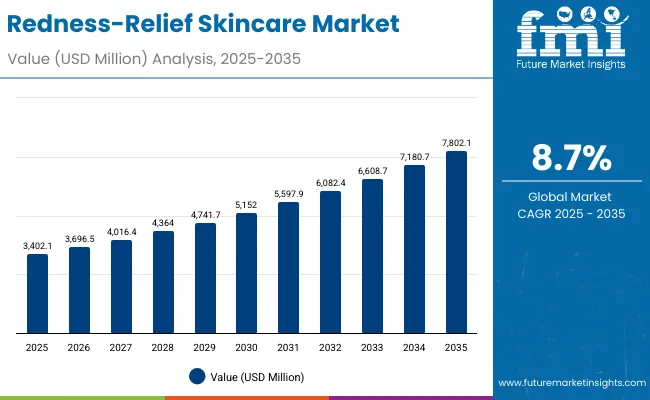

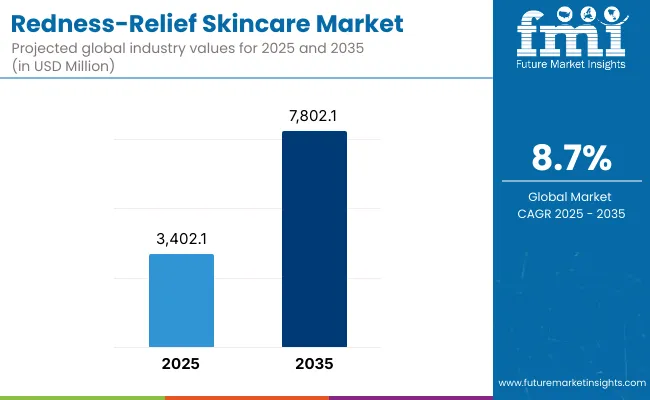

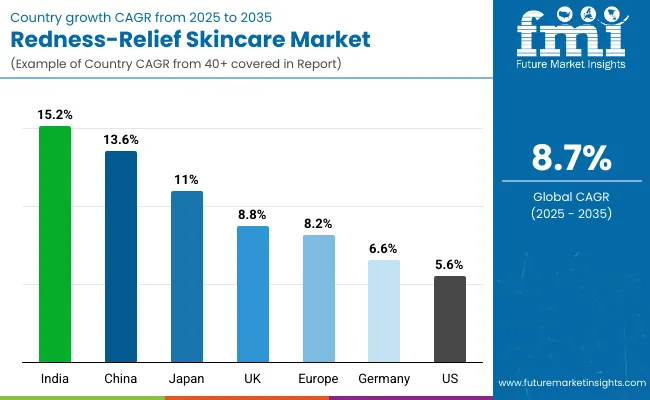

The Global Redness-Relief Skincare Market is expected to record a valuation of USD 3,402.1 million in 2025 and USD 7,802.1 million in 2035, with an increase of USD 4,400.0 million, which equals a growth of 129% over the decade. The overall expansion represents a CAGR of 8.7% and a more than 2X increase in market size.

Global Redness-Relief Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Global Redness-Relief Skincare Market Estimated Value in (2025E) | USD 3,402.1 million |

| Global Redness-Relief Skincare Market Forecast Value in (2035F) | USD 7,802.1 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,402.1 million to USD 5,152.0 million, adding USD 1,749.9 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption in pharmacies & drugstores and e-commerce, driven by dermatologist-backed formulations and increasing awareness of rosacea management. Soothing creams & balms dominate this period as they cater to over 42-45% of consumer demand, offering accessible solutions for redness relief and sensitive skin irritation.

The second half from 2030 to 2035 contributes USD 2,650.1 million, equal to 60% of total growth, as the market jumps from USD 5,152.0 million to USD 7,802.1 million. This acceleration is powered by widespread adoption of advanced actives like centellaasiatica and azelaic acid, alongside premium product formats such as serums and gel-based moisturizers. Consumers increasingly demand multifunctional products that combine anti-redness care with hydration and anti-aging benefits. Digital retail expansion, dermatology clinic recommendations, and clinical-grade brand positioning strengthen the role of e-commerce and specialty retail channels. By 2035, innovations in sensitive skin solutions and green tea polyphenol–based products will push actives-led formulations beyond 40% of the total market value.

From 2020 to 2024, the Global Redness-Relief Skincare Market grew steadily as sensitive-skin focused products gained attention worldwide. During this period, the competitive landscape was dominated by dermocosmetic brands, with European leaders such as Eucerin, La Roche-Posay, and Avene controlling nearly 20% of global revenue. Competitive differentiation relied on dermatologist endorsements, clinical trials, and hypoallergenic claims, while mass retail products and pharmacy-driven launches acted as accessibility drivers. Specialist formulations such as thermal spring water sprays from France and niacinamide-based serums from the U.S. expanded consumer adoption. Service-based clinic treatments contributed less than 15% of total market value, with OTC retail maintaining dominance.

Demand for redness-relief skincare is set to expand further, with USD 3,402.1 million in 2025 rising to USD 7,802.1 million in 2035. The revenue mix will shift as serums and gel-based moisturizers grow faster than traditional balms, and key actives like niacinamide and centellaasiatica capture more market share. Traditional European dermocosmetic leaders face rising competition from U.S. and Asian players offering AI-powered skin analysis, subscription-based sensitive-skin kits, and digital-first brand ecosystems. Competitive advantage is moving beyond product claims to ecosystem strength, scientific backing, and dermatologist trust.

Advances in soothing formulations and active ingredients have improved efficacy and speed of redness reduction, allowing for more efficient relief across rosacea, sensitive skin, and environmentally triggered irritation. Soothing creams & balms continue to dominate due to their familiarity and dermatologist trust, while serums and gel-based moisturizers are gaining traction for younger consumers seeking lightweight formats.

The rise of niacinamide and centellaasiatica has contributed to enhanced results in reducing redness, strengthening the skin barrier, and providing hydration without irritation. Industries such as dermocosmetics, pharmacy retail, and online beauty platforms are driving demand for solutions that can integrate seamlessly into both skincare routines and dermatology-recommended regimens.

Expansion of post-inflammatory redness care and anti-pollution skincare has fueled market growth, especially in Asia-Pacific where environmental irritation is a key driver. Innovations in portable thermal spring water sprays, green tea polyphenol–based antioxidant systems, and dermatologist-tested sensitive-skin lines are expected to open new application areas. Segment growth is expected to be led by soothing creams & balms in product type, niacinamide in actives, and rosacea care in skin concerns, supported by channel diversification through pharmacies and e-commerce.

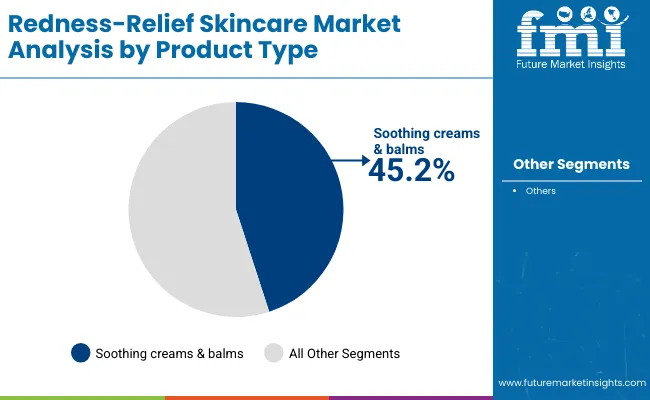

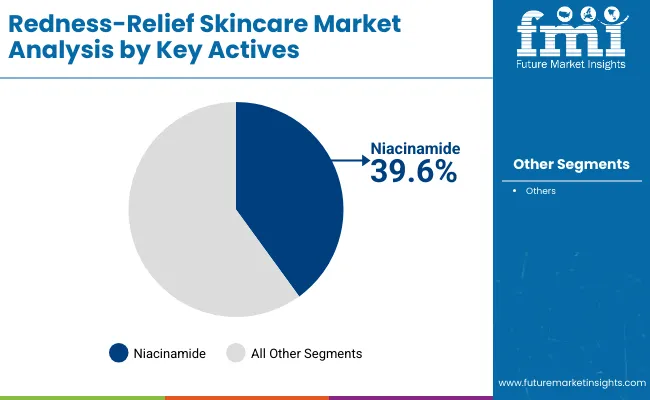

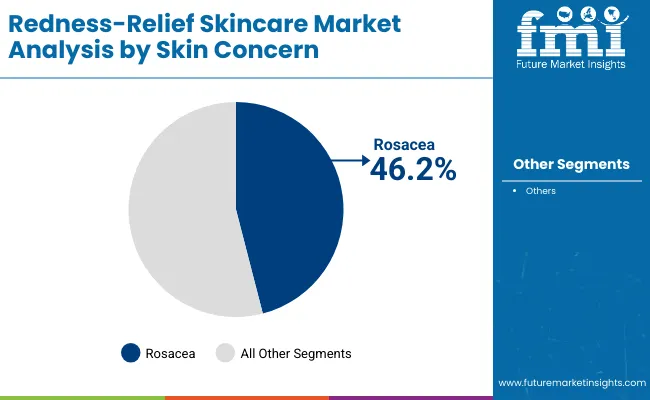

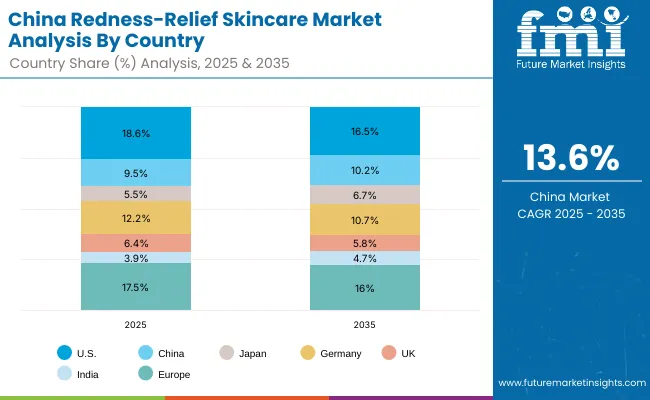

The Global Redness-Relief Skincare Market is segmented by product type, key actives, skin concern, channel, end user, and geography. By product type, soothing creams & balms lead with 45.2% share in 2025 (USD 1,537.75 million), while serums, gel-based moisturizers, and thermal spring water sprays together account for 54.8% (USD 1,864.35 million). By key actives, niacinamide dominates with 39.6% (USD 1,347.23 million), supported by rising use of centellaasiatica and azelaic acid. By skin concern, rosacea drives the largest share at 46.2% (USD 1,571.77 million), followed by post-inflammatory redness and environmental irritation. Pharmacies & drugstores and e-commerce are the strongest channels, with dermatology clinics gaining importance for clinical-grade solutions. Adults and women remain the largest end-user groups, while men and sensitive-skin prone consumers represent emerging growth clusters. Geographically, the USA holds the largest market size at USD 632.41 million in 2025, China grows fastest at a 13.6% CAGR, and India records the highest expansion at 15.2% CAGR, with Europe and Japan sustaining maturity through dermocosmetic leadership.

| Product Type | Value Share % 2025 |

|---|---|

| Soothing creams & balms | 45.2% |

| Others | 54.8% |

The soothing creams & balms segment is projected to contribute 45.2% of the Global Redness-Relief Skincare Market revenue in 2025, maintaining its lead as the dominant product type. This leadership stems from the wide use of topical calming formulations that offer immediate relief for redness and irritation, particularly in consumers with rosacea and sensitive skin. These products are highly trusted by dermatologists, making them the first recommendation for patients dealing with facial redness.

The segment’s growth is also supported by the increasing demand for multipurpose creams enriched with hydrating, anti-inflammatory, and barrier-repairing ingredients. Compact tube and balm packaging formats have improved accessibility and convenience, further driving adoption. As new innovations blend redness-relief actives with anti-aging and hydration benefits, soothing creams & balms are expected to retain their position as the cornerstone of the redness-relief skincare category.

| Key Actives | Value Share % 2025 |

|---|---|

| Niacinamide | 39.6% |

| Others | 60.4% |

The niacinamide segment is forecasted to hold 39.6% of the Global Redness-Relief Skincare Market share in 2025, driven by its proven efficacy in reducing inflammation, strengthening the skin barrier, and calming redness. This vitamin B3 derivative is widely incorporated across creams, serums, and gels due to its versatility, safety, and compatibility with other active ingredients.

Its dominance is reinforced by consumer awareness campaigns and dermatologist endorsements that highlight niacinamide’s role in addressing post-inflammatory redness and sensitive-skin irritation. The surge of minimalist skincare routines further boosts its demand, as niacinamide offers multiple benefits in one active. With its rising inclusion in both mass retail and premium product lines, niacinamide is expected to remain the benchmark active ingredient for redness-relief formulations over the forecast period.

| Skin Concern | Value Share % 2025 |

|---|---|

| Rosacea | 46.2% |

| Others | 53.8% |

The rosacea segment is projected to account for 46.2% of the Global Redness-Relief Skincare Market revenue in 2025, making it the largest skin concern addressed within the industry. Rosacea is a chronic condition with high prevalence in North America and Europe, and growing diagnosis rates in Asia-Pacific are contributing to increased treatment adoption.

Consumers dealing with rosacea are highly engaged with dermatologist-recommended products, fueling steady demand for specialized redness-relief formulations. This segment’s expansion is supported by the development of targeted creams, soothing sprays, and prescription-strength skincare solutions. As awareness of rosacea as a medically recognized condition rises, combined with growing access to dermatologist clinics and e-pharmacy platforms, this segment is expected to remain the primary driver of demand within the redness-relief skincare market.

Rising Rosacea Awareness and Dermatologist-Led Prescriptions

Rosacea accounts for 46.2% of market share in 2025, making it the single largest skin concern segment. The condition has historically been underdiagnosed, but growing awareness through dermatologist campaigns, patient advocacy groups, and digital platforms has expanded treatment adoption. In the USA and Europe, dermocosmetic brands like La Roche-Posay, Avene, and Eucerin are positioned as first-line skincare for rosacea, reinforcing the medicalized narrative. This push has increased product credibility and fueled sales through pharmacies & drugstores, where prescriptions and OTC dermatologist-recommended brands overlap.

Asia-Pacific Acceleration Driven by Niacinamide Formulations

Niacinamide leads with 39.6% market share (USD 1,347.23 million in 2025), and its rapid adoption is most visible in China, India, and Japan. In China, niacinamide-based formulations already hold 36.1% share of the active segment, with strong uptake through e-commerce platforms like Tmall and JD.com. In India, sensitive-skin awareness is surging (CAGR 15.2%), and affordable niacinamide creams are gaining traction even in mass retail. This shift from luxury-only positioning to inclusive, affordable price points is accelerating Asia-Pacific growth, making it the primary driver of global expansion.

Regulatory Scrutiny on Active Ingredient Claims

While niacinamide, centellaasiatica, and azelaic acid are effective, regulators in Europe and North America are tightening scrutiny on claims of “redness-relief” and “rosacea-friendly” products. The lack of harmonized standards means some brands face delays or reformulation costs before market entry. In Germany and the UK, clinical backing is increasingly required for sensitive-skin claims, which raises compliance costs and slows launches. This restraint creates barriers for smaller or indie brands that lack resources for extensive clinical validation.

High Price Sensitivity in Emerging Markets

Despite high growth rates in India (15.2% CAGR) and China (13.6% CAGR), consumer willingness to pay remains limited outside urban centers. Premium products like thermal spring water sprays and dermatologist-endorsed balms are perceived as expensive luxuries, restricting penetration. Mass-market alternatives with diluted concentrations of actives compete strongly on price, slowing premium adoption. This creates a structural restraint: global leaders need to balance premium positioning with affordability to capture high-growth geographies.

Hybrid Positioning: Redness-Relief Plus Barrier Repair

Consumers increasingly expect redness-relief products to do more than calm irritation. Hybrid positioning that combines anti-redness with hydration, anti-aging, or barrier repair is gaining traction. For example, serums that blend niacinamide with hyaluronic acid or creams that merge centellaasiatica with ceramides are capturing younger demographics who want multifunctional products. This trend is reshaping innovation pipelines, especially in the USA and Japan, where demand for multi-benefit sensitive-skin care is rising.

Digital Dermatology and AI-Driven Customization

In China and the USA, e-commerce platforms and teledermatology apps are increasingly using AI skin analysis to recommend redness-relief solutions tailored to individual concerns (rosacea vs. environmental irritation vs. sensitive skin). Brands like Paula’s Choice and First Aid Beauty are leveraging digital-first ecosystems to deliver personalized regimens. This digital-derm trend is accelerating consumer trust and improving conversion rates in e-commerce, solidifying online retail as a core growth channel alongside pharmacies.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.6% |

| USA | 5.6% |

| India | 15.2% |

| UK | 8.8% |

| Germany | 6.6% |

| Japan | 11.0% |

| Europe | 8.2% |

China and India are the clear growth engines for the Global Redness-Relief Skincare Market, with CAGRs of 13.6% and 15.2%, respectively. In China, growth is led by the popularity of niacinamide-based formulations, which already account for over one-third of the country’s active ingredient market. E-commerce platforms such as Tmall and JD.com are amplifying access to dermatologist-endorsed products, while rising cases of urban skin irritation from pollution and climate factors are fueling demand. India, on the other hand, represents the fastest-growing country globally, with redness-relief products gaining traction among sensitive-skin prone consumers. Expanding pharmacy distribution, rising middle-class purchasing power, and the availability of affordable niacinamide and centella-based creams are driving penetration. Both countries benefit from younger demographics that are more willing to experiment with skincare routines, positioning Asia-Pacific as the central growth hub of this market.

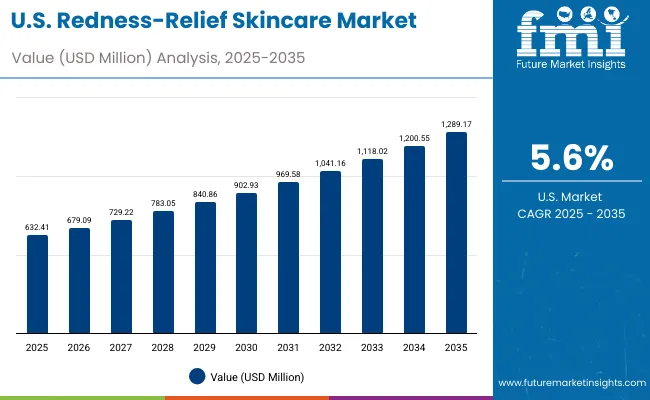

Mature markets like the USA and Europe continue to provide a solid base, but with slower growth compared to Asia. The USA grows at a modest 5.6% CAGR, reflecting its already large base of USD 632.41 million in 2025, where soothing creams & balms dominate sales through pharmacies and dermatology clinics. Europe as a region expands at 8.2% CAGR, supported by legacy dermocosmetic brands such as Eucerin, La Roche-Posay, and Avene, which maintain strong consumer trust. Within Europe, the UK shows higher-than-average growth at 8.8% CAGR, reflecting increasing adoption of clean-label and sensitive-skin positioning, while Germany grows more steadily at 6.6% CAGR, anchored by long-established pharmacy channels. Japan, with an impressive 11.0% CAGR, benefits from consumer preference for premium thermal spring sprays and hybrid formulations that combine redness relief with hydration and anti-aging benefits. Together, these dynamics illustrate a dual-speed market: fast expansion in Asia-Pacific led by affordability and awareness, contrasted with stable growth in Western markets anchored in brand heritage and dermatologist credibility.

| Year | USA Redness-Relief Skincare Market (USD Million) |

|---|---|

| 2025 | 632.41 |

| 2026 | 679.09 |

| 2027 | 729.22 |

| 2028 | 783.05 |

| 2029 | 840.86 |

| 2030 | 902.93 |

| 2031 | 969.58 |

| 2032 | 1041.16 |

| 2033 | 1118.02 |

| 2034 | 1200.55 |

| 2035 | 1289.17 |

The Global Redness-Relief Skincare Market in the United States is projected to grow at a CAGR of 5.6%, led by rising demand for dermatologist-endorsed solutions targeting rosacea, which accounts for the largest share of skin concerns. Pharmacies and dermatology clinics remain the dominant channels, supported by a strong base of prescription-driven sales and OTC dermocosmetic products. E-commerce is expanding rapidly as USA consumers increasingly rely on digital skincare consultations and AI-driven regimen recommendations. Premium soothing creams & balms dominate with over 42% share, while lightweight serums and gel-based moisturizers are gaining traction among younger, urban consumers seeking multipurpose solutions.

The Global Redness-Relief Skincare Market in the United Kingdom is expected to grow at a CAGR of 8.8%, supported by consumer demand for clean-label, sensitive-skin focused products. British pharmacies and specialty beauty retailers have expanded shelf space for dermatologist-tested brands, while e-commerce platforms are catering to rising interest in vegan and fragrance-free redness-relief ranges. The market also benefits from increasing awareness of environmental irritation and post-inflammatory redness among urban populations. Collaborations between dermatologists, national health awareness campaigns, and retailer-backed promotions are supporting adoption.

India is witnessing rapid growth in the Global Redness-Relief Skincare Market, forecast to expand at a CAGR of 15.2% through 2035, the highest worldwide. Sensitive-skin awareness campaigns, increased dermatologist visits, and rising adoption among urban middle-class households are driving demand. Affordable niacinamide and centella-based creams are gaining traction through pharmacies and e-commerce platforms, while mass retail formats are introducing entry-level products to smaller cities. Dermatology clinics are also becoming key drivers, particularly for rosacea and post-inflammatory redness management.

The Global Redness-Relief Skincare Market in China is expected to grow at a CAGR of 13.6%, among the highest globally. This momentum is driven by the dominance of niacinamide-based formulations, which already account for 36.1% of actives in 2025, and the rapid adoption of sensitive-skin skincare via e-commerce. Urban consumers face rising cases of redness from pollution, climate stressors, and lifestyle factors, fueling demand for dermatologist-endorsed and clinically proven products. Domestic brands are innovating with centellaasiatica and green tea polyphenol–based formulations, offering competitive pricing compared to imported dermocosmetic leaders.

| Country | 2025 Share (%) |

|---|---|

| USA | 18.6% |

| China | 9.5% |

| Japan | 5.5% |

| Germany | 12.2% |

| UK | 6.4% |

| India | 3.9% |

| Europe | 17.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 16.5% |

| China | 10.2% |

| Japan | 6.7% |

| Germany | 10.7% |

| UK | 5.8% |

| India | 4.7% |

| Europe | 16.0% |

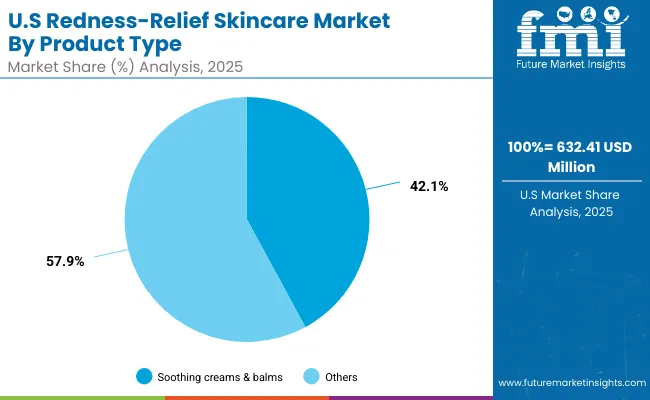

| USA By Product Type | Value Share % 2025 |

|---|---|

| Soothing creams & balms | 42.1% |

| Others | 57.9% |

The Global Redness-Relief Skincare Market in the United States is projected at USD 632.41 million in 2025. Soothing creams & balms contribute 42.1% (USD 266.24 million), while other product types including serums, gel-based moisturizers, and thermal spring water sprays hold 57.9% (USD 366.17 million). This clear dominance of multi-format categories reflects the diverse product landscape in the USA, where consumer preferences are shaped by both dermatologist recommendations and digital-first brand strategies. Serums, in particular, are gaining share as younger consumers demand lightweight textures and concentrated actives.

The USA market is heavily influenced by prescription-driven dermocosmetic adoption, with rosacea care remaining the leading demand driver. Growing use of digital consultations and e-pharmacy platforms is also catalyzing sales, offering consumers easier access to clinical-grade skincare. Brands are integrating barrier-repair ingredients with redness-relief actives to create multifunctional products that cater to evolving needs. As a result, the USA market will continue its steady growth trajectory, supported by dermatology-backed trust and expanding digital retail penetration.

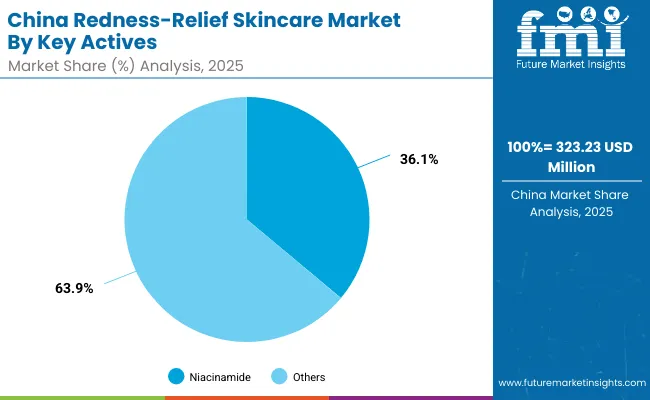

| China By Key Actives | Value Share % 2025 |

|---|---|

| Niacinamide | 36.1% |

| Others | 63.9% |

The Global Redness-Relief Skincare Market in China is valued at USD 323.23 million in 2025, with niacinamide leading at 36.1% (USD 116.69 million), followed by other actives at 63.9% (USD 206.54 million). The dominance of niacinamide is a direct outcome of its popularity in the Chinese skincare landscape, where it is recognized as a multi-functional ingredient addressing both redness and overall skin barrier repair. The affordability and wide availability of niacinamide-driven formulations across e-commerce platforms have further accelerated adoption.

China’s rapid market growth is fueled by urban consumers facing increasing environmental irritation from pollution and climate stressors. Domestic brands are leveraging green tea polyphenols and centellaasiatica to compete with global dermocosmetic leaders, offering cost-effective alternatives. E-commerce ecosystems such as Tmall and JD.com provide the primary channel for consumer education and product trials, reinforcing digital-first adoption. With CAGR at 13.6%, China represents one of the most promising markets globally, with high momentum in both premium and mass segments.

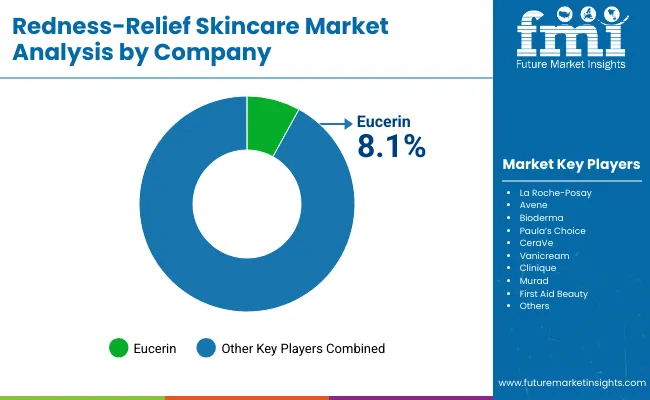

| Company | Global Value Share 2025 |

|---|---|

| Eucerin | 8.1% |

| Others | 91.9% |

The Global Redness-Relief Skincare Market is moderately fragmented, with European dermocosmetic leaders, USA-based clinical skincare brands, and emerging Asian innovators competing across diverse product formats. Eucerin leads globally with 8.1% market share in 2025, supported by its strong pharmacy distribution network and trusted dermatologist-backed formulations. Brands such as La Roche-Posay, Avene, and Bioderma consolidate their dominance in Europe by focusing on rosacea-specific and sensitive-skin ranges.

USA players including CeraVe, Clinique, Murad, and First Aid Beauty are expanding through digital-first strategies, offering hybrid regimens that combine anti-redness care with hydration and anti-aging benefits. Asian brands are increasingly competitive, with China favoringniacinamide-led formulations and Japan pushing innovation in premium thermal spring sprays. Competitive differentiation is shifting from single-function soothing balms toward multi-benefit formulations, ingredient-led positioning, and AI-driven digital retail ecosystems. The market is expected to remain highly dynamic as dermatologist trust, affordability, and digital engagement define brand leadership.

Key Developments in Global Redness-Relief Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Soothing creams & balms, Serums, Gel-based moisturizers, Thermal spring water sprays |

| Key Actives | Niacinamide , Centella asiatica , Azelaic acid, Green tea polyphenols, Allantoin |

| Skin Concern | Rosacea, Post-inflammatory redness, Environmental irritation, Sensitive skin redness |

| Channel | Pharmacies & drugstores, E-commerce, Dermatology clinics, Specialty beauty retail, Mass retail |

| End User | Adults, Women, Men, Sensitive-skin prone |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, China, India, United Kingdom, Germany, Japan |

| Key Companies Profiled | Eucerin , La Roche- Posay , Avene , Bioderma , Paula’s Choice, CeraVe , Vanicream , Clinique, Murad, First Aid Beauty |

| Additional Attributes | Dollar sales by product type and active ingredient, adoption trends in rosacea care and sensitive-skin solutions, rising demand for niacinamide and centella -based formulations, sector-specific growth in pharmacies and e-commerce, clinical validation and dermatologist endorsements driving adoption, integration of AI-driven digital consultations, regional trends influenced by pollution-linked irritation, and innovations in multi-benefit redness-relief products. |

The Global Redness-Relief Skincare Market is estimated to be valued at USD 3,402.1 million in 2025.

The market size for the Global Redness-Relief Skincare Market is projected to reach USD 7,802.1 million by 2035.

The Global Redness-Relief Skincare Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The key product types in the Global Redness-Relief Skincare Market are soothing creams & balms, serums, gel-based moisturizers, and thermal spring water sprays.

In terms of product type, soothing creams & balms are set to command 45.2% share (USD 1,537.75 million) of the Global Redness-Relief Skincare Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA