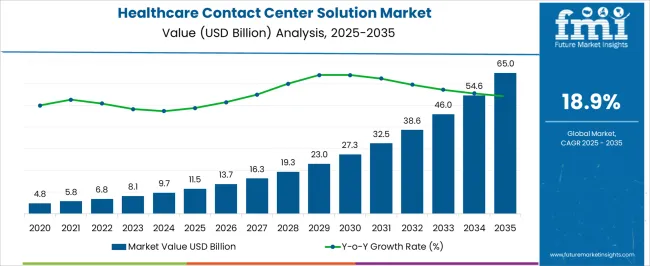

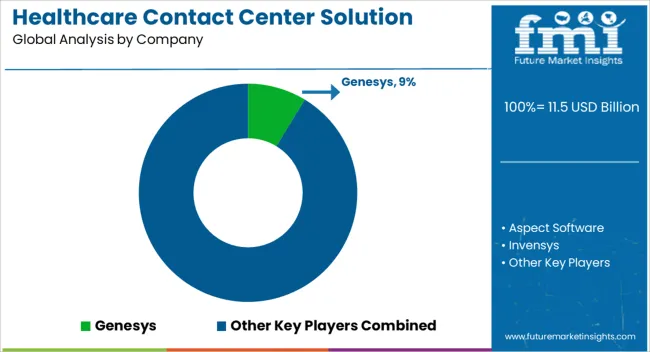

The Healthcare Contact Center Solution Market is estimated to be valued at USD 11.5 billion in 2025 and is projected to reach USD 65.0 billion by 2035, registering a compound annual growth rate (CAGR) of 18.9% over the forecast period.

| Metric | Value |

|---|---|

| Healthcare Contact Center Solution Market Estimated Value in (2025 E) | USD 11.5 billion |

| Healthcare Contact Center Solution Market Forecast Value in (2035 F) | USD 65.0 billion |

| Forecast CAGR (2025 to 2035) | 18.9% |

The healthcare contact center solution market is experiencing accelerated growth, supported by the rising need for efficient patient engagement platforms and streamlined communication systems within healthcare organizations. Hospitals and healthcare providers are increasingly adopting digital tools to improve patient experience, reduce administrative burdens, and ensure timely service delivery. Annual reports and healthcare IT publications have emphasized the role of advanced contact center solutions in integrating appointment scheduling, medical inquiries, and telehealth support into unified systems.

The growing emphasis on patient-centric care and compliance with healthcare regulations has further driven investment in secure, scalable communication technologies. Additionally, the global shift towards virtual healthcare and remote monitoring has highlighted the importance of contact centers in bridging the gap between patients and providers.

Looking ahead, the market is expected to expand further with the integration of artificial intelligence, natural language processing, and cloud computing to deliver personalized, real-time support. Segmental leadership is expected from cloud-based deployments, customer relationship management applications, and professional services due to their scalability, effectiveness, and adaptability across healthcare ecosystems.

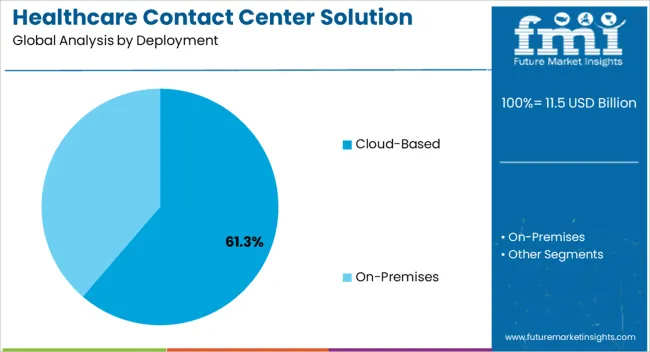

The Cloud-Based segment is projected to contribute 61.30% of the healthcare contact center solution market revenue in 2025, reflecting its position as the preferred deployment model. This dominance has been driven by the scalability, cost efficiency, and flexibility cloud platforms provide to healthcare organizations.

Cloud-based solutions have enabled providers to centralize patient data, integrate omnichannel communication, and expand services without the limitations of on-premise infrastructure. Industry updates and technology adoption reports have highlighted that cloud deployment reduces upfront capital costs while ensuring seamless updates and security compliance.

Moreover, the ability to support remote operations and disaster recovery has been particularly valuable in maintaining service continuity in critical healthcare environments. With healthcare systems increasingly shifting towards digital transformation, cloud-based deployments are expected to remain the cornerstone of contact center adoption, ensuring long-term growth for this segment.

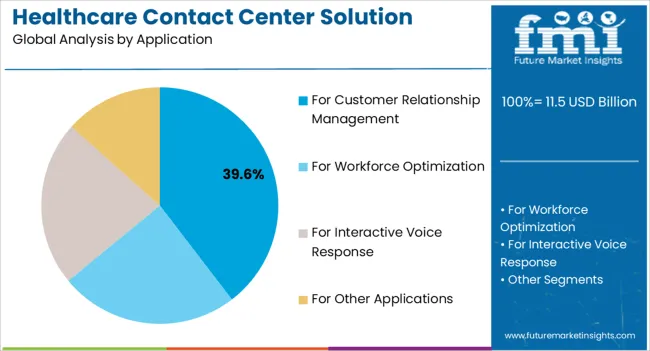

The For Customer Relationship Management (CRM) segment is projected to account for 39.60% of the healthcare contact center solution market revenue in 2025, sustaining its leadership among applications. Growth in this segment has been supported by the rising demand for personalized patient engagement and effective communication strategies.

Healthcare providers have leveraged CRM solutions to manage patient relationships by tracking interactions, coordinating care, and delivering timely follow-ups. Investor updates and industry forums have underscored the role of CRM-focused contact centers in improving patient satisfaction scores and loyalty while enhancing operational efficiency.

Furthermore, the ability to analyze patient behavior and preferences through integrated CRM systems has enabled healthcare organizations to design proactive outreach campaigns and streamline service delivery. With the growing emphasis on value-based care and long-term patient engagement, the CRM application segment is expected to remain a dominant driver in the healthcare contact center solution market.

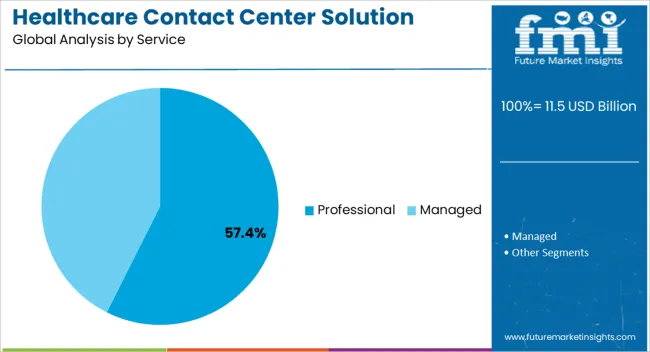

The Professional Services segment is projected to hold 57.40% of the healthcare contact center solution market revenue in 2025, establishing its leading position in the service category. This segment’s growth has been attributed to the increasing need for implementation support, system integration, and ongoing training as healthcare providers transition to advanced contact center platforms.

Press releases and consultancy reports have noted that professional services are critical for ensuring compliance with healthcare regulations, optimizing workflows, and customizing solutions to fit organizational requirements. Healthcare providers have relied on professional services to align technology adoption with their specific operational models, reducing risks associated with system downtime or inefficiency.

Additionally, professional service providers have played a key role in supporting analytics integration, security configuration, and workforce training, ensuring that healthcare organizations maximize the return on their technology investments. As the complexity of healthcare IT systems grows, the demand for specialized professional services is expected to remain strong, driving sustained growth in this segment.

Throughout the forecast period, the market for healthcare contact center solutions is anticipated to increase due to the widespread usage of cloud-based solutions and services in contact centers. Additionally, it is projected that the market for healthcare contact center solutions would expand due to the rising need for quick and efficient customer solutions.

The quick transition from analog to digital technologies and the widespread use of next-generation IVR with superior voice recognition in the healthcare sector is also projected to benefit the market's expansion for contact center solutions for healthcare providers.

The market is expanding due to major emergent dynamics such as AI, visual assistance, and data analytics. The rising need for quick and efficient client solutions creates revenue possibilities. Businesses now depend more than ever on contact centers to handle the additional demand brought on by the pandemic.

In addition, it is anticipated that there will be a significant increase in demand for healthcare contact center solutions due to the cost savings and widespread adoption of cutting-edge contact center technology solutions that help hospitals improve their operational efficiencies.

Obstacles projected to limit market expansion include compliance and regulatory challenges for product approvals. Additionally, one of the main market limitations is the high cost of Research and Development associated with the manufacture and development of healthcare contact center solutions.

The healthcare contact center solutions market is dominated by North America, which is predicted to retain a market share of 31.1% by 2025. The enormous increase is the adoption of cloud-based contact center solutions by both small and large businesses in the healthcare sector. Furthermore, it is projected that the strong need for quick and efficient customer solutions would foster the expansion of the regional industry. Additionally, the rapid transition from analog to digital technologies and the widespread use of next-generation IVR with superior voice recognition in the healthcare industry is projected to benefit the market's expansion.

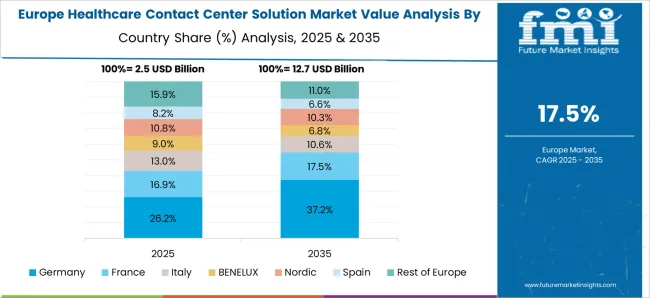

Due to extensive research and development, the second-largest healthcare contact center solutions market is in Europe. Additionally, several significant firms are trying to bolster their position in Europe through acquisitions, expansions, product launches, and approvals. The fast growth of hospital application fields, which makes it unavoidable for hospitals to move their IT infrastructure to the cloud in the future and opens up several new options, is predicted to drive demand for healthcare contact center solutions in Europe. Thus, as a result of these factors, it is anticipated that in 2025 Europe would hold a 23.3% market share for healthcare contact center solutions.

In terms of market share for healthcare contact center solutions in 2025, Asia Pacific is anticipated to account for 25%. Due to the region's vast population and rising investment in research and development from public or private healthcare organizations, it is predicted that this region will account for a significant portion of the worldwide market for healthcare contact center solutions. Additionally, it is anticipated that there will be a significant increase in demand for healthcare contact center solutions. The market is likely to expand due to the low cost and widespread adoption of cutting-edge contact center technology solutions that allow hospitals to streamline their operational efficiencies.

Many new companies are entering the marketplace with unique inventions due to a very high level of competition.

Example:

Since the healthcare contact center solutions market is extremely competitive, a clearly perceptible trend that is being noticed everywhere is that large organizations are now looking to conduct a certain business-related activity in a country that provides favorable legislation.

For instance, in September 2024, the medical information (MI) Contact Center services offered by IQVIA, a global provider of advanced analytics, technological solutions, and clinical research services to the life sciences sector, were enhanced with new AI-powered technologies. Companies in the life sciences sector utilize IQVIA's MI Contact Center services to monitor product quality and safety, provide information about new products and relevant therapeutic areas, and share information about new goods. To do this, teams of knowledgeable agents directly answer queries from customers, patients, and healthcare professionals (HCPs) worldwide. IQVIA's MI Contact Center services now employ AI-powered virtual agents alongside knowledgeable human agents to triage and answer inquiries. This mix of AI-powered agents and human agents produces faster reaction times and reporting of negative events or quality issues.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 18.9% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Deployment, Application, Service, Enterprise Type, Region |

| Regions Covered | North America; Latin America; The Asia Pacific; Middle East and Africa; Europe |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Genesys; Aspect Software; Invensys; DATAMARK Incorporated; Aspect; Ozonetel; Virtusa Corporation. |

| Customization | Available Upon Request |

The global healthcare contact center solution market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the healthcare contact center solution market is projected to reach USD 65.0 billion by 2035.

The healthcare contact center solution market is expected to grow at a 18.9% CAGR between 2025 and 2035.

The key product types in healthcare contact center solution market are cloud-based and on-premises.

In terms of application, for customer relationship management segment to command 39.6% share in the healthcare contact center solution market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA