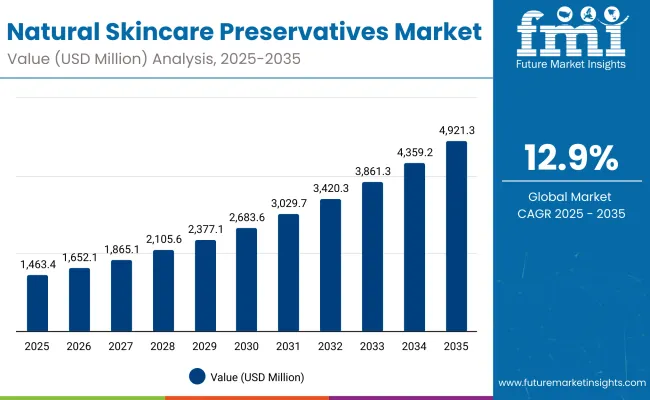

The Natural Skincare Preservatives Market is expected to record a valuation of USD 1,463.4 million in 2025 and USD 4,921.3 million in 2035, with an increase of USD 3,457.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.9% and a 3.4X increase in market size.

Natural Skincare Preservatives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,463.4 million |

| Market Forecast Value in (2035F) | USD 4,921.3 million |

| Forecast CAGR (2025 to 2035) | 12.9% |

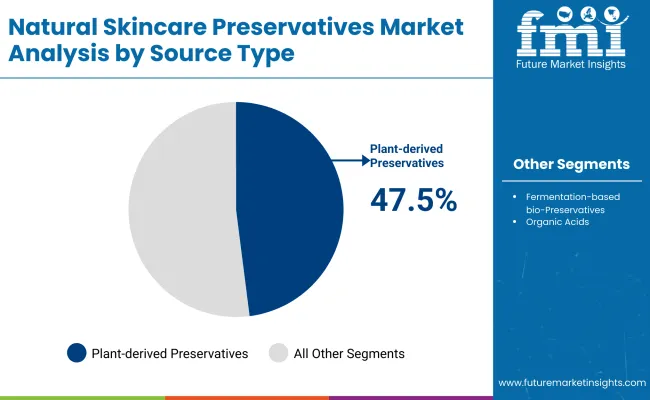

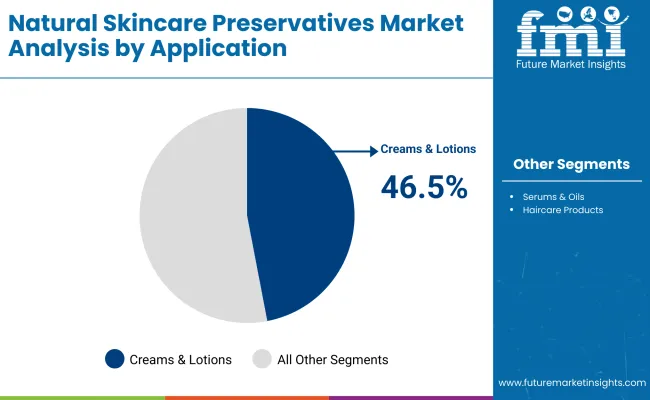

During the first five-year period from 2025 to 2030, the market increases from USD 1,463.4 million to USD 2,683.6 million, adding USD 1,220.2 million, which accounts for 35% of the total decade growth. This phase records steady adoption in creams & lotions (46.5% share) and plant-derived preservatives (47.5% share), driven by consumer demand for clean-label, botanical-based skincare.

The second half from 2030 to 2035 contributes USD 2,237.7 million, equal to 65% of total growth, as the market jumps from USD 2,683.6 million to USD 4,921.3 million. This acceleration is powered by widespread deployment of fermentation-based bio-preservatives and expansion in Asia-Pacific (China CAGR 15%, India CAGR 16.9%). Premium applications in serums, oils, and haircare products gain momentum, while ingredient suppliers strengthen B2B sales channels. By 2035, global leaders like Symrise, BASF, and Givaudan Active Beauty consolidate their share through innovation in natural and bio-preservation technologies.

From 2020 to 2024, the Natural Skincare Preservatives Market expanded steadily on the back of clean-label adoption in skincare and cosmetics, moving from a niche demand driver into a mainstream requirement across Europe and North America. During this period, the competitive landscape was fragmented, with global ingredient leaders such as Symrise, BASF, and Givaudan Active Beauty controlling a combined share of less than 15%, while the majority of revenue (over 85%) was distributed among regional and niche botanical extract suppliers. Differentiation relied heavily on ingredient purity, sourcing transparency, and regulatory compliance, while downstream cosmetic brands often treated preservatives as a secondary ingredient in formulations rather than a primary marketing lever. Service-oriented preservation solutions (e.g., customized blends, application support) contributed marginally to revenues.

Demand for Natural Skincare Preservatives will expand to USD 1,463.4 million in 2025, and the revenue mix will shift further as fermentation-based bio-preservatives and organic acids gain traction, accounting for more than half the market share. Traditional leaders face rising competition from bio-technology innovators and plant-based ingredient specialists offering eco-certifications, AI-enabled formulation insights, and clean-label positioning. Major players are pivoting to hybrid portfolios, blending plant-derived and fermentation-based solutions to maintain relevance. Emerging entrants focusing on vegan-certified, allergen-free, and personalized preservation systems are gaining visibility. The competitive advantage is moving away from scale and legacy supply chains toward sustainability credentials, innovation pipelines, and long-term brand partnerships with cosmetic manufacturers.

The acceleration of natural skincare preservatives is being propelled by stringent regulatory frameworks in North America, Europe, and Asia-Pacific mandating reduced use of synthetic parabens and formaldehyde-releasing agents. Multinational cosmetic companies are re-engineering formulations to comply with EU Cosmetic Regulation (EC) No 1223/2009 and emerging FDA guidance, positioning natural preservatives as a compliance-driven necessity rather than an optional enhancement. This regulatory push is creating a premiumization effect, enabling natural ingredient suppliers to capture margin expansion while aligning with consumer trust and safety expectations.

The market’s growth trajectory is reinforced by rapid innovation in fermentation-derived bio-preservatives, which address efficacy and stability challenges traditionally limiting plant-based extracts. Breakthroughs in microbial fermentation and controlled bioprocessing have yielded scalable, high-purity alternatives like lactobacillus-derived antimicrobials and peptide-based preservation systems. These solutions not only extend shelf-life but also deliver multifunctional benefits such as skin barrier reinforcement and antioxidant protection. The ability to reposition preservatives as active cosmeceutical enhancers creates a differentiated value proposition, encouraging brand adoption in premium skincare and haircare portfolios globally.

The market is segmented by source type, application, product form, distribution channel, and region. Source types include plant-derived preservatives (rosemary, thyme, tea tree), fermentation-based bio-preservatives, and organic acids (benzoic, sorbic, lactic), representing the core natural inputs driving adoption. Applications cover creams & lotions, serums & oils, and haircare products, reflecting the diverse end-use requirements of the cosmetics and personal care industry.

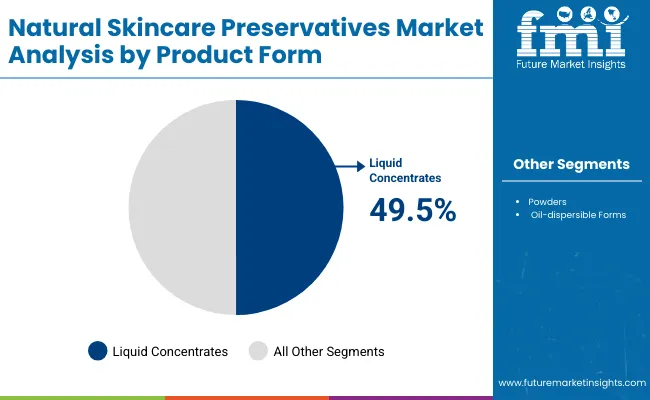

Based on product form, the segmentation includes liquid concentrates, powders, and oil-dispersible forms, tailored to meet formulation flexibility across skincare categories. Distribution channels are divided into ingredient suppliers (B2B) and cosmetic brand manufacturers (B2C), highlighting both upstream and downstream dynamics. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with significant growth led by emerging Asian markets such as China and India.

| Source Type | Value Share% 2025 |

|---|---|

| Plant-derived preservatives | 47.5% |

| Others | 52.5% |

The plant-derived preservatives segment is projected to contribute 47.5% of the Natural Skincare Preservatives Market revenue in 2025, maintaining its position as a key driver of market adoption. This leadership is underpinned by the rising consumer preference for botanical ingredients such as rosemary, thyme, and tea tree extracts, which are closely associated with clean-label and sustainable formulations in skincare.

Growth in this segment is further supported by the expansion of natural and organic cosmetic brands that emphasize transparency and allergen-free product lines. Plant-based preservatives are increasingly integrated into creams, lotions, and serums, where their natural antimicrobial and antioxidant properties enhance both efficacy and consumer appeal. As regulatory bodies tighten restrictions on synthetic preservatives, demand for botanical alternatives continues to rise. The plant-derived segment is expected to retain its strategic importance as the foundation of natural skincare preservation solutions globally.

| Application | Value Share% 2025 |

|---|---|

| Creams & lotions | 46.5% |

| Others | 53.5% |

The creams & lotions segment is forecasted to hold 46.5% of the market share in 2025, reflecting its central role in driving demand for natural skincare preservatives. This dominance is attributed to the widespread use of moisturizing and anti-aging formulations that require effective preservation to maintain product stability and extend shelf life.

Natural preservatives such as plant-derived antioxidants and fermentation-based bio-preservatives are increasingly incorporated into creams and lotions, as they align with consumer expectations for clean-label, hypoallergenic, and sustainable personal care products. The segment’s growth is also supported by premium product launches targeting hydration, anti-wrinkle, and sensitive-skin categories.

As global demand for daily-use skincare routines continues to expand, especially across Asia-Pacific and Europe, creams & lotions are expected to remain the most significant application area, ensuring consistent adoption of natural preservation solutions across both mass-market and premium skincare portfolios.

| Product Form | Value Share% 2025 |

|---|---|

| Liquid concentrates | 49.5% |

| Others | 50.5% |

The liquid concentrates segment is projected to account for 49.5% of the Natural Skincare Preservatives Market revenue in 2025, positioning it as the dominant product form. This preference stems from the ease of integration into skincare formulations, offering uniform dispersion and consistent preservative efficacy across a wide range of cosmetic products.

Liquid formats are particularly favored in creams, lotions, and serums, where stability and solubility are critical to maintaining texture and performance. Growing demand for multifunctional formulations that combine preservation with additional skin benefits, such as hydration or antioxidant support, further reinforces the segment’s importance. As cosmetic manufacturers increasingly seek scalable, easy-to-use, and formulation-friendly solutions, liquid concentrates are expected to retain their lead, while powders and oil-dispersible forms serve niche requirements. This balance ensures that the liquid form remains the backbone of natural skincare preservation strategies throughout the forecast period.

Regulatory Pressure Favoring Natural Ingredients

Regulatory tightening across major markets is compelling cosmetic manufacturers to replace synthetic parabens, phenoxyethanol, and formaldehyde donors with natural preservation systems. The European Union’s Cosmetic Regulation (EC) No 1223/2009 and increasing FDA scrutiny on synthetic agents have created compliance-led demand for plant-derived and fermentation-based preservatives. In parallel, certification bodies such as COSMOS and ECOCERT are mandating clean-label formulations, accelerating the switch. This structural shift elevates natural preservatives from a niche add-on to a baseline requirement, enabling suppliers with sustainable sourcing and traceability to secure premium pricing while gaining preferred supplier status in regulated global markets. with data cleanup, mesh generation, and format compatibility can be steep.

Consumer Demand for Clean-Label Skincare

Evolving consumer expectations around sustainability, transparency, and skin health are accelerating adoption of natural skincare preservatives. Shoppers increasingly seek products free from “chemically harsh” additives, particularly parabens, sulfates, and synthetic stabilizers. Millennials and Gen Z consumers, who dominate premium skincare purchasing, associate natural preservation systems with purity and safety. Social media influencers and wellness-driven retail positioning further amplify this trend. The result is a profound reformulation wave, with global brands embedding botanical and bio-preservatives into mainstream product lines. This clean-label movement is not only expanding market size but also reshaping competitive dynamics toward suppliers offering natural, clinically validated solutions.

Higher Cost and Formulation Complexity

Despite robust growth, adoption of natural skincare preservatives faces constraints linked to cost and technical challenges. Compared to low-cost synthetic preservatives, natural alternatives often involve higher raw material sourcing costs, complex extraction methods, and shorter shelf-life stability. These factors raise overall formulation expenses, limiting accessibility in mass-market skincare segments where pricing sensitivity is high. Additionally, compatibility issues such as maintaining efficacy in water-rich formulations or preserving across broad pH ranges create hurdles for cosmetic formulators. Smaller brands without significant R&D budgets may struggle to scale natural preservation systems, restraining full market penetration despite strong regulatory and consumer-driven momentum.

Biotechnology-Enabled Fermentation Preservatives

An emerging trend reshaping the market is the rise of biotechnology-based fermentation preservatives. Advances in microbial processing are enabling production of peptide-based antimicrobials, lactobacillus-derived extracts, and bioengineered organic acids that combine efficacy with sustainability. Unlike traditional plant extracts, these bio-preservatives offer reproducible quality, longer shelf stability, and multifunctional benefits such as antioxidant or skin-barrier support. They are increasingly marketed as both preservation agents and active cosmetic ingredients, blurring category boundaries. Global ingredient leaders are investing in fermentation technology partnerships, signaling a structural shift where biotechnology will redefine scalability, performance, and positioning of natural skincare preservation systems over the next decade.

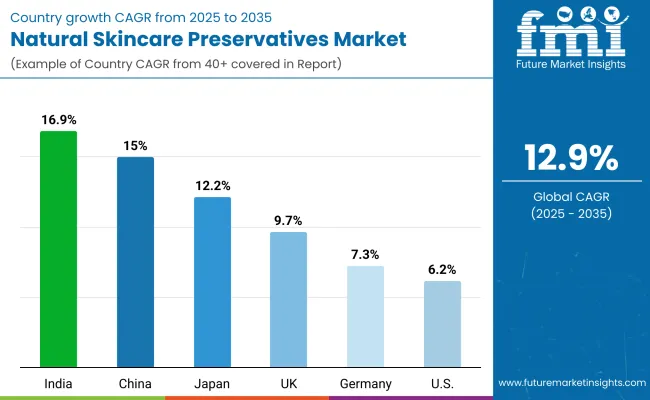

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.0% |

| USA | 6.2% |

| India | 16.9% |

| UK | 9.7% |

| Germany | 7.3% |

| Japan | 12.2% |

The global Natural Skincare Preservatives Market shows clear regional variations in growth, strongly shaped by consumer preferences for clean-label beauty, regulatory frameworks, and industry innovation ecosystems.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 16.9% CAGR and China at 15.0% CAGR. India’s trajectory reflects the surge of Ayurveda-inspired formulations and strong adoption of herbal preservatives in premium skincare. China’s growth is driven by K-beauty influences, rising disposable incomes, and supportive government policies promoting natural and sustainable cosmetics. Japan at 12.2% CAGR benefits from its deep-rooted demand for anti-aging and functional skincare solutions, accelerating the adoption of natural bio-preservatives.

Europe maintains a strong position, led by the UK (9.7%) and Germany (7.3%), driven by strict EU regulations restricting parabens and synthetic preservatives. Compliance with COSMOS and ECOCERT standards strengthens natural preservative demand, especially in organic-certified product lines. North America, led by the USA at 6.2% CAGR, reflects a more mature but steady market, where consumer-driven clean-label preferences sustain demand. Growth here is shaped less by regulatory compulsion and more by marketing-led positioning of botanical and fermentation-based preservatives across premium skincare brands.

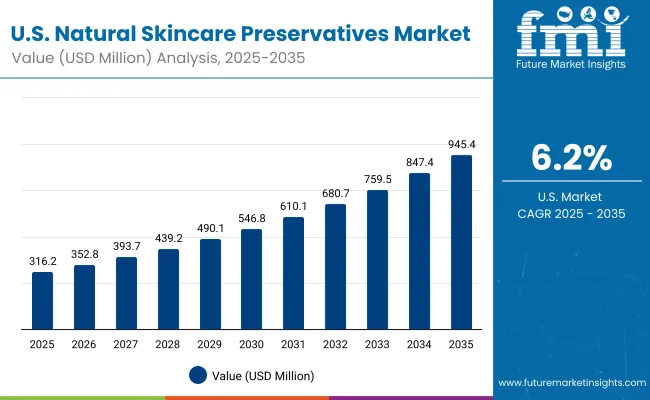

| Year | USA Natural Skincare Preservatives Market (USD Million) |

|---|---|

| 2025 | 316.29 |

| 2026 | 352.89 |

| 2027 | 393.73 |

| 2028 | 439.29 |

| 2029 | 490.13 |

| 2030 | 546.85 |

| 2031 | 610.13 |

| 2032 | 680.74 |

| 2033 | 759.52 |

| 2034 | 847.41 |

| 2035 | 945.48 |

The Natural Skincare Preservatives Market in the United States is projected to grow at a CAGR of 6.2%, supported by consistent consumer demand for clean-label formulations and compliance with FDA safety standards. Growth is concentrated in plant-derived preservatives (43.2% share in 2025, USD 136.64 Million), reflecting consumer trust in botanical-based skincare. The segment’s expansion is also driven by rising adoption of fermentation-based bio-preservatives in premium skincare and haircare lines.

Increasing pressure on brands to eliminate parabens, formaldehyde donors, and synthetic stabilizers is pushing formulators toward sustainable alternatives. Moisturizing creams and lotions remain the leading application segment in the USA, reflecting their widespread use in daily skincare routines. Serums and oils are gaining traction in premium and anti-aging categories, where natural preservatives serve both stability and marketing functions.

Ingredient suppliers (B2B) dominate distribution, but major cosmetic brands are increasingly investing in in-house preservative R&D to strengthen product claims and differentiation.

The Natural Skincare Preservatives Market in the United Kingdom is expected to grow at a CAGR of 9.7%, supported by strong regulatory alignment with EU cosmetic safety frameworks and rising consumer demand for clean-label, organic-certified products. Growth is particularly concentrated in plant-derived preservatives, reflecting consumer trust in natural botanical extracts. Premium skincare, serums, and oils are fueling adoption, as UK consumers increasingly favor sustainable and cruelty-free formulations. Government-backed sustainability initiatives and certifications such as Soil Association Organic continue to reinforce market demand. Additionally, collaborations between ingredient suppliers and UK-based indie cosmetic brands are accelerating product innovation.

India is witnessing rapid growth in the Natural Skincare Preservatives Market, forecast to expand at a CAGR of 16.9% through 2035 the highest among major emerging markets. This momentum is driven by rising adoption of Ayurveda-inspired skincare formulations, supported by government promotion of herbal and natural beauty products. Tier-2 and tier-3 cities are fueling demand as consumer awareness of clean-label skincare spreads beyond metro hubs. Local manufacturers and MSMEs are integrating plant-derived and bio-fermentation preservatives to align with export quality standards. Educational and research institutions are also emphasizing natural ingredients, fostering innovation in sustainable preservative technologies.

The Natural Skincare Preservatives Market in China is expected to grow at a CAGR of 15.0%, making it one of the fastest-growing global markets. Growth is fueled by the rise of K-beauty and C-beauty trends, which emphasize multifunctional, naturally preserved skincare products. Municipal initiatives promoting sustainability and consumer preference for eco-friendly formulations further reinforce demand. Domestic ingredient suppliers are scaling rapidly, offering cost-competitive natural and organic acids, accelerating adoption across both premium and mass-market brands. E-commerce platforms are playing a pivotal role, boosting consumer access to natural skincare ranges and driving penetration into smaller cities.

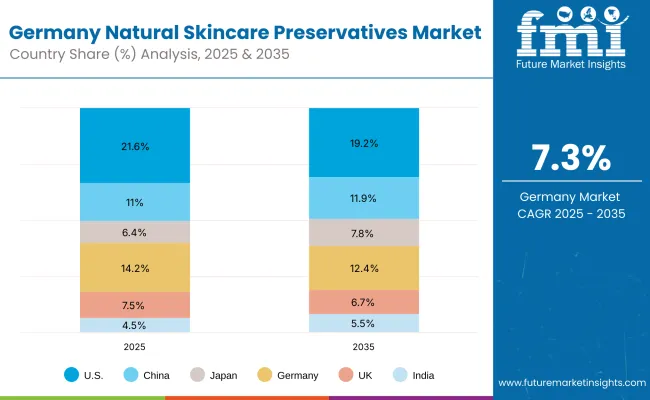

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.6% |

| China | 11.0% |

| Japan | 6.4% |

| Germany | 14.2% |

| UK | 7.5% |

| India | 4.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.2% |

| China | 11.9% |

| Japan | 7.8% |

| Germany | 12.4% |

| UK | 6.7% |

| India | 5.5% |

The Natural Skincare Preservatives Market in Germany is projected to grow at a CAGR of 7.3%, supported by the country’s leadership in sustainability-driven cosmetics and stringent EU safety compliance. German consumers are early adopters of organic-certified and eco-labeled skincare, pushing brands to shift from synthetic preservatives to natural alternatives. Manufacturers are integrating plant-derived and fermentation-based preservatives into creams, lotions, and serums to meet COSMOS and ECOCERT certification standards. Growth is also reinforced by the rise of dermocosmetics and pharmacy-distributed skincare, where clinical-grade natural formulations are in high demand. While market share is expected to soften slightly by 2035, Germany remains a core hub for regulatory-compliant, high-quality preservative innovation.

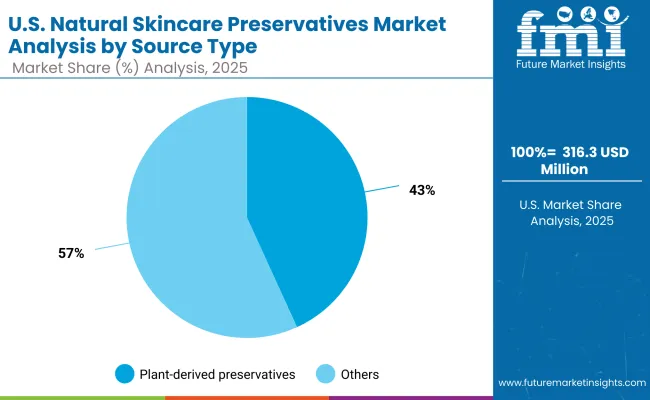

| USA By Source Type | Value Share% 2025 |

|---|---|

| Plant-derived preservatives | 43.2% |

| Others | 56.8% |

The Natural Skincare Preservatives Market in the United States is projected at USD 316.3 million in 2025, expanding steadily to reach USD 945.5 million by 2035. Plant-derived preservatives hold 43.2% share, underpinned by consumer trust in botanical formulations and rising demand for clean-label, hypoallergenic skincare. However, fermentation-based preservatives and organic acids (56.8%) are gradually outpacing plant-derived counterparts due to their superior stability and broader formulation compatibility.

The USA market reflects a transition toward scientifically validated natural ingredients, supported by FDA guidance and consumer-driven clean beauty movements. Leading cosmetic brands are investing in hybrid preservative portfolios, combining plant and bio-fermentation sources to enhance safety, shelf life, and sustainability. Digital retail channels are amplifying consumer access to naturally preserved products, with strong momentum in premium skincare and dermocosmetics.

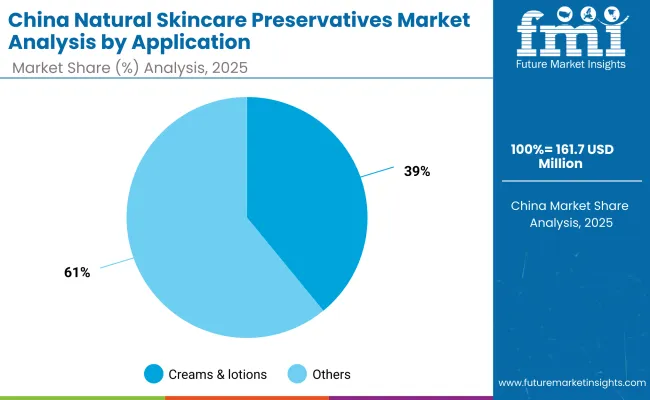

| China By Application | Value Share% 2025 |

|---|---|

| Creams & lotions | 39.1% |

| Others | 60.9% |

The Natural Skincare Preservatives Market in China is forecast to expand rapidly, growing at a CAGR of 15.0%, making it one of the fastest globally. Market adoption is led by serums, oils, and haircare products (60.9%), which are central to the booming C-beauty and K-beauty influenced segments. Creams and lotions account for 39.1% but remain essential for mass-market adoption. Domestic suppliers are gaining ground by offering cost-competitive fermentation-based preservatives and organic acids, enabling mass penetration in both premium and budget categories. E-commerce ecosystems like Tmall and JD.com are accelerating consumer access, while government-led sustainability campaigns are reinforcing the shift to naturally preserved products.

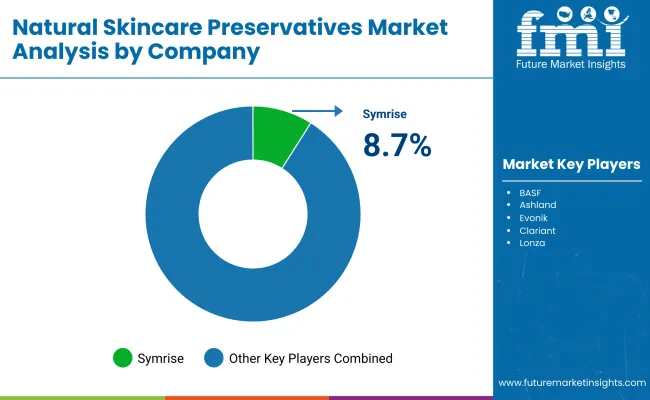

The Natural Skincare Preservatives Market is moderately fragmented, with a mix of global ingredient leaders, mid-sized innovators, and niche botanical specialists competing across applications. Global leaders such as Symrise, BASF, Givaudan Active Beauty, and Lonza hold meaningful share, leveraging their scale, R&D strength, and broad ingredient portfolios. Their strategies increasingly emphasize biotechnology-enabled fermentation preservatives, multifunctional botanical extracts, and clean-label certifications (COSMOS, ECOCERT) to strengthen adoption in premium skincare.

Mid-sized players like Ashland, Evonik, and Clariant are expanding through targeted innovation in organic acids and hybrid preservative blends, offering flexible solutions to cosmetic formulators seeking stability and compliance. Their ability to align with sustainability mandates and deliver formulation support enhances competitive relevance. Specialist providers such as Active Micro Technologies, Schülke & Mayr, and Kemin Industries focus on niche, application-specific preservation systems, particularly antimicrobial peptides and natural antioxidant complexes. Their strength lies in customization and regional adaptability, catering to organic beauty brands and indie formulators that prioritize transparency and natural positioning.

Competitive differentiation is shifting away from price and basic preservation efficacy toward integrated sustainability credentials, multifunctional preservative systems, and brand partnerships. Players able to combine natural efficacy with supply chain transparency will consolidate share in a fragmented global landscape.

Key Developments in Natural Skincare Preservatives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,463.4 Million |

| Source Type | Plant-derived preservatives (rosemary, thyme, tea tree), Fermentation-based bio-preservatives, Organic acids (benzoic, sorbic, lactic) |

| Application | Creams & lotions, Serums & oils, Haircare products |

| Product Form | Liquid concentrates, Powders, Oil-dispersible forms |

| Distribution Channel | Ingredient suppliers (B2B), Cosmetic brand manufacturers (B2C) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Symrise, BASF, Ashland, Evonik, Clariant, Lonza, Givaudan Active Beauty, Schülke & Mayr, Kemin Industries, Tonymoly |

| Additional Attributes | Dollar sales by source type and application category, adoption trends in clean-label and organic-certified skincare, rising demand for multifunctional preservatives with antioxidant and antimicrobial benefits, sector-specific growth in premium skincare, haircare, and dermocosmetics, revenue segmentation by product form (liquid concentrates, powders, oil-dispersible), integration with biotechnology and fermentation-based innovations, regional trends influenced by regulatory compliance and sustainability mandates, and advancements in plant-derived extraction methods, organic acids, and bio-fermentation technologies. |

The global Natural Skincare Preservatives Market is estimated to be valued at USD 1,463.4 million in 2025.

The market size for the Natural Skincare Preservatives Market is projected to reach USD 4,921.3 million by 2035.

The Natural Skincare Preservatives Market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key source types in Natural Skincare Preservatives Market are liquid concentrates, powders, and oil-dispersible forms.

In terms of application, the creams & lotions segment is projected to command 46.5% share in the Natural Skincare Preservatives Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Natural Fiber Composites Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA