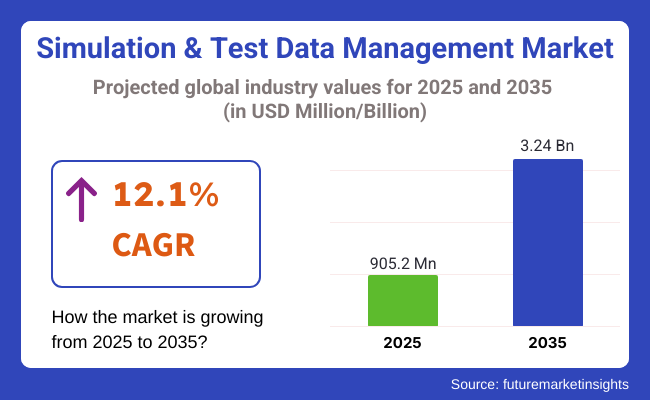

The global simulation and test data management market is expected to witness substantial growth, with its valuation projected to increase from approximately USD 905.2 million in 2025 to about USD 3.24 billion by 2035. This corresponds to a CAGR of 12.1% over the forecast period. The rising complexity of product development processes and the growing volume of test data generated across industries are key factors driving demand for robust data management solutions.

Organizations are increasingly relying on external vendors and cloud platforms to manage simulation and test data, raising concerns about data integrity, security, and regulatory compliance. This is especially critical in sectors such as automotive, healthcare, aerospace, and defense, where data accuracy directly impacts product safety and performance. The need to efficiently handle large datasets without compromising quality or confidentiality fuels market expansion.

The growth of digital twin technologies, virtual simulations, and advanced testing methods has contributed to the exponential increase in generated data. Managing this data requires sophisticated tools capable of ensuring data governance, validation, and seamless integration across development lifecycles. Solutions that offer traceability, version control, and access management help organizations maintain compliance with industry standards and regulatory requirements.

Market segmentation includes various components such as software platforms, services, and deployment models. Software platforms dominate due to their critical role in data storage, analysis, and lifecycle management. Cloud-based deployment models are gaining popularity for their scalability, cost-effectiveness, and accessibility, particularly for enterprises managing distributed teams and complex workflows. Managed services and consulting also contribute significantly by providing specialized expertise to optimize data management practices.

In March 2024, K2View introduced its AI-powered synthetic data generation service, enhancing its Test Data Management (TDM) platform. This innovation enables enterprises to create realistic, compliant test data on demand, supporting agile development and stringent data privacy regulations. K2View's solution leverages business entity-based architecture and micro-database technology, allowing for rapid provisioning and masking of sensitive information. The platform also integrates with CI/CD pipelines, facilitating seamless automation across complex data environments.

Challenges such as high implementation costs, data privacy concerns, and the complexity of integrating diverse data sources may limit market growth in some regions. However, ongoing technological advancements and rising awareness of the benefits of comprehensive data management are expected to address these obstacles.

The aerospace and defense industry is projected to grow at a strong CAGR of 14.8% from 2025 to 2035, reflecting its increasing reliance on advanced simulation and test data management solutions. Driven by the need for operational efficiency and technological superiority, aerospace and defense organizations are adopting digital engineering and virtual simulation tools to accurately model complex systems without expensive physical prototypes or live testing.

The USA Department of Defense’s (DoD) Data, Analytics, and AI Adoption Strategy underscores the critical role of robust data management and simulation capabilities in maintaining operational readiness and gaining warfighting advantages. This focus on digital transformation facilitates better decision-making, accelerates development cycles, and enhances mission outcomes.

As simulation tools evolve, the aerospace and defense sector is poised to leverage these technologies for innovative solutions, securing its leadership in the global market. The continued emphasis on upgrading digital infrastructure ensures sustained growth for simulation and test data management within this high-priority industry over the forecast period.

Test data simulation software holds a commanding market share of approximately 42.3% in 2025 in the simulation and test data management market, driven by its ability to generate accurate and reliable virtual models. This capability allows companies to perform extensive testing and validation without the need for costly physical prototypes, significantly reducing development time and expenses.

Widely adopted in sectors such as automotive, electronics, and high-tech industries, test data simulation software facilitates faster iteration cycles and improves product quality. Its flexibility and scalability enable organizations to streamline development processes, adapt to complex testing requirements, and accelerate time-to-market.

The surge in digital transformation initiatives and demand for smart testing solutions further fuel its dominance. As industries continue to optimize testing methodologies and integrate AI-driven analytics, test data simulation software is expected to solidify its leadership position, driving innovation and efficiency across multiple sectors throughout the forecast period.

| Company | Siemens Digital Industries Software |

|---|---|

| Contract/DevelopmentDetails | Secured a contract with an automotive manufacturer to provide simulation and test data management solutions, facilitating efficient product development and testing processes. |

| Date | June 2024 |

| Contract Value (USD million) | Approximately USD 20 |

| Renewal Period | 4 years |

| Company | ANSYS, Inc. |

|---|---|

| Contract/Development Details | Partnered with an aerospace company to deliver simulation data management tools, enhancing the accuracy and efficiency of engineering simulations. |

| Date | November 2024 |

| Contract Value (USD million) | Approximately USD 18 |

| Renewal Period | 3 years |

Increased adoption of AI and ML-based simulation to enhance testing efficiency

AI and ML is changing the testing efficiency game in many Simulations. Organizations can automate complex simulations using AI & ML algorithms for fashion testing, resulting in increased accuracy and reduced testing cycles. This advancement in technology includes predictive modeling for prediction of problems before they occur in real-world applications.

AI-fueled simulations are able to analyze huge data sets for patterns and outliers and make adjustments in product development proactively. The US Department of Defense has also acknowledged the potential of AI in simulation environments, which can assist with development activities as well as decision-making processes. This program illustrates how AI and ML are playing an increasingly pivotal role in making simulations faster and more reliable, and how solutions built around these areas will support reduced time-to-market and operational costs.

Expansion of digital transformation initiatives in R&D and product development

Digital transformation has been having a major impact on Research and Development (R&D) and product development sectors, which has been leading to adoption of advanced simulation and test data management solutions. By adopting digital technologies, organizations can work more easily together, enable innovation at a faster pace, and make better decisions based on existing data. Researchers can ask discovery questions and accelerate product development and innovation with a completely integrated stream of R&D data sources.

Around the world, governments are pushing digital transformation to support economic growth and the development of technologies. For instance, to develop balanced and comprehensive AI programs and partnerships, the USA government has invested heavily in AI research and development. Such investments underscore the importance of digital transformation in improving the efficiency and effectiveness of both R&D capabilities and product development processes.

Rising focus on real-time monitoring and predictive analytics in test environments

The simulation and test data management landscape onto its head with the new trend of focused real-time monitoring and predictive analytic of test environments. The ability to monitor processes in real time allows for ongoing oversight of testing, so challenges are addressed as they arise, thus increasing product reliability and safety.

Failures and performance bottlenecks can be predicted using predictive analytics and AI-driven ML, providing scope for preemptive interventions. In the field of defence, the integration of AI-powered simulations has offered greenfield training experiences with practical learnings primarily at smaller costs compared to traditional exercises, making ubiquitous training and strategic plans more effective. Not only does this approach reduce testing cycle time, it maximizes the return on investment and impact of the testing process long-term.

High implementation costs hinder adoption, especially for small and medium enterprises

The growth of the simulation and test data management solutions market is the high cost of implementation. It often involves a significant initial investment, as these solutions need specialized software, high-performance computing infrastructure, and trained personnel. In contrast to big corporates that have deep pockets for digital transformation, SMEs find it challenging to justify the investment, particularly when there is no certainty on roi. The overall cost burden continues with licensing fees for sophisticated simulation software, the expenses of storing data and costs of eventually doing maintenance on the hardware.

Most SMEs are thin on the ground when it comes to margins, so being willing to spend a ton on high-end testing and data management solutions can seem like a far less favourable option. Adoption is further complicated by the need for custom integrations with current IT environment, which typically requires additional expenditure for consulting services and software adjustments.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance requirements in automotive and aerospace drove demand for structured data management. |

| Technological Advancements | AI-enhanced simulations improved accuracy and reduced computation time. |

| Data Integration & Processing | Cloud-based data management solutions became mainstream for enhanced collaboration. |

| Security & Privacy Measures | Increased cybersecurity threats led to enhanced encryption for test data storage. |

| Market Growth Drivers | Growth in autonomous vehicles and IoT increased demand for complex simulations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered compliance automation ensures real-time adherence to evolving industry standards. |

| Technological Advancements | Digital twin technology integrates with real-time data streams for hyper-accurate simulations. |

| Data Integration & Processing | Quantum computing accelerates test data analysis, enabling real-time insights. |

| Security & Privacy Measures | Blockchain-based data integrity solutions ensure tamper-proof simulation records. |

| Market Growth Drivers | AI-driven simulation ecosystems dominate industrial R&D, reducing prototype costs. |

Tier 1 Vendors hold the majority of the STDM market due to their size, resources, and customer base. They offer comprehensive solutions that blend with existing systems, implementing end-to-end capabilities that serve large enterprises across diverse industries. This is particularly true given that the Tier 1 vendors are traditionally able to invest more heavily into research and development allowing them to stay at the forefront of technology innovation and development for changing market demand.

The Tier 2 Vendors command a decent share of the market with the providing competitive solutions that serve the needs of mid-size and bigger orgs. They have formed a concentrated business around a particular industry or region, which permits them to offer their customers bespoke solutions that are tailored to their specific market needs.

As a result, they can respond rapidly to market shifts and customer requirements, which frequently results in creative strategies in simulation and test data management: One of the key strategies for Tier 2 vendors to improve on their offerings and increase their market presence is through partnerships and collaborations with other technology providers.

They include Tier 3 Vendors: smaller firms and niche players focusing on particular aspects of simulation and test data management. These vendors focus on innovation within the industry even if they have a smaller market share. Their specialized solutions often fill gaps left by larger providers, offering customizable, flexible options for organizations with unique needs.

Tier 3 vendors can also cover certain geographic markets, offering localized support and services that larger, national organizations may not. Their innovative-driven ethos brings diversity within the market with a plethora of unique solutions available to cater for various customer needs.

The section highlights the CAGRs of countries experiencing growth in the Simulation and Test Data Management market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.8% |

| China | 14.6% |

| Germany | 11.9% |

| Japan | 12.1% |

| United States | 13.4% |

The manufacturing industry in China is experiencing a crucial transformation characterized by accelerated industrial automation and digitalization through digital twin technologies. Such an initiative stems mainly from the government's plans to improve production and rely less on foreign technology. In 2023, China registered a robot density of 470 units per 10,000 employees, outranking Germany and Japan for the first time and standing at third position in the world classification. This wave of automation signals a commitment to modernizing the industrial base of the country.

At the same time, the adoption of digital twin technologies is picking up; the government has made it compulsory to localize the software by 2027. This has motivated the development of indigenous digital twin solutions that enable real-time monitoring and optimization of manufacturing processes.

This convergence further increases the complexity of the data flow creates system-level complexities and demanding data management systems for simulation and test. This has led to a growing need for sophisticated data management solutions that can meet the requirements of automated and digitized manufacturing environments in China. China is anticipated to see substantial growth at a CAGR 14.6% from 2025 to 2035 in the Simulation and Test Data Management market.

The engineering and IT sectors in India are undergoing a paradigm shift towards cloud-based simulation tools, driven by the need for scalable and cost-effective solutions. Government initiatives, including "Digital India" and "Make in India", have contributed significantly to this shift, driving the development of digital infrastructure and accelerating technology adoption among enterprises. In 2025, the Indian government allocated USD 267 million to 'India AI Mission' to improve AI and ecosystem infrastructure.

This commitment to integrating advanced technologies into different industries is evident from this investment made by the nation. Cloud-based simulation tools provide organizations the flexibility and scalability to shorten product development cycles and enhance innovation without a large capital expenditure upfront.

Hence, for Indian companies to stay on top of the international competitiveness, there is a rising need of Cloud-based simulation solutions that will easily fit into an existing workflow and give Indian companies the flexibility to compete globally. India's Simulation and Test Data Management market is growing at a CAGR of 15.8% during the forecast period.

The growing need for regulatory compliance in the United States is driving the demand for secure test data management solutions. Sectors like healthcare, finance, and defense face strict data security laws, requiring comprehensive systems to handle and protect confidential information.

As such, the government has pushed for compliance with regulatory standards, highlighted data sovereignty, emphasized data security and undertaken initiatives to adopt beneficial cloud use while adhering to regulations.

As proven by recent reviews, cloud computing in relation to data sovereignty can be very spicy. Thus, organizations are now focused on tool-based test data management solutions that can not only ensure compliance but also provide extra security measures against data theft.

This continues the pattern of USA consulates and embassies implementing more robust secure data management systems in order to keep up with the changing regulatory framework in the USA is anticipated to see substantial growth in the Simulation and Test Data Management market significantly holds dominant share of 79.2% in 2025.

The global Simulation and Test Data Management Market Competitive Landscape for each chapter, including the following companies. Business turns their goal to innovation, automation, and AI-driven solutions to improve efficiency and minimize testing costs. It is a highly competitive market where players are distinguished on the basis of scalability, cloud integration, and real-time data analytics. Key challenges for market participants continue to be regulatory compliance, cyber security concerns and integration into existing IT ecosystems.

Industry Update

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 905.2 million |

| Projected Market Size (2035) | USD 3.24 billion |

| CAGR (2025 to 2035) | 12.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Solutions Analyzed (Segment 1) | Testing Systems, Test Data Simulation Software, Services |

| Enterprise Size Segments (Segment 2) | Small & Medium Enterprises, Large Enterprises |

| Industry Segments Covered (Segment 3) | Healthcare, Aerospace & Defense, Automotive |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, China, India, Germany, Japan, South Korea |

| Key Players Influencing the Market | K2View, DATPROF, Avo iTDM, Informatica, CA Test Data Manager, Delphix, IBM, Parasoft Virtualize, Tonic, Bitwise |

| Additional Attributes | Dollar sales by solution and industry, AI/ML integration trends, cloud migration impact, regulatory compliance challenges, cybersecurity focus |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of solution, the segment is divided into Testing Systems, Test Data Simulation Software and Services.

In terms of Enterprise Size, the segment is segregated into Small & Medium Enterprise Size and Large Enterprise.

In terms of Industry, the segment is segregated into Healthcare, Aerospace & Defense and Automotive.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Simulation and Test Data Management industry is projected to witness CAGR of 12.1% between 2025 and 2035.

The Global Simulation and Test Data Management industry stood at USD 905.2 million in 2025.

The Global Simulation and Test Data Management industry is anticipated to reach USD 3.24 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.2% in the assessment period.

The key players operating in the Global Simulation and Test Data Management Industry K2View, DATPROF, Avo iTDM, Informatica Test Data Management, CA Test Data Manager, Delphix, IBM InfoSphere Optim Test Data Management, Parasoft Virtualize, Tonic, Bitwise Test Data Management.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Industry , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 17: Global Market Attractiveness by Solution, 2023 to 2033

Figure 18: Global Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 19: Global Market Attractiveness by Industry , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Industry , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 37: North America Market Attractiveness by Solution, 2023 to 2033

Figure 38: North America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 39: North America Market Attractiveness by Industry , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Industry , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Industry , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Industry , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 77: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 78: Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 79: Europe Market Attractiveness by Industry , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Industry , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Industry , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Industry , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Industry , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Industry , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Industry , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Industry , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Industry , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Industry , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Industry , 2023 to 2033

Figure 157: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 158: MEA Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 159: MEA Market Attractiveness by Industry , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Simulation Software Market Insights – Size, Demand & Forecast 2023-2033

Biosimulation Market Size and Share Forecast Outlook 2025 to 2035

Motion Simulation Market Size and Share Forecast Outlook 2025 to 2035

Automotive Simulation Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Packaging Design And Simulation Technology

Data Center Modeling and Simulation Tools Market

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

Automated Breach and Attack Simulation Market

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA