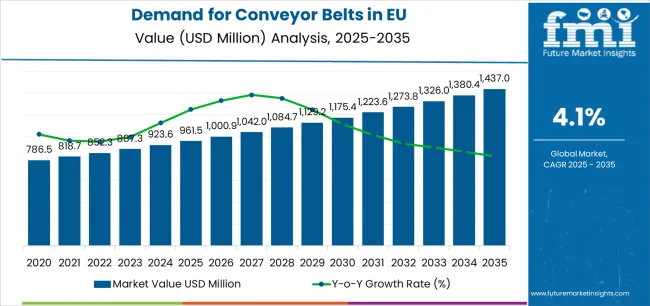

The EU conveyor belts industry stood at USD 961.5 million in 2025 and is forecast to reach USD 1,437 million by 2035, reflecting a CAGR of 4.1 percent across the decade. Historical growth during 2020 to 2024 was relatively muted, as demand was shaped more by replacement cycles and compliance requirements than by large scale new installations. Activity in food processing, automotive, mining, and logistics held steady, but volatility in raw material costs for rubber and steel cord weighed on margins. Maintenance-driven procurement sustained turnover, and vendors with responsive service networks captured share. E-commerce fulfillment centers created consistent demand for light and medium-duty belts, while cement and aggregates sustained bulk handling volumes. As per the analysis, this meant that although overall growth was incremental, aftermarket revenues, certification requirements for food-grade compounds, and safety-driven specifications helped suppliers maintain stability.

During the forecast period, the industry expansion at 4.1% CAGR is underpinned by stronger adoption of belts across warehousing, parcel handling, packaged food, beverage, and pharmaceutical processing. Unit volumes are expected to grow in modular plastic belts, sorter belts, and narrow belt formats, while upgraded materials with low elongation and high hygiene standards lift average selling prices. Bulk handling applications across biomass, recycling, and construction minerals will contribute steady revenue, supported by higher tensile class belts and long center distance projects. The growing importance of energy efficiency, uptime reliability, and reduced carryback will steer buyers toward suppliers offering condition monitoring, engineered compounds, and cleaner systems. Competitive differentiation will center on material science, in-house fabrication depth, and dense regional service coverage across major EU industrial hubs. Risks remain in cyclical sectors such as construction and heavy industry, where capex delays may dampen belt orders, and regulatory shifts could influence material selection. Even with such headwinds, conveyor belts remain essential for material handling across industries, ensuring measured but consistent revenue growth over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 961.5 million |

| Forecast Value in (2035F) | USD 1437 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

Between 2025 and 2030, EU conveyor belts demand is projected to expand from USD 961.5 million to USD 1,175.4 million, resulting in a value increase of USD 213.9 million, which represents 45.4% of the total forecast growth for the decade. This phase of development will be shaped by accelerating e-commerce fulfillment center expansion, ongoing industrial automation adoption reducing manual material handling, and growing food and beverage sector investment in automated processing and packaging lines. Manufacturers are adapting their product portfolios to address evolving requirements for improved energy efficiency characteristics, enhanced hygiene standards for food-contact applications, and specialized designs suitable for high-speed sortation systems, automated warehouse operations, and cleanroom manufacturing environments.

From 2030 to 2035, sales are forecast to grow from USD 1,175.4 million to USD 1437 million, adding another USD 257.3 million, which constitutes 54.6% of the overall ten-year expansion. This period is expected to be characterized by continued integration of smart conveyor systems featuring sensor technology and predictive maintenance capabilities, expansion of lightweight polymer-based conveyor solutions offering energy savings, and sustained demand from retail distribution networks requiring high-throughput material handling systems. The growing emphasis on sustainability and increasing requirements for energy-efficient material handling equipment will drive demand for conveyor belt products that deliver reliable performance across demanding warehouse logistics, food processing operations, and automotive assembly applications while minimizing operational costs and environmental impact.

Between 2020 and 2025, EU conveyor belts sales experienced steady expansion at a CAGR of 3.5%, growing from USD 809.5 million to USD 961.5 million. This period was driven by resilient demand from industrial manufacturing requiring material handling automation, expanding e-commerce logistics infrastructure supporting online retail growth, and ongoing food and beverage sector investment in processing automation. The industry developed as European manufacturers and logistics operators recognized conveyor automation as essential for labor cost reduction, throughput optimization, and operational efficiency improvement, driving consistent investment in material handling infrastructure across manufacturing, warehousing, and distribution facilities.

Industry expansion is being supported by the accelerating adoption of warehouse automation and logistics optimization across European distribution networks and the corresponding demand for reliable, high-performance conveyor systems with proven capabilities in demanding material handling applications. Modern warehouse operators and logistics providers rely on conveyor belts as essential material handling infrastructure for order fulfillment automation, package sortation systems, and goods-to-person picking operations, driving demand for equipment that consistently delivers required throughput capacity, reliability specifications, and integration capabilities necessary for automated logistics operations and supply chain efficiency. Even modest performance variations in conveyor systems, including belt tracking accuracy, drive component reliability, or control system responsiveness, can significantly impact operational efficiency and labor productivity across critical distribution and manufacturing facilities.

The growing requirements for food safety compliance and increasing recognition of hygienic conveyor designs for food processing applications are driving demand from food manufacturers with appropriate safety certifications and validated cleaning protocols. Regulatory authorities are increasingly establishing clear guidelines for food-contact conveyor materials, hygiene design requirements, and cleaning validation protocols to maintain food safety and ensure contamination prevention. Technical research and operational validation studies are providing evidence supporting advanced conveyor technologies including modular plastic belts, stainless steel construction, and antimicrobial surface treatments, requiring specialized design approaches and standardized maintenance protocols for optimal food safety performance, appropriate cleaning accessibility, and consistent sanitary operation supporting regulatory compliance across food and beverage processing facilities.

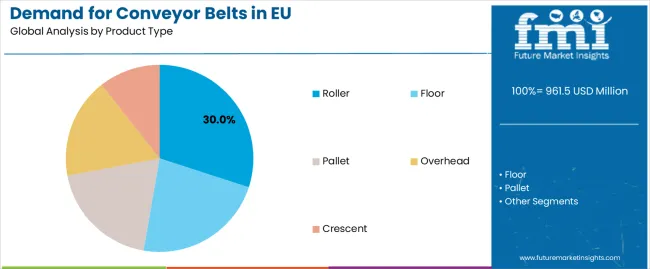

Sales are segmented by product type, application (end user), distribution channel, nature, belt type, material, installation, and country. By product type, demand is divided into roller, floor, pallet, overhead, and crescent conveyors. Based on application (end user), sales are categorized into industrial, food and beverage, retail, automotive, airport, and poultry and dairy sectors. In terms of distribution channel, demand is segmented into direct to industrial (bulk/projects), distributors/integrators, and online/indirect channels. By nature, sales are classified into bulk commodity, processed value-added, and specialty high-performance. By belt type, demand is divided into lightweight, medium-weight, and heavy-weight categories. By material, sales are segmented into polymers and metals. By installation, demand is classified into stationary and portable systems. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The roller conveyor segment is projected to account for 30% of EU conveyor belts sales in 2025, declining slightly to 28% by 2035, establishing itself as the dominant product type across European industries. This commanding position is fundamentally supported by roller conveyor's versatility across diverse material handling applications, cost-effective construction compared to powered belt systems for gravity-fed operations, and widespread suitability for package handling, pallet movement, and carton accumulation in distribution centers and manufacturing facilities. The roller conveyor format delivers exceptional adaptability, providing warehouse operators and manufacturers with reliable material handling infrastructure that facilitates goods movement through gravity-fed sections, manual handling zones, and powered conveyor integration points.

This segment benefits from established manufacturing infrastructure, straightforward installation procedures requiring minimal facility modifications, and extensive availability from numerous European conveyor manufacturers offering standard roller configurations and customized solutions. Additionally, roller conveyors offer operational advantages through minimal maintenance requirements compared to belt-driven systems, modular construction enabling easy expansion and reconfiguration, and flexible integration with automated sortation equipment and picking systems.

The roller conveyor segment is expected to decline slightly to 28% share by 2035, demonstrating modest erosion as powered belt systems, including floor conveyors and overhead systems, capture incrementally larger shares through applications requiring automated transportation and precise product positioning throughout the forecast period.

.webp)

Industrial end-user applications are positioned to represent 25% of total conveyor belts demand across European industries in 2025, declining slightly to 24% by 2035, reflecting the segment's established position as the primary application sector within the overall industry ecosystem. This substantial share directly demonstrates that general industrial manufacturing represents the largest single end-use category, with automotive parts manufacturers, machinery producers, electronics assembly facilities, and general manufacturing operations utilizing conveyor systems for production line material handling, work-in-process movement, and finished goods transfer essential for automated manufacturing operations.

Modern industrial operations increasingly rely on conveyor systems delivering precise product positioning, controlled accumulation zones preventing production line disruptions, and appropriate load-bearing capacity ensuring reliable handling of manufactured components and assemblies. The segment benefits from continuous automation expansion focused on reducing manual material handling labor, improving production line efficiency through automated work-in-process flow, and enabling flexible manufacturing systems supporting diverse product configurations and changeover requirements.

The segment's slight share decline reflects proportional growth across diversifying end uses, with industrial applications maintaining their leading position while food and beverage processing and retail distribution sectors expand their relative contributions throughout the forecast period.

EU conveyor belts sales are advancing steadily due to sustained industrial automation adoption, expanding e-commerce logistics infrastructure requiring high-throughput distribution systems, and growing food and beverage sector investment in automated processing lines. However, the industry faces challenges, including sensitivity to industrial capital expenditure cycles affecting equipment procurement timing, potential demand moderation as e-commerce warehouse capacity expansion normalizes following rapid pandemic-era growth, and raw material cost volatility affecting steel and polymer input pricing. Continued focus on energy efficiency improvements, smart system integration, and hygienic design optimization remains central to industry development.

The rapidly accelerating e-commerce sector growth is fundamentally transforming warehouse and logistics operations from manual order picking to automated fulfillment systems featuring sophisticated conveyor networks, high-speed sortation equipment, and goods-to-person picking stations supporting rapid order processing and same-day delivery capabilities. Advanced fulfillment center designs featuring multi-level conveyor systems, automated storage and retrieval integration, and robotic picking stations enable e-commerce operators to process thousands of orders hourly while minimizing labor requirements and maximizing facility space utilization. These automation investments prove particularly transformative for major e-commerce platforms, third-party logistics providers, and omnichannel retailers, where fulfillment speed and accuracy directly determine customer satisfaction and competitive positioning in online retail industries.

Modern conveyor installations systematically incorporate sensor technologies, Internet of Things connectivity, and predictive maintenance capabilities enabling real-time system monitoring, performance optimization, and proactive maintenance scheduling minimizing unplanned downtime. Strategic integration of smart technologies, including vibration sensors detecting bearing wear, thermal monitoring identifying motor overheating, and belt tracking sensors preventing mistracking failures, enables operators to transition from reactive maintenance responding to failures toward predictive approaches preventing breakdowns and optimizing maintenance timing. These technological advances prove essential for high-utilization operations including 24/7 distribution centers, continuous process manufacturing, and critical logistics hubs, where unexpected conveyor failures cause significant operational disruptions and revenue losses.

European food processing operations increasingly prioritize conveyor systems featuring hygienic design principles, including smooth surfaces preventing bacterial harboring, open frame construction enabling cleaning accessibility, and food-grade materials meeting regulatory requirements for direct food contact applications. This hygiene focus enables conveyor manufacturers to differentiate premium offerings through modular plastic belt designs facilitating thorough cleaning, stainless steel construction preventing corrosion and contamination, and validated cleaning protocols supporting food safety audit requirements. Hygienic design proves particularly important for meat and poultry processing, dairy production, and ready-to-eat food manufacturing where conveyor contamination presents significant food safety risks and regulatory compliance challenges.

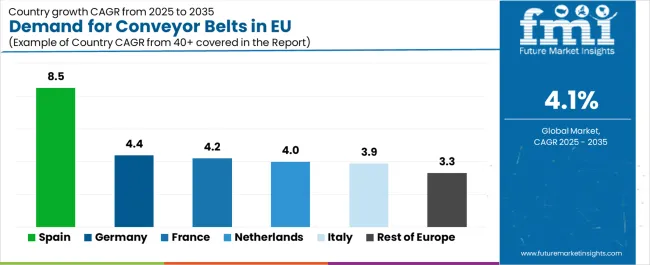

| Country | CAGR % |

|---|---|

| Spain | 8.5% |

| Germany | 4.4% |

| France | 4.2% |

| Netherlands | 4.0% |

| Italy | 3.9% |

| Rest of Europe | 3.3% |

EU conveyor belts sales demonstrate varied growth across major European economies, with Spain leading expansion at 8.5% CAGR through 2035, driven by rapidly expanding logistics infrastructure and e-commerce distribution capacity development. Germany maintains strong positioning through substantial manufacturing base and advanced automation adoption. France benefits from warehouse modernization initiatives and food industry automation. Netherlands leverages logistics hub positioning and concentrated distribution center operations. Italy maintains consistent growth through manufacturing automation and food processing sector investment. The Rest of Europe demonstrates modest expansion reflecting mature industry characteristics. Overall, sales show stable regional development reflecting sustained automation adoption and ongoing logistics infrastructure investment across EU economies.

Revenue from conveyor belts in Spain is projected to exhibit exceptional growth with a CAGR of 8.5% through 2035, driven by rapidly expanding e-commerce logistics infrastructure, substantial distribution center development serving European industries, and increasing food processing automation supporting agricultural product exports. Spain's strategic geographic positioning and growing logistics sector prominence are creating sustained demand for conveyor systems across warehouse distribution, food processing, and manufacturing applications.

Major logistics operators, e-commerce companies establishing Spanish fulfillment centers, food processors, and manufacturing facilities systematically invest in conveyor automation supporting operational efficiency and capacity expansion. Spanish demand benefits from substantial e-commerce growth driving fulfillment center construction, logistics real estate development concentrated in strategic regions near major population centers and transportation corridors, and food industry modernization supporting export competitiveness.

Revenue from conveyor belts in Germany is expanding at a CAGR of 4.4%, substantially supported by Europe's most substantial manufacturing base, advanced industrial automation adoption across automotive and machinery production, and sophisticated intralogistics infrastructure serving diverse industries. Germany's internationally recognized manufacturing excellence and industrial automation leadership are systematically driving stable demand for conveyor systems across manufacturing, warehouse, and logistics applications.

Major automotive manufacturers, machinery producers, food processing companies, and logistics operators source conveyor systems from domestic manufacturers and European suppliers ensuring technology leadership and engineering excellence. German demand particularly benefits from automotive industry automation requiring sophisticated assembly line conveyors, food industry investment in automated processing lines, and advanced warehouse operations serving manufacturing supply chains and distribution networks.

Revenue from conveyor belts in France is growing at a CAGR of 4.2%, fundamentally driven by warehouse modernization initiatives, food and beverage industry automation investments, and retail distribution network optimization supporting omnichannel commerce strategies. France's diversified industrial structure and ongoing logistics infrastructure development are supporting sustained conveyor demand across multiple application sectors.

Major retailers, food processors, logistics operators, and manufacturing facilities source conveyor systems from European suppliers and system integrators ensuring operational optimization and technology integration. French sales particularly benefit from retail sector investment in automated distribution centers supporting e-commerce growth, food industry modernization improving processing efficiency and food safety compliance, and logistics network optimization serving domestic and European industries.

Demand for conveyor belts in the Netherlands is expanding at a CAGR of 4.0%, fundamentally driven by concentrated logistics operations serving European distribution, major port facilities requiring cargo handling infrastructure, and food processing sector prominence including horticultural products and dairy processing. Dutch logistics sector specialization and strategic European positioning are creating focused demand for conveyor systems supporting warehouse operations and material handling applications.

Netherlands demand significantly benefits from concentrated distribution center operations serving European industries from strategic Dutch locations, major port facilities including Rotterdam requiring cargo handling and warehouse conveyors, and substantial food processing sector utilizing automated production lines. The country's logistics infrastructure concentration creates substantial conveyor demand supporting warehouse operations, parcel sortation facilities, and airport cargo handling systems.

Revenue from conveyor belts in Italy is growing at a steady CAGR of 3.9%, fundamentally driven by manufacturing sector automation, substantial food processing industry requiring automated production lines, and automotive component production supporting assembly operations. Italy's diversified manufacturing base and prominent food industry are supporting sustained conveyor demand across industrial and food processing applications.

Major manufacturing facilities, food processors concentrated in Italian production regions, automotive component suppliers, and packaging operations source conveyor systems from European suppliers ensuring technology integration and operational efficiency. Italian sales particularly benefit from food industry automation supporting quality improvement and export competitiveness, manufacturing sector adoption of automated material handling, and logistics operations serving domestic and international industries.

Revenue from conveyor belts in the Rest of Europe region is expanding at a CAGR of 3.3%, reflecting mature industry characteristics across smaller European economies with established manufacturing sectors and ongoing replacement demand supporting steady equipment sales. Regional industrial activity and logistics operations are maintaining consistent conveyor demand across diverse applications.

Industrial consumers across Rest of Europe industries, including manufacturers, food processors, logistics operators, and airport authorities, source conveyor systems from European suppliers ensuring equipment availability and technical support. Rest of Europe demand reflects steady replacement cycles for aging equipment, modest capacity expansion supporting industrial growth, and logistics infrastructure maintenance supporting operational requirements across mature European industries.

EU conveyor belts sales are projected to grow from USD 961.5 million in 2025 to USD 1437 million by 2035, registering a CAGR of 4.1% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 8.5% CAGR, supported by expanding logistics infrastructure, growing e-commerce distribution capacity, and increasing food processing automation. Germany follows with a 4.4% CAGR, attributed to substantial manufacturing base and advanced industrial automation adoption.

France demonstrates 4.2% CAGR, reflecting steady warehouse modernization and food industry investment. Netherlands shows 4.0% CAGR, supported by logistics hub positioning and distribution center concentration. Italy exhibits 3.9% CAGR, driven by manufacturing sector automation and food processing operations. The Rest of Europe demonstrates 3.3% CAGR, reflecting mature industry characteristics across smaller European economies.

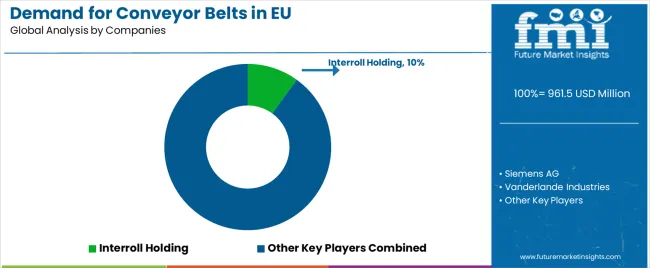

EU conveyor belts sales are defined by competition among specialized material handling equipment manufacturers, automation system integrators, and regional conveyor suppliers serving diverse industrial applications. Companies are investing in product innovation improving energy efficiency and reliability, smart technology integration enabling predictive maintenance, hygienic design development addressing food processing requirements, and engineering services to deliver high-performance, application-optimized, and cost-effective conveyor solutions.

Major participants include Interroll Holding with an estimated 10% share, leveraging its specialized roller conveyor technology, comprehensive intralogistics product portfolio, and established European presence serving warehouse and distribution applications. Interroll benefits from innovative roller drive technology enabling energy-efficient powered conveyors, modular product designs supporting flexible system configurations, and technical expertise addressing complex material handling requirements across e-commerce, retail, and manufacturing sectors.

Siemens AG holds approximately 9.0% share, emphasizing its automation technology integration, drive systems and control platforms powering conveyor installations, and system integrator partnerships delivering comprehensive material handling solutions. Siemens' success in providing integrated automation platforms combining conveyor drives, control systems, and warehouse management software creates competitive positioning, supported by industrial automation expertise and comprehensive product portfolio.

Vanderlande Industries accounts for roughly 8.0% share through its position as a leading airport baggage handling and parcel sortation system provider, offering integrated conveyor solutions for high-throughput automated facilities. The company benefits from airport infrastructure specialization, comprehensive system integration capabilities, and established relationships with airport authorities and logistics operators requiring sophisticated automated material handling systems.

TGW Logistics Group represents approximately 7.0% share, supporting growth through e-commerce fulfillment system specialization, comprehensive warehouse automation solutions, and integrated conveyor systems supporting automated storage and picking operations. TGW leverages e-commerce sector expertise, system integration capabilities delivering turnkey fulfillment centers, and technology innovation supporting high-performance order processing operations.

Fives accounts for approximately 5.0% share through parcel sortation technology, airport cargo handling solutions, and automated conveyor systems serving logistics operations. Fives benefits from sortation technology expertise, comprehensive engineering capabilities, and established presence in airport and logistics applications requiring high-speed automated material handling systems. Other companies and regional suppliers collectively hold 61.0% share, reflecting the moderately fragmented nature of European conveyor belts sales.

| Item | Value |

|---|---|

| Quantitative Units | USD 1437 million |

| Product Type | Roller, Floor, Pallet, Overhead, Crescent |

| Application (End User) | Industrial, Food & Beverage, Retail, Automotive, Airport, Poultry &Dairy |

| Distribution Channel | Direct to Industrial (Bulk/Projects), Distributors/Integrators, Online/Indirect |

| Nature | Bulk Commodity, Processed Value-Added, Specialty High-Performance |

| Belt Type | Lightweight, Medium-Weight, Heavy-Weight |

| Material | Polymers, Metals |

| Installation | Stationary, Portable |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Interroll Holding, Siemens AG, Vanderlande Industries, TGW Logistics Group, Fives, Regional manufacturers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type, application (end user), distribution channel, nature, belt type, material, and installation; regional demand trends across major European industries; competitive landscape analysis with established material handling equipment manufacturers and system integrators; industrial consumer preferences for various conveyor configurations and performance characteristics; integration with warehouse automation systems, manufacturing production lines, and logistics operations; innovations in energy efficiency, smart technology integration, and hygienic design; adoption across direct project procurement and system integrator channels. |

The global demand for conveyor belts in eu is estimated to be valued at USD 961.5 million in 2025.

The market size for the demand for conveyor belts in eu is projected to reach USD 1,437.0 million by 2035.

The demand for conveyor belts in eu is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for conveyor belts in eu are roller, floor, pallet, overhead and crescent.

In terms of application (end user), industrial segment to command 25.0% share in the demand for conveyor belts in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle East Conveyor Belts Market - Growth & Demand 2025 to 2035

Conveyor Belt Tracking Devices Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Conveyor Belt Market Size and Share Forecast Outlook 2025 to 2035

Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA