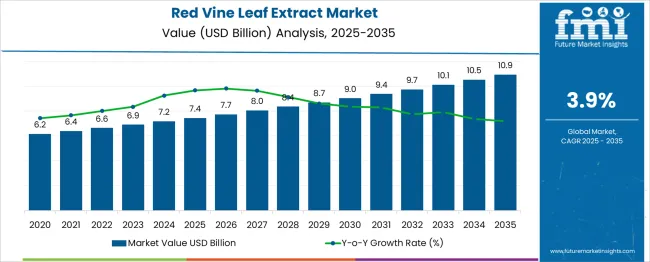

The Red Vine Leaf Extract Market is estimated to be valued at USD 7.4 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. This growth translates into an absolute dollar opportunity of USD 3.5 billion between 2025 and 2035. This consistent rise reflects increasing global interest in natural and plant-based health supplements. Red vine leaf extract, known for its benefits in improving blood circulation, reducing varicose vein symptoms, and offering anti-inflammatory properties, is gaining popularity in both dietary supplements and pharmaceutical applications. The expanding elderly population and growing incidence of chronic venous disorders further contribute to rising demand.

From 2025 to 2030, the market is expected to grow from USD 7.4 billion to approximately USD 8.7 billion, generating an opportunity of USD 1.3 billion in just five years. The period from 2030 to 2035 adds another USD 2.2 billion, reaching USD 10.9 billion. This steady increase highlights favorable conditions for both established players and new entrants in functional and herbal ingredient segments. The market’s absolute dollar opportunity underscores the potential for investment in product innovation, clean-label formulations, and expansion into emerging markets where awareness of botanical health products is rapidly growing.

| Metric | Value |

|---|---|

| Red Vine Leaf Extract Market Estimated Value in (2025 E) | USD 7.4 billion |

| Red Vine Leaf Extract Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The Red Vine Leaf Extract market operates within the broader herbal and botanical extracts market, a key segment of the global nutraceuticals and natural health ingredients industry. As of 2025, the global herbal extracts market is valued at over USD 50 billion, with applications in dietary supplements, pharmaceuticals, cosmetics, and functional foods. Red vine leaf extract, known for its venotonic, antioxidant, and anti-inflammatory properties, is primarily used in vascular health supplements and natural therapeutics. Within the herbal extracts market, leaf-based extracts account for approximately 30% of total market share, and red vine leaf extract holds a niche but growing position. It represents about 1.5–2% of the total herbal extracts market, equating to a market size of roughly USD 7.4 billion in 2025, and is expected to reach USD 10.9 billion by 2035. Growth is driven by rising consumer demand for plant-based remedies, especially in Europe and North America, where natural treatments for chronic venous insufficiency (CVI) and leg pain are widely accepted. Leading players in the parent market include Naturex (Givaudan), Indena, Martin Bauer Group, and Sabinsa, all of which offer specialized plant-derived ingredients, including grapevine-derived extracts for therapeutic applications.

The red vine leaf extract market is experiencing consistent growth as consumer preference shifts toward plant-based and functional ingredients in health and wellness products. Demand is being driven by increased awareness of natural solutions for venous insufficiency, circulatory support, and inflammation reduction. The market is further being shaped by growing interest in botanical therapeutics within nutraceuticals, pharmaceuticals, and cosmeceuticals.

Innovations in plant extraction technologies, clean-label product development, and stringent quality control practices have contributed to expanding product adoption across regions. Organic certifications, transparency in sourcing, and traceability standards have become influential in purchase decisions, particularly in European and North American markets.

With expanding applications in dietary supplements and functional foods, the Red Vine Leaf Extract market is expected to maintain its upward trajectory. The ability of manufacturers to align product offerings with consumer demand for sustainable, ethically sourced, and efficacious botanicals will continue to determine competitive positioning and future growth potential.

The red vine leaf extract market is segmented by product type, form, application, distribution channel, and geographic regions. The red vine leaf extract market is divided by product type into Organic red vine leaf extract and Conventional red vine leaf extract. The red vine leaf extract market is classified by form into Powder, Liquid, Capsules, and Tablets. Based on the application of the red vine leaf extract, the market is segmented into Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, and Others. The distribution channel of the red vine leaf extract market is segmented into Online Retail, Direct Sales, Pharmacies & Drugstores, Health & Wellness Stores, Supermarkets/Hypermarkets, and Others. Regionally, the red vine leaf extract industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

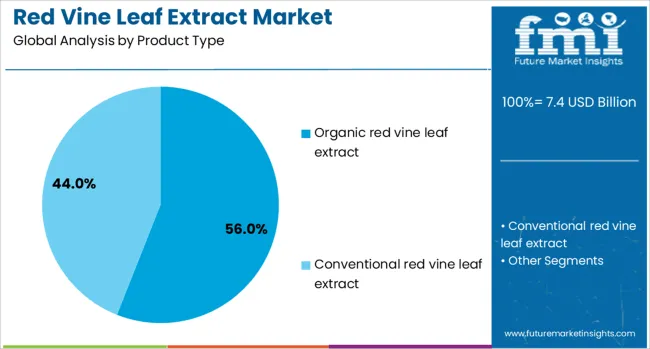

The organic red vine leaf extract subsegment is projected to account for 56% of the Red Vine Leaf Extract market revenue share in 2025, positioning it as the dominant product type. This leadership has been supported by rising consumer demand for clean-label, pesticide-free botanicals with verifiable origins. As awareness around the long-term health benefits of natural ingredients continues to rise, preference has shifted toward certified organic formulations that align with wellness trends.

The segment has also benefited from regulatory support for organic labeling and increased penetration in premium nutraceutical brands. With organic sourcing often perceived as a mark of quality and safety, purchasing decisions have been strongly influenced by sustainability credentials and farming practices.

Retailers and formulators have shown greater interest in organic extracts due to their compatibility with ethical marketing and consumer trust. As transparency and environmental responsibility become purchasing priorities, the organic product type is expected to retain its competitive advantage in the global market..

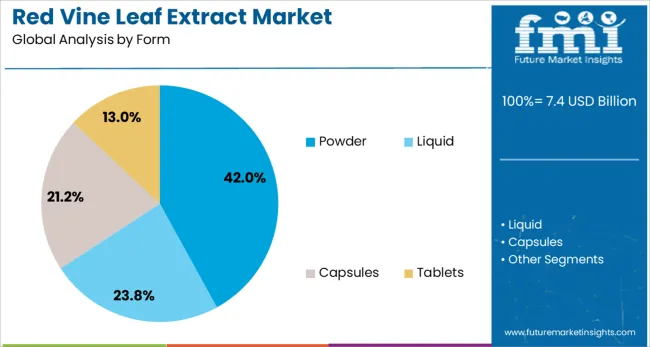

The powder form subsegment is expected to represent 42% of the Red Vine Leaf Extract market revenue share in 2025, making it the leading formulation. Growth in this segment has been supported by the versatility, shelf stability, and ease of formulation that powders offer across dietary supplements, capsules, and functional food products. Powdered extracts have been favored for their ability to maintain potency during processing and storage, while also offering precise dosing in manufacturing applications.

Their compatibility with both solid and liquid dosage forms has expanded their use across a broad range of product categories. The demand for dry botanical extracts has also been reinforced by the rising popularity of personalized nutrition and DIY supplement formats.

Additionally, powders provide logistical advantages such as reduced transportation costs and longer shelf life, enhancing their appeal to manufacturers. The segment is expected to maintain its lead as product developers seek flexible, stable, and scalable formats that align with modern health and wellness trends.

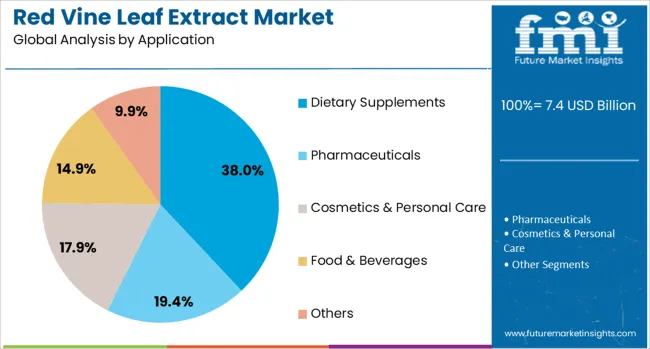

The dietary supplements subsegment is anticipated to hold 38% of the Red Vine Leaf Extract market revenue share in 2025, establishing it as the leading application area. This prominence has been driven by growing consumer reliance on natural supplements to support circulatory health, reduce leg swelling, and manage venous disorders. Red vine leaf extract has gained recognition for its clinical efficacy in improving vascular function, which has encouraged its incorporation into premium nutraceutical formulations.

The segment’s growth has also been supported by the expansion of e-commerce distribution channels and direct-to-consumer models that offer increased access to herbal supplements. Regulatory validation of health claims and consumer familiarity with botanical actives have further reinforced market demand.

As aging populations seek natural alternatives to manage chronic vascular conditions, the application of dietary supplements is expected to see sustained uptake. The alignment of this segment with preventive health trends and evidence-based formulations continues to fuel its market leadership.

The red vine leaf extract market is expanding due to rising demand for natural health ingredients targeting cardiovascular wellness, microcirculation, and anti-inflammatory support. Its adoption in dietary supplements, cosmetics, and pharmaceuticals is accelerating, especially in Europe and North America, with Asia-Pacific emerging. Key drivers include technological innovation, aging populations, and clean-label trends. However, growth is moderated by standardization challenges, regulatory inconsistencies, and raw material constraints. Market leaders focus on product traceability, improved bioavailability, and science-backed efficacy to differentiate in competitive, quality-conscious sectors.

Consistent quality remains a core challenge in the red vine leaf extract market. Variations in leaf variety, harvesting time, and extraction processes lead to fluctuating levels of key actives like flavonoids and polyphenols. Without industry-wide standards, product efficacy and safety may differ across batches, limiting credibility among formulators and health professionals. Cosmetic and pharmaceutical segments demand validated assays, traceable sourcing, and alignment with pharmacopeial benchmarks. This adds operational complexity and cost. Suppliers that invest in standardized production protocols and certifications (e.g., EMA, USP, or traditional herbal compendia) gain trust but face regulatory overhead. Inconsistencies can hinder regulatory approval or lead to consumer skepticism. Brands failing to ensure compositional reliability risk exclusion from premium market segments. Until harmonized extraction and testing frameworks are adopted globally, market fragmentation and quality variability will continue to challenge widespread adoption and scale-up, particularly for applications demanding high consistency and clinical-grade performance.

Advances in extraction and delivery technologies are transforming the red vine leaf extract market. Sophisticated techniques such as optimized solvent extraction, supercritical CO₂ processing, and nanofiber encapsulation enhance the concentration and bioavailability of active compounds like resveratrol and quercetin. Nanotechnology-based delivery—such as electrospun nanofibers—improves solubility and gastrointestinal absorption, enabling smaller doses with equivalent or superior therapeutic outcomes. High-performance liquid chromatography (HPLC) ensures precision in standardizing anthocyanin and polyphenolic profiles across batches. These innovations allow formulators to create high-efficacy products for niche health areas, including vascular protection and anti-aging. Collaborations between extract manufacturers and academic or clinical research bodies support evidence-based claims, boosting credibility in competitive markets. As end-users and professionals demand efficacy-backed products, technological differentiation has become essential. Companies utilizing science-driven platforms not only command price premiums but also open access to regulated pharmaceutical, cosmeceutical, and medical nutrition markets, where performance, consistency, and delivery innovation are critical for regulatory and consumer acceptance.

Red vine leaf extract adoption is significantly shaped by complex, region-specific regulatory environments. In the European Union, the extract is approved under the Traditional Herbal Medicinal Product Directive (THMPD) for applications such as chronic venous insufficiency, enabling moderate health claims. However, in North America and most of Asia-Pacific, it is typically classified as a dietary supplement, subject to stricter restrictions on therapeutic messaging unless backed by clinical data. This divergence requires manufacturers to adapt product formulations, marketing language, and compliance documentation to each target region. Inconsistent definitions and approval requirements increase time-to-market and legal risks, especially in pharmaceutical and cosmeceutical channels. Some emerging markets offer significant demand potential but lack formal regulatory pathways, slowing product introduction. Suppliers that align with recognized regulatory frameworks, such as pharmacopeia listings or local health authority certifications, improve market access and consumer trust. Until global harmonization occurs, regulatory complexity will remain a barrier to seamless expansion and innovation.

The red vine leaf extract market is becoming more competitive as established global producers and regional entrants vie for market share. Leading suppliers differentiate through branded, standardized ingredients, clinical validation, and strong R&D partnerships, while newer players may compete on price but often lack consistency or compliance credentials. Supply chain reliability is a growing concern due to dependence on grapevine agriculture, seasonal harvesting cycles, and climate variability. Disruptions in raw material availability, along with logistical delays, can limit production and affect pricing. Companies that invest in vertically integrated sourcing models, including contract farming and geographic diversification, gain resilience and control over quality. In parallel, growing interest in sustainability and clean-label sourcing is driving demand for eco-friendly extraction techniques and organic certifications. The ability to ensure year-round supply, uphold high traceability standards, and deliver performance-tested products will determine competitive advantage as the market shifts toward premium wellness and therapeutic applications.

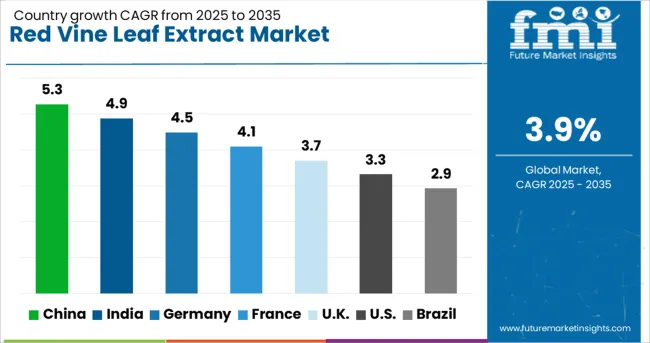

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The Red Vine Leaf Extract Market is projected to expand at a CAGR of 3.9% through 2035, driven by growing demand for natural remedies in vascular health and skincare. China leads with a growth rate of 5.3%, supported by a booming herbal supplement industry and increasing consumer awareness of traditional botanical extracts. India follows at 4.9%, where rising interest in plant-based therapeutics and holistic wellness fuels demand. Germany’s market, growing at 4.5%, is supported by strong regulatory standards and integration into over-the-counter pharmaceuticals for venous support. The UK, at 3.7%, is experiencing growing popularity of herbal formulations in functional health and beauty applications. Meanwhile, the USA, with a growth rate of 3.3%, sees increased adoption in dietary supplements and cosmetic products. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has recorded a CAGR of 5.3% in the red vine leaf extract market, driven by increased interest in botanical supplements and plant-based personal care products. The extract is gaining traction in both pharmaceutical and cosmetic sectors due to its reported benefits in supporting circulation and skin care. Domestic nutraceutical brands are expanding their offerings with red vine leaf capsules and functional beverages. Local cosmetic manufacturers have begun incorporating the extract into anti-aging and soothing formulations. Consumer preference for traditional and natural health solutions aligns with this trend, and distribution is growing via both e-commerce and retail pharmacies. Imports from European producers support product quality, while domestic farms in temperate zones are also experimenting with local cultivation. Educational campaigns highlighting vein and capillary health have supported adoption.

India has achieved a CAGR of 4.9% in the red vine leaf extract market, fueled by growing demand for natural remedies and plant-based therapies. Health-conscious consumers are increasingly turning to botanical supplements for managing circulation and leg fatigue, especially among older adults and desk-bound workers. Ayurvedic and herbal wellness brands are incorporating the extract into blends targeting vascular support. While red vine leaf is not native to India, imports and collaborations with European suppliers have ensured ingredient availability and compliance with global standards. Online health platforms and pharmacy chains are expanding product access across urban and semi-urban areas. Marketing is focused on the extract’s role in blood flow enhancement and anti-inflammatory properties. Domestic capsule production is increasing due to rising interest in convenient supplement formats.

Germany has posted a CAGR of 4.5 percent in the red vine leaf extract market, supported by strong traditions in herbal medicine and standardized botanical formulations. The extract is widely used in over-the-counter vascular health products and approved by health authorities for managing chronic venous insufficiency. German manufacturers lead in clinical-grade production of red vine leaf capsules, creams, and oral solutions. Retail pharmacies and health stores offer a range of SKUs focused on vein health and leg fatigue. Consumer trust in herbal therapy continues to support sales, especially among aging populations. Regulatory clarity and scientific backing allow clear communication of benefits. Exports of German-made products are also growing, particularly to Asia and the Americas, where trust in European pharmacopeia is strong.

The United Kingdom has reported a CAGR of 3.7% in the red vine leaf extract market, with demand coming from both the wellness and personal care industries. Consumers seeking alternatives to synthetic treatments are showing preference for botanical ingredients. Health supplement companies are offering red vine leaf capsules marketed for circulation support and reduced leg discomfort. Online wellness platforms have enabled broad availability, and interest has grown among fitness communities and older adults. The cosmetic sector is also beginning to test red vine leaf extract in formulations aimed at soothing redness and boosting skin hydration. EU-compliant labeling and formulation rules continue to shape product messaging. Retail health chains stock imported and private-label products with targeted claims.

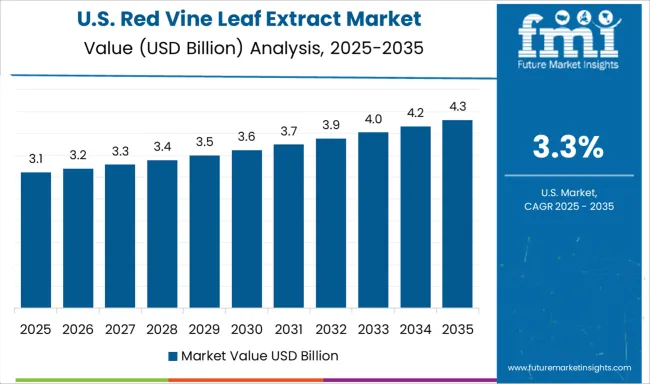

The United States has achieved a CAGR of 3.3% in the red vine leaf extract market, primarily influenced by the rise in plant-based supplements and interest in European herbal solutions. The extract is often positioned as a natural aid for circulation and leg health, particularly among aging populations and office workers. Supplement companies are introducing capsules and drink mixes that include red vine leaf alongside other botanical ingredients. Distribution through specialty retailers, online marketplaces, and holistic health practitioners has expanded. While consumer awareness is still developing, endorsements by wellness influencers and inclusion in premium supplement stacks have driven visibility. USA-based manufacturers are increasingly sourcing the extract from trusted European farms to meet quality standards.

The red vine leaf extract market is driven by the rising demand for natural vascular health solutions, herbal anti-inflammatories, and clean-label nutraceuticals. Derived from the leaves of Vitis vinifera, red vine leaf extract is rich in flavonoids and polyphenols that support blood circulation, reduce leg swelling, and combat oxidative stress. Its applications are expanding across dietary supplements, cosmeceuticals, and pharmaceutical formulations targeting chronic venous insufficiency and skin health.

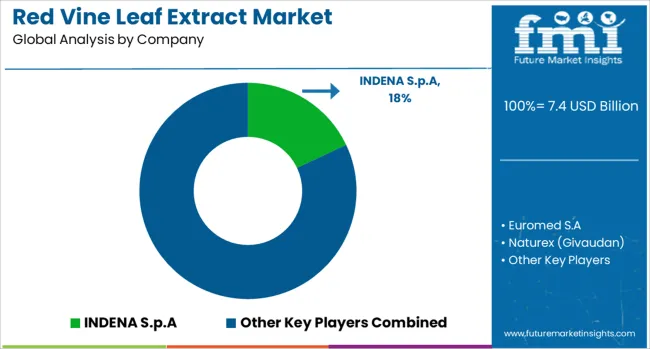

INDENA S.p.A, a global leader in botanical extracts for pharmaceutical use, offers high-purity, clinically validated red vine leaf extract optimized for vascular health. The company’s emphasis on science-backed efficacy, traceability, and pharmaceutical-grade manufacturing makes it a preferred partner for health brands worldwide. Euromed S.A similarly provides standardized extracts under strict GMP compliance, with a focus on European Pharmacopeia standards and eco-friendly processing methods. Naturex, now part of Givaudan, leverages its global sourcing and extraction capabilities to supply red vine leaf ingredients tailored for dietary supplements and functional beverages. Martin Bauer GmbH & Co. KG, with its deep herbal expertise, delivers customizable extract grades for both therapeutic and wellness-oriented applications.

Bio-Botanica, Inc., a USA-based manufacturer, supports clean-label and organic formulations with its holistic line of herbal extracts, including red vine leaf. As consumer preferences shift toward plant-based, clinically supported health solutions, suppliers with transparent sourcing, consistent potency, and regulatory-ready extracts are best positioned to lead this niche botanical market.

Active Inside offers a red vine leaf extract standardized to ~10% polyphenols and ~4% bioflavonoids. Indena’s extract meets French Pharmacopoeia standards (≥3.0% flavonoids, ≥0.3% anthocyanins). Naturex (Givaudan) and Döhler are confirmed global industry leaders in the red vine leaf extract market.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.4 Billion |

| Product Type | Organic red vine leaf extract and Conventional red vine leaf extract |

| Form | Powder, Liquid, Capsules, and Tablets |

| Application | Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, and Others |

| Distribution Channel | Online Retail, Direct Sales, Pharmacies & Drugstores, Health & Wellness Stores, Supermarkets/Hypermarkets, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | INDENA S.p.A, Euromed S.A, Naturex (Givaudan), Martin Bauer GmbH & Co. KG, and Bio-Botanica, Inc. |

| Additional Attributes | Dollar sales by red vine leaf extract type include liquid extracts, powder extracts, and standardized extracts, applied in the pharmaceuticals, dietary supplements (nutraceuticals), cosmetics & personal care, and food & beverages sectors across North America, Europe, Asia‑Pacific, Latin America, and Middle East & Africa |

The global red vine leaf extract market is estimated to be valued at USD 7.4 billion in 2025.

The market size for the red vine leaf extract market is projected to reach USD 10.9 billion by 2035.

The red vine leaf extract market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in red vine leaf extract market are organic red vine leaf extract and conventional red vine leaf extract.

In terms of form, powder segment to command 42.0% share in the red vine leaf extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Redness-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Butter Market Size and Share Forecast Outlook 2025 to 2035

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Cheese Market Size, Growth, and Forecast for 2025 to 2035

Reduced Fat Dairy Market Analysis by Ice cream, Yogurt, Skim milk and Others through 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Reduced Iron Powder Market Analysis by Product, Application and Distribution Channel Through 2035

Redox Meter Market

Reduced Fat Cheeses Market

Red Berries Market Trends – Growth, Demand & Health Benefits

Red Clover Extracts for Hormonal Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dredging Market Size and Share Forecast Outlook 2025 to 2035

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Quality Assurance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Predictive Touch Market Size and Share Forecast Outlook 2025 to 2035

Dredging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Predictive Analytics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Predictive Automobile Technology Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA