The eucommia leaf extract market is expected to see steady growth over the next decade, with the market value rising from USD 160.5 million in 2025 to USD 359.7 million in 2035, reflecting a compound annual growth rate (CAGR) of 8.4%. This growth trajectory is characterized by incremental annual increases in market value, signaling consistent demand. The YoY growth rates, calculated based on the projected values, show a consistent acceleration, particularly in the earlier years of the forecast period.

For instance, from 2025 to 2026, the market value grows by approximately 8.4%, and similar increases are expected in the following years. This reflects a stable market expansion driven by the increasing demand for natural health supplements, functional foods, and traditional herbal remedies.

As the years progress, the rate of growth slightly decelerates but remains robust, reflecting a well-established market trend. This deceleration in growth rate after initial spikes can be attributed to market saturation and the maturation of consumer awareness about Eucommia leaf extract benefits. However, with expanding applications across various industries such as personal care, pharmaceuticals, and functional food, the market will maintain a healthy growth rate.

This long-term growth will continue to be driven by rising interest in natural ingredients, increasing research into their health benefits, and a growing consumer preference for alternative medicinal products. The market's resilience is evident, even as it faces minor fluctuations in growth patterns, highlighting the increasing acceptance and demand for Eucommia leaf extract in various sectors.

| Eucommia Leaf Extract Market | Value |

|---|---|

| Market Value (2025) | USD 160.5 million |

| Market Forecast Value (2035) | USD 359.7 million |

| Market Forecast CAGR | 8.4% |

The eucommia leaf extract market commands a relevant share within the herbal extracts market, contributing about 6% of the overall share, as it is increasingly sought after for its health benefits. In the dietary supplements market, the share is approximately 8%, reflecting its use in promoting joint health and overall wellness. Within the functional foods market, the market share stands at around 5%, as Eucommia leaf extract is integrated into foods targeting specific health benefits. The natural health products market sees about 7%, as consumer preference for plant-based solutions is fueling demand for Eucommia-based products. In the phytochemicals market, it holds roughly 4%, driven by the extract’s bioactive compounds that have medicinal properties.

Market expansion is being supported by the rapid increase in consumer demand for natural health products worldwide and the corresponding need for standardized botanical extracts that provide documented health benefits and superior antioxidant properties in modern nutraceutical and functional food formulations. Modern supplement manufacturers rely on eucommia leaf extracts to deliver consistent bioactive compound concentrations and comprehensive quality assurance including dietary supplements, functional beverages, and cosmetic formulations. Even minor standardization inconsistencies can require comprehensive formulation adjustments to maintain optimal product efficacy and regulatory compliance.

The growing complexity of nutraceutical formulation requirements and increasing demand for evidence-based botanical ingredients are driving demand for eucommia leaf extracts from certified extract manufacturers with appropriate standardization capabilities and phytochemical expertise. Supplement companies and functional food manufacturers are increasingly requiring documented chlorogenic acid content and bioactivity validation to maintain product quality and marketing claim substantiation. Industry specifications and regulatory standards are establishing standardized extract procedures that require specialized extraction technologies and trained phytochemical analysts.

The Eucommia Leaf Extract market is entering a new phase of robust growth, driven by demand for natural antioxidants, functional ingredients, and evolving nutraceutical standards. By 2035, these pathways together can unlock USD 75-95 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Health Products Excellence (Nutraceutical Applications) The health products segment already holds the largest share due to proven antioxidant and metabolic benefits. Expanding clinical research, evidence-based formulations, and personalized nutrition applications can consolidate leadership. Opportunity pool: USD 25-32 million.

Pathway B -- Premium Standardization Leadership (High-Purity Extracts) High standardization levels offer superior bioactivity and premium positioning. Enhanced 25% and 98% chlorogenic acid extracts with validated bioavailability create substantial growth opportunities. Opportunity pool: USD 18-25 million.

Pathway C -- Functional Foods Integration (Food & Beverage Applications) Functional foods represent growing demand for natural antioxidants in everyday products. Enhanced extract solutions for beverages, dairy, and bakery applications offer substantial potential. Opportunity pool: USD 12-18 million.

Pathway D -- Cosmetic Applications Expansion (Anti-Aging Products) Cosmetic applications require natural antioxidants for anti-aging and skin health. Specialized extracts for topical applications and cosmeceuticals create premium market segments. Opportunity pool: USD 10-15 million.

Pathway E -- Bioavailability Enhancement Innovation (Advanced Formulations) Enhanced bioavailability technologies improve efficacy and enable premium positioning. Advanced delivery systems and nano-formulations offer substantial value creation opportunities. Opportunity pool: USD 8-12 million.

Pathway F -- Animal Nutrition Applications (Feed Additives) Animal feed applications require natural antioxidants for livestock health. Enhanced extract solutions for poultry, swine, and aquaculture create growing market opportunities. Opportunity pool: USD 6-9 million.

Pathway G -- Emerging Market Penetration (Global Health Awareness) Developing countries are expanding natural health product adoption. Cost-effective extract solutions for emerging markets create volume growth opportunities. Opportunity pool: USD 4-6 million.

Pathway H -- Sustainable Sourcing and Certification Sustainability certifications and ethical sourcing create premium positioning. Organic, fair-trade, and sustainably sourced extracts offer advanced market differentiation. Opportunity pool: USD 3-5 million.

The market is segmented by purity level, application, and region. By purity level, the market is divided into 5% chlorogenic acid, 25% chlorogenic acid, 98% chlorogenic acid, and others. Based on application, the market is categorized into health products, functional foods, cosmetics, animal feed, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

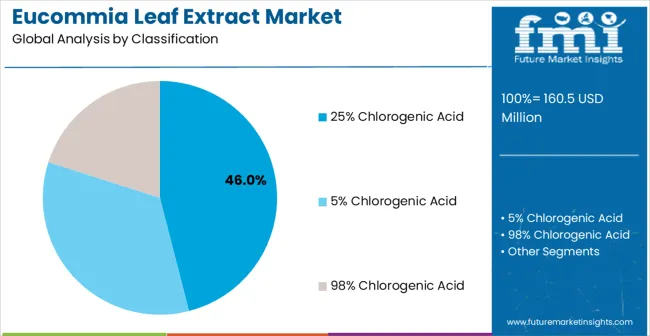

In 2025, the 25% chlorogenic acid eucommia leaf extract segment is projected to capture around 46% of the total market share, making it the leading purity category. This dominance is largely driven by the widespread adoption of standardized extract concentrations that provide optimal balance between bioactivity and cost-effectiveness, catering to a wide variety of nutraceutical and functional food applications with diverse formulation requirements. 25% chlorogenic acid extract technology is particularly favored for its ability to deliver significant antioxidant benefits while maintaining reasonable production costs and formulation compatibility. Supplement manufacturers, functional food producers, cosmetic companies, and nutraceutical formulators increasingly prefer this standardization level, as it meets efficacy requirements without imposing excessive raw material costs or complex processing procedures.

The availability of well-established extraction protocols, along with comprehensive analytical methods and technical documentation from leading botanical extract manufacturers, further reinforces the segment's market position. Additionally, this purity category benefits from consistent demand across regions, as it is considered a practical high-performance solution for manufacturers requiring proven bioactivity with commercial viability. The combination of proven efficacy, cost optimization, and formulation flexibility makes 25% chlorogenic acid eucommia leaf extracts a preferred choice, ensuring their continued popularity in the botanical extract market.

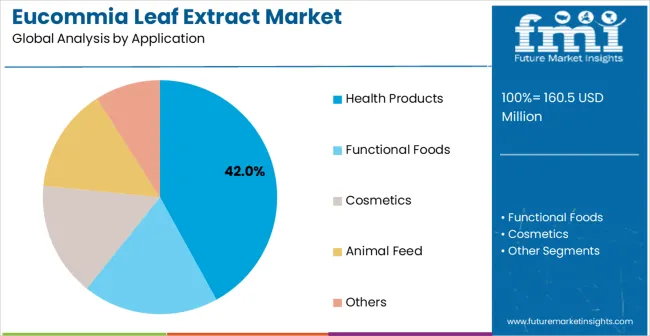

The health products segment is expected to represent 42% of eucommia leaf extract demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of the nutraceutical industry, where natural antioxidant ingredients and proven health benefits are critical to product differentiation and consumer acceptance. Health product manufacturing often features complex formulation requirements that extend throughout lengthy product development cycles, demanding reliable and standardized botanical ingredients. Eucommia leaf extracts are particularly well-suited to these applications due to their ability to provide consistent chlorogenic acid content with documented antioxidant and metabolic health benefits, even in challenging formulation matrices. As supplement companies globally advance toward evidence-based natural ingredients and clean label formulations, the demand for standardized botanical extracts continues to rise.

The segment also benefits from increased consumer interest in metabolic health and antioxidant supplementation programs, where manufacturers are increasingly prioritizing natural ingredient sourcing and bioactivity validation as essential product features. With health product companies investing in premium natural ingredients and scientific substantiation programs, eucommia leaf extracts provide an essential solution to deliver superior product efficacy. The growth of personalized nutrition, functional supplements, and evidence-based natural health products, coupled with increased focus on botanical ingredient standardization, ensures that health products will remain the largest and most stable demand driver for eucommia leaf extracts in the forecast period.

The Eucommia Leaf Extract market is advancing steadily due to increasing consumer interest in natural health products and growing recognition of chlorogenic acid benefits over synthetic antioxidants in nutraceutical applications. However, the market faces challenges including seasonal supply variations affecting raw material availability, complex standardization requirements for different bioactive compounds, and varying regulatory classifications across different geographic regions. Performance optimization efforts and extraction technology advancement programs continue to influence processing methods and market adoption patterns.

The growing development of advanced extraction technologies is enabling enhanced bioactive compound recovery with improved purity levels and reduced processing costs. Advanced extraction methods and purification techniques provide superior chlorogenic acid yields while maintaining cost-effective production scalability. These technologies are particularly valuable for botanical extract manufacturers and supplement companies who require reliable extraction processes that can support diverse product requirements with consistent quality performance.

Modern eucommia leaf extract manufacturers are incorporating advanced bioavailability enhancement techniques and formulation technologies that improve absorption and biological activity. Integration of nano-encapsulation systems and bioavailability enhancers enables superior product efficacy and comprehensive formulation capabilities. Advanced enhancement features support application in diverse nutraceutical environments while meeting various efficacy requirements and formulation specifications.

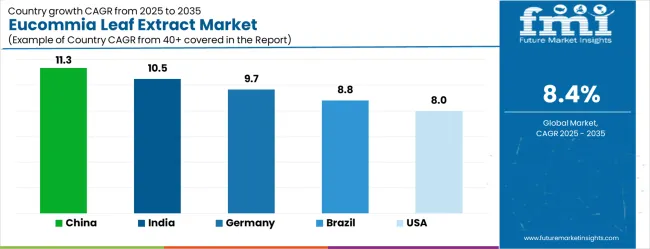

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| Brazil | 8.8% |

| United States | 8.0% |

| United Kingdom | 7.1% |

| Japan | 6.3% |

The eucommia leaf extract market is experiencing strong growth, with China leading at an 11.3% CAGR through 2035, driven by extensive traditional medicine integration and increasing adoption of standardized herbal extracts across nutraceutical manufacturing, functional food production, and traditional Chinese medicine modernization sectors. India follows at 10.5%, supported by rising Ayurvedic and herbal medicine industry growth and growing demand for natural antioxidant ingredients in health product manufacturing. Germany grows robustly at 9.7%, integrating eucommia leaf extract technology into its established phytopharmaceutical and nutraceutical manufacturing infrastructure. Brazil records 8.8%, emphasizing natural product industry modernization and botanical extract development initiatives. The United States shows substantial growth at 8.0%, focusing on dietary supplement innovation and functional food advancement. The United Kingdom demonstrates strong progress at 7.1%, maintaining established nutraceutical applications and botanical research leadership. Japan records 6.3% growth, concentrating on premium natural ingredient manufacturing and ultra-high quality extract standards.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The eucommia leaf extract market in China is projected to exhibit the highest growth rate with a CAGR of 11.3% through 2035, driven by extensive traditional Chinese medicine modernization programs and increasing demand for standardized herbal extracts across nutraceutical manufacturing, functional food production, and pharmaceutical applications. The country's rich botanical heritage and growing domestic health product capabilities are creating significant demand for advanced eucommia leaf extract systems. Major herbal extract manufacturers and nutraceutical companies are establishing comprehensive standardization facilities to support the increasing requirements of domestic and international markets across major traditional medicine development zones.

National traditional medicine development initiatives are supporting establishment of world-class botanical extraction facilities and phytochemical research centers, driving demand for advanced extract processing equipment throughout major herbal medicine industrial parks. Traditional medicine modernization programs are facilitating adoption of standardized extraction technologies that enhance product quality and international market competitiveness across herbal medicine supply chains.

The eucommia leaf extract market in India is expanding at a CAGR of 10.5%, supported by increasing Ayurvedic and herbal medicine industry development and growing awareness of natural antioxidant benefits for health product applications. The country's expanding traditional medicine sector and rising natural product export standards are driving demand for advanced eucommia leaf extract solutions. Ayurvedic companies and herbal product manufacturers are gradually implementing standardized extraction processes to maintain international quality standards and export competitiveness.

Ayurvedic industry growth and global market integration are creating opportunities for extract suppliers that can support diverse formulation requirements and international quality specifications. Professional training and development programs are building technical expertise among herbal processing professionals, enabling effective utilization of standardized extract technology that meets international standards and regulatory requirements.

The eucommia leaf extract market in Germany is projected to grow at a CAGR of 9.7%, supported by the country's emphasis on phytopharmaceutical quality standards and advanced botanical extract manufacturing adoption. German nutraceutical companies and phytopharmaceutical manufacturers are implementing cutting-edge eucommia leaf extract systems that meet stringent regulatory requirements and international quality specifications. The market is characterized by focus on extract standardization, bioactivity validation, and compliance with comprehensive pharmaceutical engineering standards.

Phytopharmaceutical industry investments are prioritizing advanced extraction technology that demonstrates superior bioactive compound recovery and regulatory compliance while meeting German quality and international pharmaceutical standards. Professional certification programs are ensuring comprehensive technical expertise among botanical extraction engineers and phytochemical specialists, enabling specialized extract processing capabilities that support diverse pharmaceutical applications and regulatory requirements.

The eucommia leaf extract market in Brazil is growing at a CAGR of 8.8%, driven by increasing natural product industry modernization and growing recognition of botanical extract advantages for nutraceutical and functional food applications. The country's expanding herbal product sector is gradually integrating advanced extraction equipment to enhance product standardization and international market access. Natural product companies and botanical manufacturers are investing in eucommia leaf extract technology to address evolving quality expectations and export competitiveness.

Natural product modernization is facilitating adoption of advanced extraction technologies that support comprehensive botanical manufacturing capabilities across production regions. Professional development programs are enhancing technical capabilities among botanical processing professionals, enabling effective eucommia leaf extract utilization that meets evolving quality standards and international requirements.

The eucommia leaf extract market in the USA is expanding at a CAGR of 8.0%, driven by established dietary supplement industry leadership and growing emphasis on natural ingredient innovation and functional food advancement. Large supplement companies and functional food manufacturers are implementing comprehensive eucommia leaf extract capabilities to serve diverse nutraceutical and food application requirements. The market benefits from established botanical extract networks and professional training programs that support various supplement and functional food applications.

Dietary supplement industry leadership is enabling standardized extract utilization across multiple product types, providing consistent bioactivity and comprehensive quality coverage throughout regional nutraceutical markets. Professional development and certification programs are building specialized technical expertise among supplement formulators and food technologists, enabling effective eucommia leaf extract utilization that supports evolving product development requirements.

The eucommia leaf extract market in the UK is projected to grow at a CAGR of 7.1%, supported by established nutraceutical research sectors and growing emphasis on botanical ingredient innovation capabilities. British supplement companies and functional food providers are implementing eucommia leaf extract solutions that meet industry quality standards and international regulatory requirements. The market benefits from established botanical research infrastructure and comprehensive training programs for nutraceutical professionals.

Nutraceutical research investments are prioritizing advanced botanical extraction systems that support diverse health product applications while maintaining established quality and regulatory standards. Professional development programs are building botanical expertise among research personnel, enabling specialized eucommia leaf extract operation capabilities that meet evolving institutional requirements and nutraceutical technology standards.

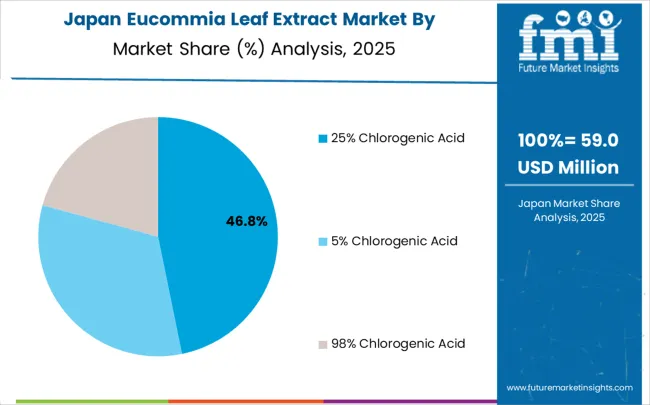

The eucommia leaf extract market in Japan is growing at a CAGR of 6.3%, driven by the country's focus on premium natural ingredient manufacturing innovation and ultra-high quality botanical extract applications. Japanese nutraceutical companies and botanical manufacturers are implementing advanced eucommia leaf extract systems that demonstrate superior purity reliability and operational excellence. The market is characterized by emphasis on technological perfection, quality assurance, and integration with established natural ingredient manufacturing workflows.

Natural ingredient industry investments are prioritizing innovative extraction solutions that combine advanced eucommia leaf processing with precision engineering while maintaining Japanese quality and reliability standards. Professional development programs are ensuring comprehensive technical expertise among botanical engineers and quality specialists, enabling specialized precision extraction capabilities that support diverse nutraceutical applications and quality requirements.

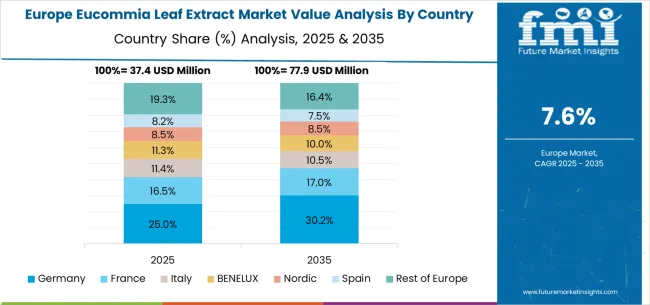

The eucommia leaf extract market in Europe is forecast to expand from USD 41.9 million in 2025 to USD 94.0 million by 2035, registering a CAGR of 8.4%. Germany will remain the largest market, holding 33.0% share in 2025, easing to 32.5% by 2035, supported by strong phytopharmaceutical infrastructure and advanced botanical extract manufacturing capabilities. The United Kingdom follows, rising from 27.5% in 2025 to 28.0% by 2035, driven by nutraceutical research innovation and botanical ingredient advancement. France is expected to maintain stability around 22.0%, reflecting steady natural product investment patterns. Italy maintains stability at around 11.0%, supported by nutraceutical manufacturing and herbal product growth, while Spain grows from 4.5% to 5.0% with expanding botanical infrastructure and natural product modernization. BENELUX markets ease from 1.8% to 1.7%, while the remainder of Europe hovers near 0.2%-0.3%, balancing emerging Eastern European botanical development against mature Nordic natural ingredient markets.

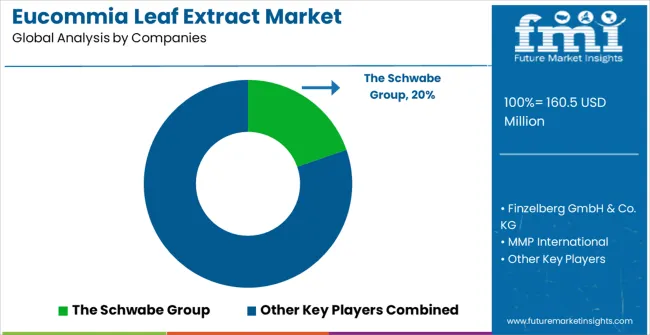

The Eucommia Leaf Extract market is defined by competition among specialized botanical extract manufacturers, phytochemical companies, and natural ingredient solution providers. Companies are investing in advanced extraction technology development, standardization optimization, bioactivity enhancement improvements, and comprehensive application capabilities to deliver reliable, standardized, and cost-effective botanical extract solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

The Schwabe Group offers comprehensive phytopharmaceutical solutions with established botanical extraction expertise and standardization capabilities. Finzelberg GmbH & Co. KG provides specialized botanical extract manufacturing with focus on pharmaceutical-grade standardization and quality assurance. MMP International delivers advanced natural ingredient technology with emphasis on nutraceutical applications and international market supply. Wellgreen Technology specializes in herbal extract manufacturing with comprehensive standardization integration.

Xi'an Tianguangyuan Biotechnology offers botanical extraction solutions with focus on traditional Chinese medicine applications and modern standardization processes. Naturalin Bio-Resources provides natural ingredient manufacturing with emphasis on international quality standards and export markets. Shaanxi Huachen Biotechnology delivers botanical processing with comprehensive extraction capabilities. Shanghai YiYi Biotechnology, Xi'an Rainbow Biotech, Changsha Staherb Natural Ingredients, Shandong Longchang Animal Health Products, and Shaanxi Muyun Biotech offer specialized botanical expertise, extraction reliability, and comprehensive product development across global and regional natural ingredient market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 160.5 million |

| Purity Level | 5% Chlorogenic Acid, 25% Chlorogenic Acid, 98% Chlorogenic Acid |

| Application | Health Products, Functional Foods, Cosmetics, Animal Feed, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | The Schwabe Group, Finzelberg GmbH & Co. KG, MMP International, Wellgreen Technology, Xi'an Tianguangyuan Biotechnology, Naturalin Bio-Resources, Shaanxi Huachen Biotechnology, Shanghai YiYi Biotechnology, Xi'an Rainbow Biotech, Changsha Staherb Natural Ingredients, Shandong Longchang Animal Health Products, Shaanxi Muyun Biotech |

| Additional Attributes | Dollar sales by purity level and application segment, regional demand trends across major markets, competitive landscape with established botanical extract manufacturers and emerging phytochemical specialists, customer preferences for different standardization levels and extraction methods, integration with nutraceutical manufacturing systems and quality control protocols, innovations in extraction technology and bioavailability enhancement capabilities, and adoption of sustainable sourcing features with enhanced standardization characteristics for improved natural ingredient workflows. |

The global eucommia leaf extract market is estimated to be valued at USD 160.5 million in 2025.

The market size for the eucommia leaf extract market is projected to reach USD 359.7 million by 2035.

The eucommia leaf extract market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in eucommia leaf extract market are 25% chlorogenic acid, 5% chlorogenic acid and 98% chlorogenic acid.

In terms of application, health products segment to command 42.0% share in the eucommia leaf extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Olive Leaf Extract Market

Red Vine Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Camellia Sinensis Leaf Extract Market

Platycladus Orientalis Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Leaf Spring Assembly Market Size and Share Forecast Outlook 2025 to 2035

Leaf Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Bay Leaf Oil Market Size and Share Forecast Outlook 2025 to 2035

Bay Leaf Market Size and Share Forecast Outlook 2025 to 2035

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA