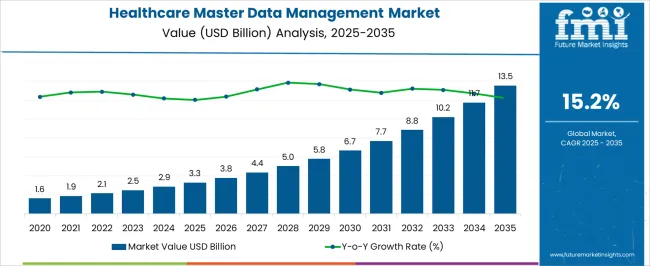

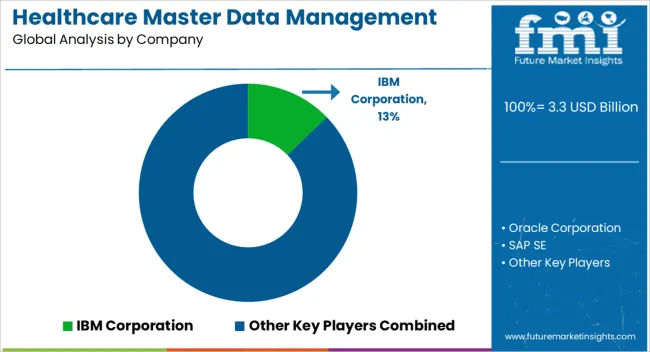

The Healthcare Master Data Management Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 13.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

| Metric | Value |

|---|---|

| Healthcare Master Data Management Market Estimated Value in (2025 E) | USD 3.3 billion |

| Healthcare Master Data Management Market Forecast Value in (2035 F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The Healthcare Master Data Management market is witnessing steady growth, driven by the increasing need for accurate, consistent, and unified data across healthcare organizations. Rising adoption of electronic health records, health information exchanges, and interoperable systems is fueling demand for robust master data management solutions. These systems enable healthcare providers to consolidate patient, provider, and operational data, enhancing data quality, reducing redundancies, and improving decision-making.

The integration of cloud computing, AI-driven analytics, and automation is further accelerating adoption by offering scalability, real-time updates, and cost efficiency. Regulatory compliance requirements, such as patient privacy laws and standards for healthcare data governance, are reinforcing the importance of MDM solutions.

The growing focus on value-based care, population health management, and analytics-driven clinical and operational decision-making is shaping market dynamics As healthcare organizations continue to prioritize data integrity, interoperability, and analytics readiness, the Healthcare Master Data Management market is expected to experience sustained growth, driven by technological innovation and increasing investments in data governance strategies.

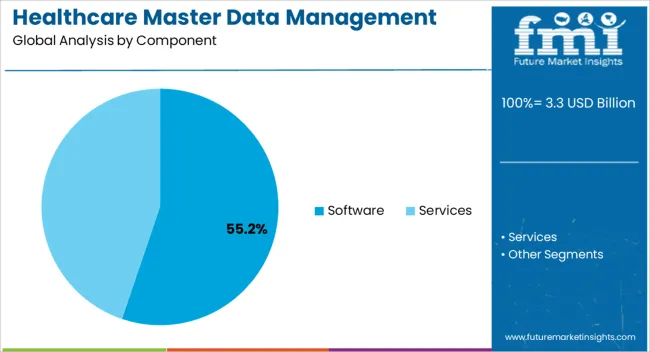

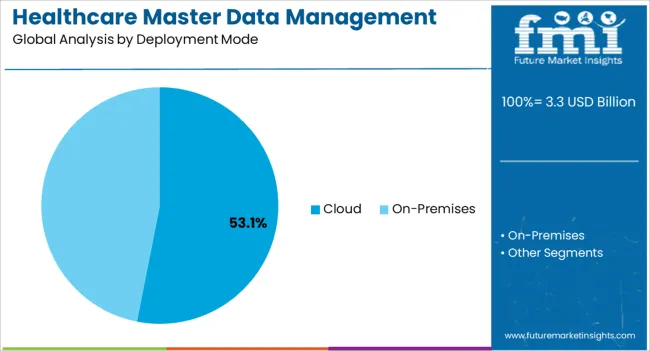

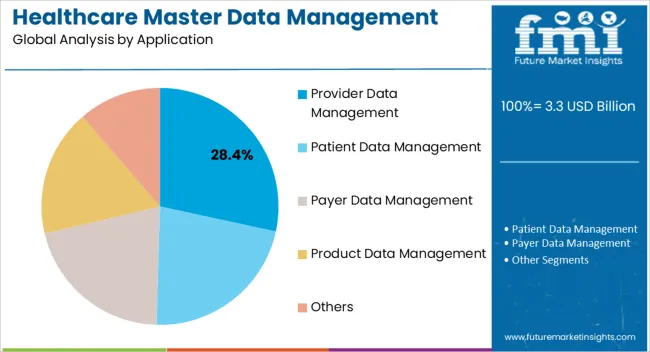

The healthcare master data management market is segmented by component, deployment mode, application, end-user, and geographic regions. By component, healthcare master data management market is divided into Software and Services. In terms of deployment mode, healthcare master data management market is classified into Cloud and On-Premises. Based on application, healthcare master data management market is segmented into Provider Data Management, Patient Data Management, Payer Data Management, Product Data Management, and Others. By end-user, healthcare master data management market is segmented into Healthcare Providers, Healthcare Payers, Life Science Companies, and Others. Regionally, the healthcare master data management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to hold 55.2% of the market revenue in 2025, establishing it as the leading component. Growth in this segment is being driven by the demand for centralized platforms that enable healthcare organizations to manage, integrate, and govern diverse data sources efficiently.

Software-based solutions provide capabilities such as data cleansing, deduplication, validation, and real-time synchronization, which reduce errors and improve operational efficiency. Integration with existing electronic health record systems, analytics platforms, and cloud environments enhances adoption and value realization.

The software segment also benefits from continuous updates, scalability, and AI-driven enhancements that improve accuracy, predictive insights, and compliance readiness As healthcare providers seek to optimize provider data management, patient information quality, and analytics-driven operations, the software segment is expected to maintain its leadership position, supported by technological advancements, regulatory enforcement, and increasing emphasis on data-driven decision-making across the healthcare ecosystem.

The cloud deployment mode segment is anticipated to account for 53.1% of the market revenue in 2025, making it the leading deployment model. Its growth is driven by the need for scalable, cost-effective, and flexible solutions that support distributed healthcare networks and multiple data sources. Cloud deployment enables real-time access to centralized master data, facilitates collaboration among providers, and reduces the need for on-premises infrastructure and maintenance.

Security features, compliance with healthcare data regulations, and disaster recovery capabilities further reinforce adoption. Organizations benefit from rapid deployment, simplified system upgrades, and the ability to integrate with analytics and AI-driven applications.

The rising adoption of telehealth, digital health platforms, and population health initiatives is accelerating demand for cloud-based MDM solutions As healthcare organizations increasingly prioritize interoperability, operational efficiency, and cost optimization, the cloud deployment mode is expected to remain the dominant model, supporting sustained market expansion and driving improved data governance practices.

The provider data management application segment is projected to hold 28.4% of the market revenue in 2025, establishing it as the leading application. Growth in this segment is being driven by the critical need to maintain accurate, up-to-date information about healthcare providers, including licensing, specialties, affiliations, and performance metrics.

Accurate provider data supports regulatory compliance, quality of care, reimbursement processes, and operational efficiency. Healthcare organizations are increasingly leveraging MDM solutions to integrate provider information with clinical, operational, and financial systems, reducing errors and improving decision-making.

Automation, AI-driven validation, and real-time updates enhance accuracy and operational reliability As healthcare systems expand and data sources proliferate, the provider data management segment is expected to remain a key driver of market growth, supported by ongoing investments in data quality, governance, and interoperability, ensuring accurate and actionable insights for operational and clinical decision-making.

Information Technology has revolutionised every industry and brought about substantial changes. It has made the world more interconnected, interdependent and increased the volume of data to be processed enormously. However, if the data is compromised by way of a leak or hack, it can also have devastating consequences.

This is particularly true in medical healthcare and thus, there is a focus on the healthcare Master Data Management market. MDM is the processes, policies, and tools that allow an organisation to define and manage its critical data, leading to a single point of reference.

The healthcare master data management market is a major component of MDM. Medical healthcare facilities need to keep critical records of their patients’ health and security. Any lapse by way of administering an inadequate or incorrect dosage could even lead to death. It is vital for organisations to keep accurate, up-to-date records of their patients to avoid mistakes that could lead to reputational as well as financial harm to the organisation. Master data in healthcare is mainly divided into identifying data like the patient, provider or location and reference data i.e. linkable vocabulary like LOINC, RxNorm, ICD, SNOMED, etc.

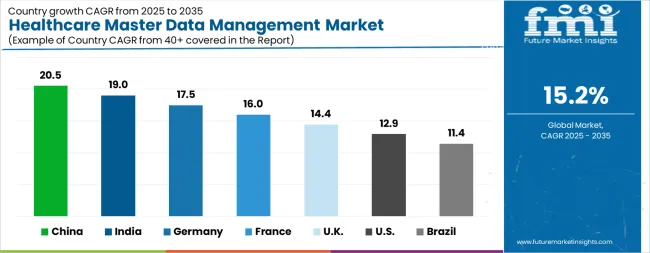

| Country | CAGR |

|---|---|

| China | 20.5% |

| India | 19.0% |

| Germany | 17.5% |

| France | 16.0% |

| UK | 14.4% |

| USA | 12.9% |

| Brazil | 11.4% |

The Healthcare Master Data Management Market is expected to register a CAGR of 15.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.5%, followed by India at 19.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.4%, yet still underscores a broadly positive trajectory for the global Healthcare Master Data Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.5%. The USA Healthcare Master Data Management Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 3.8 billion by 2035. Sales are projected to rise at a CAGR of 12.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 149.1 million and USD 111.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Component | Software and Services |

| Deployment Mode | Cloud and On-Premises |

| Application | Provider Data Management, Patient Data Management, Payer Data Management, Product Data Management, and Others |

| End-User | Healthcare Providers, Healthcare Payers, Life Science Companies, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM Corporation, Oracle Corporation, SAP SE, Informatica LLC, Reltio Inc., Stibo Systems, Profisee Group, Inc., SAS Institute Inc., Teradata Corporation, SymphonyAI (formerly Symphony Health Solutions), Ataccama Corporation, TIBCO Software Inc., Veeva Systems Inc., and Informatica Corporatio |

The global healthcare master data management market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the healthcare master data management market is projected to reach USD 13.5 billion by 2035.

The healthcare master data management market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in healthcare master data management market are software and services.

In terms of deployment mode, cloud segment to command 53.1% share in the healthcare master data management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Market Growth – Demand, Trends & Forecast 2025–2035

Data Center Power Management Market Insights – Demand & Growth 2024-2034

Dynamic Data Management System Market Report – Trends & Forecast 2023-2033

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Technology Management Market Insights – Growth & Forecast 2024-2034

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Data Management Market

Healthcare Revenue Cycle Management Software Market – Forecast 2017-2022

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Automotive Data Management Market Size and Share Forecast Outlook 2025 to 2035

Structured Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Data Center Infrastructure Management Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Wireless Healthcare Asset Management Market Analysis by Region Through 2035

Simulation and Test Data Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA