambridge aggressively pursue blockchain research and work with business partners to spur innovation.

This academic environment promotes a vibrant flow of knowledge and skills, strengthening the United Kingdom's standing as a leading hub for blockchain innovation and knowledge globally.

The blockchain interoperability ecosystem in China is anticipated to develop with a 28% CAGR from 2025 to 2035. China leads in blockchain infrastructure, accounting for a sizable portion of the global blockchain patents and hosting several of the major blockchain platforms and mining activities. Due to its advanced technology and extensive internet connectivity, the nation is well-positioned to develop and use blockchain technology on a large scale.

China is seeing a rise in innovative blockchain applications, especially in the domains of government services, digital identification, and supply chain management.

Companies and governmental organizations are using blockchain technology to increase efficiency, traceability, and transparency across a range of industries, demonstrating the creative approach of China to the adoption and application of blockchain technology.

The blockchain interoperability industry in Japan is anticipated to reach a 28.2% CAGR from 2025 to 2035. Japan has developed precise legislation pertaining to blockchain technology and cryptocurrencies, giving investors and companies’ confidence. The encouraging outlook encourages investment and creativity in blockchain initiatives, which helps the sector expand.

The robust history of industry-academia partnership in Japan fosters innovation in blockchain technology. In order to develop innovative blockchain solutions, universities and research centers collaborate closely with companies, making use of the abundant talent and knowledge base of the region.

The blockchain interoperability ecosystem in South Korea is likely to evolve with a 29.2% CAGR during the forecast period. The government of South Korea actively supports blockchain projects by providing financing and providing clear regulations, creating an atmosphere that encourages innovation.

Blockchain technology has been adopted by South Korean industries including banking and gambling, which has accelerated the integration of technology into other applications and market development.

With its highly qualified workforce and innovative technological infrastructure, South Korea offers a strong platform for the development and implementation of blockchain solutions. This strong infrastructure helps blockchain firms flourish and makes it easier to deploy blockchain ideas in a variety of sectors.

Companies in the global market for blockchain interoperability are developing technologies to connect various blockchain networks and facilitate asset transfers and smooth communication between them.

They concentrate on developing middleware, decentralized exchanges, and interoperability protocols that enable data sharing, smart contract execution, and cross-chain transactions.

These companies seek to solve issues with interoperability, security, and scalability in order to promote the broad use of blockchain technology. Through facilitating interoperability, they open up new avenues for decentralized finance, identity verification, supply chain management, and other applications, spurring efficiency and creativity across a range of sectors globally. The key players in this market include:

Significant advancements in the blockchain interoperability market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 27.5% from 2025 to 2035 |

| Market value in 2025 | USD 261 million |

| Market value in 2035 | USD 3 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Solution, Application, Vertical, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

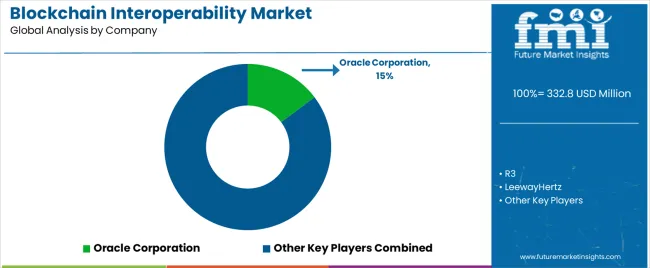

| Key Companies Profiled | Oracle Corporation; R3; LeewayHertz; Ontology; INERY PTE. LTD.; Datachain Inc.; Quant Network Limited; Band protocol; LiquidApps; Orb Labs |

| Customization Scope | Available on Request |

The global blockchain interoperability market is estimated to be valued at USD 332.8 million in 2025.

The market size for the blockchain interoperability market is projected to reach USD 1,832.3 million by 2035.

The blockchain interoperability market is expected to grow at a 18.6% CAGR between 2025 and 2035.

The key product types in blockchain interoperability market are cross-chain bridging, cross-chain apis, federated or consortium interoperability and others.

In terms of application, dapps segment to command 36.4% share in the blockchain interoperability market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Blockchain in Banking Market

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Automotive Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Interoperability Solutions Market Analysis – Trends & Growth 2025 to 2035

WiMAX (Worldwide Interoperability For Microwave Access) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA