Healthcare video conferencing solutions market will grow steadily from 2025 to 2035, owing to growing demand for telehealth services, the digital transformation of healthcare systems, and the demand for real-time medical collaboration across geographies.

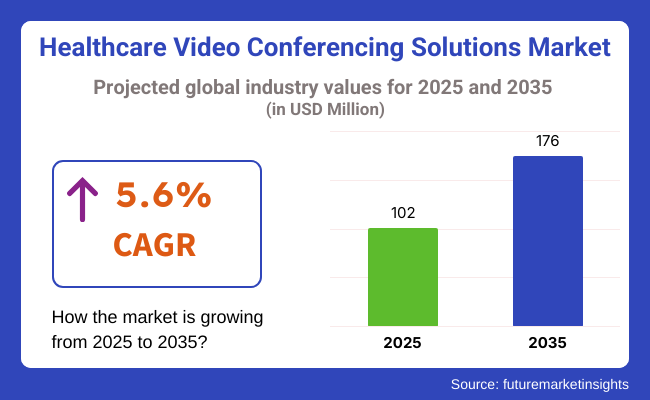

These include remote consultations, virtual patient monitoring, specialist collaboration and medical training. The market is anticipated to grow to around USD 102 Million by 2025 and to witness a CAGR of 5.6% in the years to come to reach USD 176 million by 2035.

The growth in the market is driven by geriatric population, need for accessible healthcare, and an investment in the digital infrastructure. Increase adoption with electronic health records (EHR) integration, HIPAA compliance, and artificial intelligence (AI) capabilities such as free transcription and diagnostics. But growth could be limited by challenges including interoperability issues, data privacy concerns, and resistance to digital tools in traditional settings. In addressing these challenges, providers emphasize scalable cloud-based platforms, cybersecurity, and user-focused interface design.

Key Market Metrics

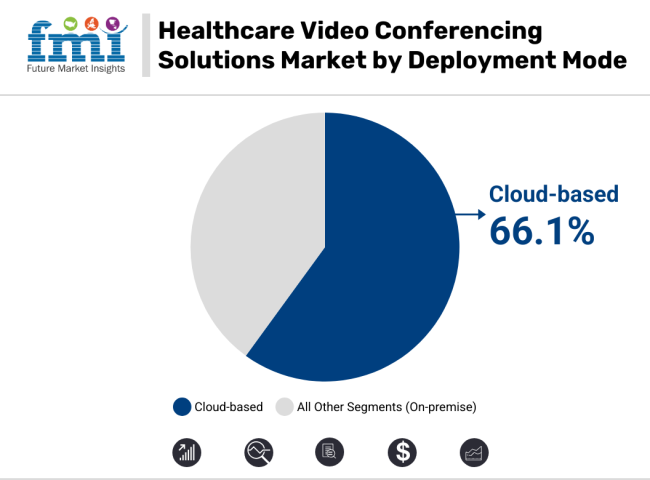

Based on type, the healthcare video conferencing solutions market is segmented into two forms deployment model, and end-user. Some important deployment types are cloud-based and on premise solutions. These solutions are mostly cloud based because they are scalable, accessible remotely and require virtually no maintenance costs.

Hospitals are the top end-users for virtual specialist consultations and multidisciplinary care coordination. Next are clinics and ambulatory centers, which use video conferencing to check on patients and triage remotely. Due to this fact, home care settings are also expanding as remote monitoring and continuity of care become increasingly important. With telemedicine regulation changing, providers uniquely configure solutions to regional compliance standards and design multilingual, device-supported interfaces for better accessibility.

North America is a dominant region in the healthcare video conferencing solutions market owning to matured healthcare IT infrastructure telehealth reimbursement policies and growing adoption of remote care models. The US and Canada follow closely for adopting virtual platforms into existing clinical workflows.

In Europe, market is supported by national digital health strategies, cross-border healthcare initiatives and increasing acceptance of virtual consultations. Leading adoption are Germany, France, and the UK with support from government-backed programs for e-health services and privacy-compliant alternatives for video communication.

The healthcare video conferencing market in the Asia-Pacific region is expected to grow at the fastest rate, driven by rural healthcare outreach, smartphone penetration, and public-private investment in telemedicine. Southeast Asian nations like China, India, Japan, and Australia should invest in telehealth infrastructure as a witness to address shortages of specialists and enhance equity in their healthcare system.

Challenge

Data Privacy Compliance and Integration with Legacy Systems

Healthcare video conferencing solutions market has a few challenges, as data can be confidential, security compliance, and not causing significant interoperability of existing infrastructure. Solutions must comply with stringent regulations, including HIPAA in the USA, GDPR in Europe, and other regional requirements, mandating aspects like end-to-end encryption, audit trails, and secure data at rest.

In developing parts of the world, many healthcare providers are still using legacy electronic health record (EHR) systems, with aging IT networks laden with integration and latency challenges. Maintaining seamless performance, clinical-grade video quality, and real-time data sharing without sacrificing security is still a core technical and financial challenge especially for smaller clinics and rural providers.

Opportunity

Rise in Telehealth Adoption and Remote Patient Monitoring

The market is expected to pose significant growth opportunities due to the global trend towards telehealth, chronic disease management, and remote care delivery models. Healthcare video conferencing solutions covering all aspects of remote treatment from individual and online consultations to multidisciplinary care coordination, virtual diagnostics, and mental health therapy while improving both availability and cost-effectiveness.

Providers are able to reach underserved and aging populations particularly for home healthcare, rural clinics, and post-acute care with growing Internet penetration and access to smartphones. AI-based triage support tools, integrated data streams from wearable technologies, and mobile-friendly platforming options are evolving video conferencing tools into critical workflows for contemporary care delivery.

The market saw an explosive growth between 2020 and 2024 as healthcare systems rushed to adopt video conferencing for virtual consultation, handling of disease outbreak situation, and continuity of care with minimal in-person visits. Most providers preferred platforms that offered secure video links as well as integration with EHR and features to facilitate prescriptions sharing. But differences in reimbursement policies, patient tech literacy, and platform standardization limited wider institutional uptake beyond emergency measures.

In 2025 to 2035, the ecosystem will be cloud-native with AI-enabled video health capabilities including automatic transcription, real-time sharing of vitals, multilingual and predictive analysis, among others. The rise of hybrid healthcare models, cross-border consultations, and value-based care will drive demand for scalable, interoperable, and standards-compliant solutions. Integration with wearables and IoT will enable constant patient monitoring throughout each session, fostering both preventive care and early intervention.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focused on HIPAA/GDPR compliance and emergency telehealth waivers. |

| Technological Advancements | Use of basic encrypted video platforms integrated with EHRs. |

| Sustainability Trends | Increased interest in remote consultations to reduce patient travel and facility congestion. |

| Market Competition | Led by general video platforms adapted for healthcare. |

| Industry Adoption | Common in mental health, primary care, and post-acute check-ups. |

| Consumer Preferences | Demand for accessible, mobile-friendly, and appointment-based video consultations. |

| Market Growth Drivers | Growth driven by COVID-era telehealth acceleration and remote access needs. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion into cross-border licensing, AI regulation, and full digital consent frameworks. |

| Technological Advancements | Integration of AI triage, smart scheduling, vitals data streaming, and language translation tools. |

| Sustainability Trends | Emphasis on virtual-first care models, energy-efficient cloud infrastructure, and digital carbon offsetting. |

| Market Competition | Rise of specialized telehealth platforms offering end-to-end clinical and diagnostic services. |

| Industry Adoption | Expansion into surgical follow-ups, global specialist consultations, and AI-assisted diagnostics. |

| Consumer Preferences | Preference for on-demand care, integrated patient portals, and wearable-compatible video sessions. |

| Market Growth Drivers | Expansion driven by chronic disease management, hybrid care models, and digital health equity initiatives. |

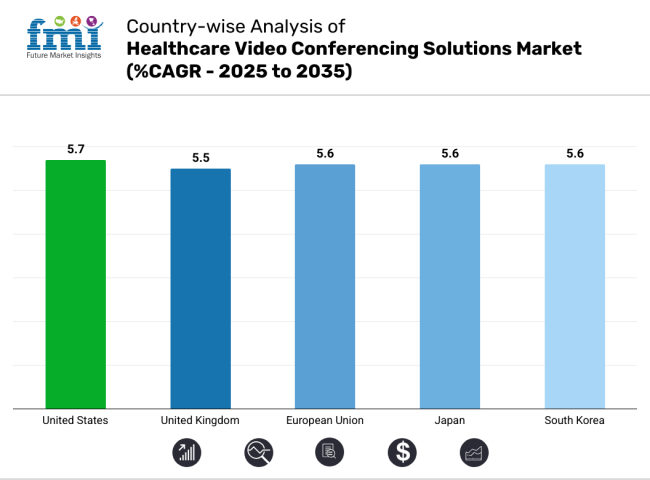

The United States healthcare video conferencing solutions market is also growing steadily due to the culmination of telehealth into mainstream care delivery, increasing focus on virtual care infrastructure, and demand for HIPAA-compliant communication platforms. Health systems and private practices continue to harness video conferencing solutions for use in remote consultation, mental health services delivery, and chronic care management.

With large technology vendors showing up across the telehealth market place and favourable reimbursement models from Medicare and private payers, there has been a flurry of investment to cloud-based high-definition video platforms with embedded EHR connectivity and AI-driven diagnostics. Ongoing expansion of rural health access initiatives are further driving adoption across underserved geographies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

A growing number of UK healthcare payers and providers are already deploying video conferencing in their organizations for the reasons outlined above, aided by the NHS's digital health strategy as well as the increasing need for remote patient interactions and efficiency in clinical workflows. Videoconferencing is becoming commonplace across primary care, behavioural health, and specialist referrals, leading healthcare organizations to deploy simple, secure video solutions.

Investment by the public sector in digital-first healthcare models and virtual ward programs is driving forward the adoption of technology. Also, the UK’s increasing focus on mental health services and outpatient surveillance is driving demand for interoperate, real-time video communication systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

The European Union market for healthcare video conferencing solutions is effectively growing with cross-border digital health projects, a rise in teleconsultations, and a growing focus on the efficiency of the healthcare system. Germany, France, and the Netherlands, among others, have invested in secure video platforms, integrated in EHR, to facilitate clinical collaboration and remote diagnostic activities.

A related development of providing large-scale encrypted, high-reliability video solutions across hospitals, facilitated by compliance with EU regulations on patient data privacy (GDPR), as well as digital health funding through EU4Health and Horizon Europe, and the provision of home care through a hospital. Supporting multiple languages and cross-regional access becomes a default feature.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

The healthcare video conferencing solutions market in Japan is witnessing a gradual growth, supported by the country’s aging population, the need for at-home care, and a national strategy to encourage the digital health transformation. Video consultations have become more prevalent in geriatric care, oncology follow-ups and psychiatric services, bolstered by the Japanese government’s shift toward reimbursing telemedicine.

Local vendors have tailored solutions that including high-resolution imaging, multi-device support, and Japanese language compliance in the product, which are customized to comply with clinical and patient experience requirements. As rural health access becomes a priority, video conferencing is serving as a vital bridge between urban specialists and rural health centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The market for South Korean healthcare video conferencing solutions is on a fast track growth, with a solid digital forte and government initiatives to increase telehealth as well as increasing usage of remote care technologies in hospitals and clinics. Healthcare providers are adopting high-speed, secure video platforms to engage with patients in real time as well as for diagnostics and interdepartmental consultations.

By promoting the development of interoperable video conferencing systems that can be implemented in both public and private healthcare environments, South Korea is also focusing on AI-the enhancements in clinical workflows, mobile accessibility through local interfacing systems, and data integration are some of the features that are being integrated along with interoperability while building robust video conferencing systems. Regular upgradations in eHealth regulations and smart hospital frameworks provide another accelerator for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Healthcare video conferencing solutions market is growing continuously as medical providers are adopting digital communication platforms to provide remote care, collaboration, and consultations. This is part of a global shift toward digitalisation of healthcare delivery, in particular it is driven by patients wanting the provision of services, such as prescriptions, their data and results, in a convenient real-time fashion.

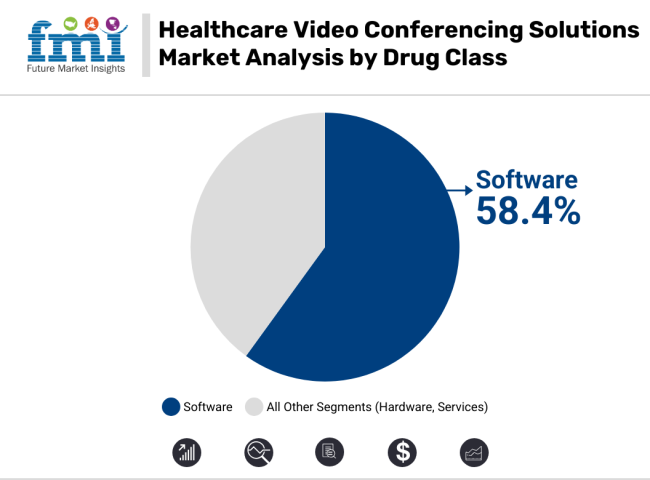

In this expanding space, cloud-based deployment and software platforms are the largest segments of this landscape, providing secure, flexible and scalable solutions designed for both clinical and non-clinical healthcare requirements.

With modernization of healthcare systems, shared stakeholders are looking for interoperable video conferencing tools that integrates right with EMR systems, compliance and user-friendly experience. Cloud-based platforms provide infrastructure for large-scale virtual care networks, while software components enable diagnostics, therapy, training and internal communication capabilities. These sectors continue to dominate the strategic growth telehealth across hospitals another private practices, another rural health programs.

Due to the flexibility, cost-effectiveness, and accessibility of cloud-based video conferencing platforms, they have thus become the most popular deployment model for healthcare providers. These solutions help healthcare teams provide virtual consultations, mental health services, and remote diagnostics, without the need for complex on premise infrastructure investment.

Cloud platforms enable real-time video, file sharing, and patient data to be shared across multiple locations, allowing healthcare systems to reach patients in underserved and remote communities. Cloud deployment requires little hardware and reduces the burden of IT, speeding adoption in big and small practices alike.

Cloud-based models provide healthcare organizations with the flexibility to scale operations with increasing patient volume or expansion of services. Implementing hybrid care models while the industry increasingly moves towards hybrid care models, cloud systems provide seamless integration with mobile-based devices, wearable technologies and third-party applications.

Cloud video conferencing platforms are equipped with strong security features such as end-to-end encryption, HIPAA compliance, and access control to meet the healthcare regulatory standards. As virtual care becomes not just a clinical but also a business requirement, and as hyper-specialization creates teams of providers around the care journey, cloud-based deployments will remain the crucible for agile, patient-centered care delivery.

Software solutions form the core of healthcare video conferencing systems, allowing communication, diagnostics, and administrative coordination through providers and customers. So whether it takes the form of browser-based apps or operating as embedded telehealth modules in EHR systems, software enables scheduling, video sessions, documentation and post-consultation follow-up.

These platforms enable a range of use cases, from primary care, behavioural therapy, chronic disease management, and surgical consultations, stretching the reach of specialists and enhancing the coordination of care across the continuum.

The healthcare software vendors focus on building adhered, interfaced systems with functions namely multi-party video, screen sharing, virtual waiting room, and language interpretation6. To enhance session quality and clinician workflow, AI-enabled capabilities such as transcription, facial recognition, and clinical decision support are also being implemented. Healthcare providers can address evolving needs with software updates that mitigate system downtime while maintaining data integrity. As healthcare continues to undergo digital transformation, software platforms are at the heart of innovation, integration, and video conferencing for care delivery.

The healthcare video conferencing solutions market is a dynamic and competitive sector of the digital health technology landscape, fuelled by the increase in demand for telemedicine, remote consultations, multidisciplinary care coordination, and virtual patient engagement. Healthcare providers are now adopting these platforms more than ever, as they provide better accessibility to care, cost-effectiveness, and continuity of care.

Foundation Meeting for HIPAA-Compliant Communication, EHR Integration, AI-Driven Scheduling, and Device Interoperability Multinational companies specializing in telehealth platforms, in addition to unified communications companies, and providers of cloud-based video solutions are part of the market that serves hospitals, clinics, mental health systems, and home healthcare networks.

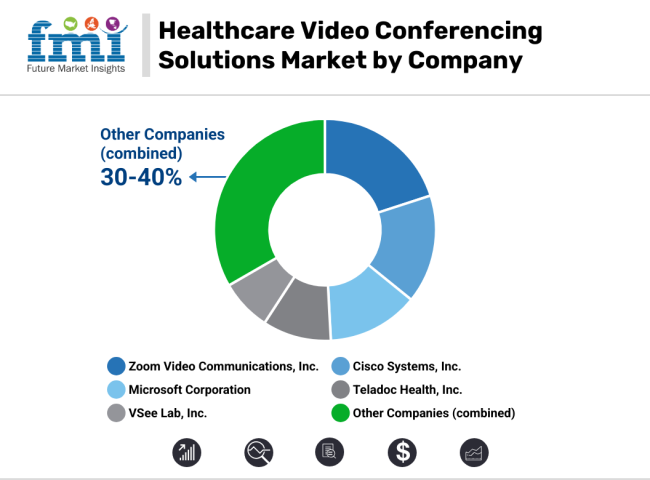

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Zoom Video Communications, Inc. | Rolled out Zoom for Healthcare with HIPAA/PIPEDA compliance and EHR integrations in 2025 , enabling virtual rounds and specialist collaboration. |

| Cisco Systems, Inc. | Expanded Webex for Healthcare in 2024 , integrating teleconsultation, clinical workflow tools, and secure patient communications. |

| Microsoft Corporation | Launched Microsoft Teams Healthcare Edition in 2025 , with FHIR integration, scheduling automation, and virtual clinic templates. |

| Teladoc Health, Inc. | Released new features for end-to-end telehealth platforms in 2024 , including AI triage, mental health tools, and multi-language support. |

| VSee Lab, Inc. | Introduced customizable telehealth modules with low-bandwidth optimization in 2025 , supporting multi-specialty practices and rural connectivity. |

Key Company Insights

Zoom Video Communications, Inc.

Zoom takes its secure, scalable platform for healthcare virtual consultations, team huddles, and care coordination across their systems integrated with health IT systems and leads with it.

Cisco Systems, Inc.

We have enabled secure patient portals on Webex to support hospital-grade video infrastructure, allowing for a safe virtual visit, remote diagnostics and patient monitoring integrations.

Microsoft Corporation

At Microsoft, we offer Teams-based care coordination platforms that integrate with clinical systems, supporting cross-functional collaboration in hybrid models of care in the future.

Teladoc Health, Inc.

Teladoc is now one of the leading telehealth platforms tailored for specialty care, offering chronic condition management, virtual therapy, and patient engagement functions.

VSee Lab, Inc.

VSee offers flexible video conferencing solutions for clinics and remote programs, with emphasis on low-bandwidth support and modular telehealth tools.

Other Key Players (30-40% Combined)

Several other companies contribute to the healthcare video conferencing solutions market, focusing on real-time diagnostics, privacy-first architecture, and specialty-specific configurations:

The overall market size for the healthcare video conferencing solutions market was USD 102 million in 2025.

The healthcare video conferencing solutions market is expected to reach USD 176 million in 2035.

The increasing need for remote patient consultations, rising adoption of telehealth technologies, and growing reliance on cloud-based platforms and integrated software components fuel the healthcare video conferencing solutions market during the forecast period.

The top 5 countries driving the development of the healthcare video conferencing solutions market are the USA, UK, European Union, Japan, and South Korea.

Cloud-based platforms and software components lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million), By Deployment, 2018 to 2022

Table 2: Global Market Value (US$ Million), By Deployment, 2023 to 2033

Table 3: Global Market Value (US$ Million), By Component, 2018 to 2022

Table 4: Global Market Value (US$ Million), By Component, 2023 to 2033

Table 5: Global Market, By Region, 2018 to 2022

Table 6: Global Market, By Region, 2023 to 2033

Table 7: North America Market Value (US$ Million), By Deployment, 2018 to 2022

Table 8: North America Market Value (US$ Million), By Deployment, 2023 to 2033

Table 9: North America Market Value (US$ Million), By Component, 2018 to 2022

Table 10: North America Market Value (US$ Million), By Component, 2023 to 2033

Table 11: North America Market, By Country, 2018 to 2022

Table 12: North America Market, By Country, 2023 to 2033

Table 13: Latin America Market Value (US$ Million), By Deployment, 2018 to 2022

Table 14: Latin America Market Value (US$ Million), By Deployment, 2023 to 2033

Table 15: Latin America Market Value (US$ Million), By Component, 2018 to 2022

Table 16: Latin America Market Value (US$ Million), By Component, 2023 to 2033

Table 17: Latin America Market, By Country, 2018 to 2022

Table 18: Latin America Market, By Country, 2023 to 2033

Table 19: Europe Market Value (US$ Million), By Deployment, 2018 to 2022

Table 20: Europe Market Value (US$ Million), By Deployment, 2023 to 2033

Table 21: Europe Market Value (US$ Million), By Component, 2018 to 2022

Table 22: Europe Market Value (US$ Million), By Component, 2023 to 2033

Table 23: Europe Market, By Country, 2018 to 2022

Table 24: Europe Market, By Country, 2023 to 2033

Table 25: Asia Pacific Market Value (US$ Million), By Deployment, 2018 to 2022

Table 26: Asia Pacific Market Value (US$ Million), By Deployment, 2023 to 2033

Table 27: Asia Pacific Market Value (US$ Million), By Component, 2018 to 2022

Table 28: Asia Pacific Market Value (US$ Million), By Component, 2023 to 2033

Table 29: Asia Pacific Market, By Country, 2018 to 2022

Table 30: Asia Pacific Market, By Country, 2023 to 2033

Table 31: MEA Market Value (US$ Million), By Deployment, 2018 to 2022

Table 32: MEA Market Value (US$ Million), By Deployment, 2023 to 2033

Table 33: MEA Market Value (US$ Million), By Component, 2018 to 2022

Table 34: MEA Market Value (US$ Million), By Component, 2023 to 2033

Table 35: MEA Market, By Country, 2018 to 2022

Table 36: MEA Market, By Country, 2023 to 2033

Table 37: Global Market Incremental $ Opportunity, By Deployment, 2018 to 2022

Table 38: Global Market Incremental $ Opportunity, By Component, 2023 to 2033

Table 39: Global Market Incremental $ Opportunity, By Region, 2023 to 2033

Table 40: North America Market Incremental $ Opportunity, By Deployment, 2018 to 2022

Table 41: North America Market Incremental $ Opportunity, By Component, 2023 to 2033

Table 42: North America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 43: Latin America Market Incremental $ Opportunity, By Deployment, 2018 to 2022

Table 44: Latin America Market Incremental $ Opportunity, By Component, 2023 to 2033

Table 45: Latin America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 46: Europe Market Incremental $ Opportunity, By Deployment, 2018 to 2022

Table 47: Europe Market Incremental $ Opportunity, By Component, 2023 to 2033

Table 48: Europe Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 49: Asia Pacific Market Incremental $ Opportunity, By Deployment, 2018 to 2022

Table 50: Asia Pacific Market Incremental $ Opportunity, By Component, 2023 to 2033

Table 51: Asia Pacific Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 52: MEA Market Incremental $ Opportunity, By Deployment, 2018 to 2022

Table 53: MEA Market Incremental $ Opportunity, By Component, 2023 to 2033

Table 54: MEA Market Incremental $ Opportunity, By Country, 2023 to 2033

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 2: Global Market Absolute $ Historical Gain (2018 to 2022) and Opportunity (2023 to 2033), US$ Million

Figure 3: Global Market Share, By Deployment, 2023 & 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Deployment - 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Deployment - 2023 to 2033

Figure 6: Global Market Share, By Component, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 8: Global Market Attractiveness Index, By Component - 2023 to 2033

Figure 9: Global Market Share, By Region, 2023 & 2033

Figure 10: Global Market Y-o-Y Growth Projections, By Region - 2023 to 2033

Figure 11: Global Market Attractiveness Index, By Region - 2023 to 2033

Figure 12: North America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 13: North America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 14: North America Market Share, By Deployment, 2023 & 2033

Figure 15: North America Market Y-o-Y Growth Projections, By Deployment - 2023 to 2033

Figure 16: North America Market Attractiveness Index, By Deployment - 2023 to 2033

Figure 17: North America Market Share, By Component, 2023 & 2033

Figure 18: North America Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 19: North America Market Attractiveness Index, By Component - 2023 to 2033

Figure 20: North America Market Share, By Country, 2023 & 2033

Figure 21: North America Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 22: North America Market Attractiveness Index, By Country - 2023 to 2033

Figure 23: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 24: Latin America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 25: Latin America Market Share, By Deployment, 2023 & 2033

Figure 26: Latin America Market Y-o-Y Growth Projections, By Deployment - 2023 to 2033

Figure 27: Latin America Market Attractiveness Index, By Deployment - 2023 to 2033

Figure 28: Latin America Market Share, By Component, 2023 & 2033

Figure 29: Latin America Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 30: Latin America Market Attractiveness Index, By Component - 2023 to 2033

Figure 31: Latin America Market Share, By Country, 2023 & 2033

Figure 32: Latin America Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 33: Latin America Market Attractiveness Index, By Country - 2023 to 2033

Figure 34: Europe Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 35: Europe Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 36: Europe Market Share, By Deployment, 2023 & 2033

Figure 37: Europe Market Y-o-Y Growth Projections, By Deployment - 2023 to 2033

Figure 38: Europe Market Attractiveness Index, By Deployment - 2023 to 2033

Figure 39: Europe Market Share, By Component, 2023 & 2033

Figure 40: Europe Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 41: Europe Market Attractiveness Index, By Component - 2023 to 2033

Figure 42: Europe Market Share, By Country, 2023 & 2033

Figure 43: Europe Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 44: Europe Market Attractiveness Index, By Country - 2023 to 2033

Figure 45: MEA Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 46: MEA Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 47: MEA Market Share, By Deployment, 2023 & 2033

Figure 48: MEA Market Y-o-Y Growth Projections, By Deployment - 2023 to 2033

Figure 49: MEA Market Attractiveness Index, By Deployment - 2023 to 2033

Figure 50: MEA Market Share, By Component, 2023 & 2033

Figure 51: MEA Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 52: MEA Market Attractiveness Index, By Component - 2023 to 2033

Figure 53: MEA Market Share, By Country, 2023 & 2033

Figure 54: MEA Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 55: MEA Market Attractiveness Index, By Country - 2023 to 2033

Figure 56: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 57: Asia Pacific Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 58: Asia Pacific Market Share, By Deployment, 2023 & 2033

Figure 59: Asia Pacific Market Y-o-Y Growth Projections, By Deployment - 2023 to 2033

Figure 60: Asia Pacific Market Attractiveness Index, By Deployment - 2023 to 2033

Figure 61: Asia Pacific Market Share, By Component, 2023 & 2033

Figure 62: Asia Pacific Market Y-o-Y Growth Projections, By Component - 2023 to 2033

Figure 63: Asia Pacific Market Attractiveness Index, By Component - 2023 to 2033

Figure 64: Asia Pacific Market Share, By Country, 2023 & 2033

Figure 65: Asia Pacific Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 66: Asia Pacific Market Attractiveness Index, By Country - 2023 to 2033

Figure 67: USA Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 68: USA Market Share, By Deployment, 2022

Figure 69: USA Market Share, By Component, 2022

Figure 70: Canada Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 71: Canada Market Share, By Deployment, 2022

Figure 72: Canada Market Share, By Component, 2022

Figure 73: Brazil Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 74: Brazil Market Share, By Deployment, 2022

Figure 75: Brazil Market Share, By Component, 2022

Figure 76: Mexico Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 77: Mexico Market Share, By Deployment, 2022

Figure 78: Mexico Market Share, By Component, 2022

Figure 79: Germany Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 80: Germany Market Share, By Deployment, 2022

Figure 81: Germany Market Share, By Component, 2022

Figure 82: United Kingdom Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 83: United Kingdom Market Share, By Deployment, 2022

Figure 84: United Kingdom Market Share, By Component, 2022

Figure 85: France Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 86: France Market Share, By Deployment, 2022

Figure 87: France Market Share, By Component, 2022

Figure 88: Italy Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 89: Italy Market Share, By Deployment, 2022

Figure 90: Italy Market Share, By Component, 2022

Figure 91: BENELUX Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 92: BENELUX Market Share, By Deployment, 2022

Figure 93: BENELUX Market Share, By Component, 2022

Figure 94: Nordic Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 95: Nordic Countries Market Share, By Deployment, 2022

Figure 96: Nordic Countries Market Share, By Component, 2022

Figure 97: China Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 98: China Market Share, By Deployment, 2022

Figure 99: China Market Share, By Component, 2022

Figure 100: Japan Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 101: Japan Market Share, By Deployment, 2022

Figure 102: Japan Market Share, By Component, 2022

Figure 103: South Korea Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 104: South Korea Market Share, By Deployment, 2022

Figure 105: South Korea Market Share, By Component, 2022

Figure 106: GCC Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 107: GCC Countries Market Share, By Deployment, 2022

Figure 108: GCC Countries Market Share, By Component, 2022

Figure 109: South Africa Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 110: South Africa Market Share, By Deployment, 2022

Figure 111: South Africa Market Share, By Component, 2022

Figure 112: Turkey Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 113: Turkey Market Share, By Deployment, 2022

Figure 114: Turkey Market Share, By Component, 2022

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Interoperability Solutions Market Analysis – Trends & Growth 2025 to 2035

Connected Enterprise Video Surveillance Solutions Market

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA