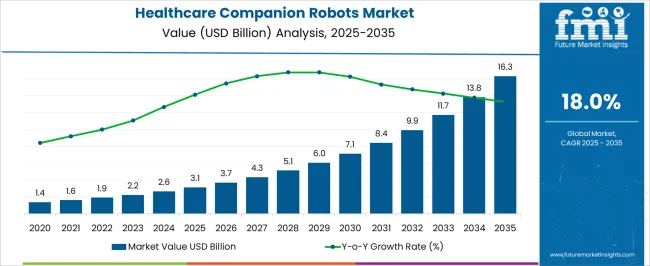

The Healthcare Companion Robots Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 16.3 billion by 2035, registering a compound annual growth rate (CAGR) of 18.0% over the forecast period.

| Metric | Value |

|---|---|

| Healthcare Companion Robots Market Estimated Value in (2025 E) | USD 3.1 billion |

| Healthcare Companion Robots Market Forecast Value in (2035 F) | USD 16.3 billion |

| Forecast CAGR (2025 to 2035) | 18.0% |

The healthcare companion robots market is expanding steadily due to the rising need for emotional support solutions, especially in pediatric and geriatric care. These robots are being increasingly integrated into care environments to enhance patient interaction, reduce feelings of isolation, and support mental well being.

Advances in AI driven behavioral responses, speech recognition, and interactive sensory features are elevating their therapeutic value. Healthcare institutions and caregivers are adopting these robots to provide personalized companionship and reduce caregiver burden.

The shift toward non invasive care tools and the growing focus on holistic patient experience are further accelerating adoption. With evolving healthcare models emphasizing mental wellness and patient centered approaches, the outlook for this market remains positive, particularly as robot design and functionality continue to align with therapeutic and emotional needs across age groups.

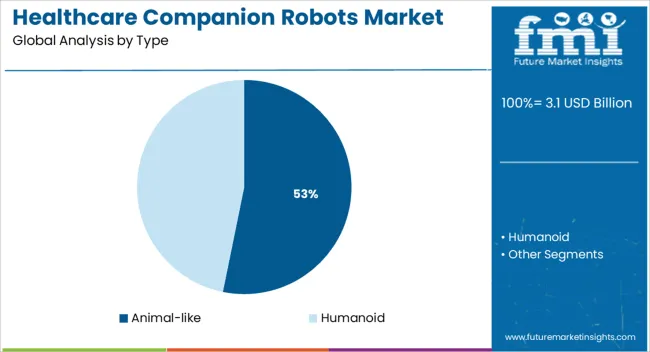

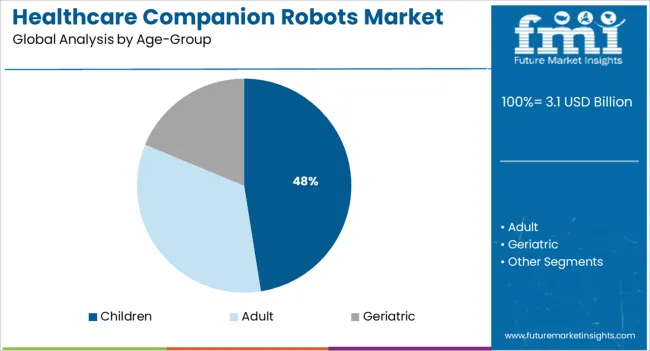

The market is segmented by Type and Age-Group and region. By Type, the market is divided into Animal-like and Humanoid. In terms of Age-Group, the market is classified into Children, Adult, and Geriatric. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The animal like segment is projected to account for 53.20% of the total revenue by 2025 within the type category, positioning it as the leading segment. This dominance is attributed to the strong emotional connection users, particularly children and older adults, establish with animal mimicking robots.

Their familiar and comforting appearance enhances user engagement, leading to better psychological outcomes and increased acceptance in therapeutic settings. These robots often incorporate soft textures, lifelike movements, and interactive behavior, which are proven to reduce stress, anxiety, and agitation in care environments.

As emotional wellness becomes a core component of patient care, animal like robots continue to lead this segment by providing comfort, companionship, and therapeutic interaction in a non intrusive and relatable form.

The children segment is expected to contribute 47.50% of total market revenue by 2025 under the age group category, establishing it as the most prominent segment. This trend is driven by the increasing use of companion robots in pediatric hospitals, therapy centers, and home care to support emotional development and reduce treatment related anxiety.

These robots are designed to foster interactive play, build communication skills, and provide educational reinforcement in a safe and engaging manner. Their ability to adapt to the behavioral needs of children and integrate with gamified therapy sessions has made them particularly valuable in addressing developmental challenges and emotional disorders.

As healthcare providers seek to create supportive and child friendly environments, the demand for pediatric focused companion robots continues to grow, reinforcing the leadership of the children segment.

According to market research and competitive intelligence provider Future Market Insights- the market for healthcare companion robots reflected a value of 10% during the historical period, 2020 to 2025. dental virtual visits have enabled the reach of oral healthcare in underserved areas of developing countries.

The outbreak of COVID-19 positively impacted the market growth. The lockdown and social distancing imposed by the government resulted in social isolation and feeling of loneliness. This raised the acceptance of companion robots as it helped to fill in the gaps and reduce loneliness, especially in the elderly population. Also, they were used to assist the therapies in order to improve the mental condition of people and help them to overcome anxiety issues. Moreover, they are also used for monitoring health remotely and managing medication. Thus, the market for healthcare companion robots is expected to register a CAGR of 18% in the forecast period 2025 to 2035.

Companion robots reduce loneliness and offer support to patients of all age groups

Companion robot helps to enhance well-being and quality of life through their assistance features. It mainly provides cognitive support, mobility support, and relaxation. Also, it helps in monitoring health and provides self-care support through interaction. The rising geriatric population across the globe and the limited number of healthcare professionals to care for the older population, particularly in countries like Japan is likely to raise the demand for companion robots. Furthermore, various initiatives undertaken by the government are supporting market growth.

Technological advancement in the field of medical robotics is another factor driving market growth. Various robotic products are developed to assist patients and improve their outcomes. For instance, Service Robotics, a United Kingdom-based startup offers medical care robotics as a service (RaaS). The company developed a humanoid robot GenieConnect, an AI-based voice and video robot that provides engagement and stimuli to promote cognitive retention. Also, it helps in alleviating loneliness. In addition, it integrates with smart home devices and wearables to provide comprehensive and personalized care for users.

Robot Companions helping Disabled and Geriatric Population to Function Independently

Furthermore, the rising rate of people suffering from disabilities is another factor driving the companion robots market. As per the World Health Organization, 1 in 7 people experience some kind of disability. Companion robot helps to improve the life of such people by assisting them. As per the International Robotics Federation, about 34,000 assistance robots were mainstreamed during the period between 2020 and 2024 so as to facilitate people suffering from disabilities.

In addition, the development of innovative products by key players is impelling market growth. For instance, in June 2024, Hanson Robotics launched a robot Grace. It is designed to interact with elderly people and isolated COVID-19 patients. Similarly, the Kaspar robot developed by the University of Hertfordshire is a humanoid robot that acts as a companion to improve the lives of children with autism and other communication difficulties. Such initiatives are expected to impel market growth in the forecast period.

Expensive nature and unskilled geriatric population affecting the growth of the healthcare companion robots market

Although healthcare companion robots are becoming popular, their commercialization of the same is expensive. Moreover, certain people with disability have not shown keen interest in investing in healthcare companion robots as it adds to the stigma and intensifies the same.

The usability factor of healthcare companion robots is being questioned as the geriatric population finds it difficult to get accustomed to technology. Furthermore, robots with lesser functions are not finding buyers owing to the constant development of the healthcare companion robots market.

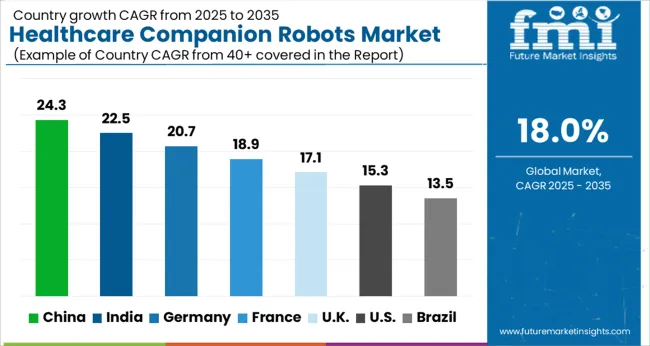

Government Initiatives supporting the use of Healthcare Robots in the Asia Pacific

In 2025, Asia Pacific is expected to dominate the healthcare companion robots market with a share of 50%. The increasing geriatric population in the region and various initiatives undertaken by the government for the development of companion robots to support the elderly population are the major factors contributing to the dominance.

For instance, in September 2025, Myongji Hospital, a healthcare institution in South Korea is working on the development of an AI-driven care robot to assist patients with dementia. Also, the local governments in South Korea have provided companion robots to single persons and those who are living with mental health issues to support their well-being. In addition, the declining rate of healthcare providers in countries like Japan has raised the demand for robots in healthcare facilities.

Development of innovative products creating lucrative opportunities for the healthcare companion robots market in North America

North America is expected to witness the fastest growth rate owing to the increasing demand for humanoid robots in healthcare facilities, the presence of well-developed healthcare infrastructure, and increasing investment by key companies to develop innovative products. Also, the initiatives undertaken by the government for the deployment of companion robots to support the lives of the elderly population are expected to impel the market over a forecast period.

The proliferation of artificial intelligence (AI) and machine learning technologies will enable more advanced features in companion robots, thereby driving their demand. Growing awareness about the benefits of using companion robots is likely to fuel their uptake over the forecast period. Rapid advancements in robotics technology are anticipated to result in declining prices of companion robots, making them more affordable for a wider audience. Thus, North America is expected to possess a 41% market share of the healthcare companion robots market in 2025.

Children and the geriatric population benefit from using humanoid robots

By type, the humanoid segment is expected to hold the largest share of nearly 75% in 2025 due to the benefits offered by these robots such as perfection and minimum human errors. These robots are used for the implementation of techno-psychological distraction for children during a medical procedure as it helps to reduce the pain resulting from anxiety and stress.

Furthermore, the rise in demand for robotics due to the increasing disabled and aging population to tackle problems that arise from their inability to relate effectively with their environment has contributed to the market share of humanoid robots. In addition, humanoid robots are also implemented in Autism Special Education where they can engage children with applications designed for special education.

Animal-like robots interact positively with patients and improving well-being

The animal-like segment is anticipated to expand at the fastest rate over a forecast period. Paro, an animal-like robot companion is increasingly used in dementia care due to the positive effects that interacting with these robots can have on the well-being of these patients. Also, these pet/animal-designed robots with animal aesthetics and behaviors have particular potential in aged care. They also help in alleviating loneliness in older adults, which is positively impacting segment growth.

Companion robots reducing hospitalization for Geriatric Population

By age group, the geriatric segment is expected to hold the largest share of 40% in 2025. The use of companion robots has shown a significant improvement in the lives of the elderly population. The integration of technologies has enabled home healthcare and it supports aging at home thereby reducing the risk of falls.

As per a study conducted and published by Bold in December 2024, the use of companion robots has reduced falls and associated hospitalizations by 46%. Furthermore, companion robots are in demand to assist people suffering from dementia and may help to reduce depression and agitation.

Robot Companions supporting the emotional and cognitive development of children

The children segment is anticipated to expand at a faster rate in the forecast period owing to the rising demand for companion robots to support the emotional and cognitive development of children.

Also, these robots are increasingly used to assist therapy for children diagnosed with disabilities such as autism. Buddy the Robot developed by Blue Frog Robotics, is one such robot that helps to assist children with autism. In addition, various innovative product developed by key companies targeting the children population is impelling the segment growth. For instance, in 2024, Embodied Inc. launched Moxie, with the intent to help children between the ages of 5 years to 10 years to develop social, cognitive, and emotional skills.

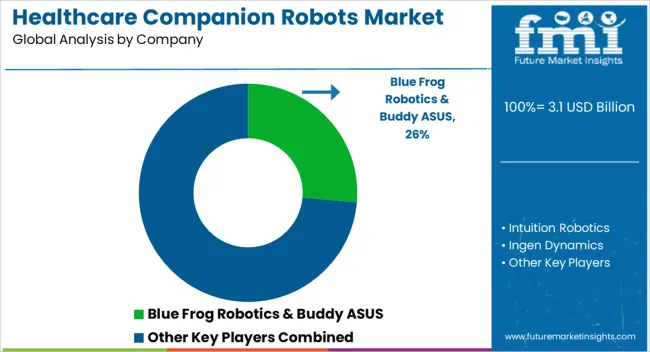

Key players in the healthcare companion robots are Cutii, Co-Robotics, Service Robotics, MJI Robotics, Experr Technologies

Various strategies such as product development, partnerships, etc. adopted by key players are driving the healthcare companion robots market. Some prominent players in the global healthcare companion robots market include Blue Frog Robotics & Buddy ASUS, Intuition Robotics, inGen Dynamics, PARO Robots USA, Inc, No Isolation, Luvozo, Honda Robotics, Hanson Robotics, Ubtech, Emotix, and Jibo

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 3.1 billion |

| Market Value in 2035 | USD 16.3 billion |

| Growth Rate | CAGR of 18% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Age-group, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Blue Frog Robotics & Buddy ASUS; Intuition Robotics; Ingen Dynamics; PARO Robots USA, Inc.; No Isolation; Luvozo; Honda Robotics; Hanson Robotics; Ubtech; Emotix; Jibo |

| Customization | Available Upon Request |

The global healthcare companion robots market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the healthcare companion robots market is projected to reach USD 16.3 billion by 2035.

The healthcare companion robots market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in healthcare companion robots market are animal-like and humanoid.

In terms of age-group, children segment to command 47.5% share in the healthcare companion robots market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA