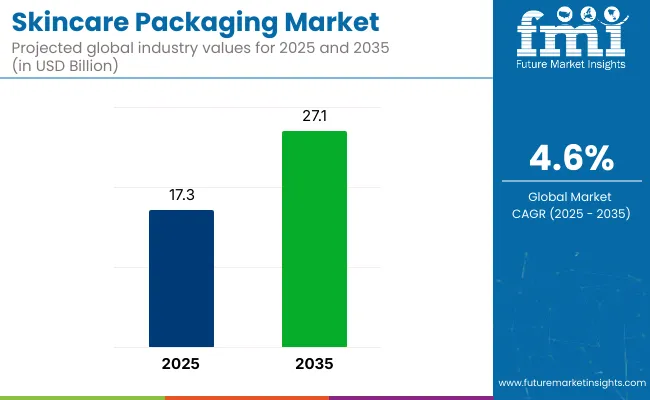

The skincare packaging market is projected to grow from USD 17.3 billion in 2025 to USD 27.1 billion by 2035, registering a CAGR of 4.6% during the forecast period. Sales in 2024 reached USD 16.5 billion. Increased consumer focus on personal care routines, growing demand for hygienic, functional, and aesthetically appealing containers, and a rising preference for sustainable cosmetic packaging are fueling growth.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 17.3 billion |

| Projected Market Size in 2035 | USD 27.1 billion |

| CAGR (2025 to 2035) | 4.6% |

Adoption of refillable systems and smart packaging innovations by leading skincare brands has contributed further to the upward trajectory. Preference for airless pumps, recyclable tubes, and biodegradable jars in both mass and premium categories has reinforced demand globally.

In June 2025, Aptar Beauty, a global leader in dispensing systems for the fragrance and cosmetics markets, celebrates the 60th anniversary of its site in Normandy, France. Aptar Beauty is taking actions to reduce its environmental footprint by promoting energy transition. Integrating Post-Consumer Recycled (PCR) materials into packaging.

“Within five years, Aptar’s Normandy platform aims to become a global benchmark for our prestige fragrance and cosmetics clients in terms of innovation, quality, and service.” Jean-Noël Coninx, Normandy Operations Director, Aptar Beauty. By adding new machines, including an additional filling line and the site’s first electric molding presses.

Skincare brands are increasingly integrating sustainability into their packaging value chain through adoption of bio-based materials, mono-material systems, and PCR (post-consumer recycled) plastics. Regulatory pressures and retailer mandates are accelerating reformulations of packaging components to reduce landfill impact.

Refillable formats, material minimalism, and lifecycle-aware designs have been emphasized by leading manufacturers. Digital watermarking and smart QR labeling are also being piloted to enhance traceability and customer engagement across the skincare industry. Furthermore, the adoption of automation, enhanced traceability, and digital supply chain technologies is expected to drive greater cost-efficiency and operational resilience.

The skincare packaging market is set to benefit from the convergence of digitalization, personalization, and cutting-edge material science. Brands that embrace innovations such as advanced barrier coatings, compostable films, and packaging designed to create engaging, tactile experiences will gain a competitive edge.

With the rising popularity of premium skincare products in regions like Asia-Pacific and Latin America, there is a growing need for packaging solutions that reflect local tastes and involve strategic investments in regional manufacturing. These developments are shaping a dynamic landscape where adaptability, sustainability, and consumer-centric design are central to success in the skincare packaging industry.

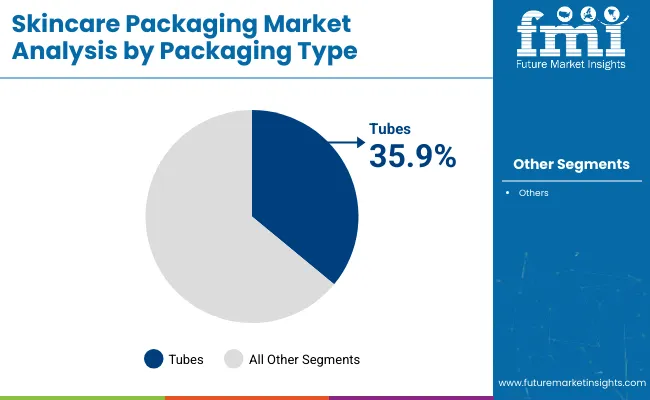

The market is segmented based on packaging type, order type, product form, application, and region. By packaging type, the segmentation includes tubes (Plastic Barrier Laminated and Aluminum Barrier Laminated), COEX tubes, bottles & jars, and flexible pouches, each selected for product integrity and convenience.

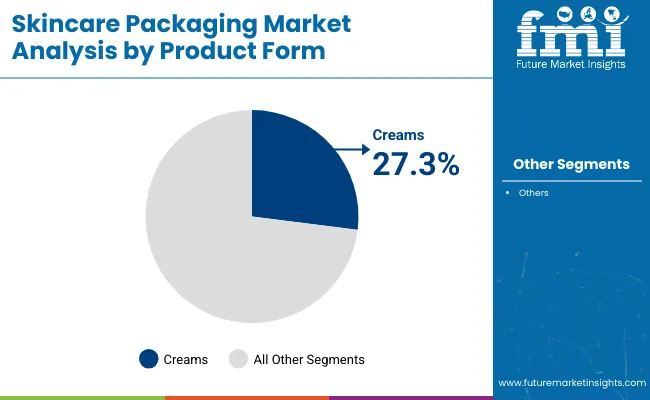

Order type is divided into OTC (Over-the-Counter) and prescription-specific jars and containers, reflecting distribution and regulatory compliance. Product forms include ointments, creams, gels and sols, and liquids differentiated based on viscosity and dosing requirements.

Applications span cleansers & toners, moisturizers, sunscreens, and serums & tonics, with packaging tailored to preserve efficacy and ensure consumer-friendly dispensing. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Tubes are projected to hold a 35.9% share of the skincare packaging market by 2025. Plastic Barrier Laminated (PBL) and Aluminum Barrier Laminated (ABL) tubes have been favored for their lightweight structure and excellent barrier protection. Airless dispensing tubes have been increasingly used to prevent oxidation of sensitive skincare ingredients.

Compact sizes and controlled dispensing have made tubes suitable for daily use products. Multilayer laminates have been utilized to preserve product efficacy and extend shelf life. PBL tubes have been selected over aluminum formats for improved recyclability in eco-conscious product lines. High-definition printing and decorative foil stamping have been applied to enhance shelf appeal. Customization in cap types and applicator tips has been offered by packaging suppliers for brand differentiation.

COEX tubes have been introduced for products requiring enhanced chemical resistance and viscosity control. Flexible shoulder designs and matte finishes have been adopted to meet premium brand aesthetics. Anti-microbial inner layers have been incorporated into select product lines. Sustainable alternatives using bio-based or recycled resins have been launched by major packaging converters.

High-speed filling compatibility and lower per-unit cost have supported their use in mass-market and derma-cosmetic lines. Tamper-evident closures and seal linings have been deployed to ensure safety. Hybrid formats combining tube and pouch characteristics have entered niche markets. With increasing demand for personalization and sustainability, tube formats are expected to remain dominant in skincare packaging.

Creams are expected to command 27.3% of the skincare product form packaging market by 2025. Their thicker consistency and widespread use in moisturizers, anti-aging products, and SPF formulations have supported strong demand. Packaging formats for creams have included tubes, jars, and airless pump bottles. Shelf-stable barrier protection has been prioritized for creams containing active ingredients.

Demand for facial and hand creams has been driven by personal care routines and rising awareness around skin hydration. Single-dose sachets and travel-size tubes have been used for promotional packaging and on-the-go convenience. Dermatologist-recommended brands have selected clinical-grade containers with minimal oxygen ingress. Packaging designs have emphasized hygiene, controlled dispensing, and aesthetic branding.

Premium creams have been offered in glass or acrylic jars with protective inner lids and spatulas. Refills and recyclable container programs have been introduced by luxury skincare brands. Tamper-proof seals and smart labels have been implemented to assure quality and build consumer trust. Custom-shaped containers have been favored to improve grip and application ease.

Multi-functional creams with SPF, brightening agents, and vitamins have been packed in hybrid pump-jars. Usage patterns for night creams and eye creams have dictated container size and material selection. Temperature-sensitive products have been developed with thermochromics indicators on outer packaging. Growth is expected to continue as functional, clean-label, and derma-grade creams gain traction globally.

| Price (USD) (2022 to 2025) | Explanation |

|---|---|

| USD 0.10 - USD 0.50 per unit | The pandemic drives a surging need for skincare products further influencing the need for packaging. However, the global supply chain disruption triggers costs for materials and production. |

| USD 0.12 - USD 0.55 per unit | As economies began to recover, demand for sustainable packaging options (e.g., recyclable, biodegradable) surged, causing slight increases in the price range. Increased material costs (especially plastics) were noted |

| USD 0.15 - USD 0.60 per unit | With rising environmental awareness, premium and eco-friendly packaging options gained popularity, pushing costs up further. Inflation in material costs and logistics challenges continued to affect prices. |

| USD 0.18 - USD 0.65 per unit | Prices continued to rise due to inflation and growing demand for custom packaging and innovative designs. Regulatory requirements for sustainability also started impacting costs. |

| USD 0.20 - USD 0.70 per unit | The market sees a continued focus on sustainable practices. Price pressure from material suppliers and labour shortages affect overall costs. Technological advancements like smart packaging may introduce premium pricing. |

| USD 0.22 - USD 0.75 per unit | Packaging design and materials are expected to be more advanced, with a focus on convenience and eco-friendliness. Prices continue to increase due to high demand for personalized and high-quality packaging. |

Future Market Insights identifies sustainability, consumer awareness, rise in online shopping and personalization as major drivers. In addition, the challenges include growing costs of raw materials, and supply chain disruptions. Here are some highlights:

Enhanced Consumer Awareness and Sustainable Packaging Influences Growth

Enlightened consumers on the benefits of skincare are more demanding of skincare products that are high-performing and aesthetically appealing, accompanied by packaging that emphasizes efficacy. There is a trend towards sustainable packaging options. Increased purchasing of brands that focus on sustainability, hence the demand for recycling or biodegradable packaging.

Growth in Online Shopping and Personalization is Highly Evident

The insatiable hunger for online shopping has expanded the world of Skincare products. Attractive and functional-driven packaging is vital for online sales since it makes the unboxing experience more appealing to consumers and enables them to make purchase decisions.

As the market is tilting towards personalized solutions for skincare it needs to have tailored packaging catered suitably to meet individual consumer needs for packaging under this trend.

Rising Cost of Materials Inhibits Demand

The cost of raw materials such as plastic, glass, and metals are growing steadily. For eco-friendly packaging, it often requires new types of materials such as biodegradable plastics which can be significantly higher.

Supply Chain Disruptions to Create Sustainability Challenges

Global supply-chain disruptions such as raw material shortages, transportation delays, and inflation affects packaging production costs and timelines. Brands face longer lead times and higher production costs.

Sustainability and Eco-friendly Packaging

With increasing consumer focus on environmental protection, brands are adopting sustainable materials for better protection of the environment. Examples range from biodegradable, recyclable, and refillable packaging, among others.

Examples embrace brands like Lush and Kiehl, who introduced stations for refilling and reuse, together with packaging from recycled materials. Aveda uses 100 percent recycled plastics in its packaging.

Minimalistic and Clean Design

There is a fast-growing trend of minimalist packaging, which focuses on clean aesthetics and simplicity. This trend reflects the trend toward organic and natural skincare products. For example, the popular skincare brand The Ordinary uses simple, transparent bottles with clear labels to highlight the authenticity and purity of its product.

Popularity of Airless Packaging

Airless pumps are becoming more popular in skincare packaging because they preserve product freshness by preventing air from contaminating the formula. Leading examples include La Mer and other luxury skincare brands, which use airless pumps to protect their sensitive formulas from oxidation, which extends shelf life and ensures constant product performance.

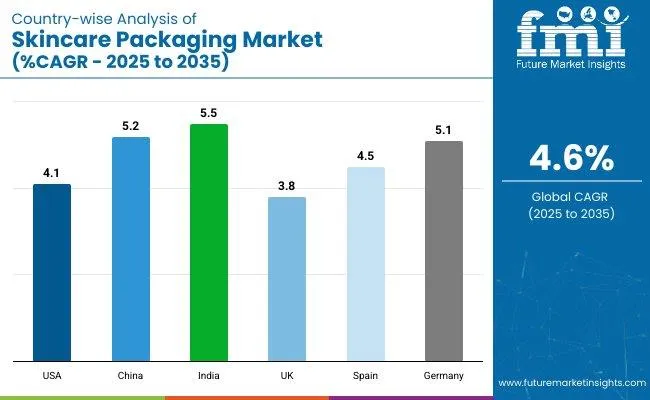

| Countries | CAGR |

|---|---|

| USA | 4.1% |

| China | 5.2% |

| India | 5.5% |

| UK | 3.8% |

| Spain | 4.5% |

| Germany | 5.1% |

The USA skincare product packaging market is expected to grow at a CAGR of 4.1%, driven by several key factors. The increase in consumer awareness highlights the significance of packaging and ensures product integrity and efficacy. Increased demand for sustainable packaging options enables brands to use eco-friendly materials. Different skincare creams, serums, and masks have distinct packaging requirements.

E-commerce has also grown in size and significance bringing in a further demand for product-safe transit packages that improve the unboxing experience. Technological advances such as airless pumps and smart packaging also increase customer attraction, further boosting the overall market growth.

The skincare packaging market in China is likely to grow at a CAGR of 5.2% driven by several factors that point to the dynamic beauty industry. Rapid urbanization and rise in middle-income groups influences consumer interest in skincare products, where increasingly inclusive forms of packaging appeal to the popularly conscious younger generation.

The demand for sustainable and eco-friendly packaging is increasing as consumers are eco-conscious. The rapid growth of e-commerce in China accelerates the need for packaging that ensures product safety during shipping and enhances overall customer experience. In addition, advances in packaging technology, such as smart packaging and user-friendly designs are gaining attention and driving market expansion in this competitive landscape.

In India, several key trends developing in the beauty and personal care sector have been driving the growth of the skincare product packaging market. The growth is projected at a CAGR of 5.5% by 2035. The demand for a wide range of products catering to various customer requirements is gaining traction due to the rise in disposable incomes and awareness about the significance of skin health.

Growth in e-commerce has hugely affected the industry as online products require packaging that ensures product safety. Moreover, the preference for sustainable packaging options is on the rise due to consumer concern for environmental issues. The technological advancement in packaging, such as airless dispensers and biodegradable materials support the market growth.

Due to the shift in consumer preferences, the UK skincare product packaging market is estimated to grow at a CAGR of 3.8% by 2035. Awareness for skin products, increasing premiums related to the aspect, and the desire to invest in high-quality packaging makes the products more appealing to the consumer. The need for eco-friendly, sustainable packaging solutions is emerging, followed with the consumer concerns for sustainability.

The Spain skincare packaging market is experiencing steady growth, with a CAGR of 4.5% by 2035. This growth is driven by an increasing demand for skincare products, innovations in packaging design, and the rising preference for eco-friendly, sustainable packaging solutions. As consumer awareness about environmental issues grows, brands are increasingly opting for materials that are recyclable, biodegradable, or made from renewable resources.

Driven by a shift in consumer preferences, the German skincare packaging market is projected to grow at a CAGR of 5.1% by 2035. Increased consumer awareness of skincare products, along with a growing demand for premium packaging that enhances product appeal, is fueling this growth.

The rising emphasis on high-quality packaging, combined with consumers' growing desire for sustainability, has led to a surge in demand for eco-friendly and recyclable packaging solutions. As consumers become more environmentally conscious, brands are prioritizing sustainable practices, making eco-conscious packaging an essential factor in the market's evolution.

The skincare packaging industry is quite fragmented. This includes multinationals, and innovative start-ups. The fragmentary nature is driven by the diverse needs of the skincare brands in terms of different product types and consumer preferences toward sustainability.

Major players such as Amcor, Berry Global, and Albea dominate the market, but new brands are emerging to create niches through eco-friendly packaging solutions. Companies are investing heavily in research and development to create innovative packaging, including airless pumps and smart designs to enhance user experience and product differentiation.

Demand for eco-friendly packaging indicating upward trend has resulted in brands selecting recyclable and biodegradable materials to support eco-friendly initiatives.

E-commerce packaging contributes as a secure, aesthetically appealing design that remains intact in transportation. Overall, companies that successfully combine aesthetics, functionality, and sustainability are well-positioned to thrive in the competitive and ever-changing landscape.

| Company | Area of Focus |

|---|---|

| EcoEnclose | Providing biodegradable and recyclable packaging options. |

| Lush | Offering products without traditional packaging to reduce waste. |

| Packlane | Create custom packaging designs that reflect their identity, enabling a unique unboxing experience for consumers. |

| Smartrac | Art packaging technologies that incorporate QR codes and NFC tags. |

| Loop | Packaging systems that encourage consumers to return used containers for refills, promoting a zero-waste approach. |

| Haeckels | Minimalistic and visually appealing designs that attract eco-conscious consumers, blending aesthetics with sustainability. |

| Aptar | Known for its functional packaging solutions that enhance user experience, such as pumps and dispensers tailored for skincare products. |

The market is predicted to reach a size of USD 27.1 billion by 2035.

The market is estimated to reach USD 17.3 billion in 2025.

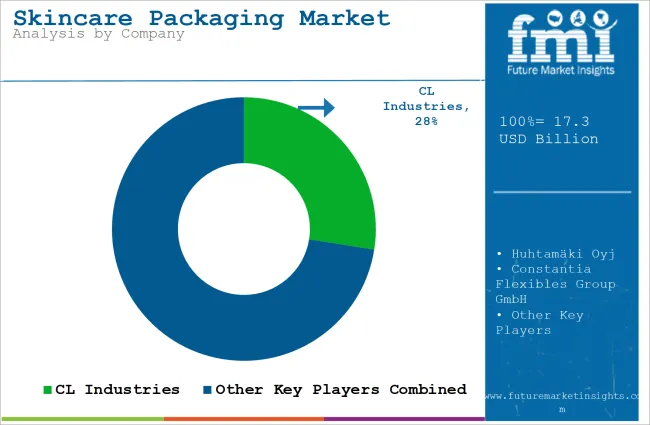

The prominent companies in the market include CL Industries, Huhtamäki Oyj, Constantia Flexibles Group GmbH, Mondi Plc, Uflex Ltd, Coveris Holdings S.A, AptarGroup, Inc., Proampac LLC, Gerresheimer Ag, Epl Limited.

The USA is a key hub for product manufacturers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA