Over the forecast period, from 2025 to 2035, the global healthcare API market is expected to expand at a significant rate, owing to the increase in the interoperability requirements in the healthcare industry, rise in the consumption of digital health solutions, and development of cloud-based healthcare solutions.

Healthcare APIs allow for the smooth transfer of data between healthcare applications, providing improved patient management, real-time health tracking, and safe access to electronic health records (EHRs). Market growth is driven by an increasing focus on patient-centric healthcare, along with novel Artificial-Intelligence powered and blockchain-enabled APIs. The shift to telehealth, increased funding toward health IT infrastructure, and regulatory focus to securely and uniformly exchange data are also helping to push the industry along at a steady clip.

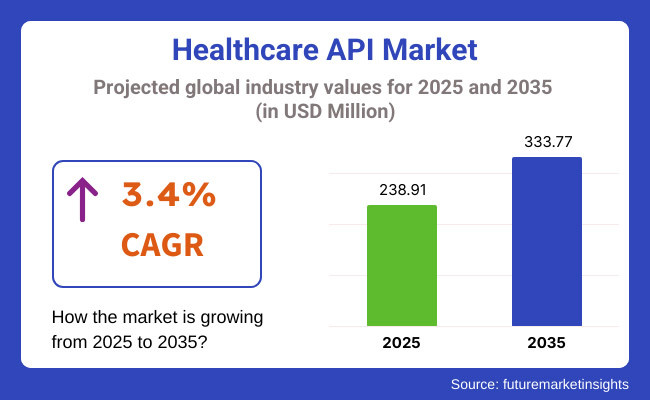

In 2025, the healthcare API market was valued at approximately USD 238.91 million. By 2035, it is projected to reach USD 333.77 million, reflecting a compound annual growth rate (CAGR) of 3.4%. The growth of this market is attributed to increasing adoption of healthcare APIs in patient engagement, clinical workflow integration, and healthcare analytics, rising consumer preference for real-time health data accessibility, and expanding investments in next-generation healthcare IT solutions.

The integration of AI-driven analytics, enhanced cybersecurity protocols, and cost-effective cloud-based solutions is further supporting market expansion. Additionally, the development of open-source, highly secure, and scalable healthcare APIs is playing a crucial role in market penetration and industry adoption.

North America continues to lead the healthcare API market, driven by a robust demand for connected healthcare solutions; rising investment in digital health technologies and notable developments in cloud-based interoperability frameworks. Next generation APIs for healthcare including tools such as AI-based decision support and patient data management platforms are advancing fastest in the USA and Canada.

The market is being fueled by the rising need for seamless EHR integrations increasing emphasis on regulatory compliance and an ascent in the adoption of remote patient monitoring APIs. Moreover, the shift towards value-based care models and API-driven healthcare ecosystems are also contributing to the acceleration of product innovation and adoption.

Europe's market has shown a growing demand for standardized healthcare data exchange, favorable government policies facilitating digital health transformation, along with advancements in API security and authentication technologies. Germany, France, UK and other countries are working on building High-Performance, Interoperable healthcare APIs as a foundational element of their strategy for better hospital management, patient engagement and clinical decision.

This advantage fuels the use case for markets based on increasingly efficient, AI-driven diagnostics, but also increases attention on research in blockchain-powered healthcare APIs, all of which drives market adoption. There are also more opportunities for healthcare API developers and IT solution providers, expanding applications in the integration of wearable health, remote consultations, and real-time patient data analytics.

The healthcare API market in the Asia-Pacific region is projected to grow at the highest rate powered by rising investments in IT infrastructure for healthcare, increasing implementation of digital healthcare platforms, and surging need for cloud-based health data solutions. In countries such as China, India, and Japan using cost-effective and high-security healthcare APIs on telemedicine, EHR analysis, and mobile-health applications is being heavily funded.

The increasing demand for AI-based healthcare analytics, rising number of digital health startups, and increasing regulatory changes alongside the expansion of IT modernization initiatives by the government are driving the regional growth of the markets. In addition, rise in health care awareness in terms of cybersecurity and improvements within API integration for real time disease monitoring are also fuelling market penetration. Moreover, the establishment of domestic health tech startups and collaborations with global IT firms is expected to further drive the market growth.

Stateful ecosystem with rapid API driven healthcare integration, ongoing AI enabled patient engagement, and secure cloud-based data transfer, the healthcare API market is expected to reflect a steady growth over the next decade. Companies put effort in API Security Innovation, better Interoperability across healthcare networks, and new-age Mobile Health API solutions to enhance Functionality, Market appeal, and long-term usability.

Also, the maturing regulatory landscape, the growing consumer interest in personalized digital health solutions, and the growing integration of digital into the clinical decision-making process continue to shape the future of the industry. Integrating AI-powered data analytics, next-gen blockchain-secured APIs, and cloud-native health IT solutions to enhance healthcare efficiency and ensure widespread high-performance healthcare API adoption takes care of all these challenges.

Challenge

Data Security and Compliance with Healthcare Regulations

Stringent regulations surrounding patient data security, like HIPAA, GDPR, and the HITECH act, are a major impediment to the growth of the Healthcare API market. Complexity is increased by the need to ensure API security, whilst maintaining interoperability between healthcare systems. Patient privacy can be considerably compromised by unauthorized access, data breaches, and cybersecurity threats. This niche will simultaneously need advanced encryption, AI-powered threat detection, and blockchain-based data protection.

Integration Complexity with Legacy Systems

Most of the healthcare organizations are working with legacy IT infrastructure which is not aligned with modern API-driven solutions. A big challenge is integrating with legacy electronic health record (EHR) systems, hospital management software, and billing platforms. Data standardization issues are also another obstacle by creating inconsistencies in the interoperability of various healthcare stakeholders. The integration challenges can be addressed through API standardization, middleware solutions, and AI-powered data mapping.

Opportunity

Growing Demand for Telehealth and Remote Patient Monitoring

Growing adoption of telehealth, wearable health devices, and remote patient monitoring is propelling demand for secure and scalable healthcare APIs. APIs facilitate smooth data transfer between healthcare institutions, mobile applications, and cloud services, increasing patient engagement and enhancing care coordination. Market Overview Companies focusing on real-time data analytics, AI-based diagnostics, and API-enabled telemedicine solutions will take advantage of this growing market segment.

Advancements in AI and Machine Learning for Healthcare Interoperability

AI and Machine Learning in Health Care APIs the use of AI-powered APIs is capable to evaluate big data of the patient to provide predictions, automate administrative work, and improve treatment suggestions. Another benefit of blockchain-enabled APIs is that they enhance data integrity and auditability. Organizations that build AI-based API ecosystems, predictive analytics for healthcare, and blockchain-enabled patient record systems will have a unique market advantage.

Between 2020 and 2024, healthcare institution had accelerated integration movement, giving rise to healthcare API market. Nonetheless, security risks, slow legacy system modernization, and different global regulations constrained seamless integration. In response, the companies stepped up API security, invested in FHIR-compliant solutions and strengthened partnerships with healthcare IT providers.

In fact, predicting the future for 2025 to 2035, the future holds AI-driven healthcare automation and decentralized data sharing models, along with quantum-secure encryption to secure APIs. These use-case models will reshape industry norms with widespread adoption of patient-centric APIs, predictive healthcare analytics, and decentralized identity management systems.

Furthermore, edge computing innovations, 6G-powered healthcare APIs, and IoT-based health monitoring systems will drive the next generation of digital healthcare. The future of the global Healthcare API market will belong to the companies that can provide cyber-security, real-time connectivity, and AI powered healthcare intelligence.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with HIPAA, GDPR, and FHIR interoperability standards |

| Technological Advancements | Growth in cloud-based APIs and EHR integration |

| Industry Adoption | Increased use in telehealth, patient portals, and remote monitoring |

| Supply Chain and Sourcing | Dependence on centralized data repositories |

| Market Competition | Dominance of established EHR and healthcare IT vendors |

| Market Growth Drivers | Demand for real-time health data sharing and telemedicine integration |

| Sustainability and Energy Efficiency | Initial focus on cloud-based optimization and secure API frameworks |

| Integration of Smart Monitoring | Limited real-time API security and data tracking |

| Advancements in Healthcare Innovation | Development of patient-centric API ecosystems |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking, blockchain-based regulatory audits, and quantum-secure healthcare APIs |

| Technological Advancements | Expansion of AI-driven healthcare APIs, 6G-enabled telehealth, and edge computing for real-time health monitoring |

| Industry Adoption | Widespread adoption of decentralized patient identity systems, AI-powered diagnosis APIs, and smart wearables |

| Supply Chain and Sourcing | Shift toward decentralized data storage, blockchain-enabled patient data access, and secure multi-cloud interoperability |

| Market Competition | Rise of AI-driven health tech startups, blockchain-powered API providers, and decentralized healthcare platforms |

| Market Growth Drivers | Growth in predictive healthcare analytics, self-sovereign patient data models, and AI-driven clinical decision support |

| Sustainability and Energy Efficiency | Large-scale implementation of energy-efficient AI processing, sustainable cloud data centers, and green computing |

| Integration of Smart Monitoring | AI-powered anomaly detection, blockchain-enabled patient data consent management, and quantum encryption for healthcare APIs |

| Advancements in Healthcare Innovation | Introduction of self-learning AI APIs, digital twin healthcare models, and decentralized clinical research networks |

The USA holds the share of the healthcare API market, owing to the surging adoption of digital health solutions, increasing requirement for interoperability among healthcare systems, and extensive government initiatives for electronic health records (EHR) integration. Focus on patient-centric care & ease of data exchange further propel market growth. The market growth is also complemented by increasing investments in AI-powered healthcare APIs, innovations in cloud-based health data platforms, and real-time patient monitoring systems.

The usage of Blockchain for secure medical transaction, new telehealth’s API capabilities, and automated claims processing all lead to more efficient healthcare services. Querying and fetching these health data is essential, as companies are developing FHIR (Fast Healthcare Interoperability Resources) and HIPAA-compliant APIs, which are relatively new and being used by companies to comply with changing regulatory and security standards. In addition, the growing adoption of AP-driven healthcare applications in remote patient monitoring, clinical decision support, and personalized medicine is further accelerating demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

The UK is a major market for healthcare APIs due to the increasing digitalization of healthcare in the region, rising demand for integrated health platforms, and growing data privacy and security regulations. Market growth of NHS interoperability & patient engagement another factor that is propelling the market towards growth is the emphasis on NHS interoperability and patient engagement. Market growth is enhanced due to government policies promoting digitization of the healthcare and advancement of cloud-based health APIs. In addition, solutions related to AI-powered diagnostics, real-time health monitoring APIs, and health wearables integration are also on the rising tide.

They are also investing in secure patient authentication, diagnostic and treatment predictive analytics APIs, digital health assistants, etc. Moreover, the growing demand for API-based telemedicine, digital prescription management, and mobile health apps is also one handle for the market growth in the country. Moreover, the transition to value-based care and data-driven decision-making is driving the need for healthcare API solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.2% |

The European healthcare API market is primarily dominated by Germany, France, and Italy owing to strong regulatory support for digital healthcare, increasing EHR system adoption, and growing investments in health information exchange (HIE) networks. The European Union's drive towards enhancing healthcare connectivity in tandem with funding towards cross-border health data sharing frameworks creates a resilient market growth.

The rise of API supported AI diagnostics, automated medical billing systems along with the real-time syncing of data captured via wearable digital devices is also driving the healthcare efficiency. Market growth is additionally driven by the increase in adoption of real-time remote monitoring, API-based clinical workflow automation, and patient engagement software. The adoption is also fueled by extended EU regulations on data security, interoperability and digital health infrastructure. Moreover, with growing research on blockchain-based patient records and decentralizing health data storage, the healthcare API industry is also experiencing rapid innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.3% |

Factored by advanced adoption of medical technology, adoption of cloud-based health data solutions, and growing applications in personalized medicine, the Japan healthcare API market is expected to grow progressively. Baby boomers are aging and the demand for automated patient data sharing and AI-driven health insights is market growth. A concentration on digital health transformation in the nation, and progress in API-driven robotic surgery, virtual health assistants, and AI-powered diagnostics spurring innovation.

Additionally, stringent government regulations regarding patients data security and increased investments in next-generation health informatics platforms is prompting the companies to form high-performance API solutions. In Japan's digital health industry, the growing need for API-based telehealth apps, smart hospital management systems, and predictive healthcare analytics is contributing to the market boom. Furthermore, with Japan investing in blockchain-based medical records and even IoT-enabled healthcare devices you are witnessing the development of API driven health technology in the future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

The South Korean market is benefiting from some proactive government initiatives towards smart healthcare solutions, as well as rising demand for emerging health platforms integrating AI-based capabilities and connected health applications. Stringent regulations regarding medical data security and authoritative consumptions followed by rising investments concerning API-enabled, cloud healthcare solutions also fuel the market growth. Furthermore, the country is strengthening its competitiveness with a stronger focus on telemedicine, AI-based medical imaging, and IoT-based real-time patient monitor APIs.

Moreover, the market is growing due to the increasing usage of wearable health devices, medical chatbot applications, and remote chronic disease management platforms integrated with APIs. In order to streamline digital healthcare solutions, organizations are investing in FHIR-compliant APIs, smart health analytics, and blockchain-enabled health data exchange. This growth is further fueled in South Korea by the increasing implementation of precision medicine, remote diagnostics and more personalized health tracking.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

The cloud-based healthcare APIs segment is leading the market due to its scalability, remote access, and real-time data synchronization capabilities. These APIs can make it easier for healthcare organizations to combine patient records, allow for easier information sharing and better interoperability between different healthcare systems.

Increasing adoption of cloud computing and AI-driven analytics, along with telehealth solutions, has propelled the demand for cloud-based application programming interfaces. Further, the growing emphasis on data encryption, HIPAA-compliant security measures, sensitive data protection, and decentralized data storage solutions is increasing the reliability and security of the cloud-based healthcare API infrastructures.

On-premise healthcare APIs are still relevant mainly in large healthcare facilities, government hospitals, and strictly regulated medical environments. They allow for greater control over patient data, create custom security protocols, and feed more smoothly into legacy systems.

It is the growing need of data sovereignty, managing internal IT infrastructure, and compliance with strict healthcare regulations that have led to an increased demand for on premise API deployment. The adoption of on premise healthcare APIs is further supported by advancements in localized data processing, private cloud integration, and AI-driven data security solutions.

Remote patient monitoring (RPM) has become an essential pillar of ambulatory care, supporting ongoing observation of health metrics and the management of chronic diseases. These APIs enable constant monitoring of vital parameters, telehealth consultations and automated notifications for the healthcare service providers.

The growing demand for chronic disease management, an aging population, and the trends toward personalized medicine have been driving the rapid incorporation of the RPM service into the healthcare ecosystem. AI-based health analytics, IoT-enabled integrated wearable sensors and predictive diagnostics integrated with machine learning is ushering a new wave in technologies integrating with remote patient monitoring APIs.

EHR access services remain the backbone of healthcare APIs, enabling secure sharing of real-time patient records between hospitals, clinics, and insurance providers. These APIs provide enhanced interoperability of patient data, reduced administrative bottlenecks, and improved healthcare decision options.

As value-based care, data-driven clinical workflows, and AI-assisted diagnosis models are gaining popularity, the demand for advanced EHR API integrations is also increasing. By leveraging interoperable FHIR standards, using blockchain-based medical records for compliance and security, and deploying cloud-based EHR solutions, healthcare organizations will continue to expand the way patient data can be accessed and shared into the future.

The healthcare API end-user segment is led by healthcare providers, such as hospitals, clinics, and specialty care centers. Focusing on APIs integration across these institutions enables improved access to patient data and treatment coordination leading to overall clinical efficiency.

The more progressive digital healthcare transformation, AI-based diagnostic tools, and smart hospital ecosystems have also contributed to the higher adoption of advanced API solutions. With advancements in virtual care technologies, AI-based patient engagement systems, and streamlined medical imaging data sharing, the role of APIs in contemporary healthcare delivery is constantly evolving.

Healthcare payers such as insurance companies and government health agencies are increasingly turning to APIs to automate claims processing, fraud detection and demographic information of policyholder’s automation. These APIs add real-time insurance verification, claims adjudication, and secure payment transactions.

This rising demand for automated billing solutions, AI-based risk assessment models, and blockchain for proof of insurance has accelerated the adoption of APIs among the healthcare payers. The user payer-side healthcare APIs are also getting increasing efficiency through improvements in predictive analytics, AI-assisted fraud detection, and digital health reimbursement solution techniques.

The healthcare API market is growing owing to the rising acceptance of digital health solutions by healthcare providers, interoperability requirements, and the growing adoption of cloud-based healthcare applications. To take healthcare efficiency to the next level, companies are working on secure data exchange, analytics powered by artificial intelligence, and smooth EHR integration. Some of the key trends are FHIR (Fast Healthcare Interoperability Resources)-compliant APIs, patient-centric data sharing, and better security measures.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google Cloud Healthcare API | 18-22% |

| Microsoft Azure Healthcare API | 14-18% |

| Epic Systems Corporation | 11-15% |

| Cerner Corporation (Oracle Health) | 8-12% |

| Change Healthcare (Optum) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google Cloud Healthcare API | Leading provider of AI-powered healthcare APIs for EHR integration, analytics, and interoperability. |

| Microsoft Azure Healthcare API | Specializes in cloud-based healthcare APIs with FHIR compliance and secure data sharing. |

| Epic Systems Corporation | Develops APIs for seamless EHR connectivity, patient engagement, and digital health applications. |

| Cerner Corporation (Oracle Health) | Offers healthcare data exchange solutions with advanced API-driven automation. |

| Change Healthcare (Optum) | Focuses on revenue cycle management and claims processing APIs for healthcare providers. |

Key Company Insights

Google Cloud Healthcare API (18-22%)

Google Cloud serves as a leading healthcare API provider with AI-powered solutions for interoperability, analytics, and EHR integration. The Company is focused on machine learning and cloud security to provide better data processing capabilities. Google strengthens its market leadership through partnerships with healthcare providers and research institutions.

Microsoft Azure Healthcare API (14-18%)

With a focus on cloud-based healthcare APIs for seamless data exchange and regulatory compliance. Its FHIR-compliant APIs allow you to create secure and scalable healthcare applications. Microsoft consolidates its competitive position in digital health infrastructure through its integration with AI and IoT solutions.

Epic Systems Corporation (11-15%)

Epic Systems offers healthcare APIs for EHR connectivity, patient engagement and application development. The company specializes in the usability of data exchange and interoperability across all parts of the healthcare ecosystem. Ubiquity at hospitals and health networks helps drive Epic’s expansion into the market.

Cerner Corporation (Oracle Health) (8-12%)

Continuing the theme of rapid hospital interoperability lies Cerner, now an Indiana-based entity within Oracle Health who specializes in API-driving healthcare data exchange solutions to refine hospital workflows and increase automation. We focus on the ability to access real-time patient data and the management of population health. The security and stability of API-based EHR modernization reinforces Cerner's position in the industry.

Change Healthcare (Optum) (6-10%)

A sister company of Optum, Change Healthcare provides APIs for revenue cycle management, insurance claims processing, and real-time patient data exchange. It then implements AI and automation to improve billing and financial processes. Change Healthcare's strength in healthcare transactions helps its competitive positioning.

Other Key Players (30-40% Combined)

The market is highly competitive and dominated by both global and regional companies that offer healthcare APIs ensuring secure interoperability, which provide high-value visibility across the healthcare ecosystem through advanced analytics, and are designed as hosted or cloud-based healthcare solutions. Key players include:

The overall market size for healthcare API market was USD 238.91 million in 2025.

The healthcare API market expected to reach USD 333.77 million in 2035.

The demand for the healthcare API market will be driven by increasing adoption of digital health solutions, rising demand for interoperability in healthcare systems, growing use of telemedicine and wearable devices, advancements in AI-driven healthcare analytics, and regulatory support for seamless data exchange and patient-centric care.

The top 5 countries which drives the development of healthcare API market are USA, UK, Europe Union, Japan and South Korea.

Cloud-based and on premise healthcare APIs drive market growth to command significant share over the assessment period.

Table 01: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 02: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Services

Table 03: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 04: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 05: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 07: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Services

Table 08: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 09: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 10: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Services

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 13: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 14: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 15: Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Services

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 17: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 18: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 19: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Services

Table 20: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 21: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 23: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Services

Table 24: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 25: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 26: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 27: Oceania Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Services

Table 28: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 29: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 30: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Deployment

Table 31: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Services

Table 32: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Figure 01: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022–2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, by Deployment

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Deployment

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Deployment

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, by Services

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Services

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by Services

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by End User

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 13: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Region

Figure 15: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 16: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 17: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 18: North America Market Value Share, by Deployment (2023 E)

Figure 19: North America Market Value Share, by Services (2023 E)

Figure 20: North America Market Value Share, by End User (2023 E)

Figure 21: North America Market Value Share, by Country (2023 E)

Figure 22: North America Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 23: North America Market Attractiveness Analysis by Services, 2023 to 2033

Figure 24: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 25: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 26: USA Market Value Proportion Analysis, 2022

Figure 27: Global Vs. USA Growth Comparison

Figure 28: USA Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 29: USA Market Share Analysis (%) by Services, 2022 & 2033

Figure 30: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs. Canada. Growth Comparison

Figure 33: Canada Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 34: Canada Market Share Analysis (%) by Services, 2022 & 2033

Figure 35: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 36: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 37: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 38: Latin America Market Value Share, by Deployment (2023 E)

Figure 39: Latin America Market Value Share, by Services (2023 E)

Figure 40: Latin America Market Value Share, by End User (2023 E)

Figure 41: Latin America Market Value Share, by Country (2023 E)

Figure 42: Latin America Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 43: Latin America Market Attractiveness Analysis by Services, 2023 to 2033

Figure 44: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 46: Mexico Market Value Proportion Analysis, 2022

Figure 47: Global Vs Mexico Growth Comparison

Figure 48: Mexico Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 49: Mexico Market Share Analysis (%) by Services, 2022 & 2033

Figure 50: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 51: Brazil Market Value Proportion Analysis, 2022

Figure 52: Global Vs. Brazil. Growth Comparison

Figure 53: Brazil Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 54: Brazil Market Share Analysis (%) by Services, 2022 & 2033

Figure 55: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 56: Argentina Market Value Proportion Analysis, 2022

Figure 57: Global Vs Argentina Growth Comparison

Figure 58: Argentina Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 59: Argentina Market Share Analysis (%) by Services, 2022 & 2033

Figure 60: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 61: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 62: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 63: Europe Market Value Share, by Deployment (2023 E)

Figure 64: Europe Market Value Share, by Services (2023 E)

Figure 65: Europe Market Value Share, by End User (2023 E)

Figure 66: Europe Market Value Share, by Country (2023 E)

Figure 67: Europe Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 68: Europe Market Attractiveness Analysis by Services, 2023 to 2033

Figure 69: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 70: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 71: UK Market Value Proportion Analysis, 2022

Figure 72: Global Vs. UK Growth Comparison

Figure 73: UK Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 74: UK Market Share Analysis (%) by Services, 2022 & 2033

Figure 75: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 76: Germany Market Value Proportion Analysis, 2022

Figure 77: Global Vs. Germany Growth Comparison

Figure 78: Germany Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 79: Germany Market Share Analysis (%) by Services, 2022 & 2033

Figure 80: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 81: Italy Market Value Proportion Analysis, 2022

Figure 82: Global Vs. Italy Growth Comparison

Figure 83: Italy Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 84: Italy Market Share Analysis (%) by Services, 2022 & 2033

Figure 85: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 86: France Market Value Proportion Analysis, 2022

Figure 87: Global Vs France Growth Comparison

Figure 88: France Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 89: France Market Share Analysis (%) by Services, 2022 & 2033

Figure 90: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 91: Spain Market Value Proportion Analysis, 2022

Figure 92: Global Vs Spain Growth Comparison

Figure 93: Spain Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 94: Spain Market Share Analysis (%) by Services, 2022 & 2033

Figure 95: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 96: Russia Market Value Proportion Analysis, 2022

Figure 97: Global Vs Russia Growth Comparison

Figure 98: Russia Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 99: Russia Market Share Analysis (%) by Services, 2022 & 2033

Figure 100: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 101: BENELUX Market Value Proportion Analysis, 2022

Figure 102: Global Vs BENELUX Growth Comparison

Figure 103: BENELUX Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 104: BENELUX Market Share Analysis (%) by Services, 2022 & 2033

Figure 105: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 106: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 107: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 108: East Asia Market Value Share, by Deployment (2023 E)

Figure 109: East Asia Market Value Share, by Services (2023 E)

Figure 110: East Asia Market Value Share, by End User (2023 E)

Figure 111: East Asia Market Value Share, by Country (2023 E)

Figure 112: East Asia Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 113: East Asia Market Attractiveness Analysis by Services, 2023 to 2033

Figure 114: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 115: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 116: China Market Value Proportion Analysis, 2022

Figure 117: Global Vs. China Growth Comparison

Figure 118: China Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 119: China Market Share Analysis (%) by Services, 2022 & 2033

Figure 120: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 121: Japan Market Value Proportion Analysis, 2022

Figure 122: Global Vs. Japan Growth Comparison

Figure 123: Japan Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 124: Japan Market Share Analysis (%) by Services, 2022 & 2033

Figure 125: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 126: South Korea Market Value Proportion Analysis, 2022

Figure 127: Global Vs South Korea Growth Comparison

Figure 128: South Korea Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 129: South Korea Market Share Analysis (%) by Services, 2022 & 2033

Figure 130: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 131: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 132: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 133: South Asia Market Value Share, by Deployment (2023 E)

Figure 134: South Asia Market Value Share, by Services (2023 E)

Figure 135: South Asia Market Value Share, by End User (2023 E)

Figure 136: South Asia Market Value Share, by Country (2023 E)

Figure 137: South Asia Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 138: South Asia Market Attractiveness Analysis by Services, 2023 to 2033

Figure 139: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 140: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 141: India Market Value Proportion Analysis, 2022

Figure 142: Global Vs. India Growth Comparison

Figure 143: India Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 144: India Market Share Analysis (%) by Services, 2022 & 2033

Figure 145: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 146: Indonesia Market Value Proportion Analysis, 2022

Figure 147: Global Vs. Indonesia Growth Comparison

Figure 148: Indonesia Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 149: Indonesia Market Share Analysis (%) by Services, 2022 & 2033

Figure 150: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 151: Malaysia Market Value Proportion Analysis, 2022

Figure 152: Global Vs. Malaysia Growth Comparison

Figure 153: Malaysia Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 154: Malaysia Market Share Analysis (%) by Services, 2022 & 2033

Figure 155: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 156: Thailand Market Value Proportion Analysis, 2022

Figure 157: Global Vs. Thailand Growth Comparison

Figure 158: Thailand Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 159: Thailand Market Share Analysis (%) by Services, 2022 & 2033

Figure 160: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 161: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 162: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 163: Oceania Market Value Share, by Deployment (2023 E)

Figure 164: Oceania Market Value Share, by Services (2023 E)

Figure 165: Oceania Market Value Share, by End User (2023 E)

Figure 166: Oceania Market Value Share, by Country (2023 E)

Figure 167: Oceania Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 168: Oceania Market Attractiveness Analysis by Services, 2023 to 2033

Figure 169: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 171: Australia Market Value Proportion Analysis, 2022

Figure 172: Global Vs. Australia Growth Comparison

Figure 173: Australia Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 174: Australia Market Share Analysis (%) by Services, 2022 & 2033

Figure 175: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 176: New Zealand Market Value Proportion Analysis, 2022

Figure 177: Global Vs New Zealand Growth Comparison

Figure 178: New Zealand Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 179: New Zealand Market Share Analysis (%) by Services, 2022 & 2033

Figure 180: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 181: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 182: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 183: Middle East & Africa Market Value Share, by Deployment (2023 E)

Figure 184: Middle East & Africa Market Value Share, by Services (2023 E)

Figure 185: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 186: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 187: Middle East & Africa Market Attractiveness Analysis by Deployment, 2023 to 2033

Figure 188: Middle East & Africa Market Attractiveness Analysis by Services, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 191: GCC Countries Market Value Proportion Analysis, 2022

Figure 192: Global Vs GCC Countries Growth Comparison

Figure 193: GCC Countries Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 194: GCC Countries Market Share Analysis (%) by Services, 2022 & 2033

Figure 195: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 196: Türkiye Market Value Proportion Analysis, 2022

Figure 197: Global Vs. Türkiye Growth Comparison

Figure 198: Türkiye Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 199: Türkiye Market Share Analysis (%) by Services, 2022 & 2033

Figure 200: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 201: South Africa Market Value Proportion Analysis, 2022

Figure 202: Global Vs. South Africa Growth Comparison

Figure 203: South Africa Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 204: South Africa Market Share Analysis (%) by Services, 2022 & 2033

Figure 205: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 206: North Africa Market Value Proportion Analysis, 2022

Figure 207: Global Vs North Africa Growth Comparison

Figure 208: North Africa Market Share Analysis (%) by Deployment, 2022 & 2033

Figure 209: North Africa Market Share Analysis (%) by Services, 2022 & 2033

Figure 210: North Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA