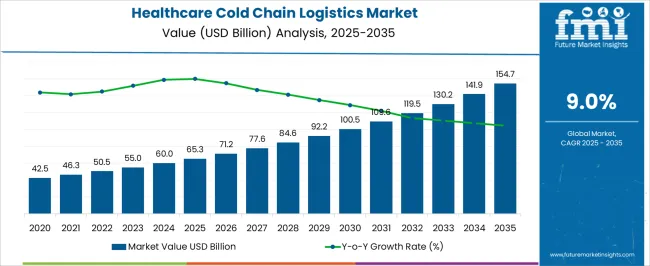

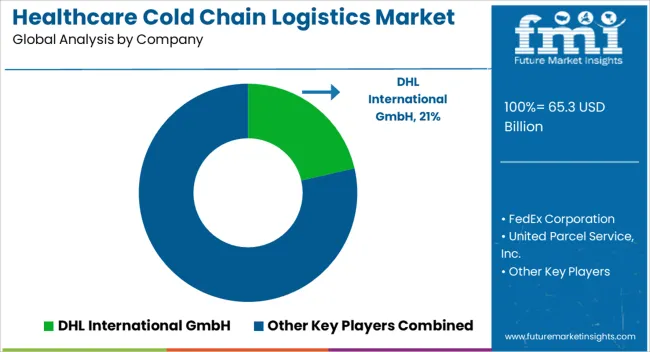

The healthcare cold chain logistics market is estimated to be valued at USD 65.3 billion in 2025 and is projected to reach USD 154.7 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

The healthcare cold chain logistics market is forecasted to expand from USD 65.3 billion in 2025 to USD 154.7 billion by 2035, registering a CAGR of 9%. Year-on-year growth patterns reflect a steady rise, with values moving from USD 65.3 billion in 2025 to USD 92.2 billion by 2029, and further to USD 154.7 billion in 2035. This consistent increase highlights that demand for temperature-controlled storage and distribution is becoming indispensable across pharmaceuticals, biologics, and vaccines. The market trajectory shows that each passing year is strengthening the reliance on advanced logistics networks, where precision and reliability in handling sensitive healthcare products are being prioritized by producers and distributors alike.

Over the decade, the healthcare cold chain logistics market is expected to be driven by rising complexities in product portfolios and expanding trade flows for temperature-sensitive medicines. The YoY growth curve highlights that logistics service providers are adapting quickly by enhancing cold storage capacity, improving last-mile delivery models, and integrating real-time monitoring systems to reduce wastage risks. By 2030, values are anticipated to surpass USD 100 billion, affirming the sector’s role as a backbone for modern healthcare distribution. From an industry perspective, this upward path reflects more than just growth in revenue; it reveals a transition toward a logistics environment where controlled conditions, reliability, and scalability will shape competitive advantage in the global healthcare supply chain.

| Metric | Value |

|---|---|

| Healthcare Cold Chain Logistics Market Estimated Value in (2025 E) | USD 65.3 billion |

| Healthcare Cold Chain Logistics Market Forecast Value in (2035 F) | USD 154.7 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The healthcare cold chain logistics market is estimated to hold a notable proportion within its parent markets, accounting for approximately 20-22% of the cold chain logistics market, around 18-19% of the pharmaceutical logistics market, close to 15-16% of the biopharmaceutical supply chain market, about 8-9% of the medical devices logistics market, and roughly 6-7% of the temperature-sensitive packaging market. Collectively, the cumulative share across these parent segments is observed in the range of 67-73%, reflecting a dominant role of healthcare-focused cold chain solutions in safeguarding pharmaceutical, biologics, and medical device distribution.

The market has been influenced by the rising demand for temperature-controlled storage and transportation, where product safety, regulatory compliance, and uninterrupted delivery are highly prioritized. Adoption has been guided by procurement strategies that emphasize reliability, quality assurance, and end-to-end visibility across supply chains. Service providers have focused on specialized vehicles, advanced refrigeration systems, and real-time monitoring solutions to ensure product integrity throughout critical stages of distribution. As a result, the healthcare cold chain logistics market has not only captured a significant share within the broader cold chain and pharmaceutical logistics domains but has also shaped biopharmaceutical, medical device, and packaging markets, highlighting its strategic role in maintaining the efficacy of life-saving products and reinforcing trust across healthcare delivery systems worldwide.

The healthcare cold chain logistics market is witnessing significant expansion, primarily driven by the rising demand for temperature-sensitive biopharmaceuticals, vaccines, and clinical trial materials. As global healthcare systems evolve and biologics gain prominence in therapeutic protocols, the need for reliable and efficient cold chain systems has become critical. The market is benefiting from increasing investments in life sciences infrastructure and stringent regulatory mandates ensuring product integrity during storage and transportation.

Growing global immunization efforts, pandemic preparedness strategies, and the rising prevalence of chronic diseases are contributing to heightened demand for advanced logistics solutions. Technological advancements in temperature monitoring, real-time tracking, and packaging insulation are enhancing cold chain reliability and visibility. Additionally, partnerships between pharmaceutical manufacturers and logistics providers are optimizing supply chain efficiency and cost-effectiveness.

With rising globalization of clinical trials and biopharmaceutical trade, the need for end-to-end cold chain continuity is gaining traction These trends collectively indicate a promising growth trajectory for the market, with strategic focus areas including capacity expansion, digital integration, and regional infrastructure development.

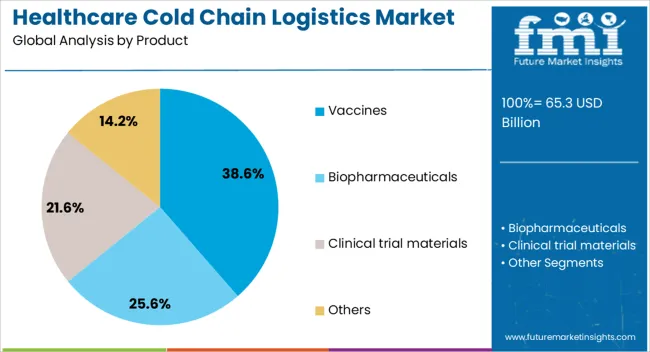

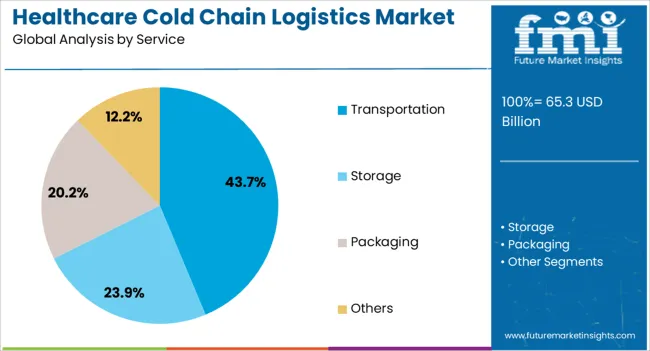

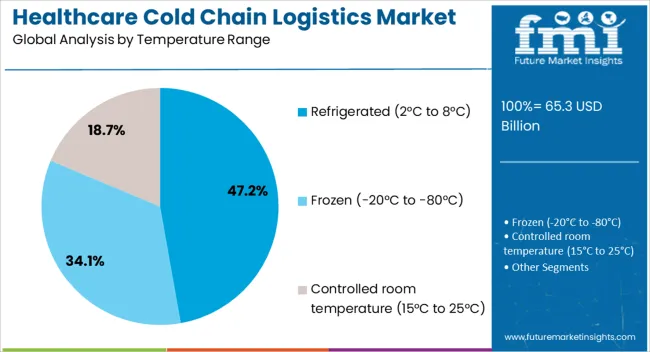

The healthcare cold chain logistics market is segmented by product, service, temperature range, end user, and geographic regions. By product, healthcare cold chain logistics market is divided into vaccines, biopharmaceuticals, clinical trial materials, and others. In terms of service, healthcare cold chain logistics market is classified into transportation, storage, packaging, and others. Based on temperature range, healthcare cold chain logistics market is segmented into refrigerated (2°C to 8°C), frozen (-20°C to -80°C), and controlled room temperature (15°C to 25°C). By end user, healthcare cold chain logistics market is segmented into biopharmaceutical companies, hospitals and clinics, research institutions, and others. Regionally, the healthcare cold chain logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vaccines segment is projected to account for 38.6% of the healthcare cold chain logistics market revenue share in 2025, positioning it as the leading product category. This leadership is attributed to the stringent temperature control requirements of vaccines, which demand precise and uninterrupted cold chain logistics to maintain efficacy and compliance with health regulations. Global vaccination programs, including those for childhood immunizations, seasonal influenza, and emerging infectious diseases, are driving consistent demand for temperature-controlled logistics services.

The success of global immunization campaigns heavily relies on the efficient distribution of vaccines through well-established cold chains, particularly in remote and underserved regions. Additionally, national and international health agencies are prioritizing investments in cold chain infrastructure to support the rollout of new and existing vaccines.

The emergence of combination vaccines and advanced biologic formulations is also contributing to the need for robust cold chain capabilities As vaccine distribution continues to expand due to public health initiatives and emergency preparedness programs, the segment is expected to maintain its strong market position.

The transportation segment is expected to capture 43.7% of the healthcare cold chain logistics market revenue share in 2025, making it the dominant service type. This prominence is driven by the essential role transportation plays in ensuring timely and temperature-compliant delivery of biopharmaceutical products. As the complexity of healthcare supply chains increases, the demand for multimodal, real-time monitored, and validated transportation services is intensifying.

The segment is benefiting from technological advancements such as GPS tracking, telematics, and active temperature-controlled containers, which enhance visibility and compliance throughout the supply chain. Strategic investments by logistics providers in expanding dedicated healthcare fleets and specialized handling facilities are improving service reliability and geographic reach. With rising cross-border pharmaceutical trade and time-sensitive distribution requirements, the need for efficient and compliant transportation networks has become critical.

Additionally, regulatory oversight from authorities such as the FDA and WHO is compelling logistics operators to adopt advanced practices and certifications These factors are reinforcing transportation as the backbone of the cold chain infrastructure in the healthcare sector.

The refrigerated temperature range of 2°C to 8°C is projected to hold 47.2% of the healthcare cold chain logistics market revenue share in 2025, making it the largest temperature category. This dominance is supported by the fact that a majority of vaccines, biologics, and other temperature-sensitive therapeutics require storage and transportation within this range to preserve efficacy and prevent degradation. The segment is gaining momentum due to increasing global vaccine distribution efforts and the rapid growth of biologics in the pharmaceutical pipeline.

Advanced refrigerated solutions are being adopted to ensure precise temperature maintenance throughout the logistics journey, from manufacturing facilities to end-user delivery points. Innovations in cold storage containers, thermal packaging, and last-mile refrigeration are improving segment performance and reducing spoilage risks.

Furthermore, infrastructure development in emerging markets is enhancing accessibility and reliability of refrigerated logistics services As healthcare supply chains become more complex and quality assurance remains a top priority, the demand for reliable solutions within the 2°C to 8°C range is expected to sustain its strong market share.

The healthcare cold chain logistics market is driven by rising demand for biologics, vaccines, and specialty medicines. Opportunities are growing through the expansion of global clinical trials, while trends show greater use of monitoring and predictive data tools. Challenges, however, persist due to infrastructure limitations, customs delays, and high operational costs. Overall, the market is being shaped by its vital role in maintaining product integrity, ensuring regulatory compliance, and supporting pharmaceutical firms in distributing temperature-sensitive products safely and effectively across diverse regions.

The healthcare cold chain logistics market has been experiencing notable demand due to the increasing reliance on biologics, vaccines, and temperature-sensitive drugs. Pharmaceutical firms are emphasizing reliable transportation and storage systems to maintain efficacy and compliance. Distribution of specialty medicines, oncology treatments, and mRNA-based therapies has placed strong requirements on temperature-controlled logistics networks. Hospitals, clinics, and retail pharmacies are depending heavily on third-party logistics providers for precision handling. With patient safety and product integrity at the forefront, investments are being directed into specialized warehouses, refrigerated vehicles, and real-time monitoring systems that ensure consistent temperature adherence throughout the supply chain.

Significant opportunities in the healthcare cold chain logistics market are emerging from the global expansion of clinical trials. Drug developers are conducting multi-country studies that demand careful handling of biological samples, investigational drugs, and patient-specific treatments. Logistics providers are well positioned to capture value by offering tailored services that integrate compliance, documentation, and cross-border temperature control. Partnerships with contract research organizations and pharmaceutical manufacturers are being pursued to streamline trial-related distribution. Cold chain players who can demonstrate reliability in maintaining product quality across complex routes are expected to be favored, as trial sponsors demand high precision in sample preservation and drug delivery.

Key trends in the healthcare cold chain logistics market highlight the integration of advanced monitoring and tracking systems. Real-time data loggers, cloud-based platforms, and GPS-enabled devices are being deployed to enhance visibility and reduce risks of spoilage or deviation. Companies are moving toward predictive analytics to anticipate disruptions and mitigate risks proactively. Compliance with stringent regulations such as GDP (Good Distribution Practice) is being reinforced through improved audit trails and documentation systems. Stakeholders are increasingly focused on end-to-end transparency, as pharmaceutical companies and regulators both demand verifiable assurance that temperature thresholds are not breached during shipment and storage.

The market faces considerable challenges due to inadequate infrastructure in emerging regions and the high costs associated with refrigerated transport. Limited availability of specialized warehouses and temperature-controlled vehicles often compromises supply reliability. Rising fuel prices, electricity expenses, and regulatory compliance requirements further intensify operational costs for logistics providers. Smaller companies may struggle to scale due to capital-intensive infrastructure demands. Cross-border delays and customs restrictions present additional risks of product degradation. These persistent hurdles create financial and operational strain, making cost optimization, route planning, and investment in resilient networks critical for long-term viability in this market segment.

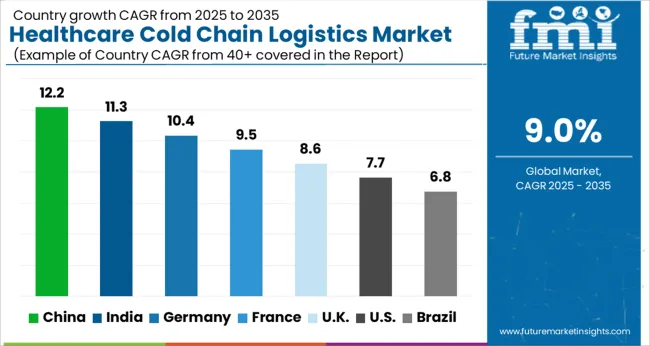

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global healthcare cold chain logistics market is projected to grow at a CAGR of 9% from 2025 to 2035. China leads with a growth rate of 12.2%, followed by India at 11.3% and Germany at 10.4%. The United Kingdom shows a CAGR of 8.6%, while the United States records the slowest growth among the leading countries at 7.7%. Rising demand is being shaped by the expansion of pharmaceutical manufacturing, the rise in biologics and vaccines, and the need for stringent temperature-controlled logistics to ensure quality and compliance. While Asia is emerging as the primary growth hub, developed nations such as the USA, UK, and Germany emphasize innovation in infrastructure, regulatory compliance, and long-term reliability of the supply chain. This report includes insights on 40+ countries; the top markets are shown here for reference.

The healthcare cold chain logistics market in China is projected to grow at a CAGR of 12.2%. Market growth is fueled by rapid expansion of pharmaceutical production, the surge in vaccine distribution, and rising demand for biologics and temperature-sensitive medications. Chinese logistics providers are investing in advanced cold storage facilities, refrigerated transport, and IoT-enabled monitoring systems to ensure real-time visibility and compliance with safety standards. Government policies supporting pharmaceutical exports and investments in healthcare infrastructure also enhance adoption. Increasing collaborations with global logistics providers strengthen service efficiency and reliability across domestic and international markets. The growing patient population and healthcare reforms create additional demand for efficient cold chain solutions.

The healthcare cold chain logistics market in India is projected to grow at a CAGR of 11.3%. Expansion is driven by rising pharmaceutical manufacturing, vaccine exports, and higher consumption of biologics and specialty medicines. Logistics providers are upgrading infrastructure by investing in refrigerated vehicles, modern cold storage facilities, and digital tracking technologies. The government’s initiatives to promote vaccine self-reliance and strengthen healthcare distribution channels further accelerate adoption. Partnerships between domestic logistics firms and global supply chain players are improving service standards and operational efficiency. With rising healthcare demand from rural and urban areas, India is expected to remain one of the fastest-growing markets in the healthcare cold chain segment.

The healthcare cold chain logistics market in Germany is projected to grow at a CAGR of 10.4%. Growth is driven by the country’s strong pharmaceutical sector, rising biologics production, and increased demand for specialty drugs. German logistics companies are investing in state-of-the-art refrigerated facilities, automated warehouses, and sensor-based monitoring systems to comply with EU regulations. The country’s central position in Europe enables it to serve as a logistics hub for cross-border pharmaceutical distribution. Collaborations with global logistics players and ongoing advancements in digital supply chain technologies enhance efficiency and transparency. With growing emphasis on reliability and compliance, Germany is expected to maintain steady growth in healthcare cold chain logistics.

The healthcare cold chain logistics market in the United Kingdom is projected to grow at a CAGR of 8.6%. Growth is supported by rising imports of biologics, vaccines, and specialty drugs that require advanced cold storage and transport. UK logistics providers are focusing on enhancing supply chain transparency through digital monitoring and IoT solutions. Regulatory compliance with stringent standards such as GDP (Good Distribution Practices) encourages the adoption of reliable cold chain systems. The increasing demand from the National Health Service (NHS) and private healthcare providers boosts logistics requirements. Collaborations with international logistics partners and investments in new refrigerated transport fleets contribute to the market’s steady expansion.

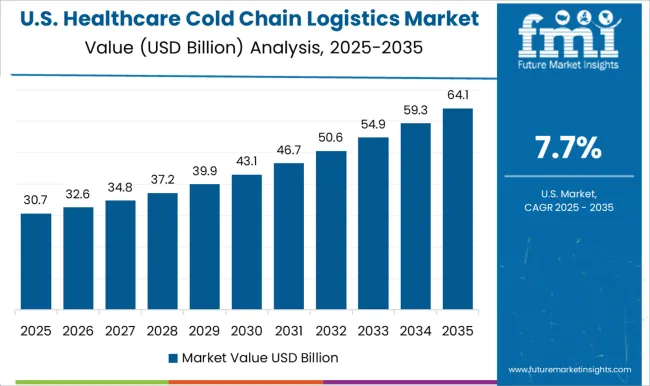

The healthcare cold chain logistics market in the United States is projected to grow at a CAGR of 7.7%. Market growth is influenced by the rising demand for biologics, specialty drugs, and personalized medicines. USA logistics providers are focusing on expanding refrigerated transport fleets, automated warehouses, and blockchain-enabled monitoring to strengthen supply chain transparency. Regulatory compliance with FDA standards drives investments in advanced monitoring technologies and temperature-controlled infrastructure.

Strong demand from pharmaceutical giants and healthcare providers, combined with robust R&D in biologics, supports ongoing expansion. Strategic collaborations with international logistics firms also strengthen global distribution capabilities. Despite slower growth compared to Asian markets, the USA remains one of the most significant contributors to healthcare cold chain logistics.

The healthcare cold chain logistics market is shaped by leading global logistics providers that ensure the safe, reliable, and temperature-controlled transportation of pharmaceuticals, vaccines, biologics, and other critical healthcare products. DHL International GmbH, FedEx Corporation, and United Parcel Service, Inc. (UPS) dominate with extensive global networks, advanced cold chain monitoring systems, and specialized healthcare logistics divisions that guarantee compliance with stringent regulatory requirements. These companies emphasize precision in temperature management, real-time tracking, and specialized packaging solutions, which are highlighted in their brochures as essential for maintaining product efficacy during transit.

Kuehne + Nagel International AG and DB Schenker focus on integrating end-to-end supply chain services with advanced data-driven platforms, enabling predictive analytics and proactive risk management to reduce spoilage and enhance reliability. Their service portfolios showcase multi-modal transport solutions supported by Good Distribution Practice (GDP) standards, catering to global pharmaceutical manufacturers and healthcare providers. CEVA Logistics and DSV strengthen market competition with tailored solutions for vaccine distribution, biologic materials, and clinical trial supplies. Their brochures highlight specialized warehousing capabilities, value-added services like customs clearance expertise, and innovative thermal packaging technologies designed for extreme conditions.

Investments in green logistics and energy-efficient cold storage facilities are also outlined, enhancing their service differentiation. The competitive landscape reflects a shift toward digitized cold chain visibility, regulatory compliance, and risk mitigation strategies, with all major players emphasizing resilience, scalability, and reliability. Ultimately, the healthcare cold chain logistics market remains heavily focused on safeguarding product integrity while providing end-to-end efficiency and minimizing losses, ensuring that life-saving medicines and therapies reach patients worldwide without compromise.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.3 billion |

| Product | Vaccines, Biopharmaceuticals, Clinical trial materials, and Others |

| Service | Transportation, Storage, Packaging, and Others |

| Temperature Range | Refrigerated (2°C to 8°C), Frozen (-20°C to -80°C), and Controlled room temperature (15°C to 25°C) |

| End User | Biopharmaceutical companies, Hospitals and clinics, Research Institutions, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL International GmbH, FedEx Corporation, United Parcel Service, Inc., Kuehne + Nagel International AG, DB Schenker, CEVA Logistics, and DSV |

| Additional Attributes | Dollar sales by service type (storage, transportation, packaging) and product type (biopharmaceuticals, vaccines, clinical trial materials, medical devices) are key metrics. Trends include rising demand for temperature-sensitive healthcare products, growth in biologics and specialty drugs, and adoption of advanced monitoring technologies. Regional deployment, regulatory compliance, and infrastructure development are driving market growth. |

The global healthcare cold chain logistics market is estimated to be valued at USD 65.3 billion in 2025.

The market size for the healthcare cold chain logistics market is projected to reach USD 154.7 billion by 2035.

The healthcare cold chain logistics market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in healthcare cold chain logistics market are vaccines, biopharmaceuticals, clinical trial materials and others.

In terms of service, transportation segment to command 43.7% share in the healthcare cold chain logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Healthcare Natural Language Processing (NLP) Market Insights – Trends & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA