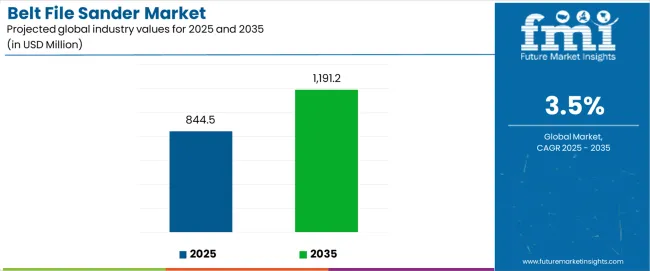

The global belt file sander market is projected to expand from USD 844.5 million in 2025 to USD 1,191.2 million in 2035, representing an absolute gain of USD 346.7 million at a CAGR of 3.5%. Much of this trajectory will be shaped by advancements in production processes and product technology. Belt file sanders, once regarded as basic hand-held power tools, are evolving into precision-engineered systems that reflect larger changes in electric motor design, ergonomics, and dust control technologies across the forecast horizon.

Production is centered around established power tool hubs in Asia-Pacific, Europe, and North America, where OEMs and contract manufacturers provide differentiated offerings for both professional and consumer markets. In 2025, most production capacity remains geared toward corded models, but manufacturing lines are rapidly shifting toward cordless belt file sanders, supported by battery standardization and improvements in lithium-ion supply chains. By 2030, large-scale assembly in China, Japan, and Germany is expected to dominate, reflecting the ability of regional manufacturers to produce at scale while integrating high-efficiency brushless motors into compact designs. Production cost optimization is achieved by modular assembly, which allows toolmakers to adapt belt sander configurations across multiple product families with shared parts and components.

Technological innovation is a key driver of competitive differentiation. In 2025, the focus is on transitioning from brushed to brushless motor systems. Brushless motors deliver superior durability, lower maintenance, and higher efficiency—characteristics that are especially important for professional workshops and industrial users. Adoption is also supported by demand for variable speed control, which has shifted from a premium feature to a baseline expectation by 2030. Manufacturers are investing heavily in smart electronic controllers that allow precise adjustment of sanding speeds depending on material hardness, ensuring reduced surface damage and improved efficiency.

Dust collection technology represents another technological frontier. In 2025, external dust collection units are still common, but integrated filtration systems are becoming standard by 2030. These compact dust extraction modules improve worker safety, extend tool life, and meet increasingly strict regulatory requirements, especially in Europe. By 2035, seamless integration with centralized workshop ventilation systems is expected, making advanced dust control a defining feature of mass-market offerings.

Cordless technology also drives market expansion. Early cordless models in 2025 suffer from short runtimes and high costs, but improvements in battery density and fast-charging platforms are expected to transform adoption by 2035. Manufacturers are expected to launch belt sanders that connect directly with automated workshop platforms, enabling digital usage tracking, preventive maintenance alerts, and performance analytics.

The belt file sander market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the belt file sander market progresses through its advanced motor technology adoption phase, expanding from USD 844.5 million to USD 1,002.9 million with steady annual increments averaging 3.6% growth. This period showcases the transition from basic universal motors to advanced brushless systems with enhanced variable speed control and integrated dust management becoming mainstream features.

The 2025 to 2030 phase adds USD 158.4 million to market value, representing 46% of total decade expansion. Market maturation factors include standardization of belt specifications, declining manufacturing costs for high-performance motors, and increasing professional awareness of premium tool benefits reaching 75-80% effectiveness in precision sanding applications. Competitive landscape evolution during this period features established manufacturers like Metabo and Milwaukee expanding their product portfolios while new entrants focus on specialized cordless solutions and enhanced dust collection technology.

From 2030 to 2035, market dynamics shift toward advanced customization and multi-sector deployment, with growth accelerating from USD 1,002.9 million to USD 1,191.2 million, adding USD 188.3 million or 54% of total expansion. This phase transition logic centers on universal high-performance systems, integration with automated workshop equipment, and deployment across diverse application scenarios, becoming standard rather than specialized tool formats. The competitive environment matures with focus shifting from basic power ratings to comprehensive performance capabilities and compatibility with modern workshop operations.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 844.5 million |

| Market Forecast (2035) | USD 1,191.2 million |

| Growth Rate | 3.50% CAGR |

| Leading Type | Corded |

| Primary Application | Professional Workshop Segment |

The belt file sander market demonstrates strong fundamentals with corded systems capturing a dominant share through superior power characteristics and uninterrupted operation capabilities. Professional workshop applications drive primary demand, supported by increasing precision sanding requirements and enhanced productivity management solutions. Geographic expansion remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrialization projects and rising craftsman awareness activity.

The belt file sander market represents a compelling intersection of power tool innovation, motor technology advancement, and precision sanding optimization management. With robust growth projected from USD 844.5 million in 2025 to USD 1,191.2 million by 2035 at a 3.50% CAGR, this market is driven by increasing manufacturing expansion trends, professional workshop requirements, and craftsman demand for reliable precision tools.

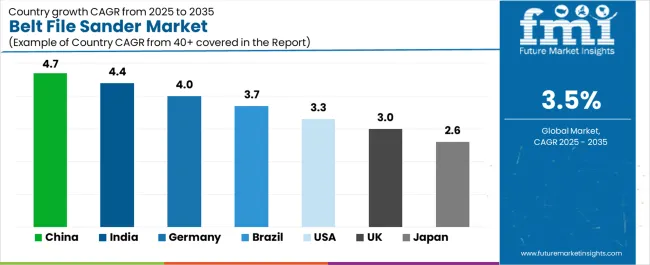

The belt file sander market's expansion reflects a fundamental shift in how professionals and DIY enthusiasts approach precision sanding infrastructure. Strong growth opportunities exist across diverse applications, from woodworking operations requiring fine finish control to metalworking facilities demanding heavy-duty solutions. Geographic expansion is particularly pronounced in Asia-Pacific markets, led by China (4.7% CAGR) and India (4.4% CAGR), while established markets in North America and Europe drive innovation and specialized segment development.

The dominance of corded systems and professional applications underscores the importance of proven power technology and operational reliability in driving adoption. Motor efficiency and dust management complexity remain key challenges, creating opportunities for companies that can deliver consistent performance while maintaining ergonomic design.

Market expansion rests on three fundamental shifts driving adoption across professional and consumer sectors. Manufacturing growth creates compelling advantages through belt file sander systems that provide comprehensive precision sanding with consistent surface finish quality, enabling workshops to achieve enhanced productivity and maintain professional standards while ensuring efficient material removal operations and justifying investment over basic sanding methods.

Professional workshop modernization accelerates as craftsmen worldwide seek reliable power tools that deliver operational precision directly to daily operations, enabling cost reduction that aligns with productivity expectations and maximizes sanding efficiency. Industrial automation increases drive adoption from manufacturing consumers requiring precise surface preparation tools that maximize material quality while maintaining consistent finish performance during production and assembly operations.

The growth faces headwinds from raw material price variations that differ across motor suppliers regarding cost stability and supply chain reliability, potentially limiting margin consistency in price-sensitive professional categories. Environmental compliance also persists regarding noise regulations and dust control requirements that may increase complexity standards in markets with demanding workplace safety protocols.

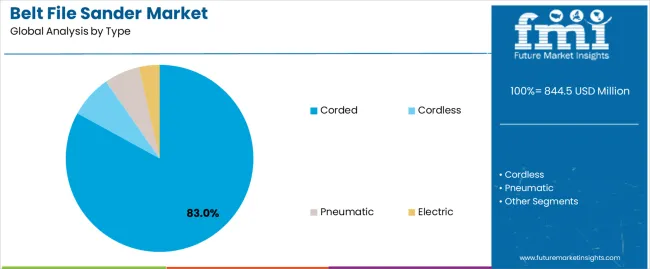

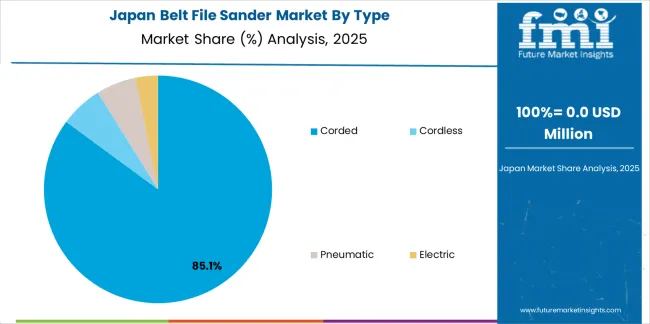

Primary Classification: The market segments by type into corded, cordless, pneumatic, and electric categories, representing the evolution from basic AC motors to advanced brushless formats for comprehensive precision sanding operations.

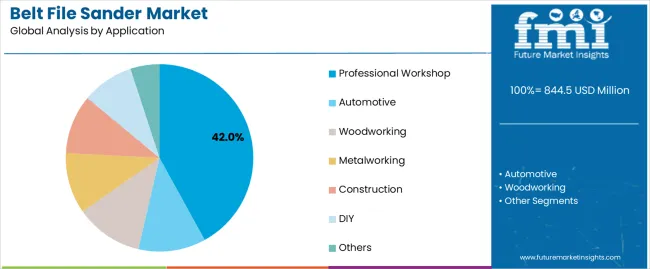

Secondary Breakdown: Application segmentation divides the belt file sander market into professional workshops, automotive, woodworking, metalworking, construction, and DIY sectors, reflecting distinct requirements for power characteristics, precision specifications, and durability performance.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with developed markets leading innovation while emerging economies show accelerating growth patterns driven by industrial development programs.

The segmentation structure reveals technology progression from standard corded tools toward integrated cordless platforms with enhanced battery and motor capabilities, while application diversity spans from professional operations to consumer markets requiring comprehensive precision sanding and surface finishing solutions.

Corded segment is estimated to account for 83% of the belt file sander market share in 2025. The segment's leading position stems from its fundamental role as a critical component in precision sanding applications and its extensive use across multiple professional and industrial sectors. Corded systems' dominance is attributed to their superior power-to-weight ratio, including excellent torque consistency, unlimited runtime capability, and balanced cost-effectiveness that make them indispensable for continuous workshop operations.

Market Position: Corded systems command the leading position in the belt file sander market through advanced motor technologies, including comprehensive speed control, uniform power delivery, and reliable performance characteristics that enable professionals to deploy precision tools across diverse work environments.

Value Drivers: The segment benefits from craftsman preference for proven power profiles that provide exceptional performance without requiring battery management costs. Efficient manufacturing processes enable deployment in workshop tools, industrial sanders, and professional applications where power reliability and operational continuity represent critical selection requirements.

Competitive Advantages: Corded systems differentiate through excellent power consistency, proven durability ratings, and compatibility with standard electrical infrastructure that enhance sanding capabilities while maintaining economical operational profiles suitable for diverse workshop applications.

Key market characteristics:

Professional workshop segment is projected to hold 42% of the belt file sander market share in 2025. The segment's market leadership is driven by the extensive use of belt file sanders in cabinetmaking, furniture manufacturing, automotive refinishing, and precision metalworking, where motor-driven tools serve as both a material removal solution and surface finishing system. The professional sector's consistent demand for reliable precision sanders supports the segment's dominant position.

Market Context: Professional workshop applications dominate the belt file sander market due to widespread adoption of precision sanding solutions and increasing focus on surface quality, productivity enhancement, and operational efficiency that enhance manufacturing output while maintaining professional standards.

Appeal Factors: Professional users prioritize consistent performance, durability ratings, and integration with existing dust collection systems that enable coordinated deployment across multiple sanding operations. The segment benefits from substantial manufacturing growth and workshop expansion that emphasize reliable precision tools for professional applications.

Growth Drivers: Manufacturing facilities incorporate belt file sanders as standard components for surface preparation and finishing operations. At the same time, productivity initiatives are increasing demand for premium features that comply with professional standards and enhance operational capabilities.

Market Challenges: Motor technology costs and specialized belt requirements may limit deployment flexibility in ultra-price-sensitive markets or workshops with varying precision requirements.

Application dynamics include:

Growth Accelerators: Manufacturing expansion drives primary adoption as belt file sander systems provide exceptional precision capabilities that enable surface finishing without material waste, supporting quality improvement and workshop efficiency that require reliable motor-driven tools. Professional growth accelerates market expansion as craftsmen seek advanced sanding solutions that maintain consistency during operation while enhancing productivity through standardized performance and operational advantages. Consumer awareness increases worldwide, creating sustained demand for precision sanding systems that complement workshop routines and provide operational advantages in surface preparation efficiency.

Growth Inhibitors: Motor technology costs differ across power tool markets regarding component pricing and manufacturing consistency, which may limit margin predictability and investment planning in price-sensitive professional categories with demanding affordability requirements. Regulatory complexity persists regarding noise standards and dust control compliance that may increase manufacturing costs in jurisdictions with strict workplace safety protocols. Market fragmentation across multiple power specifications and belt configurations creates compatibility concerns between different tool systems and existing workshop infrastructure.

Market Evolution Patterns: Adoption accelerates in professional and industrial sectors where precision benefits justify tool investments, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by manufacturing and workshop development. Technology advancement focuses on enhanced motor efficiency, improved dust collection integration, and compatibility with cordless platforms that optimize sanding performance and operational convenience. The belt file sander market could face disruption if alternative surface preparation methods or automated finishing systems significantly challenge traditional belt sander advantages in precision applications.

The belt file sander market demonstrates varied regional dynamics with growth leaders including China (4.7% CAGR) and India (4.4% CAGR) driving expansion through manufacturing growth and workshop modernization. Steady Performers encompass Germany (4.0% CAGR), Brazil (3.7% CAGR), USA (3.3% CAGR), UK (3.0% CAGR), and Japan (2.6% CAGR), benefiting from established manufacturing systems and professional tool adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| USA | 3.3% |

| UK | 3.0% |

| Japan | 2.6% |

Regional synthesis reveals Asia-Pacific markets leading growth through manufacturing expansion and workshop development, while European countries maintain steady expansion supported by specialized applications and precision manufacturing requirements. North American markets show moderate growth driven by professional demand and industrial facility upgrades.

China establishes regional leadership through rapid industrial development and comprehensive manufacturing modernization, integrating advanced belt file sander systems as standard components in furniture production, automotive manufacturing, and precision metalworking operations. The country's 4.7% CAGR through 2035 reflects manufacturing growth promoting industrial density and workshop infrastructure development that mandate the use of reliable precision tools in production operations. Growth concentrates in major industrial areas, including Guangdong, Jiangsu, and Zhejiang, where manufacturing networks showcase integrated belt sander systems that appeal to factory operators seeking enhanced productivity efficiency and international manufacturing standards.

Chinese manufacturers are developing innovative belt file sander solutions that combine local production advantages with international quality specifications, including variable speed control and advanced dust collection capabilities.

Strategic Market Indicators:

The Indian market emphasizes workshop applications, including rapid manufacturing development and comprehensive industrial expansion that increasingly incorporates belt file sanders for furniture production, automotive refinishing, and construction applications. The country is projected to show a 4.4% CAGR through 2035, driven by massive industrialization activity under manufacturing initiatives and professional demand for standardized, high-quality precision tools. Indian manufacturing facilities prioritize cost-effectiveness with belt sanders delivering operational efficiency through economical tool usage and reliable performance capabilities.

Technology deployment channels include major manufacturers, workshop operators, and construction companies that support high-volume usage for domestic and commercial applications.

Performance Metrics:

The German market emphasizes advanced belt sander features, including innovative motor technologies and integration with comprehensive workshop platforms that manage furniture manufacturing, automotive operations, and precision applications through unified tool systems. The country is projected to show a 4.0% CAGR through 2035, driven by manufacturing expansion under Industry 4.0 trends and professional demand for premium, reliable precision tools. German workshops prioritize efficiency with belt sanders delivering comprehensive surface preparation through enhanced dust collection and operational innovation.

Technology deployment channels include major tool manufacturers, professional workshops, and industrial facilities that support custom development for premium operations.

Performance Metrics:

In São Paulo, Rio de Janeiro, and Belo Horizonte, Brazilian manufacturing facilities and workshop operators are implementing advanced belt file sander systems to enhance production capabilities and support operational efficiency that aligns with industrial protocols and quality standards. The Brazilian market demonstrates sustained growth with a 3.7% CAGR through 2035, driven by manufacturing development programs and industrial investments that emphasize reliable precision tools for furniture and automotive applications. Brazilian facilities are prioritizing belt sander systems that provide exceptional surface quality while maintaining compliance with production standards and minimizing operational complexity, particularly important in manufacturing operations and professional workshop applications.

Market expansion benefits from industrial programs that mandate enhanced precision in manufacturing specifications, creating sustained demand across Brazil's manufacturing and workshop sectors, where productivity improvement and surface quality represent critical requirements.

Strategic Market Indicators:

The USA market emphasizes advanced belt sander features, including innovative cordless technologies and integration with comprehensive workshop platforms that manage professional operations, construction applications, and manufacturing through unified precision systems. The country is projected to show a 3.3% CAGR through 2035, driven by professional expansion under productivity trends and contractor demand for premium, reliable precision tools. American workshops prioritize versatility with belt sanders delivering comprehensive surface preparation through enhanced portability and operational innovation.

Technology deployment channels include major retailers, professional contractors, and manufacturing facilities that support custom development for demanding applications.

Performance Metrics:

The UK market demonstrates meticulous belt sander deployment, growing at 3.0% CAGR, with documented operational excellence in furniture manufacturing and construction applications through integration with existing workshop systems and quality assurance infrastructure. The country leverages engineering expertise in motor technology and precision manufacturing to maintain market competitiveness. Manufacturing centers, including the West Midlands, Yorkshire, and Scotland, showcase advanced installations where belt sander systems integrate with comprehensive production platforms and quality systems to optimize surface preparation and operational efficiency.

British manufacturing facilities prioritize precision control and operational consistency in tool selection, creating demand for premium belt sander systems with advanced features, including variable speed control and integration with dust collection protocols. The belt file sander market benefits from established manufacturing infrastructure and willingness to invest in specialized motor technologies that provide superior performance and regulatory compliance.

Market Intelligence Brief:

Japan's sophisticated manufacturing market demonstrates meticulous belt sander deployment, growing at 2.6% CAGR, with documented operational excellence in precision manufacturing and automotive applications through integration with existing production systems and quality control infrastructure. The country leverages engineering expertise in motor manufacturing and precision tools to maintain market leadership. Manufacturing centers, including Tokyo, Osaka, and Nagoya, showcase advanced installations where belt sander systems integrate with comprehensive automation platforms and quality systems to optimize surface preparation and operational efficiency.

Japanese manufacturing facilities prioritize precision accuracy and material consistency in tool selection, creating demand for premium belt sander systems with advanced features, including micro-speed adjustment and integration with automated production protocols. The market benefits from established manufacturing infrastructure and willingness to invest in specialized precision technologies that provide superior surface quality and regulatory compliance.

Market Intelligence Brief:

The belt file sander market in Europe is projected to grow from USD 295.4 million in 2025 to USD 412.8 million by 2035, registering a CAGR of 3.4% over the forecast period. Germany is expected to maintain its leadership position with a 38.2% market share in 2025, increasing slightly to 38.7% by 2035, supported by its manufacturing excellence and major industrial centers, including Baden-Württemberg and North Rhine-Westphalia.

France follows with a 21.5% share in 2025, projected to reach 21.8% by 2035, driven by comprehensive manufacturing programs and professional workshop initiatives. The United Kingdom holds a 17.3% share in 2025, expected to maintain 17.5% by 2035 through established industrial sectors and construction adoption. Italy commands a 13.2% share, while Spain accounts for 8.1% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 1.7% to 2.2% by 2035, attributed to increasing industrial development in Eastern European countries and emerging manufacturing programs implementing precision tool systems.

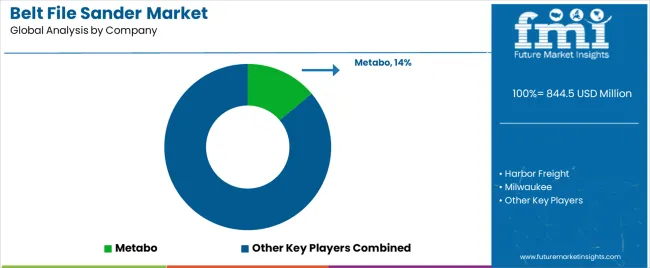

The belt file sander market operates with moderate concentration, featuring approximately 20-28 participants, where leading companies control roughly 45-52% of the global market share through established distribution networks and comprehensive product portfolio capabilities. Competition emphasizes motor performance, manufacturing quality, and operational efficiency rather than premium feature rivalry.

Market leaders encompass Metabo, Harbor Freight, and Milwaukee, which maintain competitive advantages through extensive power tool manufacturing expertise, global distribution networks, and comprehensive technical support capabilities that create retailer loyalty and support professional requirements. These companies leverage decades of motor technology experience and ongoing engineering investments to develop advanced belt file sander systems with exceptional precision and durability features.

Specialty challengers include DeWalt, Hilti, and Einhell, which compete through specialized application innovation focus and efficient manufacturing solutions that appeal to professional buyers seeking reliable performance formats and custom specification flexibility. These companies differentiate through operational excellence emphasis and specialized market focus.

Market dynamics favor participants that combine consistent motor performance with advanced manufacturing support, including automated production and distribution capabilities. Competitive pressure intensifies as traditional power tool manufacturers expand into precision sanding systems. At the same time, specialized tool converters challenge established players through innovative motor formulations and cost-effective production targeting emerging professional segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 844.5 million |

| Type | Corded, Cordless, Pneumatic, Electric |

| Application | Professional Workshop, Automotive, Woodworking, Metalworking, Construction, DIY, Others |

| Distribution Channel | Online Sales, Offline Sales |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 25+ additional countries |

| Key Companies Profiled | Metabo, Harbor Freight, Milwaukee, DeWalt, Hilti, Einhell |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with power tool manufacturers and precision equipment converters, professional preferences for motor characteristics and operational performance, integration with dust collection equipment and workshop systems, innovations in motor technology and cordless systems, and development of specialized precision solutions with enhanced speed control and ergonomic features |

The global belt file sander market is estimated to be valued at USD 844.5 million in 2025.

The market size for the belt file sander market is projected to reach USD 1,191.2 million by 2035.

The belt file sander market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in belt file sander market are corded, cordless, pneumatic and electric.

In terms of application, professional workshop segment to command 42.0% share in the belt file sander market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Belt Feeders Market Size and Share Forecast Outlook 2025 to 2035

Cross-Belt Sorters Market

Chamber Belt Vacuum Machine Market Analysis Size and Share Forecast Outlook 2025 to 2035

Packing Belt Market Insights - Growth & Forecast 2025 to 2035

Modular Belt Drive Market

Conveyor Belt Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Belt Materials Market

Ammunition Belt Market Size and Share Forecast Outlook 2025 to 2035

Automotive Belts Market Growth - Trends & Forecast 2025 to 2035

Industrial V Belts Market Growth - Trends & Forecast 2025 to 2035

Conveyors and Belt Loaders Market Growth - Trends & Forecast 2025 to 2035

Automotive Seat Belts Market Size and Share Forecast Outlook 2025 to 2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Automotive Timing Belt Market

Demand for Conveyor Belts in EU Size and Share Forecast Outlook 2025 to 2035

Respiration Monitor Belt Market Size and Share Forecast Outlook 2025 to 2035

Middle East Conveyor Belts Market - Growth & Demand 2025 to 2035

Seating And Positioning Belts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Timing Chain & Belt Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA