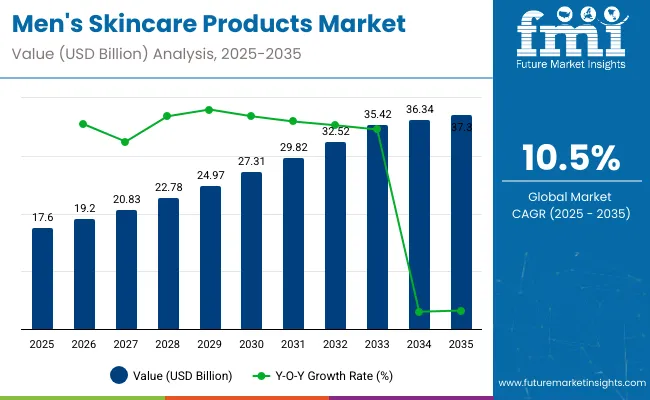

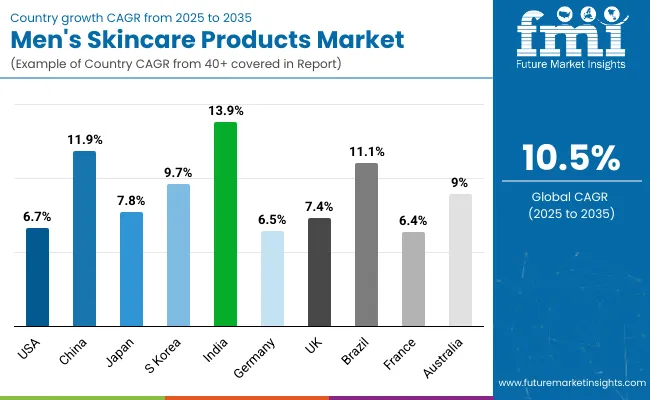

The men’s skincare products market is projected to grow from USD 17.6 billion in 2025 to USD 37.3 billion by 2035, reflecting a CAGR of 10.5%. Among global markets, the United States stands out as the most lucrative, holding the largest share in terms of revenue due to strong grooming culture and high per capita skincare spending. However, India is expected to be the fastest-growing market, recording a stellar CAGR of 13.9% over the same period, driven by increasing urbanization, youth population, and expanding e-commerce access across Tier 2 and Tier 3 cities.

This robust growth trajectory is supported by multiple tailwinds. Increasing awareness among men regarding skincare routines, rising disposable incomes in emerging economies, and changing cultural perceptions around male grooming are driving demand. Regulatory backing such as safety endorsements of ingredients like niacinamide and hyaluronic acid has encouraged product innovation and consumer trust.

In parallel, evolving retail dynamics are shaping purchase behavior, with facial cleansers, moisturizers, and sunscreens seeing high uptake through direct-to-consumer (DTC) models and online-first platforms. Digital engagement, such as AI-powered skin analysis, and product transparency via QR-coded packaging, are reshaping how men interact with brands. The rise of clean-label claims and minimalist skincare routines is further influencing brand strategies across mass and premium segments.

Looking ahead, the market is poised for further disruption through personalized, multi-functional, and skin-type-adapted formulations. Key players are expected to focus on combining efficacy with sustainability and ingredient traceability to meet evolving consumer expectations.

The Asia-Pacific region will emerge as the epicenter of growth, fueled by increasing product penetration in South Korea, India, and China. By 2035, online channels are projected to contribute nearly 50% of all global sales, highlighting the growing importance of omnichannel innovation, influencer-led marketing, and digital brand storytelling in scaling long-term brand equity and consumer loyalty.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 17.6 billion |

| Projected Value (2035F) | USD 37.3 billion |

| Value-based CAGR (2025 to 2035) | 10.5% |

Per capita spending on men’s skincare products has been rising globally, reflecting changing attitudes toward male grooming and self-care. This shift is especially pronounced in urban areas, where exposure to global beauty trends, digital marketing, and increased product availability are influencing consumer behavior. While developed countries lead in both product penetration and spending, emerging economies are quickly catching up.

Exporting nations benefit from strong cosmetics industries and well-established brands that appeal to international consumers. These countries produce a wide range of products, from luxury items to innovative grooming solutions. Meanwhile, importing countries are often those with growing markets, rising male consumer awareness, and increasing demand for premium skincare options.

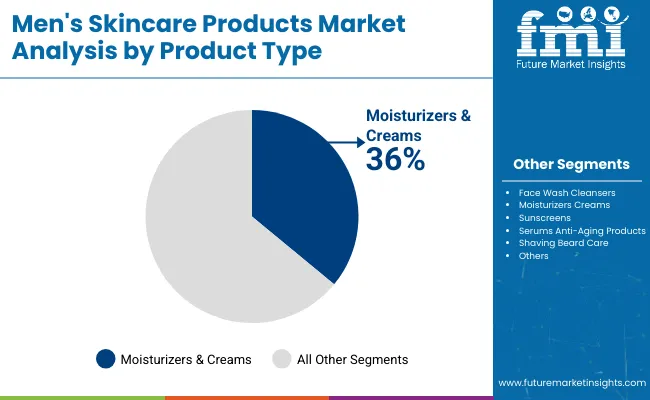

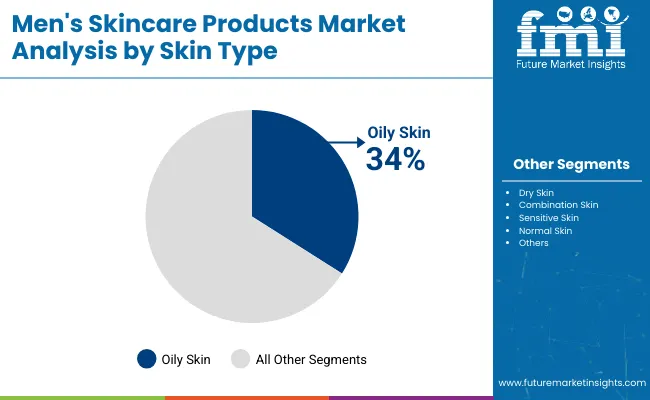

By product type, the men’s skincare products market includes face wash & cleansers, moisturizers & creams, sunscreens, and others, which comprise serums, eye creams, face scrubs, toners, aftershave balms, anti-fatigue gels, and blemish-correcting treatments. By skin type, segments include oily skin, dry skin, combination skin, and others, such as sensitive skin, aging skin, acne-prone skin, and blemish-prone skin categories, often requiring hypoallergenic or specialized formulations.

By sales channel, the market is segmented into supermarkets/hypermarkets, specialty stores, online, and others, which include pharmacies, salons, departmental stores, and direct-to-consumer (DTC) pop-up outlets. By region, the market is assessed across North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Moisturizers & creams are poised to lead the next growth cycle in the men’s skincare products market, registering a CAGR of 9.4%. This surge is primarily driven by the rising adoption of anti-aging and hydrating solutions among Gen Z and millennial consumers. Face wash & cleansers are the second-fastest growing segment, fueled by increasing urban pollution levels and routine grooming habits. Sunscreens are witnessing strong traction, with heightened consumer awareness around SPF benefits and broader application in tropical regions.

Meanwhile, the others category which includes serums, eye creams, toners, and scrubs is expected to grow modestly. Limited consumer education and lower usage frequency continue to constrain these niche segments, despite their popularity in premium skincare lines. However, targeted product innovations and influencer-led marketing campaigns are slowly driving interest in these specialized formats. Brands investing in multi-functional, clean-label formulations may unlock additional demand, particularly in the urban premium segment.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Moisturizers & Creams | 9.4% |

Oily skin is the most lucrative segment, expected to command over 34% market share in 2025 and a CAGR of 9.4% through 2035. Oily skin is positioned to lead the next phase of expansion in the men’s skincare products market, driven by climate-induced sebum activity in tropical economies and the prevalence of acne-prone skin among urban youth. The segment is undergoing a shift from generic oil-control solutions to specialized formulations such as mattifying gels, non-comedogenic moisturizers, and niacinamide-rich cleansers tailored for high-frequency usage.

Combination skin represents the second tier of opportunity, benefiting from dual-action routines and hybrid formulations that address dry and oily zones simultaneously. Dry skin, while essential in colder geographies, exhibits relatively slower growth due to longer product life cycles and lower daily usage. The others segment, which includes sensitive and aging skin types, remains constrained by limited consumer awareness and higher price elasticity.

| Skin Type Segment | Market Share (2025) |

|---|---|

| Oily Skin | 34% |

Online channels are emerging as the most dynamic sales avenue in the men’s skincare products market, projected to register the fastest CAGR of 11.6% between 2025 and 2035. This surge is fueled by rising smartphone penetration, D2C brand strategies, and AI-powered personalization tools that enhance the online buying experience. Specialty stores remain a strong growth corridor, supported by in-store consultations, curated product displays, and premium dermatology-backed offerings.

Supermarkets and hypermarkets, while maintaining the highest share in 2025, are expected to grow more gradually with value-focused sales and FMCG bundling playing key roles. The others channel which includes pharmacies, salons, and departmental stores is projected to grow moderately, driven by localized retail formats and exclusive product tie-ins. Increasing omnichannel integration and experiential retail are likely to shape future sales strategies across all formats. Additionally, flash sales, influencer collaborations, and subscription models are boosting customer retention online. Brands are also leveraging data-driven insights to tailor promotions by region and consumer segment.

| Sales Channel Segment | CAGR (2025 to 2035) |

|---|---|

| Online | 11.6% |

The United States dominates the men’s skincare products industry, accounting for the largest revenue share globally. Valued at USD 4.65 billion in 2025, the USA industry is projected to reach USD 8.95 billion by 2035, reflecting a CAGR of 6.7%.

The cultural normalization of male grooming routines has accelerated, driven by Gen Z and millennial cohorts prioritizing skincare in daily hygiene. Second, product diversification in facial cleansers, SPF moisturizers, and post-shave serums is reshaping shelf-space in both drugstore and online retail.

Regulatory pressure by the USA FDA and FTC on ingredient labeling and anti-wrinkle claims has improved transparency, enhancing consumer trust and conversion rates. Third, omnichannel penetration across platforms such as Amazon, Ulta, and Walmart ensures wide product accessibility and brand exposure. Private-label expansion and celebrity-driven DTC campaigns (e.g., Humanrace by Pharrell) are attracting new buyers and increasing trial volumes.

However, industry saturation and high brand churn pose risks, particularly in the premium segment where switching costs are low. Profit pools remain favorable due to low per-unit CoGS and bundling strategies across shaving, fragrance, and skincare lines. On balance, USA growth will remain steady, with product education and dermatological trust as key competitive differentiators.

| Country | CAGR 2025 to 2035 |

|---|---|

| United States | 6.70% |

China is the highest-growth engine in the men’s skincare products industry, beginning at USD 2.85 billion in 2025 and expected to surge to USD 8.95 billion by 2035, achieving a CAGR of 11.9%. Three levers are powering this expansion.

First, normalization of skincare among male consumers is rising across Tier 1 and Tier 2 cities, supported by influencer-driven campaigns on platforms such as Douyin and Xiaohongshu. Second, regulatory support from China’s National Medical Products Administration (NMPA) has bolstered consumer confidence through stronger testing and labeling standards, especially around SPF and whitening claims.

Third, international and domestic brands are rapidly expanding through digital commerce and social selling. L'Oréal, Inoherb, and Pechoin have each scaled omnichannel penetration while offering hyper-localized SKUs tailored for oily, acne-prone, and pollution-affected skin-characteristics prevalent in urban Chinese males.

The younger male demographic, aged 18-30, accounts for 58% of volume share, with moisturizers and tone-correcting serums topping repeat purchase metrics. However, pricing pressures remain a watch item due to fierce promotional competition on e-commerce platforms.

Despite this, China will continue to command disproportionate share of global value creation and volume growth, with product education, AI-based skin diagnostics, and cross-border trade agreements enhancing accessibility and scale.

| Country | CAGR 2025 to 2035 |

|---|---|

| China | 11.90% |

Japan’s men’s skincare industry is forecast to expand from USD 1.58 billion in 2025 to USD 3.35 billion by 2035, reflecting a CAGR of 7.8%. Cultural emphasis on personal grooming, driven by workplace aesthetics and societal standards, provides structural support to skincare adoption. Shiseido, Kanebo, and Rohto dominate legacy brand presence, while K-beauty crossovers and minimalist routines are trending among younger consumers.

Regulatory consistency under Japan’s Ministry of Health, Labour and Welfare ensures stable product approvals and allergen labeling-a key enabler for sensitive-skin formulations. Moisturizers and multi-use serums hold the largest share, with rising preference for paraben-free and non-alcoholic bases.

Distribution remains retail-heavy with drugstores such as Matsumoto Kiyoshi and Aeon sustaining scale. However, online growth is catching up via Rakuten and Amazon Japan, especially for imported and niche premium brands. Male consumers in their 30s and 40s are driving demand for anti-aging and skin-tone balancing products.

While overall volume growth is moderate, Japan’s high per-unit spend ensures profitable outcomes. The country’s role as an R&D and formulation leader, especially in biotechnology-based skincare, continues to influence regional product development across East Asia.

| Country | CAGR 2025 to 2035 |

|---|---|

| Japan | 7.80% |

South Korea’s men’s skincare industry is expected to grow from USD 1.26 billion in 2025 to USD 3.15 billion by 2035, delivering a CAGR of 9.7%. Globally regarded as the benchmark for skincare innovation, South Korea benefits from deep consumer sophistication and high male grooming penetration.

The Ministry of Food and Drug Safety’s streamlined approvals for cosmeceuticals have encouraged rapid innovation, particularly in BB creams, tone-up moisturizers, and peptide serums. Men aged 20-40 exhibit daily regimen loyalty, often using four or more skincare steps. Online-first channels such as Coupang and Olive Young drive volume, but physical outlets continue to offer tactile sampling advantages.

New growth is surfacing in functional skincare-especially anti-blue light and prebiotic-infused formats. However, industry fragmentation and short innovation cycles pressure brand stickiness and unit economics. Still, South Korea remains among the most lucrative premium skincare environments globally, with high-value consumption per user and regional influence across ASEAN and China.

| Country | CAGR 2025 to 2035 |

|---|---|

| South Korea | 9.70% |

India is positioned as the breakout volume growth industry, expanding from USD 0.96 billion in 2025 to USD 3.65 billion by 2035-clocking a CAGR of 13.9%. Rising urbanization, higher disposable income, and a generational shift in grooming habits underpin structural tailwinds.

FMCG giants like Emami, Himalaya, and ITC have led the charge in tiered pricing and Ayurvedic product innovation, while D2C disruptors such as The Man Company and Beardo are gaining millennial traction. Regulatory support through India’s Bureau of Indian Standards and Food Safety and Standards Authority (FSSAI) has clarified ingredient transparency, especially around herbal actives. Face washes, anti-pollution creams, and oil-control formulations dominate, aligning with environmental and skin-type needs.

E-commerce and quick commerce platforms-like Nykaa, Blinkit, and Amazon India-are vital for reach, particularly in Tier 2 and Tier 3 cities. Price sensitivity remains a barrier for premium penetration, though value-driven combo packs and influencer-based conversions are lifting ticket sizes. With over 600 million male consumers under age 35, India will contribute the largest absolute volume growth of any industry.

| Country | CAGR 2025 to 2035 |

|---|---|

| India | 13.90% |

Germany’s men’s skincare products market is projected to expand from USD 1.10 billion in 2025 to USD 2.05 billion by 2035, registering a CAGR of 6.5%. Germany’s highly regulated cosmetics industry-guided by the Federal Office of Consumer Protection and Food Safety-ensures rigorous standards on formulation safety and environmental labeling.

Clean-label demand has intensified, with paraben-free, cruelty-free, and vegan-certified products gaining shelf dominance. Drugstore chains such as dm, Rossmann, and Müller serve as primary distribution nodes, offering both national and private-label SKUs. Moisturizers and facial cleansers lead demand, with seasonal usage spikes for SPF and hydration creams during summer and winter.

Consumer awareness campaigns on sun damage and pollution effects have aided trial across age brackets. However, price elasticity remains high, particularly in the under-30 demographic. Cross-border e-commerce remains underdeveloped due to language and compliance barriers, limiting international brand penetration. Despite this, Germany remains the most valuable men’s skincare industry in continental Europe, supported by stable consumption and rising dermatological awareness.

| Country | CAGR 2025 to 2035 |

|---|---|

| Germany | 6.50% |

The United Kingdom’s men’s skincare products market is forecast to rise from USD 1.02 billion in 2025 to USD 2.10 billion by 2035, reflecting a CAGR of 7.4%. Demand is underpinned by a growing cultural shift toward self-care and grooming, accelerated by post-pandemic wellness trends and digital beauty campaigns. Regulatory clarity from the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) has eased compliance for both domestic and imported brands.

The industry is led by players such as Bulldog Skincare, Nivea Men, and L’Oréal Men Expert, which dominate the mass-premium aisle in Tesco, Boots, and Sainsbury’s. Clean, cruelty-free, and recyclable packaging features are increasingly influencing consumer decisions. Online channels account for approximately 30% of revenue, with high-margin sales driven by content-rich e-commerce platforms.

Anti-aging, hydration, and SPF-based moisturizers have seen notable traction among men aged 30-55. However, economic uncertainty and inflationary pressures could compress consumer spending on non-essential grooming. Despite this, brand loyalty and skin-specific awareness among UK males remain comparatively high, sustaining long-term volume stability and profitability for mass and dermocosmetic players.

| Country | CAGR 2025 to 2035 |

|---|---|

| United Kingdom | 7.40% |

Brazil’s men’s skincare products market is projected to grow from USD 0.85 billion in 2025 to USD 2.45 billion by 2035, achieving a CAGR of 11.1%. Demand is anchored by climate-driven skincare needs, especially for oil control and UV protection in tropical zones.

Local FMCG players such as Natura &Co, Boticário, and multinational entrants like Unilever and Nivea dominate with regional formulations that align with skin tone, humidity, and cultural grooming practices. The National Health Surveillance Agency (ANVISA) has enhanced cosmetic product monitoring, boosting consumer confidence.

Retail expansion in drugstore chains like RaiaDrogasil, along with digital channel growth via Americanas and Mercado Livre, is driving multi-regional accessibility. Male grooming is increasingly normalized, with 42% of men aged 18-35 using moisturizers weekly, up from 28% in 2020.

However, price sensitivity and informal competition from low-cost imports temper the premium segment. Brazil remains one of the few large-volume industrys with headroom for both consumption growth and innovation scale.

| Country | CAGR 2025 to 2035 |

|---|---|

| Brazil | 11.1% |

France’s men’s skincare industry is projected to grow from USD 0.93 billion in 2025 to USD 1.75 billion by 2035, with a CAGR of 6.4%. The segment is defined by high dermatological awareness, ingredient scrutiny, and minimalist routines. Regulatory supervision under the French Agency for the Safety of Health Products (ANSM) ensures strict formulation and labeling norms.

French brands such as La Roche-Posay, Vichy, and Clarins Men continue to dominate pharmacy channels and specialty skincare outlets. Urban consumers are increasingly gravitating toward anti-pollution serums, sensitive-skin moisturizers, and SPF solutions.

E-commerce platforms like Sephora.fr and Amazon France support product discovery, especially among younger demographics. However, slower digital adoption among older consumers and high brand fragmentation limit velocity in middle-income segments. France remains a formulation and export hub for premium men’s skincare, with rising demand from inbound tourism and duty-free retail further stabilizing industry performance.

| Country | CAGR 2025 to 2035 |

|---|---|

| France | 6.4% |

Australia’s men’s skincare industry is forecast to grow from USD 0.77 billion in 2025 to USD 1.80 billion by 2035, registering a CAGR of 9.0%. High sun exposure has led to broad SPF adoption among men, with suncare-moisturizer hybrids and after-sun gels dominating seasonal sales.

The Therapeutic Goods Administration (TGA) enforces strict labeling and UV efficacy standards, driving trust in functional skincare. Brands like Sukin, Natio, and Bondi Sands have localized their offerings using natural and reef-safe ingredients. Online-first channels-including Adore Beauty and Chemist Warehouse-are capturing high-value millennial and Gen Z segments, especially in metropolitan areas.

Product trials and influencer-led campaigns are reshaping brand preference across face washes, scrubs, and beard-care-integrated moisturizers. However, rural industry penetration remains low due to limited retail infrastructure and inconsistent demand. Still, Australia is positioned as a growth industry for skin health-oriented male grooming, with wellness and environmental ethics as key value drivers.

| Country | CAGR 2025 to 2035 |

|---|---|

| Australia | 9.0% |

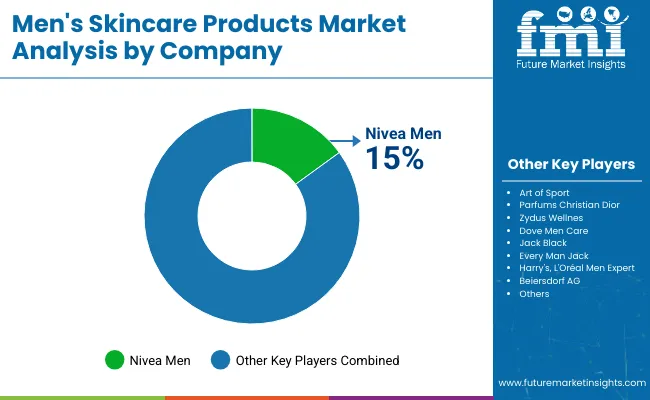

The men’s skincare market is rapidly expanding, driven by growing awareness and shifting grooming norms. Key players like Nivea Men and L’Oréal Men Expert leverage their strong global presence and wide product ranges to dominate the mass market, focusing on affordability and accessibility.

Premium brands such as Clinique for Men and Shiseido Men emphasize dermatologist-backed formulas and luxury positioning to attract urban, high-income consumers. Meanwhile, emerging direct-to-consumer (DTC) brands like Hims, Geologie, and Lumin use personalized skincare regimens and subscription models to target younger, digitally savvy audiences. Many brands also invest heavily in influencer marketing and social media engagement to boost visibility and brand loyalty.

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 17.6 billion |

| Projected Industry Size (2035) | USD 37.3 billion |

| CAGR (2025 to 2035) | 10.50% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Industry Analysis Parameters | Revenue in USD billion |

| By Product Type | Face Wash & Cleansers, Moisturizers & Creams, and Sunscreens |

| By Skin Type | Oily Skin, Dry Skin, and Combination Skin |

| By Sales | Super markets /Hyper markets, Specialty Stores, and Online. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa, Oceania, and MEA |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Art of Sport, Parfums Christian Dior, Zydus Wellness, Dove Men Care, Nivea Men, Jack Black, Every Man Jack, Harry's, L'Oréal Men Expert, and Beiersdorf AG |

| Additional Attributes | Dollar sales by value, industry share analysis by region, country-wise analysis. |

Face Wash Cleansers, Moisturizers Creams, Sunscreens, Serums Anti-Aging Products, Shaving Beard Care, and Others.

Oily Skin, Dry Skin, Combination Skin, Sensitive Skin, and Normal Skin.

Channel: Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drug Stores, Online, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East Africa (MEA).

The industry is poised to reach USD 17.6 billion in 2025.

The industry is projected to register USD 37.3 billion by 2035.

Moisturizers & creams are the most widely used products, driven by demand for hydration, anti-aging, and SPF protection.

India, slated to grow at a 13.9% CAGR during the forecast period, is poised for the fastest growth in this sector.

Key companies in the industry include L’Oréal Men Expert, Nivea Men (Beiersdorf AG), Dove Men+Care, Jack Black, Every Man Jack, Harry’s, Zydus Wellness, Art of Sport, and Parfums Christian Dior.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Source, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Source, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Source, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Source, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Source, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Source, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by Source, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Skin Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Skin Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by Source, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Skin Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 34: Global Market Attractiveness by Source, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Skin Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 70: North America Market Attractiveness by Source, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Skin Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Skin Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Skin Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Skin Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Skin Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Skin Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Skin Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Skin Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Skin Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Skin Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Skin Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Men’s Grooming Products Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA