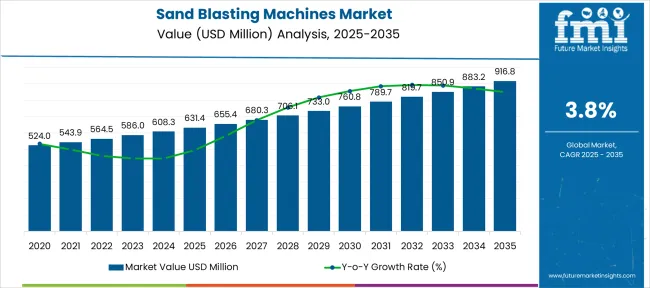

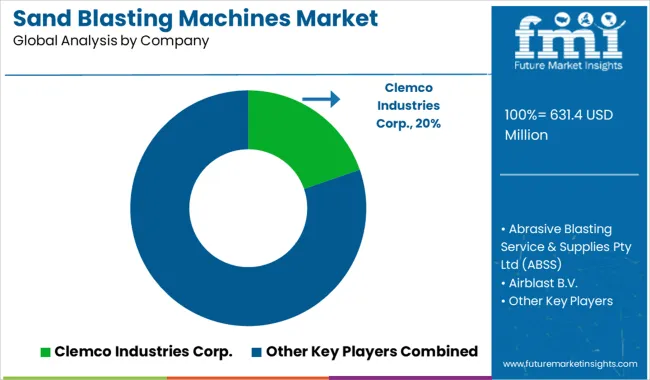

The Sand Blasting Machines Market is estimated to be valued at USD 631.4 million in 2025 and is projected to reach USD 916.8 million by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Sand Blasting Machines Market Estimated Value in (2025 E) | USD 631.4 million |

| Sand Blasting Machines Market Forecast Value in (2035 F) | USD 916.8 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

The versatility of sand blasting machines in cleaning, finishing, and coating applications has driven their adoption. Industry trends show a preference for efficient and environmentally friendly blasting methods, with dry blasting gaining popularity due to its effectiveness and lower water consumption. Technological advancements in control systems have improved precision and automation, enhancing operational efficiency and safety.

Growing infrastructure projects and the need for maintenance of aging assets have contributed to market expansion. Future growth is expected as manufacturers focus on developing portable solutions for on-site applications and enhancing automation capabilities. Segmental growth is forecasted to be led by portable machines in product type, dry blasting as the preferred blasting method, and automatic control systems for improved process management.

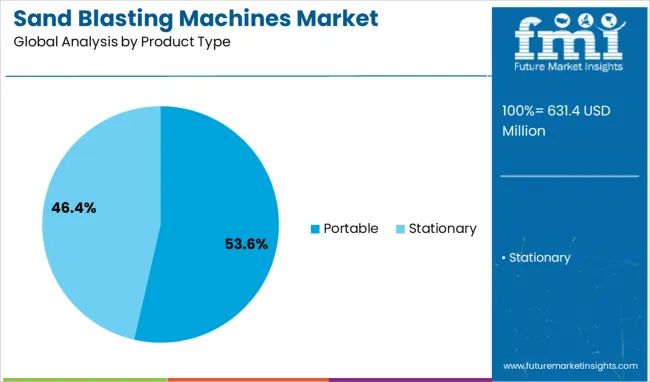

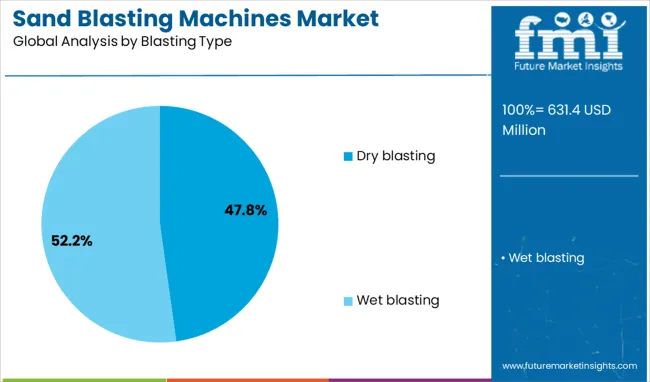

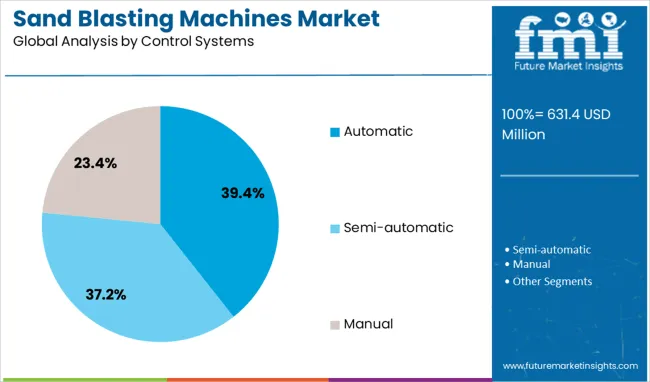

The sand blasting machines market is segmented by product type, blasting type, control systems, capacity, end-use, and geographic regions. The sand blasting machines market is divided by product type into Portable and Stationary. In terms of blasting type, the sand blasting machines market is classified into Dry blasting and Wet blasting. The sand blasting machines market is segmented into Automatic, Semi-automatic, and Manual.

The sand blasting machines market is segmented into 1,000L to 2,000L, Less than 1,000 L, 2,000L to 3,000L, and Above 3,000 L. By end-use, the sand blasting machines market is segmented into Automotive, Construction, Marine, Oil & gas, Petrochemicals, and Others. Regionally, the sand blasting machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Portable segment is projected to hold 53.6% of the sand blasting machines market revenue in 2025, establishing its position as the leading product type. Growth has been driven by the increasing requirement for mobile and flexible blasting equipment suitable for diverse work environments. Portable sand blasting machines enable on-site operations, reducing downtime and transportation costs.

Their ease of use and adaptability have made them popular among contractors and maintenance teams. Furthermore, portable units are favored for small to medium-scale projects where accessibility and maneuverability are critical.

As industries prioritize operational flexibility and cost efficiency, the portable segment is expected to maintain its dominance.

The Dry Blasting segment is expected to account for 47.8% of the market revenue in 2025, remaining the preferred blasting method. Dry blasting is favored for its ability to deliver effective surface cleaning without the use of water, reducing waste management challenges. This method is particularly useful in environments where water use is restricted or undesirable.

Advances in abrasive materials and blasting technology have enhanced the efficiency and environmental profile of dry blasting. Operators appreciate the ease of handling and reduced setup time associated with dry blasting.

Given the increasing emphasis on sustainable industrial practices, the dry blasting segment is poised to sustain its growth.

The Automatic control systems segment is projected to contribute 39.4% of the sand blasting machines market revenue in 2025, positioning it as the leading control system type. The growth of this segment has been propelled by the demand for precision and repeatability in blasting operations. Automated systems provide consistent performance, reduce operator fatigue, and improve safety by minimizing human intervention.

Integration of advanced sensors and programmable controls allows for optimized blasting parameters and real-time monitoring. These systems are increasingly preferred in large-scale industrial applications where efficiency and quality control are paramount.

As industries adopt Industry 4.0 technologies, the automatic control systems segment is expected to continue driving market innovation and growth.

The sand blasting machines market is expanding steadily as demand rises across automotive, aerospace, shipbuilding, and construction sectors. Surface-preparation requirements are driving investment in both stationary and portable units. Regulatory and quality standards are supporting adoption in manufacturing and refurbishment projects. Equipment automation and compact module launches are enhancing productivity. However, abrasive material cost volatility and environmental compliance challenges remain key constraints. It is believed that providers offering energy-efficient systems, multi-operation models, and integrated dust suppression will capture competitive advantage through 2025-global projections show mid single-digit CAGR through 2031–2034.

Growth in the power discrete and modules market has been fueled by strong adoption in automotive electrification, industrial automation, and renewable power applications. In 2024, electric vehicle sales surpassed expectations across Europe and Asia, significantly boosting demand for insulated gate bipolar transistors (IGBTs) and MOSFET modules. Utility-scale solar and wind projects have also increased the requirement for high-efficiency power modules for inverters and grid interfaces. It is widely believed that OEMs and tier-one suppliers are accelerating partnerships with semiconductor firms to secure critical components for high-performance power conversion and energy management systems.

Opportunities are being created through automation and modular machine design targeting advanced fabrication and maintenance applications. In 2025, manufacturers introduced robotic sandblasting lines and semi-automatic units capable of precise finishing in aerospace paint stripping and automotive component restoration. Automated dust collection and remote operation features gained traction among industrial users in North America and Europe. It is considered that firms supplying programmable, multi-mode sand blasting systems with low operating costs will attract key OEM and maintenance contractor contracts.

A notable trend through 2024 and 2025 is integration of advanced dust suppression systems and eco-conscious blast media formulations. Equipment vendors began embedding HEPA-filtered exhaust units and closed-loop vacuum collection to meet environmental regulations. Reusable abrasive media and dry blast technology retaining particulate containment were adopted in industries with strict emission limits. It is strongly believed that operators prioritizing compliant, low-dust equipment will differentiate themselves and align with increasing regulatory scrutiny and workplace safety requirements.

Fluctuating prices of blast media, energy demands, and growing regulatory burdens on silica dust exposure impose major restraints. In 2024, abrasive supply constraints and rising material costs affected margins for mid-sized manufacturers. Compliance with occupational health standards and permits for abrasive operations extended commissioning timelines in several regions. It is considered that without efficient dust control integration, flexible media sourcing, and simplified compliance frameworks, many buyers may defer new equipment installation or favor refurbished machinery over new investment.

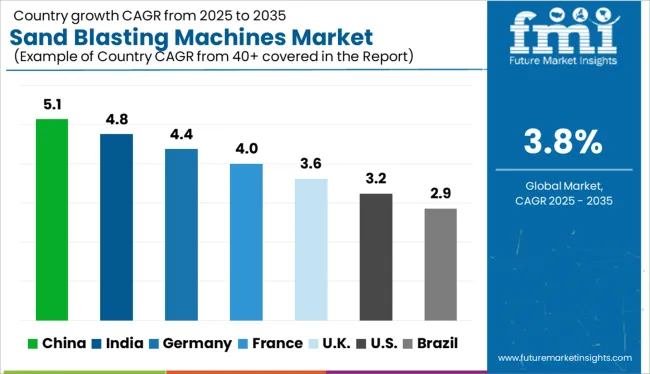

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

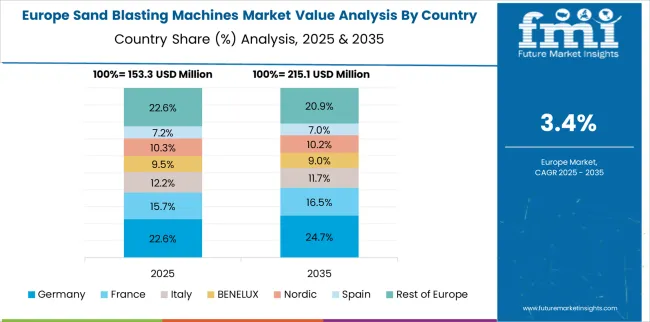

The global sand blasting machines market is projected to grow at a 3.8% CAGR from 2025 to 2035. China leads at 5.1% CAGR, driven by large-scale infrastructure and heavy engineering projects. India follows with 4.8%, propelled by manufacturing growth and surface treatment requirements in automotive and shipbuilding. Germany posts 4.4%, supported by demand in precision engineering and aerospace sectors. The UK stands at 3.6%, while the United States records 3.2%, reflecting mature industrial bases with incremental upgrades. Growth differentials highlight Asia’s dominance due to industrialization and aggressive investment in surface preparation technologies, while Western economies focus on equipment automation and compliance with dust-control regulations.

China dominates the global sand blasting machines market with a projected 5.1% CAGR through 2035. Demand is driven by high-volume requirements in construction, shipbuilding, and large-scale metal fabrication industries. Investments in automotive production lines and steel plants further strengthen the adoption of automated sand blasting systems. Local manufacturers focus on cost-effective units, while international players offer advanced blasting cabins integrated with robotic arms and real-time monitoring for dust and media control. The growing popularity of eco-friendly abrasive materials, including steel grit and glass beads, enhances compliance with environmental standards and worker safety guidelines.

India’s sand blasting machines market is set to rise at a 4.8% CAGR, driven by demand from automotive, construction, and energy sectors. Surface preparation requirements in oil and gas infrastructure and thermal power plant maintenance contribute to steady equipment consumption. Domestic manufacturers emphasize compact, mobile blasting units for smaller workshops, while large industries invest in automated machines for batch processing. Government-led infrastructure modernization projects and shipyard expansions support long-term demand. Innovations in abrasive recycling systems are emerging as buyers prioritize operational cost reduction and environmental compliance.

Germany records a 4.4% CAGR, benefiting from precision-driven applications in aerospace, defense, and automotive sectors. German industries favor automated blasting systems for controlled surface profiling and coating preparation. Manufacturers are upgrading with robotic and CNC-integrated blasting solutions to meet stringent EU health and safety norms. Demand is reinforced by turbine blade cleaning and corrosion prevention in renewable energy installations. Major suppliers focus on eco-compliant technologies, including water-based blasting, to reduce airborne particulate emissions. Continuous innovation in pressure-controlled systems strengthens adoption across metal finishing lines.

The UK is forecast to expand at 3.6% CAGR during 2025–2035. Demand comes primarily from defense, shipbuilding repair, and maintenance operations across industrial hubs. The country is witnessing an uptick in robotic blasting units for precision engineering and metal component refurbishment. While traditional blasting machines remain common in SMEs, sustainability measures are pushing for enclosed blasting booths and dust extraction systems. Growth opportunities exist in aftermarket services, particularly for portable equipment used in on-site maintenance. International brands dominate premium automated systems, whereas local players provide cost-sensitive models for general-purpose applications.

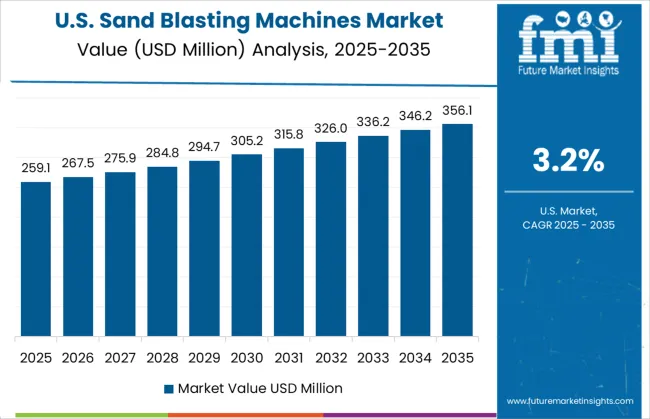

The US market is projected to grow at 3.2% CAGR, reflecting steady adoption in mature industrial sectors such as oil and gas, aerospace, and automotive. Growth primarily stems from modernization initiatives, retrofitting older blasting systems with advanced automation and safety controls. The push for environmentally safe abrasives, like garnet and steel shot, aligns with OSHA regulations targeting silica dust exposure. Portable sand blasting units witness demand from repair and maintenance activities in construction and transportation sectors. Vendors are leveraging telematics for real-time performance monitoring to minimize downtime and enhance operational productivity.

The sand blasting machines market is moderately consolidated, with Clemco Industries Corp. recognized as a leading player due to its extensive portfolio of blasting equipment, accessories, and safety gear designed for industrial surface preparation. The company’s focus on durability, high performance, and advanced dust-control technologies has reinforced its leadership across global markets.

Key players include Abrasive Blasting Service & Supplies Pty Ltd (ABSS), Airblast B.V., Burwell Technologies, Empire Abrasive Equipment, Graco Inc., Guyson Corporation, Kramer Industries Inc., Laempe Mössner Sinto GmbH, Midwest Finishing Systems, Inc., Norton Sandblasting Equipment, Sinto Group, Torbo Engineering Keizers GmbH, Trinco Trinity Tool Co., and Wheelabrator Group.

These companies offer a range of products, including portable blasting units, cabinet systems, and automated blasting solutions catering to automotive, aerospace, shipbuilding, and construction industries. Market growth is driven by increasing demand for surface finishing, rust removal, and coating preparation in manufacturing and maintenance operations. Manufacturers are focusing on innovations such as eco-friendly abrasive systems, dustless blasting technology, and automation for high-volume applications.

Additionally, growing adoption of robotic blasting systems for precision applications and compliance with workplace safety standards are shaping the competitive landscape. North America and Europe dominate due to advanced industrial infrastructure, while Asia-Pacific is witnessing rapid growth fueled by heavy construction, shipbuilding, and automotive production.

In August 2024, Clemco Industries released its EcoQuip 2 series of vapor abrasive blasting machines. Designed to meet stringent environmental regulations, these systems enhance performance in industrial applications while reducing dust and emissions, ideal for construction, marine, and infrastructure maintenance operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 631.4 Million |

| Product Type | Portable and Stationary |

| Blasting Type | Dry blasting and Wet blasting |

| Control Systems | Automatic, Semi-automatic, and Manual |

| Capacity | 1,000L to 2,000L, Less than 1,000 L, 2,000L to 3,000L, and Above 3,000 L |

| End-Use | Automotive, Construction, Marine, Oil & gas, Petrochemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clemco Industries Corp., Abrasive Blasting Service & Supplies Pty Ltd (ABSS), Airblast B.V., Burwell Technologies, Empire Abrasive Equipment, Graco Inc., Guyson Corporation, Kramer Industries Inc., Laempe Mössner Sinto GmbH, Midwest Finishing Systems, Inc., Norton Sandblasting Equipment, Sinto Group, Torbo Engineering Keizers GmbH, Trinco Trinity Tool Co., and Wheelabrator Group |

| Additional Attributes | Dollar sales categorized by machine type (stationary vs portable), operation mode (manual, semi‑automatic, automatic), and application (automotive, construction, industrial). Asia-Pacific dominates market share, while North America shows fastest growth. Buyers prioritize mobility, automation, and dust suppression. Innovations include eco‑friendly abrasive media, AI-driven blasting control, and seamless integration with surface preparation and coating systems. |

The global sand blasting machines market is estimated to be valued at USD 631.4 million in 2025.

The market size for the sand blasting machines market is projected to reach USD 916.8 million by 2035.

The sand blasting machines market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in sand blasting machines market are portable and stationary.

In terms of blasting type, dry blasting segment to command 47.8% share in the sand blasting machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Screens Market Analysis - Size, Growth, and Forecast 2025 to 2035

Sand Control Screens Market Growth - Trends & Forecast 2025 to 2035

Sandwich Containers Market Insights & Industry Analysis 2023-2033

Sand Control Tools Market

Sanding Sugar Market

Sander Market

Sandwich Preparation Refrigerators Market

Sandboxing Market

Sandbags Market

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA