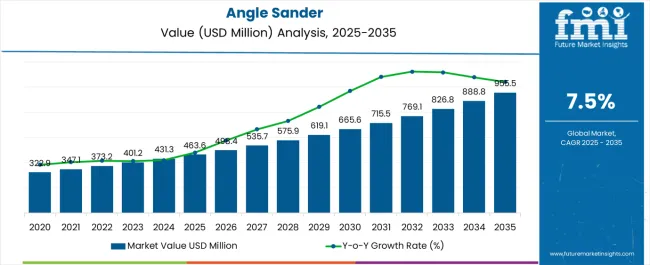

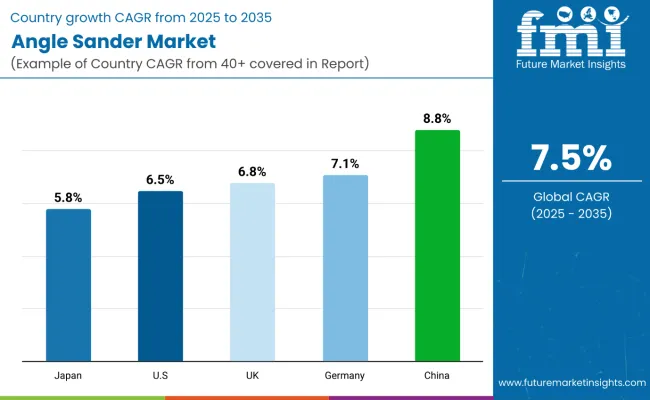

The global angle sander market is expected to be valued at USD 463.6 million in 2025 and is projected to reach approximately USD 955.5 million by 2035. This reflects an absolute increase of USD 491.9 million, equivalent to a growth of 106.1% over the forecast period. The expansion is forecast to occur at a compound annual growth rate (CAGR) of 7.5%, with the market size estimated to grow by nearly 2.1X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 463.6 million |

| Industry Value (2035F) | USD 955.5 million |

| CAGR (2025 to 2035) | 7.5% |

Between 2025 and 2030, the market is projected to expand from USD 463.6 million to USD 665.6 million, resulting in a value addition of USD 202 million. This initial phase of growth is expected to be supported by the rising use of angle sanders in metal fabrication units, infrastructure rehabilitation projects, and routine maintenance activities in the industrial sector. Increased spending on construction and remodeling across Asia and North America is likely to contribute to elevated demand for compact, high-torque angle sanding tools.

From 2030 to 2035, the market is expected to grow from USD 665.6 million to USD 955.5 million, accounting for a cumulative increase of USD 289.9 million. This latter phase of growth is anticipated to be shaped by advancements in cordless electric tools, improved brushless motor technologies, and the growing integration of sensor-enabled feedback features. The adoption of ergonomic and safety-enhancing designs is likely to influence procurement decisions among professional users and consumer segments, particularly across European and East Asian markets.

From 2020 to 2024, the angle sander market expanded gradually, driven by steady demand in industrial maintenance, metalworking, and light fabrication sectors. During this period, the market value increased from USD 322.9 million in 2020 to USD 431.3 million in 2024, reflecting consistent adoption across both developed and developing economies. Growth was supported by rising construction and infrastructure rehabilitation activities, particularly in Asia and Eastern Europe, where angle sanders were utilized extensively for surface preparation and finishing.

The product landscape during this time was dominated by corded models with variable speed control and heavy-duty motor configurations. These tools were widely adopted across automotive repair units, machinery workshops, and shipbuilding yards due to their reliability in high-load applications. Market participation was led by established power tool manufacturers leveraging distributor networks and bundled promotional offerings for small contractors and industrial buyers.

By 2025, the market is expected to reach a valuation of USD 463.6 million. This transition is being influenced by the rising preference for cordless models, improvements in battery performance, and integration of dust management systems to support regulatory compliance.

As industries continue to adopt safer and more efficient handheld tools, demand is gradually shifting toward models that combine mobility, operator comfort, and extended runtime. The 2025 baseline is set to serve as a springboard for more rapid growth, particularly as the sector aligns with ergonomic standards and energy efficiency mandates in large-scale construction and manufacturing environments.

The growth of the angle sander market is being driven by multiple converging factors, including advancements in motor technology, rising demand for surface finishing precision, and increased adoption across diversified end-use industries. Manufacturers have introduced brushless motors and overload protection mechanisms that extend product lifespan and reduce maintenance downtime, improving overall cost efficiency for industrial users.

The surge in construction, retrofitting, and metal fabrication projects has reinforced the need for reliable surface finishing tools. Angle sanders are increasingly being integrated into maintenance cycles for industrial plants, shipyards, and heavy equipment refurbishing operations. Product demand is also being influenced by the shift toward modular tool systems that allow tool-less accessory changes, enhancing productivity on-site.

Consumer-driven segments such as DIY repair and hobbyist fabrication are contributing to the expansion of compact and ergonomically designed angle sanders. Growth in e-commerce platforms and brand-led digital marketing campaigns is increasing product visibility and driving sales in non-professional user groups.

Compliance with safety and dust emission standards is encouraging the use of sanders equipped with integrated dust extraction systems. Combined with longer battery life and higher torque output, these enhancements are positioning cordless variants as the preferred option across varied job sites.

The market is segmented by product type into corded, cordless, and pneumatic models, catering to varied operational needs. Motor types are classified into brushed and brushless, offering different performance and maintenance profiles. End-use categories include general purpose, industrial purpose, and heavy-duty applications. Key application areas span metal fabrication, automotive, construction, woodworking, shipbuilding, and others, indicating broad industrial and commercial usage. Regionally, the market covers North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa, enabling analysis of demand trends and growth opportunities across diverse economic and industrial landscapes worldwide.

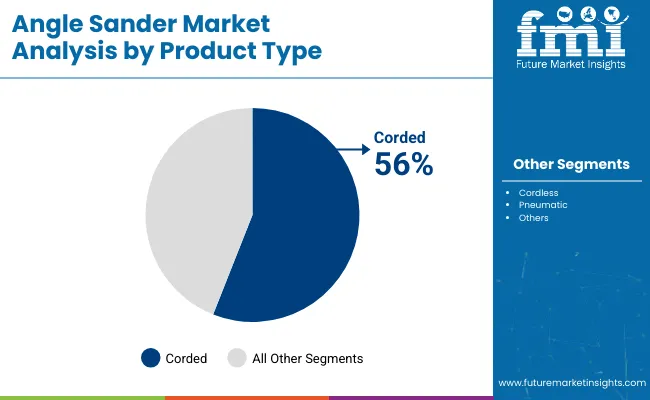

Corded angle sanders are estimated to capture 56% share of the product type segment in 2025 and are projected to grow steadily through the forecast period. Their dominance is attributed to continuous power output, cost-effectiveness, and suitability for prolonged use in workshops and industrial environments.

Compared to cordless or pneumatic models, corded variants are widely used across repair shops, metalworking units, and general-purpose maintenance due to their availability in various disc sizes and wattage ratings. Dependability and minimal downtime during operation reinforce their adoption in applications requiring uninterrupted performance.

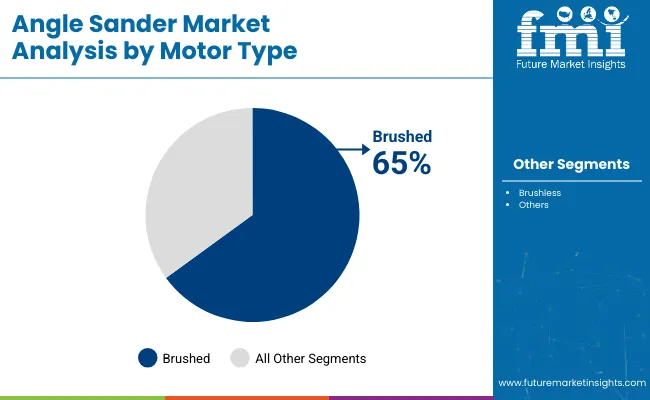

Brushed motors are expected to account for 65% share of the motor type segment in 2025, with consistent demand anticipated through 2035. These motors are preferred in cost-sensitive applications where high-speed rotation and basic sanding functionality suffice.

Simpler construction, ease of repair, and compatibility with standard electric systems make brushed motors widely adopted in corded models used by general contractors and workshop operators. Although brushless alternatives are gaining traction, brushed motors remain entrenched due to their economic advantages and familiarity among traditional users.

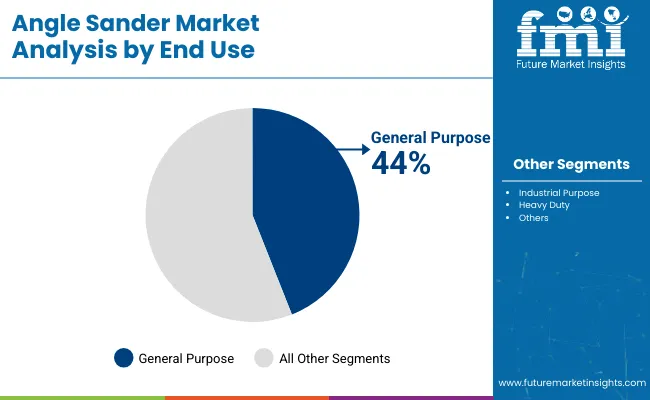

General-purpose usage is forecasted to represent 44% share of the end-use segment in 2025, sustaining leadership across residential, DIY, and small-scale professional applications. Angle sanders in this category are used for routine grinding, polishing, and sanding tasks in home improvement, small metal workshops, and light repair activities.

Their appeal lies in affordable pricing, user-friendly design, and versatility across multiple materials including wood, metal, and plastic. The segment benefits from the growing trend of self-reliant maintenance and repair work across both emerging and developed markets.

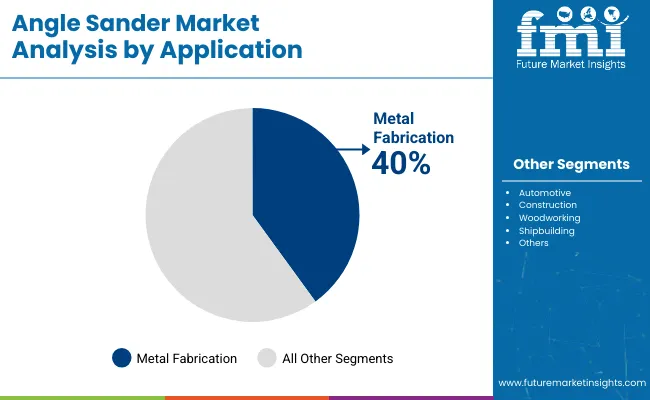

Metal fabrication is projected to hold a 40% share in the application segment in 2025 and continues to be a primary demand driver for angle sanders globally. The segment’s prominence is shaped by grinding and finishing needs across welding shops, structural component processing, and sheet metal applications.

Sanders are used extensively for deburring, surface smoothing, rust removal, and edge rounding in metal fabrication plants. Growing infrastructure development, automotive part production, and localized fabrication units in Asia and Europe are contributing to sustained demand in this segment.

Demand for angle sanders is being supported by increased activity in construction, shipbuilding, and industrial maintenance, although high operating noise levels, tool weight, and limited consumer familiarity with safety protocols continue to limit broader adoption in DIY and semi-professional segments.

Rising Demand from Metal Fabrication and Heavy Maintenance Applications

The angle sander market is being driven by its expanding role in surface preparation and finishing tasks within shipyards, manufacturing plants, and repair facilities. The ability of angle sanders to handle high-load grinding and edge refinement tasks makes them essential for welding operations, rust removal, and abrasive cleaning. Growth is further reinforced by industrial modernization programs in Asia-Pacific and Europe, where plant refurbishments are increasing tool procurement.

Shift Toward Cordless Sanders with Advanced Power and Ergonomics

Cordless angle sanders are gaining traction due to improvements in lithium-ion battery capacity, torque consistency, and motor durability. These models are preferred in confined or mobile work environments, as they reduce cord clutter and enhance operator mobility. Ergonomic enhancements such as soft grip handles, adjustable side grips, and anti-vibration design features are supporting adoption across both professional and light industrial users.

Emphasis on Dust Control and Regulatory Compliance

Growing awareness of occupational health and safety is driving the demand for dust-extraction-compatible angle sanders. Tool models integrated with sealed motor housings and dust shrouds are being prioritized, especially in regions enforcing stricter airborne particulate exposure limits. As workplace safety regulations evolve, compliance-driven upgrades are expected to create recurring sales opportunities for OEMs and distributors.

Germany’s angle sander market is forecast to grow at a CAGR of 7.1% through 2035. Demand is driven by precision metalworking, mechanical maintenance, and strong emphasis on tool safety. Manufacturers are integrating digital control interfaces, vibration control, and energy-efficient motors to align with German industrial standards.

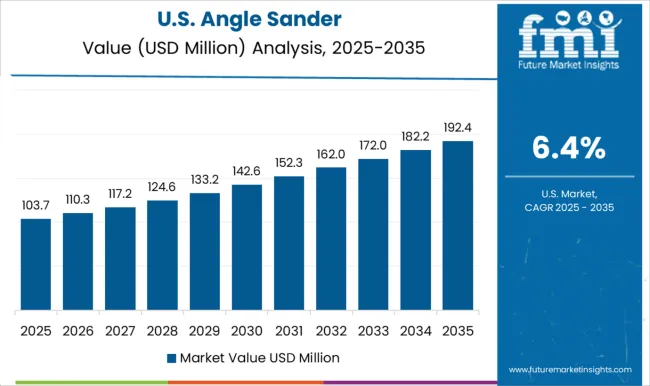

The USA angle sander market is projected to grow at a CAGR of 6.5% from 2025 to 2035. Growth is being supported by sustained demand from industrial maintenance operations, metal fabrication workshops, and general construction activity. The shift toward cordless tools with enhanced runtime and OSHA-compliant dust control features is shaping purchasing decisions in both contractor and DIY channels.

The UK angle sander market is projected to grow at a CAGR of 6.8% between 2025 and 2035. National infrastructure renewal programs, paired with growth in home improvement projects, are creating steady demand across both heavy-duty and consumer-grade segments.

Japan’s angle sander market is expected to expand at a CAGR of 5.8% during the forecast period. Preference for compact, quiet, and high-precision sanding tools remains strong across automotive repair centers, shipbuilding units, and industrial equipment maintenance operations.

China’s angle sander market is forecast to grow at a CAGR of 8.8% from 2025 to 2035. Construction, infrastructure, and manufacturing investments are accelerating demand, while competitive pricing from domestic brands is expanding reach into mid-tier industrial and small business segments.

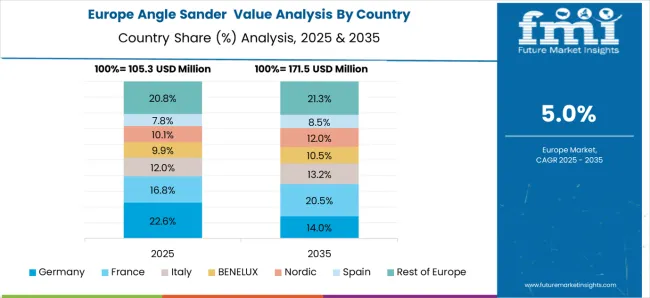

The European angle sander market is projected to grow at a CAGR of 5.0% from 2025 to 2035, reaching a valuation of USD 171.5 million by the end of the forecast period, up from USD 105.3 million in 2025. Market dynamics are expected to shift gradually as countries respond to evolving industrial demands, labor safety standards, and equipment modernization needs.

Germany is projected to remain the largest contributor, although its share is expected to decline from 22.6% in 2025 to 14.0% by 2035, indicating maturing demand and potential saturation in its industrial sector. Meanwhile, Spain and the Rest of Europe are poised to gain share, rising from 16.8% and 20.8% respectively in 2025 to 20.5% and 21.3% by 2035. This growth reflects increased tool penetration in Southern and Eastern European industrial hubs.

Italy, the Nordic region, and BENELUX markets are expected to maintain moderate share gains, driven by infrastructure refurbishments and manufacturing automation trends. The UK and France also remain stable contributors, with slight upward shifts driven by regulatory compliance and adoption of dust control-enabled tools.

The angle sander market in Japan is projected to demonstrate stable growth through 2035, with demand largely concentrated in general-purpose applications, which account for 50% of the total market share in 2025. This dominance is underpinned by Japan’s strong DIY consumer culture, compact workshop networks, and precision-focused small and medium manufacturing enterprises.

General-purpose angle sanders are preferred for their flexibility, portability, and compatibility with light to medium-intensity tasks such as equipment upkeep, furniture finishing, and routine maintenance.

The South Korean angle sander market is driven by metal fabrication and automotive sectors, which together represent 61% of the total application share in 2025. Metal fabrication leads with 37%, fueled by the country’s robust machinery, electronics, and industrial components manufacturing. Automotive applications account for 24%, supported by a high-volume aftermarket repair network and increasing focus on vehicle body refinishing and maintenance.

The angle sanders market is growing more competitive, with key players expanding their cordless tool offerings to meet increasing demand for power, convenience, and performance. Companies are focusing on developing tools that provide the power of corded models without the hassle, such as new cordless orbit sanders offering up to 40% more power than pneumatic alternatives. Innovations like variable speed control and improved maneuverability in tight spaces are becoming key differentiators.

| Item | Value |

|---|---|

| Quantitative Units | USD 463.6 Million (2025) |

| Product Type | Corded, Cordless, Pneumatic |

| Motor Type | Brushed, Brushless |

| End Use | General Purpose, Industrial Purpose, Heavy Duty |

| Application | Metal Fabrication, Automotive, Construction, Woodworking, Shipbuilding, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, South Korea, Spain, BENELUX |

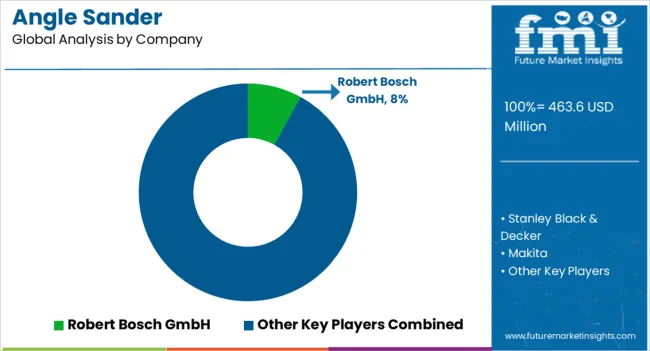

| Key Companies Profiled | Robert Bosch GmbH, Stanley Black & Decker, Makita, Techtronic Industries, Metabo , Hilti, Würth Group, Festool , Positec |

The global angle sander market is estimated to be valued at USD 463.6 million in 2025, supported by steady demand from metal fabrication, construction, and industrial maintenance sectors.

The market is projected to reach approximately USD 955.5 million by 2035, reflecting the growing preference for cordless tools and ergonomic sanding solutions across regions.

The market is forecast to expand at a compound annual growth rate (CAGR) of 7.5% over the period, with total market size expected to grow by nearly 2.1X.

Corded angle sanders are expected to retain strong demand in heavy-duty industrial environments, while cordless models are gaining traction due to enhanced mobility and battery performance.

Metal fabrication is projected to be the leading application in 2025, particularly in South Korea and Germany, where demand is supported by industrial manufacturing and precision engineering sectors.

Key companies include Robert Bosch GmbH, Stanley Black & Decker, Makita, Techtronic Industries, Metabo, Hilti, Würth Group, Festool, and Positec.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Angle Grinder Market Size and Share Forecast Outlook 2025 to 2035

Angle-Resolved Photoemission Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Weld Angle Brackets Market Size and Share Forecast Outlook 2025 to 2035

Right Angle Fastener Market Analysis - Size, Share, and Forecast 2025 to 2035

Sander Market

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Sanders Market Analysis Size and Share Forecast Outlook 2025 to 2035

Belt File Sander Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA