The healthcare interoperability solutions market is projected to experience substantial growth between 2025 and 2035, driven by the increasing need for seamless data exchange across healthcare systems and the rising adoption of electronic health records (EHRs) and digital healthcare solutions.

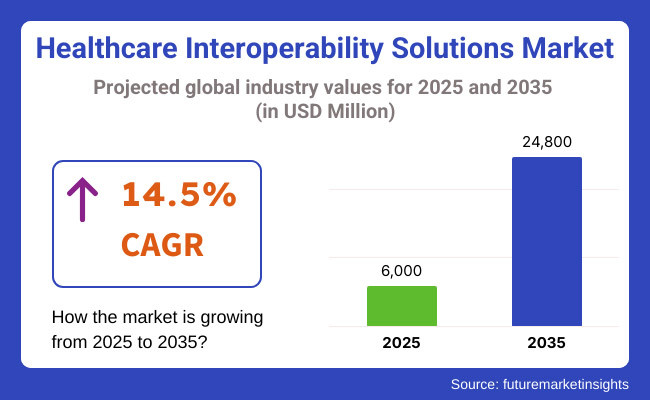

The market was valued at USD 6,000 million in 2025 and is expected to reach USD 24,800 million by 2035, reflecting a compound annual growth rate (CAGR) of 14.5% over the forecast period.

Several factors are fuelling market expansion, including government initiatives promoting healthcare IT infrastructure, the rising demand for coordinated patient care, and the need to reduce medical errors. The adoption of cloud-based interoperability solutions, integration of artificial intelligence (AI), and growing investments in digital healthcare transformation are further propelling the market forward.

Despite the positive outlook, challenges such as data security concerns, high implementation costs, and interoperability complexities across different healthcare systems remain. However, advancements in block chain technology, API-based data sharing, and strategic partnerships among healthcare providers are expected to drive further innovation and market expansion.

Healthcare interoperability solutions market will be boosted considerably because healthcare organizations are emphasizing data integration, patient-centred care, and digital transformation. The proliferation of AI-enabled analytics and interoperability frameworks will significantly drive the field in the coming decade.

North America dominates the healthcare interoperability solutions market due to the implementation of electronic health records (EHRs), regulatory requirements, and a growing demand for interoperability among healthcare providers. In the region, the United States and Canada are lights for initiatives such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and the 21st Century Cures Act that drives interoperability and patient access to data.

The growth of the market is further supported by through the high presence of major healthcare IT companies and established healthcare infrastructure. However, there are still difficulties such as data security issues, integration complexities and high implementation costs. To tackle these challenges, organizations are emphasizing cloud-based solutions, AI-powered interoperability, and improved security measures.

In Europe, there is a fast-growing market for healthcare interoperability solutions due to government initiatives pushing for data standardization and cross-border healthcare data exchange. Countries like Germany, UK, France, and the Netherlands are leading the way in adopting interoperable healthcare systems, with the European Health Data Space (EHDS) initiative pushing the agenda of seamless health data exchanger.

General Data Protection Regulation (GDPR) strict data privacy regulation shapes interoperability data systems development, requiring compliance-oriented innovations. Market growth is primarily driven by the rising demand for integrated care models, regulation of telehealth expansion, and the rising number of patients with chronic diseases. To improve the sharing of data among disparate healthcare systems, healthcare IT vendors are investing in AI-driven analytics, block chain-based security, and open API frameworks.

The highest growth of the healthcare interoperability solutions market is seen in the Asia-Pacific, due to the increasing adoption of digital health, government initiatives supporting health IT infrastructure development, and a rise of chronic disease burden. China India Japan and Australia have overwhelming investments in healthcare digitalization which drives the demand for interoperability solutions.

The increasing adoption of telemedicine, mobile health application and cloud-based electronic health records is providing an additional impetus to the market growth. Obstacles like fragmented health care IT systems, diverse regulatory regimes and data security issues remain.

This means removing seasoned barriers, the ability to participate in multi-dimensional care, seamless data transfer to and from different platforms of healthcare systems, and optimized outcomes through policies such as public-private partnerships, and scalable interoperability solutions (data integration using artificial intelligence) offered by healthcare IT.

Challenges - Data Security and Privacy Concerns

Healthcare interoperability solutions face one of the most critical challenges in ensuring data security and patient privacy. As healthcare organizations implement electronic health records (EHR), telemedicine platforms, and medical devices, they become susceptible to cyber threats, data violations, and compliance breaches.

Given the harsh regulations in this field (like HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation)), advanced encryption techniques, the most advanced authentication protocols, and data-sharing policies are a must. In order to reduce risks and create patient trust, healthcare providers need to invest in cybersecurity solutions and regulatory-compliant interoperability frameworks.

Opportunities - Advancements in AI and Cloud-Based Interoperability

Leading the way, AI-driven data analytics and cloud-based interoperability solutions are transforming how healthcare systems work. It always goes back to AI that can analyse huge volumes of datasets, notice anomalies and help with real-time clinical decisions to enhance patient outcomes and operational efficiency.

Cloud technology elevates data sharing, remote patient monitoring, and expands the scale of healthcare networks, facilitating the access of medical information across the hospital, clinic, and telemedicine technology providers. Firms that adopt block chain based security, artificial intelligence-driven predictive analytics, and cloud-integrated solutions will lead innovation and create competitive advantage.

From 2020 to 2024, healthcare interoperability solutions created better EHR integration, the rise of telehealth and AI powered diagnostics pushing up how data is transformed. Yet, fragmented healthcare IT systems and issues surrounding the standardization of interoperability offered challenges.

The future of the market 2025 to 2035 relies on technology like biometrics, AI-integrated interoperability, block chain data security, and predictive healthcare analytics. The future of health interoperability is personalized medicine, real-time health care monitoring and frictionless transfer of health care data across countries.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with HIPAA, GDPR, and FHIR standards |

| Technological Advancements | Cloud-based EHR integration and AI-powered diagnostics |

| Industry Adoption | Growing use of telehealth and digital health records |

| Supply Chain and Sourcing | Challenges in IT infrastructure standardization |

| Market Competition | Presence of established EHR providers and start-ups |

| Market Growth Drivers | Regulatory requirements and increased digital healthcare adoption |

| Sustainability and Energy Efficiency | Initial cloud adoption and digital record-keeping |

| Consumer Preferences | Demand for secure and accessible patient records |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring and real-time regulatory updates |

| Technological Advancements | Block chain security, predictive AI, and real-time data-sharing platforms |

| Industry Adoption | Expansion of global healthcare data exchange and personalized AI diagnostics |

| Supply Chain and Sourcing | Seamless integration of IoT, wearables, and smart healthcare systems |

| Market Competition | Dominance of AI-powered healthcare interoperability platforms |

| Market Growth Drivers | AI-driven automation, predictive healthcare, and global medical data standardization |

| Sustainability and Energy Efficiency | Eco-friendly data centers and energy-efficient healthcare IT solutions |

| Consumer Preferences | Preference for real-time, AI-driven, and personalized healthcare experiences |

Healthcare interoperability solutions market in USA is driven by the similar government regulations that promotes sharing and integrating of data across various formats. Programs like the Health Information Technology for Economic and Clinical Health (HITECH) Act and the 21st Century Cures Act pushed for the rapid adoption of interoperable electronic health records (EHRs). As major health-tech companies grow, so do the investments in AI-powered interoperability solutions, propelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 14.5% |

The UK is seeing slow and steady market growth due to government initiatives which led to the creation of a consolidated digital health ecosystem. Evidence of this can be seen in the National Health Service (NHS) which is revolutionizing healthcare delivery by implementing cloud-based interoperability solutions. Rising implementations of digital health applications and increasing demand for secure data-sharing platforms are driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 13.6% |

In Europe, EU Digital Health Strategy is fuelling the growth of healthcare interoperability solutions. Countries including Germany, France and the Netherlands have begun imposing harsh data-sharing regulations and expanding their digital health infrastructures. The market development is being driven by increasing focus on cross-border healthcare interoperability, and rising investments in health IT.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 14.2% |

The healthcare interoperability market in Japan is growing with the increasing government initiatives and digital transformation in healthcare. AI-driven systems for sharing data and cloud-based EHRs are being developed to improve patient care throughout the country. The rise of IoT and telemedicine solutions that are integrated into the hospital network is further propelling the growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.8% |

Digital health technology is therefore one area for which South Korea is becoming a linchpin, he added. Overlapping themes such as regulatory initiatives which promote health data exchange, AI-driven diagnostic decision support systems, block chain based solutions for secure interoperability, are strengthening further market growth. 5G healthcare networks and the adoption of electronic medical records (EMRs) are additionally driving interoperability initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.6% |

The healthcare interoperability solutions market is experiencing steady growth, driven by the growing demand for efficient data sharing across healthcare organizations, payers, and patients. Digital healthcare ecosystems have rendered interoperability solutions increasingly critical in facilitating effective communication across disparate healthcare IT systems. With government mandates and regulatory frameworks, the need for emerging interoperability solutions is only going to continue to grow because it will become paramount for healthcare organizations to achieve.

As healthcare facilities are moving towards value-based care models, the need for access to real-time patient data and secure exchange of information has increased manifolds. Healthcare data management has been remoulded by technological developments like cloud-based interoperability, AI-driven data analytics and block chain integration. These advancements allow providers to increase workflow efficiency and improve patient outcomes, all while minimizing operational expenses.

Within the interoperability level category, Semantic Interoperability market has highest share as it enables the exchange of data that is both meaningful and standard among various healthcare systems. This degree of interoperability means that information that is transmitted is both interpretable by the system that receives it, and usable by that system. Semantic interoperability provides superior clinical decision support through the use of standard terminologies (e.g., HL7 FHIR (Fast Healthcare Interoperability Resources) and SNOMED CT) thereby improving data accuracy.

With the advancement of precision medicine, population health management, and real-time patient monitoring, healthcare organizations around the world are progressively adopting Semantic Interoperability. This vertical has gained momentum in recent years triggered by the demand for reducing medical errors, improving workflows, and delivery analytics.

Semantic interoperability achieves this exchange in a much more rich way than simply sharing data by utilizing structured data models and AI-enabled algorithms to ensure that the data presented is comprehensible to products enabled by multiple vendors.

On the other hand, Structural interoperability ensures that healthcare data is formatted correctly for transmission across secure systems. It defines procedures for organizing data, allowing EHRs, laboratory results, and imaging data to be transmitted while maintaining integrity. It formats data that allows disparate healthcare IT infrastructures to exchange information, providing the basis for integration.

On the basis of deployment, Cloud-based interoperability solutions have been particularly popular as they offer advantages such as scalability, flexibility, and cost-effectiveness.

They take care of potential set up challenges, so the healthcare organization does not need to have huge on premise infrastructure even if your healthcare organization has several facilities, you can integrate data from all of them with low initial cost using a cloud-based interoperable system. With the advent of telehealth services, remote patient monitoring, and digital health initiatives, the need for interoperability platforms built on cloud computing has only increased.

And in healthcare, the cloud's ability to offer real-time access to patient records and analytics has revolutionized operations, facilitating better care coordination and clinical workflows. Moreover, improved cybersecurity tools such as block chain and multi-factor authentication at this stage have relieved concerns about data security and compliance.

The emergence of AI and machine learning for predictive analytics, personalized treatment plans, and automated report generation with respect to integration toward cloud-based open-source platforms is another driver enhancing the market growth.

The increasing adoption of cloud-based solutions notwithstanding, on-premises interoperability solutions remain a significant part of the market, especially in large healthcare institutions and the government sector. Such on premise deployment also provides improved data control, security measures, and adherence to strict regulatory requirements, making it an ideal preference for institutions that manage sensitive patient information.

Thus, many healthcare organizations adopt hybrid models, using a mixture of on premise and cloud-based interoperability to maximize efficiency lately and security protocols.

Healthcare interoperability solutions market from the perspective of the industry as a whole, with emphasis on its profitability and future prospects, while stakeholders strive to create opportunities in the specific sector. Increasing focus on interoperability to support patient-centered care, compliance, and digital transformation in healthcare is expected to drive a positive transformation in the interoperability landscape to build a connected global healthcare ecosystem.

The healthcare interoperability solutions market is witnessing significant growth driven by the increasing need for efficient healthcare data exchange, regulatory requirements, and trends in digital health technologies. Growing adoption of EHRs, integration of AI, and demand for seamless patient data exchange act as some drivers of the market.

The healthcare-related companies are working on building even more the interoperability platforms as well as cloud-based solutions to comply with the healthcare regulation and security.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cerner Corporation | 20-24% |

| Epic Systems Corporation | 15-19% |

| Infor, Inc. | 12-16% |

| Allscripts Healthcare | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cerner Corporation | Provides advanced healthcare interoperability platforms enabling seamless EHR integration and data sharing. |

| Epic Systems Corporation | Specializes in comprehensive health information exchange (HIE) solutions, ensuring secure and efficient data flow. |

| Infor, Inc. | Develops cloud-based interoperability solutions designed to enhance hospital workflow management and patient outcomes. |

| Allscripts Healthcare | Offers interoperability software that integrates with multiple healthcare systems, improving clinical data access. |

Key Company Insights

Cerner Corporation (20-24%)

Cerner Corporation is a key provider for the healthcare interoperability solutions market with state-of-the-art interoperability platforms. Its mission is to promote seamless communication among healthcare providers through enhanced data integration, AI-powered analytics and regulatory compliance.

Epic Systems Corporation (15-19%)

Epic Systems Corporation offers powerful health information exchange (HIE) solutions that give healthcare providers access to real-time patient data. Focus on data security, AI-driven analytics, and cloud-based solutions further solidifies its enterprise position.

Infor, Inc. (12-16%)

Infor, Inc. is focused on providing cloud-based interoperability solutions that help hospitals manage their systems, including patient outcomes and healthcare analytics. AI integration and workflow automation drive the growth of this market.

Allscripts Healthcare (10–14%)

Allscripts Healthcare is another significant vendor in the field of interoperability software solutions integrating clinical data across platforms. Their services feature real-time data exchange, healthcare regulations and patient-centered interoperability.

Other Players (30-40% Combined)

The healthcare interoperability solutions market is growing at high pace and present there is high competitive environment with few emerging players who are making advanced and innovative investment in innovative data exchange, developed of regulatory-compliant software, and AI-generative healthcare interoperability. Key players include:

The overall market size for the healthcare interoperability solutions market was USD 6,000 million in 2025.

The healthcare interoperability solutions market is expected to reach USD 24,800 million in 2035.

The demand for healthcare interoperability solutions is expected to rise due to the increasing need for seamless data exchange across healthcare systems, rising adoption of electronic health records (EHRs), regulatory mandates for healthcare data sharing, and advancements in digital healthcare technologies.

The top five countries driving the development of the healthcare interoperability solutions market are the USA, Germany, UK, China, and Japan.

Semantic interoperability market and cloud-based interoperability platforms are expected to command a significant share over the assessment period.

Table 01: Global Market Size (US$ Million) Analysis and Forecast 2023 to 2033, by Type

Table 02: Global Market Size (US$ Million) Analysis and Forecast 2023 to 2033, by Level of Interoperability

Table 03: Global Market Size (US$ Million) Analysis and Forecast 2023 to 2033, by Deployment

Table 04: Global Market Value (US$ Million) Analysis- and Forecast 2023 to 2033, by End User

Table 05: North America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 06: North America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 07: North America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 08: North America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 09: North America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 10: Latin America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 11: Latin America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 12: Latin America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 13: Latin America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 14: Latin America Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 15: Europe Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 16: Europe Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 17: Europe Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 18: Europe Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 19: Europe Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 20: South Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 21: South Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 22: South Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 23: South Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 24: South Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 25: East Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 26: East Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 27: East Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 28: East Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 29: East Asia Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 30: Oceania Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 31: Oceania Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 32: Oceania Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 33: Oceania Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 34: Oceania Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 35: Middle East & Africa Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 36: Middle East & Africa Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Type

Table 37: Middle East & Africa Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Level of Interoperability

Table 38: Middle East & Africa Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 39: Middle East & Africa Market Size Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Figure 01: Global Market Value Analysis (US$ Million), 2017 to 2022

Figure 02: Global Market Value Forecast (US$ Million), 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity, 2022 - 2033

Figure 04: Global Market Share Analysis (%), by Type, 2023 & 2033

Figure 05: Global Market Y-o-Y Analysis (%), by Type, 2023 to 2033

Figure 06: Global Market Attractiveness Analysis by Type, 2023 to 2033

Figure 07: Global Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 08: Global Market Y-o-Y Analysis (%), by Level of Interoperability, 2023 to 2033

Figure 09: Global Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 10: Global Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 11: Global Market Y-o-Y Analysis (%), by Deployment, 2023 to 2033

Figure 12: Global Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 13: Global Market Share Analysis (%), End User, 2023 & 2033

Figure 14: Global Market Y-o-Y Analysis (%), End User, 2023 to 2033

Figure 15: Global Market Attractiveness Analysis End User, 2023 to 2033

Figure 16: North America Market Value Share by Type 2023 (E)

Figure 17: North America Market Value Share by Level of Interoperability 2023 (E)

Figure 18: North America Market Value Share by Deployment 2023 (E)

Figure 19: North America Market Value Share End User 2023 (E)

Figure 20: North America Market Value Share by Country 2023 (E)

Figure 21: North America Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 22: North America Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 23: North America Market Attractiveness Analysis by Type, 2023 to 2033

Figure 24: North America Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 25: North America Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 26: North America Market Attractiveness Analysis End User, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 28: USA Market Value Proportion Analysis, 2022

Figure 29: USA Market Share Analysis (%), by Type, 2023 & 2033

Figure 30: USA Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 31: USA Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 32: USA Market Share Analysis (%), End User, 2023 & 2033

Figure 33: Canada Market Value Proportion Analysis, 2022

Figure 34: Canada Market Share Analysis (%), by Type, 2023 & 2033

Figure 35: Canada Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 36: Canada Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 37: Canada Market Share Analysis (%), End User, 2023 & 2033

Figure 38: Latin America Market Value Share by Type 2023 (E)

Figure 39: Latin America Market Value Share by Level of Interoperability 2023 (E)

Figure 40: Latin America Market Value Share by Deployment 2023 (E)

Figure 41: Latin America Market Value Share End User 2023 (E)

Figure 42: Latin America Market Value Share by Country 2023 (E)

Figure 43: Latin America Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 44: Latin America Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 45: Latin America Market Attractiveness Analysis by Type, 2023 to 2033

Figure 46: Latin America Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Brazil Market Value Proportion Analysis, 2022

Figure 51: Brazil Market Share Analysis (%), by Type, 2023 & 2033

Figure 52: Brazil Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 53: Brazil Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 54: Brazil Market Share Analysis (%), End User, 2023 & 2033

Figure 55: Mexico Market Value Proportion Analysis, 2022

Figure 56: Mexico Market Share Analysis (%), by Type, 2023 & 2033

Figure 57: Mexico Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 58: Mexico Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 59: Mexico Market Share Analysis (%), End User, 2023 & 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Argentina Market Share Analysis (%), by Type, 2023 & 2033

Figure 62: Argentina Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 63: Argentina Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 64: Argentina Market Share Analysis (%), End User, 2023 & 2033

Figure 65: Europe Market Value Share by Type 2023 (E)

Figure 66: Europe Market Value Share by Level of Interoperability 2023 (E)

Figure 67: Europe Market Value Share by Deployment 2023 (E)

Figure 68: Europe Market Value Share End User 2023 (E)

Figure 69: Europe Market Value Share by Country 2023 (E)

Figure 70: Europe Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 71: Europe Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 72: Europe Market Attractiveness Analysis by Type, 2023 to 2033

Figure 73: Europe Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 75: Europe Market Attractiveness Analysis End User, 2023 to 2033

Figure 76: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 77: Italy Market Value Proportion Analysis, 2022

Figure 78: Italy Market Share Analysis (%), by Type, 2023 & 2033

Figure 79: Italy Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 80: Italy Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 81: Italy Market Share Analysis (%), End User, 2023 & 2033

Figure 82: Germany Market Value Proportion Analysis, 2022

Figure 83: Germany Market Share Analysis (%), by Type, 2023 & 2033

Figure 84: Germany Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 85: Germany Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 86: Germany Market Share Analysis (%), End User, 2023 & 2033

Figure 87: United kingdom Market Value Proportion Analysis, 2022

Figure 88: United kingdom Market Share Analysis (%), by Type, 2023 & 2033

Figure 89: United kingdom Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 90: United kingdom Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 91: United kingdom Market Share Analysis (%), End User, 2023 & 2033

Figure 92: France Market Value Proportion Analysis, 2022

Figure 93: France Market Share Analysis (%), by Type, 2023 & 2033

Figure 94: France Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 95: France Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 96: France Market Share Analysis (%), End User, 2023 & 2033

Figure 97: Spain Market Value Proportion Analysis, 2022

Figure 98: Spain Market Share Analysis (%), by Type, 2023 & 2033

Figure 99: Spain Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 100: Spain Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 101: Spain Market Share Analysis (%), End User, 2023 & 2033

Figure 102: BENELUX Market Value Proportion Analysis, 2022

Figure 103: BENELUX Market Share Analysis (%), by Type, 2023 & 2033

Figure 104: BENELUX Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 105: BENELUX Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 106: BENELUX Market Share Analysis (%), End User, 2023 & 2033

Figure 107: Nordic Countries Market Value Proportion Analysis, 2022

Figure 108: Nordic Countries Market Share Analysis (%), by Type, 2023 & 2033

Figure 109: Nordic Countries Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 110: Nordic Countries Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 111: Nordic Countries Market Share Analysis (%), End User, 2023 & 2033

Figure 112: Russia Market Value Proportion Analysis, 2022

Figure 113: Russia Market Share Analysis (%), by Type, 2023 & 2033

Figure 114: Russia Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 115: Russia Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 116: Russia Market Share Analysis (%), End User, 2023 & 2033

Figure 117: South Asia Market Value Share by Type 2023 (E)

Figure 118: South Asia Market Value Share by Level of Interoperability 2023 (E)

Figure 119: South Asia Market Value Share by Deployment 2023 (E)

Figure 120: South Asia Market Value Share End User 2023 (E)

Figure 121: South Asia Market Value Share by Country 2023 (E)

Figure 122: South Asia Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 123: South Asia Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 124: South Asia Market Attractiveness Analysis by Type, 2023 to 2033

Figure 125: South Asia Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 126: South Asia Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 127: South Asia Market Attractiveness Analysis End User, 2023 to 2033

Figure 128: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 129: India Market Value Proportion Analysis, 2022

Figure 130: India Market Share Analysis (%), by Type, 2023 & 2033

Figure 131: India Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 132: India Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 133: India Market Share Analysis (%), End User, 2023 & 2033

Figure 134: Thailand Market Value Proportion Analysis, 2022

Figure 135: Thailand Market Share Analysis (%), by Type, 2023 & 2033

Figure 136: Thailand Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 137: Thailand Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 138: Thailand Market Share Analysis (%), End User, 2023 & 2033

Figure 139: Indonesia Market Value Proportion Analysis, 2022

Figure 140: Indonesia Market Share Analysis (%), by Type, 2023 & 2033

Figure 141: Indonesia Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 142: Indonesia Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 143: Indonesia Market Share Analysis (%), End User, 2023 & 2033

Figure 144: Malaysia Market Value Proportion Analysis, 2022

Figure 145: Malaysia Market Share Analysis (%), by Type, 2023 & 2033

Figure 146: Malaysia Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 147: Malaysia Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 148: Malaysia Market Share Analysis (%), End User, 2023 & 2033

Figure 149: East Asia Market Value Share by Type 2023 (E)

Figure 150: East Asia Market Value Share by Level of Interoperability 2023 (E)

Figure 151: East Asia Market Value Share by Deployment 2023 (E)

Figure 152: East Asia Market Value Share End User 2023 (E)

Figure 153: East Asia Market Value Share by Country 2023 (E)

Figure 154: East Asia Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 155: East Asia Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 156: East Asia Market Attractiveness Analysis by Type, 2023 to 2033

Figure 157: East Asia Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 158: East Asia Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 159: East Asia Market Attractiveness Analysis End User, 2023 to 2033

Figure 160: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 161: China Market Value Proportion Analysis, 2022

Figure 162: China Market Share Analysis (%), by Type, 2023 & 2033

Figure 163: China Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 164: China Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 165: China Market Share Analysis (%), End User, 2023 & 2033

Figure 166: Japan Market Value Proportion Analysis, 2022

Figure 167: Japan Market Share Analysis (%), by Type, 2023 & 2033

Figure 168: Japan Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 169: Japan Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 170: Japan Market Share Analysis (%), End User, 2023 & 2033

Figure 171: South Korea Market Value Proportion Analysis, 2022

Figure 172: South Korea Market Share Analysis (%), by Type, 2023 & 2033

Figure 173: South Korea Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 174: South Korea Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 175: South Korea Market Share Analysis (%), End User, 2023 & 2033

Figure 176: Oceania Market Value Share by Type 2023 (E)

Figure 177: Oceania Market Value Share by Level of Interoperability 2023 (E)

Figure 178: Oceania Market Value Share by Deployment 2023 (E)

Figure 179: Oceania Market Value Share End User 2023 (E)

Figure 180: Oceania Market Value Share by Country 2023 (E)

Figure 181: Oceania Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 182: Oceania Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 183: Oceania Market Attractiveness Analysis by Type, 2023 to 2033

Figure 184: Oceania Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 185: Oceania Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 186: Oceania Market Attractiveness Analysis End User, 2023 to 2033

Figure 187: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 188: Australia Market Value Proportion Analysis, 2022

Figure 189: Australia Market Share Analysis (%), by Type, 2023 & 2033

Figure 190: Australia Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 191: Australia Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 192: Australia Market Share Analysis (%), End User, 2023 & 2033

Figure 193: New Zealand Market Value Proportion Analysis, 2022

Figure 194: New Zealand Market Share Analysis (%), by Type, 2023 & 2033

Figure 195: New Zealand Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 196: New Zealand Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 197: New Zealand Market Share Analysis (%), End User, 2023 & 2033

Figure 198: Middle East & Africa Market Value Share by Type 2023 (E)

Figure 199: Middle East & Africa Market Value Share by Level of Interoperability 2023 (E)

Figure 200: Middle East & Africa Market Value Share by Deployment 2023 (E)

Figure 201: Middle East & Africa Market Value Share End User 2023 (E)

Figure 202: Middle East & Africa Market Value Share by Country 2023 (E)

Figure 203: Middle East & Africa Market Historical Market Size (US$ Million) Analysis, 2017 to 2022

Figure 204: Middle East & Africa Market Current and Future Market Size (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis

Figure 205: Middle East & Africa Market Attractiveness Analysis by Type, 2023 to 2033

Figure 206: Middle East & Africa Market Attractiveness Analysis by Level of Interoperability, 2023 to 2033

Figure 207: Middle East & Africa Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 208: Middle East & Africa Market Attractiveness Analysis End User, 2023 to 2033

Figure 209: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 210: GCC Countries Market Value Proportion Analysis, 2022

Figure 211: GCC Countries Market Share Analysis (%), by Type, 2023 & 2033

Figure 212: GCC Countries Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 213: GCC Countries Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 214: GCC Countries Market Share Analysis (%), End User, 2023 & 2033

Figure 215: South Africa Market Value Proportion Analysis, 2022

Figure 216: South Africa Market Share Analysis (%), by Type, 2023 & 2033

Figure 217: South Africa Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 218: South Africa Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 219: South Africa Market Share Analysis (%), End User, 2023 & 2033

Figure 220: North Africa Market Value Proportion Analysis, 2022

Figure 221: North Africa Market Share Analysis (%), by Type, 2023 & 2033

Figure 222: North Africa Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 223: North Africa Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 224: North Africa Market Share Analysis (%), End User, 2023 & 2033

Figure 225: Türkiye Market Value Proportion Analysis, 2022

Figure 226: Türkiye Market Share Analysis (%), by Type, 2023 & 2033

Figure 227: Türkiye Market Share Analysis (%), by Level of Interoperability, 2023 & 2033

Figure 228: Türkiye Market Share Analysis (%), by Deployment, 2023 & 2033

Figure 229: Türkiye Market Share Analysis (%), End User, 2023 & 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA